Professional Documents

Culture Documents

Functions and Responsibilities: Powers

Functions and Responsibilities: Powers

Uploaded by

aefaefOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Functions and Responsibilities: Powers

Functions and Responsibilities: Powers

Uploaded by

aefaefCopyright:

Available Formats

Functions and responsibilities[edit]

The Preamble of the Securities and Exchange Board of India describes the basic functions of the

Securities and Exchange Board of India as "...to protect the interests of investors in securities

and to promote the development of, and to regulate the securities market and for matters

connected there with or incidental there to".

SEBI has to be responsive to the needs of three groups, which constitute the market:

issuers of securities

investors

market intermediaries

SEBI has three powers rolled into one body: quasi-legislative, quasi-judicial and quasi-executive.

It drafts regulations in its legislative capacity, it conducts investigation and enforcement action in

its executive function and it passes rulings and orders in its judicial capacity. Though this makes

it very powerful, there is an appeal process to create accountability. There is a Securities

Appellate Tribunal which is a three-member tribunal and is currently headed by Justice Tarun

Agarwala, former Chief Justice of the Meghalaya High Court.[8] A second appeal lies directly to

the Supreme Court. SEBI has taken a very proactive role in streamlining disclosure requirements

to international standards.[9]

Securities and Exchange Board of India (SEBI)

Powers[edit]

For the discharge of its functions efficiently, SEBI has been vested with the following powers:

to approve by−laws of Securities exchanges.

to require the Securities exchange to amend their by−laws.

inspect the books of accounts and call for periodical returns from recognised

Securities exchanges.

inspect the books of accounts of financial intermediaries.

compel certain companies to list their shares in one or more Securities exchanges.

registration of Brokers and sub-brokers

♦ SEBI committees

Technical Advisory Committee

Committee for review of structure of infrastructure institutions

Advisory Committee for the SEBI Investor Protection and Education Fund

Takeover Regulations Advisory Committee

Primary Market Advisory Committee (PMAC)

Secondary Market Advisory Committee (SMAC)

Mutual Fund Advisory Committee

Corporate Bonds & Securitisation Advisory Committee

♦ There are two types of brokers:

Discount brokers

Merchant brokers

Eliminate malpractices in security market

You might also like

- EStatement PDFDocument4 pagesEStatement PDFLilia75% (4)

- Project Report On SEBIDocument26 pagesProject Report On SEBIRahul Pillai56% (36)

- Ty Bms Project On SebiDocument36 pagesTy Bms Project On Sebilaxmi10120980% (5)

- Insurance Law-ContributionDocument5 pagesInsurance Law-ContributionDavid FongNo ratings yet

- Deed of Absolute Sale A SampleDocument3 pagesDeed of Absolute Sale A Samplecharie20% (1)

- Track 2 Diplomacy ReportDocument18 pagesTrack 2 Diplomacy ReportFernando AquinoNo ratings yet

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaNo ratings yet

- BE 10 B SEBIDocument1 pageBE 10 B SEBIAnmol HuriyaNo ratings yet

- Securities and Exchange Board of IndiaDocument13 pagesSecurities and Exchange Board of Indiasonal jainNo ratings yet

- Sebi Sensex Nifty Bse NseDocument47 pagesSebi Sensex Nifty Bse NseKushal WaliaNo ratings yet

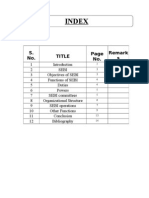

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaNo ratings yet

- SEBI - The Securities and Exchange Board of IndiaDocument35 pagesSEBI - The Securities and Exchange Board of IndiaRohan FodnaikNo ratings yet

- Securities and Exchange Board of IndiaDocument23 pagesSecurities and Exchange Board of IndiaAppan Kandala VasudevacharyNo ratings yet

- SebiDocument18 pagesSebiSandeep Galipelli50% (2)

- Difference Between Money Markets and Capital MarketsDocument4 pagesDifference Between Money Markets and Capital MarketsSachin TiwariNo ratings yet

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanNo ratings yet

- Securities and Exchange Board of IndiaDocument1 pageSecurities and Exchange Board of IndiaPrachi PawarNo ratings yet

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriNo ratings yet

- SEBI-Functions ResponsibilitiesDocument10 pagesSEBI-Functions ResponsibilitiesNavin PamnaniNo ratings yet

- Security Exchange & Board of IndiaDocument11 pagesSecurity Exchange & Board of IndiaLyco BhardwajNo ratings yet

- Executive SummaryDocument35 pagesExecutive SummaryAmit PasiNo ratings yet

- Labour Law AssignmentDocument8 pagesLabour Law AssignmentTanya SinghNo ratings yet

- Investment and Securities AssignmentDocument16 pagesInvestment and Securities Assignmentkhusboo kharbandaNo ratings yet

- Introduction Sebi ProjectDocument37 pagesIntroduction Sebi Projectcvb cgbNo ratings yet

- Capital Market and SEBIDocument4 pagesCapital Market and SEBINishant GoyalNo ratings yet

- SEBI - Securities and Exchange Board of IndiaDocument6 pagesSEBI - Securities and Exchange Board of IndiaRAVI RAUSHAN JHANo ratings yet

- 3 14 16 Prof. Manojkumar T. RathodDocument3 pages3 14 16 Prof. Manojkumar T. Rathod123rajnikantNo ratings yet

- SEBIDocument29 pagesSEBImagico- maniacNo ratings yet

- National Law Institute University Bhopal: Project - Administrative Law SebiDocument20 pagesNational Law Institute University Bhopal: Project - Administrative Law SebiSurbhi LaddhaNo ratings yet

- FMR AssignmentDocument8 pagesFMR AssignmentABHISHEK MARORIANo ratings yet

- Securities and Exchange Board of India PDFDocument18 pagesSecurities and Exchange Board of India PDFShifa RasheedNo ratings yet

- 1.7 Business Legal Systems: Mfa 1 SemesterDocument53 pages1.7 Business Legal Systems: Mfa 1 SemesterSoumyaparna SinghaNo ratings yet

- Business Environment - 5Document10 pagesBusiness Environment - 5phanisantoshNo ratings yet

- Corporate Law Project NewDocument10 pagesCorporate Law Project NewAyushi VermaNo ratings yet

- Be SebiDocument10 pagesBe SebiShilpi SinghNo ratings yet

- Role of SebiDocument10 pagesRole of Sebimiliaggarwal2004No ratings yet

- Role of SebiDocument81 pagesRole of Sebimanwanimuki12No ratings yet

- IFM&IDocument3 pagesIFM&IArko GhoshNo ratings yet

- FR NotesDocument17 pagesFR NotesNitu YadavNo ratings yet

- Securities and Exchange Board of India SEBI Economics Study Material Amp NotesDocument3 pagesSecurities and Exchange Board of India SEBI Economics Study Material Amp NotesRaghav DhillonNo ratings yet

- Unit 8Document16 pagesUnit 8tusharsharma72062No ratings yet

- Securities and Exchange Board of IndiaDocument73 pagesSecurities and Exchange Board of IndiaSurya ParkashNo ratings yet

- Security AnalysisDocument78 pagesSecurity AnalysisArpit AroraNo ratings yet

- SEBIDocument3 pagesSEBILion Naresh PradhanNo ratings yet

- Innovative Derivative ProductsDocument26 pagesInnovative Derivative ProductsSanjeev33% (3)

- SebiDocument2 pagesSebiT MnNo ratings yet

- Securities and Exchange Board of India (SEBI) : AboutDocument3 pagesSecurities and Exchange Board of India (SEBI) : AboutLamheNo ratings yet

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Home Work of Securities and Investment LawDocument3 pagesHome Work of Securities and Investment LawABHINAV DEWALIYANo ratings yet

- Securities and Exchange Board of INDIADocument15 pagesSecurities and Exchange Board of INDIAAmbreen NasirNo ratings yet

- Chapter - 5 Derivatives Market in IndiaDocument7 pagesChapter - 5 Derivatives Market in IndiaMandy RandiNo ratings yet

- Internal Backlog Company Law Role of Sebi in Stock ExchangeDocument9 pagesInternal Backlog Company Law Role of Sebi in Stock ExchangeApoorv SrivastavaNo ratings yet

- The Investment Industry for IT Practitioners: An Introductory GuideFrom EverandThe Investment Industry for IT Practitioners: An Introductory GuideNo ratings yet

- A simple approach to equity investing: An introductory guide to investing in equities to understand what they are, how they work and what the main strategies areFrom EverandA simple approach to equity investing: An introductory guide to investing in equities to understand what they are, how they work and what the main strategies areNo ratings yet

- Mastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesFrom EverandMastering the Markets: Advanced Trading Strategies for Success and Ethical Trading PracticesNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- The Board of Directors and Audit Committee Guide to Fiduciary Responsibilities: Ten Crtical Steps to Protecting Yourself and Your OrganizationFrom EverandThe Board of Directors and Audit Committee Guide to Fiduciary Responsibilities: Ten Crtical Steps to Protecting Yourself and Your OrganizationNo ratings yet

- Mistake of FactDocument6 pagesMistake of FactMayank SrivastavaNo ratings yet

- Dalit LeadersDocument2 pagesDalit LeadersThe WireNo ratings yet

- Ceasiom End-User License Agreement ("Eula")Document2 pagesCeasiom End-User License Agreement ("Eula")Charlton EddieNo ratings yet

- Procedure For OccupancyDocument1 pageProcedure For Occupancypa3ckblancoNo ratings yet

- WEEK 1: Administrative Disciplinary Machinery: WEEK 2. People's Law Enforcement Board (PLEB)Document5 pagesWEEK 1: Administrative Disciplinary Machinery: WEEK 2. People's Law Enforcement Board (PLEB)Lovely Alyssa Bonifacio100% (1)

- The Pakistan-US RelationshipDocument5 pagesThe Pakistan-US RelationshipChemist ChemistNo ratings yet

- Columbia WHTDocument7 pagesColumbia WHTAnilNo ratings yet

- Human Rights Law Case Digest: Mejoff V. Director of Prisons (1951)Document2 pagesHuman Rights Law Case Digest: Mejoff V. Director of Prisons (1951)MaggieNo ratings yet

- Criminal ProcedureDocument3 pagesCriminal ProcedureDoc BrevzNo ratings yet

- Scope of Administrative LawDocument2 pagesScope of Administrative LawAnonymous oDPxEkdNo ratings yet

- VP Government Affairs Relations in Washington DC Resume Segundo Mercado-LlorensDocument2 pagesVP Government Affairs Relations in Washington DC Resume Segundo Mercado-LlorensSegundoMercadoLlorensNo ratings yet

- G.R. No. 161006 ROGELIO BARONDA, Petitioner Hon. Court of Appeals, and Hideco Sugar Milling Co., Inc., Respondents Decision Bersamin, J.Document6 pagesG.R. No. 161006 ROGELIO BARONDA, Petitioner Hon. Court of Appeals, and Hideco Sugar Milling Co., Inc., Respondents Decision Bersamin, J.Ego sum pulcherNo ratings yet

- MCSO Use of ForceDocument16 pagesMCSO Use of ForceAdrienneNo ratings yet

- Provisions of CitzenshipDocument8 pagesProvisions of CitzenshipsophiabarnacheaNo ratings yet

- Montgomery County Bill 15-23, Landlord-Tenant Relations - Anti Rent Gouging ProtectionsDocument9 pagesMontgomery County Bill 15-23, Landlord-Tenant Relations - Anti Rent Gouging ProtectionsABC7NewsNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of Indiababji dudekulaNo ratings yet

- Power of RBI To Issue DirectionsDocument6 pagesPower of RBI To Issue DirectionsAbhjeet Kumar SinhaNo ratings yet

- Minutes of The MeetingDocument2 pagesMinutes of The MeetingJeremy Gaddi100% (1)

- 29 May 2009pay Commission Notification Punjab Govt Notification by Vijay Kumar HeerDocument6 pages29 May 2009pay Commission Notification Punjab Govt Notification by Vijay Kumar HeerVIJAY KUMAR HEER33% (3)

- FIR Against All Illegal Slaughter Houses in Gurgaon by Naresh Kadian.Document18 pagesFIR Against All Illegal Slaughter Houses in Gurgaon by Naresh Kadian.Naresh KadyanNo ratings yet

- 7-8. ENGL 158 - Meeting and Minutes WritingDocument42 pages7-8. ENGL 158 - Meeting and Minutes Writingtitus obengNo ratings yet

- Office of The Ombudsman vs. ENOCDocument3 pagesOffice of The Ombudsman vs. ENOCCarlo Vincent Balicas100% (1)

- 116346-2007-Vda. de Melencion v. Court of Appeals20190508-5466-1er7ln PDFDocument11 pages116346-2007-Vda. de Melencion v. Court of Appeals20190508-5466-1er7ln PDFVenice Jamaila DagcutanNo ratings yet

- National Sovereignty and Children's DayDocument4 pagesNational Sovereignty and Children's DayDiego BlancoNo ratings yet

- Ferlin Acol Quiz 2 Gross Estate Part 1Document3 pagesFerlin Acol Quiz 2 Gross Estate Part 1Julienne UntalascoNo ratings yet

- Grand River Enterprises Six Nations v. Nat'l Dist. Noorani - Seneca Tobacco Trademark Complaint PDFDocument28 pagesGrand River Enterprises Six Nations v. Nat'l Dist. Noorani - Seneca Tobacco Trademark Complaint PDFMark JaffeNo ratings yet