Professional Documents

Culture Documents

US Internal Revenue Service: fw3 - 2000

US Internal Revenue Service: fw3 - 2000

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: fw3 - 2000

US Internal Revenue Service: fw3 - 2000

Uploaded by

IRSCopyright:

Available Formats

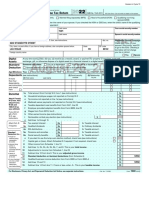

DO NOT STAPLE OR FOLD

a Control number For Official Use Only 䊳

33333 OMB No. 1545-0008

䊳

b 941 Military 943 1 Wages, tips, other compensation 2 Federal income tax withheld

Kind

of Hshld. Medicare

Payer CT-1 3 Social security wages 4 Social security tax withheld

emp. govt. emp.

c Total number of Forms W-2 d Establishment number 5 Medicare wages and tips 6 Medicare tax withheld

e Employer identification number 7 Social security tips 8 Allocated tips

f Employer’s name 9 Advance EIC payments 10 Dependent care benefits

11 Nonqualified plans 12 Deferred compensation

13

14

g Employer’s address and ZIP code

h Other EIN used this year 15 Income tax withheld by third-party payer

i Employer’s state I.D. no.

Contact person Telephone number Fax number E-mail address

( ) ( )

Under penalties of perjury, I declare that I have examined this return and accompanying documents, and, to the best of my knowledge and belief,

they are true, correct, and complete.

Signature 䊳 Title 䊳 Date 䊳

Form W-3 Transmittal of Wage and Tax Statements 2000 Department of the Treasury

Internal Revenue Service

Send this entire page with the entire Copy A page of Form(s) W-2 to the Social Security Administration. Photocopies are NOT acceptable.

Do NOT send any remittance (cash, checks, money orders, etc.) with Forms W-2 and W-3.

An Item To Note Where To File

Separate instructions. See the separate 2000 Send this entire page with the entire Copy A page

Instructions for Forms W-2 and W-3 for of Form(s) W-2 to:

information on completing this form. Social Security Administration

Purpose of Form Data Operations Center

Wilkes-Barre, PA 18769-0001

Use this form to transmit Copy A of Form(s) W-2,

Wage and Tax Statement. Make a copy of Form Note: If you use “Certified Mail” to file, change the

W-3, and keep it with Copy D (For Employer) of ZIP code to “18769-0002.” If you use an IRS

Form(s) W-2 for your records. Use Form W-3 for approved private delivery service, add “ATTN: W-2

the correct year. File Form W-3 even if only one Process, 1150 E. Mountain Dr.” to the address and

Form W-2 is being filed. If you are filing Form(s) change the ZIP code to “18702-7997.” See

W-2 on magnetic media or electronically, do not Circular E, Employer’s Tax Guide (Pub. 15), for a

file Form W-3. list of IRS approved private delivery services.

When To File

File Form W-3 with Copy A of Form(s) W-2 by

February 28, 2001.

For Privacy Act and Paperwork Reduction Act Notice, see the 2000 Instructions for Forms W-2 and W-3.

Cat. No. 10159Y

You might also like

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- W-2 Form George PDFDocument1 pageW-2 Form George PDFGeorge Lucas100% (1)

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- Balancing Security and Liberty Critical Perspectives On Terrorism Law ReformDocument19 pagesBalancing Security and Liberty Critical Perspectives On Terrorism Law ReformJoana SaloméNo ratings yet

- US Internal Revenue Service: fw3 - 1999Document1 pageUS Internal Revenue Service: fw3 - 1999IRSNo ratings yet

- US Internal Revenue Service: fw3 - 1998Document4 pagesUS Internal Revenue Service: fw3 - 1998IRSNo ratings yet

- US Internal Revenue Service: fw3ss - 2000Document6 pagesUS Internal Revenue Service: fw3ss - 2000IRSNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument2 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employermuhammad mudassarNo ratings yet

- US Internal Revenue Service: fw3ss - 2003Document6 pagesUS Internal Revenue Service: fw3ss - 2003IRSNo ratings yet

- US Internal Revenue Service: fw3ss - 2001Document6 pagesUS Internal Revenue Service: fw3ss - 2001IRS100% (1)

- US Internal Revenue Service: fw3ss - 2005Document8 pagesUS Internal Revenue Service: fw3ss - 2005IRSNo ratings yet

- US Internal Revenue Service: fw3ss - 1996Document6 pagesUS Internal Revenue Service: fw3ss - 1996IRSNo ratings yet

- US Internal Revenue Service: fw3ss - 1993Document6 pagesUS Internal Revenue Service: fw3ss - 1993IRSNo ratings yet

- Instructions For Form W-2: Wage and Tax StatementDocument8 pagesInstructions For Form W-2: Wage and Tax StatementIRSNo ratings yet

- US Internal Revenue Service: fw3ss - 1995Document6 pagesUS Internal Revenue Service: fw3ss - 1995IRSNo ratings yet

- US Internal Revenue Service: p393 - 1996Document4 pagesUS Internal Revenue Service: p393 - 1996IRSNo ratings yet

- US Internal Revenue Service: p393 - 1994Document4 pagesUS Internal Revenue Service: p393 - 1994IRSNo ratings yet

- US Internal Revenue Service: p393 - 1995Document4 pagesUS Internal Revenue Service: p393 - 1995IRSNo ratings yet

- F 4852Document2 pagesF 4852IRSNo ratings yet

- Instructions For Forms W-2 and W-3: Pager/SgmlDocument15 pagesInstructions For Forms W-2 and W-3: Pager/SgmlIRSNo ratings yet

- F 4852Document2 pagesF 4852Goodinespressurewashing100% (1)

- US Internal Revenue Service: Iw2 - 1999Document12 pagesUS Internal Revenue Service: Iw2 - 1999IRSNo ratings yet

- US Internal Revenue Service: Iw2w3 - 2001Document12 pagesUS Internal Revenue Service: Iw2w3 - 2001IRSNo ratings yet

- Instructions For Forms W-2 and W-3: Pager/SgmlDocument13 pagesInstructions For Forms W-2 and W-3: Pager/SgmlIRSNo ratings yet

- Newmass W9Document2 pagesNewmass W9Christian PazNo ratings yet

- Instructions For Forms W-2 and W-3: Pager/SgmlDocument12 pagesInstructions For Forms W-2 and W-3: Pager/SgmlIRSNo ratings yet

- US Internal Revenue Service: Fw2as - 2000Document10 pagesUS Internal Revenue Service: Fw2as - 2000IRSNo ratings yet

- US Internal Revenue Service: Iw2cw3cDocument4 pagesUS Internal Revenue Service: Iw2cw3cIRSNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialHaiOuNo ratings yet

- US Internal Revenue Service: I941mDocument4 pagesUS Internal Revenue Service: I941mIRSNo ratings yet

- US Internal Revenue Service: Fw2vi - 2000Document10 pagesUS Internal Revenue Service: Fw2vi - 2000IRSNo ratings yet

- TaxForm PDFDocument6 pagesTaxForm PDFJoseph RobinsonNo ratings yet

- Sean 2022 Tax ReturnDocument18 pagesSean 2022 Tax Returnaaakinkumi115100% (1)

- 2022 Individual Tax ReturnDocument6 pages2022 Individual Tax ReturnstephinecaustonNo ratings yet

- Attention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialDocument11 pagesAttention:: Not File Copy A Downloaded From This Website With The SSA. The OfficialMia JacksonNo ratings yet

- Tax Monat 2023Document1 pageTax Monat 2023angelinastep95No ratings yet

- FederalFormsResource 2020Document6 pagesFederalFormsResource 2020Soriano GabbyNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- u Ve i Hh 069412 h 0314320211454111104202Document2 pagesu Ve i Hh 069412 h 0314320211454111104202Lonmar L. Lentch LopezNo ratings yet

- US Internal Revenue Service: Fw2gu - 2000Document10 pagesUS Internal Revenue Service: Fw2gu - 2000IRSNo ratings yet

- US Internal Revenue Service: Fw2as - 1995Document10 pagesUS Internal Revenue Service: Fw2as - 1995IRSNo ratings yet

- Instructions For Form 943: Pager/SgmlDocument4 pagesInstructions For Form 943: Pager/SgmlIRSNo ratings yet

- Swe Win 2022 1099 PDFDocument2 pagesSwe Win 2022 1099 PDFKuka Win50% (2)

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- US Internal Revenue Service: Fw2vi - 1995Document10 pagesUS Internal Revenue Service: Fw2vi - 1995IRSNo ratings yet

- Instructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesDocument3 pagesInstructions For Form 943: Employer's Annual Tax Return For Agricultural EmployeesIRSNo ratings yet

- US Internal Revenue Service: I1099msc - 2003Document7 pagesUS Internal Revenue Service: I1099msc - 2003IRSNo ratings yet

- Tax ReturnDocument5 pagesTax Returnsmartmaxtv111No ratings yet

- Attention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsDocument3 pagesAttention Filers of Form 1096:: WWW - Irs.gov/form1099 WWW - IRS.gov/orderforms Employer and Information ReturnsJoshua Sygnal Gutierrez100% (1)

- 4506 T FormDocument1 page4506 T FormSolomon WoldeNo ratings yet

- IRS Form Break Down Estate PDFDocument8 pagesIRS Form Break Down Estate PDFSylvester Moore100% (1)

- US Internal Revenue Service: fw3ss - 1992Document6 pagesUS Internal Revenue Service: fw3ss - 1992IRSNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlinepdizypdizyNo ratings yet

- This Is The Trial Version. Click Here To Get The Full Calc VersionDocument16 pagesThis Is The Trial Version. Click Here To Get The Full Calc VersionMounesh KumarNo ratings yet

- WCEihh 05607 H 434910223005072219102Document2 pagesWCEihh 05607 H 434910223005072219102whitneydemetria007No ratings yet

- Internal Use Only Draft As of August 26, 2022: U.S. Individual Income Tax ReturnDocument2 pagesInternal Use Only Draft As of August 26, 2022: U.S. Individual Income Tax ReturnTrish HitNo ratings yet

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- The Role of Youth in SocietyDocument12 pagesThe Role of Youth in SocietyJoshua CadioganNo ratings yet

- People vs. Serzo, Jr.Document22 pagesPeople vs. Serzo, Jr.JoVic2020No ratings yet

- Republic Act No. 7942 Philippine Mining Act of 1995Document2 pagesRepublic Act No. 7942 Philippine Mining Act of 1995Sara Andrea SantiagoNo ratings yet

- Cultural Drivers of Corruption in GovernanceDocument2 pagesCultural Drivers of Corruption in GovernanceJonalvin KENo ratings yet

- 66 Nass Qns and AnswersDocument48 pages66 Nass Qns and AnswersZvandaziva Nelisher100% (3)

- Codal Admin LawDocument123 pagesCodal Admin LawJanine CorderoNo ratings yet

- 01 Chapter OneDocument24 pages01 Chapter OneMitiku YibeltalNo ratings yet

- South Asia Tribune Weekly UKDocument31 pagesSouth Asia Tribune Weekly UKShahid KhanNo ratings yet

- Somalia Press StatementDocument2 pagesSomalia Press StatementUK Mission to the UN100% (1)

- PIL DigestsDocument4 pagesPIL Digestspokeball001No ratings yet

- 1975-Vanmeter-Policy Implementation Process - Conceptual FrameworkDocument45 pages1975-Vanmeter-Policy Implementation Process - Conceptual FrameworkDiego Mauricio Diaz Velásquez70% (10)

- Seaweed Farming LawsDocument5 pagesSeaweed Farming LawsRyan AcostaNo ratings yet

- Media Law and EthicsDocument64 pagesMedia Law and EthicsAnonymous 5fIgXAx100% (1)

- CASES Citizenship Admin Election LawDocument4 pagesCASES Citizenship Admin Election LawMR. LemmingNo ratings yet

- Brett Shibley v. Genesis Healthcare, 3rd Cir. (2011)Document6 pagesBrett Shibley v. Genesis Healthcare, 3rd Cir. (2011)Scribd Government DocsNo ratings yet

- California Bar Examination: JULY 2012 Essay Questions 1, 2, and 3Document8 pagesCalifornia Bar Examination: JULY 2012 Essay Questions 1, 2, and 3Trial UserNo ratings yet

- LAC (Line of Actual Control)Document9 pagesLAC (Line of Actual Control)Malik ZeeshanNo ratings yet

- Sample 501c3 BylawsDocument6 pagesSample 501c3 BylawsRobert Raleigh100% (1)

- Scope & Nature of Public AdministrationDocument3 pagesScope & Nature of Public AdministrationJunaid KhanNo ratings yet

- CH 3 Corporate GovernanceDocument29 pagesCH 3 Corporate GovernanceMazhar IqbalNo ratings yet

- Theories of Underdevelopment - Paul BarrenDocument23 pagesTheories of Underdevelopment - Paul BarrenIshrat PopyNo ratings yet

- Adm. Case No. 4673. April 27, 2001 ATTY. HECTOR TEODOSIO, Petitioner, vs. MERCEDES NAVA, Respondent. FactsDocument6 pagesAdm. Case No. 4673. April 27, 2001 ATTY. HECTOR TEODOSIO, Petitioner, vs. MERCEDES NAVA, Respondent. FactsshahiraNo ratings yet

- The Real Thirteenth Article of AmendmentDocument13 pagesThe Real Thirteenth Article of AmendmentnaebyosNo ratings yet

- Youth Parliament 3Document7 pagesYouth Parliament 3Utsaw SagarNo ratings yet

- Chapter 18 TestDocument4 pagesChapter 18 Testapi-327140658No ratings yet

- In Memory of Andrew McNaughtanDocument2 pagesIn Memory of Andrew McNaughtanJude ConwayNo ratings yet

- ToR Gender Sensitivity TrainingsDocument3 pagesToR Gender Sensitivity TrainingsDilg ConcepcionNo ratings yet