Professional Documents

Culture Documents

US Internal Revenue Service: fw4p - 1994

US Internal Revenue Service: fw4p - 1994

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: fw4p - 1994

US Internal Revenue Service: fw4p - 1994

Uploaded by

IRSCopyright:

Available Formats

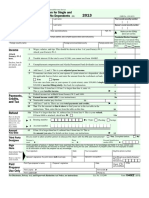

Department of the Treasury

Form W-4P Internal Revenue Service

What Is Form W-4P? This form is for What Do I Need To Do? If you want no tax When Should I File? File as soon as possible

recipients of income from annuity, pension, to be withheld, you can skip the worksheet to avoid underwithholding problems.

and certain other deferred compensation below and go directly to the form at the Multiple Pensions? More Than One

plans to tell payers whether income tax is to bottom of this page. Otherwise, complete Income? To figure the number of allowances

be withheld and on what basis. Your options lines A through F of the worksheet. Many you may claim, combine allowances and

depend on whether the payment is periodic recipients can stop at line F. income subject to withholding from all

or nonperiodic (including an eligible rollover Other Income? If you have a large amount of sources on one worksheet. You can file a

distribution) as explained on page 3. income from other sources not subject to Form W-4P with each pension payer, but do

You can use this form to choose to have withholding (such as interest, dividends, or not claim the same allowances more than

no income tax withheld from the payment taxable social security), you should consider once. Your withholding will usually be more

(except for eligible rollover distributions or making estimated tax payments using Form accurate if you claim all allowances on the

payments to U.S. citizens delivered outside 1040-ES, Estimated Tax for Individuals. Call Form W-4P for the largest source of income

the United States or its possessions) or to 1-800-829-3676 for copies of Form 1040-ES, subject to withholding.

have an additional amount of tax withheld. and Pub. 505, Tax Withholding and Estimated

Tax.

Personal Allowances Worksheet

A Enter “1” for yourself if no one else can claim you as a dependent A

$ %

● You are single and have only one pension; or

● You are married, have only one pension, and your

B Enter “1” if: spouse has no income subject to withholding; or B

● Your income from a second pension or a job, or your spouse’s

pension or wages (or the total of all) is $1,000 or less.

C Enter “1” for your spouse. You may choose to enter -0- if you are married and have either a spouse who has

income subject to withholding or you have more than one source of income subject to withholding. (This may help

you avoid having too little tax withheld.) C

D Enter number of dependents (other than your spouse or yourself) you will claim on your return D

E Enter “1” if you will file as a head of household on your tax return E

F Add lines A through E and enter total here © F

● If you plan to itemize or claim other deductions and want to reduce your withholding, use the

Deductions and Adjustments Worksheet on page 2.

For

● If you have more than one source of income subject to withholding or a spouse with income

accuracy,

subject to withholding AND your combined earnings from all sources exceed $30,000, ($50,000

do all

if married filing jointly), use the Multiple Pensions/More Than One Income Worksheet on page

worksheets

2 if you want to avoid having too little tax withheld.

that apply.

● If neither situation applies, stop here and enter the number from line F above on line 2 of Form

W-4P below.

Cut here and give the certificate to the payer of your pension or annuity. Keep the top portion for your records.

Form W-4P Withholding Certificate for OMB No. 1545-0415

Department of the Treasury

Pension or Annuity Payments

Internal Revenue Service

Type or print your full name Your social security number

Home address (number and street or rural route) Claim or identification number

(if any) of your pension or

annuity contract

City or town, state, and ZIP code

Complete the following applicable lines:

1 I elect not to have income tax withheld from my pension or annuity. (Do not complete lines 2 or 3.) ©

2 I want my withholding from each periodic pension or annuity payment to be figured using the number of allowances

and marital status shown. (You may also designate a dollar amount on line 3.) ©

(Enter number

Marital status: Single Married Married, but withhold at higher Single rate of allowances.)

3 I want the following additional amount withheld from each pension or annuity payment. Note: For periodic payments,

you cannot enter an amount here without entering the number (including zero) of allowances on line 2 © $

Your signature © Date ©

Cat. No. 10225T

Form W-4P (1994) Page 2

Deductions and Adjustments Worksheet

NOTE: Complete only if you plan to itemize deductions or claim adjustments to income on your 1994 tax retur n.

1. Enter an estimate of your 1994 itemized deductions. These include qualifying home mortgage interest, charitable

contributions, state and local taxes (but not sales taxes), medical expenses in excess of 7.5% of your income,

and miscellaneous deductions in excess of 2% of your income. (For 1994, you may have to reduce your itemized

deductions if your income is over $111,800 ($55,900 if married filing separately). Get Pub. 919 for details.) 1 $

$ %

$6,350 if married filing jointly or qualifying widow(er)

$5,600 if head of household 2 $

2. Enter:

$3,800 if single

$3,175 if married filing separately

3. Subtract line 2 from line 1. If line 2 is greater than line 1, enter -0- 3 $

4. Enter estimate of your 1994 adjustments to income. These include alimony paid and deductible IRA contributions 4 $

5. Add lines 3 and 4 and enter the total 5 $

6. Enter an estimate of your 1994 income not subject to withholding (such as dividends or interest income) 6 $

7. Subtract line 6 from line 5. Enter the result, but not less than zero 7 $

8. Divide the amount on line 7 by $2,500 and enter the result here. Drop any fraction 8

9. Enter the number from Personal Allowances Worksheet, line F, on page 1 9

10. Add lines 8 and 9 and enter the total here. If you plan to use the Multiple Pensions/More Than One

Income Worksheet, also enter this total on line 1 below. Otherwise stop here and enter this total on

Form W-4P, line 2, on page 1 10

Multiple Pensions/More Than One Income Worksheet

NOTE: Complete only if the instructions under line F on page 1 direct you here. This applies if you (and your

spouse if marr ied filing a joint return) have more than one source of income subject to withholding (such as

more than one pension, or a pension and a job, or you have a pension and your spouse works).

1. Enter the number from line F on page 1 (or from line 10 above if you used the Deductions and

Adjustments Worksheet) 1

2. Find the number in Table 1 below that applies to the LOWEST paying pension or job and enter it here 2

3. If line 1 is GREATER THAN OR EQUAL TO line 2, subtract line 2 from line 1. Enter the result here (if

zero, enter -0-) and on Form W-4P, line 2, page 1. Do not use the rest of this worksheet 3

4. If line 1 is LESS THAN line 2, enter -0- on Form W-4P, line 2, page 1, and enter the number from line

2 of this worksheet here 4

5. Enter the number from line 1 of this worksheet 5

6. Subtract line 5 from line 4 and enter the result here 6

7. Find the amount in Table 2 below that applies to the HIGHEST paying pension or job and enter it here 7 $

8. Multiply line 7 by line 6 and enter the result here 8 $

9. Divide line 8 by the number of pay periods in each year. (For example, divide by 12 if you are paid every

month.) Enter the result here and on Form W-4P, line 3, page 1. This is the additional amount to be

withheld from each payment 9 $

Table 1: Multiple Pensions/More Than One Income Worksheet

Married Filing Jointly All Others

If amounts from LOWEST Enter on If amounts from LOWEST Enter on If amounts from LOWEST Enter on

paying pension or job is— line 2 above paying pension or job is— line 2 above paying pension or job is— line 2 above

0 - $3,000 0 39,001 - 50,000 9 0 - $4,000 0

3,001 - 6,000 1 50,001 - 55,000 10 4,001 - 10,000 1

6,001 - 11,000 2 55,001 - 60,000 11 10,001 - 14,000 2

11,001 - 16,000 3 60,001 - 70,000 12 14,001 - 19,000 3

16,001 - 21,000 4 70,001 - 80,000 13 19,001 - 23,000 4

21,001 - 27,000 5 80,001 - 90,000 14 23,001 - 45,000 5

27,001 - 31,000 6 90,001 and over 15 45,001 - 60,000 6

31,001 - 34,000 7 60,001 - 70,000 7

34,001 - 39,000 8 70,001 and over 8

Table 2: Multiple Pensions/More Than One Income Worksheet

Married Filing Jointly All Others

If amounts from HIGHEST Enter on If amounts from HIGHEST Enter on

paying pension or job is— line 7 above paying pension or job is— line 7 above

0 - $ 50,000 $370 0 - $ 30,000 $370

50,001 - 100,000 690 30,001 - 60,000 690

100,001 - 130,000 760 60,001 - 110,000 760

130,001 - 220,000 880 110,001 - 220,000 880

220,001 and over 970 220,001 and over 970

Form W-4P (1994) Page 3

Paperwork Reduction Act Notice.—We Caution: There are penalties for not paying nonperiodic payment by filing Form W-4P

ask for the information on this form to enough tax during the year, either through with the payer and checking the box on

carry out the Internal Revenue laws of the withholding or estimated tax payments. line 1. Generally, your election to have no

United States. The Internal Revenue Code New retirees, especially, should see Pub. tax withheld will apply to any later payment

requires this information under sections 505. It explains the estimated tax from the same plan. You cannot use line 2

3405 and 6109 and their regulations. requirements and penalties in detail. You for nonperiodic payments. But you may

Failure to provide this information may may be able to avoid quarterly estimated use line 3 to specify that an additional

result in inaccurate withholding on your tax payments by having enough tax amount be withheld.

payment(s). withheld from your pension or annuity

The time needed to complete this form using Form W-4P. Exemption From Withholding—

will vary depending on individual Unless you tell your payer otherwise, tax Payments Outside the

circumstances. The estimated average time must be withheld on periodic payments as United States

is: if you are married and claiming three The election to be exempt from income tax

Recordkeeping 40 min. withholding allowances. This means that withholding does not apply to any periodic

Learning about the law or the tax will be withheld if your pension or payment or nonperiodic distribution that is

form 20 min. annuity is more than $1,141 a month delivered outside the United States or its

Preparing the form 38 min. ($13,700 a year). possessions to a U.S. citizen or resident

Copying, assembling, There are some kinds of periodic alien.

and sending the form 11 min. payments for which you cannot use Form Other recipients who have these

If you have comments concerning the W-4P since they are already defined as payments delivered outside the United

accuracy of these time estimates or wages subject to income tax withholding. States or its possessions can elect

suggestions for making this form more Retirement pay for service in the U.S. exemption only if an individual certifies to

simple, we would be happy to hear from Armed Forces generally falls into this the payer that the individual is not (1) a

you. You can write to both the Internal category. Certain nonqualified deferred U.S. citizen or resident alien or (2) an

Revenue Service, Attention: Reports compensation plans and state and local individual to whom section 877 of the

Clearance Officer, PC:FP, Washington, DC deferred compensation plans described in Internal Revenue Code applies (concerning

20224; and the Office of Management section 457 also fall into this category. expatriation to avoid tax). The certification

and Budget, Paperwork Reduction Project Your payer should be able to tell you must be made in a statement to the payer

(1545-0415), Washington, DC 20503. DO whether Form W-4P will apply. Social under the penalties of perjury. A

NOT send the tax form to either of these security payments are not subject to nonresident alien who elects exemption

offices. Instead, give it to your payer. withholding but may be includible in from withholding under section 3405 is

income. subject to withholding under section 1441.

For periodic payments, your certificate

Withholding From Pensions stays in effect until you change or revoke Revoking the Exemption From

and Annuities it. Your payer must notify you each year of Withholding

Generally, withholding applies to payments your right to elect to have no tax withheld If you want to revoke your previously filed

made from pension, profit-sharing, stock or to revoke your election. exemption from withholding for periodic

bonus, annuity, and certain deferred Nonperiodic payments will have income payments, file another Form W-4P with the

compensation plans; from individual tax withheld at a flat 10% rate unless the payer. If you want tax withheld at the rate

retirement arrangements (IRAs); and from payment is an eligible rollover distribution. set by law (married with three allowances),

commercial annuities. The method and rate You do not have the option of claiming write “Revoked” by the checkbox on line 1

of withholding depends on the kind of exemption from withholding for eligible of the form. If you want tax withheld at any

payment you receive. rollover distributions from qualified pension different rate, complete line 2 on the form.

Periodic payments from any plan above or annuity plans (e.g., 401(k) pension plans) If you want to revoke your previously

are treated as wages for the purpose of or tax-sheltered annuity plans. See Pub. filed exemption for nonperiodic payments,

withholding. A periodic payment is one that 505 for more details. Tax will be withheld write “Revoked” by the checkbox on line 1

is includible in your income for tax from an eligible rollover distribution at a flat and file Form W-4P with the payer.

purposes and that you receive in 20% rate, unless the entire distribution is

installments at regular intervals over a transferred by the plan administrator in a Statement of Income Tax

period of more than 1 full year from the direct rollover to an IRA or qualified Withheld From Your Pension or

starting date of the pension or annuity. The pension or tax-shelter annuity plan. Since Annuity

intervals can be annual, quarterly, monthly, you are no longer entitled to claim

etc. exemption from withholding on By January 31 of next year, you will

distributions from such plans, do not file receive a statement from your payer

You can change the amount of tax to be showing the total amount of your pension

Form W-4P with your plan administrator.

withheld by using lines 2 and 3 of Form or annuity payments and the total income

W-4P or to exempt the payments from Distributions from an IRA that are tax withheld during the year.

withholding by using line 1 of Form W-4P. payable on demand are treated as

This exemption from withholding does not nonperiodic payments. You can elect to

apply to certain recipients who have have no income tax withheld from a

payments delivered outside the United

States or its possessions. See Exemption

From Income Tax Withholding later.

Printed on recycled paper

You might also like

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Tratamentul Total Al CanceruluiDocument71 pagesTratamentul Total Al CanceruluiAntal98% (98)

- US Internal Revenue Service: fw4p - 1995Document3 pagesUS Internal Revenue Service: fw4p - 1995IRSNo ratings yet

- US Internal Revenue Service: fw4p - 1993Document3 pagesUS Internal Revenue Service: fw4p - 1993IRSNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocument4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocument4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSNo ratings yet

- US Internal Revenue Service: fw4p - 2003Document4 pagesUS Internal Revenue Service: fw4p - 2003IRSNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Document4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)imimranNo ratings yet

- US Internal Revenue Service: fw4p07 AccessibleDocument4 pagesUS Internal Revenue Service: fw4p07 AccessibleIRSNo ratings yet

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSNo ratings yet

- US Internal Revenue Service: fw4p - 2001Document4 pagesUS Internal Revenue Service: fw4p - 2001IRSNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Document4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)quylowNo ratings yet

- US Internal Revenue Service: fw4p - 2002Document4 pagesUS Internal Revenue Service: fw4p - 2002IRSNo ratings yet

- US Internal Revenue Service: fw4p - 2000Document4 pagesUS Internal Revenue Service: fw4p - 2000IRSNo ratings yet

- US Internal Revenue Service: fw4 - 1998Document2 pagesUS Internal Revenue Service: fw4 - 1998IRSNo ratings yet

- US Internal Revenue Service: fw4p 06Document4 pagesUS Internal Revenue Service: fw4p 06IRSNo ratings yet

- US Internal Revenue Service: fw4 - 1994Document2 pagesUS Internal Revenue Service: fw4 - 1994IRSNo ratings yet

- US Internal Revenue Service: fw4 - 1993Document2 pagesUS Internal Revenue Service: fw4 - 1993IRSNo ratings yet

- US Internal Revenue Service: fw4 - 2002Document2 pagesUS Internal Revenue Service: fw4 - 2002IRSNo ratings yet

- fw4 PDFDocument2 pagesfw4 PDFbikash PrajapatiNo ratings yet

- US Internal Revenue Service: fw4 - 1997Document2 pagesUS Internal Revenue Service: fw4 - 1997IRSNo ratings yet

- US Internal Revenue Service: fw4 - 2000Document2 pagesUS Internal Revenue Service: fw4 - 2000IRSNo ratings yet

- fw418510 0Document2 pagesfw418510 0ezra242100% (2)

- Form W-4 (2009) : Employee's Withholding Allowance CertificateDocument1 pageForm W-4 (2009) : Employee's Withholding Allowance Certificateezra242No ratings yet

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSNo ratings yet

- Form W-4 (2008) : Employee's Withholding Allowance CertificateDocument3 pagesForm W-4 (2008) : Employee's Withholding Allowance CertificatetarisadNo ratings yet

- fw46707 0Document2 pagesfw46707 0ezra242No ratings yet

- FW 4Document2 pagesFW 4Ana MartinezNo ratings yet

- US Internal Revenue Service: fw4s - 1998Document2 pagesUS Internal Revenue Service: fw4s - 1998IRSNo ratings yet

- Form 107Document1 pageForm 107api-509940248No ratings yet

- US Internal Revenue Service: fw4 - 1995Document2 pagesUS Internal Revenue Service: fw4 - 1995IRSNo ratings yet

- US Internal Revenue Service: fw4s - 1999Document2 pagesUS Internal Revenue Service: fw4s - 1999IRSNo ratings yet

- US Internal Revenue Service: fw4s - 2005Document2 pagesUS Internal Revenue Service: fw4s - 2005IRSNo ratings yet

- Payroll Setup ChecklistDocument4 pagesPayroll Setup ChecklistcaliechNo ratings yet

- Webcam For AdultDocument2 pagesWebcam For AdultDixieojmwwNo ratings yet

- Form W-4 (2013) : Employee's Withholding Allowance CertificateDocument2 pagesForm W-4 (2013) : Employee's Withholding Allowance Certificateapi-20374706No ratings yet

- Withholding Certificate For Pension or Annuity Payments: General InstructionsDocument6 pagesWithholding Certificate For Pension or Annuity Payments: General InstructionsАндрей КрайниковNo ratings yet

- US Internal Revenue Service: fw4s - 1994Document2 pagesUS Internal Revenue Service: fw4s - 1994IRSNo ratings yet

- US Internal Revenue Service: fw4s 06Document2 pagesUS Internal Revenue Service: fw4s 06IRSNo ratings yet

- F1040ez 2008Document2 pagesF1040ez 2008jonathandeauxNo ratings yet

- Income Tax Return For Single and Joint Filers With No DependentsDocument2 pagesIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNo ratings yet

- California DE-4Document4 pagesCalifornia DE-4Tuğrul SarıkayaNo ratings yet

- US Internal Revenue Service: fw4s - 1995Document2 pagesUS Internal Revenue Service: fw4s - 1995IRSNo ratings yet

- W4 SheetDocument2 pagesW4 Sheetnaru_vNo ratings yet

- Beta 1040 EzDocument2 pagesBeta 1040 EzLeonard RosentholNo ratings yet

- F1040ez PDFDocument2 pagesF1040ez PDFjc75aNo ratings yet

- Tax Form 2016Document2 pagesTax Form 2016Sharkman1234566100% (1)

- Monica L Lindo Tax FormDocument2 pagesMonica L Lindo Tax Formapi-299234513No ratings yet

- Employment Eligibility Verification: U.S. Citizenship and Immigration ServicesDocument2 pagesEmployment Eligibility Verification: U.S. Citizenship and Immigration ServicesAnonymous xnDtZ93LNo ratings yet

- De 4Document4 pagesDe 4fschalkNo ratings yet

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Document4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)ts0m3No ratings yet

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxNo ratings yet

- US Internal Revenue Service: F1040ez - 1992Document2 pagesUS Internal Revenue Service: F1040ez - 1992IRSNo ratings yet

- fw4v PDFDocument2 pagesfw4v PDFAnonymous KmCLdfNShbNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesFrom EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNo ratings yet

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryFrom EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- US Internal Revenue Service: 2290rulesty2007v4 0Document6 pagesUS Internal Revenue Service: 2290rulesty2007v4 0IRSNo ratings yet

- 2008 Objectives Report To Congress v2Document153 pages2008 Objectives Report To Congress v2IRSNo ratings yet

- 2008 Data DictionaryDocument260 pages2008 Data DictionaryIRSNo ratings yet

- 2008 Credit Card Bulk Provider RequirementsDocument112 pages2008 Credit Card Bulk Provider RequirementsIRSNo ratings yet

- 7.1 - en-US - 2022-04 - BRK - Flygt Basic Repair KitDocument52 pages7.1 - en-US - 2022-04 - BRK - Flygt Basic Repair KitFernando ChavesNo ratings yet

- Analisis Penggunaan Hedging Forward Contract Sebagai Upaya Perlindungan Atas Eksposur Transaksi (Pada PT Multibintang Indonesia Tahun 2015)Document9 pagesAnalisis Penggunaan Hedging Forward Contract Sebagai Upaya Perlindungan Atas Eksposur Transaksi (Pada PT Multibintang Indonesia Tahun 2015)dini sodexoNo ratings yet

- 4 5774074240839978028Document57 pages4 5774074240839978028Abera AsefaNo ratings yet

- Divided Wall Column 498Document3 pagesDivided Wall Column 498GeorgeNo ratings yet

- Introduction To Business Environment: Muhammad Shahmeer Hashmi BE-17-17Document18 pagesIntroduction To Business Environment: Muhammad Shahmeer Hashmi BE-17-17Usama vlogsNo ratings yet

- Intellectual CapitalDocument2 pagesIntellectual CapitalraprapNo ratings yet

- Eduardo Maldonado-Filho - Release and Tying Up of Productive Capital and The 'Transformation Problem'Document16 pagesEduardo Maldonado-Filho - Release and Tying Up of Productive Capital and The 'Transformation Problem'kmbence83No ratings yet

- Market Indices/ Stock IndexDocument2 pagesMarket Indices/ Stock IndexDipikaVermaniNo ratings yet

- Understanding GDP and GNP: A Comparative AnalysisDocument9 pagesUnderstanding GDP and GNP: A Comparative Analysisdeepti1734No ratings yet

- 660D14 Painting Schedule For Silo 1 - Rev 0Document1 page660D14 Painting Schedule For Silo 1 - Rev 0Mohammad AdilNo ratings yet

- FA-10-01 Accounts For November 2009Document17 pagesFA-10-01 Accounts For November 2009uncleadolphNo ratings yet

- Fail-Ajay Sagathiya-Marksheet - A061800401Document2 pagesFail-Ajay Sagathiya-Marksheet - A061800401anushNo ratings yet

- Who Acts For The Top FTSE Companies?Document33 pagesWho Acts For The Top FTSE Companies?lifeinthemixNo ratings yet

- Chapter-Four 4. Security Analysis Fundamental and Technical AnalysisDocument23 pagesChapter-Four 4. Security Analysis Fundamental and Technical AnalysisTedros BelaynehNo ratings yet

- Journal of Balkan and Near Eastern Studies (JBNES) Call For PapersDocument2 pagesJournal of Balkan and Near Eastern Studies (JBNES) Call For PapersPlakoudas SpyrosNo ratings yet

- Kampar Creditor Update 31.07.2021Document5,271 pagesKampar Creditor Update 31.07.2021gracious pharmacy 2No ratings yet

- WallercountytaxresaleDocument2 pagesWallercountytaxresaleseaharriorNo ratings yet

- Tutorial 6 - 10Document8 pagesTutorial 6 - 10Mindy Mayda JohnNo ratings yet

- Power Sector MCQ PartDocument40 pagesPower Sector MCQ PartHossainNo ratings yet

- The Political Environment: A Critical ConcernDocument42 pagesThe Political Environment: A Critical ConcernabraamNo ratings yet

- دور الإعذار في التحصيل الجبري لاشتراكات الضّمان الاجتماعي في التشريع الجزائريDocument13 pagesدور الإعذار في التحصيل الجبري لاشتراكات الضّمان الاجتماعي في التشريع الجزائريToufik BenaiadNo ratings yet

- George Morris: Population Pressure: A Factor of Political Destabilization Tallon F. Fam Dev. 1993Document4 pagesGeorge Morris: Population Pressure: A Factor of Political Destabilization Tallon F. Fam Dev. 1993taylor swiftieNo ratings yet

- Future Group - WikipediaDocument5 pagesFuture Group - WikipediaRakesh HaldarNo ratings yet

- Jacobin 31Document117 pagesJacobin 31AndrewReyes100% (1)

- ITI CountDocument4 pagesITI CountMarimuthuNo ratings yet

- How To Calculate A Settlement in A Workman's Compensation Injury?Document3 pagesHow To Calculate A Settlement in A Workman's Compensation Injury?Jagjeet SinghNo ratings yet

- Report of Receipts and Disbursements: FEC Form 3Document371 pagesReport of Receipts and Disbursements: FEC Form 3Daniel StraussNo ratings yet

- Salarios Policia Quiebra - Denegacion Levantamiento Stay Fupo ConapolDocument7 pagesSalarios Policia Quiebra - Denegacion Levantamiento Stay Fupo ConapolEmily RamosNo ratings yet

- Return To The Energy and Resources InstituteDocument5 pagesReturn To The Energy and Resources InstitutevijisignhNo ratings yet

- The Impact of Population Growth On Economic Development of Barangay Purisima, Tago, Surigao Del SurDocument27 pagesThe Impact of Population Growth On Economic Development of Barangay Purisima, Tago, Surigao Del SurTrisha SimbolasNo ratings yet