Professional Documents

Culture Documents

Turkey: Negative Surprise in July Industrial Production

Turkey: Negative Surprise in July Industrial Production

Uploaded by

Ali KalemOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Turkey: Negative Surprise in July Industrial Production

Turkey: Negative Surprise in July Industrial Production

Uploaded by

Ali KalemCopyright:

Available Formats

Turkey: Negative surprise in July industrial production

Ali Batuhan Barlas / Adem Ileri / Berk Orkun Isa / Seda Guler Mert / Yesim Ugurlu Solaz

13 Septem ber 2021

Industrial Production (IP) grew remarkably lower than expectations by 8.7% yoy in calendar adjusted terms

(vs. 15.2% consensus) in July, whereas it contracted by 2.3% yoy in raw series. The month-on-month figure

also implied a large negative contraction of 4.2%, showing weaknesses across-the-board but especiall y i n

capital goods production. Our Big Data demand proxies and other high frequency indicators have

maintained a recovery in recent months, being contrary to today’s IP figure, which signals further depletion

of inventories in certain sectors especially in need of intermediary goods. August data might shed light on

the continuation of this trend but domestic demand remains on track and exports keep imp roving, which is

confirmed by our monthly GDP indicator nowcasting a mild positive quarterly growth rate for 3Q. Although

positive base effects fade away 3Q onwards and today’s data surprised on the downside, we keep our 2021

GDP growth forecast at 9%, given the strong momentum so far and still recovering global growth.

IP recorded the strongest monthly contraction since the start of pandemic

IP contracted by 4.2% mom in July and surprised on the downside after growing by +2.2% mom the month before.

The worsening was broad-based, led by all main subsectors except for the energy goods production (+2.7% mom).

Consumer goods (durable & non-durable -7.2% & -1.2% mom, respectively), capital goods (-11.6% mom) and

intermediate goods production (-3.5% mom) all contracted. In sectoral detail, most of the sectors subtrac ted from

the overall growth, where other transport equipment (-37.2%), rubber & plastic (-10.4%), motor vehic les (-7. 2% ),

electrical equipment (-10.1%) and textile production (-5.2%) were the pioneers in negative contribution. Contrary t o

the previous months when weakening exporting sectors production was compensated by still strong domestic

demand oriented sectors, this month both displayed deteriorations. Therefore, despite the continuat ion of s t rong

demand from both domestically and abroad, negative July IP surprise might have signaled further stock deplet ion

as we already observed in the previous quarters. Our big data indicators, manufacturing PMI (Aug: 54.1), capacit y

utilization rate rising to 76.8% in August and still solid electricity production all indicate the maintenance of the

recovery pattern. Though, July IP’s downward surprise leads us to be cautious on the upcoming August IP figure,

where the compensation of the other sectors will also be critical to understand the overall momentum in 3Q.

Figure 1. Activity Indicators Figure 2. Garanti BBVA Research Monthly GDP Indicator

(%yoy, 3M Moving Avg.) (%yoy, 3-month moving avg.)

2021 30%

July : 14.6% (100% of inf.)

Mean Jan Feb Mar Apr May Jun Jul Aug Sep 26% Aug: 10.6% (52% of inf.)

Industrial Production 6.5 9.6 8.7 11.3 26.6 38.9 40.4 18.2

22% Sep: 8.1% (33% of inf.)

Non-metal Mineral Production 4.7 24.0 23.8 22.3 32.5 43.1 43.1 22.4

Electricity Production 4.2 5.9 3.8 7.0 16.7 26.2 26.8 18.9 16.5 13.7 18%

Auto Sales 2.8 30.7 26.2 60.5 76.8 98.1 54.0 -2.6 -14.3

Auto Imports 4.1 23.2 23.6 58.5 64.9 88.7 57.9 3.9 -11.0

14%

Auto Exports 7.7 -12.0 -13.0 -5.5 32.8 62.5 59.3 -10.5 6.2 10%

Number of Employed 3.2 -3.3 -1.4 2.6 6.3 9.2 9.8 8.7

6%

Number of Unemployed 4.8 -6.7 -3.3 2.1 8.1 8.9 0.6 -8.0

Real Sector Confidence 105.6 107.0 109.3 110.8 111.0 110.3 113.0 114.8 113.9 2%

Manufacturing PMI 50.9 54.4 51.7 52.6 50.4 49.3 51.3 54.0 54.1

-2%

Total Loans growth 13-week 17.4 3.0 3.0 9.3 12.2 6.8 6.5 7.8 12.3 11.5

-6%

Garanti BBVA BigData Cons. 4.0 -1.6 -3.5 3.7 19.7 29.0 30.3 21.4 19.1 17.7

Garanti BBVA BigData Invest. 3.0 10.5 10.7 14.3 20.2 28.4 28.3 19.2 8.1 4.1 -10%

GDP Nowcasting Results YoY 14.6% 10.6% 8.1% -14%

Mar-18

Mar-19

Mar-20

Mar-21

Jun-17

Jun-18

Jun-19

Jun-20

Jun-21

Dec-17

Dec-18

Dec-19

Dec-20

Sep-17

Sep-18

Sep-19

Sep-20

Sep-21

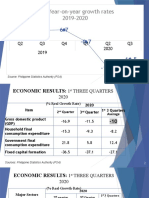

GDP YoY 7.2% 21.7%

Contraction Slow-down Growth Boom

Source: Garanti BBVA Research, Turkstat *Garanti BBVA Research monthly GDP is dynamic factor model (DFM) synthesizing high-

frequency indicators to proxy monthly GDP (GBTRGDPY Index in BBG)

Downside surprise of July IP might be temporary, given the strong demand

July’s weaker than expected IP could have stemmed from supply shortages, deepening cost-push factors and side

effects of the long religious holiday. As our nowcast indicates, still growing domestic demand and s t rong ex port s

might result in a mild positive quarterly growth rate in 3Q. We expect 2021 GDP growth to be 9%, with risks still on

the upside; though today’s data might partially eliminate those risks, which will be clearer with August data.

Tur key Activity Pulse / September 13, 2021 1

Figure 3. BBVA Big Data Dom estic Dem and Indicators Figure 4. BBVA Big Data Consum ption Indicators

(28-day sum, nominal, YoY) (28-day sum, nominal, YoY)

125% 140%

105% 120%

100%

85%

80%

65% 60%

45% 40%

25% 20%

0%

5%

-20%

-15%

-40%

-35% -60%

23-Feb-21

10-Mar-20

20-Mar-21

18-Jun-20

29-Jan-21

28-Jun-21

13-Jul-20

23-Jul-21

3-Jun-21

4-Jan-21

29-Apr-20

14-Apr-21

24-May-20

15-Nov-20

26-Sep-20

10-Dec-20

17-Aug-21

11-Sep-21

21-Oct-20

4-Apr-20

7-Aug-20

9-May-21

1-Sep-20

20-Mar-21

10-Mar-20

23-Feb-21

18-Jun-20

29-Jan-21

28-Jun-21

13-Jul-20

23-Jul-21

3-Jun-21

4-Jan-21

9-May-21

24-May-20

15-Nov-20

10-Dec-20

26-Sep-20

17-Aug-21

11-Sep-21

14-Apr-21

29-Apr-20

21-Oct-20

7-Aug-20

1-Sep-20

4-Apr-20

Consumption Investment Goods Services

Source: Garanti BBVA Research, Turkstat Source: Garanti BBVA Research, Turkstat

Figure 5. BBVA Big Data Investm ent Indicators Figure 6. BBVA Monthly Consum ption Now cast

(28-day sum, nominal, YoY) (3m yoy)

160%

28% Jun: 22.9%

140% Jul: 13.7% (100% of inf.)

24% Aug: 7.9% (33% of inf.)

120%

20%

100%

80% 16%

60% 12%

40% 8%

20% 4%

0%

0%

-20%

-4% BBVA-GB Cons Growth (Monthly)

-40%

Cons. Growth

24-Feb-21

30-Jan-21

29-Jun-21

19-Jun-20

11-Mar-20

21-Mar-21

24-Jul-21

14-Jul-20

5-Jan-21

4-Jun-21

22-Oct-20

25-May-20

10-May-21

27-Sep-20

18-Aug-21

16-Nov-20

11-Dec-20

12-Sep-21

30-Apr-20

15-Apr-21

2-Sep-20

8-Aug-20

5-Apr-20

-8%

Cons. Growth Nowcast

-12%

Feb-18

Feb-19

Feb-20

Feb-21

Nov-17

Nov-18

Nov-19

Nov-20

May-18

May-19

May-20

May-21

Aug-17

Aug-18

Aug-19

Aug-20

Aug-21

Machinery Construction

Source: Garanti BBVA Research, Turkstat Source: BBVA Research Turkey, GBTRCGDPY Index in Bloomberg

Figure 7. BBVA Monthly Investm ent Now cast (3m yoy) Figure 8. BBVA Monthly Net Exports Now cast (cont. pp)

Hundreds

Hundreds

40% Jun: 20.3% 9% June: 6.9%

Jul: 12.1% (100% of inf.) July: 5.4%

Aug: -0.3% (57% of inf.) Aug: 5.2%

30% 6%

20% 3%

10% 0%

0% -3%

-10% -6%

-20% BBVA-GB Inv . Growth (Monthly) -9% BBVA-GB Net Exp Contribution (Monthly)

Inv . Growth Net Exp. Contribution

-30% Inv . Growth Nowcast -12% Net Exp. Contribution Nowcast

Feb-18

Feb-19

Feb-20

Feb-21

Feb-21

Feb-18

Feb-19

Feb-20

May-21

Nov-17

May-18

Nov-18

May-19

Aug-19

Nov-19

May-20

Aug-20

Aug-21

Aug-17

Aug-18

Nov-20

Aug-17

Aug-18

May-19

Aug-19

May-20

May-21

May-18

Nov-17

Nov-18

Nov-19

Aug-20

Nov-20

Aug-21

Source: BBVA Research Turkey, GBTRIGDPY Index in Bloomberg Source: BBVA Research Turkey, GBTRXGDPY and GBTRMGDPY in

Bloomberg

Tur key Activity Pulse / September 13, 2021 2

DISCLAIMER

This document has been prepared by BBVA Research Department. It is provided for information purposes only and expresses

data, opinions or estimations regarding the date of issue of the report, prepared by BBVA or obtained from or based on sources

w e consider to be reliable, and have not been independently verified by BBVA. Therefore, BBVA offers no w arranty, either

express or implicit, regarding its accuracy, integrity or correctness.

Any estimations this document may contain have been undertaken according to generally accepted methodologies and should

be considered as forecasts or projections. Results obtained in the past, either positive or negative, are no guarantee of future

performance.

This document and its contents are subject to changes w ithout prior notice depending on variables such as the economic

context or market fluctuations. BBVA is not responsible for updating thes e contents or for giving notice of such changes.

BBVA accepts no liability for any loss, direct or indirect, that may result from the use of this document or its contents.

This document and its contents do not constitute an offer, invitation or solicitation to purchase, divest or enter into any interest in

financial assets or instruments. Neither shall this document nor its contents form the basis of any contract, commitment or

decision of any kind.

With regard to investment in financial assets related to economic variables this document may cover, readers should be aw are

that under no circumstances should they base their investment decisions on the information contained in this document. Those

persons or entities offering investment products to these potential investors are legally required to provide the information

needed for them to take an appropriate investment decision.

The content of this document is protected by intellectual property law s. Reproduction, transformation, distribution, public

communication, making available, extraction, reuse, forw arding or use of any nature by any means or process is prohibited,

except in cases w here it is legally permitted or expressly authorised by BBVA.

ENQUIRIES TO:

Garanti BANKASI A.Ş. Nispetiye Mah. Aytar Cad. No:2 34340 Levent Beşiktaş İstanbul.

Tel.: +90 212 318 18 18 (ext 1064)

bbvaresearch@bbva.com www.bbvaresearch.com

You might also like

- Mckinsey Presentation On Managing The DownturnDocument16 pagesMckinsey Presentation On Managing The DownturnRehan FariasNo ratings yet

- Bulletin - CPI December 2021.Document11 pagesBulletin - CPI December 2021.kingsleyNo ratings yet

- August 2021 August 2021: Bank of Tanzania Bank of TanzaniaDocument30 pagesAugust 2021 August 2021: Bank of Tanzania Bank of TanzaniaArden Muhumuza KitomariNo ratings yet

- Monthly Chartbook 6 Jan 23Document53 pagesMonthly Chartbook 6 Jan 23avinash sharmaNo ratings yet

- SP 500 Eps EstDocument65 pagesSP 500 Eps EsteoaffxNo ratings yet

- TV Ad Volumes Insights:: The Mid-Year AnalysisDocument13 pagesTV Ad Volumes Insights:: The Mid-Year AnalysisNishtha ChaurasiaNo ratings yet

- India TV Ad Volumes Insights - The Mid-Year Analysis 2021Document13 pagesIndia TV Ad Volumes Insights - The Mid-Year Analysis 2021Poornima Shettigar UpletawalaNo ratings yet

- CS Lviii 33 19082023Document2 pagesCS Lviii 33 19082023ram917722No ratings yet

- Blemishing GDP Quarterly ResultsDocument4 pagesBlemishing GDP Quarterly ResultsCritiNo ratings yet

- Indian Economy Website Sep 3 2019Document1 pageIndian Economy Website Sep 3 2019nipun sharmaNo ratings yet

- MER February 2022Document29 pagesMER February 2022Arden Muhumuza KitomariNo ratings yet

- US-China Trade War Tariffs: An Up-to-Date Chart: Updated On December 19, 2019Document1 pageUS-China Trade War Tariffs: An Up-to-Date Chart: Updated On December 19, 2019Asha Si AchaNo ratings yet

- NBFC Tracker 2023Document10 pagesNBFC Tracker 2023jigihereNo ratings yet

- Naukri Jobspeak: Hiring Trends by City, Industry, Functional Area and ExperienceDocument10 pagesNaukri Jobspeak: Hiring Trends by City, Industry, Functional Area and ExperienceMeMyKTNo ratings yet

- Bank of Tanzania: AaaaaDocument30 pagesBank of Tanzania: AaaaaaureliaNo ratings yet

- CRFB The Fiscal Outlook After The Debt Limit DealDocument31 pagesCRFB The Fiscal Outlook After The Debt Limit DealjordanNo ratings yet

- Economic Highlights - Vietnam: Economic Data Showing Signs of Weakness in July - 30/07/2010Document4 pagesEconomic Highlights - Vietnam: Economic Data Showing Signs of Weakness in July - 30/07/2010Rhb InvestNo ratings yet

- Economy: IndiaDocument8 pagesEconomy: IndiaRavichandra BNo ratings yet

- Economic Highlights - Vietnam: Economic Activities Held Up Relatively Well in September - 29/09/2010Document4 pagesEconomic Highlights - Vietnam: Economic Activities Held Up Relatively Well in September - 29/09/2010Rhb InvestNo ratings yet

- July 2021 MerDocument32 pagesJuly 2021 MerArden Muhumuza KitomariNo ratings yet

- China - Should We Worry About The Falling FDIDocument8 pagesChina - Should We Worry About The Falling FDISumanth GururajNo ratings yet

- State Budget Analysis KA 2020-21 FinalDocument7 pagesState Budget Analysis KA 2020-21 Finalmohdahmed12345No ratings yet

- IEP Presentation June 2023 MacroDocument15 pagesIEP Presentation June 2023 MacroBona Christanto SiahaanNo ratings yet

- MOLS Ecoscpe 3 Jan 2019Document8 pagesMOLS Ecoscpe 3 Jan 2019rchawdhry123No ratings yet

- Argentina Economy - GDP, Inflation, CPI and Interest Rate PDFDocument3 pagesArgentina Economy - GDP, Inflation, CPI and Interest Rate PDFRoberto ManNo ratings yet

- Bank of Tanzania: AaaaaDocument33 pagesBank of Tanzania: AaaaaWilliam MuhomiNo ratings yet

- Indian Economy - Website - Aug 9 2022Document1 pageIndian Economy - Website - Aug 9 2022vinay jodNo ratings yet

- CS Lviii 24 17062023Document3 pagesCS Lviii 24 17062023leo lokeshNo ratings yet

- Fs Idxindust Per 2022 03Document3 pagesFs Idxindust Per 2022 03Rizki FebariNo ratings yet

- ETF Newsletter - February - 23Document20 pagesETF Newsletter - February - 23Chuck CookNo ratings yet

- The Richest 20 Percent Facing More Inflation Than The Poorest 20 PercentDocument4 pagesThe Richest 20 Percent Facing More Inflation Than The Poorest 20 PercentUttiya RoyNo ratings yet

- Macroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate HikeDocument5 pagesMacroscope: Nov18 Trade Result Could Trigger (Another) Front-Loaded Rate HikeKurnia NindyoNo ratings yet

- IIFL - D-Mart - FY22 AR Analysis - 20220727Document15 pagesIIFL - D-Mart - FY22 AR Analysis - 20220727Bhav Bhagwan HaiNo ratings yet

- LFS202020 Employed - 02dec2020 - Final1Document1 pageLFS202020 Employed - 02dec2020 - Final1alvin.requieroNo ratings yet

- Arrow - Dry Bulk Outlook - Apr-20Document22 pagesArrow - Dry Bulk Outlook - Apr-20Sahil FarazNo ratings yet

- NAMC Food Price Monitor May 2023Document16 pagesNAMC Food Price Monitor May 2023xolaneNo ratings yet

- Economic Outlook - July 2020Document8 pagesEconomic Outlook - July 2020KaraNo ratings yet

- Us China Trade War TariffsDocument11 pagesUs China Trade War TariffsazmykiranovaaNo ratings yet

- Economic - 200709 - May IPI - ADBSDocument4 pagesEconomic - 200709 - May IPI - ADBSAhmadZulkhairiNo ratings yet

- India International Trade Investment Website June 2022Document18 pagesIndia International Trade Investment Website June 2022vinay jodNo ratings yet

- Real GDPTracking SlidesDocument5 pagesReal GDPTracking SlidesmbidNo ratings yet

- Pick of The Week Ongc LTDDocument4 pagesPick of The Week Ongc LTDAnkit JagetiaNo ratings yet

- Summary of Economic and Financial Data May 2023Document16 pagesSummary of Economic and Financial Data May 2023Asare AmoabengNo ratings yet

- Sinking Deeper: Lockdowns and Restrictions Have Hit Harder Than ExpectedDocument6 pagesSinking Deeper: Lockdowns and Restrictions Have Hit Harder Than Expectedabhinavsingh4uNo ratings yet

- Macroeconomic Update 2020Document22 pagesMacroeconomic Update 2020Fuhad AhmedNo ratings yet

- 202003261100349638864web Final Industry Consumption Report February 2020 PDFDocument17 pages202003261100349638864web Final Industry Consumption Report February 2020 PDFpraful s.gNo ratings yet

- Talk Shop Asia - As of 24 Nov 2020Document9 pagesTalk Shop Asia - As of 24 Nov 2020Jonathan AguilarNo ratings yet

- Q4 Fy21 GDPDocument7 pagesQ4 Fy21 GDPsksaha1976No ratings yet

- Nomura - India InsuranceDocument10 pagesNomura - India Insuranceudhaya kumarNo ratings yet

- Africa Day Presentation VDefDocument30 pagesAfrica Day Presentation VDefBernard BiboumNo ratings yet

- TDRIDocument26 pagesTDRIChatis HerabutNo ratings yet

- Section 1 General Economic and Financial OutlookDocument8 pagesSection 1 General Economic and Financial OutlookMicheal SamaanNo ratings yet

- Monthly Economic Review - Jun 2022Document30 pagesMonthly Economic Review - Jun 2022Dan FordNo ratings yet

- JPM Retail Trading Radar - Dec 8 2022Document26 pagesJPM Retail Trading Radar - Dec 8 2022LuanNo ratings yet

- Comprehensive Report On Indian Metal Cutting Machine Tool Industry - 2019Document73 pagesComprehensive Report On Indian Metal Cutting Machine Tool Industry - 2019Dr-Prashanth GowdaNo ratings yet

- The Macroeconomic and Social Impact of COVID-19 in Ethiopia and Suggested Directions For Policy ResponseDocument51 pagesThe Macroeconomic and Social Impact of COVID-19 in Ethiopia and Suggested Directions For Policy ResponseGetachew HussenNo ratings yet

- Monthly Economic Review - Jan 2021Document32 pagesMonthly Economic Review - Jan 2021Carl RossNo ratings yet

- Revision Notes On Economy of J&K by Vidhya Tutorials.Document7 pagesRevision Notes On Economy of J&K by Vidhya Tutorials.MuzaFar100% (1)

- ReQ Real Estate Quarterly HighlightsDocument8 pagesReQ Real Estate Quarterly HighlightsVaibhav RaghuvanshiNo ratings yet

- Technological Innovation for Agricultural Statistics: Special Supplement to Key Indicators for Asia and the Pacific 2018From EverandTechnological Innovation for Agricultural Statistics: Special Supplement to Key Indicators for Asia and the Pacific 2018No ratings yet

- Infostat: Data Collection PlatformDocument40 pagesInfostat: Data Collection PlatformAli KalemNo ratings yet

- VA21P033V01 Researcher IP2 IKAM PRS ViennaDocument4 pagesVA21P033V01 Researcher IP2 IKAM PRS ViennaAli KalemNo ratings yet

- VA21P133V01 - Job - Profile - Project - Manager (Irregular Migration and Return) - LP3 - WBTR - AnkaraDocument5 pagesVA21P133V01 - Job - Profile - Project - Manager (Irregular Migration and Return) - LP3 - WBTR - AnkaraAli KalemNo ratings yet

- ICMPD Job Profile Project Manager (IBM4TR) : Organisational SettingDocument4 pagesICMPD Job Profile Project Manager (IBM4TR) : Organisational SettingAli KalemNo ratings yet

- VA21P138V01 Job Profile Project Officer (IBM4TR) LP2 WBTR AnkaraDocument3 pagesVA21P138V01 Job Profile Project Officer (IBM4TR) LP2 WBTR AnkaraAli KalemNo ratings yet

- UnemploymentDocument7 pagesUnemploymentAli KalemNo ratings yet

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaNo ratings yet

- Unit Iii Consumption FunctionDocument16 pagesUnit Iii Consumption FunctionMaster 003No ratings yet

- c4g The Impact of Covid 19 On African Smmes Operations OnlineDocument20 pagesc4g The Impact of Covid 19 On African Smmes Operations OnlineOlerato MothibediNo ratings yet

- P6-18 Unrealized Profit On Upstream SalesDocument4 pagesP6-18 Unrealized Profit On Upstream Salesw3n123No ratings yet

- Module 4 - Commodities Derivatives TradingDocument71 pagesModule 4 - Commodities Derivatives TradingLMT indiaNo ratings yet

- Il&fs FraudDocument10 pagesIl&fs FraudkrupaNo ratings yet

- Standard Ceramic Dividend PolicyDocument23 pagesStandard Ceramic Dividend PolicyEmon HossainNo ratings yet

- 7 - Exotic OptionsDocument39 pages7 - Exotic OptionsAman Kumar SharanNo ratings yet

- Cboec e 2021 02297Document3 pagesCboec e 2021 02297RatanaRoulNo ratings yet

- Analysis of The Courier Industry DTDCDocument31 pagesAnalysis of The Courier Industry DTDCMrinalini NagNo ratings yet

- Financial Economics Bocconi Lecture5Document20 pagesFinancial Economics Bocconi Lecture5Elisa CarnevaleNo ratings yet

- Make-Up & Beauty Salon: Guruji EnterprisesDocument1 pageMake-Up & Beauty Salon: Guruji EnterprisesAMITNo ratings yet

- Kế Hoạch Học PMPDocument4 pagesKế Hoạch Học PMPKhacNam NguyễnNo ratings yet

- AMEX - Glossary (ENG-SPA) - 1686735355Document8 pagesAMEX - Glossary (ENG-SPA) - 1686735355RAUL RAMIREZNo ratings yet

- Six Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionDocument5 pagesSix Sigma: High Quality Can Lower Costs and Raise Customer SatisfactionsukhpreetbachhalNo ratings yet

- International Marketing Project ReportDocument85 pagesInternational Marketing Project ReportMohit AgarwalNo ratings yet

- Quiz Box 2 - QuestionnairesDocument13 pagesQuiz Box 2 - QuestionnairesCamila Mae AlduezaNo ratings yet

- Last Writing1Document2 pagesLast Writing11997elyasinNo ratings yet

- Mitrank Final Research ReportDocument71 pagesMitrank Final Research ReportMitrank ShuklaNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/11/2020MaayaBimbamNo ratings yet

- Southern Innovator Magazine From 2011 To 2012: A Compilation of Documents From The Magazine's Early YearsDocument25 pagesSouthern Innovator Magazine From 2011 To 2012: A Compilation of Documents From The Magazine's Early YearsDavid SouthNo ratings yet

- Green HR Management (Chat GPT)Document2 pagesGreen HR Management (Chat GPT)esa arimbawaNo ratings yet

- Session1 Problem SetDocument1 pageSession1 Problem SetPattyNo ratings yet

- Kieni Dairy Brief Company Profile 2023Document2 pagesKieni Dairy Brief Company Profile 2023Solomon MainaNo ratings yet

- Connectivity Within Agricultural Supply ChainsDocument5 pagesConnectivity Within Agricultural Supply ChainsadelabdelaalNo ratings yet

- Tailoring UnitDocument8 pagesTailoring UnitSuresh sureshNo ratings yet

- BEST ICHIMOKU STRATEGY For QUICK PROFITS For BITFINEX - BTCUSD by Tradingstrategyguides - TradingViewDocument3 pagesBEST ICHIMOKU STRATEGY For QUICK PROFITS For BITFINEX - BTCUSD by Tradingstrategyguides - TradingViewhenrykayode40% (2)

- Bamboo Value Chain Story of Himalica Myanmar and Future Perspectives by DR Wah Wah HtunDocument17 pagesBamboo Value Chain Story of Himalica Myanmar and Future Perspectives by DR Wah Wah HtunAyeChan AungNo ratings yet

- International Journal of Research in Management & Social Science Volume 3, Issue 2 (II) April To June 2015 ISSN: 2322-0899Document111 pagesInternational Journal of Research in Management & Social Science Volume 3, Issue 2 (II) April To June 2015 ISSN: 2322-0899empyrealNo ratings yet

- Eurekahedge Asian Hedge Fund Awards 2010: WinnersDocument9 pagesEurekahedge Asian Hedge Fund Awards 2010: WinnersEurekahedgeNo ratings yet