Professional Documents

Culture Documents

Concept Map EC

Concept Map EC

Uploaded by

kat kale0 ratings0% found this document useful (0 votes)

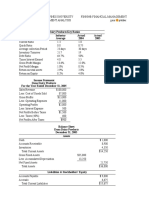

116 views2 pagesThis document provides a conceptual map of the expenditure and disbursement cycle. It outlines the key accounting standards, initial recognition, subsequent measurement, impairment, derecognition, financial statement assertions, risks, internal controls, and appropriate audit procedures for four main accounts: inventory, current liabilities, non-current liabilities, and expenses. The map shows the relationships between these accounts and how they are treated at different stages of the expenditure and disbursement process according to relevant accounting principles.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a conceptual map of the expenditure and disbursement cycle. It outlines the key accounting standards, initial recognition, subsequent measurement, impairment, derecognition, financial statement assertions, risks, internal controls, and appropriate audit procedures for four main accounts: inventory, current liabilities, non-current liabilities, and expenses. The map shows the relationships between these accounts and how they are treated at different stages of the expenditure and disbursement process according to relevant accounting principles.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

116 views2 pagesConcept Map EC

Concept Map EC

Uploaded by

kat kaleThis document provides a conceptual map of the expenditure and disbursement cycle. It outlines the key accounting standards, initial recognition, subsequent measurement, impairment, derecognition, financial statement assertions, risks, internal controls, and appropriate audit procedures for four main accounts: inventory, current liabilities, non-current liabilities, and expenses. The map shows the relationships between these accounts and how they are treated at different stages of the expenditure and disbursement process according to relevant accounting principles.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Concept Maps of Expenditure and Disbursement Cycle

Account Inventory Current Non-Current Expenses

Liabilities Liabilities

Standard(s) PAS 2 PAS 37 PAS 32,39, P Various

FRS 7,9

Initial Costs plus Invoice amount Amortized cost Period when

Recognition taxes, transport, and Best estimate (effective interest revenues to which

handling, net of trade method) they relate are

discounts received recognized

Cost on conversation Cause and Effect

Other costs incurred Systematic

in bringing the Allocation

inventories to their Immediate

present location and

condition

Subsequent Lower of cost and net None None

Measurement realizable value

(NRV)

Impairment When the sales price None None

moves below the

inventory at purchase

price, you have an

impairment.

Derecognition Sold Paid or settled Paid or settled

Obsolescence

Exchanged

FS Assertions Existence, Rights and Completeness, Completeness, Existence, Rights and

– Balances Obligations, Presentation and Presentation and Obligations,

Completeness and Disclosure and Disclosure and Completeness and

Valuation Valuation Valuation Valuation

FS Assertions Occurrence, Completeness, Completeness, Occurrence,

- Transactions Completeness, Accuracy, Cut-off and Accuracy, Cut-off and Completeness,

Accuracy, Cut-off and Classification Classification Accuracy, Cut-off and

Classification Classification

Risk and Loss, theft, damage, Understatement or

Threats and unreliable omitting of debt

suppliers. Wrong classification

of debt i.e. non-

current liabilities

recorded as current

as on the balance

sheet date.

Internal Protect its assets

Controls that against theft and

should be in waste.

place Ensure compliance

with company policies

and federal law.

Evaluate the

performance of all

personnel to promote

efficient operations.

Ensure accurate and

reliable operating

data and accounting

reports.

Appropriate

Audit

Procedures

You might also like

- Kieso17e ch13 Solutions ManualDocument89 pagesKieso17e ch13 Solutions ManualMoheeb HaddadNo ratings yet

- Audit of Cash - Exercise 2 (Solution)Document5 pagesAudit of Cash - Exercise 2 (Solution)Gazelle Calma100% (1)

- Audit AssertionsDocument3 pagesAudit Assertionsdarknessmind50% (2)

- BFC5935 - Sample Exam PDFDocument5 pagesBFC5935 - Sample Exam PDFXue XuNo ratings yet

- Ias 16 - Property, Plant and Equipment: Compiled By: Murtaza QuaidDocument8 pagesIas 16 - Property, Plant and Equipment: Compiled By: Murtaza QuaidFalak FaizNo ratings yet

- Company Resolutions, Notices, Meetings & Minutes All-In-OneDocument1,850 pagesCompany Resolutions, Notices, Meetings & Minutes All-In-OnekomalNo ratings yet

- Audit Procedure For LIABILITIESDocument2 pagesAudit Procedure For LIABILITIESDana67% (3)

- 2020 - Audcap1 - 2.3 RCCM - BunagDocument1 page2020 - Audcap1 - 2.3 RCCM - BunagSherilyn BunagNo ratings yet

- Risk Based Audit ATLASDocument41 pagesRisk Based Audit ATLASVivi100% (1)

- Afirmaciones Sobre Los Rubros de Los EEFFDocument7 pagesAfirmaciones Sobre Los Rubros de Los EEFFXimena FoianiniNo ratings yet

- Inocencio PFRS SmallEntites Matrix ACElec 1Document6 pagesInocencio PFRS SmallEntites Matrix ACElec 1alianna johnNo ratings yet

- Inocencio PFRS SMEs Matrix ACElec 1Document6 pagesInocencio PFRS SMEs Matrix ACElec 1alianna johnNo ratings yet

- Gathering Appropriate Audit Evidence: by Laura Morgan, Examiner - Professional 2 Audit PracticeDocument4 pagesGathering Appropriate Audit Evidence: by Laura Morgan, Examiner - Professional 2 Audit PracticeGodfrey MakurumureNo ratings yet

- 44 Ind AS 102 Share Based Payment 1201Document87 pages44 Ind AS 102 Share Based Payment 1201Ahmed MadhaNo ratings yet

- Corporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDocument26 pagesCorporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDayana MasturaNo ratings yet

- Difference Between Accounts & FinanceDocument4 pagesDifference Between Accounts & Financesameer amjadNo ratings yet

- Applicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresDocument3 pagesApplicable To Accounts Receivables Assertion Category (CREV) Audit Objectives Audit ProceduresRosept ParnesNo ratings yet

- 5.10 Risk Assessment and Approach To Assessed RiskDocument7 pages5.10 Risk Assessment and Approach To Assessed Riskkit coopeNo ratings yet

- Charter 2007 ACM - Key RisksDocument2 pagesCharter 2007 ACM - Key RisksIgnacio Alfredo A.F.No ratings yet

- Audit AssertionsDocument1 pageAudit AssertionsDevice Factory UnlockNo ratings yet

- Ifrs at A Glance IFRS 7 Financial Instruments: DisclosuresDocument5 pagesIfrs at A Glance IFRS 7 Financial Instruments: DisclosuresNoor Ul Hussain MirzaNo ratings yet

- Concept Map RCDocument2 pagesConcept Map RCkat kaleNo ratings yet

- Summary of Ia I: Cash & Equivalent Receivables Inventory Prepaid Expenses Investment Property, Plant & EquipmentsDocument24 pagesSummary of Ia I: Cash & Equivalent Receivables Inventory Prepaid Expenses Investment Property, Plant & EquipmentsWildanmuhammadfirdausNo ratings yet

- 6.4 Assignment - Concept MapDocument3 pages6.4 Assignment - Concept Mapjoint accountNo ratings yet

- SBR Admin PC 4Document12 pagesSBR Admin PC 4mujeebmuscatNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisFranz CampuedNo ratings yet

- CONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Document6 pagesCONSOLIDATED - PROGRAMME-RECEIVABLES-PREPAYMENT-GROUP-5-v2-1Mitch Tokong Minglana0% (1)

- Fsa c2 - Balance Sheet - Long-Lived Asset AnalysisDocument2 pagesFsa c2 - Balance Sheet - Long-Lived Asset AnalysisK59 LE NGUYEN HA ANHNo ratings yet

- AFFS w3Document21 pagesAFFS w3Thi Kim Ngan TranNo ratings yet

- Assertions in The Audit of Financial StatementsDocument4 pagesAssertions in The Audit of Financial StatementsAselleNo ratings yet

- Chapter 05Document18 pagesChapter 05Muhammad IrfanNo ratings yet

- AP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - EncryptedDocument5 pagesAP03-04-Audit of PPE-as Annotated by Sir Allan (Theories) - Encryptedkisheal kimNo ratings yet

- MydisclosureassDocument3 pagesMydisclosureassAlthea AguadillaNo ratings yet

- Assertions Relating To Classes of TransactionsDocument3 pagesAssertions Relating To Classes of TransactionsJay Mar Ortiz JorgioNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument41 pagesInvesting and Financing Decisions and The Balance SheetFadyNo ratings yet

- Sporting Business Value and Price - DamodaranDocument20 pagesSporting Business Value and Price - DamodaranFrancisco AlemanNo ratings yet

- Audit Scope Accounts Involved Audit ProcedureDocument12 pagesAudit Scope Accounts Involved Audit Procedurekarenmae intangNo ratings yet

- Aac Assignemnt 1 27 Apr 2022Document3 pagesAac Assignemnt 1 27 Apr 2022Wani KhadirNo ratings yet

- SBR Admin PC 3Document10 pagesSBR Admin PC 3mujeebmuscatNo ratings yet

- 42) Analytical Procedures - IsA 520Document4 pages42) Analytical Procedures - IsA 520kasimranjhaNo ratings yet

- Audcap1 Cash Cases SantosDocument4 pagesAudcap1 Cash Cases SantosRosette SANTOSNo ratings yet

- Accounting 101Document6 pagesAccounting 101angel luxxNo ratings yet

- chapter 6 اسئلة متنوعةDocument12 pageschapter 6 اسئلة متنوعةabbas mohammedNo ratings yet

- Repeated AUDIT RISKDocument6 pagesRepeated AUDIT RISKDawood ZahidNo ratings yet

- Audit Procedure For Account ReceivablesDocument1 pageAudit Procedure For Account ReceivablesDevine Grace A. MaghinayNo ratings yet

- FR Prep Session (2) - 1-5Document38 pagesFR Prep Session (2) - 1-5mahachem_hariNo ratings yet

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Alizeh IfthikharNo ratings yet

- SolutionDocument4 pagesSolutionDheeman ShahriNo ratings yet

- A Study On Fixed Assets Management: Science, Technology and Development ISSN: 0950-0707Document18 pagesA Study On Fixed Assets Management: Science, Technology and Development ISSN: 0950-0707Mr SmartNo ratings yet

- PAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureDocument3 pagesPAS Recognition Measurement Increase in Carrying Amount Due To Revaluation Derecognition Presentation and DisclosureTimothy james PalermoNo ratings yet

- Grey Minimalist Business Project PresentationDocument10 pagesGrey Minimalist Business Project PresentationTrixie Divine SantosNo ratings yet

- Counterparty Credit Exposure and CVA - An Intergrated Approch (UBS)Document34 pagesCounterparty Credit Exposure and CVA - An Intergrated Approch (UBS)Mo MokNo ratings yet

- Business Math Dictionary (AutoRecovered)Document30 pagesBusiness Math Dictionary (AutoRecovered)Gwyneth April DelgacoNo ratings yet

- Rizq Aly Afif - 1181002057 - Audit 6 - AKT 52Document5 pagesRizq Aly Afif - 1181002057 - Audit 6 - AKT 52Rizq Aly AfifNo ratings yet

- Agriculture Accounting For Businesses Government AccountingDocument3 pagesAgriculture Accounting For Businesses Government AccountingZeniah Domecyas ArizoNo ratings yet

- Valuation of Stressed Assets: The Institute of Cost Accountants of IndiaDocument43 pagesValuation of Stressed Assets: The Institute of Cost Accountants of IndiaAny YnaNo ratings yet

- Accounting: Assets Liabilities + Equity A L + EDocument4 pagesAccounting: Assets Liabilities + Equity A L + EJohn LeeNo ratings yet

- Chapter 18 Valuation Closing ThoughtsDocument18 pagesChapter 18 Valuation Closing ThoughtsdemelashNo ratings yet

- Ending Cash Balance EquipmentDocument5 pagesEnding Cash Balance EquipmentMiyuki NakataNo ratings yet

- Accounting For Bonds PayableDocument31 pagesAccounting For Bonds PayableJon Christian Miranda100% (2)

- 1 Fundamental Auditing ConceptsDocument25 pages1 Fundamental Auditing ConceptsblablaNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument35 pagesInvesting and Financing Decisions and The Balance Sheetfmj6687No ratings yet

- Executive's Guide to Fair Value: Profiting from the New Valuation RulesFrom EverandExecutive's Guide to Fair Value: Profiting from the New Valuation RulesNo ratings yet

- Concept Map PCDocument4 pagesConcept Map PCkat kaleNo ratings yet

- Case 1: Control Account and Subsidiary Ledger ReconciliationDocument5 pagesCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleNo ratings yet

- Case 1: Balungao Company Engaged You To Examine Its Books and Records For TheDocument2 pagesCase 1: Balungao Company Engaged You To Examine Its Books and Records For Thekat kaleNo ratings yet

- Home Office, Branch, and Agency AccountingDocument4 pagesHome Office, Branch, and Agency Accountingkat kaleNo ratings yet

- Stock Acquisition - Date of AcquisitionDocument2 pagesStock Acquisition - Date of Acquisitionkat kaleNo ratings yet

- Case 1: Audit of Accounts Receivable and Related AccountsDocument6 pagesCase 1: Audit of Accounts Receivable and Related Accountskat kaleNo ratings yet

- Partnership Formation and OperationDocument4 pagesPartnership Formation and Operationkat kaleNo ratings yet

- Partnership Dissolution and LiquidationDocument4 pagesPartnership Dissolution and Liquidationkat kaleNo ratings yet

- Links To An External Site.Document1 pageLinks To An External Site.kat kaleNo ratings yet

- Intercompany TransactionsDocument1 pageIntercompany Transactionskat kaleNo ratings yet

- Installment SalesDocument4 pagesInstallment Saleskat kaleNo ratings yet

- Construction ContractsDocument3 pagesConstruction Contractskat kaleNo ratings yet

- Corporate LiquidationDocument1 pageCorporate Liquidationkat kaleNo ratings yet

- PNL LG9408Document8 pagesPNL LG9408Vinay Kumar B LNo ratings yet

- Business Organizations: Dennis Guardado Bmhs-3A January 5, 2021 POADocument9 pagesBusiness Organizations: Dennis Guardado Bmhs-3A January 5, 2021 POADennis GuardadoNo ratings yet

- FUNDAMENTALS OF ABM 1 Section 7Document13 pagesFUNDAMENTALS OF ABM 1 Section 7Allysa Kim RubisNo ratings yet

- 3b. - Credit Risk in BankingDocument23 pages3b. - Credit Risk in Bankingonly.oranda.goldfishNo ratings yet

- Module 3A - ACCCOB2 Lecture 3 - Receivables T1AY2021Document14 pagesModule 3A - ACCCOB2 Lecture 3 - Receivables T1AY2021Cale Robert RascoNo ratings yet

- Chapter3 ExercisesDocument7 pagesChapter3 ExercisesNo NotreallyNo ratings yet

- 2 - INTRO TO Financial FSDocument19 pages2 - INTRO TO Financial FSmuhammad akbar bahmiNo ratings yet

- Final Preboard - AFAR-with AnswersDocument12 pagesFinal Preboard - AFAR-with AnswersLuiNo ratings yet

- SunEdison Carlos Domenech Complaint As FileDocument42 pagesSunEdison Carlos Domenech Complaint As FileLizHoffmanNo ratings yet

- CHAPTER 25 Statement of Financial Position (Concept Map)Document1 pageCHAPTER 25 Statement of Financial Position (Concept Map)kateyy99No ratings yet

- 4a. Ribbons An' Bows Inc Case & TNDocument7 pages4a. Ribbons An' Bows Inc Case & TNnikhilNo ratings yet

- Dividend Decision - by Dr. Suresh VaddeDocument34 pagesDividend Decision - by Dr. Suresh VaddeSuresh VaddeNo ratings yet

- The Following Information Is Available About The Capital Structure For PDFDocument1 pageThe Following Information Is Available About The Capital Structure For PDFLet's Talk With HassanNo ratings yet

- 5 Answerfsanalysisquiz04122023Document10 pages5 Answerfsanalysisquiz04122023Ralphjersy AlmendrasNo ratings yet

- Answers To Mcqs CH 10, CHAPTER 10 FINANCIAL MARKETS CBSE XIIDocument82 pagesAnswers To Mcqs CH 10, CHAPTER 10 FINANCIAL MARKETS CBSE XIIPUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Lap Keu 31 Des 2020 - MedcoEnergiDocument393 pagesLap Keu 31 Des 2020 - MedcoEnergiEdo AgusNo ratings yet

- Legal Aspects of Business AccountingDocument5 pagesLegal Aspects of Business AccountingswaggerboxNo ratings yet

- Company Law Notes Unit 1Document58 pagesCompany Law Notes Unit 1nivedita.n7No ratings yet

- Tax QuizDocument1 pageTax QuizPLO COMVALNo ratings yet

- Assignment 1Document3 pagesAssignment 1Davison JaziNo ratings yet

- SCF AnsDocument11 pagesSCF AnsA.J. ChuaNo ratings yet

- Assesment Task - Tutorial Questions Question No.1: Capital BudgetingDocument10 pagesAssesment Task - Tutorial Questions Question No.1: Capital BudgetingJaydeep KushwahaNo ratings yet

- Business LawDocument11 pagesBusiness LawRiriNo ratings yet

- Istilah Istilah Ekonomi TeknikDocument6 pagesIstilah Istilah Ekonomi Teknikreza cakralNo ratings yet

- Harkonen, E. Striking A Balance Between Investor Protectionand Access To Capital 2Document28 pagesHarkonen, E. Striking A Balance Between Investor Protectionand Access To Capital 2Fernando LandaNo ratings yet

- Bank Reconciliation Statement: Causes of Difference Between Cash Book and Pass Book BalanceDocument4 pagesBank Reconciliation Statement: Causes of Difference Between Cash Book and Pass Book Balancekumaranil_1983No ratings yet