Professional Documents

Culture Documents

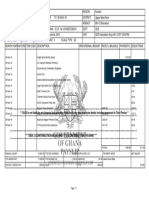

US Internal Revenue Service: I1065sk1 - 2004

US Internal Revenue Service: I1065sk1 - 2004

Uploaded by

IRSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

US Internal Revenue Service: I1065sk1 - 2004

US Internal Revenue Service: I1065sk1 - 2004

Uploaded by

IRSCopyright:

Available Formats

Userid: ________ Leading adjust: -20% ❏ Draft ❏ Ok to Print

I1065SK1.SGM

PAGER/SGML Fileid: (29-Dec-2004) (Init. & date)

D:\USERS\45sdb\documents\Epicfiles\2004 EPIC\K-1 Instructions

Filename: (1065)\12292004PartnersInstructions1065.sgm

Page 1 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2004 Department of the Treasury

Internal Revenue Service

Partner’s Instructions for

Schedule K-1 (Form 1065)

Partner’s Share of Income, Deductions, Credits, etc.

(For Partner’s Use Only)

Section references are to the Internal Revenue Code unless otherwise noted.

you must file Form 8082, Notice of If a partner is required to notify the

What’s New Inconsistent Treatment or Administrative partnership of a section 751(a) exchange

• The instructions have been revised in Adjustment Request (AAR), with your

original or amended return to identify and

but fails to do so, a $50 penalty may be

accordance with the redesign of Schedule imposed for each such failure. However, no

K-1, which uses codes to identify many of explain any inconsistency (or to note that a penalty will be imposed if the partner can

the items reported on the schedule. See the partnership return has not been filed). show that the failure was due to reasonable

specific instructions for Part III on page 5 for cause and not willful neglect.

If you are required to file Form 8082 but

more information on the codes and how fail to do so, you may be subject to the

attached statements are identified on accuracy-related penalty. This penalty is in

Schedule K-1. addition to any tax that results from making

Nominee Reporting

• There is a new worksheet on page 2 of your amount or treatment of the item Any person who holds, directly or indirectly,

these instructions that you can use to keep consistent with that shown on the an interest in a partnership as a nominee for

track of your adjusted basis in your partnership’s return. Any deficiency that another person must furnish a written

partnership interest. results from making the amounts consistent statement to the partnership by the last day

may be assessed immediately. of the month following the end of the

partnership’s tax year. This statement must

General Instructions include the name, address, and identifying

Errors number of the nominee and such other

Purpose of Schedule K-1 If you believe the partnership has made an person, description of the partnership

error on your Schedule K-1, notify the interest held as nominee for that person,

The partnership uses Schedule K-1 to report partnership and ask for a corrected and other information required by

your share of the partnership’s income, Schedule K-1. Do not change any items on

deductions, credits, etc. Keep it for your Temporary Regulations section

your copy of Schedule K-1. Be sure that the 1.6031(c)-1T. A nominee that fails to furnish

records. Do not file it with your tax return. partnership sends a copy of the corrected

The partnership has filed a copy with the this statement must furnish to the person for

Schedule K-1 to the IRS. If you are a partner whom the nominee holds the partnership

IRS. in a partnership that does not meet the small interest a copy of Schedule K-1 and related

Although the partnership generally is not partnership exception and you report any information within 30 days of receiving it

subject to income tax, you are liable for tax partnership item on your return in a manner from the partnership.

on your share of the partnership income, different from the way the partnership

whether or not distributed. Include your reported it, you must file Form 8082. A nominee who fails to furnish when due

share on your tax return if a return is all the information required by Temporary

required. Use these instructions to help you Sale or Exchange of Regulations section 1.6031(c)-1T, or who

report the items shown on Schedule K-1 on furnishes incorrect information, is subject to

your tax return. Partnership Interest a $50 penalty for each statement for which a

Generally, a partner who sells or exchanges failure occurs. The maximum penalty is

The amount of loss and deduction that $100,000 for all such failures during a

you may claim on your tax return may be a partnership interest in a section 751(a)

exchange must notify the partnership, in calendar year. If the nominee intentionally

less than the amount reported on Schedule disregards the requirement to report correct

K-1. It is the partner’s responsibility to writing, within 30 days of the exchange (or, if

earlier, by January 15 of the calendar year information, each $50 penalty increases to

consider and apply any applicable $100 or, if greater, 10% of the aggregate

limitations. See Limitations on Losses, following the calendar year in which the

exchange occurred). A “section 751(a) amount of items required to be reported,

Deductions, and Credits beginning on page

2 for more information. exchange” is any sale or exchange of a and the $100,000 maximum does not apply.

partnership interest in which any money or

other property received by the partner in

Inconsistent Treatment of exchange for that partner’s interest is International Boycotts

attributable to unrealized receivables (as

Items defined in section 751(c)) or inventory items

Every partnership that had operations in, or

related to, a boycotting country, company, or

Generally, you must report partnership items (as defined in section 751(d)). a national of a country must file Form 5713,

shown on your Schedule K-1 (and any

attached schedules) the same way that the The written notice to the partnership International Boycott Report.

partnership treated the items on its return. must include the names and addresses of If the partnership cooperated with an

This rule does not apply if your partnership both parties to the exchange, the identifying international boycott, it must give you a copy

is within the “small partnership exception” numbers of the transferor and (if known) of

of its Form 5713. You must file your own

and does not elect to have the tax treatment the transferee, and the exchange date.

of partnership items determined at the Form 5713 to report the partnership’s

partnership level. An exception to this rule is made for activities and any other boycott operations

sales or exchanges of publicly traded that you may have. You may lose certain tax

If the treatment on your original or partnership interests for which a broker is benefits if the partnership participated in, or

amended return is inconsistent with the required to file Form 1099-B, Proceeds cooperated with, an international boycott.

partnership’s treatment, or if the partnership From Broker and Barter Exchange See Form 5713 and its instructions for more

was required to but has not filed a return, Transactions. information.

Cat. No. 11396N

Page 2 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

rules, the at-risk limitations, and the passive on the partnership’s books and records and

Definitions activity limitations. Each of these limitations cannot be used to figure your basis.

is discussed separately below. You can figure the adjusted basis of your

General Partner partnership interest by adding items that

A general partner is a partner who is Other limitations may apply to specific

deductions (for example, the section 179 increase your basis and then subtracting

personally liable for partnership debts. items that decrease your basis.

expense deduction). Generally, specific

Limited Partner limitations apply before the basis, at-risk, Use the worksheet below to figure the

and passive loss limitations. basis of your interest in the partnership.

A limited partner is a partner in a partnership

formed under a state limited partnership law, For more details on the basis rules, see

whose personal liability for partnership debts Basis Rules Pub. 541.

is limited to the amount of money or other Generally, you may not claim your share of

property that the partner contributed or is a partnership loss (including a capital loss) At-Risk Limitations

required to contribute to the partnership. to the extent that it is greater than the Generally, if you have (a) a loss or other

Some members of other entities, such as adjusted basis of your partnership interest at deduction from any activity carried on as a

domestic or foreign business trusts or the end of the partnership’s tax year. Any trade or business or for the production of

limited liability companies that are classified losses and deductions not allowed this year income by the partnership and (b) amounts

as partnerships, may be treated as limited because of the basis limit can be carried in the activity for which you are not at risk,

partners for certain purposes. See, for forward indefinitely and deducted in a later you will have to complete Form 6198,

example, Temporary Regulations section year subject to the basis limit for that year. At-Risk Limitations, to figure your allowable

1.469-5T(e)(3), which treats all members The partnership is not responsible for loss.

with limited liability as limited partners for keeping the information needed to figure the The at-risk rules generally limit the

purposes of section 469(h)(2). basis of your partnership interest. Although amount of loss and other deductions that

Nonrecourse Loans the partnership does provide an analysis of you can claim to the amount you could

the changes to your capital account in item actually lose in the activity. These losses

Nonrecourse loans are those liabilities of the N of Schedule K-1, that information is based and deductions include a loss on the

partnership for which no partner bears the

economic risk of loss.

Worksheet for Adjusting the Basis of a Partner’s Interest in the Partnership

Elections (Keep for your records.)

Generally, the partnership decides how to

figure taxable income from its operations. 1. Your adjusted basis at the end of the prior year. Do not enter less than

However, certain elections are made by you zero. Enter -0- if this is your first tax year . . . . . . . . . . . . . . . . . . . 1.

separately on your income tax return and Increases:

not by the partnership. These elections are

made under the following code sections: 2. Money and your adjusted basis in property contributed to the

• Section 59(e) (deduction of certain partnership less the associated liabilities (but not less than zero) . . . . 2.

qualified expenditures ratably over the 3. Your increased share of or assumption of partnership liabilities

period of time specified in that section). For (Subtract your share of liabilities shown in Item D of your 2003

more information, see the instructions for Schedule K-1 from your share of liabilities shown in Item M of your

code K in box 13 on page 8. 2004 Schedule K-1 and add the amount of any partnership liabilities

• Section 108(b)(5) (income from the you assumed during the tax year) . . . . . . . . . . . . . . . . . . . . . . . . 3.

discharge of indebtedness).

• Section 263A(d) (preproductive 4. Your share of the partnership’s income or gain (including tax-exempt

expenses). See the instructions for code O income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

in box 13. 5. Any gain recognized this year on contributions of property. Do not 5.

• Section 617 (deduction and recapture of include gain from transfer of liabilities . . . . . . . . . . . . . . . . . . . . .

certain mining exploration expenditures).

• Section 901 (foreign tax credit). 6. Your share of the excess of the deductions for depletion (other than oil

and gas depletion) over the basis of the property subject to depletion 6.

If the partnership attaches a statement to

Schedule K-1 indicating that it has changed Decreases:

its tax year and that you may elect to report 7. Withdrawals and distributions of money and the adjusted basis of

your distributive share of the income property distributed to you from the partnership. Do not include the

attributable to that change ratably over 4 tax amount of property distributions included in the partner’s income

years, see Rev. Proc. 2003-79, 2003-45 (taxable income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

I.R.B. 1036, for details on making the

election. To make the election, you must file Caution: A distribution may be taxable if the amount exceeds your

Form 8082 with your income tax return for adjusted basis of your partnership interest immediately before the

each of the 4 tax years. File Form 8082 for distribution.

this purpose in accordance with Rev. Proc. 8. Your share of the partnership’s nondeductible expenses that are not

2003-79 instead of the Form 8082 capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

instructions.

9. Your share of the partnership’s losses and deductions (including capital

losses). However, include your share of the partnership’s section 179

Additional Information expense deduction for this year even if you cannot deduct all of it

For more information on the treatment of because of limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

partnership income, deductions, credits,

etc., see Pub. 541, Partnerships, and Pub. 10. The amount of your deduction for depletion of any partnership oil and

gas property, not to exceed your allocable share of the adjusted basis

535, Business Expenses.

of that property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

To get forms and publications, see the

instructions for your tax return. 11. Your adjusted basis in the partnership at end of this tax year. (Add lines

1 through 6 and subtract lines 7 through 10 from the total. If zero or

less, enter -0-.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

Limitations on Losses,

Caution: The deduction for your share of the partnership’s losses and

Deductions, and Credits deductions is limited to your adjusted basis in your partnership interest.

There are three separate potential If you entered zero on line 11 and the amount computed for line 11 was

limitations on the amount of partnership less than zero, a portion of your share of the partnership losses and

losses that you may deduct on your return. deductions may not be deductible. (See Basis Rules above for more

These limitations and the order in which you information.)

must apply them are as follows: the basis

-2- Partner’s Instructions for Schedule K-1 (Form 1065)

Page 3 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

disposition of assets and the section 179 which the corporation materially 1. You participated in the activity for

expense deduction. However, if you participated. more than 500 hours during the tax year.

acquired your partnership interest before For purposes of this rule, each interest in 2. Your participation in the activity for

1987, the at-risk rules do not apply to losses rental real estate is a separate activity, the tax year constituted substantially all the

from an activity of holding real property unless you elect to treat all interests in rental participation in the activity of all individuals

placed in service before 1987 by the real estate as one activity. For details on (including individuals who are not owners of

partnership. The activity of holding mineral making this election, see the Instructions for interests in the activity).

property does not qualify for this exception. Schedule E (Form 1040). 3. You participated in the activity for

The partnership should identify on an more than 100 hours during the tax year,

attachment to Schedule K-1 the amount of If you are married filing jointly, either you

or your spouse must separately meet both and your participation in the activity for the

any losses that are not subject to the at-risk tax year was not less than the participation

limitations. of the above conditions, without taking into

account services performed by the other in the activity of any other individual

Generally, you are not at risk for amounts spouse. (including individuals who were not owners

such as the following: of interests in the activity) for the tax year.

A real property trade or business is any

• Nonrecourse loans used to finance the real property development, redevelopment,

4. The activity was a significant

activity, to acquire property used in the participation activity for the tax year, and

construction, reconstruction, acquisition, you participated in all significant

activity, or to acquire your interest in the conversion, rental, operation, management,

activity, that are not secured by your own participation activities (including activities

leasing, or brokerage trade or business. outside the partnership) during the year for

property (other than the property used in the Services you performed as an employee are

activity). See the instructions for item F on more than 500 hours. A significant

not treated as performed in a real property participation activity is any trade or business

page 5 for the exception for qualified trade or business unless you owned more

nonrecourse financing secured by real activity in which you participated for more

than 5% of the stock (or more than 5% of than 100 hours during the year and in which

property. the capital or profits interest) in the

• Cash, property, or borrowed amounts employer.

you did not materially participate under any

used in the activity (or contributed to the of the material participation tests (other than

3. Working interests in oil or gas wells if this test 4).

activity, or used to acquire your interest in you were a general partner.

the activity) that are protected against loss 4. The rental of a dwelling unit any 5. You materially participated in the

by a guarantee, stop-loss agreement, or partner used for personal purposes during activity for any 5 tax years (whether or not

other similar arrangement (excluding the year for more than the greater of 14 consecutive) during the 10 tax years that

casualty insurance and insurance against days or 10% of the number of days that the immediately precede the tax year.

tort liability). residence was rented at fair rental value. 6. The activity was a personal service

• Amounts borrowed for use in the activity 5. Activities of trading personal property activity and you materially participated in the

from a person who has an interest in the for the account of owners of interests in the activity for any 3 tax years (whether or not

activity, other than as a creditor, or who is activities. consecutive) preceding the tax year. A

related, under section 465(b)(3), to a person personal service activity involves the

(other than you) having such an interest. If you are an individual, an estate, or a performance of personal services in the

You should get a separate statement of trust, and you have a passive activity loss or fields of health, law, engineering,

income, expenses, etc., for each activity credit, use Form 8582, Passive Activity Loss architecture, accounting, actuarial science,

from the partnership. Limitations, to figure your allowable passive performing arts, consulting, or any other

losses and Form 8582-CR, Passive Activity trade or business in which capital is not a

Passive Activity Limitations Credit Limitations, to figure your allowable material income-producing factor.

Section 469 provides rules that limit the passive credits. For a corporation, use Form 7. Based on all the facts and

deduction of certain losses and credits. 8810, Corporate Passive Activity Loss and circumstances, you participated in the

These rules apply to partners who: Credit Limitations. See the instructions for activity on a regular, continuous, and

• Are individuals, estates, trusts, closely these forms for more information. substantial basis during the tax year.

held corporations, or personal service If the partnership had more than one

corporations and Limited partners. If you are a limited

activity, it will attach a statement to your

• Have a passive activity loss or credit for Schedule K-1 that identifies each activity

partner, you do not materially participate in

the tax year. an activity unless you meet one of the tests

(trade or business activity, rental real estate in paragraphs 1, 5, or 6 above.

Generally, passive activities include: activity, rental activity other than rental real

1. Trade or business activities in which estate, etc.) and specifies the income (loss), Work counted toward material

you did not materially participate and deductions, and credits from each activity. participation. Generally, any work that you

2. Activities that meet the definition of Material participation. You must or your spouse does in connection with an

rental activities under Temporary determine if you materially participated (a) in activity held through a partnership (where

Regulations section 1.469-1T(e)(3) and each trade or business activity held through you own your partnership interest at the time

Regulations section 1.469-1(e)(3). the partnership and (b) if you were a real the work is done) is counted toward material

estate professional (defined above), in each participation. However, work in connection

Passive activities do not include: rental real estate activity held through the with the activity is not counted toward

1. Trade or business activities in which partnership. All determinations of material material participation if either of the following

you materially participated. participation are made based on your applies.

2. Rental real estate activities in which participation during the partnership’s tax 1. The work is not the type of work that

you materially participated if you were a year. owners of the activity would usually do and

“real estate professional” for the tax year. one of the principal purposes of the work

You were a real estate professional only if Material participation standards for that you or your spouse does is to avoid the

you met both of the following conditions: partners who are individuals are listed passive loss or credit limitations.

below. Special rules apply to certain retired

a. More than half of the personal 2. You do the work in your capacity as

or disabled farmers and to the surviving

services you performed in trades or an investor and you are not directly involved

spouses of farmers. See the Instructions for

businesses were performed in real property in the day-to-day operations of the activity.

Form 8582 for details.

trades or businesses in which you materially Examples of work done as an investor that

participated and Corporations should refer to the would not count toward material

b. You performed more than 750 hours Instructions for Form 8810 for the material participation include:

of services in real property trades or participation standards that apply to them. a. Studying and reviewing financial

businesses in which you materially Individuals (other than limited statements or reports on operations of the

participated. partners). If you are an individual (either a activity.

Note. For a closely held C corporation general partner or a limited partner who b. Preparing or compiling summaries or

(defined in section 465(a)(1)(B)), the above owned a general partnership interest at all analyses of the finances or operations of the

conditions are treated as met if more than times during the tax year), you materially activity for your own use.

50% of the corporation’s gross receipts were participated in an activity only if one or more c. Monitoring the finances or operations

from real property trades or businesses in of the following apply: of the activity in a nonmanagerial capacity.

Partner’s Instructions for Schedule K-1 (Form 1065) -3-

Page 4 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

Effect of determination. Income (loss), in modified adjusted gross income for limited by the passive loss rules. A fully

deductions, and credits from an activity are purposes of figuring on Form 8582 the taxable transaction is one in which you

nonpassive if you determine that: “special allowance” for active participation in recognize all your realized gain or loss.

• You materially participated in a trade or a non-PTP rental real estate activity. In Report the income and losses on the forms

business activity of the partnership or addition, the nonpassive income is included and schedules you normally use.

• You were a real estate professional in investment income when figuring your Note. For rules on the disposition of an

(defined on page 3) in a rental real estate investment interest expense deduction on entire interest reported using the installment

activity of the partnership. Form 4952. method, see the Instructions for Form 8582.

If you determine that you did not Example. If you have Schedule E income

materially participate in a trade or business of $8,000, and a Form 4797 prior year Special allowance for a rental real estate

activity of the partnership or if you have unallowed loss of $3,500 from the passive activity. If you actively participated in a

income (loss), deductions, or credits from a activities of a particular PTP, you have a rental real estate activity, you may be able

rental activity of the partnership (other than $4,500 overall gain ($8,000 − $3,500). On to deduct up to $25,000 of the loss from the

a rental real estate activity in which you Schedule E, line 28, report the $4,500 net activity from nonpassive income. This

materially participated as a real estate gain as nonpassive income in column (j). In “special allowance” is an exception to the

professional), the amounts from that activity column (g), report the remaining Schedule E general rule disallowing losses in excess of

are passive. Report passive income gain of $3,500 ($8,000 − $4,500). On the income from passive activities. The special

(losses), deductions, and credits as follows: appropriate line of Form 4797, report the allowance is not available if you were

1. If you have an overall gain (the prior year unallowed loss of $3,500. Be sure married, file a separate return for the year,

excess of income over deductions and to write “From PTP” to the left of each entry and did not live apart from your spouse at all

losses, including any prior year unallowed space. times during the year.

loss) from a passive activity, report the 3. If you have an overall loss (but did not Only individuals and qualifying estates

income, deductions, and losses from the dispose of your entire interest in the PTP to can actively participate in a rental real estate

activity as indicated in these instructions. an unrelated person in a fully taxable activity. Estates (other than qualifying

2. If you have an overall loss (the transaction during the year), the losses are estates), trusts, and corporations cannot

excess of deductions and losses, including allowed to the extent of the income, and the actively participate. Limited partners cannot

any prior year unallowed loss, over income) excess loss is carried forward to use in a actively participate unless future regulations

or credits from a passive activity, report the future year when you have income to offset provide an exception.

income, deductions, losses, and credits from it. Report as a passive loss on the schedule

all passive activities using the Instructions You are not considered to actively

or form you normally use the portion of the participate in a rental real estate activity if at

for Form 8582 or Form 8582-CR (or Form loss equal to the income. Report the income

8810), to see if your deductions, losses, and any time during the tax year your interest

as passive income on the form or schedule (including your spouse’s interest) in the

credits are limited under the passive activity you normally use.

rules. activity was less than 10% (by value) of all

Example. You have a Schedule E loss of interests in the activity.

Publicly traded partnerships. The passive $12,000 (current year losses plus prior year Active participation is a less stringent

activity limitations are applied separately for unallowed losses) and a Form 4797 gain of requirement than material participation. You

items (other than the low-income housing $7,200. Report the $7,200 gain on the may be treated as actively participating if

credit and the rehabilitation credit) from appropriate line of Form 4797. On Schedule you participated, for example, in making

each publicly traded partnership (PTP). E, line 28, report $7,200 of the losses as a management decisions or arranging for

Thus, a net passive loss from a PTP may passive loss in column (f). Carry forward to others to provide services (such as repairs)

not be deducted from other passive income. 2005 the unallowed loss of $4,800 ($12,000 in a significant and bona fide sense.

Instead, a passive loss from a PTP is − $7,200). Management decisions that can count as

suspended and carried forward to be If you have unallowed losses from more active participation include approving new

applied against passive income from the than one activity of the PTP or from the tenants, deciding rental terms, approving

same PTP in later years. If the partner’s same activity of the PTP that must be capital or repair expenditures, and other

entire interest in the PTP is completely reported on different forms, you must similar decisions.

disposed of, any unused losses are allowed allocate the unallowed losses on a pro rata

in full in the year of disposition. An estate is a qualifying estate if the

basis to figure the amount allowed from

If you have an overall gain from a PTP, decedent would have satisfied the active

each activity or on each form.

the net gain is nonpassive income. In participation requirement for the activity for

Tax tip. To allocate and keep a record of the tax year the decedent died. A qualifying

addition, the nonpassive income is included the unallowed losses, use Worksheets 5, 6,

in investment income to figure your estate is treated as actively participating for

and 7 of Form 8582. List each activity of the tax years ending less than 2 years after the

investment interest expense deduction. PTP in Worksheet 5. Enter the overall loss date of the decedent’s death.

Do not report passive income, gains, or from each activity in column (a). Complete

losses from a PTP on Form 8582. Instead, column (b) of Worksheet 5 according to its Modified adjusted gross income

use the following rules to figure and report instructions. Multiply the total unallowed loss limitation. The maximum special allowance

on the proper form or schedule your income, from the PTP by each ratio in column (b) that single individuals and married

gains, and losses from passive activities that and enter the result in column (c) of individuals filing a joint return can qualify for

you held through each PTP you owned Worksheet 5. Then, complete Worksheet 6 if is $25,000. The maximum is $12,500 for

during the tax year. all the loss from the same activity is to be married individuals who file separate returns

reported on one form or schedule. Use and who lived apart all times during the

1. Combine any current year income,

Worksheet 7 instead of Worksheet 6 if you year. The maximum special allowance for

gains and losses, and any prior year

have more than one loss to be reported on which an estate can qualify is $25,000

unallowed losses to see if you have an

different forms or schedules for the same reduced by the special allowance for which

overall gain or loss from the PTP. Include

activity. Enter the net loss plus any prior the surviving spouse qualifies.

only the same types of income and losses

you would include in your net income or loss year unallowed losses in column (a) of If your modified adjusted gross income

from a non-PTP passive activity. See Pub. Worksheet 6 (or Worksheet 7 if applicable). (defined below) is $100,000 or less ($50,000

925, Passive Activity and At-Risk Rules, for The losses in column (c) of Worksheet 6 or less if married filing separately), your loss

more details. (column (e) of Worksheet 7) are the allowed is deductible up to the amount of the

2. If you have an overall gain, the net losses to report on the forms or schedules. maximum special allowance referred to in

gain portion (total gain minus total losses) is Report both these losses and any income the preceding paragraph. If your modified

nonpassive income. On the form or from the PTP on the forms and schedules adjusted gross income is more than

schedule you normally use, report the net you normally use. $100,000 (more than $50,000 if married

gain portion as nonpassive income and the 4. If you have an overall loss and you filing separately), the special allowance is

remaining income and the total losses as disposed of your entire interest in the PTP to limited to 50% of the difference between

passive income and loss. To the left of the an unrelated person in a fully taxable $150,000 ($75,000 if married filing

entry space, write “From PTP.” It is transaction during the year, your losses separately) and your modified adjusted

important to identify the nonpassive income (including prior year unallowed losses) gross income. When modified adjusted

because the nonpassive portion is included allocable to the activity for the year are not gross income is $150,000 or more ($75,000

-4- Partner’s Instructions for Schedule K-1 (Form 1065)

Page 5 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

or more if married filing separately), there is real property and that is loaned or

no special allowance. Specific Instructions guaranteed by a federal, state, or local

government or borrowed from a “qualified”

Modified adjusted gross income is your person.

adjusted gross income figured without taking Part I. Information About Qualified persons include any persons

into account:

• Any passive activity loss. the Partnership actively and regularly engaged in the

business of lending money, such as a bank

• Any rental real estate loss allowed under or savings and loan association. Qualified

section 469(c)(7) to real estate professionals Item D persons generally do not include related

(as defined on page 3). If the box in item D is checked, you are a parties (unless the nonrecourse financing is

• Any taxable social security or equivalent partner in a publicly traded partnership and commercially reasonable and on

railroad retirement benefits. must follow the rules discussed on page 4 substantially the same terms as loans

under Publicly traded partnerships.

• Any deductible contributions to an IRA or involving unrelated persons), the seller of

certain other qualified retirement plans the property, or a person who receives a fee

Item E for the partnership’s investment in the real

under section 219.

If the partnership is a registration-required

• The student loan interest deduction. tax shelter, it should have completed item E.

property.

• The tuition and fees deduction. Use the information on Schedule K-1 (name

See Pub. 925 for more information on

qualified nonrecourse financing.

• The deduction for one-half of of the partnership, partnership identifying

self-employment taxes. number, and tax shelter registration number) Both the partnership and you must meet

• The exclusion from income of interest to complete your Form 8271, Investor the qualified nonrecourse rules on this debt

before you can include the amount shown

from Series EE or I U.S. Savings Bonds Reporting of Tax Shelter Registration

used to pay higher education expenses. Number. next to “Qualified nonrecourse financing” in

your at-risk computation.

• The exclusion of amounts received under Item F

an employer’s adoption assistance program. See Limitations on Losses, Deductions,

If you claim or report any income, loss, and Credits beginning on page 2 for more

Commercial revitalization deduction. deduction, or credit from a information on the at-risk limitations.

The special $25,000 allowance for the registration-required tax shelter, you must

commercial revitalization deduction from attach Form 8271 to your tax return. If the

rental real estate activities is not subject to

the active participation rules or modified

partnership has invested in a

registration-required tax shelter, it will check

Part III. Partner’s Share of

adjusted gross income limits discussed item F and it must give you a copy of its Current Year Income,

above. See code P for box 13 on page 8. Form 8271 with Schedule K-1. Use this

information to complete your Form 8271. Deductions, Credits, and

Special rules for certain other activities.

If you have net income (loss), deductions, or Other Items

credits from any activity to which special The amounts shown in boxes 1 through 20

rules apply, the partnership will identify the Part II. Information About reflect your share of income, loss,

activity and all amounts relating to it on deductions, credits, etc., from partnership

Schedule K-1 or on an attachment.

the Partner business or rental activities without

reference to limitations on losses or

If you have net income subject to Item M adjustments that may be required of you

recharacterization under Temporary Item M should show your share of the because of:

Regulations section 1.469-2T(f) and partnership’s nonrecourse liabilities, 1. The adjusted basis of your

Regulations section 1.469-2(f), report such partnership-level qualified nonrecourse partnership interest,

amounts according to the Instructions for financing, and other recourse liabilities as of 2. The amount for which you are at risk,

Form 8582 (or Form 8810). the end of the partnership’s tax year. If you or

terminated your interest in the partnership 3. The passive activity limitations.

If you have net income (loss),

during the tax year, item M should show the

deductions, or credits from any of the

share that existed immediately before the For information on these provisions, see

following activities, treat such amounts as

total disposition. A partner’s “recourse Limitations on Losses, Deductions, and

nonpassive and report them as instructed in

liability” is any partnership liability for which Credits beginning on page 2.

these instructions:

a partner is personally liable. If you are an individual and the passive

1. Working interests in oil and gas wells

if you are a general partner. Use the total of the three amounts for activity rules do not apply to the amounts

computing the adjusted basis of your shown on your Schedule K-1, take the

2. The rental of a dwelling unit any partnership interest. amounts shown and enter them on the lines

partner used for personal purposes during on your tax return as indicated in the

the year for more than the greater of 14 Generally, you may use only the

amounts shown next to “Qualified summarized reporting information shown on

days or 10% of the number of days that the the back of the Schedule K-1. If the passive

residence was rented at fair rental value. nonrecourse financing” and “Recourse” to

compute your amount at risk. Do not include activity rules do apply, report the amounts

3. Trading personal property for the shown as indicated in these instructions.

any amounts that are not at risk if such

account of owners of interests in the activity.

amounts are included in either of these If you are not an individual, report the

categories. amounts in each box as instructed on your

Self-charged interest. The partnership will tax return.

report any “self-charged” interest income or If your partnership is engaged in two or

expense that resulted from loans between more different types of activities subject to The line numbers in the summarized

you and the partnership (or between the the at-risk provisions, or a combination of reporting information on page 2 of Schedule

partnership and another partnership or S at-risk activities and any other activity, the K-1 are references to forms in use for

corporation if both entities have the same partnership should give you a statement calendar year 2004. If you file your tax

owners with the same proportional showing your share of nonrecourse return on a calendar year basis, but your

ownership interest in each entity). If there liabilities, partnership-level qualified partnership files a return for a fiscal year,

was more than one activity, the partnership nonrecourse financing, and other recourse enter the amounts on your tax return for the

will provide a statement allocating the liabilities for each activity. year in which the partnership’s fiscal year

interest income or expense with respect to Qualified nonrecourse financing secured ends. For example, if the partnership’s tax

each activity. The self-charged interest rules by real property used in an activity of year ends in February 2005, report the

do not apply to your partnership interest if holding real property that is subject to the amounts on your 2005 tax return.

the partnership made an election under at-risk rules is treated as an amount at risk. If you have losses, deductions, or credits

Regulations section 1.469-7(g) to avoid the Qualified nonrecourse financing generally from a prior year that were not deductible or

application of these rules. See the includes financing for which no one is usable because of certain limitations, such

Instructions for Form 8582 for more personally liable for repayment that is as the basis rules or the at-risk limitations,

information. borrowed for use in an activity of holding take them into account in determining your

Partner’s Instructions for Schedule K-1 (Form 1065) -5-

Page 6 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

net income, loss, or credits for this year. Box 2. Net Rental Real Estate following the rules for Publicly traded

However, except for passive activity losses partnerships on page 4.

and credits, do not combine the prior-year Income (Loss) 2. If income is reported on box 3, report

amounts with any amounts shown on this Generally, the income (loss) reported in box the income on Schedule E (Form 1040), line

Schedule K-1 to get a net figure to report on 2 is a passive activity amount for all 28, column (g). However, if the box in item D

any supporting schedules, statements, or partners. However, the income (loss) in box is checked, report the income following the

forms attached to your return. Instead, 2 is not from a passive activity if you were a rules for Publicly traded partnerships on

report the amounts on the attached real estate professional (defined on page 3) page 4.

schedule, statement, or form on a and you materially participated in the

year-by-year basis. activity. If the partnership had more than Box 4. Guaranteed Payments

one real estate rental activity, it will attach a

If you have amounts other than statement that will identify the amount of Generally, amounts on this line are not

passive income, and you should report them

! those shown on Schedule K-1 to

CAUTION report on Schedule E (Form 1040),

income or loss from each activity.

on Schedule E (Form 1040), line 28, column

If you are filing a 2004 Form 1040, use (j) (for example, guaranteed payments for

enter each item separately on line 28 of the following instructions to determine where personal services).

Schedule E. to enter a box 2 amount:

Codes. In box 11 and boxes 13 through 20, 1. If you have a loss from a passive Portfolio Income

the partnership will identify each item by activity in box 2 and you meet all of the Portfolio income or loss (shown in boxes 5

entering a code in the column to the left of following conditions, enter the loss on through 9b and in box 11, code A) is not

the dollar amount entry space. These codes Schedule E (Form 1040), line 28, column (f). subject to the passive activity limitations.

are identified on the back of Schedule K-1 a. You actively participated in the Portfolio income includes income not

and in these instructions. partnership rental real estate activities. See derived in the ordinary course of a trade or

Special allowance for a rental real estate business from interest, ordinary dividends,

Attached Statements. The partnership will activity on page 4.

enter an asterisk (*) after the code, if any, in annuities, or royalties and gain or loss on

b. Rental real estate activities with the sale of property that produces such

the column to the left of the dollar amount active participation were your only passive

entry space for each item for which it has income or is held for investment.

activities.

attached a statement providing additional c. You have no prior year unallowed Box 5. Interest Income

information. For those informational items losses from these activities.

that cannot be reported as a single dollar Report interest income on line 8a of Form

d. Your total loss from the rental real 1040.

amount, the partnership will enter an estate activities was not more than $25,000

asterisk in the left column and write “STMT” (not more than $12,500 if married filing Box 6a. Ordinary Dividends

in the dollar amount entry space to indicate separately and you lived apart from your

the information is provided on an attached Report ordinary dividends on line 9a of Form

spouse all year). 1040.

statement. e. If you are a married person filing

separately, you lived apart from your spouse Box 6b. Qualified Dividends

all year. Report any qualified dividends on line 9b of

f. You have no current or prior year

Income (Loss) unallowed credits from a passive activity.

Form 1040.

g. Your modified adjusted gross income Note: Qualified dividends are excluded

Box 1. Ordinary Business was not more than $100,000 (not more than from investment income, but you may elect

$50,000 if married filing separately and you to include part or all of these amounts in

Income (Loss) investment income. See the instructions for

lived apart from your spouse all year).

The amount reported for box 1 is your share line 4g of Form 4952, Investment Interest

h. Your interest in the rental real estate

of the ordinary income (loss) from the trade Expense Deduction, for important

activity was not held as a limited partner.

or business activities of the partnership. information on making this election.

2. If you have a loss from a passive

Generally, where you report this amount on

activity in box 2 and you do not meet all the Box 7. Royalties

Form 1040 depends on whether the amount

conditions in 1 above, report the loss

is from an activity that is a passive activity to Report royalties on Schedule E, Part I, line

following the Instructions for Form 8582 to

you. If you are an individual partner filing 4.

figure how much of the loss you can report

your 2004 Form 1040, find your situation

on Schedule E (Form 1040), line 28, column

below and report your box 1 income (loss)

(f). However, if the box in item D is checked, Box 8. Net Short-Term Capital

as instructed, after applying the basis and Gain (Loss)

report the loss following the rules for

at-risk limitations on losses. If the

Publicly traded partnerships on page 4. Report the net short-term capital gain (loss)

partnership had more than one trade or

3. If you were a real estate professional on Schedule D, line 5, column (f).

business activity, it will attach a statement

and you materially participated in the

that will identify the amount of income or Box 9a. Net Long-Term Capital

activity, report box 2 income (loss) on

loss from each activity.

Schedule E (Form 1040), line 28, column (h) Gain (Loss)

1. Report box 1 income (loss) from or (j).

partnership trade or business activities in Report the net long-term capital gain (loss)

4. If you have income from a passive

which you materially participated on on Schedule D, line 12, column (f).

activity in box 2, enter the income on

Schedule E (Form 1040), line 28, column (h) Schedule E, line 28, column (g). However, if

or (j). Box 9b. Collectibles (28%) Gain

the box in item D is checked, report the

2. Report box 1 income (loss) from income following the rules for Publicly (Loss)

partnership trade or business activities in traded partnerships on page 4. Your share of any collectibles gain or loss.

which you did not materially participate, as Include this amount on line 4 of the 28%

follows: Rate Gain Worksheet in the instructions for

a. If income is reported in box 1, report

Box 3. Other Net Rental Income Schedule D (Form 1040), line 18.

the income on Schedule E, line 28, column (Loss)

(g). However, if the box in item D is The amount in box 3 is a passive activity Box 9c. Unrecaptured Section

checked, report the income following the amount for all partners. If the partnership 1250 Gain

rules for Publicly traded partnerships on had more than one rental activity, it will There are three types of unrecaptured

page 4. attach a statement that will identify the section 1250 gain. Report your share of this

b. If a loss is reported in box 1, follow amount of income or loss from each activity. unrecaptured gain on the Unrecaptured

the Instructions for Form 8582 to figure how Report the income or loss as follows. Section 1250 Gain Worksheet in the

much of the loss can be reported on 1. If box 3 is a loss, follow the instructions for Schedule D (Form 1040) as

Schedule E, line 28, column (f). However, if instructions for Form 8582 to figure how follows.

the box in item D is checked, report the loss much of the loss can be reported on • Report unrecaptured section 1250 gain

following the rules for Publicly traded Schedule E, line 28, column (f). However, if from the sale or exchange of the

partnerships on page 4. the box in item D is checked, report the loss partnership’s business assets on line 5.

-6- Partner’s Instructions for Schedule K-1 (Form 1065)

Page 7 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

• Report unrecaptured section 1250 gain 4684, Casualties and Thefts, line 34, by the amount of intangible drilling costs,

from the sale or exchange of an interest in a columns (b)(i), (b)(ii), and (c). development costs, or mine exploration

partnership on line 10. If there was a gain (loss) from a casualty costs for the property that you capitalized

• Report unrecaptured section 1250 gain or theft to property not used in a trade or (that is, costs that you did not elect to

from an estate, trust, regulated investment business or for income-producing purposes, deduct under section 59(e)). Report a loss in

company (RIC), or real estate investment the partnership will provide you with the Part I of Form 4797. Report a gain in Part III

trust (REIT) on line 11. information you need to complete Form of Form 4797 in accordance with the

If the partnership reports only 4684. instructions for line 28. See Regulations

unrecaptured section 1250 gain from the section 1.1254-5 for more information.

Code C. Section 1256 contracts &

sale or exchange of its business assets, it straddles. The partnership will report any

• Any income, gain, or loss to the

will enter a dollar amount in box 9c. If it partnership under section 751(b). Report

net gain or loss from section 1256 contracts.

reports the other two types of unrecaptured this amount on Form 4797, line 10.

Report this amount on line 1 of Form 6781,

gain, it will provide an attached statement Gains and Losses From Section 1256 • Specially allocated ordinary gain (loss).

that shows the amount for each type of Contracts and Straddles. Report this amount on Form 4797, line 10.

unrecaptured section 1250 gain. • Gain from the sale or exchange of

Code D. Mining exploration costs qualified small business stock (as defined in

Box 10. Net Section 1231 Gain recapture. The partnership will give you a the Instructions for Schedule D) that is

schedule that shows the information needed eligible for the partial section 1202

(Loss) to recapture certain mining exploration costs

If this amount is from a rental activity, the exclusion. The partnership should also give

(section 617). See Pub. 535 for more you the name of the corporation that issued

section 1231 gain (loss) is generally a information.

passive activity amount. Likewise, if the the stock, your share of the partnership’s

Code E. Cancellation of debt. Generally, adjusted basis and sales price of the stock,

amount is from a trade or business activity this amount is included in your gross income

and you did not materially participate in the and the dates the stock was bought and

(Form 1040, line 21). Under section sold. Corporate partners are not eligible for

activity, the section 1231 gain (loss) is a 108(b)(5), you may elect to apply any

passive activity amount. the section 1202 exclusion. The following

portion of this cancellation of debt to the additional limitations apply at the partner

However, an amount from a rental real reduction of the basis of depreciable level:

estate activity is not from a passive activity if property. See Form 982 for more details. 1. You must have held an interest in the

you were a real estate professional (defined Code F. Other income (loss). Amounts partnership when the partnership acquired

on page 3) and you materially participated in with code F are other items of income, gain, the qualified small business stock and at all

the activity. or loss not included in boxes 1 through 10 or times thereafter until the partnership

If the amount is either (a) a loss that is reported in box 11 using codes A through E. disposed of the qualified small business

not from a passive activity or (b) a gain, The partnership should give you a stock.

report it on line 2, column (g), of Form 4797, description and the amount of your share for 2. Your distributive share of the eligible

Sales of Business Property. Do not each of these items. section 1202 gain cannot exceed the

complete columns (b) through (f) on line 2. Report loss items that are passive amount that would have been allocated to

Instead, write “From Schedule K-1 (Form activity amounts to you following the you based on your interest in the

1065)” across these columns. Instructions for Form 8582. However, if the partnership at the time the stock was

If the amount is a loss from a passive box in item D is checked, report the loss acquired.

activity, see Passive loss limitations in the following the rules for Publicly traded See the Instructions for Schedule D

Instructions for Form 4797. You will need to partnerships on page 4. (Form 1040) for details on how to report the

report the loss following the Instructions for gain and the amount of the allowable

Code F items may include the following:

Form 8582 to figure how much of the loss is

• Partnership gains from the disposition of exclusion.

allowed on Form 4797. However, if the box

farm recapture property (see the instructions • Gain eligible for section 1045 rollover

in item D is checked, report the loss (replacement stock purchased by the

for line 27 of Form 4797) and other items to

following the rules for Publicly traded partnership). The partnership should also

which section 1252 applies.

partnerships on page 4. If the partnership

had net section 1231 gain (loss) from more

• Income from recoveries of tax benefit give you the name of the corporation that

items. A tax benefit item is an amount you issued the stock, your share of the

than one activity, it will attach a statement partnership’s adjusted basis and sales price

deducted in a prior tax year that reduced

that will identify the amount of section 1231 of the stock, and the dates the stock was

your income tax. Report this amount on line

gain (loss) from each activity. bought and sold. Corporate partners are not

21 of Form 1040 to the extent it reduced

your tax. eligible for the section 1045 rollover. To

Box 11. Other Income (Loss)

• Gambling gains and losses. qualify for the section 1045 rollover:

Code A. Other portfolio income (loss). 1. If the partnership was not engaged in 1. You must have held an interest in the

The partnership will report portfolio income the trade or business of gambling, (a) report partnership during the entire period in which

other than interest, ordinary dividend, gambling winnings on Form 1040, line 21 the partnership held the qualified small

royalty, and capital gain (loss) income. It will and (b) deduct gambling losses to the extent business stock (more than 6 months prior to

attach a statement to tell you what kind of of winnings on Schedule A (Form 1040), line the sale) and

portfolio income is reported. 27. 2. Your distributive share of the gain

If the partnership has a residual interest 2. If the partnership was engaged in the eligible for the section 1045 rollover cannot

in a real estate mortgage investment conduit trade or business of gambling, (a) report exceed the amount that would have been

(REMIC), it will report on the statement your gambling winnings on line 28 of Schedule E allocated to you based on your interest in

share of REMIC taxable income (net loss) and (b) deduct gambling losses (to the the partnership at the time the stock was

that you report on Schedule E (Form 1040), extent of winnings) on line 28 of Schedule E, acquired.

line 38, column (d). The statement will also column (h). See the Instructions for Schedule D

report your share of any “excess inclusion” • Gain (loss) from the disposition of an (Form 1040) for details on how to report the

that you report on Schedule E, line 38, interest in oil, gas, geothermal, or other gain and the amount of the allowable

column (c), and your share of section 212 mineral properties. The partnership will give postponed gain.

expenses that you report on Schedule E, you an attached statement that provides a • Gain eligible for section 1045 rollover

line 38, column (e). If you itemize your description of the property, your share of the (replacement stock not purchased by the

deductions on Schedule A (Form 1040), you amount realized from the disposition, your partnership). The partnership should also

may also deduct these section 212 share of the partnership’s adjusted basis in give you the name of the corporation that

expenses as a miscellaneous deduction the property (for other than oil or gas issued the stock, your share of the

subject to the 2% limit on Schedule A, line properties), and your share of the total partnership’s adjusted basis and sales price

22. intangible drilling costs, development costs, of the stock, and the dates the stock was

Code B. Involuntary conversions. This is and mining exploration costs (section 59(e) bought and sold. Corporate partners are not

your net gain (loss) from involuntary expenditures) passed through for the eligible for the section 1045 rollover. To

conversions due to casualty or theft. The property. You must determine the amount of qualify for the section 1045 rollover:

partnership will give you a schedule that gain or loss from the disposition by 1. You must have held an interest in the

shows the amounts to be entered on Form increasing your share of the adjusted basis partnership during the entire period in which

Partner’s Instructions for Schedule K-1 (Form 1065) -7-

Page 8 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

the partnership held the qualified small copy of Form 8283, Noncash Charitable for the year. Do not enter them on Form

business stock (more than 6 months prior to Contributions, to attach to your tax return. 8582.

the sale), Do not deduct the amount shown on this Code K. Section 59(e)(2) expenditures.

2. Your distributive share of the gain form. It is the partnership’s contribution. On an attached statement, the partnership

eligible for the section 1045 rollover cannot Instead, deduct the amount identified by will show the type and the amount of

exceed the amount that would have been code C, box 13, subject to the 50% AGI qualified expenditures to which an election

allocated to you based on your interest in limitation, on line 16 of Schedule A (Form under section 59(e) may apply. The

the partnership at the time the stock was 1040). statement will also identify the property for

acquired, and If the partnership provides you with which the expenditures were paid or

3. You must purchase other qualified information that the contribution was incurred. If there is more than one type of

small business stock (as defined in the property other than cash and does not give expenditure, the amount of each type will

Instructions for Schedule D (Form 1040)) you a Form 8283, see the Instructions for also be listed.

during the 60-day period that began on the Form 8283 for filing requirements. Do not

date the stock was sold by the partnership. Generally, section 59(e) allows each

file Form 8283 unless the total claimed partner to elect to deduct certain expenses

See the Instructions for Schedule D deduction for all contributed items of

(Form 1040) for details on how to report the ratably over the number of years in the

property exceeds $500. applicable period rather than deduct the full

gain and the amount of the allowable

postponed gain. Code D. Noncash contributions (30%). amount in the current year. Under the

• Net short-term capital gain (loss) and net Report this amount, subject to the 30% AGI election, you may deduct circulation

long-term capital gain (loss) from Schedule limitation, on line 16 of Schedule A (Form expenditures ratably over a 3-year period.

D (Form 1065) that is not portfolio income. 1040). Research and experimental expenditures

An example is gain or loss from the Code E. Capital gain property to a 50% and mining exploration and development

disposition of nondepreciable personal organization (30%). Report this amount, costs qualify for a writeoff period of 10

property used in a trade or business activity subject to the 30% AGI limitation, on line 16 years. Intangible drilling and development

of the partnership. Report total net of Schedule A (Form 1040). See Special costs may be deducted over a 60-month

short-term gain (loss) on Schedule D (Form 30% Limit for Capital Gain Property in Pub. period, beginning with the month in which

1040), line 5, column (f). Report the total net 526. such costs were paid or incurred.

long-term gain (loss) on Schedule D (Form Code F. Capital gain property (20%). If you make this election, these items are

1040), line 12, column (f). Report this amount, subject to the 20% AGI not treated as adjustments or tax preference

limitation, on line 16 of Schedule A (Form items for purposes of the alternative

1040). minimum tax. Make the election on Form

Deductions 4562.

Code G. Deductions — portfolio

(2% floor). Amounts entered with this code Because each partner decides whether

Box 12. Section 179 Deduction are deductions that are clearly and directly to make the election under section 59(e),

allocable to portfolio income (other than the partnership cannot provide you with the

Use this amount, along with the total cost of amount of the adjustment or tax preference

section 179 property placed in service investment interest expense and section

212 expenses from a REMIC). Generally, item related to the expenses. You must

during the year from other sources, to decide both how to claim the expenses on

complete Part I of Form 4562, Depreciation you should enter these amounts on

Schedule A (Form 1040), line 22. See the your return and compute the resulting

and Amortization. Use Part I of Form 4562 adjustment or tax preference item.

to figure your allowable section 179 expense Instructions for Schedule A, lines 22 and 27,

deduction from all sources. Report the for more information. Code L. Amounts paid for medical

amount on line 12 of Form 4562 allocable to insurance. Any amounts paid during the

These deductions are not taken into tax year for insurance that constitutes

a passive activity from the partnership using account in figuring your passive activity loss

the Instructions for Form 8582. If the amount medical care for you, your spouse, and your

for the year. Do not enter them on Form dependents. On line 31 of Form 1040, you

is not a passive activity deduction, report it 8582.

on Schedule E (Form 1040), line 28, column may be allowed to deduct such amounts,

(i). However, if the box in item D is checked, Code H. Deductions — portfolio (other). even if you do not itemize deductions. If you

report this amount following the rules for Generally, you should enter these amounts do itemize deductions, enter on line 1 of

Publicly traded partnerships on page 4. on Schedule A (Form 1040), line 27. See Schedule A (Form 1040) any amounts not

the Instructions for Schedule A, lines 22 and deducted on line 31 of Form 1040.

Box 13. Other Deductions 27, for more information. These deductions Code M. Educational assistance benefits.

are not taken into account in figuring your Deduct your educational assistance benefits

Contributions. Codes A through F. The passive activity loss for the year. Do not

partnership will give you a schedule that on a separate line of Schedule E, line 28, up

enter them on Form 8582. to the $5,250 limitation. If your benefits

shows the amount of contributions subject to

the 50%, 30%, and 20% adjusted gross Code I. Investment interest expense. exceed $5,250, you may be able to use the

income limitations. For more details, see Enter this amount on Form 4952, line 1. If excess amount on Form 8863 to figure the

Pub. 526, Charitable Contributions, and the the partnership has investment income or education credits.

Instructions for Schedule A (Form 1040). If other investment expense, it will report your Code N. Dependent care benefits. The

your contributions are subject to more than share of these items in box 20 using codes partnership will report the dependent care

one of the AGI limitations, see the Filled-in A and B. Include investment income and benefits you received. You must use Form

Worksheet for Limit on Deductions in Pub. expenses from other sources to figure how 2441, line 12, to figure the amount, if any, of

526. much of your total investment interest is the benefits you may exclude from your

deductible. You will also need this income.

Charitable contribution deductions are information to figure your investment interest

not taken into account in figuring your expense deduction. Code O. Preproductive period expenses.

passive activity loss for the year. Do not You may be eligible to elect to deduct these

enter them on Form 8582. If the partnership paid or accrued interest expenses currently or capitalize them under

on debts properly allocable to investment section 263A. See Pub. 225, Farmer’s Tax

Code A. Cash contributions (50%). Enter property, the amount of interest you are

this amount subject to the 50% AGI Guide, and Regulations section 1.263A-4.

allowed to deduct may be limited.

limitation on line 15 of Schedule A (Form Code P. Commercial revitalization

1040). For more information and the special deductions from rental real estate

Code B. Cash contributions (30%). provisions that apply to investment interest activities. Follow the instructions for Form

Report this amount, subject to the 30% AGI expense, see Form 4952 and Pub. 550. 8582 to figure how much of the deduction

limitation, on line 15 of Schedule A (Form Code J. Deductions — royalty income. can be reported on Schedule E, line 28,

1040). Enter deductions allocable to royalties on column (f).

Code C. Noncash contributions (50%). If Schedule E (Form 1040), line 18. For this Code Q. Penalty on early withdrawal of

property other than cash is contributed and type of expense, write “From Schedule K-1 savings. Report this amount on Form 1040,

if the claimed deduction for one item or (Form 1065).” line 33.

group of similar items of property exceeds These deductions are not taken into Code R. Pensions and IRAs. Payments

$5,000, the partnership must give you a account in figuring your passive activity loss made on your behalf to an IRA, qualified

-8- Partner’s Instructions for Schedule K-1 (Form 1065)

Page 9 of 12 Partner’s Instructions for Schedule K-1 (Form 1065) 12:31 - 29-DEC-2004

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

plan, simplified employee pension (SEP), or investment is not taken on Schedule E employer pension plan startup costs, credit

a SIMPLE IRA plan. See Form 1040 (Form 1040). Instead, you subtract the for employer-provided childcare facilities,

instructions for line 25 to figure your IRA deduction from the amount that would biodiesel fuels credit, low sulfur diesel fuel

deduction. Enter payments made to a normally be entered as taxable income on production credit, and credit for contributions

qualified plan, SEP, or SIMPLE IRA plan on line 42 (Form 1040). In the margin to the left to selected community development

Form 1040, line 32. If the payments to a of line 42, write ‘‘CCF’’ and the amount of corporations), you must complete Form

qualified plan were to a defined benefit plan, the deduction. 3800, General Business Credit, in addition

the partnership should give you a statement The partnership will give you a to the credit forms identified below. If you

showing the amount of the benefit accrued description and the amount of your share for have more than one credit, see the

for the current tax year. each of these items. Instructions for Form 3800.

Code S. Reforestation expense Codes A and B. Low-income housing

deduction. The partnership will provide a credit. The partnership will report your

statement that describes the qualified timber Box 14. Self-Employment share of the low-income housing credit

property for these reforestation expenses. using code A if section 42(j)(5) applies. If

The expense deduction is limited to $10,000 Earnings (Loss) section 42(j)(5) does not apply, your share

($5,000 if married filing separately) for each If you and your spouse are both partners, of the credit will be reported using code B.

qualified timber property, including your each of you must complete and file your Any allowable low-income housing credit

distributive share of the partnership’s own Schedule SE (Form 1040), (reported as code A or code B) is entered on

expense and any reforestation expenses Self-Employment Tax, to report your line 5 of Form 8586, Low-Income Housing

you separately paid or incurred after partnership net earnings (loss) from Credit.

October 22, 2004, for the property. Follow self-employment. Keep a separate record of the amount of

the instructions for Form 8582 to report a Code A. Net earnings (loss) from low-income housing credit from each of

deduction allocable to a passive activity. If self-employment. If you are a general these sources so that you can correctly

you materially participated in the partner, reduce this amount before entering compute any recapture of low-income

reforestation activity, report the deduction on it on Schedule SE (Form 1040) by any housing credit that may result from the

line 28, column (h), of Schedule E (Form section 179 expense deduction claimed, disposition of all or part of your partnership

1040). unreimbursed partnership expenses interest. For more information, see the

claimed, and depletion claimed on oil and instructions for Form 8611, Recapture of

Code T. Other deductions. Amounts with gas properties. Do not reduce net earnings Low-Income Housing Credit.

this code may include: from self-employment by any separately

• Itemized deductions (Form 1040 filers stated deduction for health insurance

If part or all of the low-income housing

enter on Schedule A (Form 1040)). credit reported using code A or B is

expenses.

• Soil and water conservation expenditures. attributable to additions to qualified basis

See section 175 for limitations on the If the amount on this line is a loss, enter property placed in service before 1990, the

amount you are allowed to deduct. only the deductible amount on Schedule SE partnership will provide an attached

• Expenditures for the removal of (Form 1040). See Limitations on Losses, statement that will separately identify these

architectural and transportation barriers to Deductions, and Credits beginning on amounts. Amounts placed in service before

the elderly and disabled that the partnership page 2. 1990 are subject to different passive activity

elected to treat as a current expense. The If your partnership is an options dealer or limitation rules. See Passive Activity

deductions are limited by section 190(c) to a commodities dealer, see section 1402(i). Limitations and Form 8582-CR for more

$15,000 per year from all sources. information.

If your partnership is an investment club,

• Interest expense allocated to see Rev. Rul. 75-525, 1975-2 C.B. 350. Codes C and D. Qualified rehabilitation

debt-financed distributions. The manner in Code B. Gross farming or fishing expenditures. The partnership will report

which you report such interest expense income. If you are an individual partner, your share of the qualified rehabilitation

depends on your use of the distributed debt enter the amount from this line, as an item expenditures related to rental real estate

proceeds. If the proceeds were used in a of information, on Schedule E (Form 1040), activities using code C. Your share of

trade or business activity, report the interest line 42. Also use this amount to figure net qualified rehabilitation expenditures from

on line 28 of Schedule E (Form 1040). In earnings from self-employment under the property not related to rental real estate

column (a) enter the name of the farm optional method on Schedule SE activities will be reported using code D. On