Professional Documents

Culture Documents

Workshop On Personal Finance and Investment: Coaches For The Program

Workshop On Personal Finance and Investment: Coaches For The Program

Uploaded by

ch.tejaramOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workshop On Personal Finance and Investment: Coaches For The Program

Workshop On Personal Finance and Investment: Coaches For The Program

Uploaded by

ch.tejaramCopyright:

Available Formats

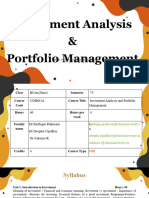

Workshop on Personal Finance and Investment

Coaches for the program

- Vaibhav Jain- https://www.linkedin.com/in/vaibhavjain87/

- Yashwant Pachisia- https://www.linkedin.com/in/yashwantpachisia/

- Rahul Baid- https://www.linkedin.com/in/baidrahul/

Module 1: Introduction to Personal Finance

● Need for Personal Finance Management

● Income tax planning with special emphasis on section80C of the Income Tax Act

● Assessment of personal risk profile

● Introduction to different asset classes and investment options available

● Reading your Salary slips

Module 2: Insurance

● Separating investment from insurance

● Importance of taking up Life Insurance, esp. Term Insurance

● Other categories of life insurances

● Selection of good medical insurance with key riders such as critical illness

Module 3: Mutual Funds

● History of Mutual Funds in India

● Discussion about SEBI control, professional management and increasing transparency

in the sector

● Kinds of Mutual Funds – Equity, Debt, Balanced, Money Market Funds, etc

● Selection of funds basis your risk profile

● Importance of diversification

Module 4:Traditional Investment Assets with special focus on overall portfolio allocation

● Discussion on traditional investment options, covering the following:

● Savings and post office deposits

● Recurring deposits

● Fixed deposits

● Corporate Deposits

● Gilt Funds

● Sovereign Bonds

● Gold bonds

● Physical gold

● Real estate

● Equities

● Interest rate regime in India–on a declining curve and how it affects your investment

decision-making

● Why is equity investment necessary and how to invest in equities

● The necessity of disciplined investment to ensure less risky and steady returns

● Investing in equities in such volatile times shrouded by the COVID-19 scare

Module 6: Alternative Investments

● REIT

● InvIT

● commodities

● AIFs

● Structured Products

Module 7: Asset Diversification

Module 8: Tax planning and Section 80C

● Detailed discussion on each investment option available under Chapter VI of the

Income Tax,1961

● The Old Tax Regime vs the New One- How to plan your finances

● Managing your tax and investment together

Module 9: Learnings from ‘Fools’ around

● There are a lot of alluring offers on Credit Cards, Personal Overdraft, Line of Credit

and Personal Loans that are marketed to working professionals. Discussion on the

pros and cons of each, and how to avoid falling into a debt trap and avoid frauds

● Key lessons like preparing for the bad times, the importance of long term investment,

not keeping all eggs in one basket

Click Here to Buy NOW

You might also like

- Valuation - The Art and Science of Corporate Investment Decisions (Titman) PDFDocument556 pagesValuation - The Art and Science of Corporate Investment Decisions (Titman) PDFmohith100% (9)

- SAP Business Process Improvement Series Transfer Pricing and Material Ledger in SAP PDFDocument40 pagesSAP Business Process Improvement Series Transfer Pricing and Material Ledger in SAP PDFali100% (1)

- Comparative Study of Various Alternatives Available in The Market For Wealth Management PDFDocument68 pagesComparative Study of Various Alternatives Available in The Market For Wealth Management PDFHenal Jhaveri100% (1)

- A Study of The Risk and Return of Alternative Investment Opportunities Available To High Net Worth Individuals in IndiaDocument56 pagesA Study of The Risk and Return of Alternative Investment Opportunities Available To High Net Worth Individuals in Indiasohailsam100% (1)

- NASD Series 7 Cheat Sheet - Monica Haven - 01Document1 pageNASD Series 7 Cheat Sheet - Monica Haven - 01HappyGhost0% (3)

- Project Part 1Document46 pagesProject Part 1Ashatt AshatttNo ratings yet

- Il&Fs Project ReportDocument61 pagesIl&Fs Project Reportmahantesh123100% (32)

- Financial Planning M4Document51 pagesFinancial Planning M4aashish kumarNo ratings yet

- Investment in Stock Market NotesDocument11 pagesInvestment in Stock Market Notesappuzzz2000zzzzNo ratings yet

- Mukhtar - Reliance Mutual FundDocument47 pagesMukhtar - Reliance Mutual FundEishan FarooqNo ratings yet

- KJ 3 BXDocument246 pagesKJ 3 BXTanvi DeshmukhNo ratings yet

- Research ReportDocument92 pagesResearch ReportSuraj DubeyNo ratings yet

- Personal Finance: Another Perspective: Intermediate Investing 2: ApplicationDocument55 pagesPersonal Finance: Another Perspective: Intermediate Investing 2: ApplicationSrinivasa Reddy SNo ratings yet

- Project Report On Icici Bank: Made by Piyush PallwalDocument18 pagesProject Report On Icici Bank: Made by Piyush PallwalPiyushE63No ratings yet

- New 1212Document86 pagesNew 1212Waseem AnsariNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document23 pagesInvestment Decision and Portfolio Management (ACFN 632)habtamuNo ratings yet

- Asset AllocationDocument22 pagesAsset AllocationhemdinsNo ratings yet

- Ueh University College of Business School of Finance: Investment Portfolio StatementDocument11 pagesUeh University College of Business School of Finance: Investment Portfolio StatementKHOA LÊ VŨ CHÂUNo ratings yet

- 65 - IM - PPT - Types of Mutual Fund ImpDocument15 pages65 - IM - PPT - Types of Mutual Fund ImpRamNo ratings yet

- Investing Pdf1 FTCDocument309 pagesInvesting Pdf1 FTCstardennisNo ratings yet

- ICICI Mutual FundDocument49 pagesICICI Mutual FundkalyanbobbydNo ratings yet

- Associate Wealth Manager AWMDocument8 pagesAssociate Wealth Manager AWMShweta ChhabraNo ratings yet

- Portfolio Management Project Submitted by WASIF MAHOOD 1806Document13 pagesPortfolio Management Project Submitted by WASIF MAHOOD 1806Daniyal WahabNo ratings yet

- How It Works To Make Better Financial LifeDocument16 pagesHow It Works To Make Better Financial LifeSunilNo ratings yet

- Investing for Tomorrow_ Building Wealth Today for a Secure FutureFrom EverandInvesting for Tomorrow_ Building Wealth Today for a Secure FutureNo ratings yet

- Effect of Covid-19 On Mutual Funds by Aneesh Kishan - IIM TiruchirapalliDocument17 pagesEffect of Covid-19 On Mutual Funds by Aneesh Kishan - IIM TiruchirapallimegamegeshNo ratings yet

- Chapter 6Document35 pagesChapter 6arnav.gopalNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document23 pagesInvestment Decision and Portfolio Management (ACFN 632)Hussen AbdulkadirNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document23 pagesInvestment Decision and Portfolio Management (ACFN 632)Hussen AbdulkadirNo ratings yet

- IAPM - Unit 1 - 2024Document61 pagesIAPM - Unit 1 - 2024vishalsingh9669No ratings yet

- CSE Awareness On Savings and Investment For The StudentsDocument33 pagesCSE Awareness On Savings and Investment For The StudentsAlexander FloresNo ratings yet

- Unit 4: Investment VehiclesDocument29 pagesUnit 4: Investment Vehiclesworld4meNo ratings yet

- 1 BackgroundDocument22 pages1 BackgroundSHIVANSH BANSALNo ratings yet

- SharekhanDocument79 pagesSharekhanVarsha GuptaNo ratings yet

- Analysis of Different Investment Plan of Mutula Fund (Reliance Money)Document103 pagesAnalysis of Different Investment Plan of Mutula Fund (Reliance Money)ShahzadNo ratings yet

- Investment Management: - Asset Allocation DecisionDocument23 pagesInvestment Management: - Asset Allocation DecisionyebegashetNo ratings yet

- Thakare 1Document50 pagesThakare 1Abhishek MishraNo ratings yet

- Mutual Fund Investment Concepts & PracticesDocument2 pagesMutual Fund Investment Concepts & PracticesMRIDUL GOELNo ratings yet

- Eed 326Document93 pagesEed 326Arinze samuelNo ratings yet

- Project Dissertation: Submitted in The Partial Fullfilment of MBADocument50 pagesProject Dissertation: Submitted in The Partial Fullfilment of MBAAshish BaniwalNo ratings yet

- Episode1 How To InvestDocument2 pagesEpisode1 How To InvestAbhijit BhowmickNo ratings yet

- Types of Investments and The Related Risks: Lesson 6.2Document26 pagesTypes of Investments and The Related Risks: Lesson 6.2Tin CabosNo ratings yet

- Commodity MarketDocument65 pagesCommodity MarketGarima DhawanNo ratings yet

- Share Market SyllabusDocument3 pagesShare Market SyllabusdoskncexamNo ratings yet

- 249 P16MC41 2020052110102834Document57 pages249 P16MC41 2020052110102834Peer MohaideenNo ratings yet

- Investment Decision and Portfolio Management (ACFN 632)Document25 pagesInvestment Decision and Portfolio Management (ACFN 632)yebegashetNo ratings yet

- Financial Services and Capital Markets: Final Course Study MaterialDocument16 pagesFinancial Services and Capital Markets: Final Course Study MaterialMANTHAN PALIWALNo ratings yet

- Wealth ManagementDocument55 pagesWealth ManagementGagandeep Singh Chandhok100% (1)

- SHAREKHANDocument79 pagesSHAREKHANDaroga ManjhiNo ratings yet

- Contents of The Report: Serial No. ParticularsDocument37 pagesContents of The Report: Serial No. ParticularsMayurika SharmaNo ratings yet

- Assignment 2 Maf653 - Group 6Document11 pagesAssignment 2 Maf653 - Group 6nurul syakirin0% (1)

- Submitted in The Partial Fulfillment For The Requirement of The Award of Degree ofDocument66 pagesSubmitted in The Partial Fulfillment For The Requirement of The Award of Degree ofJyoti YadavNo ratings yet

- Investment 101 Beginners Guide To Investing For Pinoy 1Document29 pagesInvestment 101 Beginners Guide To Investing For Pinoy 1MARY JOY B. CALINAONo ratings yet

- Financial and Investment Planning in Reference To Mutual Funds IndustryDocument16 pagesFinancial and Investment Planning in Reference To Mutual Funds IndustryIshaan KumarNo ratings yet

- Finance Project MbaDocument137 pagesFinance Project MbaMint AmiNo ratings yet

- 1 Background Updated GJDocument34 pages1 Background Updated GJRishta PorwalNo ratings yet

- FundingDocument20 pagesFundingAyinalemNo ratings yet

- IAI SP5 Syllabus 2024Document7 pagesIAI SP5 Syllabus 2024sriinaNo ratings yet

- SAPM Mod. 1Document24 pagesSAPM Mod. 1jabeanonionNo ratings yet

- Portfolio ManagementDocument20 pagesPortfolio ManagementKrishna Chandran Pallippuram100% (1)

- Project On Profile StudentDocument50 pagesProject On Profile Studentlokeshchaudhari1100No ratings yet

- Investing for the Future: A Beginner's Guide: Investment, #1From EverandInvesting for the Future: A Beginner's Guide: Investment, #1No ratings yet

- Bank L0 DumpDocument503 pagesBank L0 Dumpdhootankur60% (5)

- Hull OFOD10e MultipleChoice Questions Only Ch24Document4 pagesHull OFOD10e MultipleChoice Questions Only Ch24Kevin Molly KamrathNo ratings yet

- Sales of Goods ActDocument43 pagesSales of Goods ActPriyank bhati 2988No ratings yet

- Examination: Subject CA1 - Core Applications Concepts Paper 1 (Assets)Document12 pagesExamination: Subject CA1 - Core Applications Concepts Paper 1 (Assets)Saad MalikNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Solution 1674112112Document47 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Solution 1674112112pari maheshwariNo ratings yet

- Derivatives AccountingDocument28 pagesDerivatives Accountingkotha123No ratings yet

- Caso Southwest AirlinesDocument33 pagesCaso Southwest AirlinesshintsurichanNo ratings yet

- Credit Risk ModelingDocument3 pagesCredit Risk ModelingsinghhcmNo ratings yet

- QTRRTC Live SaverDocument114 pagesQTRRTC Live SaverTRANG NGUYỄN THUNo ratings yet

- Sensitivity Sample Model: Tornado, Spider and Sensitivity Charts (Nonlinear)Document6 pagesSensitivity Sample Model: Tornado, Spider and Sensitivity Charts (Nonlinear)cajimenezb8872No ratings yet

- TRM ASSIGNMEN VietcombakDocument24 pagesTRM ASSIGNMEN Vietcombaktrung luuchiNo ratings yet

- 1231.3376.01 -ל הרמהל ח"גאמ - Convertible ArbitrageDocument3 pages1231.3376.01 -ל הרמהל ח"גאמ - Convertible ArbitrageitzikhevronNo ratings yet

- JigsawProductManualV3 3Document54 pagesJigsawProductManualV3 3mirilinamso100% (1)

- Live Trading Session With Rishikesh SirDocument6 pagesLive Trading Session With Rishikesh SirYash GangwalNo ratings yet

- Valuation Policy by Lehman BrothersDocument107 pagesValuation Policy by Lehman BrothersAL100% (2)

- Business Builder Unit 6 Report WritingDocument22 pagesBusiness Builder Unit 6 Report WritingChristina AlexanderNo ratings yet

- Cogent Analytics M&A ManualDocument19 pagesCogent Analytics M&A Manualvan070100% (1)

- GI Book 6e-Chuong6Document56 pagesGI Book 6e-Chuong6ngocnguyen.31211022349No ratings yet

- NCFM Exam Derivatives Market (Dealers) ModuleDocument11 pagesNCFM Exam Derivatives Market (Dealers) Modulesatish_mak100% (1)

- POI Box & 50% FibDocument9 pagesPOI Box & 50% FibTomas PallumNo ratings yet

- Bettin Bots - False FavouritesDocument41 pagesBettin Bots - False Favouriteskaalingaa starNo ratings yet

- Call OptionDocument1 pageCall OptionMustafa BhaiNo ratings yet

- A New Evaluation Procedure in Real Estate Projects: Jpif 29,3Document17 pagesA New Evaluation Procedure in Real Estate Projects: Jpif 29,3Tony BuNo ratings yet

- Paying Not To Go To The GymDocument26 pagesPaying Not To Go To The GymShaark LamNo ratings yet

- Options Made SimpleDocument66 pagesOptions Made Simplefutureusmc432No ratings yet

- 8-9. Equity Linked NotesDocument7 pages8-9. Equity Linked NotesShubhangi JainNo ratings yet

- Asset Classes and Financial Instruments: Bodie, Kane, and Marcus Tenth EditionDocument49 pagesAsset Classes and Financial Instruments: Bodie, Kane, and Marcus Tenth EditionA SNo ratings yet