Professional Documents

Culture Documents

Home Assinment 2021-22new Microsoft Office Word Document

Home Assinment 2021-22new Microsoft Office Word Document

Uploaded by

Ganesh AdhalraoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Assinment 2021-22new Microsoft Office Word Document

Home Assinment 2021-22new Microsoft Office Word Document

Uploaded by

Ganesh AdhalraoCopyright:

Available Formats

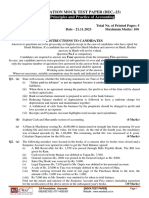

S..Y.J.C.

HOME ASSIGNMENT 2021-22

SUBJECT: BOOK KEEPING AND ACCOUNTANCY

Q.1 A. Select the most appropriate answer from the alternatives given below

and rewrite the sentences:

1._____________ means payment of the bill before due date.

a) discounting of bill b) retirement of bill) renewal of bill d) endorsement of bill

2. the person , to whom or as per his order amount of bill is payable is a

_____________.

a) drawer b) drawee c) payee d) creditor.

3.A bill drawn on 29 august 2016 for 1 months will due payable

on___________.a)2nd oct 2017 b) 1 oct 2016 c)3rdoct 2019d)30thsept

4.when bill is dishonored _________ is held responsible for the nothing charges.

a) holder b)drawee c) drawer d)endorser.

5.Asequity shar of face value Rs. 10 issued at Rs. 15 Then the equity share is

issued at _______

A At par B At premium C at dissciunt D. At more the face value

Q1 B) PREPARE A SPECIMAN OF BILL OF EXCHANG FROM THE FOLLWING

INFORMATION.

drawer Rahul chaudhari 105, g.b road ,thane.

drawee prakash patil 207, ganga road nasik.

payee sonal chaudhari, m.g. road, dhule.

period of bill 60days. Amount of bill Rs. 10,000.

Date of bill 18thdecember 2013.

Date of acceptance 18thdecember 2013.

Q2 ) on 14thmay ,2012Rohit sold goods on credit to Devidas fo rs. 30,000.

on the same date rohit draws a bill on Devidas for rs.30,000 at 3months . Devidas

accepted it and returned the bill to Rohit.

on 17thjune, 2012, rohit discounted the bill with his bank @10% p.a. on due date

devidas finds himself unable to make payment of the bill and request Rohit to

renew it. Rohit accepted the proposal on the condition that Devidas should pay rs.

10,000 on account along with interest of rs.500 in cash and should accept new bill

for the balance at 2 months.

These arrangements were carried through.Give journal entries in books of Rohit

and prepare Rohit a/c in Devidas ledger

@3)Abhay and Vijay were partners sharing profit and losses in the ratio of

2 :1 respectively Their Balance Sheet was as follows:

Balance Sheet as

On 31st March, 2010

Liabilities Amount Assets Amount

(Rs.) (Rs.)

Capital A/c : Cash at Bank 4,000

Abhay 24,000 Debtors 15,000

Vijay 16,000 Stock 23,500

Trade Creditors 26,000 Furniture 5,000

Asha Loan A/c 6,500 Building 25,000

Total 72,500 72,500

st

On 1 April 2010, Sanjay is admitted in the partnership on the following terms

1)Sanjay should bring in cash of Rs. 12,000/- as capital for 1/5 share in future

profit.

2)Goodwill A/c be raised in the books of the firm for Rs.4,500.

3)Building is revalued at Rs. 28,000 and the value of stock be reduced by Rs.

1,500.4)Reserve for doubtful debts be provided at 5% on debtors.Prepare

:a)Profit and Loss Adjustment account b)Capital account of partners

c)Balance sheet of the new firm.

Q4.)Khandelwal co.Ltd.made issue of40,000 equity share of R20 each payable

as follows: Application Rs. 5 per share Allotment Rs. 10 per

share

First call Rs. 3 per share second& final call Rs. 2 per share

The company received Applications of 45,000shares of which applicants for

5,000 shares were rejected and the money refunded. All the Shareholders paid

up to second call except Sachin ,the Allotee of 2,000 shares failed to pay final

call. Pass Journal entries for the above transactios in the books of Khandelwal &

co.

Q5.The Balance sheet of Babu and chandu who share profit & loss in the

ratio of 3:1 as on 31 march 2018.

Balance sheet As on 31 march 2018

Particulars Amt(Rs.) Particulars Amt (Rs.)

Creditors 20,000 Bank 20,000

Wokmen’s 30,000 Debtors 13,000

compensation Less-Rdd 1,000 12,000

Reserve

General Reserve 24,000 Bills Receivable 10,000

Babu capital 32,000 stock 20,000

Chandu capital 28,000 Land & Building 30,000

Total Goodwill 42,000

1,34000 1,34,000

Annu was admitted on 1.04.2018 for 1/5 share on the following terms

1. He will bring in Rs. 20,000 as his share of Goodwill and Necessary

amount for his share of capital o in cash .

2. Anil an old customer Whose account was written of as Bad he paid Rs.

400 in cash in full settlement of his dues

3. The market value of Land & Building is taken to be Rs40,000.

4. . Workmen compensation Reseve w to be increase by Rs.10,000.

5. Unaccounted Income of Rs. 200 to be accounted for .

6. The capital accounts of All the partners are to be in new profit sharing

ratio taking old partners total capital as base after adjustment.Actualcash

is to paid off or brought in by the partners for adjusting their capital

accpount prepare

1. Revalution A/c2. Partners capital A/c and Balance sheet after Annu’s

admission

You might also like

- BS Iec 60300-3-5-2001 - (2020-08-31 - 04-34-43 PM)Document74 pagesBS Iec 60300-3-5-2001 - (2020-08-31 - 04-34-43 PM)daniela fabiola CisternasNo ratings yet

- Swift MT 799Document2 pagesSwift MT 799Lincoln Reserve Group Inc.100% (2)

- SAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Document16 pagesSAMPLE PAPER-1 (Solved) : For CBSE Examination March 2017Shreya PalejkarNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- Dissolution Practice Questions PDFDocument8 pagesDissolution Practice Questions PDFUmesh JaiswalNo ratings yet

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDocument3 pagesBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNo ratings yet

- 12th Accounts Partnership Test 15 Sept.Document6 pages12th Accounts Partnership Test 15 Sept.SGEVirtualNo ratings yet

- Sample Paper (Cbse) - 2009 Accountancy - XiiDocument5 pagesSample Paper (Cbse) - 2009 Accountancy - XiiJanine AnzanoNo ratings yet

- Test Retirement Death Dissolution-1Document4 pagesTest Retirement Death Dissolution-1Vibhu VashishthNo ratings yet

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- Bcom NotesDocument91 pagesBcom NotesJ RajputNo ratings yet

- Retire Death Dissolution SheetDocument6 pagesRetire Death Dissolution SheetTanvi SisodiaNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Sy DissolutionDocument7 pagesSy Dissolutionsmit9993No ratings yet

- 12th Marking AccountancyDocument52 pages12th Marking AccountancyManoj GiriNo ratings yet

- Chapter - Partnership Accounts If There Is No Partnership DeedDocument8 pagesChapter - Partnership Accounts If There Is No Partnership DeedVijayasri KumaravelNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- Accountancy Unit Test 2 - WorksheetDocument12 pagesAccountancy Unit Test 2 - WorksheetFawaz YoosefNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- Accountancy Sample PapersDocument29 pagesAccountancy Sample Papersaguptakochi314No ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- MB 104 Basics of Accounting and FinanceDocument3 pagesMB 104 Basics of Accounting and FinancerajeshpatnaikNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- Fundamental & Dissolution of Partnership: Time Allowed: 3/2 Hrs. M.M. 50Document4 pagesFundamental & Dissolution of Partnership: Time Allowed: 3/2 Hrs. M.M. 50ashok jaiswalNo ratings yet

- Practice QP Accountancy Class Xii Set-IDocument8 pagesPractice QP Accountancy Class Xii Set-Ichokeplayer15No ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- CA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul AgrawalDocument8 pagesCA-Foundation Accounting Full Syllabus Paper by Darshan Jain and Anshul Agrawalharshveersingh480No ratings yet

- S. Y. B Com - Accounts: Piecemeal Distribution 2016-17Document5 pagesS. Y. B Com - Accounts: Piecemeal Distribution 2016-17Aman VakhariaNo ratings yet

- Test Paper 11Document8 pagesTest Paper 11Sukhjinder SinghNo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- XII Accountancy in Eng QPDocument6 pagesXII Accountancy in Eng QPSarang KrishnanNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- Answer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120Document5 pagesAnswer Any Four Questions. (4X6 24) : Time: 3 Hours Max. Marks:120hanumanthaiahgowdaNo ratings yet

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- Dissolution 2024 SPCC PDFDocument66 pagesDissolution 2024 SPCC PDFdollpees01No ratings yet

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- Subject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100Document5 pagesSubject: Accountancy: Timings Allowed: 1 HR 30 Minutes Total Marks: 100darla85nagarajuNo ratings yet

- Admission of A Partner WorksheetDocument4 pagesAdmission of A Partner Worksheetneeraj sharmaNo ratings yet

- Partner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsDocument17 pagesPartner Ship Accounts - I: Balance Sheet Dr. Cr. Particulars Amount Rs. Particulars Amount RsM JEEVARATHNAM NAIDUNo ratings yet

- Financial Accounting Punjab University: Question Paper 2018Document4 pagesFinancial Accounting Punjab University: Question Paper 2018aneebaNo ratings yet

- Guru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GDocument6 pagesGuru Gobind Singh Pubilc School: Sector - V Term - Ii, Pre-Board Examination 2021-22 Class - XII GSAURABH JAINNo ratings yet

- Important Que Advanced Cor AccDocument18 pagesImportant Que Advanced Cor Accvineethaj2004No ratings yet

- 12th BK Prelim Quesiton Paper March 2021Document8 pages12th BK Prelim Quesiton Paper March 2021Harendra PrajapatiNo ratings yet

- Corporate Account IIDocument7 pagesCorporate Account IIalphadark72No ratings yet

- G1 6.3 Partnership - DissolutionDocument15 pagesG1 6.3 Partnership - Dissolutionsridhartks100% (2)

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- 12th HSC Accounts Sample PaperDocument5 pages12th HSC Accounts Sample Papervaibhavnakashe44No ratings yet

- 12 2006 Accountancy 4Document5 pages12 2006 Accountancy 4Akash TamuliNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceDocument53 pagesBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaNo ratings yet

- Accounts Holiday HW 1Document4 pagesAccounts Holiday HW 1AlishbaNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Public Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Indonesia: Key Elements from a Financial Management PerspectiveRating: 5 out of 5 stars5/5 (1)

- Accounting Information System - Chapter 5 - ReviewerDocument8 pagesAccounting Information System - Chapter 5 - ReviewerSecret LangNo ratings yet

- 2024 Service GuideDocument8 pages2024 Service Guideapi-274081075No ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Lettergoldenretriever854No ratings yet

- Performance Appraisal & Underperformance: A Study On Apex Footwear LimitedDocument7 pagesPerformance Appraisal & Underperformance: A Study On Apex Footwear LimitedAnisha FarzanaNo ratings yet

- Ms. Thao's EssayDocument6 pagesMs. Thao's EssayG-yan Dungan MamuyacNo ratings yet

- OVERVIEW ABOUT Coca-Cola 1.1. Company and Brand IntroductionDocument11 pagesOVERVIEW ABOUT Coca-Cola 1.1. Company and Brand IntroductionLâm Tú HânNo ratings yet

- Creative and Innovative ManagementDocument14 pagesCreative and Innovative ManagementJere Jean ValencerinaNo ratings yet

- Take Home ExamDocument6 pagesTake Home Examnadya bujangNo ratings yet

- Mid Sem Exam - RoutineDocument15 pagesMid Sem Exam - Routineshashikant chitranshNo ratings yet

- Pssbooklet PDFDocument142 pagesPssbooklet PDFForkLogNo ratings yet

- Section - 5 - Conditions of Particular ApplicationDocument53 pagesSection - 5 - Conditions of Particular ApplicationHaile AndargNo ratings yet

- Ruigomez OppDocument8 pagesRuigomez OppdefiantdetectiveNo ratings yet

- Summer Training Project Report: A Detail Study On Customer Relationship Strategy Under Agarwal Auto Sales, MirzapurDocument76 pagesSummer Training Project Report: A Detail Study On Customer Relationship Strategy Under Agarwal Auto Sales, Mirzapurvikas guptaNo ratings yet

- MGT666 - HRM666 - LI FULL GUIDELINE 2021 (FinalV 12 Apr)Document26 pagesMGT666 - HRM666 - LI FULL GUIDELINE 2021 (FinalV 12 Apr)Aifaa ArinaNo ratings yet

- Ic s01 Engineering InsuranceDocument79 pagesIc s01 Engineering InsuranceRanjithNo ratings yet

- 2020 MSM Discussion ProblemsDocument48 pages2020 MSM Discussion ProblemsSai PrabhathNo ratings yet

- Commerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsDocument6 pagesCommerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsVishakha VishwakarmaNo ratings yet

- Problem 29.2Document2 pagesProblem 29.2Arian AmuraoNo ratings yet

- Lulu Hypermarket 18 - PagenumberDocument108 pagesLulu Hypermarket 18 - Pagenumberinfo100% (1)

- Engineering EconomicsDocument153 pagesEngineering EconomicsRJ MCNo ratings yet

- Meat Processing Plant Feasibility V3 1Document31 pagesMeat Processing Plant Feasibility V3 1Yasir Liaqat100% (1)

- Fundamentals of Marketing: Epp/Tle 9Document42 pagesFundamentals of Marketing: Epp/Tle 9katherine corveraNo ratings yet

- Fairtrade Geographical Scope Policy of Producer CertificationDocument4 pagesFairtrade Geographical Scope Policy of Producer CertificationALPENGIRLNo ratings yet

- Accounting SyllabusDocument1 pageAccounting SyllabusJonathan AddoNo ratings yet

- Best It Company in Dehradun - CdmindsDocument14 pagesBest It Company in Dehradun - CdmindsCreative MindsNo ratings yet

- Property Manager Data SheetDocument6 pagesProperty Manager Data SheetSanka JayarathnaNo ratings yet

- Module 1Document19 pagesModule 1Srilakshmi MaduguNo ratings yet

- Module 12. Worksheet - Hypothesis TestingDocument3 pagesModule 12. Worksheet - Hypothesis TestingShauryaNo ratings yet