Professional Documents

Culture Documents

44 - CIR vs. Liquigaz

44 - CIR vs. Liquigaz

Uploaded by

ECopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Weinstock Vs Kelly Barker ComplaintDocument102 pagesWeinstock Vs Kelly Barker ComplaintKathy TarochioneNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pelizloy Realty Corp. v. Province of Benguet20210506-11-1cl5nnyDocument11 pagesPelizloy Realty Corp. v. Province of Benguet20210506-11-1cl5nnyENo ratings yet

- Petitioner Respondents Gonzales, Batiller, Bilog & Associates Garcilaso F VegaDocument4 pagesPetitioner Respondents Gonzales, Batiller, Bilog & Associates Garcilaso F VegaENo ratings yet

- Petitioner Respondent: China Banking Corporation, City Treasurer of ManilaDocument14 pagesPetitioner Respondent: China Banking Corporation, City Treasurer of ManilaENo ratings yet

- Ericsson Telecommunications Inc. v. City Of20210505-12-12f6os4Document9 pagesEricsson Telecommunications Inc. v. City Of20210505-12-12f6os4ENo ratings yet

- Legend Int'l Resorts v. Kilusang Manggagawa NG LegendDocument2 pagesLegend Int'l Resorts v. Kilusang Manggagawa NG LegendRonnel DeinlaNo ratings yet

- Purposive Construction of Penal StatutesDocument12 pagesPurposive Construction of Penal StatutesAnanyaNo ratings yet

- G.R. No. 151895 BOC Vs SerranoDocument4 pagesG.R. No. 151895 BOC Vs SerranoJessie AncogNo ratings yet

- 5 Keppel Bank Philippines Inc Vs AdaoDocument11 pages5 Keppel Bank Philippines Inc Vs AdaoGfor FirefoxonlyNo ratings yet

- CMS Vs TeamHealth Fraud Upcoding Lawsuit September 2020Document123 pagesCMS Vs TeamHealth Fraud Upcoding Lawsuit September 2020Health Care Fraud Research0% (1)

- Character and Antecedents Verification Form: Period From ToDocument3 pagesCharacter and Antecedents Verification Form: Period From Tovikram ruhilNo ratings yet

- Takata Philippines v. BLR and SALAMAT, June 4, 2014Document13 pagesTakata Philippines v. BLR and SALAMAT, June 4, 2014bentley CobyNo ratings yet

- 36 Bicol Isarog Transport Systems Inc. v. Relucio, G.R. No. 234725, September 16, 2020Document13 pages36 Bicol Isarog Transport Systems Inc. v. Relucio, G.R. No. 234725, September 16, 2020Lex LawNo ratings yet

- Screenshot 2023-05-18 at 1.23.55 PMDocument31 pagesScreenshot 2023-05-18 at 1.23.55 PMsabNo ratings yet

- TAYLOR v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketDocument2 pagesTAYLOR v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketACELitigationWatchNo ratings yet

- Labour Law ProjectDocument20 pagesLabour Law Projectmihir khannaNo ratings yet

- The Metropolitan Bank and Trust Company v. RosalesDocument1 pageThe Metropolitan Bank and Trust Company v. RosalesJm Santos100% (1)

- TORTS - 2. Calalas v. CADocument7 pagesTORTS - 2. Calalas v. CAMark Gabriel B. MarangaNo ratings yet

- Court of Appeals RulingDocument4 pagesCourt of Appeals RulingChris BerinatoNo ratings yet

- Alex Jones Sues Jan 6 Cmte To Stop Review of Phone MetadataDocument7 pagesAlex Jones Sues Jan 6 Cmte To Stop Review of Phone MetadataDaily KosNo ratings yet

- Upcoca (Uttar Pradesh Control of Organised Crime Bill, 2018)Document6 pagesUpcoca (Uttar Pradesh Control of Organised Crime Bill, 2018)JatinNo ratings yet

- 2024 01 29 Verified Information of Contemptuous Conduct Delphi RaDocument9 pages2024 01 29 Verified Information of Contemptuous Conduct Delphi RaMatt Blac inc.No ratings yet

- Free Sample QuestionsDocument15 pagesFree Sample Questions302-30-จริยาภรณ์ โสภารัตน์No ratings yet

- Bill Hamilton's Summons and Complaint (W0238403)Document161 pagesBill Hamilton's Summons and Complaint (W0238403)Neighbors WestNo ratings yet

- Petitioners vs. vs. Respondent: Second DivisionDocument4 pagesPetitioners vs. vs. Respondent: Second DivisionVener MargalloNo ratings yet

- G.R. No. L-12219 March 15, 1918 AMADO PICART, Plaintiff-Appellant, FRANK SMITH, JR., Defendant-AppelleeDocument38 pagesG.R. No. L-12219 March 15, 1918 AMADO PICART, Plaintiff-Appellant, FRANK SMITH, JR., Defendant-AppelleeAlex FranciscoNo ratings yet

- Bravo Guerrero Vs BravoDocument2 pagesBravo Guerrero Vs BravoRedd LapidNo ratings yet

- Legal - March - Submission 3Document39 pagesLegal - March - Submission 3Harendra SinghNo ratings yet

- PNB vs. Ritratto Group Inc. (G.R. No. 142616 July 31, 2001)Document4 pagesPNB vs. Ritratto Group Inc. (G.R. No. 142616 July 31, 2001)eunice demaclidNo ratings yet

- Petitioner vs. VS.: en BancDocument7 pagesPetitioner vs. VS.: en Bancthirdy demaisipNo ratings yet

- Equity 2Document16 pagesEquity 2Harneet KaurNo ratings yet

- McCoy v. Diggs, 4th Cir. (1998)Document2 pagesMcCoy v. Diggs, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Jurisdictions - Labrel PDFDocument6 pagesJurisdictions - Labrel PDFPriscilla DawnNo ratings yet

- Smile Direct Club v. Candid Care - Complaint (Seeking 289 For UP Infringement)Document42 pagesSmile Direct Club v. Candid Care - Complaint (Seeking 289 For UP Infringement)Sarah BursteinNo ratings yet

44 - CIR vs. Liquigaz

44 - CIR vs. Liquigaz

Uploaded by

EOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

44 - CIR vs. Liquigaz

44 - CIR vs. Liquigaz

Uploaded by

ECopyright:

Available Formats

CIR vs.

Liquigaz Philippines Corporation

GR No. 215534/215557; April 18, 2016

[Assessment of internal revenue taxes > Procedural due process in tax assessments > Appeal from an administrative decision on disputed assessment]

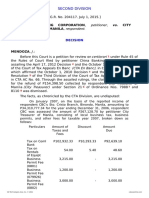

FACTS: Liquigaz Philippines Corporation (Liquigaz) is a corporation duly organized and existing under

Philippine laws. After receiving a Letter of Authority from the CIR which authorized the investigation of all

its internal revenue taxes for taxable year 2005 and a Notice of Informal Conference, it received its

Preliminary Assessment Notice (PAN) where Liquigaz was initially assessed with deficiency withholding

tax liabilities. Thereafter, Liquigaz received a Formal Letter of Demand (FLD) or Formal Assessment

Notice (FAN) where the total deficiency withholding tax liabilities amounted to P24.3 Million.

Liquigaz filed its protest against the FAN. Years later, it received a copy of the Final Decision on Disputed

Assessment (FDDA) covering the LOA for the taxable year 2005. It stated that the CIR still found Liquigaz

liable for P22.3 Million.

Consequently, Liquigaz filed a Petition for Review before the CTA Division assailing the FDDA.

CTA Division: partially granted the petition cancelled the EWT and FBT assessment but affirmed with

modification the WTC; held that the portion relating to EWT and FBT were void in violation of Section 228,

NIRC, as implemented by RR 12-99. Moreover, unlike the PAN and FAN, the FDDA did not provide the

details thereof, hence, Liquigaz had no way of knowing what items were considered by CIR in arriving at

the deficiency assessments; and that while the legal bases for the EWT and FBT assessment were stated

in the FDDA, the taxpayer was not notified of the factual bases thereof, as required in Sec. 228.

CTA en banc: affirmed the decision of the CTA Division reiterating that the requirement that the taxpayer

should be informed in writing of the law and the facts on which the assessment was made applies to the

FDDA — otherwise the assessment would be void.

ISSUE/S: When may a Final Decision on Disputed Assessment (FDDA) be declared void, and in the

event that the FDDA is found void, what would be its effect on the tax assessment

RULING:

The use of the word "shall" in Section 228 of the NIRC and in RR No. 12-99 indicates that the

requirement of informing the taxpayer of the legal and factual bases of the assessment and the decision

made against him is mandatory. The requirement of providing the taxpayer with written notice of the

factual and legal bases applies both to the FLD/FAN and the FDDA.

A void FDDA does not ipso facto render the assessment void

A “decision” differs from an “assessment” and failure of the FDDA to state the facts and law on which it is

based renders the decision void, but not the assessment.

The FDDA must contain the facts, law and rules on which the assessment is based. This is the same rule

applied for the assessment itself although it is clear that the assessment and the decision are two distinct

documents. The rationale for the requirement imposed on the assessment is to accord due process to the

taxpayer to be able to file an intelligent protest. On the other hand, if the FDDA itself does not conform to

the requirements, the same is void and thus constitutes inaction or as if no decision was rendered. The

effect therefore is that what is appealable to the CTA is the inaction of the CIR, or his duly authorized

representative.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Weinstock Vs Kelly Barker ComplaintDocument102 pagesWeinstock Vs Kelly Barker ComplaintKathy TarochioneNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pelizloy Realty Corp. v. Province of Benguet20210506-11-1cl5nnyDocument11 pagesPelizloy Realty Corp. v. Province of Benguet20210506-11-1cl5nnyENo ratings yet

- Petitioner Respondents Gonzales, Batiller, Bilog & Associates Garcilaso F VegaDocument4 pagesPetitioner Respondents Gonzales, Batiller, Bilog & Associates Garcilaso F VegaENo ratings yet

- Petitioner Respondent: China Banking Corporation, City Treasurer of ManilaDocument14 pagesPetitioner Respondent: China Banking Corporation, City Treasurer of ManilaENo ratings yet

- Ericsson Telecommunications Inc. v. City Of20210505-12-12f6os4Document9 pagesEricsson Telecommunications Inc. v. City Of20210505-12-12f6os4ENo ratings yet

- Legend Int'l Resorts v. Kilusang Manggagawa NG LegendDocument2 pagesLegend Int'l Resorts v. Kilusang Manggagawa NG LegendRonnel DeinlaNo ratings yet

- Purposive Construction of Penal StatutesDocument12 pagesPurposive Construction of Penal StatutesAnanyaNo ratings yet

- G.R. No. 151895 BOC Vs SerranoDocument4 pagesG.R. No. 151895 BOC Vs SerranoJessie AncogNo ratings yet

- 5 Keppel Bank Philippines Inc Vs AdaoDocument11 pages5 Keppel Bank Philippines Inc Vs AdaoGfor FirefoxonlyNo ratings yet

- CMS Vs TeamHealth Fraud Upcoding Lawsuit September 2020Document123 pagesCMS Vs TeamHealth Fraud Upcoding Lawsuit September 2020Health Care Fraud Research0% (1)

- Character and Antecedents Verification Form: Period From ToDocument3 pagesCharacter and Antecedents Verification Form: Period From Tovikram ruhilNo ratings yet

- Takata Philippines v. BLR and SALAMAT, June 4, 2014Document13 pagesTakata Philippines v. BLR and SALAMAT, June 4, 2014bentley CobyNo ratings yet

- 36 Bicol Isarog Transport Systems Inc. v. Relucio, G.R. No. 234725, September 16, 2020Document13 pages36 Bicol Isarog Transport Systems Inc. v. Relucio, G.R. No. 234725, September 16, 2020Lex LawNo ratings yet

- Screenshot 2023-05-18 at 1.23.55 PMDocument31 pagesScreenshot 2023-05-18 at 1.23.55 PMsabNo ratings yet

- TAYLOR v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketDocument2 pagesTAYLOR v. COMBINED INSURANCE COMPANY OF AMERICA Et Al DocketACELitigationWatchNo ratings yet

- Labour Law ProjectDocument20 pagesLabour Law Projectmihir khannaNo ratings yet

- The Metropolitan Bank and Trust Company v. RosalesDocument1 pageThe Metropolitan Bank and Trust Company v. RosalesJm Santos100% (1)

- TORTS - 2. Calalas v. CADocument7 pagesTORTS - 2. Calalas v. CAMark Gabriel B. MarangaNo ratings yet

- Court of Appeals RulingDocument4 pagesCourt of Appeals RulingChris BerinatoNo ratings yet

- Alex Jones Sues Jan 6 Cmte To Stop Review of Phone MetadataDocument7 pagesAlex Jones Sues Jan 6 Cmte To Stop Review of Phone MetadataDaily KosNo ratings yet

- Upcoca (Uttar Pradesh Control of Organised Crime Bill, 2018)Document6 pagesUpcoca (Uttar Pradesh Control of Organised Crime Bill, 2018)JatinNo ratings yet

- 2024 01 29 Verified Information of Contemptuous Conduct Delphi RaDocument9 pages2024 01 29 Verified Information of Contemptuous Conduct Delphi RaMatt Blac inc.No ratings yet

- Free Sample QuestionsDocument15 pagesFree Sample Questions302-30-จริยาภรณ์ โสภารัตน์No ratings yet

- Bill Hamilton's Summons and Complaint (W0238403)Document161 pagesBill Hamilton's Summons and Complaint (W0238403)Neighbors WestNo ratings yet

- Petitioners vs. vs. Respondent: Second DivisionDocument4 pagesPetitioners vs. vs. Respondent: Second DivisionVener MargalloNo ratings yet

- G.R. No. L-12219 March 15, 1918 AMADO PICART, Plaintiff-Appellant, FRANK SMITH, JR., Defendant-AppelleeDocument38 pagesG.R. No. L-12219 March 15, 1918 AMADO PICART, Plaintiff-Appellant, FRANK SMITH, JR., Defendant-AppelleeAlex FranciscoNo ratings yet

- Bravo Guerrero Vs BravoDocument2 pagesBravo Guerrero Vs BravoRedd LapidNo ratings yet

- Legal - March - Submission 3Document39 pagesLegal - March - Submission 3Harendra SinghNo ratings yet

- PNB vs. Ritratto Group Inc. (G.R. No. 142616 July 31, 2001)Document4 pagesPNB vs. Ritratto Group Inc. (G.R. No. 142616 July 31, 2001)eunice demaclidNo ratings yet

- Petitioner vs. VS.: en BancDocument7 pagesPetitioner vs. VS.: en Bancthirdy demaisipNo ratings yet

- Equity 2Document16 pagesEquity 2Harneet KaurNo ratings yet

- McCoy v. Diggs, 4th Cir. (1998)Document2 pagesMcCoy v. Diggs, 4th Cir. (1998)Scribd Government DocsNo ratings yet

- Jurisdictions - Labrel PDFDocument6 pagesJurisdictions - Labrel PDFPriscilla DawnNo ratings yet

- Smile Direct Club v. Candid Care - Complaint (Seeking 289 For UP Infringement)Document42 pagesSmile Direct Club v. Candid Care - Complaint (Seeking 289 For UP Infringement)Sarah BursteinNo ratings yet