Professional Documents

Culture Documents

Kami Export - U1 Vocabulary Personal Finance

Kami Export - U1 Vocabulary Personal Finance

Uploaded by

Abel CopaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kami Export - U1 Vocabulary Personal Finance

Kami Export - U1 Vocabulary Personal Finance

Uploaded by

Abel CopaCopyright:

Available Formats

33 Personal finance

A Managing your finances

Read this leaflet on personal financial management given out by a university to its students.

Note the collocations.

KEEPING AFLOAT1 – HOW TO MANAGE YOUR FINANCES

While you’re doing your degree, your main source of income may be a student loan or, if you’re lucky, a

grant or scholarship. But you may well still need to supplement2 your income by getting some kind of

part-time work. Here are some tips for avoiding financial problems:

• Open a current account at the campus bank – they have a team there specialises in helping

students with their financial matters.

• If you get into debt, try to clear3 your debts as soon as possible.

• If things are difficult, you may have to economise by, say, cutting down on

luxuries. This is far better than running up huge debts4.

• If you have a credit-card debt, try to make a payment every month, however

small. Never exceed your agreed credit limit.

• It’s a bad idea to borrow heavily to repay your debts. Always seek advice from

your bank about how to clear outstanding5 debts and pay back loans.

• Never run up an overdraft6 if you can avoid it. If you do need one, remember that most banks will

offer students an interest-free overdraft.

1 4

having enough money to pay what you owe continuing to spend and therefore owing a large

(can also be staying afloat) amount of money

2 5

add something to something to make it larger not yet paid

6

or better amount of money that a customer with a bank

3

pay in full account is temporarily allowed to owe to the bank

B Financial crimes and disputes

These newspaper extracts are all concerned with financial crimes and problems.

Credit-card fraud1 has reached an all- Mr Ambrose spent a fortune staying at

time high. One in ten people is a victim expensive hotels. He managed to run up3

of identity theft2 and the crime is on the a bill of £17,000 at one hotel. He used his

increase. employer’s funds and falsified4 records.

He made fraudulent claims for travel

expenses.

People are being encouraged to put

down a deposit5 on new homes, thanks The company is now under new

to low interest rates. But if borrowers management. Its backers have written off

default on repayments6, banks are debts8 of £500,000 on the promise of new

obliged to call in loans7. cost-cutting measures designed to solve

the company’s financial problems.

1 5

crime of misusing another person’s credit card pay a sum of money in advance as part of a

without their permission total payment

2 6

stealing someone’s personal details, usually in fail to pay a debt

7

order to access their bank accounts or credit cards demand that people pay back the money the

3

accumulate bank has lent to them

4 8

changed something, e.g. a document, in order to accepted that an amount of money has been lost

deceive people or that a debt will not be paid

70 English Collocations in Use Advanced

Exercises

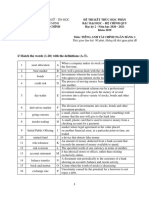

33.1 Match words from each box to form collocations from the opposite page and use them

to complete the sentences below.

borrow make spend stay supplement afloat a fortune heavily my income a payment

1 I of €500 every month to my credit-card account.

2 When I was a student I got a job in a fast-food outlet to .

3 I used to on books when I was at university.

4 I had no grant or scholarship, so I had to to finance my studies.

5 Small firms find it difficult to when costs and interest rates are

high.

33.2 Copy and complete the collocation bubbles using words from the box. Some words

collocate only with debt, some only with overdraft and some with both. Use a

dictionary to help you find one more collocation for each bubble.

dictionary.cambridge.org to arrange a(n) a bad to be in

to clear a(n) deep in facility to get a(n)

to get into a hefty the national DEBT OVERDRAFT

to pay off a(n) -ridden to run up a(n)

an unauthorised

33.3 Correct the collocation errors in these sentences.

1 The firm has huge debts and has had to borrow $10 million. The new chief executive has

introduced cost-cutting methods.

2 When I left university I had no upstanding debts, unlike most of my friends, who owed

thousands of pounds.

3 The manager falsified company recordings and stole money from her employer.

4 I had no resource of income, so I had to get a job, and quickly.

5 We placed down a deposit on a new car last week.

6 She faulted on her loan repayment and had to sell her business.

7 Many people don’t trust online banking because they are afraid of identification theft.

8 If we don’t cut up on luxuries, we’re going to find ourselves in serious debt.

9 There are special offers for students who enter a current account at the university bank.

10 You will pay a lot of interest if you go over your discussed credit limit.

33.4 Answer the questions about collocations from the opposite page.

1 What object is a person or company being compared to when we use the collocation keep or

stay afloat metaphorically?

2 What are you eventually expected to do with a loan?

3 If a bank calls in a loan, do they (a) give it (b) write it off (c) demand full payment?

4 If someone defaults on a payment, do they (a) not make it (b) make it in full (c) partially make it?

5 What is the crime called when someone makes illegal use of another person’s credit card?

33.5 Complete each sentence using the word in brackets in the appropriate form.

1 The accused was found guilty of company records. (false)

2 The insurance company takes all claims very seriously. (fraUd)

3 I try to make a into my savings account every month. (paY)

4 Identity is becoming an increasingly common crime. (thief)

5 I was glad that the bank was able to offer me an overdraft. (interest)

English Collocations in Use Advanced 71

You might also like

- Bus. Fin. WEEk 5-6Document14 pagesBus. Fin. WEEk 5-6Jessa Gallardo100% (1)

- Debt Free For LifeDocument9 pagesDebt Free For LifeTim JoyceNo ratings yet

- Nism Series Ix Merchant Banking WorkbookDocument127 pagesNism Series Ix Merchant Banking Workbookalpha012550% (2)

- Money Vocabulary PDFDocument2 pagesMoney Vocabulary PDFIstvan DanielNo ratings yet

- Debt Managemtn Content NoteDocument8 pagesDebt Managemtn Content NoteZeenat ShaikhNo ratings yet

- Credit ReviewerDocument2 pagesCredit ReviewerJAM CLNo ratings yet

- Vocabulary - Money, Finance, Bank Accounts, Public FinanceDocument2 pagesVocabulary - Money, Finance, Bank Accounts, Public FinanceNachø MV0% (1)

- Personal Finance 9th Edition pdf-181-185Document5 pagesPersonal Finance 9th Edition pdf-181-185Jan Allyson BiagNo ratings yet

- TACN-TCNH U14 FurtherPracticeDocument7 pagesTACN-TCNH U14 FurtherPracticengoclinh.131102No ratings yet

- Gen. Math TMLHT q2 Week 6Document17 pagesGen. Math TMLHT q2 Week 6Analou AvilaNo ratings yet

- 4 Managing Debts Effectively PDFDocument48 pages4 Managing Debts Effectively PDFLawrence CezarNo ratings yet

- BIFFPP-Step 7 CPA BermudaDocument8 pagesBIFFPP-Step 7 CPA BermudaRG-eviewerNo ratings yet

- Chapter 3 Money and CreditDocument33 pagesChapter 3 Money and Creditneevnk2008No ratings yet

- Banker Customer RelationshipDocument8 pagesBanker Customer RelationshipNishantNo ratings yet

- Retail BankingDocument4 pagesRetail BankingTop VideosNo ratings yet

- đề tiếng anh để thiDocument3 pagesđề tiếng anh để thiDung Võ DươngNo ratings yet

- BUSINESS FINANCE (Week 6)Document4 pagesBUSINESS FINANCE (Week 6)elyra blythe salcedoNo ratings yet

- How Bank WorksDocument3 pagesHow Bank WorksMai Mai VarelaNo ratings yet

- Topic 3 - Money SkillsDocument11 pagesTopic 3 - Money SkillsNjeri TimothysNo ratings yet

- Noticia InglesDocument2 pagesNoticia Inglesdannasanchezloaiza06No ratings yet

- Unit 3 The Individual As Producer, Consumer and Borrower: Activities: Guidance and AnswersDocument8 pagesUnit 3 The Individual As Producer, Consumer and Borrower: Activities: Guidance and AnswersJada CameronNo ratings yet

- Workbook Unit 5Document12 pagesWorkbook Unit 5RoqueNo ratings yet

- Answer Week 10 Segen Gandung S - Reguler SoreDocument4 pagesAnswer Week 10 Segen Gandung S - Reguler SoreLhutvi BasyoriNo ratings yet

- Bad Debt American English StudentDocument5 pagesBad Debt American English StudentMarie Angela FranzNo ratings yet

- Pfin3 3rd Edition Gitman Solutions ManualDocument18 pagesPfin3 3rd Edition Gitman Solutions Manualcivilianpopulacy37ybzi100% (25)

- Money Makeover - Discussion NotesDocument35 pagesMoney Makeover - Discussion Noteselia23No ratings yet

- MCQ Set 1Document6 pagesMCQ Set 1judysaysNo ratings yet

- Answer Key Chap 29 PDFDocument5 pagesAnswer Key Chap 29 PDFDuy TháiNo ratings yet

- Advanced Crossword Puzzle - BankingDocument1 pageAdvanced Crossword Puzzle - BankingnghiepNo ratings yet

- Midterm Test English 2Document4 pagesMidterm Test English 2Nguyễn Ánh NgọcNo ratings yet

- Bad Debt British English TeacherDocument6 pagesBad Debt British English TeacherAngela CentroneNo ratings yet

- (123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Document10 pages(123doc) Unit 2 Bai Giang Anh Van Chuyen Nganh Tai Chinh Thu Vien Tai Lieu Tong Hop Com Unit 2Công MinhNo ratings yet

- LiabilityDocument3 pagesLiabilityMohammed MohammedNo ratings yet

- Money, Banking and The Macro-Economy - Answers: 5.1 Checklist QuestionsDocument8 pagesMoney, Banking and The Macro-Economy - Answers: 5.1 Checklist QuestionscesarsaraujoNo ratings yet

- 72 Debt USDocument7 pages72 Debt USfajar sukmanaNo ratings yet

- Bad Debt British English StudentDocument5 pagesBad Debt British English StudentAngela CentroneNo ratings yet

- FILE - 20210407 - 081001 - Tài Liệu Tham Khảo TATMDocument18 pagesFILE - 20210407 - 081001 - Tài Liệu Tham Khảo TATMyến hoàngNo ratings yet

- 4.3. Obligations of Borrowers: Questions To PonderDocument6 pages4.3. Obligations of Borrowers: Questions To PonderTin CabosNo ratings yet

- 2021 Business English A MIDTERM EXAM PAPER 1Document6 pages2021 Business English A MIDTERM EXAM PAPER 1Anano GorgadzeNo ratings yet

- Banking Basics: Workbook 2Document32 pagesBanking Basics: Workbook 2muhammadanasmustafaNo ratings yet

- U6 - Extra Reading - PDF NoteDocument2 pagesU6 - Extra Reading - PDF Note21- Hải YếnNo ratings yet

- Sarah Stone - Personal BankruptcyDocument2 pagesSarah Stone - Personal Bankruptcyapi-552019617No ratings yet

- EverybodysCreditRepairProgramDocument108 pagesEverybodysCreditRepairProgramFreedomofMindNo ratings yet

- Module 3 Debt ManagementDocument33 pagesModule 3 Debt ManagementJane BañaresNo ratings yet

- Darylle John C Quimoyog EthicsDocument2 pagesDarylle John C Quimoyog EthicsEzra DumallegNo ratings yet

- PFIN3 3rd Edition Gitman Solutions Manual 1Document16 pagesPFIN3 3rd Edition Gitman Solutions Manual 1george100% (53)

- PFIN3 3rd Edition Gitman Solutions Manual 1Document36 pagesPFIN3 3rd Edition Gitman Solutions Manual 1rebeccabuckwecfyrisgj100% (31)

- Topic 5Document3 pagesTopic 5KyNo ratings yet

- Money and CreditDocument7 pagesMoney and Creditraimaali220077No ratings yet

- Personal Banking EBIIU5Document2 pagesPersonal Banking EBIIU5joseNo ratings yet

- Bad Debt American English StudentDocument5 pagesBad Debt American English StudentJayne Gomez ArenillaNo ratings yet

- Pfin5 5th Edition Billingsley Solutions ManualDocument22 pagesPfin5 5th Edition Billingsley Solutions Manualthoabangt69100% (32)

- E BookDocument21 pagesE BookNatsuyuki HanaNo ratings yet

- Support Guide03BF-Wk04Document33 pagesSupport Guide03BF-Wk04ranbr17No ratings yet

- Grade: Department of Education - Republic of The PhilippinesDocument16 pagesGrade: Department of Education - Republic of The PhilippinesGeraldine Gementiza Poliquit100% (4)

- THE MONETARY SYSTEM Chapter 29Document5 pagesTHE MONETARY SYSTEM Chapter 29HoàngTrúcNo ratings yet

- TACN-TCNH U14 FurtherPracticeDocument7 pagesTACN-TCNH U14 FurtherPracticengoclinh.131102No ratings yet

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Document4 pagesĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuNo ratings yet

- The Reverse Mortgage Advantage: The Tax-Free, House Rich Way to Retire Wealthy!From EverandThe Reverse Mortgage Advantage: The Tax-Free, House Rich Way to Retire Wealthy!No ratings yet

- The Debt Pit Escape Plan: Get Creditors Off Your Back, Climb Out of Debt and Rebuild Your CreditFrom EverandThe Debt Pit Escape Plan: Get Creditors Off Your Back, Climb Out of Debt and Rebuild Your CreditNo ratings yet

- N-23-14 Jai Alai V BPIDocument2 pagesN-23-14 Jai Alai V BPIKobe Lawrence VeneracionNo ratings yet

- GAPAGAPDocument6 pagesGAPAGAPAnjaliNo ratings yet

- Finacle 100 QueDocument13 pagesFinacle 100 QuesiddNo ratings yet

- A Study On RBL and Mehsana Cooperative BankDocument25 pagesA Study On RBL and Mehsana Cooperative BankMansi ThakoreNo ratings yet

- Credit and Collection: Chapter 6 - Credit Decision MakingDocument51 pagesCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataNo ratings yet

- Reviewer AccountingDocument14 pagesReviewer Accountingveronica aban100% (1)

- Faculty of Commerce Department of Business ManagementDocument17 pagesFaculty of Commerce Department of Business ManagementInnocent TakorekanaNo ratings yet

- Sep 2Document34 pagesSep 2Umakanta DassNo ratings yet

- BankConnect v2Document19 pagesBankConnect v2Apoorv KhannaNo ratings yet

- Know Your CustomerDocument3 pagesKnow Your CustomerMardi RahardjoNo ratings yet

- Financial Management: March/June 2016 - Sample QuestionsDocument8 pagesFinancial Management: March/June 2016 - Sample QuestionsVinny Lu VLNo ratings yet

- 104 Serfino vs. Far East Bank and Trust Company, Inc.Document2 pages104 Serfino vs. Far East Bank and Trust Company, Inc.JemNo ratings yet

- Pouran Abdipour Converted ResumeDocument2 pagesPouran Abdipour Converted ResumepouranpouranNo ratings yet

- Salary & Employment Forecast: Opinions You Can Count OnDocument21 pagesSalary & Employment Forecast: Opinions You Can Count OnArjun SharmaNo ratings yet

- Sip Project in Axis BankDocument12 pagesSip Project in Axis BankSwarup DeshbhratarNo ratings yet

- WB Historical Chronology 1944 2005Document424 pagesWB Historical Chronology 1944 2005Muhammad Badar Ismail DheendaNo ratings yet

- A History of Banking in The United States 1900Document948 pagesA History of Banking in The United States 1900OceanNo ratings yet

- Business Research Report For MyanmarDocument29 pagesBusiness Research Report For MyanmarBFEVietnam100% (1)

- 1961MH24Document170 pages1961MH24Satishchandra KoyandeNo ratings yet

- Bhardwaj 2012Document3 pagesBhardwaj 2012Karen KleissNo ratings yet

- Risk ManagementDocument6 pagesRisk Managementsudarshan1985No ratings yet

- NO. Subject Page No. 1: Aero Based Control Systems Private LimitedDocument51 pagesNO. Subject Page No. 1: Aero Based Control Systems Private LimitedFarzanaNo ratings yet

- Skrill Terms of UseDocument17 pagesSkrill Terms of UseFahad SheikhNo ratings yet

- HDFC Bank Case StudyDocument9 pagesHDFC Bank Case StudyNaina SinghNo ratings yet

- Checklist of Requirements For Pag-Ibig Housing Loan Application Under Regular DeveloperDocument11 pagesChecklist of Requirements For Pag-Ibig Housing Loan Application Under Regular DeveloperRe YaNo ratings yet

- Stakeholders and Their InterestsDocument9 pagesStakeholders and Their InterestsSehrish AnsariNo ratings yet

- What Is Investment BankingDocument89 pagesWhat Is Investment BankingNarendra Chhetri100% (1)

- Bank Management: Use Case ModelingDocument30 pagesBank Management: Use Case ModelingMuralidharNo ratings yet

- Cross-Selling Financial Services To Small and Medium Enterprises Via E-Banking Portals (Research-In-Progress)Document8 pagesCross-Selling Financial Services To Small and Medium Enterprises Via E-Banking Portals (Research-In-Progress)Darshan ParikhNo ratings yet