Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

35 viewsChapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual Content

Uploaded by

Man Tran Y NhiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Clinic Financial Model Excel Template v10 DEMODocument77 pagesClinic Financial Model Excel Template v10 DEMOdeddyNo ratings yet

- Managerial Accounting 16th Edition Garrison Solutions Manual DownloadDocument60 pagesManagerial Accounting 16th Edition Garrison Solutions Manual DownloadDanielRaydpac98% (41)

- BUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyDocument12 pagesBUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyPaw Akou-edi100% (2)

- Major Development Programs and Personalities in Science And-1Document27 pagesMajor Development Programs and Personalities in Science And-1Prince Sanji66% (128)

- Câu Hỏi: The best description of flexible budget isDocument10 pagesCâu Hỏi: The best description of flexible budget isMan Tran Y NhiNo ratings yet

- UGB371 Managing and Leading ChangeDocument16 pagesUGB371 Managing and Leading ChangePhương Anh Nguyễn100% (1)

- Chap 021Document19 pagesChap 021Neetu Rajaraman100% (1)

- Efas & Ifas FinalDocument2 pagesEfas & Ifas FinalTobin ThomasNo ratings yet

- SKIIDocument5 pagesSKIIvkiprickinsNo ratings yet

- GNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisDocument7 pagesGNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisMan Tran Y NhiNo ratings yet

- Chapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentDocument9 pagesChapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentMan Tran Y NhiNo ratings yet

- Standard Costs and Variances: Solutions To QuestionsDocument93 pagesStandard Costs and Variances: Solutions To QuestionsДар'я ВіталіївнаNo ratings yet

- Chapter 5: Applying ExcelDocument8 pagesChapter 5: Applying ExcelMan Tran Y NhiNo ratings yet

- Chapter 7: Applying ExcelDocument8 pagesChapter 7: Applying ExcelMan Tran Y NhiNo ratings yet

- Quiz 5 SolutionDocument5 pagesQuiz 5 SolutionMichel BanvoNo ratings yet

- Chapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentDocument6 pagesChapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentMan Tran Y NhiNo ratings yet

- D23 PM Examiner's ReportDocument17 pagesD23 PM Examiner's ReportamayrablahblahNo ratings yet

- Answers Homework # 7 Performance Management IIDocument6 pagesAnswers Homework # 7 Performance Management IIRaman ANo ratings yet

- Final Examination: Management Advisory Services Semester of A.Y. 2021-2022Document11 pagesFinal Examination: Management Advisory Services Semester of A.Y. 2021-2022Andrea Florence Guy VidalNo ratings yet

- GNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsDocument4 pagesGNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsMan Tran Y NhiNo ratings yet

- Chapter 4 Production CostsDocument18 pagesChapter 4 Production Costs刘文雨杰No ratings yet

- F5 - Mock B - QuestionsDocument15 pagesF5 - Mock B - QuestionsUmar AwanNo ratings yet

- Whirlpool Europe ExDocument7 pagesWhirlpool Europe ExAli Raza Mohammad SharifNo ratings yet

- ACCA F2 2014 Examiner ReportDocument4 pagesACCA F2 2014 Examiner Reportolofamojo2No ratings yet

- Homework 1Document8 pagesHomework 1sierrasoNo ratings yet

- Accounts IA1Document19 pagesAccounts IA1Farhan KhanNo ratings yet

- Managerial Accounting - Chapter 05Document11 pagesManagerial Accounting - Chapter 05jingsuke88% (8)

- Relevant CostingDocument58 pagesRelevant CostingAlexanderJacobVielMartinezNo ratings yet

- CHAPTER FOUR Cost and MGMT ACCTDocument12 pagesCHAPTER FOUR Cost and MGMT ACCTFeleke TerefeNo ratings yet

- CIMA P1 Updates For 2019-20 Sittings 311019Document3 pagesCIMA P1 Updates For 2019-20 Sittings 311019R DsNo ratings yet

- Planning and Operational VariancesDocument3 pagesPlanning and Operational VariancesOvais MuhammadNo ratings yet

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- AC 203 Final Exam Review WorksheetDocument6 pagesAC 203 Final Exam Review WorksheetLương Thế CườngNo ratings yet

- General Comments: The Chartered Institute of Management AccountantsDocument27 pagesGeneral Comments: The Chartered Institute of Management AccountantsZic ZacNo ratings yet

- Revision 2Document37 pagesRevision 2percy mapetereNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- Cost Management Problems CA FinalDocument131 pagesCost Management Problems CA Finalmj192100% (1)

- Mid Term 2ndDocument16 pagesMid Term 2ndMinh Thư Nguyễn ThịNo ratings yet

- BUSI 354 - CHDocument4 pagesBUSI 354 - CHBarbara SlavovNo ratings yet

- Module 5 Case Accounting For Decision and Transfer PricingDocument14 pagesModule 5 Case Accounting For Decision and Transfer PricingSamuel NderituNo ratings yet

- Revison Class StudentDocument11 pagesRevison Class StudentÁi Mỹ DuyênNo ratings yet

- Selected Homework Hints For Chapter 5Document2 pagesSelected Homework Hints For Chapter 5Sophia HeNo ratings yet

- Assignment 2 Product Process Service Design RDocument4 pagesAssignment 2 Product Process Service Design Rabhinav8803No ratings yet

- ABS DXB MBA Assignment SEP 2022 - Managerial EconomicsDocument15 pagesABS DXB MBA Assignment SEP 2022 - Managerial EconomicsLazy FrogNo ratings yet

- At 3Document8 pagesAt 3Joshua GibsonNo ratings yet

- Examiner's Report: F5 Performance Management June 2018Document8 pagesExaminer's Report: F5 Performance Management June 2018Minh PhươngNo ratings yet

- Acca f5ch18Document4 pagesAcca f5ch18HassaniNo ratings yet

- Whirlpool Europe ExDocument9 pagesWhirlpool Europe ExJosé Ma Orozco A.0% (1)

- Chapter 5 - Cost EstimationDocument36 pagesChapter 5 - Cost Estimationalleyezonmii0% (2)

- Examiner's Report: MA/FMA Management AccountingDocument9 pagesExaminer's Report: MA/FMA Management AccountingFayaz AhmedNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument106 pagesCost-Volume-Profit Relationships: Solutions To QuestionsAbene Man Wt BreNo ratings yet

- Appendix B:: Solutions To All ExercisesDocument13 pagesAppendix B:: Solutions To All ExercisesRaj ChavanNo ratings yet

- Chapter 05Document31 pagesChapter 05hlethienngocNo ratings yet

- Farmer CA1e TB Ch12 3PP AcceptedDocument65 pagesFarmer CA1e TB Ch12 3PP Accepted3ooobd1234No ratings yet

- Fall 2008 Exam 3 BDocument5 pagesFall 2008 Exam 3 BNO NameNo ratings yet

- Break Win AnalysisDocument14 pagesBreak Win Analysiskian obdinNo ratings yet

- SM CHDocument72 pagesSM CHInderjeet JeedNo ratings yet

- Using Accounting Information in DecisionDocument15 pagesUsing Accounting Information in DecisionMarj AgustinNo ratings yet

- Aquaponic Farm Production and Financial Planner v6 x3cctlDocument79 pagesAquaponic Farm Production and Financial Planner v6 x3cctlTusiime Atwooki AggreyNo ratings yet

- Exercise Chapter 6: Management Accouting Acca2Document8 pagesExercise Chapter 6: Management Accouting Acca2Bội Anh Nguyễn Bội AnhNo ratings yet

- PM Sect B Test 4Document6 pagesPM Sect B Test 4FarahAin FainNo ratings yet

- Section C Part 2 MCQDocument344 pagesSection C Part 2 MCQSaiswetha Bethi100% (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- GNBCY LN Chap01 Managerial Accounting and Business EnvironmentDocument18 pagesGNBCY LN Chap01 Managerial Accounting and Business EnvironmentMan Tran Y NhiNo ratings yet

- GNBCY LN Chap02 Cost ConceptsDocument18 pagesGNBCY LN Chap02 Cost ConceptsMan Tran Y NhiNo ratings yet

- GNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsDocument4 pagesGNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsMan Tran Y NhiNo ratings yet

- Chapter 7: Applying ExcelDocument8 pagesChapter 7: Applying ExcelMan Tran Y NhiNo ratings yet

- Chapter 5: Applying ExcelDocument8 pagesChapter 5: Applying ExcelMan Tran Y NhiNo ratings yet

- GNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisDocument7 pagesGNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisMan Tran Y NhiNo ratings yet

- Chapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentDocument6 pagesChapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentMan Tran Y NhiNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Chapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentDocument9 pagesChapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentMan Tran Y NhiNo ratings yet

- Solution Manual Accounting Information Systems 12th Edition by Romney and Steinbart Ch17Document24 pagesSolution Manual Accounting Information Systems 12th Edition by Romney and Steinbart Ch17Man Tran Y NhiNo ratings yet

- Chapter 13 Test Bank Romney AisDocument35 pagesChapter 13 Test Bank Romney AisMan Tran Y NhiNo ratings yet

- Test Bank Ais Accounting Information System Test BankDocument13 pagesTest Bank Ais Accounting Information System Test BankMan Tran Y NhiNo ratings yet

- Zenex Accounts Business Financial Accounting SoftwareDocument2 pagesZenex Accounts Business Financial Accounting SoftwareAbhivermazNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument8 pagesMultiple Choice - Problems Part 1: A. Percentage TaxWearIt Co.No ratings yet

- Simplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDocument4 pagesSimplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDarwin Dionisio ClementeNo ratings yet

- 08 Business Cycles, Unemployment, InflationDocument3 pages08 Business Cycles, Unemployment, Inflationcatherine tucayNo ratings yet

- Trade DiversionDocument2 pagesTrade DiversionJae-wook LeeNo ratings yet

- MBA EX. Mid Term Examination Schedule - Summer 2021Document1 pageMBA EX. Mid Term Examination Schedule - Summer 2021Shehreiz SiddiquiNo ratings yet

- Xxarticles of Incorporation-Stock CorpDocument6 pagesXxarticles of Incorporation-Stock CorpEdgar EnriquezNo ratings yet

- Study On Urbanization People Mobility Inclusive Development FINALDocument182 pagesStudy On Urbanization People Mobility Inclusive Development FINALBrenda Shania LombuNo ratings yet

- Market Profile - Assignment - Updt2Document22 pagesMarket Profile - Assignment - Updt2Alexandra Sanchez HavardNo ratings yet

- ICAI General InsuranceDocument333 pagesICAI General InsuranceShriya GuptaNo ratings yet

- Islamic Real Estate Investment Trust As An Investment Asset For Waqf Management in Indonesia: Regulatory Framework and Shariah-CompliancyDocument45 pagesIslamic Real Estate Investment Trust As An Investment Asset For Waqf Management in Indonesia: Regulatory Framework and Shariah-CompliancyYoga PrakasaNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Soc - Audit Manual RRP - Doc 6.9.07 LandscapeDocument653 pagesSoc - Audit Manual RRP - Doc 6.9.07 LandscapeSamgar SangmaNo ratings yet

- Making Cement BricksDocument3 pagesMaking Cement BricksCampbell OGENRWOTNo ratings yet

- E-Leadership Through Strategic AlignmentDocument22 pagesE-Leadership Through Strategic AlignmentAmin Jan FayezNo ratings yet

- Yudina PoudelDocument91 pagesYudina Poudelирина щурNo ratings yet

- Types of Opinions Provided by The AuditorDocument20 pagesTypes of Opinions Provided by The AuditorFarrukh TahirNo ratings yet

- A Practical Guide For Cloud Migration ReadinessDocument17 pagesA Practical Guide For Cloud Migration Readinesssundeep_dubeyNo ratings yet

- 1307174808status of Microfinance in India 2016-17Document278 pages1307174808status of Microfinance in India 2016-17Om PrakashNo ratings yet

- Application of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewDocument25 pagesApplication of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewVitor PontesNo ratings yet

- Salary CertificateDocument1 pageSalary CertificateselvaNo ratings yet

- Ca Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument2 pagesCa Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalG KNo ratings yet

- Account Title Amount (PHP) Bs/IsDocument14 pagesAccount Title Amount (PHP) Bs/IsAlthea Marie LazoNo ratings yet

- Impact Assessment of Personal Income Tax Reduction in The Philippines by IDEADocument44 pagesImpact Assessment of Personal Income Tax Reduction in The Philippines by IDEAVoltaire Veneracion100% (1)

- India Wine ReportDocument11 pagesIndia Wine ReportShikha BansalNo ratings yet

- Evolution of Philippine TaxationDocument4 pagesEvolution of Philippine Taxationyumi timtim50% (2)

Chapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual Content

Uploaded by

Man Tran Y Nhi0 ratings0% found this document useful (0 votes)

35 views7 pagesOriginal Title

GNBCY_AE_SM_Chap12_Standard_Costs_and_Variances

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

35 views7 pagesChapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel: Chapter 12 Standard Costs and Variances - Solutions Manual Content

Uploaded by

Man Tran Y NhiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 7

Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel

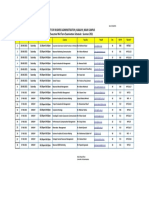

The completed worksheet is shown below.

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

1 Managerial Accounting, Asia Global Edition 2e

Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel (continued)

The completed worksheet, with formulas displayed, is shown below.

Note: The formulas for to compute whether a variance is Favorable or

Unfavorable use the IF() function. For example, in cell C26, the formula is

=IF(F22>F23,"U",IF(F22<F23,"F","")). This formula first checks whether

the actual quantity of input at the standard price (cell F22) exceeds the

standard quantity allowed for the actual output at the standard price (cell

F23). If it does, the function returns the value U, which is displayed in cell

C26. Otherwise, the formula checks whether the standard quantity allowed

for the actual output at the standard price (cell F23) exceeds the actual

quantity of input at the standard price (cell F22). If it does, the function

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

2 Managerial Accounting, Asia Global Edition 2e

Chapter 12 Standard Costs and Variances - Solutions Manual Content

returns the value F, which is displayed in cell C26. Otherwise, nothing is

displayed in cell C26.

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

3 Managerial Accounting, Asia Global Edition 2e

Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel (continued)

1. With the changes in data, the result is:

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

4 Managerial Accounting, Asia Global Edition 2e

Chapter 12 Standard Costs and Variances - Solutions Manual Content

a. The materials quantity variance is $2,800 U. This variance is the

difference between the amount of materials that should have been

used to make the actual output and the actual amount of materials

used, all evaluated at the standard price. This variance is unfavorable

because 6,500 pounds were used, but 5,800 pounds should have

been used.

b. The labor rate variance is $420 F. This variance is the difference

between the standard labor rate and the actual labor rate, multiplied

by the actual labor hours. It is favorable because the actual labor rate

was $21.60 per hour, whereas the standard labor rate was $22.00

per hour.

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

5 Managerial Accounting, Asia Global Edition 2e

Chapter 12 Standard Costs and Variances - Solutions Manual Content

Chapter 12: Applying Excel (continued)

2. With the revised data, the worksheet should look like this:

Parts a, b, and c:

Materials price variance....................... $635 U

Materials quantity variance.................. $200 U

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

6 Managerial Accounting, Asia Global Edition 2e

Chapter 12 Standard Costs and Variances - Solutions Manual Content

Labor rate variance............................. $102 U

Labor efficiency variance..................... $660 F

Variable overhead rate variance........... $1,020 F

Variable overhead efficiency variance... $180 F

© The McGraw-Hill Companies, Inc., 2015. All rights reserved.

7 Managerial Accounting, Asia Global Edition 2e

You might also like

- Clinic Financial Model Excel Template v10 DEMODocument77 pagesClinic Financial Model Excel Template v10 DEMOdeddyNo ratings yet

- Managerial Accounting 16th Edition Garrison Solutions Manual DownloadDocument60 pagesManagerial Accounting 16th Edition Garrison Solutions Manual DownloadDanielRaydpac98% (41)

- BUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyDocument12 pagesBUS 5113 Group Assignment - Group 0001A - Global Washer and Dryer Manufacturer Case StudyPaw Akou-edi100% (2)

- Major Development Programs and Personalities in Science And-1Document27 pagesMajor Development Programs and Personalities in Science And-1Prince Sanji66% (128)

- Câu Hỏi: The best description of flexible budget isDocument10 pagesCâu Hỏi: The best description of flexible budget isMan Tran Y NhiNo ratings yet

- UGB371 Managing and Leading ChangeDocument16 pagesUGB371 Managing and Leading ChangePhương Anh Nguyễn100% (1)

- Chap 021Document19 pagesChap 021Neetu Rajaraman100% (1)

- Efas & Ifas FinalDocument2 pagesEfas & Ifas FinalTobin ThomasNo ratings yet

- SKIIDocument5 pagesSKIIvkiprickinsNo ratings yet

- GNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisDocument7 pagesGNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisMan Tran Y NhiNo ratings yet

- Chapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentDocument9 pagesChapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentMan Tran Y NhiNo ratings yet

- Standard Costs and Variances: Solutions To QuestionsDocument93 pagesStandard Costs and Variances: Solutions To QuestionsДар'я ВіталіївнаNo ratings yet

- Chapter 5: Applying ExcelDocument8 pagesChapter 5: Applying ExcelMan Tran Y NhiNo ratings yet

- Chapter 7: Applying ExcelDocument8 pagesChapter 7: Applying ExcelMan Tran Y NhiNo ratings yet

- Quiz 5 SolutionDocument5 pagesQuiz 5 SolutionMichel BanvoNo ratings yet

- Chapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentDocument6 pagesChapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentMan Tran Y NhiNo ratings yet

- D23 PM Examiner's ReportDocument17 pagesD23 PM Examiner's ReportamayrablahblahNo ratings yet

- Answers Homework # 7 Performance Management IIDocument6 pagesAnswers Homework # 7 Performance Management IIRaman ANo ratings yet

- Final Examination: Management Advisory Services Semester of A.Y. 2021-2022Document11 pagesFinal Examination: Management Advisory Services Semester of A.Y. 2021-2022Andrea Florence Guy VidalNo ratings yet

- GNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsDocument4 pagesGNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsMan Tran Y NhiNo ratings yet

- Chapter 4 Production CostsDocument18 pagesChapter 4 Production Costs刘文雨杰No ratings yet

- F5 - Mock B - QuestionsDocument15 pagesF5 - Mock B - QuestionsUmar AwanNo ratings yet

- Whirlpool Europe ExDocument7 pagesWhirlpool Europe ExAli Raza Mohammad SharifNo ratings yet

- ACCA F2 2014 Examiner ReportDocument4 pagesACCA F2 2014 Examiner Reportolofamojo2No ratings yet

- Homework 1Document8 pagesHomework 1sierrasoNo ratings yet

- Accounts IA1Document19 pagesAccounts IA1Farhan KhanNo ratings yet

- Managerial Accounting - Chapter 05Document11 pagesManagerial Accounting - Chapter 05jingsuke88% (8)

- Relevant CostingDocument58 pagesRelevant CostingAlexanderJacobVielMartinezNo ratings yet

- CHAPTER FOUR Cost and MGMT ACCTDocument12 pagesCHAPTER FOUR Cost and MGMT ACCTFeleke TerefeNo ratings yet

- CIMA P1 Updates For 2019-20 Sittings 311019Document3 pagesCIMA P1 Updates For 2019-20 Sittings 311019R DsNo ratings yet

- Planning and Operational VariancesDocument3 pagesPlanning and Operational VariancesOvais MuhammadNo ratings yet

- Ch5 LimitingFactorsDocument19 pagesCh5 LimitingFactorsali202101No ratings yet

- AC 203 Final Exam Review WorksheetDocument6 pagesAC 203 Final Exam Review WorksheetLương Thế CườngNo ratings yet

- General Comments: The Chartered Institute of Management AccountantsDocument27 pagesGeneral Comments: The Chartered Institute of Management AccountantsZic ZacNo ratings yet

- Revision 2Document37 pagesRevision 2percy mapetereNo ratings yet

- Master in Managerial Advisory Services: Easy QuestionsDocument13 pagesMaster in Managerial Advisory Services: Easy QuestionsKervin Rey JacksonNo ratings yet

- Cost Management Problems CA FinalDocument131 pagesCost Management Problems CA Finalmj192100% (1)

- Mid Term 2ndDocument16 pagesMid Term 2ndMinh Thư Nguyễn ThịNo ratings yet

- BUSI 354 - CHDocument4 pagesBUSI 354 - CHBarbara SlavovNo ratings yet

- Module 5 Case Accounting For Decision and Transfer PricingDocument14 pagesModule 5 Case Accounting For Decision and Transfer PricingSamuel NderituNo ratings yet

- Revison Class StudentDocument11 pagesRevison Class StudentÁi Mỹ DuyênNo ratings yet

- Selected Homework Hints For Chapter 5Document2 pagesSelected Homework Hints For Chapter 5Sophia HeNo ratings yet

- Assignment 2 Product Process Service Design RDocument4 pagesAssignment 2 Product Process Service Design Rabhinav8803No ratings yet

- ABS DXB MBA Assignment SEP 2022 - Managerial EconomicsDocument15 pagesABS DXB MBA Assignment SEP 2022 - Managerial EconomicsLazy FrogNo ratings yet

- At 3Document8 pagesAt 3Joshua GibsonNo ratings yet

- Examiner's Report: F5 Performance Management June 2018Document8 pagesExaminer's Report: F5 Performance Management June 2018Minh PhươngNo ratings yet

- Acca f5ch18Document4 pagesAcca f5ch18HassaniNo ratings yet

- Whirlpool Europe ExDocument9 pagesWhirlpool Europe ExJosé Ma Orozco A.0% (1)

- Chapter 5 - Cost EstimationDocument36 pagesChapter 5 - Cost Estimationalleyezonmii0% (2)

- Examiner's Report: MA/FMA Management AccountingDocument9 pagesExaminer's Report: MA/FMA Management AccountingFayaz AhmedNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument106 pagesCost-Volume-Profit Relationships: Solutions To QuestionsAbene Man Wt BreNo ratings yet

- Appendix B:: Solutions To All ExercisesDocument13 pagesAppendix B:: Solutions To All ExercisesRaj ChavanNo ratings yet

- Chapter 05Document31 pagesChapter 05hlethienngocNo ratings yet

- Farmer CA1e TB Ch12 3PP AcceptedDocument65 pagesFarmer CA1e TB Ch12 3PP Accepted3ooobd1234No ratings yet

- Fall 2008 Exam 3 BDocument5 pagesFall 2008 Exam 3 BNO NameNo ratings yet

- Break Win AnalysisDocument14 pagesBreak Win Analysiskian obdinNo ratings yet

- SM CHDocument72 pagesSM CHInderjeet JeedNo ratings yet

- Using Accounting Information in DecisionDocument15 pagesUsing Accounting Information in DecisionMarj AgustinNo ratings yet

- Aquaponic Farm Production and Financial Planner v6 x3cctlDocument79 pagesAquaponic Farm Production and Financial Planner v6 x3cctlTusiime Atwooki AggreyNo ratings yet

- Exercise Chapter 6: Management Accouting Acca2Document8 pagesExercise Chapter 6: Management Accouting Acca2Bội Anh Nguyễn Bội AnhNo ratings yet

- PM Sect B Test 4Document6 pagesPM Sect B Test 4FarahAin FainNo ratings yet

- Section C Part 2 MCQDocument344 pagesSection C Part 2 MCQSaiswetha Bethi100% (1)

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Introduction to Dynamic Macroeconomic General Equilibrium ModelsFrom EverandIntroduction to Dynamic Macroeconomic General Equilibrium ModelsNo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- GNBCY LN Chap01 Managerial Accounting and Business EnvironmentDocument18 pagesGNBCY LN Chap01 Managerial Accounting and Business EnvironmentMan Tran Y NhiNo ratings yet

- GNBCY LN Chap02 Cost ConceptsDocument18 pagesGNBCY LN Chap02 Cost ConceptsMan Tran Y NhiNo ratings yet

- GNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsDocument4 pagesGNBCY AE SM Chap13 Peformance Measurement in Decentralized OrganizationsMan Tran Y NhiNo ratings yet

- Chapter 7: Applying ExcelDocument8 pagesChapter 7: Applying ExcelMan Tran Y NhiNo ratings yet

- Chapter 5: Applying ExcelDocument8 pagesChapter 5: Applying ExcelMan Tran Y NhiNo ratings yet

- GNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisDocument7 pagesGNBCY AE SM Chap11 Flexible Budgets and Performance AnalysisMan Tran Y NhiNo ratings yet

- Chapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentDocument6 pagesChapter 10: Applying Excel: Chapter 10 Master Budgeting - Solutions Manual ContentMan Tran Y NhiNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Chapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentDocument9 pagesChapter 4: Applying Excel: Chapter 4 Cost-Volume-Profit Relationships - Solution Manual ContentMan Tran Y NhiNo ratings yet

- Solution Manual Accounting Information Systems 12th Edition by Romney and Steinbart Ch17Document24 pagesSolution Manual Accounting Information Systems 12th Edition by Romney and Steinbart Ch17Man Tran Y NhiNo ratings yet

- Chapter 13 Test Bank Romney AisDocument35 pagesChapter 13 Test Bank Romney AisMan Tran Y NhiNo ratings yet

- Test Bank Ais Accounting Information System Test BankDocument13 pagesTest Bank Ais Accounting Information System Test BankMan Tran Y NhiNo ratings yet

- Zenex Accounts Business Financial Accounting SoftwareDocument2 pagesZenex Accounts Business Financial Accounting SoftwareAbhivermazNo ratings yet

- Multiple Choice - Problems Part 1: A. Percentage TaxDocument8 pagesMultiple Choice - Problems Part 1: A. Percentage TaxWearIt Co.No ratings yet

- Simplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDocument4 pagesSimplified Accounting For Entrepreneurs (SAFE) Assignment - Part 1 Journalizing, Posting, Trial BalanceDarwin Dionisio ClementeNo ratings yet

- 08 Business Cycles, Unemployment, InflationDocument3 pages08 Business Cycles, Unemployment, Inflationcatherine tucayNo ratings yet

- Trade DiversionDocument2 pagesTrade DiversionJae-wook LeeNo ratings yet

- MBA EX. Mid Term Examination Schedule - Summer 2021Document1 pageMBA EX. Mid Term Examination Schedule - Summer 2021Shehreiz SiddiquiNo ratings yet

- Xxarticles of Incorporation-Stock CorpDocument6 pagesXxarticles of Incorporation-Stock CorpEdgar EnriquezNo ratings yet

- Study On Urbanization People Mobility Inclusive Development FINALDocument182 pagesStudy On Urbanization People Mobility Inclusive Development FINALBrenda Shania LombuNo ratings yet

- Market Profile - Assignment - Updt2Document22 pagesMarket Profile - Assignment - Updt2Alexandra Sanchez HavardNo ratings yet

- ICAI General InsuranceDocument333 pagesICAI General InsuranceShriya GuptaNo ratings yet

- Islamic Real Estate Investment Trust As An Investment Asset For Waqf Management in Indonesia: Regulatory Framework and Shariah-CompliancyDocument45 pagesIslamic Real Estate Investment Trust As An Investment Asset For Waqf Management in Indonesia: Regulatory Framework and Shariah-CompliancyYoga PrakasaNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- Soc - Audit Manual RRP - Doc 6.9.07 LandscapeDocument653 pagesSoc - Audit Manual RRP - Doc 6.9.07 LandscapeSamgar SangmaNo ratings yet

- Making Cement BricksDocument3 pagesMaking Cement BricksCampbell OGENRWOTNo ratings yet

- E-Leadership Through Strategic AlignmentDocument22 pagesE-Leadership Through Strategic AlignmentAmin Jan FayezNo ratings yet

- Yudina PoudelDocument91 pagesYudina Poudelирина щурNo ratings yet

- Types of Opinions Provided by The AuditorDocument20 pagesTypes of Opinions Provided by The AuditorFarrukh TahirNo ratings yet

- A Practical Guide For Cloud Migration ReadinessDocument17 pagesA Practical Guide For Cloud Migration Readinesssundeep_dubeyNo ratings yet

- 1307174808status of Microfinance in India 2016-17Document278 pages1307174808status of Microfinance in India 2016-17Om PrakashNo ratings yet

- Application of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewDocument25 pagesApplication of Industry 4.0 in The Procurement Processes of Supply Chains: A Systematic Literature ReviewVitor PontesNo ratings yet

- Salary CertificateDocument1 pageSalary CertificateselvaNo ratings yet

- Ca Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalDocument2 pagesCa Final SFM (New) Chapterwise Abc & Marks Analysis - Ca Ravi AgarwalG KNo ratings yet

- Account Title Amount (PHP) Bs/IsDocument14 pagesAccount Title Amount (PHP) Bs/IsAlthea Marie LazoNo ratings yet

- Impact Assessment of Personal Income Tax Reduction in The Philippines by IDEADocument44 pagesImpact Assessment of Personal Income Tax Reduction in The Philippines by IDEAVoltaire Veneracion100% (1)

- India Wine ReportDocument11 pagesIndia Wine ReportShikha BansalNo ratings yet

- Evolution of Philippine TaxationDocument4 pagesEvolution of Philippine Taxationyumi timtim50% (2)