Professional Documents

Culture Documents

Cost Accounting (Tooba)

Cost Accounting (Tooba)

Uploaded by

Ali AbbasCopyright:

Available Formats

You might also like

- Chapter 6Document24 pagesChapter 6jake doinog88% (16)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- B1031181069 Enelia LabAkuntansiBiayaDocument5 pagesB1031181069 Enelia LabAkuntansiBiayaEneliaNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- Management Accounting (Workbook) PDFDocument85 pagesManagement Accounting (Workbook) PDFRizza azilia kNo ratings yet

- Case A Case B Case CDocument2 pagesCase A Case B Case Ckhiladi883No ratings yet

- Activity 2 - Masagana-Co.Document3 pagesActivity 2 - Masagana-Co.happypotatoo6No ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- AUDITING PROB Activity 2Document4 pagesAUDITING PROB Activity 2Joody CatacutanNo ratings yet

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- 2b Problem On Cost of Goods SoldDocument5 pages2b Problem On Cost of Goods Soldalamin shawonNo ratings yet

- Full download Accounting for Managers Canadian 1st Edition Collier Solutions Manual all chapter 2024 pdfDocument40 pagesFull download Accounting for Managers Canadian 1st Edition Collier Solutions Manual all chapter 2024 pdfdarciooomes92100% (7)

- Particulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Document7 pagesParticulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Jhoanne Marie TederaNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Tugas 2Document2 pagesTugas 2Silvia Fudjiyani79No ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (30)

- Required: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeDocument3 pagesRequired: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeKean Brean GallosNo ratings yet

- Assignment #1 SolutionDocument18 pagesAssignment #1 SolutionJesse DanielsNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Statement of Comprehensive Income ProblemsDocument2 pagesStatement of Comprehensive Income ProblemsDarlyn Dalida San PedroNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- Manufacturing Costs and Inventory Costing: Session 4Document37 pagesManufacturing Costs and Inventory Costing: Session 4MarcoNo ratings yet

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Karen Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Document8 pagesKaren Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Althea Gabrielle PinedaNo ratings yet

- Chapter 6 Exercise Activity With AnswersDocument25 pagesChapter 6 Exercise Activity With Answers乙คckคrψ YTNo ratings yet

- Cost Accounting de Leon Chapter 3 SolutionsDocument9 pagesCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- 10E - Build A Spreadsheet 02-44Document2 pages10E - Build A Spreadsheet 02-44MISRET 2018 IEI JSCNo ratings yet

- Master BudgetDocument2 pagesMaster BudgetAli SwizzleNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- 07 Reconciliation FTDocument7 pages07 Reconciliation FTnsm2zmvnbbNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Basic Terminologies Used in Stock ExchangeDocument2 pagesBasic Terminologies Used in Stock ExchangeAli AbbasNo ratings yet

- Dubai Tourism: Presented By: AribaDocument7 pagesDubai Tourism: Presented By: AribaAli AbbasNo ratings yet

- Core Functions of State Bank of PakistanDocument5 pagesCore Functions of State Bank of PakistanAli AbbasNo ratings yet

- Economic Systems and Islamic Finance: Instructor: Muhammad KashifDocument30 pagesEconomic Systems and Islamic Finance: Instructor: Muhammad KashifAli AbbasNo ratings yet

- Khadim Ali Shah Bukhari Institute of Technology,: Project: Khat-E-NaskhDocument11 pagesKhadim Ali Shah Bukhari Institute of Technology,: Project: Khat-E-NaskhAli AbbasNo ratings yet

- Matz Usry Part 4 - 1Document218 pagesMatz Usry Part 4 - 1taha tahaNo ratings yet

- Adv Cost Assignment 2023Document6 pagesAdv Cost Assignment 2023GETAHUN ASSEFA ALEMUNo ratings yet

- (W-10) SI-5101 Data Envelopment Analysis (2021)Document27 pages(W-10) SI-5101 Data Envelopment Analysis (2021)krisnaadithaNo ratings yet

- What Is Cost?: Fixed Cost and Variable CostDocument10 pagesWhat Is Cost?: Fixed Cost and Variable CostNayyar Muhammad100% (1)

- AP Micro HW 11 PDFDocument6 pagesAP Micro HW 11 PDFLouis wuNo ratings yet

- Cost Accounting and Control by de Leon 2019Document182 pagesCost Accounting and Control by de Leon 2019Sly BlueNo ratings yet

- Bab 7Document33 pagesBab 7Juli SitohangNo ratings yet

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- Production CostsDocument3 pagesProduction CostsNiño Rey LopezNo ratings yet

- Pertemuan 7 Fungsi ProduksiDocument19 pagesPertemuan 7 Fungsi ProduksiCanderaNo ratings yet

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- EcoDocument20 pagesEcoapi-357947974No ratings yet

- Sace I EconomicsDocument9 pagesSace I EconomicssaiNo ratings yet

- Job and Bach CostingDocument10 pagesJob and Bach Costingnyashamagutsa93No ratings yet

- HRM 413 - Productivity Notes by Miss TDocument83 pagesHRM 413 - Productivity Notes by Miss TKevin NdabambiNo ratings yet

- Bài kiểm tra KTQTDocument10 pagesBài kiểm tra KTQTDUYÊN LÊ NGUYỄN MỸNo ratings yet

- PRODUCTIONDocument6 pagesPRODUCTIONDevesh sarafNo ratings yet

- Problems On Relevant Costs For ReviewDocument22 pagesProblems On Relevant Costs For ReviewIrish SanchezNo ratings yet

- 10479-3 Tips and Tricks For Configuring Cloud Cost Accounting For Your Supply Chain-Presentation - 696Document31 pages10479-3 Tips and Tricks For Configuring Cloud Cost Accounting For Your Supply Chain-Presentation - 696AhmedNo ratings yet

- 06 Consolidation AnnotatedDocument18 pages06 Consolidation AnnotatedLloydNo ratings yet

- ME - Price Output Determination (Monopolistic Comp.)Document5 pagesME - Price Output Determination (Monopolistic Comp.)soubhagya_babuNo ratings yet

- Single Period Model - Full Marginal Cost Analysis Approach: Number PurchasedDocument18 pagesSingle Period Model - Full Marginal Cost Analysis Approach: Number PurchasedHernan Pumasupa SolanoNo ratings yet

- Garrison12ce PPT Ch02Document63 pagesGarrison12ce PPT Ch02Yatharth AggarwalNo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Equilibrium of The Firm and Industry Under Perfect CompetitionDocument37 pagesEquilibrium of The Firm and Industry Under Perfect CompetitionMOHIT SIGIRISETTYNo ratings yet

- 4 Relevant CostingDocument10 pages4 Relevant CostingXyril MañagoNo ratings yet

- Ilanchelian (P121958) - ZCMC6122 - Individual Assignment 2Document24 pagesIlanchelian (P121958) - ZCMC6122 - Individual Assignment 2Ilanchelian ChandranNo ratings yet

- Add'l Exercises For Merchandising - Jenny Boo, 12 Dwight MoodyDocument6 pagesAdd'l Exercises For Merchandising - Jenny Boo, 12 Dwight MoodyJenny BooNo ratings yet

- Besanko and Braeutigam Microeconomics 3-169-173Document5 pagesBesanko and Braeutigam Microeconomics 3-169-173Leonardo ReinosoNo ratings yet

- Practice Questions For Tutorial Solutions 3 - 2020 - Section BDocument8 pagesPractice Questions For Tutorial Solutions 3 - 2020 - Section BtanNo ratings yet

Cost Accounting (Tooba)

Cost Accounting (Tooba)

Uploaded by

Ali AbbasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Accounting (Tooba)

Cost Accounting (Tooba)

Uploaded by

Ali AbbasCopyright:

Available Formats

Fall Term 2021 Assignment 1

Date of Assignment: October 10, 2021

0 Date of Submission: October 15, 2021

Student Name: Tooba__I.D:16116 _________

Code: ACC – 251 Class: _BBA 4A_

Course: Cost Accounting Marks: 10 Marks

Instructor: Sanam Iqbal

Instructions:

1. Assignment should be handwritten

.3

Question 1: - The following is the trial balance of Falcon Manufacturing Company as at September 30,

2017

Dr. Rs. Cr. Rs. Dr. Rs. Cr. Rs.

Cash 30, 350 Accrued Dividends 11, 000

Acc Receivables (net) 28, 150 Capital Stock at par value 90,000

Dir Material Inv – Oct 01 9, 650 Paid-in-capital 25, 000

Work-in-process Oct 01 6, 900 Re Earnings – Oct 01 20, 350

Fin Goods Inv Oct 01 3, 750 Sales 391, 200

Prepaid Expenses 1, 600 Sales Returns 2, 850

Factory Equipment 131,500 Purchases of Material 93, 100

Acc Dep – Fac Equip 31, 400 Direct Labor 119, 700

Selling Equipment 71, 350 Factory Overhead 60, 750

Acc Dep – Selling Equip 23, 700 Gen & Admin Expense 32, 050

Patents 19, 100 Income Tax Expense 23, 272

Accounts Payable 15, 422

Salary Payable 26, 000 634, 072 634, 072

The inventories as at September 30, 2017 are as follows:

Direct Material Inventory Rs. 9, 020 Work-in-process Inventory Rs. 5, 250

Finished goods Inventory 2, 250

Instructions: - Prepare the following external financial statements

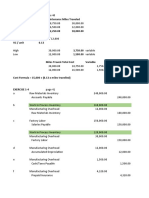

a. Cost of Goods Manufactured Statement

b. Income Statement

c. Statement of Retained Earnings

Fall Term 2021 Assignment 1

Fall Term 2021 Assignment 1

Fall Term 2021 Assignment 1

Question 2: Determine the missing amounts in each of the following independent cases.

Case A Case B Case C

Sales ? ? $240,000

Beginning inventory, raw material ? $ 60,000 7,500

Ending inventory, raw material $ 180,000 ? 15,000

Purchases of raw material 200,000 255,000 ?

Direct material used 140,000 285,000 ?

Direct labor ? 300,000 62,500

Manufacturing overhead 500,000 ? 80,000

Total manufacturing costs 1,040,000 1,035,000 170,000

Beginning inventory, work in process 70,000 60,000 ?

Ending inventory, work in process ? 105,000 2,500

Cost of goods manufactured 1,050,000 ? 175,000

Beginning inventory, finished goods 100,000 120,000 ?

Cost of goods available for sale ? ? 185,000

Ending inventory, finished goods ? ? 12,500

Cost of goods sold 1,090,000 990,000 ?

Gross margin 510,000 510,000 ?

Selling and administrative expenses ? 225,000 ?

Income before taxes 300,000 ? 45,000

Income tax expense 80,000 135,000 ?

Net income ? ? 27,500

Fall Term 2021 Assignment 1

Case A Case B Case C

Sales 1600000 1500000 $240,000

Beginning inventory, raw material 120000 $ 60,000 7,500

Ending inventory, raw material $ 180,000 30000 15,000

Purchases of raw material 200,000 255,000 35000

Direct material used 140,000 285,000 27500

Direct labor 400000 300,000 62,500

Manufacturing overhead 500,000 450000 80,000

Total manufacturing costs 1,040,000 1,035,000 170,000

Beginning inventory, work in process 70,000 60,000 7500

Ending inventory, work in process 60000 105,000 2,500

Cost of goods manufactured 1,050,000 990000 175,000

Beginning inventory, finished goods 100,000 120,000 10000

Cost of goods available for sale 1150000 1110000 185,000

Ending inventory, finished goods 60000 120000 12,500

Cost of goods sold 1,090,000 990,000 172500

Gross margin 510,000 510,000 67500

Selling and administrative expenses 210000 225,000 22500

Income before taxes 300,000 285000 45,000

Income tax expense 80,000 135,000 17500

Net income 220000 150000 27,500

Fall Term 2021 Assignment 1

You might also like

- Chapter 6Document24 pagesChapter 6jake doinog88% (16)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- B1031181069 Enelia LabAkuntansiBiayaDocument5 pagesB1031181069 Enelia LabAkuntansiBiayaEneliaNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- Management Accounting (Workbook) PDFDocument85 pagesManagement Accounting (Workbook) PDFRizza azilia kNo ratings yet

- Case A Case B Case CDocument2 pagesCase A Case B Case Ckhiladi883No ratings yet

- Activity 2 - Masagana-Co.Document3 pagesActivity 2 - Masagana-Co.happypotatoo6No ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- AUDITING PROB Activity 2Document4 pagesAUDITING PROB Activity 2Joody CatacutanNo ratings yet

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- 2b Problem On Cost of Goods SoldDocument5 pages2b Problem On Cost of Goods Soldalamin shawonNo ratings yet

- Full download Accounting for Managers Canadian 1st Edition Collier Solutions Manual all chapter 2024 pdfDocument40 pagesFull download Accounting for Managers Canadian 1st Edition Collier Solutions Manual all chapter 2024 pdfdarciooomes92100% (7)

- Particulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Document7 pagesParticulars: (Format and Additional Data Provided - Statement of Income and Expense Tab)Jhoanne Marie TederaNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Tugas 2Document2 pagesTugas 2Silvia Fudjiyani79No ratings yet

- Accounting For Managers Canadian 1st Edition Collier Solutions ManualDocument17 pagesAccounting For Managers Canadian 1st Edition Collier Solutions Manualnicholassmithyrmkajxiet100% (30)

- Required: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeDocument3 pagesRequired: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeKean Brean GallosNo ratings yet

- Assignment #1 SolutionDocument18 pagesAssignment #1 SolutionJesse DanielsNo ratings yet

- Problem Lecture - MANUFACTURING 2 With ANSWERSDocument4 pagesProblem Lecture - MANUFACTURING 2 With ANSWERSNia BranzuelaNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Statement of Comprehensive Income ProblemsDocument2 pagesStatement of Comprehensive Income ProblemsDarlyn Dalida San PedroNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- Manufacturing Costs and Inventory Costing: Session 4Document37 pagesManufacturing Costs and Inventory Costing: Session 4MarcoNo ratings yet

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Karen Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Document8 pagesKaren Company Statement of Cost of Goods Manufactured For The Year Ended Dec. 31, 2020Althea Gabrielle PinedaNo ratings yet

- Chapter 6 Exercise Activity With AnswersDocument25 pagesChapter 6 Exercise Activity With Answers乙คckคrψ YTNo ratings yet

- Cost Accounting de Leon Chapter 3 SolutionsDocument9 pagesCost Accounting de Leon Chapter 3 SolutionsRichelle SangatananNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNo ratings yet

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- 10E - Build A Spreadsheet 02-44Document2 pages10E - Build A Spreadsheet 02-44MISRET 2018 IEI JSCNo ratings yet

- Master BudgetDocument2 pagesMaster BudgetAli SwizzleNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- 07 Reconciliation FTDocument7 pages07 Reconciliation FTnsm2zmvnbbNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Basic Terminologies Used in Stock ExchangeDocument2 pagesBasic Terminologies Used in Stock ExchangeAli AbbasNo ratings yet

- Dubai Tourism: Presented By: AribaDocument7 pagesDubai Tourism: Presented By: AribaAli AbbasNo ratings yet

- Core Functions of State Bank of PakistanDocument5 pagesCore Functions of State Bank of PakistanAli AbbasNo ratings yet

- Economic Systems and Islamic Finance: Instructor: Muhammad KashifDocument30 pagesEconomic Systems and Islamic Finance: Instructor: Muhammad KashifAli AbbasNo ratings yet

- Khadim Ali Shah Bukhari Institute of Technology,: Project: Khat-E-NaskhDocument11 pagesKhadim Ali Shah Bukhari Institute of Technology,: Project: Khat-E-NaskhAli AbbasNo ratings yet

- Matz Usry Part 4 - 1Document218 pagesMatz Usry Part 4 - 1taha tahaNo ratings yet

- Adv Cost Assignment 2023Document6 pagesAdv Cost Assignment 2023GETAHUN ASSEFA ALEMUNo ratings yet

- (W-10) SI-5101 Data Envelopment Analysis (2021)Document27 pages(W-10) SI-5101 Data Envelopment Analysis (2021)krisnaadithaNo ratings yet

- What Is Cost?: Fixed Cost and Variable CostDocument10 pagesWhat Is Cost?: Fixed Cost and Variable CostNayyar Muhammad100% (1)

- AP Micro HW 11 PDFDocument6 pagesAP Micro HW 11 PDFLouis wuNo ratings yet

- Cost Accounting and Control by de Leon 2019Document182 pagesCost Accounting and Control by de Leon 2019Sly BlueNo ratings yet

- Bab 7Document33 pagesBab 7Juli SitohangNo ratings yet

- MAS 9204 Product Costing Activity-Based Costing (ABC)Document19 pagesMAS 9204 Product Costing Activity-Based Costing (ABC)Mila Casandra CastañedaNo ratings yet

- Production CostsDocument3 pagesProduction CostsNiño Rey LopezNo ratings yet

- Pertemuan 7 Fungsi ProduksiDocument19 pagesPertemuan 7 Fungsi ProduksiCanderaNo ratings yet

- Variable and Absorption CostingDocument5 pagesVariable and Absorption CostingAllan Jay CabreraNo ratings yet

- EcoDocument20 pagesEcoapi-357947974No ratings yet

- Sace I EconomicsDocument9 pagesSace I EconomicssaiNo ratings yet

- Job and Bach CostingDocument10 pagesJob and Bach Costingnyashamagutsa93No ratings yet

- HRM 413 - Productivity Notes by Miss TDocument83 pagesHRM 413 - Productivity Notes by Miss TKevin NdabambiNo ratings yet

- Bài kiểm tra KTQTDocument10 pagesBài kiểm tra KTQTDUYÊN LÊ NGUYỄN MỸNo ratings yet

- PRODUCTIONDocument6 pagesPRODUCTIONDevesh sarafNo ratings yet

- Problems On Relevant Costs For ReviewDocument22 pagesProblems On Relevant Costs For ReviewIrish SanchezNo ratings yet

- 10479-3 Tips and Tricks For Configuring Cloud Cost Accounting For Your Supply Chain-Presentation - 696Document31 pages10479-3 Tips and Tricks For Configuring Cloud Cost Accounting For Your Supply Chain-Presentation - 696AhmedNo ratings yet

- 06 Consolidation AnnotatedDocument18 pages06 Consolidation AnnotatedLloydNo ratings yet

- ME - Price Output Determination (Monopolistic Comp.)Document5 pagesME - Price Output Determination (Monopolistic Comp.)soubhagya_babuNo ratings yet

- Single Period Model - Full Marginal Cost Analysis Approach: Number PurchasedDocument18 pagesSingle Period Model - Full Marginal Cost Analysis Approach: Number PurchasedHernan Pumasupa SolanoNo ratings yet

- Garrison12ce PPT Ch02Document63 pagesGarrison12ce PPT Ch02Yatharth AggarwalNo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Equilibrium of The Firm and Industry Under Perfect CompetitionDocument37 pagesEquilibrium of The Firm and Industry Under Perfect CompetitionMOHIT SIGIRISETTYNo ratings yet

- 4 Relevant CostingDocument10 pages4 Relevant CostingXyril MañagoNo ratings yet

- Ilanchelian (P121958) - ZCMC6122 - Individual Assignment 2Document24 pagesIlanchelian (P121958) - ZCMC6122 - Individual Assignment 2Ilanchelian ChandranNo ratings yet

- Add'l Exercises For Merchandising - Jenny Boo, 12 Dwight MoodyDocument6 pagesAdd'l Exercises For Merchandising - Jenny Boo, 12 Dwight MoodyJenny BooNo ratings yet

- Besanko and Braeutigam Microeconomics 3-169-173Document5 pagesBesanko and Braeutigam Microeconomics 3-169-173Leonardo ReinosoNo ratings yet

- Practice Questions For Tutorial Solutions 3 - 2020 - Section BDocument8 pagesPractice Questions For Tutorial Solutions 3 - 2020 - Section BtanNo ratings yet