Professional Documents

Culture Documents

Name: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial Periods

Name: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial Periods

Uploaded by

Hernando MaulanaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Name: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial Periods

Name: Date: NPM: Course:: INSTRUCTION: Determine Depreciation For Partial Periods

Uploaded by

Hernando MaulanaCopyright:

Available Formats

Name: Date:

NPM: Course:

INSTRUCTION: Determine depreciation for partial periods.

Swinton Company purchased a new machine on October 1, 2012, at a cost of $120,000 The

company estimated that the machine will have a salvage value of $12,000 The machine is

expected to be used for 10,000 working hours during its 5 -year life.

Instructions:

Compute the depreciation expense under the following methods for the year indicated:

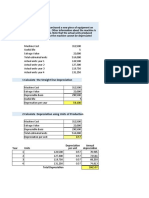

(a) Straight-line for 2012. (The Excel "SLN" formula can be used for this method.)

Cost: Amount Depreciation Expense:

Salvage value: Amount Depreciation Expense only for 2012:

Life in years: Number

Months in first year: Number

(b) Units-of-activity for 2012, assuming machine usage was 1,700 hours.

Cost: Amount

Salvage value: Amount

Title Formula

Life in hours: Number

Depreciation value/hour: Formula

Hours in 2012: Number

Depreciation in 2012: Formula

(c) Declining-balance using double the straight-line rate for 2012 and 2013.

2012 Depreciation:

Book Value, 1 January 2013:

2013 Depreciation:

562065082.xlsx, Soal 2, Page 1 of 5 Page(s), 12/05/202112:34:02

Assalamualaikum Warrahmatullahi Wabarakatuh

Soal ujian terdiri dari 2 soal komprehensif mengenai Fixed Asset dan Bond

Waktu ujian adalah 2 jam (120 menit) dimulai dari pukul 10.00 - 12.00 WIB

Soal langsung dijawab di tempat yang tersedia

Jawaban dikumpulkan ke email: rahmawijayanti@tazkia.ac.id

Subject email jawaban: nama mahasiswa-UTS SP PA 2

Tidak diperkenankan:

Melihat buku, slide perkuliahan, browsing dan menyalin jawaban mahasiswa

Selamat mengerjakan, semoga Allah mudahkan

Name: Date:

NPM: Course:

On January 1, 2012, Zakiuddin Company purchased the following two machines for use in its production process.

Machine A: The cash price of this machine was $55,000

Related expenditures included:

Sales tax: $2,750

Shipping costs $100

Insurance during shipping $75

Installation and testing $75

Oil and lubricants to used with the

machine during its first year of $90

operations:

Zakiuddin estimates that the useful life of the machine is 4 years with a

$5,000 salvage value remaining at the end of that time period.

Machine B: The recorded cost of this machine was $100,000 Zakiuddin estimates that the useful

life of the machine is 4 years with a $10,000 $10,000 salvage value remaining at

the end of that time period.

Instructions:

(a) Prepare the following for Machine A:

(a) (1) The journal entry to record its purchase on January 1, 2012.

Title Amount

Title Amount

Title Amount

Title Amount

Title Amount

Total cost of machinery Amount

Account title Amount

Entry -->

Account title Amount

(a) (2) The journal entry to record annual depreciation at December 31, 2012, assuming the straight-line method of

depreciation is used.

Recorded cost Amount

Title Amount

Title Amount

Title Amount

Annual depreciation Amount

Account title Amount

Entry -->

Account title Amount

(b) Calculate the amount of depreciation expense that Zakiuddin should record for machine B each year of its useful life

under the following assumption.

(b) (1) Zakiuddin uses the straight-line method of depreciation.

Recorded cost Amount

Title Amount

Title Amount

Title Amount

Annual depreciation Amount

562065082.xlsx, Fixed Asset, Page 3 of 5 Page(s), 12/05/202112:34:02

Name: Date:

NPM: Course:

(b) (2) Zakiuddin uses the declining-balance method. The rate used is twice the straight-line rate.

Book Value Annual

at Beginning Depreciation Accumulated

Year of Year DDB Rate Expense Depreciation

2012 Amount Percentage Formula Formula

2013 Formula Percentage Formula Formula

2014 Formula Percentage Formula Formula

2015 Formula Percentage Formula Formula

Area for computation as needed

Area for computation as needed

(b) (3) Zakiuddin uses the units-of-activity method and estimates the useful life of the machine is 25,000

units. Actual usage is as follows: 2012 5,500 2014 8,000

2013 7,000 2015 4,500

Area for computation as needed

Annual Depreciation Expense

Year: Activity: Rate: Period Depreciation:

2012 Number Amount Formula

2013 Number Amount Formula

2014 Number Amount Formula

2015 Number Amount Formula

(c) Which method used to calculate depreciation on machine B reports the lowest amount of depreciation expense in

year 1 (2012)? The lowest amount in year 4 (2015)? The lowest total amount over the 4-year period?

Enter text answer here

Enter text answer here

Enter text answer here

Enter text answer here

562065082.xlsx, Fixed Asset, Page 4 of 5 Page(s), 12/05/202112:34:02

Name: Date:

NPM: Course:

INSTRUCTION: Prepare entries to record issuance of bonds, payment of interest, and amortization of bond discount using

effective interest method.

On July 1, 2015, Leo inc issued $4,500,000 face value, 9% 10 -year bonds

at $4,219,600 This price resulted in an effective-interest rate of 10% on the bonds. Sagittarius

uses the effective-interest method to amortize bond premium or discount. The bonds pay semiannual interest July 1 and January 1.

Instructions: (Round all computations to the nearest dollar.)

(a) Prepare the journal entry to record the issuance of the bonds on July 1, 2015.

Jul 1, 15 Cash 4,219,600

Discount on Bonds Payable 280,600

Bonds Payable 4,500,000

(b) Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2015.

SAGITTARIUS CORPORATION

Bond Discount Amortization

Effective-Interest Method—Semiannual Interest Payments

9% Bonds Issued at 10%

(A) (B) (C) (D) (E)

Interest Bond

Semi-annual Interest Expense Discount Unamortized Carrying

Interest to Be to Be Amortization Discount Value

Periods Paid Recorded (B) – (A) (D) – (C) ($4,500,000 - D)

Issue date $280,600 $4,219,600

1 $202,500 $210,980 $8,480 271,920 4,228,080

2 202,500 211,404 $8,904 263,016 4,236,984

3 202,500 211,849 $9,349 253,667 4,246,333

(c) Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2015.

Dec 31, 15 Interest Expense 210,980

Discount on Bonds Payable 8,480

Interest Payable 202,500

(d) Prepare the journal entry to record the payment of interest and the amortization of the discount on July 1, 2016, assuming that

interest was not accrued on June 30.

Jul 1, 16 interest Expense 211,404

Discount on Bonds Payable 8,904

Cash 202,500

(e) Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2016.

Dec 31, 16 Interest Expense 211,849

Discount on Bonds Payable 9,349

Interest Payable 202,500

562065082.xlsx, Bond , Page 5 of 5 Page(s), 12/05/202112:34:02

You might also like

- AC216 Unit 3 Assignment 4 - Depreciation Methods MorganDocument2 pagesAC216 Unit 3 Assignment 4 - Depreciation Methods MorganEliana MorganNo ratings yet

- Accounting Policy Memo - Cash Equivalents & ST InvestmentsDocument2 pagesAccounting Policy Memo - Cash Equivalents & ST Investmentsdalebowen100% (1)

- The Business Model CanvasDocument2 pagesThe Business Model CanvasgwegNo ratings yet

- Lecture Note DepreciationDocument7 pagesLecture Note DepreciationRia Athirah100% (2)

- Abdc Finance Journal ListDocument12 pagesAbdc Finance Journal ListGeetikabbeNo ratings yet

- Multiple-Choice Questions: B: Rejecting Is A Term Used To Describe A Situation WhenDocument4 pagesMultiple-Choice Questions: B: Rejecting Is A Term Used To Describe A Situation WhenRavi SatyapalNo ratings yet

- Suci Akutansi Smester 3Document19 pagesSuci Akutansi Smester 3suci astutiNo ratings yet

- Car Manufacutring Student Sheet English 2022 VersionDocument24 pagesCar Manufacutring Student Sheet English 2022 VersionSelin PusatNo ratings yet

- PA2 X IE HW7 G2 Radja Chendykia Ifanka LubisDocument8 pagesPA2 X IE HW7 G2 Radja Chendykia Ifanka LubischendyradjaNo ratings yet

- CE 22 - Engineering Economy: General InstructionsDocument1 pageCE 22 - Engineering Economy: General InstructionsMarco ConopioNo ratings yet

- CH 11Document6 pagesCH 11Saleh RaoufNo ratings yet

- Short Form Questions: Winter Exam-2016Document7 pagesShort Form Questions: Winter Exam-2016Kashif NiaziNo ratings yet

- المحاضرة التاسعة والعاشرةDocument6 pagesالمحاضرة التاسعة والعاشرةAly SaadNo ratings yet

- USN Dayananda Sagar College of Engineering: UG Semester End Examination TemplateDocument3 pagesUSN Dayananda Sagar College of Engineering: UG Semester End Examination Templaterockurocky gaNo ratings yet

- ACC101 Chapter8newDocument19 pagesACC101 Chapter8newLaras Sukma Nurani TirtawidjajaNo ratings yet

- CE 22 - Engineering Economics: Problem SetDocument1 pageCE 22 - Engineering Economics: Problem SetNathan TanNo ratings yet

- Depreciation For Partial Period SL Syd and DDB Alladin Company PDFDocument1 pageDepreciation For Partial Period SL Syd and DDB Alladin Company PDFAnbu jaromiaNo ratings yet

- M 2010 and 2011 June PDFDocument91 pagesM 2010 and 2011 June PDFMoses LukNo ratings yet

- Final Exam Accounting & Finance For Managers 13th March 2021Document4 pagesFinal Exam Accounting & Finance For Managers 13th March 2021Belidet Girma100% (1)

- MAS MCQsDocument181 pagesMAS MCQsanvillemarieNo ratings yet

- Lesson-04, DEPPRECIATION ACCDocument17 pagesLesson-04, DEPPRECIATION ACCZegera MgendiNo ratings yet

- Depreciation - Inventory Valuation MethodsDocument48 pagesDepreciation - Inventory Valuation MethodsArun Panwar100% (1)

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeoneNo ratings yet

- PPE Depreciaiton LectureDocument12 pagesPPE Depreciaiton Lecturecjorillosa2004No ratings yet

- Final Business Plan TemplateDocument14 pagesFinal Business Plan TemplateAbdul Rakib RabbeNo ratings yet

- T9 - ABFA1153 FA I (Tutor)Document6 pagesT9 - ABFA1153 FA I (Tutor)Wu kai AngNo ratings yet

- Dfa6233 2017 2 PT PDFDocument6 pagesDfa6233 2017 2 PT PDFmy pcNo ratings yet

- DepreciationDocument25 pagesDepreciationArshad ChaudharyNo ratings yet

- IA Chapter11Document89 pagesIA Chapter11yunsu638No ratings yet

- Tugas Individual 345Document7 pagesTugas Individual 345Mochamad PutraNo ratings yet

- DepreciationDocument24 pagesDepreciationKRISHNA KANT GUPTANo ratings yet

- ACC Chapter 8 QuestionsDocument12 pagesACC Chapter 8 Questionsmasud.mily06No ratings yet

- Tutorial Solution Week 06Document4 pagesTutorial Solution Week 06itmansaigonNo ratings yet

- CH 2Document15 pagesCH 2mmaf250No ratings yet

- Output PDFDocument81 pagesOutput PDFPravin ThoratNo ratings yet

- Chapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Document18 pagesChapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Raa100% (1)

- Class 8Document48 pagesClass 8NkNo ratings yet

- BhaDocument25 pagesBharishu jainNo ratings yet

- Depreciation Session 8Document76 pagesDepreciation Session 8Madhura Dabak100% (1)

- Depreciation in Final AccountsDocument26 pagesDepreciation in Final Accountsndagarachel015No ratings yet

- Paper 10Document5 pagesPaper 10Abhishek RoyNo ratings yet

- 2013 June Management Accounting L2 PDFDocument21 pages2013 June Management Accounting L2 PDFDixie CheeloNo ratings yet

- Cost Accounting 2 Question PaperDocument6 pagesCost Accounting 2 Question PaperSajitha100% (1)

- DepreciationDocument3 pagesDepreciationAdnan ShabeerNo ratings yet

- CH 8 PPE Part I PowerpointDocument32 pagesCH 8 PPE Part I Powerpointxa. vieNo ratings yet

- Practice SetDocument10 pagesPractice Setkaeya alberichNo ratings yet

- Cma Updated Past PapersDocument379 pagesCma Updated Past PapersLunasNo ratings yet

- Paper 1 CA Inter CostingDocument8 pagesPaper 1 CA Inter CostingtchargeipatchNo ratings yet

- Management Information: Time Allowed-2:15 Hours Total Marks - 100Document2 pagesManagement Information: Time Allowed-2:15 Hours Total Marks - 100Prabir Kumer RoyNo ratings yet

- DepriciatonDocument20 pagesDepriciatonSaumya TripathiNo ratings yet

- DEPRECIATION Acc PresentationDocument19 pagesDEPRECIATION Acc PresentationNishant SalujaNo ratings yet

- Cost Accounting-2 QPDocument7 pagesCost Accounting-2 QPMohammed MidlajNo ratings yet

- 71656bos57659 Inter p3qDocument7 pages71656bos57659 Inter p3qShubhangi MishraNo ratings yet

- Bhawana Jain, ASB, EttimadaiDocument64 pagesBhawana Jain, ASB, EttimadaiDeepak PrabhakarNo ratings yet

- Non-Current AssetsDocument6 pagesNon-Current AssetsMaryam EhsanNo ratings yet

- Part A: Managerial Accounting Assessment - ACC720 - March 2020Document4 pagesPart A: Managerial Accounting Assessment - ACC720 - March 2020Helmy YusoffNo ratings yet

- Chapter 9: Basic Time and Material Project: ObjectivesDocument10 pagesChapter 9: Basic Time and Material Project: ObjectivesVenkatesh NNo ratings yet

- Kts g11 - Principles of Accounts Final AdjustmentsDocument16 pagesKts g11 - Principles of Accounts Final AdjustmentsBupe Banda100% (1)

- Accounting Standards: © The Institute of Chartered Accountants of IndiaDocument45 pagesAccounting Standards: © The Institute of Chartered Accountants of IndiamuraleeNo ratings yet

- Accounting (Depreciation)Document15 pagesAccounting (Depreciation)heynuhh gNo ratings yet

- M 2010 Jun PDFDocument35 pagesM 2010 Jun PDFMoses LukNo ratings yet

- TUTORIAL TOPIC 4 - Cost Estimation, Behaviour and CVP AnalysisDocument10 pagesTUTORIAL TOPIC 4 - Cost Estimation, Behaviour and CVP AnalysisQudwah HasanahNo ratings yet

- Acc102 W2Document28 pagesAcc102 W2Moheb RefaatNo ratings yet

- Chapter 01-The Role and Environment of Managerial FinanceDocument24 pagesChapter 01-The Role and Environment of Managerial FinancemmtusharNo ratings yet

- ArbitrageDocument10 pagesArbitragesachinremaNo ratings yet

- Concept and Reasons of Corporate RestructuringDocument9 pagesConcept and Reasons of Corporate RestructuringAkash PoojariNo ratings yet

- Ifii 2017Document53 pagesIfii 2017Gracellyn AlexaNo ratings yet

- A Framework For Characterizing Business Models Applied by Forestry Service ContractorsDocument11 pagesA Framework For Characterizing Business Models Applied by Forestry Service ContractorsAde HermawanNo ratings yet

- Ar Lpin 2022Document147 pagesAr Lpin 2022GABRIELLA GUNAWANNo ratings yet

- ElementsBookKeepingAccountancy SQPDocument6 pagesElementsBookKeepingAccountancy SQPMohd JamaluddinNo ratings yet

- QS12 - Midterm 2 ReviewDocument5 pagesQS12 - Midterm 2 Reviewlyk0texNo ratings yet

- Product Life Cycle of LuxDocument7 pagesProduct Life Cycle of LuxPuneet Singh Chhabra100% (1)

- FAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4Document6 pagesFAR 160 Group Project Semester Mar 2023 - Jul 2023: Prepared By: Name Student Id 1. 2. 3. 4NUR NAJWA MURSYIDAH NAZRINo ratings yet

- Chapter 3 CVPDocument37 pagesChapter 3 CVPfekadeNo ratings yet

- ACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarDocument14 pagesACCA FM TuitionExam CBE 2021-2022 Qs JG21Jan SPi15MarchimbanguraNo ratings yet

- What Is Market EquilibriumDocument2 pagesWhat Is Market EquilibriumNormashita Che DinNo ratings yet

- Deloitte Au Audit Transparency Report 2022Document27 pagesDeloitte Au Audit Transparency Report 2022Gurkirat Singh OberoiNo ratings yet

- Capital BudgetingDocument26 pagesCapital BudgetingKhaled WalidNo ratings yet

- Marketing, 69, 155-166.: Perspective, Acta Polytechnica Hungarica 6 (4) 146-162Document1 pageMarketing, 69, 155-166.: Perspective, Acta Polytechnica Hungarica 6 (4) 146-162Fakhira ShehzadiNo ratings yet

- Complete-Purchase-Forms BCPC MedicinesDocument13 pagesComplete-Purchase-Forms BCPC MedicinesArtacho BautistaNo ratings yet

- 2024 Tutorial 3-SolutionDocument6 pages2024 Tutorial 3-SolutionNdondoNo ratings yet

- Case Study #11: Frieslandcampina Global RolloutDocument4 pagesCase Study #11: Frieslandcampina Global RolloutmohamedelwarithNo ratings yet

- Introduction To Branding: by Robert Jones (Author)Document42 pagesIntroduction To Branding: by Robert Jones (Author)Miko Irwanto100% (1)

- FM MCQ For Ca InterDocument75 pagesFM MCQ For Ca Interaadvikjoshi0No ratings yet

- Role of Digital MarketingDocument2 pagesRole of Digital MarketingZarish IlyasNo ratings yet

- Inventory Accounting, Accounting For Depreciation, Accounting For CapitalisationDocument65 pagesInventory Accounting, Accounting For Depreciation, Accounting For CapitalisationShubham SaxenaNo ratings yet

- Replacement Project AnalysisDocument6 pagesReplacement Project Analysisdineshpasa76074No ratings yet

- Econ 1001 Lecture Notes - Week 2Document6 pagesEcon 1001 Lecture Notes - Week 2shotboi69No ratings yet

- Date Account Titles and Explanation Debit Credit Aug. 1 MaterialsDocument25 pagesDate Account Titles and Explanation Debit Credit Aug. 1 MaterialsRose Ann GarciaNo ratings yet