Professional Documents

Culture Documents

Week 9: Merchandise Inventory Adjustments and Special Journals

Week 9: Merchandise Inventory Adjustments and Special Journals

Uploaded by

France Delos SantosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 9: Merchandise Inventory Adjustments and Special Journals

Week 9: Merchandise Inventory Adjustments and Special Journals

Uploaded by

France Delos SantosCopyright:

Available Formats

WEEK 9

MERCHANDISE INVENTORY ADJUSTMENTS

AND SPECIAL JOURNALS

Objectives:

At the end of the lesson, the students are able to:

1. differentiate purchase returns and allowances from purchase discount;

2. explain the summary of purchasing transaction;

3. compare and contrast sales return and allowances and sales discounts;

4. discuss special journals;

Purchase Returns and Allowances

A purchaser may be dissatisfied with the merchandise received because the goods are damaged

or defective, of inferior quality, or do not meet the purchaser’s specifications. In such cases, the

purchaser may return the goods to the seller for credit if the sale was made on credit, or for a cash

refund if the purchase was for cash. This transaction is known as a purchase return. Alternatively,

the purchaser may choose to keep the merchandise if the seller is willing to grant an allowance

(deduction) from the purchase price. This transaction is known as a purchase allowance. Assume

that on May 8 Sauk Stereo returned to PW Audio Supply goods costing P300. The following entry

by Sauk Stereo for the returned merchandise decreases (debits) Accounts Payable and decreases

(credits) Merchandise Inventory.

Because Sauk Stereo increased Merchandise Inventory when the goods were received,

Merchandise Inventory is decreased when Sauk returns the goods (or when it is granted an

allowance).

Purchase Discounts

The credit terms of a purchase on account may permit the buyer to claim a cash discount for prompt

payment. The buyer calls this cash discount a purchase discount. This incentive offers

advantages to both parties: The purchaser saves money, and the seller shortens the operating

cycle by more quickly converting the accounts receivable into cash.

Credit terms specify the amount of the cash discount and time period in which it is offered. They

also indicate the time period in which the purchaser is expected to pay the full invoice price. In the

sales invoice in Illustration 12-5 credit terms are 2/10, n/30, which is read “two-ten, net thirty.” This

means that the buyer may take a 2% cash discount on the invoice price less (“net of”) any returns

or allowances, if payment is made within 10 days of the invoice date (the discount period). If the

buyer does not pay in that time, the invoice price, less any returns or allowances, is due 30 days

from the invoice date.

Alternatively, the discount period may extend to a specified number of days following the month in

which the sale occurs. For example, 1/10 EOM (end of month) means that a 1% discount is

available if the invoice is paid within the first 10 days of the next month.

When the seller elects not to offer a cash discount for prompt payment, credit terms will specify

only the maximum time period for paying the balance due.

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 1 of

10

For example, the invoice may state the time period as n/30, n/60, or n/10 EOM. This means,

respectively, that the buyer must pay the net amount in 30 days, 60 days, or within the first 10 days

of the next month.

When the buyer pays an invoice within the discount period, the amount of the discount decreases

Merchandise Inventory. Why? Because companies record inventory at cost and, by paying within

the discount period, the merchandiser has reduced that cost.

To illustrate, assume Sauk Stereo pays the balance due of P3,500 (gross invoice price of P3,800

less purchase returns and allowances of P300) on May 14, the last day of the discount period. The

cash discount is P70 (P3,500 x 2%), and Sauk Stereo pays P3,430 (P3,500 - P70). The entry Sauk

makes to record its May 14 payment decreases (debits) Accounts Payable by the amount of the

gross invoice price, reduces (credits) Merchandise Inventory by the P70 discount, and reduces

(credits) Cash by the net amount owed.

If Sauk Stereo failed to take the discount, and instead made full payment of P3,500 on June 3, it

would debit Accounts Payable and credit Cash for P3,500 each.

As a rule, a company usually should take all available discounts. Passing up the discount may be

viewed as paying interest for use of the money. For example, passing up the discount offered by

PW Audio would be comparable to Sauk Stereo paying an interest rate of 2% for the use of P3,500

for 20 days. This is the equivalent of an annual interest rate of approximately 36.5% (2% x 365/20).

Obviously, it would be better for Sauk Stereo to borrow at prevailing bank interest rates of 6% to

10% than to lose the discount.

Summary of Purchasing Transactions

The following T account (with transaction descriptions in blue) provides a summary of the effect of

the previous transactions on Merchandise Inventory. Sauk originally purchased P3,800 worth of

inventory for resale. It then returned P300 of goods. It paid P150 in freight charges, and finally, it

received a P70 discount off the balance owed because it paid within the discount period. This

results in a balance in Merchandise Inventory of P3,580.

Recording Sales of Merchandise

Companies record sales revenues, like service revenues, when earned, in compliance with the

revenue recognition principle. Typically, companies earn sales revenues when the goods transfer

from the seller to the buyer. At this point the sales transaction is complete and the sales price

established. Sales may be made on credit or for cash.

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 2 of

10

A business document should support every sales transaction, to provide written evidence of the

sale. Cash register tapes provide evidence of cash sales. Sales invoice provides support for a

credit sale. The original copy of the invoice goes to the customer, and the seller keeps a copy for

use in recording the sale. The invoice shows the date of sale, customer name, total sales price,

and other relevant information.

The seller makes two entries for each sale. The first entry records the sale: The seller increases

(debits) Cash (or Accounts Receivable, if a credit sale), and also increases (credits) Sales for the

invoice price of the goods. The second entry records the cost of the merchandise sold: The seller

increases (debits) Cost of Goods Sold, and also decreases (credits) Merchandise Inventory for the

cost of those goods. As a result, the Merchandise Inventory account will show at all times the

amount of inventory that should be on hand. To illustrate a credit sales transaction, PW Audio

Supply records its May 4 sale of P3,800 to Sauk Stereo (see Illustration) as follows. (Here, we

assume the merchandise cost PW Audio Supply P2,400.)

Sales Returns and Allowances

We now look at the “flipside” of purchase returns and allowances, which the seller records as sales

returns and allowances. PW Audio Supply’s entries to record credit for returned goods involve (1)

an increase in Sales Returns and Allowances and a decrease in Accounts Receivable at the P300

selling price, and (2) an increase in Merchandise Inventory (assume a P140 cost) and a decrease

in Cost of Goods Sold as shown below (assuming that the goods were not defective).

If Sauk returns goods because they are damaged or defective, then PW Audio Supply’s entry to

Merchandise Inventory and Cost of Goods Sold should be for the estimated value of the returned

goods, rather than their cost. For example, if the returned goods were defective and had a scrap

value of P50, PW Audio would debit Merchandise Inventory for P50, and would credit Cost of Goods

Sold for P50.

Sales Returns and Allowances is a contra-revenue account to Sales. The normal balance of

Sales Returns and Allowances is a debit. Companies use a contra account, instead of debiting

Sales, to disclose in the accounts and in the income statement the amount of sales returns and

allowances. Disclosure of this information is important to management: Excessive returns and

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 3 of

10

allowances may suggest problems—inferior merchandise, inefficiencies in filling orders, errors in

billing customers, or delivery or shipment mistakes. Moreover, a decrease (debit) recorded directly

to Sales would obscure the relative importance of sales returns and allowances as a percentage

of sales. It also could distort comparisons between total sales in different accounting periods.

Sales Discounts

As mentioned earlier, the seller may offer the customer a cash discount—called by the seller a

sales discount—for the prompt payment of the balance due. It is based on the invoice price less

returns and allowances, if any. The seller increases (debits) the Sales Discounts account for

discounts that are taken. For example, PW Audio Supply makes the following entry to record the

cash receipt on May 14 from Sauk Stereo within the discount period.

Like Sales Returns and Allowances, Sales Discounts is a contra-revenue account to Sales. Its

normal balance is a debit. PW Audio uses this account, instead of debiting sales, to disclose the

amount of cash discounts taken by customers. If Sauk Stereo does not take the discount, PW Audio

Supply increases Cash for P3,500 and decreases Accounts Receivable for the same amount at the

date of collection.

Adjusting Entries

A merchandising company generally has the same types of adjusting entries as a service company.

However, a merchandiser using a perpetual system will require one additional adjustment to make

the records agree with the actual inventory on hand. Here’s why: At the end of each period, for

control purposes, a merchandising company that uses a perpetual system will take a physical count

of its goods on hand. The company’s unadjusted balance in Merchandise Inventory usually does

not agree with the actual amount of inventory on hand. The perpetual inventory records may be

incorrect due to recording errors, theft, or waste. Thus, the company needs to adjust the perpetual

records to make the recorded inventory amount agree with the inventory on hand. This involves

adjusting Merchandise Inventory and Cost of Goods Sold.

Example: Suppose that PW Audio Supply has an unadjusted balance of P40,500 in Merchandise

Inventory. Through a physical count, PW Audio determines that its actual merchandise inventory at

year-end is P40,000. The company would make an adjusting entry as follows.

Closing Entries

A merchandising company, like a service company, closes to Income Summary all accounts that

affect net income. In journalizing, the company credits all temporary accounts with debit balances,

and debits all temporary accounts with credit balances, as shown below for PW Audio Supply. Note

that PW Audio closes Cost of Goods Sold to Income Summary.

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 4 of

10

After PW Audio has posted the closing entries, all temporary accounts have zero balances. Also,

R.A. Lamb, Capital has a balance that is carried over to the next period.

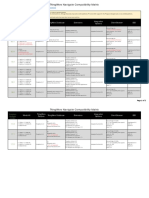

Summary of Merchandising Entries

The following illustration summarizes the entries for the merchandising accounts using a perpetual

inventory system.

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 5 of

10

Special Journals

So far you have learned to journalize transactions in a two-column general journal and post each

entry to the general ledger. This procedure is satisfactory in only the very smallest companies. To

expedite journalizing and posting, most companies use special journals in addition to the general

journal. Companies use special journals to record similar types of transactions.

Examples are all sales of merchandise on account, or all cash receipts. The types of transactions

that occur frequently in a company determine what special journals the company uses. Most

merchandising enterprises record daily transactions using the journals shown in Illustration.

Illustration: Use of special journals and the general journal

If a transaction cannot be recorded in a special journal, the company records it in the

general journal. For example, if a company had special journals for only the four types of

transactions listed above, it would record purchase returns and allowances in the general journal.

Similarly, correcting, adjusting, and closing entries are recorded in the general journal. In

some situations, companies might use special journals other than those listed above. For example,

when sales returns and allowances are frequent, a company might use a special journal to record

these transactions. Special journals permit greater division of labor because several people can

record entries in different journals at the same time. For example, one employee may journalize all

cash receipts, and another may journalize all credit sales. Also, the use of special journals reduces

the time needed to complete the posting process. With special journals, companies may post

some accounts monthly, instead of daily.

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 6 of

10

The 5 special journals

1. Sales journal 4. Cash payments journal

2. Cash receipts journal 5. General journal

3. Purchases journal

Sales Journal

In the sales journal, companies record sales of merchandise on account. Cash sales of

merchandise go in the cash receipts journal. Credit sales of assets other than merchandise go in

the general journal.

Advantages of the Sales Journal

The use of a special journal to record sales on account has a number of advantages. First, the one-

line entry for each sales transaction saves time. In the sales journal, it is not necessary to write out

the four account titles for each transaction. Second, only totals, rather than individual entries, are

posted to the general ledger. This saves posting time and reduces the possibilities of errors in

posting. Finally, a division of labor results, because one individual can take responsibility for the

sales journal.

Illustration: Sample Sales Journal

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 7 of

10

Cash Receipts Journal

In the cash receipts journal, companies record all receipts of cash. The most common types of

cash receipts are cash sales of merchandise and collections of accounts receivable. Many other

possibilities exist, such as receipt of money from bank loans and cash proceeds from disposal of

equipment. A one- or two-column cash receipts journal would not have space enough for all

possible cash receipt transactions. Therefore, companies use a multiple-column cash receipts

journal. Generally, a cash receipts journal includes the following columns: debit columns for Cash

and Sales Discounts, and credit columns for Accounts Receivable, Sales, and “Other” accounts.

Companies use the “Other Accounts” category when the cash receipt does not involve a cash sale

or a collection of accounts receivable. Under a perpetual inventory system, each sales entry also

is accompanied by an entry that debits Cost of Goods Sold and credits Merchandise Inventory for

the cost of the merchandise sold.

Companies may use additional credit columns if these columns significantly reduce postings to a

specific account. For example, a loan company, such as Household International, receives

thousands of cash collections from customers. Using separate credit columns for Loans Receivable

and Interest Revenue, rather than the Other Accounts credit column, would reduce postings.

Illustration: Sample Cash Receipts Journal

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 8 of

10

Purchases Journal

In the purchases journal, companies record all purchases of merchandise on account. Each entry

in this journal results in a debit to Merchandise Inventory and a credit to Accounts Payable. When

using a one-column purchases journal a company cannot journalize other types of purchases on

account or cash purchases in it.

Illustration: Sample Purchases Journal

Cash Payments Journal

In a cash payment (or cash disbursements) journal, companies record all disbursements of cash.

Entries are made from prenumbered checks. Because companies make cash payments for various

purposes, the cash payments journal has multiple columns.

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 9 of

10

Illustration: Sample cash payments journal

Effects of Special Journals on the General Journal

Special journals for sales, purchases, and cash substantially reduce the number of entries that

companies make in the general journal. Only transactions that cannot be entered in a special

journal are recorded in the general journal. For example, a company may use the general journal

to record such transactions as granting of credit to a customer for a sales return or allowance,

granting of credit from a supplier for purchases returned, acceptance of a note receivable from a

customer, and purchase of equipment by issuing a note payable. Also, correcting, adjusting, and

closing entries are made in the general journal.

The general journal has columns for date, account title and explanation, reference, and debit and

credit amounts. When control and subsidiary accounts are not involved, the procedures for

journalizing and posting of transactions are the same as those described in earlier lesson. When

control and subsidiary accounts are involved, companies make two changes from the earlier

procedures:

1. In journalizing, they identify both the control and the subsidiary accounts.

2. In posting, there must be a dual posting: once to the control account and once to the

subsidiary account.

End of 9th week

---------------------------------------Nothing Follows--------------------------------------

ACCTG 111: Fundamentals of Accounting

SOUTH EAST ASIAN INSTITUTE OF TECHNOLOGY, INC. Page 10 of

10

You might also like

- Administering Subsidiary Accounts and Ledgers PDFDocument33 pagesAdministering Subsidiary Accounts and Ledgers PDFnigus78% (9)

- EY Introduction To Financial ModellingDocument8 pagesEY Introduction To Financial ModellingPrashantKNo ratings yet

- Sales Revenue Cost of Goods SoldDocument6 pagesSales Revenue Cost of Goods SoldblablaNo ratings yet

- CombinepdfDocument226 pagesCombinepdfjed rolluque decena100% (1)

- Merchandising OperationsDocument39 pagesMerchandising OperationsRyan Jeffrey Padua Curbano50% (2)

- Module 10 and 11 AccDocument4 pagesModule 10 and 11 Accnorie jane pacisNo ratings yet

- Sales DiscountsDocument42 pagesSales DiscountsOliviaDuchessNo ratings yet

- H. Chapter 7 Accounting For Merchandising BusinessDocument8 pagesH. Chapter 7 Accounting For Merchandising BusinessRiron CassandraNo ratings yet

- Recognizing Revenue, Cash Collection, Sales Discount, SRADocument3 pagesRecognizing Revenue, Cash Collection, Sales Discount, SRACyril DE LA VEGANo ratings yet

- Big PictureDocument11 pagesBig Picturekakay poNo ratings yet

- ACTG 101-101a Topic 4 Processing Transactions of A Merchandising BusinessDocument67 pagesACTG 101-101a Topic 4 Processing Transactions of A Merchandising BusinessEdmar Lerin100% (1)

- Lecture Notes - Chapter 7Document17 pagesLecture Notes - Chapter 7Nova Grace LatinaNo ratings yet

- Accounts ReceivableDocument9 pagesAccounts ReceivableTrang LeNo ratings yet

- Adjusted Trial Balance ProfittDocument4 pagesAdjusted Trial Balance ProfittShesharam ChouhanNo ratings yet

- Accounting Activity of Merchandising OperationsDocument20 pagesAccounting Activity of Merchandising OperationsAndrew Jamerich PlatillaNo ratings yet

- Accounting 211 Chapter 5Document46 pagesAccounting 211 Chapter 5Darwin QuintosNo ratings yet

- Chapter-5: Accounting For Merchandising OperationsDocument39 pagesChapter-5: Accounting For Merchandising OperationsNoel Buenafe JrNo ratings yet

- Hotel Revenue Accounting (Chapter 1)Document16 pagesHotel Revenue Accounting (Chapter 1)Atif KhosoNo ratings yet

- Chapter Five: Special Issues For MerchantsDocument26 pagesChapter Five: Special Issues For Merchantswww_jeffersoncruz008No ratings yet

- Week4 Handout WORKEDDocument14 pagesWeek4 Handout WORKEDLecia Lebby CNo ratings yet

- Chap 1 Mod 5 July 2022Document26 pagesChap 1 Mod 5 July 2022hmaz.roid91No ratings yet

- All DefinitionDocument27 pagesAll DefinitionAAC aacNo ratings yet

- Far (Midterm)Document48 pagesFar (Midterm)Christine ChuaNo ratings yet

- Introduction To Income Statement 1Document13 pagesIntroduction To Income Statement 1Yuj Cuares Cervantes100% (1)

- CH03 PaiDocument14 pagesCH03 PaiKanbiro OrkaidoNo ratings yet

- Chapter 3Document8 pagesChapter 3Nigussie BerhanuNo ratings yet

- Chapter 13 HW SolutionsDocument41 pagesChapter 13 HW Solutionsemaileric0% (1)

- Chapter ThreeDocument20 pagesChapter ThreeNatty STAN100% (1)

- Im Accounting For A Merchandising BusinessDocument15 pagesIm Accounting For A Merchandising BusinesschristineruthdolfoNo ratings yet

- Short Term ReceivablesDocument13 pagesShort Term Receivableskrisha milloNo ratings yet

- Problem 1 C7Document5 pagesProblem 1 C7Erica CastroNo ratings yet

- Chapter Four: Complied By: Ganfure T., (WSU, 2006)Document27 pagesChapter Four: Complied By: Ganfure T., (WSU, 2006)Tariku KolchaNo ratings yet

- 10 Bbfa1103 T6Document31 pages10 Bbfa1103 T6djaljdNo ratings yet

- Lecture, Chap. 5Document5 pagesLecture, Chap. 5Moshe FarzanNo ratings yet

- Accounting of Transactions in Merchandising BusinessDocument8 pagesAccounting of Transactions in Merchandising BusinessJohn Rhey ObeñaNo ratings yet

- Fabm 1: Accounting For Merchandising ConcernDocument29 pagesFabm 1: Accounting For Merchandising ConcernJan Vincent A. LadresNo ratings yet

- Merchandising BusinessDocument26 pagesMerchandising BusinessDan Gideon CariagaNo ratings yet

- Lesson 2 The Statement of Comprehensive Income (Part 1 of 2)Document5 pagesLesson 2 The Statement of Comprehensive Income (Part 1 of 2)Franchesca CalmaNo ratings yet

- Lecture Note - Receivables Sy 2014-2015Document10 pagesLecture Note - Receivables Sy 2014-2015LeneNo ratings yet

- I. Merchandising OperationsDocument16 pagesI. Merchandising OperationsHà PhạmNo ratings yet

- Accounting For Non-Accounting Students - Summary Chapter 4Document4 pagesAccounting For Non-Accounting Students - Summary Chapter 4Megan Joye100% (1)

- Chapter 3 NotesDocument10 pagesChapter 3 NotesInhoi TchoiNo ratings yet

- Definition of Purchase DiscountDocument2 pagesDefinition of Purchase DiscountRaymart CruzNo ratings yet

- Fabm Module5Document20 pagesFabm Module5Paulo VisitacionNo ratings yet

- A231 - Topic 5 - Robiah - EdDocument88 pagesA231 - Topic 5 - Robiah - Ed2024917551No ratings yet

- Chapter 01Document47 pagesChapter 01KelumNo ratings yet

- Senior High School Department: Quarter 3 - Module 9: Merchandising Concern (Part 2)Document18 pagesSenior High School Department: Quarter 3 - Module 9: Merchandising Concern (Part 2)Jaye RuantoNo ratings yet

- Information Sheet 2.1-1Document3 pagesInformation Sheet 2.1-1Sweetzel PrecinioNo ratings yet

- Reviewer For MerchandisingDocument22 pagesReviewer For Merchandisings2301911No ratings yet

- Balance Sheet Statement of Cash Flows Statement of Stockholders' EquityDocument8 pagesBalance Sheet Statement of Cash Flows Statement of Stockholders' Equitygaykar2009100% (1)

- Chapter 6 SolutionsDocument12 pagesChapter 6 SolutionsLaura CarsonNo ratings yet

- Glossary of Accounting TermsDocument8 pagesGlossary of Accounting TermsFauTahudAmparoNo ratings yet

- CHAPTER 1 Account ReciavableDocument41 pagesCHAPTER 1 Account Reciavablegm29No ratings yet

- Net Credit Sales: August 19, 2017Document10 pagesNet Credit Sales: August 19, 2017Armira Rodriguez ConchaNo ratings yet

- Discussion Guide - Chapter 5Document7 pagesDiscussion Guide - Chapter 5Khoi NguyenNo ratings yet

- Accounting For Training Merchandising BusinessDocument109 pagesAccounting For Training Merchandising BusinessIsa NgNo ratings yet

- Objectives: ReceivablesDocument5 pagesObjectives: ReceivablesBurhan Al MessiNo ratings yet

- AssignmentDocument5 pagesAssignmentAbdulai S SesayNo ratings yet

- Journal Entries For The Perpetual Inventory MethodDocument4 pagesJournal Entries For The Perpetual Inventory MethodRicky Paul Adiyudha100% (1)

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Week 11 & 12 Electronic Commerce SecurityDocument15 pagesWeek 11 & 12 Electronic Commerce SecurityFrance Delos SantosNo ratings yet

- South East Asian Institute of Technology, IncDocument10 pagesSouth East Asian Institute of Technology, IncFrance Delos SantosNo ratings yet

- South East Asian Institute of Technology, IncDocument8 pagesSouth East Asian Institute of Technology, IncFrance Delos SantosNo ratings yet

- South East Asian Institute of Technology, Inc. National Highway, Crossing Rubber, Tupi, South CotabatoDocument17 pagesSouth East Asian Institute of Technology, Inc. National Highway, Crossing Rubber, Tupi, South CotabatoFrance Delos SantosNo ratings yet

- LORENZOPABLOMARKETINGPLAN2021Document13 pagesLORENZOPABLOMARKETINGPLAN2021France Delos SantosNo ratings yet

- Professional Practice-Ii Law of Land: Prepared By: - Bhoomit Kansara Yash Gosai Sahil Vora Part SisodiyaDocument19 pagesProfessional Practice-Ii Law of Land: Prepared By: - Bhoomit Kansara Yash Gosai Sahil Vora Part SisodiyaMayur KotechaNo ratings yet

- Eddie The Carpet FitterDocument3 pagesEddie The Carpet Fittermaria praveenNo ratings yet

- ch1 - Part 2Document13 pagesch1 - Part 2Vivvian Grace M MolahidNo ratings yet

- Burrows & Badgers - Warband RosterDocument3 pagesBurrows & Badgers - Warband RosterDannicusNo ratings yet

- Physics 12 - 4Document30 pagesPhysics 12 - 4zeamayf.biasNo ratings yet

- (Toni) TX MS W Chinese Scalp AcupDocument16 pages(Toni) TX MS W Chinese Scalp AcupAngelaNo ratings yet

- Guess Paper General Ability CSS 2023 by Sir Sabir HussainDocument2 pagesGuess Paper General Ability CSS 2023 by Sir Sabir Hussainjamil ahmedNo ratings yet

- Manual Sierra Biro 3334-4003Document47 pagesManual Sierra Biro 3334-4003SEBASTIAN PEREZNo ratings yet

- Marketing Analysis 1. What Company Did You Choose, and Why?Document4 pagesMarketing Analysis 1. What Company Did You Choose, and Why?Tatiana PosseNo ratings yet

- TMCM-1231 Hardware Manual hw1.1 Rev1.02Document25 pagesTMCM-1231 Hardware Manual hw1.1 Rev1.02Ian MechuraNo ratings yet

- Apps For Educators: A Definitive Guide To Choosing The Right App For School Communication in 2021Document7 pagesApps For Educators: A Definitive Guide To Choosing The Right App For School Communication in 2021SchoolvoiceNo ratings yet

- Glorious Innings of Prof.a R RaoDocument24 pagesGlorious Innings of Prof.a R RaoMeghmeghparva100% (1)

- Exodus (Comics)Document8 pagesExodus (Comics)alexNo ratings yet

- Asy13144Document87 pagesAsy13144Oz DemonNo ratings yet

- Night of Tournaments 2010 MW2 RulesDocument2 pagesNight of Tournaments 2010 MW2 RulesrohinvijNo ratings yet

- Code BatmanDocument43 pagesCode BatmanLi Jie TeoNo ratings yet

- A Strategic Study On How Tata Motors Entered Into The Manufacturing of Electric VehiclesDocument13 pagesA Strategic Study On How Tata Motors Entered Into The Manufacturing of Electric VehiclesTangirala AshwiniNo ratings yet

- Wired Drill Pipe-Fosse - Martin PDFDocument62 pagesWired Drill Pipe-Fosse - Martin PDFMohamed Anis Boumaza100% (1)

- NHA Bulacan District Muzon, Pabahay 2000: P U P Santa Maria Bulacan CampusDocument4 pagesNHA Bulacan District Muzon, Pabahay 2000: P U P Santa Maria Bulacan CampusXyrile InguilloNo ratings yet

- Food MovementDocument18 pagesFood MovementSubhadipta BiswasNo ratings yet

- Physics Investigatory Project PDFDocument20 pagesPhysics Investigatory Project PDFJoker 1NNo ratings yet

- St. Paul's English High School: Cambridge Section Mid-Term Examination - 2019Document20 pagesSt. Paul's English High School: Cambridge Section Mid-Term Examination - 2019WasiqNo ratings yet

- Bayview's Last Stand: Protecting Historic Black Neighborhoods - John William Templeton Speaker FilmmakerDocument5 pagesBayview's Last Stand: Protecting Historic Black Neighborhoods - John William Templeton Speaker FilmmakerJW TempletonNo ratings yet

- Doyle: Lot No 249Document20 pagesDoyle: Lot No 249watevaidNo ratings yet

- 1000 Puzzle Series Set - 1 To 25 Merged PDFDocument417 pages1000 Puzzle Series Set - 1 To 25 Merged PDFSangam ChauhanNo ratings yet

- Cap Observation Form 1 Announced PolizzoittiDocument3 pagesCap Observation Form 1 Announced Polizzoittiapi-317761911No ratings yet

- Pigeonhole PrincipleDocument5 pagesPigeonhole PrincipleNoisyPoisyNo ratings yet

- Effect On The PerformanceDocument11 pagesEffect On The Performancehanna abadiNo ratings yet

- ThingWorx Navigate Compatibility MatrixDocument2 pagesThingWorx Navigate Compatibility Matrixair_jajaNo ratings yet