Professional Documents

Culture Documents

Amman TRY Sponge and Power Private Limited

Amman TRY Sponge and Power Private Limited

Uploaded by

Kathiresan Mathavi's SonCopyright:

Available Formats

You might also like

- Performance Improvement PlanDocument3 pagesPerformance Improvement PlanBadhi Ratsie100% (2)

- Case Study On Tata and Reliance ROHITH AND SAMPATHDocument8 pagesCase Study On Tata and Reliance ROHITH AND SAMPATHArchanareddy100% (1)

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Prateek Wires (P) LTD - R - 08102020Document6 pagesPrateek Wires (P) LTD - R - 08102020DarshanNo ratings yet

- July 8, 2021Document12 pagesJuly 8, 2021786rohitsandujaNo ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Press Release Anjani Portland Cement LimitedDocument5 pagesPress Release Anjani Portland Cement LimitedSandy SanNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Saakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedDocument4 pagesSaakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedRanib SainjuNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- Arcelormittal Sa: Summary of Rated InstrumentsDocument6 pagesArcelormittal Sa: Summary of Rated Instrumentspavan reddyNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- CRISIL Research - Ipo Grading Rat - Modern TubeDocument12 pagesCRISIL Research - Ipo Grading Rat - Modern Tubejaydeep daveNo ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Nezone Pipes & Structures-R-05042018Document7 pagesNezone Pipes & Structures-R-05042018rahul badgujarNo ratings yet

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Tata Steel - Equity Research ReportDocument11 pagesTata Steel - Equity Research Reportmridulrathi4No ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Amtek Auto LTDDocument22 pagesAmtek Auto LTDsulabh_mdiNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- KSB AnalysisDocument7 pagesKSB AnalysisCharles LeeNo ratings yet

- The Tata Power Company Limited 202214Document11 pagesThe Tata Power Company Limited 202214pratik567No ratings yet

- Press Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- KRC Uttam 27aug09Document1 pageKRC Uttam 27aug09sabri1234No ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Press Release AVR Infra Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release AVR Infra Private Limited: Details of Instruments/facilities in Annexure-1ACE CONSULTANTSNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- LGB Q4FY12Update 05may2012Document4 pagesLGB Q4FY12Update 05may2012equityanalystinvestorNo ratings yet

- SKH Metals Limited: Summary of Rated InstrumentsDocument8 pagesSKH Metals Limited: Summary of Rated InstrumentsShivank SharmaNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- M&A - Cia Ii: Gammon India Ltd. and AtslDocument7 pagesM&A - Cia Ii: Gammon India Ltd. and AtslAnurag JaiswalNo ratings yet

- Shree Cement LTD.: Credit Analysis & Research LimitedDocument7 pagesShree Cement LTD.: Credit Analysis & Research LimitedlalitsharmachoklattyNo ratings yet

- Rockman Industries Jan 2020 ICRADocument9 pagesRockman Industries Jan 2020 ICRAPuneet367No ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- Sanjeev Auto Parts Manufacturers Private Limited-03-03-2017Document6 pagesSanjeev Auto Parts Manufacturers Private Limited-03-03-2017ram shindeNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Sailar201819 PDFDocument204 pagesSailar201819 PDFShikha MishraNo ratings yet

- SAIL Annual Report 2018-19Document204 pagesSAIL Annual Report 2018-19Ashutosh kumarNo ratings yet

- Ismt LTD (2018-2019)Document10 pagesIsmt LTD (2018-2019)Nimit BhimjiyaniNo ratings yet

- Mukand Ltd. - Stock Note 12071720170712031412Document13 pagesMukand Ltd. - Stock Note 12071720170712031412Ayushi GuptaNo ratings yet

- MSP Metallics Ltd.Document5 pagesMSP Metallics Ltd.Suraj ShawNo ratings yet

- Shivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedDocument6 pagesShivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedvikramNo ratings yet

- Ace Designers-R-05042018 PDFDocument7 pagesAce Designers-R-05042018 PDFkachadaNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- TCS India Process - Separation Kit - 16 Sep 2020Document26 pagesTCS India Process - Separation Kit - 16 Sep 2020KrishnaTejaNo ratings yet

- Unity of CommandDocument2 pagesUnity of CommandHafizullah AnsariNo ratings yet

- Project Report On::: Insider TradingDocument8 pagesProject Report On::: Insider TradingMadhuri KanadeNo ratings yet

- Project Feasibility Study: The Key To Successful Implementation of Sustainable and Socially Responsible Construction Management PracticeDocument24 pagesProject Feasibility Study: The Key To Successful Implementation of Sustainable and Socially Responsible Construction Management PracticeNhan DoNo ratings yet

- The Role of Servicescape in Hotel Buffet Restaurant 2169 0286 1000152Document8 pagesThe Role of Servicescape in Hotel Buffet Restaurant 2169 0286 1000152ghada kotbNo ratings yet

- Qatar Airways New Brand Refresh Campaign. Project Analysis PresentationDocument15 pagesQatar Airways New Brand Refresh Campaign. Project Analysis PresentationMazen EidNo ratings yet

- Desarrollo de Habilidades Directivas - 11Document14 pagesDesarrollo de Habilidades Directivas - 11Julio Matos FujiuNo ratings yet

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Annual Report 2015-16 Mahanagar GasDocument108 pagesAnnual Report 2015-16 Mahanagar GasPrakash BatwalNo ratings yet

- 1136 3669 1 PBDocument17 pages1136 3669 1 PBica oktianaNo ratings yet

- Generic Po CandumanDocument3 pagesGeneric Po Candumanjuvenillefbuhi.on91No ratings yet

- Introduction To Knowledge Management Chap#1Document12 pagesIntroduction To Knowledge Management Chap#1raja farhanNo ratings yet

- Learning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceDocument9 pagesLearning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceMatt Yu EspirituNo ratings yet

- Item Rule Time Required: A53 Work Statutory Authorities/undertakersDocument1 pageItem Rule Time Required: A53 Work Statutory Authorities/undertakersVimalNo ratings yet

- Group2 NetflixDocument9 pagesGroup2 NetflixRitika KandpalNo ratings yet

- Chapter 1 - General Introduction To Supply Chain and Supply Chain ManagementDocument24 pagesChapter 1 - General Introduction To Supply Chain and Supply Chain ManagementKim Anh ĐặngNo ratings yet

- Cartage Advice With Receipt - TB00833501Document2 pagesCartage Advice With Receipt - TB00833501CP KrunalNo ratings yet

- Save Costs When Moving To S - 4HANA - 190916Document23 pagesSave Costs When Moving To S - 4HANA - 190916rsreevatsNo ratings yet

- PRS Econ CH02 9eDocument51 pagesPRS Econ CH02 9eDamla HacıNo ratings yet

- Caselet 4 - 2019023 - Melinda DCostaDocument2 pagesCaselet 4 - 2019023 - Melinda DCostaAnanya SrivastavaNo ratings yet

- MA4850 Supply Chain & Logistics ManagementDocument25 pagesMA4850 Supply Chain & Logistics ManagementQy LeeNo ratings yet

- Megawide Construction Corporation - SEC Form 17-Q 2Q2022 - 2022 08 12Document79 pagesMegawide Construction Corporation - SEC Form 17-Q 2Q2022 - 2022 08 12Mc Jim Thaddeus MasayonNo ratings yet

- CIPS Apprenticeship Information SheetDocument4 pagesCIPS Apprenticeship Information Sheethiman almassiNo ratings yet

- 2022 Non-Exclusive Copyright Licensing Agreement - The Millionaire S MistressDocument23 pages2022 Non-Exclusive Copyright Licensing Agreement - The Millionaire S MistressSyariffah NadyatusSyifaNo ratings yet

- Commission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentDocument6 pagesCommission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentJade Darping KarimNo ratings yet

- Oracle Social NetworkDocument3 pagesOracle Social NetworkParesh PatilNo ratings yet

- Presented By: Ankit JainDocument17 pagesPresented By: Ankit Jainakki00009No ratings yet

Amman TRY Sponge and Power Private Limited

Amman TRY Sponge and Power Private Limited

Uploaded by

Kathiresan Mathavi's SonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amman TRY Sponge and Power Private Limited

Amman TRY Sponge and Power Private Limited

Uploaded by

Kathiresan Mathavi's SonCopyright:

Available Formats

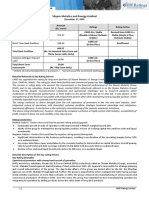

Press Release

Amman TRY Sponge and Power Private Limited

January 25, 2021

Ratings

Amount

Facilities/Instruments Ratings Rating Action

(Rs. crore)

CARE BBB; Stable

Long-term Bank Facilities 5 Reaffirmed

(Triple B; Outlook: Stable )

CARE A3

Short-term Bank Facilities 15 Reaffirmed

(A Three )

20

Total Bank Facilities

(Rs. Twenty crore only)

Detailed Rationale & Key Rating Drivers

The ratings assigned to the bank facilities of Amman TRY Sponge and Power Pvt Ltd (ATSPL) continue to take into account

the significant experience of the promoters in the steel industry, long track record of operations of the Amman group in the

steel business and established market position with integrated nature of operations. The ratings also take note of the

group’s financial risk profile characterized by a stable operational performance, comfortable capital structure and debt

service protection metrics.

The ratings are, however, constrained on account of the commodity nature of the finished product, susceptibility of margins

to volatile raw material prices & foreign exchange rate fluctuations and cyclical nature of the steel industry.

Key Rating Sensitivities

Positive Factors

• Consistent improvement in PBILDT margin above the range of 7%-8%.

Successful completion of the capex and scaling up of operations from the new capacities

Negative Factors

• Consistent deterioration in capital structure with gearing levels above 1.00x.

• Decline in PBILDT margins on a consistent basis below 4%

Detailed description of the key rating drivers

Key Rating Strengths

Experience of the promoters and long track record of operations

The Amman group was promoted by Mr S. P. Muthuramalingam who has an experience of more than three decades in the

steel industry and is the Chairman of the group. The group came into being when he established Amman Steel Corporation

(ASC) in 1978 for the trading of steel scrap. His son Mr Somasundaram (Managing Director of ATSPL) was instrumental in

establishing Shri Amman Steel & Allied Industries P Ltd (SASAI) and the other group companies. He is associated with the

group since 1999. SASAI was incorporated in 1998 and it is engaged in the manufacture and sale of Thermo-Mechanically

Treated (TMT) bars. Subsequently, the group also established another rolling mill in the name of Amman TRY Steels Private

Limited (ASPL) in 2006 engaged in the manufacture and sale of TMT bars. The promoters are involved in strategic decision

making while the day-to-day operations are largely delegated to a team of managers.

Established market position with partially integrated operations:

The group companies (SASAI and ASPL) are engaged in the manufacture and sale of TMT steel bars under the brand name

‘Amman TRY’, a recognized brand in Tamil Nadu catering mainly to the construction industry. With major portion of

ATSPL’s production being supplied to the group, and advance granted by the group companies to ATSPL for its working

capital requirements, there exist operational and financial synergies within the group. During FY20 (refers to the period

April 1 to March 31), around 90% of ATSPL’s total sales were to group companies as against 78% of the total sales during

FY19. The group also has two windmills with total capacity of 2500 kilowatts (kWh) in Tamil Nadu that satisfies around 50-

55% of the group’s power requirement.

Stable operational performance

The operating income witnessed a decline of 29% y-o-y to Rs.403.99 crore in FY20 from Rs. 508 crore in FY19 due to

decline in selling price of TMT bars & billets in the domestic market. Owing to drop in revenue with similar level of fixed

costs, the PBILDT margin moderated from 5.58% during FY19 to 4.89% during FY20 for the group. During FY20, due to high

demand, ATSPL operated at 127% capacity utilization levels. Hence, as a measure of the expanding the geographical

1 CARE Ratings Limited

Press Release

presence, the group is adding a new rolling mill plant and capacity addition in billet production in ATSPL near its existing

billet plant at Nellore, Andhra Pradesh.

Comfortable financial position characterized by comfortable capital structure and debt service protection metrics

The capital structure of the group continued to remained comfortable with overall gearing at 0.25x as on March 31, 2020

against 0.36x as on March 31, 2019 with minimal term loan borrowings and low working capital utilizations.

Key Rating Weaknesses

Volatile profit margin due to commoditized nature of products

Due to commodity nature of the finished products and volatile raw material prices, profitability margins are low. The

group meets 90% of its power requirement from APGENCO and the remaining power requirements were catered to by

third parties through renewable PPA agreements. Power consumed per tonne of billets dropped by 10% from 868

units/tonne during FY19 to 776 units/tonne during FY20 through higher operational efficiency and use of better quality

scrap.

Raw material price risk and foreign exchange risk

Steel scrap is the major raw material consumed by ATSPL contributing around 60% of the total consumption by volume

and the rest is sponge iron. Prices of scrap are generally volatile in nature. Generally the company hedges around 100% of

its forex exposure anytime. During FY20, ATSPL made a forex loss amounting to Rs.32 lakh (FY19 – loss of Rs.19 lakh).

Liquidity: Adequate

The group has adequate liquidity characterized by sufficient cushion in accruals vis-à-vis repayment obligations of Rs. 1.77

crore in FY21 and cash balance of Rs.1.72 crore. The average working capital utilisation of limits stood comfortable at

12.09% for twelve months ended December 2020 supported by an above unity current ratio. Further, the group has not

availed any deferment of interest or taken any Covid loan under Covid relief measures prescribed by RBI.

Impact of covid and industry outlook

The group’s unit was shut down during the last week of FY20 and for a period of one week in the current year. Being a

continuous process industry, the units resumed operations thereafter after obtaining permission from the local authority.

Recovery in domestic demand has been slow due to migration of labour, supply-chain disruptions, prevailing lockdown in

many cities etc. With a pick-up in domestic demand import of finished steel has witnessed growth while exports have

declined. Domestic steel production and consumption is expected to remain steady going forward in H2FY21. For the

whole year FY21, CARE expects crude steel production to be lower by 10-12% and consumption to be lower by 14-17%,

mainly impacted by poor first half.

Analytical approach: Combined

CARE has combined the credit risk profile of Amman-Try Sponge and Power Private Limited (ATSPL) and its group

companies Shri Amman Steel and Allied Industries Private Limited (SASAI) and Amman Try Steels Private Limited (ASPL)

(hereafter referred to as the Amman group) as all the entities are engaged in a similar line of business, share significant

group synergies and operate under the same management.

Applicable Criteria

CARE’s methodology for manufacturing companies

Criteria on assigning Outlook and credit watch to Ratings

CARE’s Policy on Default Recognition

Criteria for Short Term Instruments

Financial ratios – Non-Financial Sector

Liquidity Analysis of Non-Financial Sector Entities

Rating Methodology – Consolidation

Rating Methodology – Steel industry

About the Company

ATSPL is part of the Tamil Nadu-based Amman group of companies, having interests in manufacturing steel ingots and

steel bars, local bus transportation and real estate. In order to meet raw material requirement of its group companies

SASAI and ASPL the group has established billet making unit under ATSPL. ATSPL was incorporated in September 2008 and

commenced commercial operations in July 2011. It is engaged in the manufacture of steel billets. ATSPL has a steel

melting shop in Nellore, Andhra Pradesh, with production capacity of 65,000 tonnes per annum (TPA) of billets.

2 CARE Ratings Limited

Press Release

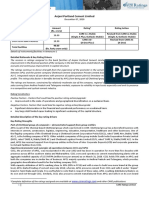

Brief Financials (Rs. crore) FY19 (A) FY20 (A)

Total operating income 281.28 282.04

PBILDT 11.29 10.68

PAT 6.46 6.09

Overall gearing (times) 0.47 0.36

Interest coverage (times) 17.04 11.95

A: Audited

Status of non-cooperation with previous CRA: NA

Any other information: NA

Rating History for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated for this company: Annexure 4

Annexure-1: Details of Instruments/Facilities

Size of the Rating assigned

Name of the Date of Coupon Maturity

Issue along with Rating

Instrument Issuance Rate Date

(Rs. crore) Outlook

Fund-based - LT-Cash CARE BBB; Stable

- - - 5.00

Credit

Non-fund-based - ST- CARE A3

- - - 15.00

Letter of credit

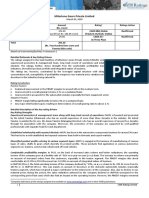

Annexure-2: Rating History of last three years

Current Ratings Rating history

Name of the Type Rating Date(s) & Date(s) & Date(s) & Date(s) &

Sr. Amount

Instrument/Bank Rating(s) Rating(s) Rating(s) Rating(s)

No. Outstanding

Facilities assigned in assigned in assigned in assigned in

(Rs. crore)

2020-2021 2019-2020 2018-2019 2017-2018

1)CARE 1)CARE

CARE 1)CARE

BBB; Stable BBB; Stable

Fund-based - LT-Cash BBB; BBB; Stable

1. LT 5.00 - (13-Mar- (22-Mar-

Credit Stable (23-Feb-18)

20) 19)

1)CARE A3 1)CARE A3

1)CARE A3

Non-fund-based - ST- CARE A3 (13-Mar- (22-Mar-

2. ST 15.00 - (23-Feb-18)

Letter of credit 20) 19)

Annexure 3: Detailed explanation of covenants of the rated facilities: Not Applicable

Annexure 4: Complexity level of various instruments rated for this company

Sr.

Name of the Instrument Complexity Level

No.

1. Fund-based - LT-Cash Credit Simple

2. Non-fund-based - ST-Letter of credit Simple

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity.

This classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome

to write to care@careratings.com for any clarifications

3 CARE Ratings Limited

Press Release

Contact us

Media Contact

Name: Mr. Mradul Mishra

Contact no. – +91-22-6837 4424

Email ID – mradul.mishra@careratings.com

Analyst Contact

Name: Mrs. Swathi Subramanian

Contact no.: 0422 450 2399

Email ID: swathi.subramanian@careratings.com

Relationship Contact

Name: Mr. V Pradeep Kumar

Contact no. : 044 2850 1001

Email ID: pradeep.kumar@careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading credit rating

agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as an External Credit

Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place in the Indian capital market

built around investor confidence. CARE Ratings provides the entire spectrum of credit rating that helps the corporates to raise capital

for their various requirements and assists the investors to form an informed investment decision based on the credit risk and their own

risk-return expectations. Our rating and grading service offerings leverage our domain and analytical expertise backed by the

methodologies congruent with the international best practices.

Disclaimer

CARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. CARE’s ratings

do not convey suitability or price for the investor. CARE’s ratings do not constitute an audit on the rated entity. CARE has based its

ratings/outlooks on information obtained from sources believed by it to be accurate and reliable. CARE does not, however, guarantee

the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results

obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE have paid a credit rating

fee, based on the amount and type of bank facilities/instruments. CARE or its subsidiaries/associates may also have other commercial

transactions with the entity. In case of partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on

the capital deployed by the partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo

change in case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial

performance and other relevant factors. CARE is not responsible for any errors and states that it has no financial liability whatsoever to

the users of CARE’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve acceleration

of payments in case of rating downgrades. However, if any such clauses are introduced and if triggered, the ratings may see volatility

and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careratings.com

4 CARE Ratings Limited

You might also like

- Performance Improvement PlanDocument3 pagesPerformance Improvement PlanBadhi Ratsie100% (2)

- Case Study On Tata and Reliance ROHITH AND SAMPATHDocument8 pagesCase Study On Tata and Reliance ROHITH AND SAMPATHArchanareddy100% (1)

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Prateek Wires (P) LTD - R - 08102020Document6 pagesPrateek Wires (P) LTD - R - 08102020DarshanNo ratings yet

- July 8, 2021Document12 pagesJuly 8, 2021786rohitsandujaNo ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Press Release Anjani Portland Cement LimitedDocument5 pagesPress Release Anjani Portland Cement LimitedSandy SanNo ratings yet

- Jeevaka Industries PVT R 06042020Document7 pagesJeevaka Industries PVT R 06042020saikiran reddyNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Saakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedDocument4 pagesSaakha Steel Industries Private Limited Bank Facilities Rating ReaffirmedRanib SainjuNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- Arcelormittal Sa: Summary of Rated InstrumentsDocument6 pagesArcelormittal Sa: Summary of Rated Instrumentspavan reddyNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- CRISIL Research - Ipo Grading Rat - Modern TubeDocument12 pagesCRISIL Research - Ipo Grading Rat - Modern Tubejaydeep daveNo ratings yet

- Unit OperatorDocument7 pagesUnit OperatorJimmyNo ratings yet

- Nezone Pipes & Structures-R-05042018Document7 pagesNezone Pipes & Structures-R-05042018rahul badgujarNo ratings yet

- Hyundai Steel India - R - 08062018Document7 pagesHyundai Steel India - R - 08062018Andrew BruceNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Tata Steel - Equity Research ReportDocument11 pagesTata Steel - Equity Research Reportmridulrathi4No ratings yet

- L.G. Balakrishnan & Bros Limited: Summary of Rating ActionDocument7 pagesL.G. Balakrishnan & Bros Limited: Summary of Rating ActionChromoNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- Milestone Gears Private Limited-03-09-2020Document4 pagesMilestone Gears Private Limited-03-09-2020Puneet367No ratings yet

- Press Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Airo Lam Limited: Details of Instruments/facilities in Annexure-1flying400No ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Amtek Auto LTDDocument22 pagesAmtek Auto LTDsulabh_mdiNo ratings yet

- Press Release MaharajaDocument5 pagesPress Release MaharajaMS SAMIRANNo ratings yet

- KSB AnalysisDocument7 pagesKSB AnalysisCharles LeeNo ratings yet

- The Tata Power Company Limited 202214Document11 pagesThe Tata Power Company Limited 202214pratik567No ratings yet

- Press Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Aro Granite Industries Limited: Details of Instruments/facilities in Annexure-1Ravi BabuNo ratings yet

- KRC Uttam 27aug09Document1 pageKRC Uttam 27aug09sabri1234No ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Tata Advanced Materials-R-28062019Document7 pagesTata Advanced Materials-R-28062019shoaib merchantNo ratings yet

- Press Release AVR Infra Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release AVR Infra Private Limited: Details of Instruments/facilities in Annexure-1ACE CONSULTANTSNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- LGB Q4FY12Update 05may2012Document4 pagesLGB Q4FY12Update 05may2012equityanalystinvestorNo ratings yet

- SKH Metals Limited: Summary of Rated InstrumentsDocument8 pagesSKH Metals Limited: Summary of Rated InstrumentsShivank SharmaNo ratings yet

- MSL Driveline Systems - R - 16102020Document8 pagesMSL Driveline Systems - R - 16102020DarshanNo ratings yet

- M&A - Cia Ii: Gammon India Ltd. and AtslDocument7 pagesM&A - Cia Ii: Gammon India Ltd. and AtslAnurag JaiswalNo ratings yet

- Shree Cement LTD.: Credit Analysis & Research LimitedDocument7 pagesShree Cement LTD.: Credit Analysis & Research LimitedlalitsharmachoklattyNo ratings yet

- Rockman Industries Jan 2020 ICRADocument9 pagesRockman Industries Jan 2020 ICRAPuneet367No ratings yet

- Vinayak Steels Limited Financial ReportDocument7 pagesVinayak Steels Limited Financial Reportsaikiran reddyNo ratings yet

- Sanjeev Auto Parts Manufacturers Private Limited-03-03-2017Document6 pagesSanjeev Auto Parts Manufacturers Private Limited-03-03-2017ram shindeNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- Sailar201819 PDFDocument204 pagesSailar201819 PDFShikha MishraNo ratings yet

- SAIL Annual Report 2018-19Document204 pagesSAIL Annual Report 2018-19Ashutosh kumarNo ratings yet

- Ismt LTD (2018-2019)Document10 pagesIsmt LTD (2018-2019)Nimit BhimjiyaniNo ratings yet

- Mukand Ltd. - Stock Note 12071720170712031412Document13 pagesMukand Ltd. - Stock Note 12071720170712031412Ayushi GuptaNo ratings yet

- MSP Metallics Ltd.Document5 pagesMSP Metallics Ltd.Suraj ShawNo ratings yet

- Shivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedDocument6 pagesShivam Cements Limited: (ICRANP) LA+ Upgraded /A1 ReaffirmedvikramNo ratings yet

- Ace Designers-R-05042018 PDFDocument7 pagesAce Designers-R-05042018 PDFkachadaNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- TCS India Process - Separation Kit - 16 Sep 2020Document26 pagesTCS India Process - Separation Kit - 16 Sep 2020KrishnaTejaNo ratings yet

- Unity of CommandDocument2 pagesUnity of CommandHafizullah AnsariNo ratings yet

- Project Report On::: Insider TradingDocument8 pagesProject Report On::: Insider TradingMadhuri KanadeNo ratings yet

- Project Feasibility Study: The Key To Successful Implementation of Sustainable and Socially Responsible Construction Management PracticeDocument24 pagesProject Feasibility Study: The Key To Successful Implementation of Sustainable and Socially Responsible Construction Management PracticeNhan DoNo ratings yet

- The Role of Servicescape in Hotel Buffet Restaurant 2169 0286 1000152Document8 pagesThe Role of Servicescape in Hotel Buffet Restaurant 2169 0286 1000152ghada kotbNo ratings yet

- Qatar Airways New Brand Refresh Campaign. Project Analysis PresentationDocument15 pagesQatar Airways New Brand Refresh Campaign. Project Analysis PresentationMazen EidNo ratings yet

- Desarrollo de Habilidades Directivas - 11Document14 pagesDesarrollo de Habilidades Directivas - 11Julio Matos FujiuNo ratings yet

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Annual Report 2015-16 Mahanagar GasDocument108 pagesAnnual Report 2015-16 Mahanagar GasPrakash BatwalNo ratings yet

- 1136 3669 1 PBDocument17 pages1136 3669 1 PBica oktianaNo ratings yet

- Generic Po CandumanDocument3 pagesGeneric Po Candumanjuvenillefbuhi.on91No ratings yet

- Introduction To Knowledge Management Chap#1Document12 pagesIntroduction To Knowledge Management Chap#1raja farhanNo ratings yet

- Learning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceDocument9 pagesLearning Activity Sheets 8, Quarter 2 For Business Finance Grade 12 Business FinanceMatt Yu EspirituNo ratings yet

- Item Rule Time Required: A53 Work Statutory Authorities/undertakersDocument1 pageItem Rule Time Required: A53 Work Statutory Authorities/undertakersVimalNo ratings yet

- Group2 NetflixDocument9 pagesGroup2 NetflixRitika KandpalNo ratings yet

- Chapter 1 - General Introduction To Supply Chain and Supply Chain ManagementDocument24 pagesChapter 1 - General Introduction To Supply Chain and Supply Chain ManagementKim Anh ĐặngNo ratings yet

- Cartage Advice With Receipt - TB00833501Document2 pagesCartage Advice With Receipt - TB00833501CP KrunalNo ratings yet

- Save Costs When Moving To S - 4HANA - 190916Document23 pagesSave Costs When Moving To S - 4HANA - 190916rsreevatsNo ratings yet

- PRS Econ CH02 9eDocument51 pagesPRS Econ CH02 9eDamla HacıNo ratings yet

- Caselet 4 - 2019023 - Melinda DCostaDocument2 pagesCaselet 4 - 2019023 - Melinda DCostaAnanya SrivastavaNo ratings yet

- MA4850 Supply Chain & Logistics ManagementDocument25 pagesMA4850 Supply Chain & Logistics ManagementQy LeeNo ratings yet

- Megawide Construction Corporation - SEC Form 17-Q 2Q2022 - 2022 08 12Document79 pagesMegawide Construction Corporation - SEC Form 17-Q 2Q2022 - 2022 08 12Mc Jim Thaddeus MasayonNo ratings yet

- CIPS Apprenticeship Information SheetDocument4 pagesCIPS Apprenticeship Information Sheethiman almassiNo ratings yet

- 2022 Non-Exclusive Copyright Licensing Agreement - The Millionaire S MistressDocument23 pages2022 Non-Exclusive Copyright Licensing Agreement - The Millionaire S MistressSyariffah NadyatusSyifaNo ratings yet

- Commission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentDocument6 pagesCommission On Audit Circular No. 92-125A March 4, 1992 TO: All Heads of Departments, Bureaus and Offices of The National GovernmentJade Darping KarimNo ratings yet

- Oracle Social NetworkDocument3 pagesOracle Social NetworkParesh PatilNo ratings yet

- Presented By: Ankit JainDocument17 pagesPresented By: Ankit Jainakki00009No ratings yet