Professional Documents

Culture Documents

Weekly Followup 031221 v1

Weekly Followup 031221 v1

Uploaded by

Jesper ChristiansenCopyright:

Available Formats

You might also like

- Chinas Technology War Why Beijing Took Down Its Tech Giants Andrew Collier Full ChapterDocument67 pagesChinas Technology War Why Beijing Took Down Its Tech Giants Andrew Collier Full Chapterdavid.blumenthal530100% (8)

- Product Service Avai Lable in The MarketDocument13 pagesProduct Service Avai Lable in The MarketNamy Lyn Gumamera50% (2)

- Individual EPPM4014Document15 pagesIndividual EPPM4014Yu XinleiNo ratings yet

- Population Growth Chapter 1Document23 pagesPopulation Growth Chapter 1simonsin6a30No ratings yet

- Q4 U.S. Stock Market Outlook: Delta Delays, But Doesn't Derail October 2021Document48 pagesQ4 U.S. Stock Market Outlook: Delta Delays, But Doesn't Derail October 2021Irfan AzmiNo ratings yet

- Carry Trades & Currency CrashesDocument27 pagesCarry Trades & Currency Crashesfredtag4393No ratings yet

- TechSpotlight 1 13 2023Document3 pagesTechSpotlight 1 13 2023Elcano MirandaNo ratings yet

- Mobile App - Figma ExportDocument7 pagesMobile App - Figma Exportcenel 13No ratings yet

- Robo MYS Mys 00000 2022-03Document9 pagesRobo MYS Mys 00000 2022-03zamzuribNo ratings yet

- Daily Research: Statistics HighlightDocument10 pagesDaily Research: Statistics HighlightDavid Nathanael SutyantoNo ratings yet

- Index Dashboard FEB2024Document2 pagesIndex Dashboard FEB2024ridhimac47No ratings yet

- BetaDocument1 pageBetaalirazajokarNo ratings yet

- For The Fed: WaitingDocument5 pagesFor The Fed: WaitingAndre SetiawanNo ratings yet

- MONTHLY REPORT - Net Foriegn Buy/Sell (Values Are in Millions 1,000,000)Document6 pagesMONTHLY REPORT - Net Foriegn Buy/Sell (Values Are in Millions 1,000,000)ανατολή και πετύχετεNo ratings yet

- Acoustic LouversDocument7 pagesAcoustic LouversflexbyoNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersTirthankar DasNo ratings yet

- Market Summary: Indexes Last Change Percent Bid AskDocument4 pagesMarket Summary: Indexes Last Change Percent Bid Askapi-16363627No ratings yet

- Fairbairn - September 30 2018Document2 pagesFairbairn - September 30 2018Tiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Fairbairn - November 20 2017Document2 pagesFairbairn - November 20 2017Tiso Blackstar GroupNo ratings yet

- JM Daily - 23 Aug - EquityDocument183 pagesJM Daily - 23 Aug - EquityPravin SinghNo ratings yet

- Fairbairn - November 17 2017Document2 pagesFairbairn - November 17 2017Tiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Singapore REITs FundametalsDocument2 pagesSingapore REITs FundametalsGandhiNo ratings yet

- Daily Research: Statistics Market PreviewDocument8 pagesDaily Research: Statistics Market PreviewDaniel PandapotanNo ratings yet

- Fairbairn - September 7 2018Document2 pagesFairbairn - September 7 2018Tiso Blackstar GroupNo ratings yet

- Super Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualDocument5 pagesSuper Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualAndre SetiawanNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- 52 Week High Low NAV Equity FundDocument4 pages52 Week High Low NAV Equity FundWealth Maker BuddyNo ratings yet

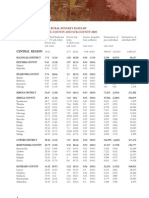

- Uganda Rural Poverty Rates 2005Document27 pagesUganda Rural Poverty Rates 2005Open MicrodataNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- The Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Document4 pagesThe Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Andre SetiawanNo ratings yet

- Full ModelDocument8 pagesFull ModelRahmat WahyudiNo ratings yet

- LS Sar Page50Document1 pageLS Sar Page50Ljubisa MaticNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersTirthankar DasNo ratings yet

- Priv - Outliers Omitted - NGO Still SignDocument8 pagesPriv - Outliers Omitted - NGO Still Signfedro120No ratings yet

- Markets and Commodity Figures: 10 June 2018Document2 pagesMarkets and Commodity Figures: 10 June 2018Tiso Blackstar GroupNo ratings yet

- Index Dashboard AUG2020Document2 pagesIndex Dashboard AUG2020PNo ratings yet

- Daily Research: Statistics HighlightDocument10 pagesDaily Research: Statistics HighlightDavid Nathanael SutyantoNo ratings yet

- 3 RatiosDocument1 page3 RatiosPratik KumarNo ratings yet

- Markets and Commodity Figures: 03 October 2017Document2 pagesMarkets and Commodity Figures: 03 October 2017Tiso Blackstar GroupNo ratings yet

- Steel Pipe Weight and SupportDocument1 pageSteel Pipe Weight and SupportHarley añanaNo ratings yet

- Daily Market Report - 27 May 2021Document1 pageDaily Market Report - 27 May 2021Soko DirectoryNo ratings yet

- Yulan Sari - P07134221008 - Grafik Leavy JenningDocument2 pagesYulan Sari - P07134221008 - Grafik Leavy JenningSyava HemasNo ratings yet

- ETF Tracker - SheetMetric - Public Version For Educational Purposes OnlyDocument26 pagesETF Tracker - SheetMetric - Public Version For Educational Purposes Onlysnehalbpatil1991No ratings yet

- LS Sar Page51Document1 pageLS Sar Page51Ljubisa MaticNo ratings yet

- Quantitative Analysis SOD Report: Tuesday, March 5, 2019Document8 pagesQuantitative Analysis SOD Report: Tuesday, March 5, 2019Anonymous W9ONsW1No ratings yet

- Markets and Commodity Figures: 04 February 2018Document2 pagesMarkets and Commodity Figures: 04 February 2018Tiso Blackstar GroupNo ratings yet

- CDC - US Healthinsurance1968-2015Document2 pagesCDC - US Healthinsurance1968-2015LTNo ratings yet

- Fairbairn - October 1 2018Document2 pagesFairbairn - October 1 2018Tiso Blackstar GroupNo ratings yet

- All Equity Funds 06 Sep 2021 1201Document2 pagesAll Equity Funds 06 Sep 2021 1201AlexNo ratings yet

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Document5 pagesDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanNo ratings yet

- Pages From ASCE 7-10 (3rd Print)Document1 pagePages From ASCE 7-10 (3rd Print)DanNo ratings yet

- 031117fairbairn PDFDocument2 pages031117fairbairn PDFTiso Blackstar GroupNo ratings yet

- Index Dashboard: Broad Market IndicesDocument2 pagesIndex Dashboard: Broad Market IndicesVagaram ChowdharyNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Dimensions & Weights Welded and Seamless Wrought Steel Pipe ASME B36.10Document6 pagesDimensions & Weights Welded and Seamless Wrought Steel Pipe ASME B36.10MaysaraNo ratings yet

- Markets and Commodity Figures: 25 September 2017Document2 pagesMarkets and Commodity Figures: 25 September 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: 25 September 2017Document2 pagesMarkets and Commodity Figures: 25 September 2017Tiso Blackstar GroupNo ratings yet

- SVVV Confluence Directory 19 Dec 2020Document81 pagesSVVV Confluence Directory 19 Dec 2020Akash NetkeNo ratings yet

- Maths Pa 2 Question PaperDocument6 pagesMaths Pa 2 Question PaperSai Sumedh ChellapillaNo ratings yet

- Ratio Rate Proportion and PercentDocument1 pageRatio Rate Proportion and PercentMyla Nazar OcfemiaNo ratings yet

- CMU793945331 Auth LetterDocument3 pagesCMU793945331 Auth LetteryutongyNo ratings yet

- MS Excel 1 - Common FormulasDocument7 pagesMS Excel 1 - Common FormulasriasibuloNo ratings yet

- Interest Encon 1Document10 pagesInterest Encon 1Erina SmithNo ratings yet

- The Effect of Inventory Management On Firm PerformanceDocument15 pagesThe Effect of Inventory Management On Firm PerformanceSachie BeeNo ratings yet

- Accounting For Partnership Firm - FundamentalsDocument15 pagesAccounting For Partnership Firm - FundamentalsYutika DoshiNo ratings yet

- Equity Valuation: Why Determine Value of A StockDocument12 pagesEquity Valuation: Why Determine Value of A StockRUKUDZO KNOWLEDGE DAWANo ratings yet

- VF Brands Submission Supply ChainDocument5 pagesVF Brands Submission Supply Chainkarthik sNo ratings yet

- Presentation On Retail Strategy: Mahima Big BazarDocument18 pagesPresentation On Retail Strategy: Mahima Big BazaraksrinivasNo ratings yet

- IAESP BugallonDocument4 pagesIAESP BugallonmaskmediaphNo ratings yet

- Cash Disbursement RegisterDocument3 pagesCash Disbursement RegisterDecember CoolNo ratings yet

- ZIMRA Strategy 2019-2023Document35 pagesZIMRA Strategy 2019-2023Ospen Noah SitholeNo ratings yet

- MBA-III Project Management-PART-2Document18 pagesMBA-III Project Management-PART-2choudharypatel08No ratings yet

- 04 Prof Suyono Dikun - Value Capture in Urban Infrastructure DevelopmentDocument8 pages04 Prof Suyono Dikun - Value Capture in Urban Infrastructure DevelopmentFadhiel MuhammadNo ratings yet

- Canton Corporation Is A Privately Owned Firm That Engages inDocument1 pageCanton Corporation Is A Privately Owned Firm That Engages inTaimur TechnologistNo ratings yet

- Midterm Exam of Managerial Economics 2022Document4 pagesMidterm Exam of Managerial Economics 2022dayeyoutai779No ratings yet

- 30th May 2022 - Regional Economics and Land Rent Theory - 2nd Mid-TermDocument8 pages30th May 2022 - Regional Economics and Land Rent Theory - 2nd Mid-TermHalef Michel Bou KarimNo ratings yet

- Conceptual Framework QuizDocument4 pagesConceptual Framework QuizPamela Ledesma SusonNo ratings yet

- FEMADocument30 pagesFEMASankalp RajNo ratings yet

- GePG PRESENTATION - ICTC - ANNUAL - CONFERENCE - 2023Document12 pagesGePG PRESENTATION - ICTC - ANNUAL - CONFERENCE - 2023Dishon EsekaNo ratings yet

- Allama Iqbal Open University: Report of Business LawDocument17 pagesAllama Iqbal Open University: Report of Business Lawmanomasho100% (2)

- Rbi Grade B 2023 Esi FM Descriptive Questions Answer KeyDocument8 pagesRbi Grade B 2023 Esi FM Descriptive Questions Answer KeyvenshmasuslaNo ratings yet

- Change of Name EnglishDocument2 pagesChange of Name EnglishdsfNo ratings yet

- Sample Test - HP3 - K46 - UpdatedDocument10 pagesSample Test - HP3 - K46 - UpdatedTuyền NguyễnNo ratings yet

- New Research Report Maximizing Digital Banking Engagement 1676131939Document70 pagesNew Research Report Maximizing Digital Banking Engagement 1676131939Mario AnchundiaNo ratings yet

Weekly Followup 031221 v1

Weekly Followup 031221 v1

Uploaded by

Jesper ChristiansenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Followup 031221 v1

Weekly Followup 031221 v1

Uploaded by

Jesper ChristiansenCopyright:

Available Formats

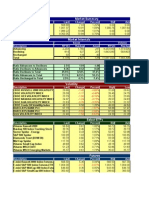

Markets 2021 …

2021-12-03

ETF's 5D MTD YTD

ACWI iShares MSCI ACWI Index Fund (1.01) (0.53) 13.61

SPY SPDR S&P 500 (1.22) (0.52) 22.58 Portfolios 5D MTD YTD

ACWX iShares MSCI ACWI ex US Index F (0.16) 0.05 4.24 Classic 60/40 0.11 0.33 13.25

EZU iShares MSCI Eurozone ETF (0.36) (0.29) 8.69 Swensen (0.35) 0.16 13.97

IWM iShares Russell 2000 ETF (3.65) (1.59) 10.22 El-Erian (0.42) 0.06 9.63

QQQ Invesco QQQ Trust, Series 1 (2.06) (2.71) 22.55 Arnott 0.19 0.57 8.36

EEM iShares MSCI Emerging Index Fun 0.45 0.16 (4.91) Permanent/Saxo 0.22 0.46 3.79

VLUE iShares MSCI USA Value Factor E (0.76) 1.45 21.29 A Tobias 0.27 0.40 8.69

MTUM iShares MSCI USA Momentum Facto (3.66) (2.66) 10.88 W Berstein (0.75) (0.11) 9.07

ARKK ARK Innovation ETF (12.69) (11.51) (24.87) Ivy (0.79) 0.23 17.31

QCLN First Trust NASDAQ Clean Edge G (8.58) (8.88) 0.05 Risk Parity(Unlev) 0.49 0.60 3.80

IGOV iShares International Treasury 0.57 0.10 (8.47) Cash Plus 0.02 (0.48) 3.85

IEF iShares 7-10 Year Treasury Bond 0.93 0.56 (2.27) RP II (Lev 2) 1.04 0.68 2.45

TLT iShares 20+ Year Treasury Bond 2.66 1.94 (0.75) Diversified 60/40 (0.71) - 8.37

TIP iShares TIPS Bond ETF 0.05 0.19 5.45 MRTI Aggressiv (1.37) (1.48) 9.99

LQD iShares iBoxx $ Investment Grad 1.37 1.08 (0.74) MRTI Defensiv (1.53) (2.04) 4.64

HYG iShares iBoxx $ High Yield Corp 0.95 0.75 2.20 New Steen 100 yr (0.59) (0.50) 22.34

EMB iShares J.P. Morgan USD Emergin 2.28 1.43 (2.93) Steen(2020) 100yr Adj (1.32) (1.36) 11.16

VNQ Vanguard Real Estate ETF (0.21) 0.96 29.34 Stagflation (1.01) (0.44) 16.10

DBC Invesco DB Commodity Index Trac (2.65) 0.10 32.65 Reflation (0.48) (0.22) 15.27

VXZ iPath Series B S&P 500 VIX Mid- 4.21 3.53 (6.69) Inflation (0.97) (0.12) 18.24

BTC-USD Bitcoin USD / 1000 0.36 (5.69) 85.38 Global Recession 0.49 (0.06) 5.67

GLD SPDR Gold Trust (0.13) 0.68 (6.58)

UUP Invesco DB USD Index Bullish Fu - 0.27 6.31

SHV iShares Short Treasury Bond ETF (0.01) 0.03 (0.10)

Weekly Follow-up December 3, 2021

12/3/2021 Page 1

Macro Next Week

Weekly Follow-up December 3, 2021

12/3/2021 Page 2

US Q4 Atlanta Fed GDP Now Forecast

Weekly Follow-up December 3, 2021

12/3/2021 Page 3

Climate ETFs 2021 …

Weekly Follow-up December 3, 2021

12/3/2021 Page 4

Asset Class Performance

ETF / Portfolios Close DTD 5Days MTD QTD YTD R60d Vol60 SHr60d SHytd R_Shytd R_Ret

ACWI iShares MSCI ACWI Index Fund 102.33 (0.85) (1.01) (0.53) 2.41 13.61 (1.30) 12.85 (0.10) 1.07 9 7

SPY SPDR S&P 500 53.34 (0.86) (1.22) (0.52) 5.71 22.58 2.12 13.79 0.16 1.64 2 4

ACWX iShares MSCI ACWI ex US Index F 54.71 (0.71) (0.16) 0.05 (1.26) 4.24 (5.05) 13.29 (0.38) 0.33 14 13

EZU iShares MSCI Eurozone ETF 47.46 (0.82) (0.36) (0.29) (1.37) 8.69 (5.80) 15.08 (0.38) 0.58 11 10

IWM iShares Russell 2000 ETF 214.71 (2.05) (3.65) (1.59) (1.85) 10.22 (2.82) 20.83 (0.13) 0.50 13 9

QQQ Invesco QQQ Trust, Series 1 383.13 (1.74) (2.06) (2.71) 7.03 22.55 1.85 16.89 0.11 1.34 5 5

EEM iShares MSCI Emerging Index Fun 48.92 (1.41) 0.45 0.16 (2.90) (4.91) (6.80) 15.95 (0.42) (0.30) 20 21

VLUE iShares MSCI USA Value Factor E 103.70 (0.06) (0.76) 1.45 2.98 21.29 1.73 15.54 0.11 1.38 4 6

MTUM iShares MSCI USA Momentum Facto 178.28 (2.17) (3.66) (2.66) 1.53 10.88 (1.32) 18.57 (0.07) 0.59 10 8

ARKK ARK Innovation ETF 93.53 (5.54) (12.69) (11.51) (15.38) (24.87) (22.36) 35.12 (0.64) (0.71) 24 25

QCLN First Trust NASDAQ Clean Edge G 70.26 (4.94) (8.58) (8.88) 12.24 0.05 7.66 34.82 0.22 - 15 15

IGOV iShares International Treasury 50.92 0.24 0.57 0.10 (0.84) (8.47) (3.36) 7.22 (0.46) (1.16) 25 24

IEF iShares 7-10 Year Treasury Bond 116.36 0.59 0.93 0.56 1.21 (2.27) (0.18) 6.42 (0.02) (0.34) 21 19

TLT iShares 20+ Year Treasury Bond 154.35 1.19 2.66 1.94 7.35 (0.75) 4.40 16.35 0.27 (0.04) 17 18

TIP iShares TIPS Bond ETF 129.72 0.21 0.05 0.19 2.18 5.45 1.03 4.89 0.22 1.14 8 12

LQD iShares iBoxx $ Investment Grad 134.26 0.83 1.37 1.08 1.50 (0.74) (0.18) 7.22 (0.02) (0.09) 18 17

HYG iShares iBoxx $ High Yield Corp 86.00 - 0.95 0.75 (0.74) 2.20 (1.12) 4.42 (0.24) 0.52 12 14

EMB iShares J.P. Morgan USD Emergin 108.64 0.13 2.28 1.43 (0.33) (2.93) (2.83) 7.23 (0.39) (0.39) 22 20

VNQ Vanguard Real Estate ETF 107.77 (0.33) (0.21) 0.96 5.89 29.34 1.92 15.80 0.12 1.86 1 3

DBC Invesco DB Commodity Index Trac 19.50 0.10 (2.65) 0.10 (3.37) 32.65 0.72 21.28 0.04 1.54 3 2

VXZ iPath Series B S&P 500 VIX Mid- 28.71 3.87 4.21 3.53 6.14 (6.69) 8.18 30.60 0.27 (0.22) 19 23

BTC-USD Bitcoin USD / 1000 53.76 (4.81) 0.36 (5.69) 22.77 85.38 19.78 67.01 0.30 1.28 6 1

GLD SPDR Gold Trust 166.63 0.84 (0.13) 0.68 1.47 (6.58) (0.33) 13.12 (0.02) (0.49) 23 22

UUP Invesco DB USD Index Bullish Fu 25.77 (0.04) - 0.27 1.82 6.31 3.62 5.58 0.66 1.15 7 11

SHV iShares Short Treasury Bond ETF 110.42 (0.01) (0.01) 0.03 (0.05) (0.10) (0.05) 0.17 - - 15 16

12/3/2021 Weekly Follow-up December 3, 2021 Page 5

AA Alternative Portfolios

2021 Assets Allocation and NEW 2021 Portfolios

Portfolio_names ACWI SPY ACWX EZU IWM QQQ EEM VLUE MTUMARKK ICLN IGOV IEF TLT TIP LQD HYG EMB VNQ DBC XVZ GBTC GLD UUP SHV

Classic 60/40 0% 60% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 40% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

Swensen 0% 30% 20% 0% 0% 0% 0% 0% 0% 0% 0% 0% 15% 0% 15% 0% 0% 0% 20% 0% 0% 0% 0% 0% 0%

El-Erian 0% 25% 25% 0% 0% 0% 12% 0% 0% 0% 0% 9% 0% 5% 5% 0% 0% 0% 6% 7% 0% 0% 0% 0% 6%

Arnott 0% 10% 10% 0% 0% 0% 0% 0% 0% 0% 0% 10% 0% 10% 10% 10% 10% 10% 10% 10% 0% 0% 0% 0% 0%

Permanent/Saxo 0% 25% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 25% 0% 0% 0% 0% 0% 0% 0% 0% 25% 0% 25%

A Tobias 0% 33% 33% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 33% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

W Berstein 0% 25% 25% 0% 25% 0% 0% 0% 0% 0% 0% 0% 0% 25% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0%

Ivy 0% 20% 20% 0% 0% 0% 0% 0% 0% 0% 0% 0% 20% 0% 0% 0% 0% 0% 20% 20% 0% 0% 0% 0% 0%

Risk Parity(Unlev) 0% 8% 8% 0% 0% 0% 0% 0% 0% 0% 0% 0% 35% 0% 0% 15% 10% 10% 5% 5% 0% 0% 5% 0% 0%

Cash Plus 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 5% 5% 0% 90%

RP II (Lev 2) 0% 22% 22% 0% 0% 0% 0% 0% 0% 0% 0% 0% 156% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% -100%

Diversified 60/40 0% 10% 10% 0% 10% 0% 0% 15% 15% 0% 0% 0% 10% 10% 0% 10% 10% 0% 0% 0% 0% 0% 0% 0% 0%

MRTI Aggressiv 10% 0% 0% 0% 0% 10% 0% 0% 0% 5% 5% 0% 0% 0% 20% 0% 0% 0% 0% 10% 5% 5% 10% 0% 20%

MRTI Defensiv 0% 0% 0% 10% 0% 5% 0% 0% 0% 5% 10% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 5% 5% 0% 60%

New Steen 100 yr 0% 30% 0% 0% 0% 5% 0% 0% 0% 0% 0% 0% 5% 0% 8% 0% 0% 0% 20% 10% 5% 7% 10% 0% 0%

Steen(2020) 100yr Adj 0% 20% 0% 0% 0% 5% 0% 0% 0% 5% 5% 0% 20% 0% 10% 0% 0% 0% 0% 10% 3% 5% 10% 0% 7%

Stagflation 0% 0% 0% 0% 0% 10% 10% 10% 0% 0% 0% 0% 0% 0% 20% 0% 0% 0% 0% 25% 0% 5% 20% 0% 0%

Reflation 15% 10% 0% 10% 0% 0% 10% 20% 0% 0% 0% 0% 0% 0% 10% 0% 10% 0% 0% 5% 0% 5% 5% 0% 0%

Inflation 0% 0% 10% 0% 10% 0% 0% 20% 0% 0% 0% 0% 0% 0% 20% 0% 0% 0% 10% 15% 0% 5% 10% 0% 0%

Global Recession 0% 15% 5% 0% 0% 0% 0% 0% 0% 0% 0% 15% 15% 20% 10% 0% 0% 0% 0% 0% 0% 5% 15% 0% 0%

12/3/2021 Weekly Follow-up December 3, 2021 Page 6

Alternative Portfolio Performance

ETF / Portfolios Close DTD 5Days MTD QTD YTD R60d Vol60 SHr60d SHytd R_Shytd R_Ret

Classic 60/40 93.74 (0.15) 0.11 0.33 6.28 13.25 2.91 10.32 0.29 1.29 10 7

Swensen 85.41 (0.38) (0.35) 0.16 3.33 13.97 0.24 7.26 0.04 1.94 4 6

El-Erian 66.13 (0.49) (0.42) 0.06 1.36 9.63 (1.26) 7.57 (0.16) 1.28 11 10

Arnott 89.92 0.04 0.19 0.57 1.55 8.36 (0.16) 6.17 (0.02) 1.37 9 14

Permanent/Saxo 121.18 0.21 0.22 0.46 3.68 3.79 1.56 7.64 0.21 0.51 19 19

A Tobias 87.47 (0.19) 0.27 0.40 3.85 8.69 0.36 9.30 0.04 0.94 13 12

W Berstein 119.28 (0.67) (0.75) (0.11) 2.35 9.07 (0.46) 11.60 (0.04) 0.79 15 11

Ivy 70.34 (0.26) (0.79) 0.23 1.56 17.31 0.03 8.33 0.01 2.09 2 3

Risk Parity(Unlev) 103.13 0.22 0.49 0.60 1.08 3.80 (0.54) 5.13 (0.10) 0.76 16 18

Cash Plus 110.40 (0.42) 0.02 (0.48) 1.71 3.85 1.44 1.94 0.76 2.03 3 17

RP II (Lev 2) 94.87 0.49 1.04 0.68 3.04 2.45 (0.86) 11.61 (0.07) 0.22 20 20

Diversified 60/40 123.67 (0.49) (0.71) - 1.85 8.37 (0.24) 9.83 (0.02) 0.86 14 13

MRTI Aggressiv 127.50 (0.86) (1.37) (1.48) 2.84 9.99 1.38 8.49 0.17 1.19 12 9

MRTI Defensiv 112.88 (1.29) (1.53) (2.04) 2.37 4.64 0.54 7.26 0.08 0.65 18 16

New Steen 100 yr 96.72 (0.69) (0.59) (0.50) 5.53 22.34 3.38 9.29 0.37 2.42 1 1

Steen(2020) 100yr Adj 104.15 (0.84) (1.32) (1.36) 3.34 11.16 1.62 7.72 0.22 1.46 8 8

Stagflation 120.41 (0.51) (1.01) (0.44) 1.89 16.10 1.45 8.47 0.18 1.91 5 4

Reflation 84.63 (0.77) (0.48) (0.22) 2.70 15.27 0.55 9.43 0.06 1.63 7 5

Inflation 106.68 (0.58) (0.97) (0.12) 2.33 18.24 1.41 9.89 0.15 1.85 6 2

Global Recession 107.35 (0.16) 0.49 (0.06) 4.44 5.67 1.96 7.82 0.26 0.74 17 15

12/3/2021 Weekly Follow-up December 3, 2021 Page 7

YtD Return Contribution

No Portfolio_names ACWI SPY ACWX EZU IWM QQQ EEM VLUE MTUMARKK QCLN IGOV IEF TLT TIP LQD HYG EMB VNQ DBC XVZ BTC GLD UUP SHV Total

YtD 13.61 22.58 4.24 8.69 10.22 22.55 -4.91 21.29 10.88 -24.9 0.05 -8.47 -2.27 -0.75 5.45 -0.74 2.2 -2.93 29.34 32.65 -6.69 85.38 -6.58 6.31 -0.1

1 Classic 60/40 - 1,355 - - - - - - - - - - - (30) - - - - - - - - - - - 1,325

2 Swensen - 677 85 - - - - - - - - - (34) - 82 - - - 587 - - - - - - 1,397

3 El-Erian - 565 106 - - - (59) - - - - (76) - (4) 27 - - - 176 229 - - - - (1) 963

4 Arnott - 226 42 - - - - - - - - (85) - (8) 55 (7) 22 (29) 293 327 - - - - - 836

5 Permanent/Saxo - 565 - - - - - - - - - - - (19) - - - - - - - - (165) - (3) 379

6 A Tobias - 753 141 - - - - - - - - - - (25) - - - - - - - - - - - 869

7 W Berstein - 565 106 - 256 - - - - - - - - (19) - - - - - - - - - - - 907

8 Ivy - 452 85 - - - - - - - - - (45) - - - - - 587 653 - - - - - 1,731

9 Risk Parity(Unlev) - 169 32 - - - - - - - - - (79) - - (11) 22 (29) 147 163 - - (33) - - 380

10 Cash Plus - - - - - - - - - - - - - - - - - - - - - 427 (33) - (9) 385

11 RP II (Lev 2) - 497 93 - - - - - - - - - (354) - - - - - - - - - - - 10 246

12 Diversified 60/40 - 226 42 - 102 - - 319 163 - - - (23) (8) - (7) 22 - - - - - - - - 837

13 MRTI Aggressiv 136 - - - - 226 - - - (124) 0 - - - 109 - - - - 327 (33) 427 (66) - (2) 999

14 MRTI Defensiv - - - 87 - 113 - - - (124) 1 - - - - - - - - - - 427 (33) - (6) 464

15 New Steen 100 yr - 677 - - - 113 - - - - - - (11) - 44 - - - 587 327 (33) 598 (66) - - 2,234

16 Steen(2020) 100yr Adj - 452 - - - 113 - - - (124) 0 - (45) - 55 - - - - 327 (20) 427 (66) - (1) 1,116

17 Stagflation - - - - - 226 (49) 213 - - - - - - 109 - - - - 816 - 427 (132) - - 1,610

18 Reflation 204 226 - 87 - - (49) 426 - - - - - - 55 - 22 - - 163 - 427 (33) - - 1,527

19 Inflation - - 42 - 102 - - 426 - - - - - - 109 - - - 293 490 - 427 (66) - - 1,824

20 Global Recession - 339 21 - - - - - - - - (127) (34) (15) 55 - - - - - - 427 (99) - - 567

12/3/2021 Weekly Follow-up December 3, 2021 Page 8

Selected Portfolios

Selected AA Portfolios

1.3

1.25

1.2

1.15

1.1

1.05

0.95

El-Erian Classic 60/40 New Steen 100 yr MRTI Defensiv

12/3/2021 Weekly Follow-up December 3, 2021 Page 9

Performance/Technical

Date 2021-12-03

ETF / Portfolios Close DTD WTD MTD QTD YTD R60d Vol60 SHr60d SHytd SMA20 SMA50 SMA100 MFI14 pctB pctDC YTDcap YTDcry

ACWI iShares MSCI ACWI Index Fund 102.33 (0.85) (1.01) (0.53) 2.41 13.61 (1.30) 12.85 (0.10) 1.07 105.55 104.12 103.52 29.88 3.07 10.31 12.80 0.81

SPY SPDR S&P 500 53.34 (0.86) (1.22) (0.52) 5.71 22.58 2.12 13.79 0.16 1.64 54.63 53.32 52.69 46.89 (2.50) 13.92 21.34 1.24

ACWX iShares MSCI ACWI ex US Index F 54.71 (0.71) (0.16) 0.05 (1.26) 4.24 (5.05) 13.29 (0.38) 0.33 56.61 56.58 56.80 37.97 12.39 13.14 3.15 1.09

EZU iShares MSCI Eurozone ETF 47.46 (0.82) (0.36) (0.29) (1.37) 8.69 (5.80) 15.08 (0.38) 0.58 49.70 49.53 49.86 37.07 11.40 8.57 7.67 1.03

IWM iShares Russell 2000 ETF 214.71 (2.05) (3.65) (1.59) (1.85) 10.22 (2.82) 20.83 (0.13) 0.50 231.41 227.97 224.50 18.03 5.71 4.98 9.51 0.70

QQQ Invesco QQQ Trust, Series 1 383.13 (1.74) (2.06) (2.71) 7.03 22.55 1.85 16.89 0.11 1.34 395.13 380.76 375.45 29.40 (8.68) (4.97) 22.12 0.43

EEM iShares MSCI Emerging Index Fun 48.92 (1.41) 0.45 0.16 (2.90) (4.91) (6.80) 15.95 (0.42) (0.30) 50.55 50.88 51.38 31.55 15.62 15.04 (5.32) 0.41

VLUE iShares MSCI USA Value Factor E 103.70 (0.06) (0.76) 1.45 2.98 21.29 1.73 15.54 0.11 1.38 105.76 104.24 104.10 46.85 16.80 33.49 19.32 1.97

MTUM iShares MSCI USA Momentum Facto 178.28 (2.17) (3.66) (2.66) 1.53 10.88 (1.32) 18.57 (0.07) 0.59 187.40 185.26 181.85 30.17 (7.70) (6.11) 10.53 0.35

ARKK ARK Innovation ETF 93.53 (5.54) (12.69) (11.51) (15.38) (24.87) (22.36) 35.12 (0.64) (0.71) 111.60 114.41 117.35 15.34 (4.19) (10.00) (24.87) 0.00

QCLN First Trust NASDAQ Clean Edge G 70.26 (4.94) (8.58) (8.88) 12.24 0.05 7.66 34.82 0.22 0.00 78.65 72.64 69.05 32.92 (22.02) (23.62) 0.04 0.01

IGOV iShares International Treasury 50.92 0.24 0.57 0.10 (0.84) (8.47) (3.36) 7.22 (0.46) (1.16) 50.85 51.12 51.96 48.21 50.04 53.88 (8.47) 0.00

IEF iShares 7-10 Year Treasury Bond 116.36 0.59 0.93 0.56 1.21 (2.27) (0.18) 6.42 (0.02) (0.34) 114.91 114.80 116.01 57.70 93.67 107.92 (2.99) 0.72

TLT iShares 20+ Year Treasury Bond 154.35 1.19 2.66 1.94 7.35 (0.75) 4.40 16.35 0.27 (0.04) 148.67 146.42 147.81 69.69 102.79 115.94 (2.14) 1.40

TIP iShares TIPS Bond ETF 129.72 0.21 0.05 0.19 2.18 5.45 1.03 4.89 0.22 1.14 129.93 128.96 129.09 46.33 38.79 43.88 1.62 3.83

LQD iShares iBoxx $ Investment Grad 134.26 0.83 1.37 1.08 1.50 (0.74) (0.18) 7.22 (0.02) (0.09) 132.94 133.02 134.18 69.55 75.23 76.67 (2.80) 2.06

HYG iShares iBoxx $ High Yield Corp 86.00 0.00 0.95 0.75 (0.74) 2.20 (1.12) 4.42 (0.24) 0.52 86.47 86.85 87.26 30.39 28.82 29.69 (1.49) 3.69

EMB iShares J.P. Morgan USD Emergin 108.64 0.13 2.28 1.43 (0.33) (2.93) (2.83) 7.23 (0.39) (0.39) 108.86 109.32 110.93 56.89 42.01 50.41 (6.27) 3.34

VNQ Vanguard Real Estate ETF 107.77 (0.33) (0.21) 0.96 5.89 29.34 1.92 15.80 0.12 1.86 109.14 107.39 107.05 50.07 19.68 44.48 26.89 2.45

DBC Invesco DB Commodity Index Trac 19.50 0.10 (2.65) 0.10 (3.37) 32.65 0.72 21.28 0.04 1.54 20.76 20.96 20.04 31.30 8.76 12.88 32.65 0.00

VXZ iPath Series B S&P 500 VIX Mid- 28.71 3.87 4.21 3.53 6.14 (6.69) 8.18 30.60 0.27 (0.22) 26.23 26.02 26.10 71.67 107.63 110.43 (6.69) 0.00

BTC-USD Bitcoin USD / 1000 53.76 (4.81) 0.36 (5.69) 22.77 85.38 19.78 67.01 0.30 1.28 59.75 57.53 50.36 19.62 15.56 1.27 85.38 0.00

GLD SPDR Gold Trust 166.63 0.84 (0.13) 0.68 1.47 (6.58) (0.33) 13.12 (0.02) (0.49) 170.08 167.46 167.54 21.37 19.77 19.92 (6.58) 0.00

UUP Invesco DB USD Index Bullish Fu 25.77 (0.04) 0.00 0.27 1.82 6.31 3.62 5.58 0.66 1.15 25.65 25.39 25.15 55.84 67.25 71.95 6.31 0.00

SHV iShares Short Treasury Bond ETF 110.42 (0.01) (0.01) 0.03 (0.05) (0.10) (0.05) 0.17 0.00 0.00 110.44 110.45 110.46 39.58 14.24 42.86 (0.10) 0.00

Classic 60/40 93.74 (0.15) 0.11 0.33 6.28 13.25 2.91 10.32 0.29 1.29 92.25 90.56 90.56 59.07 0.95 97.06 11.95 1.30

Swensen 85.41 (0.38) (0.35) 0.16 3.33 13.97 0.24 7.26 0.04 1.94 86.27 85.35 85.35 42.96 0.15 37.06 12.20 1.76

El-Erian 66.13 (0.49) (0.42) 0.06 1.36 9.63 (1.26) 7.57 (0.16) 1.28 67.01 66.49 66.49 28.45 0.15 25.25 8.59 1.04

Arnott 89.92 0.04 0.19 0.57 1.55 8.36 (0.16) 6.17 (0.02) 1.37 89.89 89.39 89.39 55.69 0.47 48.07 6.45 1.91

Permanent/Saxo 121.18 0.21 0.22 0.46 3.68 3.79 1.56 7.64 0.21 0.51 120.95 119.41 119.41 51.14 0.49 57.99 3.13 0.66

A Tobias 87.47 (0.19) 0.27 0.40 3.85 8.69 0.36 9.30 0.04 0.94 86.64 85.44 85.44 54.45 0.79 73.00 7.45 1.24

W Berstein 119.28 (0.67) (0.75) (0.11) 2.35 9.07 (0.46) 11.60 (0.04) 0.79 122.83 121.07 121.07 22.11 0.13 18.31 7.96 1.11

Ivy 70.34 (0.26) (0.79) 0.23 1.56 17.31 0.03 8.33 0.01 2.09 71.21 70.61 70.61 41.05 0.15 33.72 16.21 1.10

Risk Parity(Unlev) 103.13 0.22 0.49 0.60 1.08 3.80 (0.54) 5.13 (0.10) 0.76 103.03 102.78 102.78 67.59 0.47 50.76 2.24 1.56

Cash Plus 110.40 (0.42) 0.02 (0.48) 1.71 3.85 1.44 1.94 0.76 2.03 110.88 110.65 110.65 19.01 0.14 1.89 3.85 0.00

RP II (Lev 2) 94.87 0.49 1.04 0.68 3.04 2.45 (0.86) 11.61 (0.07) 0.22 93.30 92.81 92.81 57.73 0.83 88.63 0.82 1.63

Diversified 60/40 123.67 (0.49) (0.71) 0.00 1.85 8.37 (0.24) 9.83 (0.02) 0.86 126.54 125.32 125.32 22.11 0.10 16.99 6.94 1.44

MRTI Aggressiv 127.50 (0.86) (1.37) (1.48) 2.84 9.99 1.38 8.49 0.17 1.19 131.04 128.74 128.74 27.04 (0.07) (0.26) 9.10 0.89

MRTI Defensiv 112.88 (1.29) (1.53) (2.04) 2.37 4.64 0.54 7.26 0.08 0.65 115.92 114.49 114.49 21.13 (0.10) (10.86) 4.51 0.13

New Steen 100 yr 96.72 (0.69) (0.59) (0.50) 5.53 22.34 3.38 9.29 0.37 2.42 98.69 96.74 96.74 26.99 0.02 18.18 21.12 1.22

Steen(2020) 100yr Adj 104.15 (0.84) (1.32) (1.36) 3.34 11.16 1.62 7.72 0.22 1.46 106.76 105.14 105.14 28.09 (0.03) 3.52 10.36 0.80

Stagflation 120.41 (0.51) (1.01) (0.44) 1.89 16.10 1.45 8.47 0.18 1.91 123.32 120.99 120.99 19.58 0.02 10.13 15.05 1.05

Reflation 84.63 (0.77) (0.48) (0.22) 2.70 15.27 0.55 9.43 0.06 1.63 86.64 85.72 85.72 18.14 0.10 14.37 13.74 1.54

Inflation 106.68 (0.58) (0.97) (0.12) 2.33 18.24 1.41 9.89 0.15 1.85 109.96 108.60 108.60 32.40 0.10 14.82 16.65 1.59

Global Recession 107.35 (0.16) 0.49 (0.06) 4.44 5.67 1.96 7.82 0.26 0.74 107.12 105.89 105.89 52.16 0.51 55.53 4.66 1.01

12/3/2021 Weekly Follow-up December 3, 2021 Page 10

Bond Rates

Interest Rates Overview (Bloomberg) 12/3/2021 22:21 CET

Americas - 10yr Spread

US Nominals Coupon Price Yield 1Day 1 Month 1 Year Time (EST) Country Yield 1 Day 1 Month 1 Year Time (EDT) vs GE vs US

T-Bils 3 Month - 0.04 0.04% 0 (3) 4:19 PM United States » 1.35% (10) (25) 45 4:16 PM 1.74% 0.00%

T-Bills 6 Month - 0.09 0.09% 2 0 4:19 PM Canada 1.44% (7) (29) 71 4:16 PM 1.83% 0.09%

T-Bills 12 Month - 0.25 0.25% 9 15 4:19 PM Brazil 0.39% -1.35%

UST 2Yr 0.500 99.82 0.59% 59.0 13 44 4:19 PM Mexico 7.37% (7) (15) 166 4:16 PM 7.76% 6.02%

UST 5Yr 1.250 100.56 1.13% 113.0 (5) 74 4:19 PM

UST 10Yr 1.380 100.19 1.35% 135.0 (26) 44 4:19 PM Europe - 10yr

UST 30Yr 1.880 104.52 1.68% 168.0 (34) 2 4:19 PM Country Yield 1 Day 1 Month 1 Year Time (EDT)

Germany » -0.39% (2) (22) 17 11:59 AM 0.00% -1.74%

Coupon Price Yield 1Day 1 Month 1 Year BEI Time(EST) United Kingdom » 0.74% (6) (32) 43 11:59 AM 1.13% -0.61%

USTII 5 0.130 108.91 -1.63% (163.0) 9.0 (21.0) 2.76% 4:19 PM France -0.03% (2) (21) 29 11:59 AM 0.36% -1.38%

USTII 10 0.130 112.52 -1.11% (111.0) (14.0) (13.0) 2.46% 4:19 PM Italy 0.91% (4) (13) 31 11:59 AM 1.30% -0.44%

USTII 30 0.130 122.97 -0.60% (60.0) (28.0) (26.0) 2.28% 4:19 PM Spain 0.34% (3) (18) 28 11:59 AM 0.73% -1.01%

5Y5Y BEI 2.16% (6.7) 2.16% Netherlands -0.26% (3) (22) 22 11:59 AM 0.13% -1.61%

Portugal 0.27% (3) (15) 24 11:59 AM 0.66% -1.08%

Yield 1Day 1 Month 1 Year Greece 1.17% 0 1 57 11:59 AM 1.56% -0.18%

US 2-10 76 76 (39) 0 Switzerland -0.34% (1) (19) 24 11:39 AM 0.05% -1.69%

US 10-30 33 33 (8) (42)

Asia - 10yr

Germany Coupon Price Yield 1 Day 1 Month 1 Year Time (EST) Country Yield 1 Day 1 Month 1 Year Time (EDT)

German 2yr - 101.54 -0.76% 0 (9) (1) 11:59 AM Japan » 0.04% 0 (1) (3) 2:59 AM 0.43% -1.31%

Germany 5yr - 103.14 -0.64% (1) (16) 12 11:59 AM Australia » 1.60% 0 (7) (24) 12:39 AM 1.99% 0.25%

Germany 10yr - 103.87 -0.39% (2) (22) 17 11:59 AM New Zealand 2.37% 0 (3) (17) 12/2/2021 2.76% 1.02%

Germany 30yr - 103.14 -0.11% (3) (24) 4 11:59 AM Hong Kong 1.30% 0 0 0 2:58 AM 1.69% -0.05%

Singapore 1.67% 0 0 (12) 5:29 AM 2.06% 0.32%

US Dollar 96.16 0.00% 4:08 PM ESDT South Korea 2.22% 0 222 (28) 6:07 AM 2.61% 0.87%

EURUSD 1.1313 0.07% 9:17 PM BST India 6.36% 0 1 0 4:18 AM 6.75% 5.01%

USDJPY 112.78 -0.38% 9:18 PM BST

12/3/2021 Weekly Follow-up December 3, 2021 Page 11

Eurodollar

IB 0

Bid Size Bid Ask Ask Size Last Last Size Volum e High Low Close Change Tim e Avg Rates' Q-Q

Dec 4339 99.795 99.798 2 99.7975 2 199,951 99.81 99.80 99.8 0.25 22:19:02 99.7963 0.20

Mar 264 99.710 99.715 804 99.71 804 231,311 99.73 99.69 99.705 (0.50) 22:19:03 99.7125 0.29 8.75

Jun 1923 99.530 99.535 1 99.535 1 303,134 99.55 99.49 99.515 (2.00) 22:19:02 99.5325 0.47 17.5

Sep 9476 99.305 99.315 40 99.31 40 306,903 99.33 99.23 99.28 (3.00) 22:19:03 99.31 0.69 22.5

Dec 1297 99.030 99.035 1 99.035 1 587,152 99.05 98.93 98.995 (4.00) 22:19:02 99.0325 0.97 27.5

Mar 2870 98.820 98.830 10 98.825 10 265,983 98.85 98.72 98.785 (4.00) 22:19:03 98.825 1.18 21

Jun 139 98.630 98.635 35 98.63 35 254,378 98.66 98.52 98.585 (4.50) 22:19:03 98.6325 1.37 19.5

Sep 711 98.475 98.480 1 98.48 1 242,291 98.51 98.37 98.435 (4.50) 22:19:03 98.4775 1.52 15

Dec 1305 98.400 98.405 32 98.405 32 472,167 98.44 98.30 98.355 (5.00) 22:19:03 98.4025 1.60 7.5

Mar 30 98.390 98.395 1 98.39 1 174,324 98.43 98.28 98.325 (6.50) 22:19:02 98.3925 1.61 1.5

Jun 2316 98.390 98.395 5 98.395 5 163,367 98.44 98.28 98.325 (7.00) 22:19:03 98.3925 1.61 -0.5

Sep 394 98.390 98.395 1 98.39 1 165,235 98.44 98.28 98.315 (7.50) 22:19:03 98.3925 1.61 0.5

Dec 1768 98.380 98.385 11 98.385 11 288,925 98.44 98.28 98.305 (8.00) 22:19:03 98.3825 1.61 0.5

Mar 19 98.405 98.410 51 98.405 51 83,797 98.44 98.29 98.32 (8.50) 22:19:03 98.4075 1.60 -2

Jun 307 98.420 98.425 2 98.425 2 68,604 98.45 98.31 98.33 (9.50) 22:19:03 98.4225 1.58 -2

Dec-22 vs Dec-22 88

1.80 4

1.60 2

1.40 0

1.20

-2

1.00

-4

0.80

-6

0.60

0.40 -8

0.20 -10

- -12

Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25

Series3 12/3/2021 11/30/2021

12/3/2021 Weekly Follow-up December 3, 2021 Page 12

Commodities

Name preM Today SD 12/1/2021 12/2/2021 LastDChg RSI14 W14 R% Boll% Nov mtd 10/29/2021

GC=F Gold Feb 22 1,785.10 1.27% 1.4 1,781.60 1,760.70 -1.17% 37 (100) 10 0.12% 1,783.00

SI=F Silver Mar 22 22.55 1.05% 0.7 22.30 22.28 -0.09% 31 (96) 6 -5.83% 23.95

PL=F Platinum Jan 22 927.80 -0.57% (0.3) 934.50 932.40 -0.22% 33 (97) 12 -9.00% 1,019.60

HG=F Copper Mar 22 4.28 -0.35% (0.3) 4.25 4.30 1.21% 45 (66) 26 -2.09% 4.38

ALI=F Aluminum Futures,Feb-2022 2,648.50 2.45% 1.2 2,628.50 2,585.25 -1.65% 40 (64) 33 -3.99% 2,758.50

PA=F Palladium Mar 22 1,800.00 1.61% 0.6 1,751.10 1,769.90 1.07% 35 (86) 17 -9.37% 1,986.10

CL=F Crude Oil Jan 22 66.39 -0.17% (0.1) 65.57 66.50 1.42% 29 (79) 7 -20.56% 83.57

BZ=F Brent Crude Oil Last Day Financ 69.99 0.46% 0.2 68.87 69.67 1.16% 29 (78) 3 -17.05% 84.38

NG=F Natural Gas Jan 22 4.09 0.89% 0.2 4.26 4.06 -4.74% 35 (99) (12) -24.59% 5.43

RB=F RBOB Gasoline Jan 22 1.96 -0.50% (0.2) 1.95 1.97 0.85% 31 (82) 4 -20.48% 2.46

HO=F Heating Oil Jan 22 2.10 -0.25% (0.1) 2.08 2.10 1.27% 33 (78) 11 -15.95% 2.50

ZC=F Corn Futures,Mar-2022 585.00 1.43% 1.2 572.00 577.00 0.87% 57 (44) 65 2.95% 568.25

ZO=F Oat Futures,Mar-2022 717.00 -2.32% (1.2) 710.00 740.75 4.33% 56 (41) 54 -1.75% 729.75

KE=F KC HRW Wheat Futures,Mar-2022 825.75 -1.96% (1.1) 814.25 838.50 2.98% 56 (63) 58 5.09% 785.75

ZM=F Soybean Meal Futures,Jan-2022 359.00 2.92% 1.8 356.50 358.00 0.42% 56 (63) 55 7.94% 332.60

ZL=F Soybean Oil Futures,Jan-2022 57.30 1.70% 1.0 55.05 56.23 2.14% 39 (79) 12 -6.48% 61.27

ZS=F Soybean Futures,Mar-2022 1,272.75 1.82% 1.6 1,228.25 1,244.25 1.30% 51 (60) 56 2.99% 1,235.75

GF=F Feeder Cattle Futures,Jan-2022 163.95 -1.10% (1.2) 165.82 165.77 -0.03% 68 (20) 81 4.71% 156.57

HE=F Lean Hogs Futures,Feb-2022 81.38 -0.76% (0.4) 73.63 74.40 1.05% 45 (60) 38 6.97% 76.07

LE=F Live Cattle Futures,Feb-2022 139.03 -0.39% (0.4) 136.00 137.65 1.21% 72 (19) 89 9.15% 127.38

CC=F Cocoa Mar 22 2,466.00 0.53% 0.3 2,320.00 2,421.00 4.35% 46 (57) 43 -3.07% 2,544.00

KC=F Coffee Mar 22 242.50 2.49% 1.1 234.20 237.45 1.39% 63 (33) 68 18.90% 203.95

CT=F Cotton Mar 22 104.03 0.32% 0.2 109.39 108.90 -0.45% 36 (105) (11) -9.42% 114.85

SB=F Sugar #11 Mar 22 18.79 0.91% 0.6 18.60 18.62 0.11% 35 (93) 0 -2.49% 19.27

DBC Invesco DB Commodity Index Trac 19.50 0.10% 0.1 19.31 19.48 0.88% 31 (87) 3 -8.67% 21.35

DBA Invesco DB Agriculture Fund 19.74 0.41% 0.5 19.33 19.66 1.71% 50 (67) 44 2.33% 19.29

BTC-USD Bitcoin USD 53,750.56 -5.65% (1.9) 57,229.83 56,477.82 -1.31% 44 (55) 34 -13.62% 62,227.96

ETH-USD Ethereum USD 4,228.38 -6.81% (1.9) 4,586.99 4,511.30 -1.65% 55 (32) 71 -4.22% 4,414.75

12/3/2021 Weekly Follow-up December 3, 2021 Page 13

Crypto Currencies/Assets

2,307.59

Name Symbol Price(USD) Market Cap Price (BTC) Chg 1D Chg 7D 30-Nov Dec%

Bitcoin USD BTC 53895 1018.08 1 -4.57% 0.61% 57,005 -5.46%

Ethereum USD ETH 4244 503.35 0.078746 -5.92% 5.29% 4,631.48 -8.37%

BinanceCoin USDBNB 598.2700 99.79 0.011101 -3.42% 2.24% 622.67 -3.92%

Tether USD USDT 0.9996 74.07 0.000019 -0.06% -0.07% 1.00 -0.07%

Solana USD SOL1 217.781 66.56 0.004041 -6.93% 13.72% 208.67 4.37%

Cardano USD ADA 1.5852 52.81 0.000029 -7.59% 3.71% 1.55 1.95%

XRP USD XRP 0.9328 44.07 0.000017 -4.06% -0.37% 1.00 -6.60%

USDCoin USD USDC 1 38.93 0.000019 0.02% -0.08% 1.00 0.05%

Polkadot USD DOT1 34.0515440 33.63 0.000632 -4.77% -0.97% 37.96 -10.30%

Dogecoin USD DOGE 0.2008 26.58 0.000004 -4.27% -0.06% 0.21 -6.48%

Crypto Change in November

Bitcoin USD BTC 53,895

Ethereum USD ETH 4244

BinanceCoin USD BNB 598.27 BTC Tracker

Tether USD USDT 0.9996 ETH Tracker

Solana USD SOL1 217.781

Cardano USD ADA 1.5852

BTM Nov Fut

Impliced BTC Tracker

XRP USD XRP 0.9328

ETH Nov Fut

USDCoin USD USDC 1

Impliced ETH Tracker

Polkadot USD DOT1 34.051544

Dogecoin USD DOGE 0.2008

-12.00% -10.00% -8.00% -6.00% -4.00% -2.00% 0.00% 2.00% 4.00% 6.00%

12/3/2021 Weekly Follow-up December 3, 2021 Page 14

Key Market Changes 2020

31-Dec-20 3-Dec-21 Chg. % / bp

BTC 29,155 53,845 84.69%

USD 89.97 96.12 6.84% 31-Dec-20 26-Nov-21 Chg. % / bp

Gold 1901.5 1785.3 -6.11% BTC 29,155 54,345 86.40%

EUR 1.2216 1.1309 -7.43% USD 89.97 94.13 4.62%

Gold 1901.5 1789.2 -5.91%

JPY 103.26 112.79 9.22%

EUR 1.2216 1.1306 -7.45%

CNY 6.5065 6.3729 -2.05% JPY 103.26 113.23 9.65%

AUD 0.76855 0.7000 -8.91% CNY 6.5065 6.3986 -1.66%

EUR/CHF 1.0841 1.0383 -4.22% AUD 0.76855 0.7120 -7.36%

GBP 1.3625 1.3238 -2.84% EUR/CHF 1.0841 1.0436 -3.73%

GBP 1.3625 1.3332 -2.15%

US 3M DEC21 99.78 99.79625 -2

US 3M DEC21 99.78 99.78625 -1

US - 10 0.91 1.35 44 US - 10 0.91 1.49 58

US - 30 1.64 1.68 4 US - 30 1.64 1.83 19

US 30-10 0.73 0.33 -40 US 30-10 0.73 0.34 -39

US 5Y5Y BEI 2.01 2.16 15 US 5Y5Y BEI 2.01 2.18 17

EONIA (0.46) (0.46) 0 EONIA (0.46) (0.46) 0

EU 3M DEC21 100.55 100.58 -3

EU 3M DEC21 100.55 100.57 -2

DE - 10 (0.57) (0.34) 23

DE - 10 (0.57) (0.39) 18 EMB 115.91 106.57 -8.06%

EMB 115.91 108.64 -6.27% HYG 87.30 85.47 -2.10%

HYG 87.30 86.00 -1.49%

OIL 48.40 68.74 42.02%

OIL 48.40 66.55 37.50% DBC 14.70 20.03 36.26%

DBA 16.14 19.97 23.73%

DBC 14.70 19.50 32.65%

DBA 16.14 19.74 22.30% S&P 3,748.50 4,578.88 22.15%

Eurostoxx 50 3,541.0 4,078.0 15.17%

S&P 3,748.50 4,531.13 20.88% China A50 (XINA50) 17,712 15,367.0 -13.24%

Eurostoxx 50 3,541.0 4,077.5 15.15% EEM 51.7 48.70 -5.75%

China A50 (XINA50) 17,712 15,509.5 -12.44%

EEM 51.7 48.92 -5.32%

12/3/2021 Weekly Follow-up December 3, 2021 Page 15

Technicals – Key OMXCPH Listed Shares

5-21

1Da yC MA DMI+/D Bol l _L %Wi l l i

La s t 30D Vol 1DVa R 1DChg hgVa r H180D L180D Now OffH RSI3 RSI14 MOV5 MOV50 MOV100 O/B MI- DMI- DMI ADX 14d bLow21d bMed21d bUp21d ev am ATR

Ma ers k 20040.00 32.89 672.59 155 23% 20,720.0 16,370.0 84% -3% 67 58 19,884 O 18,670 O 18,481 O O 1.06 20.81 Neutra l 17.10 18,979 19,643 20,306 80% -21 560.71

Novo 704.30 20.31 14.6 2.4 16% 753.6 491.6 81% -7% 32 45 708 B 688 O 657 O B 0.45 30.33 DOWN 30.19 695.60 728.86 762.12 13% -78 16.28

FLS 228.20 35.17 8.2 -2.9 -35% 275.0 213.0 25% -17% 36 39 227 O 239 B 235 B B 0.61 32.77 DOWN 23.41 219.89 244.10 268.31 17% -67 7.38

Pa n 844.20 38.70 33.34 9.2 28% 943.8 754.0 48% -11% 43 43 833 O 864 B 836 O B 0.58 30.63 DOWN 23.05 807.57 890.77 973.98 22% -80 25.54

Gen 2457.00 33.32 83.56 4 5% 3,100.0 2,453.0 1% -21% 20 30 2,511 B 2,781 B 2,831 B B 0.36 39.57 DOWN 28.15 2,364.65 2,695.10 3,025.54 14% -97 85.64

Da ns ke 112.10 29.49 3.37 0.15 4% 118.3 101.2 64% -5% 52 50 111 O 111 O 110 O B 0.82 27.85 Neutra l 16.62 108.06 112.56 117.05 45% -48 2.43

Ca rl b 1015.50 22.16 22.97 -8 -35% 1,183.5 1,000.0 8% -14% 22 33 1,030 B 1,071 B 1,084 B B 0.43 32.97 DOWN 23.62 1,013.35 1,076.43 1,139.51 2% -89 23.43

Jys k 330.50 28.80 9.71 -1.9 -20% 349.8 259.0 79% -6% 41 49 331 B 320 O 305 O B 0.82 25.79 Neutra l 26.58 325.35 339.00 352.65 19% -52 8.40

Ves tas 203.00 71.21 14.75 -4.5 -31% 279.7 203.0 0% -27% 17 33 214 B 240 B 244 B B 0.50 34.25 DOWN 23.21 203.93 222.50 241.07 -2% -87 8.76

Nzymes 493.90 26.84 13.53 3.2 24% 520.0 429.3 71% -5% 43 50 494 O 474 O 482 O B 1.02 17.29 Neutra l 27.92 476.51 502.42 528.33 34% -80 11.53

Col o 1053.50 32.38 34.81 1 3% 1,182.5 968.2 40% -11% 20 38 1,071 B 1,067 B 1,091 B B 0.70 25.92 DOWN 24.60 1,031.42 1,120.76 1,210.10 12% -91 28.29

Nda 77.32 25.04 1.98 -1.57 -79% 83.1 67.5 63% -7% 31 40 78 B 80 B 78 B B 0.49 33.08 DOWN 19.61 76.86 80.40 83.95 7% -60 1.73

ISS 119.10 30.43 3.70 -0.1 -3% 158.8 116.5 6% -25% 37 35 119 B 130 B 137 B B 0.28 31.59 DOWN 34.26 113.04 126.95 140.86 22% -80 3.43

Dema nt 303.20 36.86 11.40 -1.2 -11% 389.8 287.0 16% -22% 28 38 312 B 316 B 339 B B 0.56 23.69 DOWN 21.10 302.92 325.71 348.51 1% -98 10.76

DSV 1361.50 30.43 42.29 -11 -26% 1,679.0 1,361.5 0% -19% 16 29 1,408 B 1,507 B 1,542 B B 0.39 35.26 DOWN 22.09 1,360.87 1,497.21 1,633.56 0% -94 50.54

CHa ns en 485.00 26.41 13.07 -8.7 -67% 602.0 485.0 0% -19% 20 34 491 B 516 B 540 B B 0.53 30.62 DOWN 23.85 480.14 518.31 556.48 6% -73 13.12

LUN 158.65 23.83 3.86 -3.35 -87% 202.4 158.7 0% -22% 12 27 163 B 175 B 181 B B 0.36 34.59 DOWN 25.74 158.33 173.03 187.74 1% -95 3.83

Si mcorp 637.80 28.59 18.61 -1.8 -10% 881.6 637.8 0% -28% 5 18 658 B 755 B 800 B B 0.21 43.73 DOWN 34.31 613.90 738.27 862.63 10% -98 21.46

Ors ted 792.60 31.66 25.61 -23.8 -93% 1,048.0 792.6 0% -24% 20 32 831 B 873 B 916 B B 0.58 23.85 DOWN 17.83 806.02 859.03 912.04 -13% -100 23.51

SAS 0.87 67.42 0.06 -0.021 -35% 1.6 0.9 0% -46% 19 23 1 B 1 B 1 B B 0.16 41.51 DOWN 41.14 0.83 1.09 1.36 8% -78 0.06

Rockwool 2766.00 26.50 74.81 6 8% 3,429.0 2,605.0 20% -19% 31 36 2,750 O 2,890 B 3,090 B B 0.29 29.55 DOWN 31.26 2,642.17 2,963.48 3,284.79 19% -69 133.54

Ba va ri a n N 301.40 43.27 13.31 -10.8 -81% 366.8 237.2 50% -18% 35 46 318 B 310 B 303 B O 1.24 20.14 Neutra l 12.93 285.23 306.03 326.84 39% -45 11.71

AMBU 160.15 56.79 9.28 -11.35 -122% 241.7 160.2 0% -34% 17 34 178 B 184 B 200 B B 0.84 25.79 Neutra l 17.99 166.72 185.20 203.68 -18% -87 9.48

Mdri l 230.40 57.46 13.51 -1.4 -10% 287.8 200.2 34% -20% 11 35 237 B 249 B 241 B B 0.63 30.06 DOWN 22.77 223.89 253.50 283.12 11% -93 8.26

Netcompa ny 680.00 31.08 21.57 6.5 30% 855.5 669.5 6% -21% 27 34 691 B 730 B 763 B B 0.48 31.52 DOWN 17.24 665.14 726.98 788.81 12% -92 23.00

Kbh L 5400.00 26.73 147.32 -20 -14% 7,600.0 5,400.0 0% -29% 15 24 5,616 B 6,391 B 6,506 B B 0.27 35.87 DOWN 30.80 5,375.05 6,124.76 6,874.47 2% -90 211.43

Da te 12/3/2021 101.2

12/3/2021 Weekly Follow-up December 3, 2021 Page 16

You might also like

- Chinas Technology War Why Beijing Took Down Its Tech Giants Andrew Collier Full ChapterDocument67 pagesChinas Technology War Why Beijing Took Down Its Tech Giants Andrew Collier Full Chapterdavid.blumenthal530100% (8)

- Product Service Avai Lable in The MarketDocument13 pagesProduct Service Avai Lable in The MarketNamy Lyn Gumamera50% (2)

- Individual EPPM4014Document15 pagesIndividual EPPM4014Yu XinleiNo ratings yet

- Population Growth Chapter 1Document23 pagesPopulation Growth Chapter 1simonsin6a30No ratings yet

- Q4 U.S. Stock Market Outlook: Delta Delays, But Doesn't Derail October 2021Document48 pagesQ4 U.S. Stock Market Outlook: Delta Delays, But Doesn't Derail October 2021Irfan AzmiNo ratings yet

- Carry Trades & Currency CrashesDocument27 pagesCarry Trades & Currency Crashesfredtag4393No ratings yet

- TechSpotlight 1 13 2023Document3 pagesTechSpotlight 1 13 2023Elcano MirandaNo ratings yet

- Mobile App - Figma ExportDocument7 pagesMobile App - Figma Exportcenel 13No ratings yet

- Robo MYS Mys 00000 2022-03Document9 pagesRobo MYS Mys 00000 2022-03zamzuribNo ratings yet

- Daily Research: Statistics HighlightDocument10 pagesDaily Research: Statistics HighlightDavid Nathanael SutyantoNo ratings yet

- Index Dashboard FEB2024Document2 pagesIndex Dashboard FEB2024ridhimac47No ratings yet

- BetaDocument1 pageBetaalirazajokarNo ratings yet

- For The Fed: WaitingDocument5 pagesFor The Fed: WaitingAndre SetiawanNo ratings yet

- MONTHLY REPORT - Net Foriegn Buy/Sell (Values Are in Millions 1,000,000)Document6 pagesMONTHLY REPORT - Net Foriegn Buy/Sell (Values Are in Millions 1,000,000)ανατολή και πετύχετεNo ratings yet

- Acoustic LouversDocument7 pagesAcoustic LouversflexbyoNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersTirthankar DasNo ratings yet

- Market Summary: Indexes Last Change Percent Bid AskDocument4 pagesMarket Summary: Indexes Last Change Percent Bid Askapi-16363627No ratings yet

- Fairbairn - September 30 2018Document2 pagesFairbairn - September 30 2018Tiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Fairbairn - November 20 2017Document2 pagesFairbairn - November 20 2017Tiso Blackstar GroupNo ratings yet

- JM Daily - 23 Aug - EquityDocument183 pagesJM Daily - 23 Aug - EquityPravin SinghNo ratings yet

- Fairbairn - November 17 2017Document2 pagesFairbairn - November 17 2017Tiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Singapore REITs FundametalsDocument2 pagesSingapore REITs FundametalsGandhiNo ratings yet

- Daily Research: Statistics Market PreviewDocument8 pagesDaily Research: Statistics Market PreviewDaniel PandapotanNo ratings yet

- Fairbairn - September 7 2018Document2 pagesFairbairn - September 7 2018Tiso Blackstar GroupNo ratings yet

- Super Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualDocument5 pagesSuper Stock of The Day: Date Company Period F/C PRV Actual F/C PRV ActualAndre SetiawanNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- 52 Week High Low NAV Equity FundDocument4 pages52 Week High Low NAV Equity FundWealth Maker BuddyNo ratings yet

- Uganda Rural Poverty Rates 2005Document27 pagesUganda Rural Poverty Rates 2005Open MicrodataNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- The Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Document4 pagesThe Sidelines: .DJI 12,426.75 (+32.85) .SPX 1,335.54 (+2.91) .IXIC 2,799.82 (+8.63)Andre SetiawanNo ratings yet

- Full ModelDocument8 pagesFull ModelRahmat WahyudiNo ratings yet

- LS Sar Page50Document1 pageLS Sar Page50Ljubisa MaticNo ratings yet

- Morning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersDocument6 pagesMorning Report: Equity Latest % CHG NSE Sect. Indices Latest % CHG Nifty GainersTirthankar DasNo ratings yet

- Priv - Outliers Omitted - NGO Still SignDocument8 pagesPriv - Outliers Omitted - NGO Still Signfedro120No ratings yet

- Markets and Commodity Figures: 10 June 2018Document2 pagesMarkets and Commodity Figures: 10 June 2018Tiso Blackstar GroupNo ratings yet

- Index Dashboard AUG2020Document2 pagesIndex Dashboard AUG2020PNo ratings yet

- Daily Research: Statistics HighlightDocument10 pagesDaily Research: Statistics HighlightDavid Nathanael SutyantoNo ratings yet

- 3 RatiosDocument1 page3 RatiosPratik KumarNo ratings yet

- Markets and Commodity Figures: 03 October 2017Document2 pagesMarkets and Commodity Figures: 03 October 2017Tiso Blackstar GroupNo ratings yet

- Steel Pipe Weight and SupportDocument1 pageSteel Pipe Weight and SupportHarley añanaNo ratings yet

- Daily Market Report - 27 May 2021Document1 pageDaily Market Report - 27 May 2021Soko DirectoryNo ratings yet

- Yulan Sari - P07134221008 - Grafik Leavy JenningDocument2 pagesYulan Sari - P07134221008 - Grafik Leavy JenningSyava HemasNo ratings yet

- ETF Tracker - SheetMetric - Public Version For Educational Purposes OnlyDocument26 pagesETF Tracker - SheetMetric - Public Version For Educational Purposes Onlysnehalbpatil1991No ratings yet

- LS Sar Page51Document1 pageLS Sar Page51Ljubisa MaticNo ratings yet

- Quantitative Analysis SOD Report: Tuesday, March 5, 2019Document8 pagesQuantitative Analysis SOD Report: Tuesday, March 5, 2019Anonymous W9ONsW1No ratings yet

- Markets and Commodity Figures: 04 February 2018Document2 pagesMarkets and Commodity Figures: 04 February 2018Tiso Blackstar GroupNo ratings yet

- CDC - US Healthinsurance1968-2015Document2 pagesCDC - US Healthinsurance1968-2015LTNo ratings yet

- Fairbairn - October 1 2018Document2 pagesFairbairn - October 1 2018Tiso Blackstar GroupNo ratings yet

- All Equity Funds 06 Sep 2021 1201Document2 pagesAll Equity Funds 06 Sep 2021 1201AlexNo ratings yet

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Document5 pagesDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanNo ratings yet

- Pages From ASCE 7-10 (3rd Print)Document1 pagePages From ASCE 7-10 (3rd Print)DanNo ratings yet

- 031117fairbairn PDFDocument2 pages031117fairbairn PDFTiso Blackstar GroupNo ratings yet

- Index Dashboard: Broad Market IndicesDocument2 pagesIndex Dashboard: Broad Market IndicesVagaram ChowdharyNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Dimensions & Weights Welded and Seamless Wrought Steel Pipe ASME B36.10Document6 pagesDimensions & Weights Welded and Seamless Wrought Steel Pipe ASME B36.10MaysaraNo ratings yet

- Markets and Commodity Figures: 25 September 2017Document2 pagesMarkets and Commodity Figures: 25 September 2017Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: 25 September 2017Document2 pagesMarkets and Commodity Figures: 25 September 2017Tiso Blackstar GroupNo ratings yet

- SVVV Confluence Directory 19 Dec 2020Document81 pagesSVVV Confluence Directory 19 Dec 2020Akash NetkeNo ratings yet

- Maths Pa 2 Question PaperDocument6 pagesMaths Pa 2 Question PaperSai Sumedh ChellapillaNo ratings yet

- Ratio Rate Proportion and PercentDocument1 pageRatio Rate Proportion and PercentMyla Nazar OcfemiaNo ratings yet

- CMU793945331 Auth LetterDocument3 pagesCMU793945331 Auth LetteryutongyNo ratings yet

- MS Excel 1 - Common FormulasDocument7 pagesMS Excel 1 - Common FormulasriasibuloNo ratings yet

- Interest Encon 1Document10 pagesInterest Encon 1Erina SmithNo ratings yet

- The Effect of Inventory Management On Firm PerformanceDocument15 pagesThe Effect of Inventory Management On Firm PerformanceSachie BeeNo ratings yet

- Accounting For Partnership Firm - FundamentalsDocument15 pagesAccounting For Partnership Firm - FundamentalsYutika DoshiNo ratings yet

- Equity Valuation: Why Determine Value of A StockDocument12 pagesEquity Valuation: Why Determine Value of A StockRUKUDZO KNOWLEDGE DAWANo ratings yet

- VF Brands Submission Supply ChainDocument5 pagesVF Brands Submission Supply Chainkarthik sNo ratings yet

- Presentation On Retail Strategy: Mahima Big BazarDocument18 pagesPresentation On Retail Strategy: Mahima Big BazaraksrinivasNo ratings yet

- IAESP BugallonDocument4 pagesIAESP BugallonmaskmediaphNo ratings yet

- Cash Disbursement RegisterDocument3 pagesCash Disbursement RegisterDecember CoolNo ratings yet

- ZIMRA Strategy 2019-2023Document35 pagesZIMRA Strategy 2019-2023Ospen Noah SitholeNo ratings yet

- MBA-III Project Management-PART-2Document18 pagesMBA-III Project Management-PART-2choudharypatel08No ratings yet

- 04 Prof Suyono Dikun - Value Capture in Urban Infrastructure DevelopmentDocument8 pages04 Prof Suyono Dikun - Value Capture in Urban Infrastructure DevelopmentFadhiel MuhammadNo ratings yet

- Canton Corporation Is A Privately Owned Firm That Engages inDocument1 pageCanton Corporation Is A Privately Owned Firm That Engages inTaimur TechnologistNo ratings yet

- Midterm Exam of Managerial Economics 2022Document4 pagesMidterm Exam of Managerial Economics 2022dayeyoutai779No ratings yet

- 30th May 2022 - Regional Economics and Land Rent Theory - 2nd Mid-TermDocument8 pages30th May 2022 - Regional Economics and Land Rent Theory - 2nd Mid-TermHalef Michel Bou KarimNo ratings yet

- Conceptual Framework QuizDocument4 pagesConceptual Framework QuizPamela Ledesma SusonNo ratings yet

- FEMADocument30 pagesFEMASankalp RajNo ratings yet

- GePG PRESENTATION - ICTC - ANNUAL - CONFERENCE - 2023Document12 pagesGePG PRESENTATION - ICTC - ANNUAL - CONFERENCE - 2023Dishon EsekaNo ratings yet

- Allama Iqbal Open University: Report of Business LawDocument17 pagesAllama Iqbal Open University: Report of Business Lawmanomasho100% (2)

- Rbi Grade B 2023 Esi FM Descriptive Questions Answer KeyDocument8 pagesRbi Grade B 2023 Esi FM Descriptive Questions Answer KeyvenshmasuslaNo ratings yet

- Change of Name EnglishDocument2 pagesChange of Name EnglishdsfNo ratings yet

- Sample Test - HP3 - K46 - UpdatedDocument10 pagesSample Test - HP3 - K46 - UpdatedTuyền NguyễnNo ratings yet

- New Research Report Maximizing Digital Banking Engagement 1676131939Document70 pagesNew Research Report Maximizing Digital Banking Engagement 1676131939Mario AnchundiaNo ratings yet