Professional Documents

Culture Documents

Cash Segment - Trade Summary Cum Bill Report For Today

Cash Segment - Trade Summary Cum Bill Report For Today

Uploaded by

mcmeenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Segment - Trade Summary Cum Bill Report For Today

Cash Segment - Trade Summary Cum Bill Report For Today

Uploaded by

mcmeenaCopyright:

Available Formats

Digitally signed by Deepak

Redekar

Date: 2021.10.11 17:02:24

UTC

G-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Tel: 022-68071111/022-42185454 E-mail: support@angelbroking.com

Website: www.angelbroking.com

Date: 11/10/2021

To,

Name : MAHESH .

Address : VPO BAGAR RAJPUT DISTT.ALWAR BLOCK RAMGARH ALWAR Rajasthan-301001

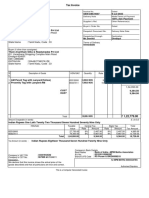

Cash Segment -Trade Summary cum bill report for Today

TradingCode

Trading Code: :M284478

M284478

Segment Scrip Name Buy Buy Market Sell Qty Sell Market Brokerage STT Other Charges Grand Total

Qty Rate(Avg) Rate(Avg)

NSECM Indian Railway Catering and To (Delivery) 1 4800.00 0 0.00 0.00 5.00 1.20 -4806.20

Total 1 0 0.00 5.00 1.20 -4806.20

Disclaimer : Buy Rate (Avg) & Sell Rate (Avg) have rounded to 2 decimal for your convenience, kindly refer the Contract Notes for accurate values of Buy Rate & Sell Rate.

PAGE NO : 1 Client Code : M284478

CONTRACT NOTE CUM TAX INVOICE

(TAX Invoice under section 31 of GST ACT)

Angel Broking Limited

(formerly known as Angel Broking Private Limited)

Registered Office: G-1, Akruti Trade Centre,Road No7,MIDC Marol,Andheri(E),Mumbai - 400093 Tel No:(022) 28358800 / 30837700 Fax No:022-28358811,

CIN No :-L67120MH1996PLC101709

SEBI Regn.No.: INZ000161534 - BSE : CM, F&O, CD | NSE : CM, F&O, CD |MSEI: CD |MCX:F&O | NCDEX : F&O

Member Code: BSE: 612 | MSEI: 10500 | NSE: 12798 |MCX: 12685 |NCDEX: 00220

Visit us at :www.angelbroking.com | For Investor complaints / queries / feedback email us at support@angelbroking.com or call us on 022-42185454 & 022-68071111

Compliance Officer : Ms. Richa Ghosh (Email Id:Compliance@angelbroking.com, Tel: 022-39413940)

Dealing Office Address: 401, 4th Floor, Broadway Business Centre, Opp. Samtheshwar Mahadev,Opp. Law Garden, Ellisbridge,AHMEDABAD-380006 GUJARAT

GST Location : RAJASTHAN 2/3, 1ST FLR., MULTI STORY COMPLEX, 1ST M. I. ROAD, OPP. AMRAPURA TEMPLE, JAIPUR - 302 001.

Client Name : MAHESH . Trading Back office code : Same as UCC Code for all segment EXCHANGE BSE CAPITAL NSE CAPITAL

Address : VPO BAGAR RAJPUT DISTT.ALWAR, Contract Note No : 0045881261 SETTLEMENT NO NA 2021192-NORMAL

BLOCK RAMGARH, GST NO : SETTLEMENT NA 13/10/2021

DATE

ALWAR, Trade Date : 11/10/2021

Rajasthan-301001.

Client Code(UCC) : M284478(MPBS/MPDIY)

PAN Number : EBDPM3082A

Sir/Madam,

I/We have this day done by your order and on your account the following transactions:

Closing Rate

Buy Gross Rate/Trade Brokerage Net Total (Before

Security/Contract Net Rate Per Unit per Unit (Only

Order No Order Time Trade No. Trade Time / Qty Price Per Unit(₹) Per Levies Remarks

Description (₹) for Derivatives)

Sell @ Unit(₹) (₹)

(₹)

NSE - CAPITAL - NORMAL (2021192 - N - 13/10/2021 - REF. NO: 031266567)

1100000020856616 15:00:15 31274866 15:02:13 INDIAN RAIL TOUR COR BUY 1D 4800.0000 0.0000 4800.0000 0.0000 -4800.0000

ISIN: INE335Y01012 1 -4800.0000

(NET TOTAL)

Order Wise Details:

Exchange / Segment Security/Contract Description Buy/ Sell Order No Qty Gross Rate/Trade Price **Trade Value Brokerage

NSE-CAPITAL INDIAN RAIL TOUR COR BUY 1100000020856616 1 4800.00 4800.00 0.00

TOTAL 4800.00 0.00

Securities Exchange SEBI Auction/

Pay In/Pay Out Taxable value of *CGST *SGST Stamp Net Amount Receivable by

Exchange Transaction Transaction turnover Other

Obligation supply (@ 9.00%) (@ 9.00%) Duty Client /(Payable by Client)

Tax Charges Fees. Charges

NSE-CAPITAL -4800.00 5.00 0.17 0.01 0.01 0.16 0.00 1.00 0.00 -4806.20

TOTAL(NET) -4800.00 5.00 0.17 0.01 0.01 0.16 0.00 1.00 0.00 -4806.20

Total Brokerage = 0.00

Taxable Value of Supply Includes Total brokerage + Exchange Transaction Charges + SEBI Turnover Fees

*CGST:-Central GST; SGST: - State GST; IGST:- Integrated GST; UTT:- Union Territory Tax. Yours faithfully,

** Trade value for options brokerage is calculated as (Strike + Premium ) x Lot size. Brokerage is also charged on expired, exercised and assigned options contract. For Angel Broking Limited

@ Converted into INR based on RBI reference rate as on the date of transaction.

ISIN's are subject to change due to corporate actions.

Details of trade-wise levies shall be provided on request.

Transactions mentioned in this contract note cum Tax invoice shall be governed and subject to the Rules, Bye-laws and Regulations

and Circulars of the respective Exchanges on which trades have been executed and Securities and Exchange Board of India Authorised Signatory

from time to time. It shall also be subject to the relevant Acts, Rules, Regulations, Directives, Notifications, Guidelines (including GST Laws) & PAN No.:AAACM6094R

Circulars issued by SEBI / Government of India / State Governments and Union Territory Governments issued from time to time. Description of Services : Stock Broking services

The Exchanges provide Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). Accounting code of services : 997152

The client may approach its nearest centre, details of which are available on respective Exchanges website. GST NO.: 08AAACM6094R1ZP

Please visit www.bseindia.com for BSE, www.msei.in for MSEI, www.nseindia.com for NSE.

Date: 11/10/2021

Place : MUMBAI

PAGE NO : 2 Client Code : M284478

You might also like

- MacBook Pro M2 InvoiceDocument1 pageMacBook Pro M2 InvoiceAadisons Techno SolutionsNo ratings yet

- Founder Stock Purchase Agreement-Template-1Document10 pagesFounder Stock Purchase Agreement-Template-1David Jay Mor100% (2)

- Presentation Summary UGGedit-2Document26 pagesPresentation Summary UGGedit-2Satrio SadewoNo ratings yet

- Chap 006Document14 pagesChap 006Adi SusiloNo ratings yet

- Institute of Actuaries of India: Subject ST1 - Health and Care InsuranceDocument4 pagesInstitute of Actuaries of India: Subject ST1 - Health and Care InsuranceVignesh SrinivasanNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodaymcmeenaNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayUnreal PlayerNo ratings yet

- 8/2/2021CN 08022021Document2 pages8/2/2021CN 08022021LakshmanNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayHappyNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument3 pagesCash Segment - Trade Summary Cum Bill Report For TodaySimul MondalNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument3 pagesCash Segment - Trade Summary Cum Bill Report For TodaySanu Moni BorahNo ratings yet

- Digitally Signed by Deepak Redekar Date: 2020.06.19 16:16:01 UTCDocument2 pagesDigitally Signed by Deepak Redekar Date: 2020.06.19 16:16:01 UTCanitaselvarajanNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayawarialocksNo ratings yet

- CN - P170656 - 27112020 Day TwoDocument3 pagesCN - P170656 - 27112020 Day TwoUnreal PlayerNo ratings yet

- Digitally Signed by Deepak Redekar Date: 2021.09.08 19:29:11 UTCDocument3 pagesDigitally Signed by Deepak Redekar Date: 2021.09.08 19:29:11 UTCKumar ManavNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayAlpesh BhesaniyaNo ratings yet

- Digitally Signed by Deepak Redekar Date: 2022.11.15 23:08:16 UTCDocument9 pagesDigitally Signed by Deepak Redekar Date: 2022.11.15 23:08:16 UTCRavikumar RavikumarNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For Today8460272421No ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayAlpesh BhesaniyaNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument4 pagesCash Segment - Trade Summary Cum Bill Report For Todayushasridhar2010No ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayVikashNo ratings yet

- Angel Broking Limited: Contract NoteDocument2 pagesAngel Broking Limited: Contract NoteMUTHYALA NEERAJANo ratings yet

- CN Piyp1031 26022020Document2 pagesCN Piyp1031 26022020muthiah sNo ratings yet

- CN Vipo1037 08032023 PDFDocument3 pagesCN Vipo1037 08032023 PDFDass AniNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For Todaymunajangid484No ratings yet

- Cash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2021.08.16 17:30:54 UTCDocument3 pagesCash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2021.08.16 17:30:54 UTCSoma Sundaram NNo ratings yet

- Retail: GSTIN - No.: 24AACCV1726H1ZKDocument3 pagesRetail: GSTIN - No.: 24AACCV1726H1ZKpremainduNo ratings yet

- G-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093Document2 pagesG-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093Rama shankarNo ratings yet

- G-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093Document3 pagesG-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093Nirav PandyaNo ratings yet

- CN Sucn1091 04082023Document3 pagesCN Sucn1091 04082023RahulkumarNo ratings yet

- CN Derr1217 19022024Document2 pagesCN Derr1217 19022024dsshivhare07No ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayAbhishek BurseNo ratings yet

- Rikhav Securities LTD.: (Tax Invoice Under Section 31 of GST Act)Document1 pageRikhav Securities LTD.: (Tax Invoice Under Section 31 of GST Act)Dhruv Harshal ShahNo ratings yet

- Digitally Signed by Deepak Redekar Date: 2023.09.21 06:22:50 UTCDocument5 pagesDigitally Signed by Deepak Redekar Date: 2023.09.21 06:22:50 UTCmanjuralhoque41No ratings yet

- InvoiceDocument2 pagesInvoicersengunthar1No ratings yet

- RT 2021-22 01078Document1 pageRT 2021-22 01078M A InteriorsNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For Todayvijay patelNo ratings yet

- MSF R.K.P Sec-13 - Aug'23Document2 pagesMSF R.K.P Sec-13 - Aug'23vineet.tpsNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2022.12.06 20:25:30 UTCDocument3 pagesCash Segment - Trade Summary Cum Bill Report For Today: Digitally Signed by Deepak Redekar Date: 2022.12.06 20:25:30 UTCSahil UgaleNo ratings yet

- ICICI Securities Limited: Signature Not VerifiedDocument3 pagesICICI Securities Limited: Signature Not VerifiedmskhandelwalNo ratings yet

- Contract NotesDocument3 pagesContract NotesHarshal VaidyaNo ratings yet

- G-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093Document3 pagesG-1, Ackruti Trade Center, Road No. 7, MIDC, Andheri (E), Mumbai - 400 093Rajat AseejaNo ratings yet

- Compliance MSVRG August 2021 TL29T2122 17954Document1 pageCompliance MSVRG August 2021 TL29T2122 17954Saurabh KatiyarNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoicemarketbus12No ratings yet

- Tax Invoice: SEN/CBE/0007 9-Jul-2022 100% Adv PaymentDocument1 pageTax Invoice: SEN/CBE/0007 9-Jul-2022 100% Adv PaymentMPM SENTHILNo ratings yet

- Derivaties Segment - Trade Summary For TodayDocument2 pagesDerivaties Segment - Trade Summary For TodayPrabhas AnilNo ratings yet

- Salk1000152223-NoidaDocument5 pagesSalk1000152223-NoidaPratik GosaviNo ratings yet

- NDTL JLN STADIUM - Sept'23Document1 pageNDTL JLN STADIUM - Sept'23vineet.tpsNo ratings yet

- Fyers Securities Private Limited: Rahul Kumar Gupta FR2162 Bangalore Branch Code: Branch NameDocument1 pageFyers Securities Private Limited: Rahul Kumar Gupta FR2162 Bangalore Branch Code: Branch NameAbhishek GuptaNo ratings yet

- Contract NotesDocument2 pagesContract NotesdharmendraNo ratings yet

- Prabhudas Lilladher Pvt. LTD.: NSE CashDocument2 pagesPrabhudas Lilladher Pvt. LTD.: NSE CashYash BanarjeeNo ratings yet

- Adobe Scan 15-Apr-2023Document1 pageAdobe Scan 15-Apr-2023VISHAL JANGRANo ratings yet

- TRX Equity ReemaDocument51 pagesTRX Equity ReemaKrystle MathisNo ratings yet

- Perfoma InvoiceDocument1 pagePerfoma InvoiceashishNo ratings yet

- Pci 22-23Document2 pagesPci 22-23Wall Street Forex (WSFx)No ratings yet

- Survey No.528/1, Perambakkam Road, Mannur Village, Sriperambudur Taluk, Chennai-602 105, TamilnaduDocument4 pagesSurvey No.528/1, Perambakkam Road, Mannur Village, Sriperambudur Taluk, Chennai-602 105, TamilnaduShakti MahaveerNo ratings yet

- Compliance MSVRG May 2021 TL29T2122 7099Document1 pageCompliance MSVRG May 2021 TL29T2122 7099Saurabh KatiyarNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceiamnagarajnairyNo ratings yet

- Z9nji4016401Document1 pageZ9nji4016401OP KARTIKNo ratings yet

- QTL Inv Q2-2022Document2 pagesQTL Inv Q2-2022irshad khanNo ratings yet

- Financial Statement: Tradebulls Securities (P) LimitedDocument1 pageFinancial Statement: Tradebulls Securities (P) LimitedPIVOT GRAVITYNo ratings yet

- Date: 01/04/2020 Mumbai For ICICI Securities Limited. Yours Faithfully, PlaceDocument2 pagesDate: 01/04/2020 Mumbai For ICICI Securities Limited. Yours Faithfully, PlaceVikas KunduNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Chaper 03 John Hull Presentation. Options Futures and Other Derivatives. Finance, Pretince Hall Manual.Document23 pagesChaper 03 John Hull Presentation. Options Futures and Other Derivatives. Finance, Pretince Hall Manual.Yolibi KhunNo ratings yet

- G.R. NoDocument9 pagesG.R. NoDaniel Danjur DagumanNo ratings yet

- 9706 w09 QP 41Document8 pages9706 w09 QP 41roukaiya_peerkhanNo ratings yet

- Bilateral Trading ExampleDocument4 pagesBilateral Trading Examplelinkin_slayerNo ratings yet

- Iron Condor Trading GuideDocument33 pagesIron Condor Trading GuideSrini Donapati67% (3)

- INVG60809Document25 pagesINVG60809Karthi KeyanNo ratings yet

- Portfolio HJB EquationDocument33 pagesPortfolio HJB EquationMakos_AntoniouNo ratings yet

- Finance 101 Insead Lec 1Document15 pagesFinance 101 Insead Lec 1Dwijesh RajwadeNo ratings yet

- Futures 1Document56 pagesFutures 1Rajat KatariaNo ratings yet

- BA4825 PP 1Document23 pagesBA4825 PP 1Ayla YahyayevaNo ratings yet

- New Trends in Energy Derivatives: Alexander Eydeland Morgan StanleyDocument33 pagesNew Trends in Energy Derivatives: Alexander Eydeland Morgan StanleyakwoviahNo ratings yet

- Rahul TradeDocument9 pagesRahul TradeNayagraNintyNo ratings yet

- Suzlon Annual ReportDocument154 pagesSuzlon Annual ReportcabhargavNo ratings yet

- 420jjpb2wmtfx0 PDFDocument19 pages420jjpb2wmtfx0 PDFDaudSutrisnoNo ratings yet

- Practice QuestionsDocument8 pagesPractice QuestionschrisNo ratings yet

- Case Analysis:: PV Technologies, Inc.: Were They Asleep at The Switch?Document4 pagesCase Analysis:: PV Technologies, Inc.: Were They Asleep at The Switch?msbinuNo ratings yet

- Advacc 1 Final Quiz JoyceDocument73 pagesAdvacc 1 Final Quiz Joycenena cabañesNo ratings yet

- Modern Trader January 2018Document86 pagesModern Trader January 2018chocobrownie0% (2)

- Full Download Ebook PDF Investments Analysis and Management 13th Edition PDFDocument41 pagesFull Download Ebook PDF Investments Analysis and Management 13th Edition PDFjason.lollar844100% (42)

- Correlation Study BTW Sensex and Nifty - IndiabullsDocument4 pagesCorrelation Study BTW Sensex and Nifty - IndiabullsMohmmedKhayyumNo ratings yet

- Equity Smile A Monte-Carlo ApproachDocument2 pagesEquity Smile A Monte-Carlo ApproachSol FernándezNo ratings yet

- Finance MCQDocument46 pagesFinance MCQPallavi GNo ratings yet

- USPS Contract RedactedDocument73 pagesUSPS Contract RedactedPatrick CoffeeNo ratings yet

- Risk-Markets and ModelsDocument4 pagesRisk-Markets and ModelsBaderalhussain0No ratings yet

- Swing Trading Simplified Larry D Spears PDFDocument115 pagesSwing Trading Simplified Larry D Spears PDFAmine Elghazi100% (4)

- The Generalized Black-Scholes Model For Pricing Derivative Securities: Exact Solutions For Arbitrary PayoffDocument19 pagesThe Generalized Black-Scholes Model For Pricing Derivative Securities: Exact Solutions For Arbitrary PayoffresalvinoNo ratings yet