Professional Documents

Culture Documents

AC20 MIDTERM EXAMINATION FY21 22 - DGCupd

AC20 MIDTERM EXAMINATION FY21 22 - DGCupd

Uploaded by

Maricar PinedaCopyright:

Available Formats

You might also like

- Restructuring - ProblemDocument2 pagesRestructuring - ProblemMarie GarpiaNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- NumerologyDocument24 pagesNumerologyphani60% (5)

- AnswerrDocument7 pagesAnswerrLeslie Mae Vargas ZafeNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Bonds PayableDocument5 pagesBonds PayableJoseph AsisNo ratings yet

- Far-Pw 5.23Document9 pagesFar-Pw 5.23Miguel ManagoNo ratings yet

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- 1st Final Quiz Assignment QuestionnaireDocument11 pages1st Final Quiz Assignment QuestionnaireBashayer M. SultanNo ratings yet

- Problem No. 1: QuestionsDocument3 pagesProblem No. 1: QuestionsPamela Ledesma SusonNo ratings yet

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument10 pagesNfjpia Nmbe Taxation 2017 AnsjaysonNo ratings yet

- ACC12 - Auditing and Assurance Concepts and Applications 1 Midterm ExaminationDocument2 pagesACC12 - Auditing and Assurance Concepts and Applications 1 Midterm ExaminationUn knownNo ratings yet

- Share-Based Payments - 2Document13 pagesShare-Based Payments - 2Dave GoNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- Module 5&6Document29 pagesModule 5&6Lee DokyeomNo ratings yet

- Case 2 - Chapter 9: RequiredDocument4 pagesCase 2 - Chapter 9: RequiredEricaNo ratings yet

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- Practical Accounting 1 ReviewerDocument13 pagesPractical Accounting 1 ReviewerKimberly RamosNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- Shareholders' Equity-Contributed Capital or Paid in CapitalDocument4 pagesShareholders' Equity-Contributed Capital or Paid in CapitalJennifer AdvientoNo ratings yet

- ACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesDocument18 pagesACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesMarilou Arcillas PanisalesNo ratings yet

- IA3 Chapter 15 AnswersDocument1 pageIA3 Chapter 15 AnswersBea TumulakNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Module 1 - Fundamental Principles of Assurance EngagementsDocument10 pagesModule 1 - Fundamental Principles of Assurance EngagementsLysss EpssssNo ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- EDP Auditing SemiFinalDocument4 pagesEDP Auditing SemiFinalErwin Labayog MedinaNo ratings yet

- Chapter Six Control &AISDocument6 pagesChapter Six Control &AISAmbelu AberaNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) LawDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) LawElmer JuanNo ratings yet

- Transaction Price - Problems (1) - Sarmiento, Jefferson D.Document3 pagesTransaction Price - Problems (1) - Sarmiento, Jefferson D.jefferson sarmientoNo ratings yet

- IA2 Quiz1 (ANTIDO)Document4 pagesIA2 Quiz1 (ANTIDO)Claire Magbunag AntidoNo ratings yet

- At 9402Document14 pagesAt 9402Epfie SanchesNo ratings yet

- MAS.07 Drill Balanced Scorecard and Responsibility AccountingDocument6 pagesMAS.07 Drill Balanced Scorecard and Responsibility Accountingace ender zeroNo ratings yet

- AUDCIS Problems PrelimDocument16 pagesAUDCIS Problems PrelimLian GarlNo ratings yet

- Lesson H - 1 Ch10 Exp. Cycle Act. Tech.Document57 pagesLesson H - 1 Ch10 Exp. Cycle Act. Tech.Blacky PinkyNo ratings yet

- GovernanceDocument3 pagesGovernanceAndrea Marie CalmaNo ratings yet

- AsdasdDocument3 pagesAsdasdMark Domingo MendozaNo ratings yet

- Psa 550 FNDocument1 pagePsa 550 FNkristel-marie-pitogo-4419No ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Quiz Mid PDFDocument8 pagesQuiz Mid PDFsino akoNo ratings yet

- AT EscalaDocument18 pagesAT EscalaRaiNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- CE On Agriculture T1 AY2020-2021Document2 pagesCE On Agriculture T1 AY2020-2021Luna MeowNo ratings yet

- AudTheo Reporting Chapter 3Document58 pagesAudTheo Reporting Chapter 3Tuya Dayom100% (1)

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- Intercompany Sale of PropertyDocument6 pagesIntercompany Sale of PropertyClauie BarsNo ratings yet

- Chapter 3 Auditing Theory 15 16 RoqueDocument34 pagesChapter 3 Auditing Theory 15 16 RoqueDarlene Ventura0% (1)

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- Corruption Is The Misuse of Entrusted Power (By HeritageDocument5 pagesCorruption Is The Misuse of Entrusted Power (By HeritageJhazreel BiasuraNo ratings yet

- University of Luzon College of Accountancy Adjusting EntriesDocument91 pagesUniversity of Luzon College of Accountancy Adjusting EntriesIL MareNo ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Responsibility Accounting and Transfer PricingDocument13 pagesResponsibility Accounting and Transfer PricingNicole Andrea TuazonNo ratings yet

- Situation 8 11Document8 pagesSituation 8 11GuinevereNo ratings yet

- Prelim Exam Aud AnswersDocument5 pagesPrelim Exam Aud Answerslois martinNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- June 9-Acquisition of PPEDocument2 pagesJune 9-Acquisition of PPEJolo RomanNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- What Makes The Banking Industry A Specialized IndustryDocument3 pagesWhat Makes The Banking Industry A Specialized IndustrylalagunajoyNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Module 1 Quick Review of The Need To Study Information TechnologyDocument15 pagesModule 1 Quick Review of The Need To Study Information TechnologyMaricar PinedaNo ratings yet

- Module 3 Transactions Processing CyclesDocument25 pagesModule 3 Transactions Processing CyclesMaricar PinedaNo ratings yet

- ELEC2 - Module 7 - Other Concepts and Valuation TechniquesDocument87 pagesELEC2 - Module 7 - Other Concepts and Valuation TechniquesMaricar PinedaNo ratings yet

- AIS Module 7Document98 pagesAIS Module 7Maricar PinedaNo ratings yet

- AIS Module 8 - 11Document30 pagesAIS Module 8 - 11Maricar PinedaNo ratings yet

- 1700 Itr SampleDocument2 pages1700 Itr SampleMaricar PinedaNo ratings yet

- Module 2 The Accounting Information SystemsDocument49 pagesModule 2 The Accounting Information SystemsMaricar PinedaNo ratings yet

- Cdi Pre Board Answer KeyDocument6 pagesCdi Pre Board Answer KeyMaricar Pineda100% (1)

- Module 4 Application of The Principles of Systems Analysis DesignDocument48 pagesModule 4 Application of The Principles of Systems Analysis DesignMaricar PinedaNo ratings yet

- ELEC2 - Module 2 - Asset Based ValuationDocument27 pagesELEC2 - Module 2 - Asset Based ValuationMaricar Pineda100% (1)

- ELEC2 - Module 3 - Liquidation Value MethodDocument31 pagesELEC2 - Module 3 - Liquidation Value MethodMaricar PinedaNo ratings yet

- Criminalistics Pre Board Answer KeyDocument6 pagesCriminalistics Pre Board Answer KeyMaricar Pineda100% (5)

- AC19 MODULE 5 - UpdatedDocument14 pagesAC19 MODULE 5 - UpdatedMaricar PinedaNo ratings yet

- Ac20 Quiz 4 - DGCDocument8 pagesAc20 Quiz 4 - DGCMaricar PinedaNo ratings yet

- Case Study 3 - Volume Telemarketing CompanyDocument2 pagesCase Study 3 - Volume Telemarketing CompanyMaricar PinedaNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- ELEC2 - Module 1 - Fundamentals Principles of ValuationDocument32 pagesELEC2 - Module 1 - Fundamentals Principles of ValuationMaricar PinedaNo ratings yet

- Quiz 2 Receivables - Solution GuideDocument8 pagesQuiz 2 Receivables - Solution GuideMaricar PinedaNo ratings yet

- Ac19 Module 4 - DGCDocument19 pagesAc19 Module 4 - DGCMaricar PinedaNo ratings yet

- ELEC2 - Module 4 - Income Based ValuationDocument30 pagesELEC2 - Module 4 - Income Based ValuationMaricar Pineda100% (2)

- Case Study 4 - Kennedy GraphicsDocument2 pagesCase Study 4 - Kennedy GraphicsMaricar PinedaNo ratings yet

- Ac20 Exercise 1 Solution - DGCDocument6 pagesAc20 Exercise 1 Solution - DGCMaricar PinedaNo ratings yet

- Case Study 2 Carlson Department StoreDocument2 pagesCase Study 2 Carlson Department StoreMaricar PinedaNo ratings yet

- Ac19 Module 1 - DGCDocument10 pagesAc19 Module 1 - DGCMaricar PinedaNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Alex M. Versola: Personal InformationDocument3 pagesAlex M. Versola: Personal InformationMaricar PinedaNo ratings yet

- Auditing Theory SkeletonDocument6 pagesAuditing Theory SkeletonMaricar PinedaNo ratings yet

- Sabaw Ulam Gulay Isda OthersDocument1 pageSabaw Ulam Gulay Isda OthersMaricar PinedaNo ratings yet

- End of Chapter 2 ExerciesDocument11 pagesEnd of Chapter 2 ExerciesMaricar PinedaNo ratings yet

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDocument5 pagesPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaNo ratings yet

- Chapter 2 Indian Economy 1950-1990Document27 pagesChapter 2 Indian Economy 1950-1990Ajay pandeyNo ratings yet

- Rule 19 - Conduct of Vessels in RestrictedDocument58 pagesRule 19 - Conduct of Vessels in RestrictedMitch SpeederNo ratings yet

- Orangutan ListDocument5 pagesOrangutan ListRam ChandiranNo ratings yet

- CAPEX Acquisition ProcessDocument5 pagesCAPEX Acquisition ProcessRajaIshfaqHussainNo ratings yet

- BIOLS102-UOB-Chapter 10Document8 pagesBIOLS102-UOB-Chapter 10Noor JanahiNo ratings yet

- Prist University, Trichy Campus Department of Comnputer Science and Engineering B.Tech - Arrear Details (Part Time)Document2 pagesPrist University, Trichy Campus Department of Comnputer Science and Engineering B.Tech - Arrear Details (Part Time)diltvkNo ratings yet

- Notes On Jean Piaget DeweyDocument2 pagesNotes On Jean Piaget DeweyfadzillahNo ratings yet

- A 201Document1 pageA 201AnuranjanNo ratings yet

- Chapter 04Document37 pagesChapter 04BLESSEDNo ratings yet

- Distribution Channel of AMULDocument13 pagesDistribution Channel of AMULMeet JivaniNo ratings yet

- TCS AIP Take Home AssignmentDocument16 pagesTCS AIP Take Home AssignmentShruthiSAthreyaNo ratings yet

- 5 6Document3 pages5 6Giorgi VasadzeNo ratings yet

- Historical Moroccan JewishDocument10 pagesHistorical Moroccan JewishSanduNo ratings yet

- Fragment D Une Statue D Osiris ConsacreDocument11 pagesFragment D Une Statue D Osiris ConsacrePedro Hernández PostelNo ratings yet

- wst03 01 Que 20220611 1Document28 pageswst03 01 Que 20220611 1Rehan RagibNo ratings yet

- Sccan Resourcemanual Allpages Update v2Document154 pagesSccan Resourcemanual Allpages Update v2SiangNo ratings yet

- Tender InformationDocument167 pagesTender InformationComments ModeratorNo ratings yet

- Swathi Final Project AnilDocument100 pagesSwathi Final Project AnilHussainNo ratings yet

- Into Thy Word Bible Study in HebrewsDocument6 pagesInto Thy Word Bible Study in Hebrewsrichard5049No ratings yet

- Eb 12Document25 pagesEb 12SrewaBenshebilNo ratings yet

- Detailed Report On Gwadar PortDocument4 pagesDetailed Report On Gwadar PortxeninNo ratings yet

- Raga Purna Pancama: Analysis ModesDocument1 pageRaga Purna Pancama: Analysis ModesKermitNo ratings yet

- LSS Benefits of Kaizen To Business Excellence Evidence From A Case Study 2169 0316 1000251 (3197)Document15 pagesLSS Benefits of Kaizen To Business Excellence Evidence From A Case Study 2169 0316 1000251 (3197)Dasa ShelkNo ratings yet

- Low Voltage Current and Voltage Transformers PDFDocument260 pagesLow Voltage Current and Voltage Transformers PDFGustavo GamezNo ratings yet

- Shotgun StatisticsDocument1 pageShotgun Statistics-No ratings yet

- Soal BAHASA INGGRIS XIIDocument5 pagesSoal BAHASA INGGRIS XIIZiyad Frnandaa SyamsNo ratings yet

- Jiabs 26-2Document197 pagesJiabs 26-2JIABSonline100% (1)

- 1000mm BOPP Tape Coating Machine Two Color Printing 40 Speed TangerangDocument6 pages1000mm BOPP Tape Coating Machine Two Color Printing 40 Speed TangerangJaja JamaludinNo ratings yet

AC20 MIDTERM EXAMINATION FY21 22 - DGCupd

AC20 MIDTERM EXAMINATION FY21 22 - DGCupd

Uploaded by

Maricar PinedaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC20 MIDTERM EXAMINATION FY21 22 - DGCupd

AC20 MIDTERM EXAMINATION FY21 22 - DGCupd

Uploaded by

Maricar PinedaCopyright:

Available Formats

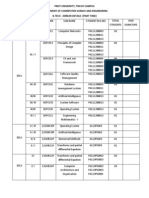

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

STUDENT NAME: SCORE RATING

SECTION:

DAY & TIME:

DATE OF EXAM:

ADVISER:

INSTRUCTIONS

• Read carefully all the questions below and write clearly.

• Final Answer should be clearly written.

Rizal Technological University 1

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

TABLE OF SPECIFICATION:

MODULE TOPICS NUMBER OF

QUESTIONS

MODULE 1 AUDIT OF CASH 6

MODULE 2 AUDIT OF ACCOUNTS RECEIVABLES 4

MODULE 3 AUDIT OF INVENTORIES 10

MODULE 4 AUDIT OF PROPERTY, PLANT AND EQUIPMENT 12

PROBLEM 1

In connection with the audit of ABC Company’s land and building accounts, you obtained the following

data:

Cash paid to purchase the land with an old building P4,500,000

Payment to tenants to vacate the building 60,000

Cost to demolish the building in the above purchase 40,000

Expenses of land survey 30,000

Expenses for search of land title 6,000

Land excavation costs 150,000

Construction permit fee 10,000

Payment to construction workers for injuries sustained (no 85,000

insurance was carried)

Temporary building to house construction workers 50,000

Construction cost 9,800,000

Interest on borrowed funds used in construction 90,000

Cost of paving parking area adjoining building. 45,000

1. How much is the cost of the land?

a. 4,636,000

b. 4,461,000

c. 4,661,000

d. 4,536,000

2. How much is the cost of the building?

a. 10,135,000

b. 10,310,000

c. 10,010,000

d. 10,260,000

PROBLEM 2

You are called upon to determine the amount of cash shortage, if any, for HIPO Company. HIPO

Company is a micro-enterprise in the buy and sell of FTWs. The owner suspects that there might be

come irregularities involving cash because of poor internal control brought about by the concentration of

functions delegated to certain company staff.

NOVEMBER 30, 2020 DECEMBER 31, 2020

Cash account balance P10,000 P?

Bank statement balance ? 103,500

Cash on hand 4,000 6,000

Checks outstanding 13,000 15,000

Bank service charges for month 100 400

NSF checks 2,000 3,000

Collections by bank from HIPO Company 55,000 70,000

customers

Rizal Technological University 2

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

Monthly bank reconciliation is prepared on a regular basis. Reconciling items are recorded in the general

journal in the month following the month covered by the bank reconciliation. Examination of bank

statements and cash records disclosed the following:

Total bank credits in December amounted to P138,000

Canceled checks and debit memos per bank statement, P101,400

Cash column of cash receipts book totaled, P80,000 in December while cash credits per cash

disbursements book totaled P92,000.

Based on the above data, determine the following:

3. The adjusted cash balance as of November 30:

a. 57,900

b. 60,900

c. 65,000

d. 62,900

4. The adjusted cash balance as of December 31:

a. 117,500

b. 114,100

c. 50,900

d. 94,500

5. The cash shortage as of November 30:

a. 7,100

b. 2,900

c. 5,000

d. Nil

6. The cash shortage as of December 31:

a. Nil

b. 23,000

c. 19,600

d. 18,000

7. What is the amount of unaccounted receipts in December?

a. Nil

b. 10,000

c. 5,000

d. 45,000

8. What is the amount unsupported disbursements in December?

a. 5,900

b. 10,100

c. 8,000

d. Nil

PROBLEM 3

The American Corp. grants its customers 30 days credit. The company uses the allowance method for

its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying

2% by the amount of credit sales for the month. At the fiscal year-end of December 31, an aging of

accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted

accordingly.

At the end of 2020 before any audit adjustments, the general ledger accounts showed balances of

accounts receivable at P1,230,000 and the allowance for bad debt of P106,000. Accounts Receivable

activity for 2020 included the following:

Credit Sales P12,800,000

Write offs 82,000

Rizal Technological University 3

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

The company’s controller prepared the following aging summary of year-end accounts receivable:

Age Group Amount Percent Collectible

0-60 days P825,000 98%

61-90 days 220,000 90%

91-120 days 50,000 70%

Over 120 days 128,000 60%

It was ascertained that P40,000 from the over 120 days accounts are absolutely worthless.

Requirements:

9. How much is the unreconciled difference between the general ledger and the subsidiary ledger

balance of accounts receivable and how should it be accounted for:

a. P7,000; GL prevails over SL, with the difference being charged against sales

b. P10,000; GL prevails over SL, with the difference being charged to bad debt expense.

c. P7,000; SL prevails over GL, with the difference being charged against sales

d. P10,000; SL prevails over GL, with the difference being charged to bad debt expense

10. How much is the total bad debt expense for 2020?

a. 304,700

b. 278,700

c. 280,700

d. 294,700

11. How much is the net realizable value of accounts receivable at December 31, 2020?

a. 1,123,000

b. 1,118,300

c. 1,094,300

d. 1,223,000

12. When there are a large number of relatively small account balances, negative confirmation of

accounts receivable is feasible if the internal control is

a. Strong and the individuals receiving the information request are unlikely to give them

adequate consideration

b. Weak and the individuals receiving the confirmation requests are unlikely to give them

adequate consideration

c. Weak and the individuals receiving the confirmation requests are likely to give them

adequate control consideration

d. Strong and the individuals receiving the confirmation requests are likely to give them

adequate consideration

PROBLEM 4

Your audit of LAVAN Restaurant which was established on July 1, 2020, disclosed that the owner started

with an investment totaling P5 million, composed of P3 million in cash from his personal funds and P2

million worth of equipment. On September 1, LAVAN restaurant borrowed P5 million from Import Bank.

The loan is due in 5 equal monthly installments beginning October 1. Interest of P100,000 applicable to

this loan was deducted in advance from principal amount.

During the year, LAVAN collected P19 million from its customers. Amount still due from corporate

customers amounted to P2 million. Purchases for kitchen supplies amounted to P18.5 million, P2.3

million of which was paid in January 2021. The restaurant operations were made at 50 % above cost.

The owner purchased a new equipment on October 1, 2020. Depreciation of P80,000 was recorded for

this equipment during the year.

Rizal Technological University 4

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

All operating expenses, including purchase of new equipment, were paid in cash.

Equipment is depreciated using the straight-line method over a five-year life taking into account a

residual value equal to 20% of the cost.

LAVAN Restaurant business operations ending December 31, 2020 showed a net income of P1.2

million.

Compute for the following:

13. Acquisition cost of the new equipment

a. 1 million

b. 2 million

c. 1.6 million

d. .8 million

14. Payment of operating expenses during 2020

a. 5,220,000

b. 5,420,000

c. 5,540,000

d. 5,460,000

15. Cash balance as of December 31, 2020

a. 240,000

b. 880,000

c. 1,440,000

d. 1,240,000

16. Inventory as of December 31, 2020

a. 9,520,000

b. 8,100,000

c. 2,200,000

d. 4,500,000

17. Total assets as of December 31, 2020

a. 11,500,000

b. 11,700,000

c. 10,500,000

d. 10,900,000

PROBLEM 5

LONELY Co started operations on September 1, 2015. LONELY’s accounts at December 31, 2018

included the following balances:

Machinery (at cost) P910,000

Accumulated depreciation – machinery 482,000

Vehicles (at cost, purchased November 21, 2017) 468,000

Accumulated depreciation – vehicles 196,560

Land (at cost, purchased October 25, 2015 810,000

Building (at cost, purchased October 25, 2015) 1,857,200

Accumulated depreciation – building 286,140

Rizal Technological University 5

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

Details of machines owned at December 31, 2018, are as follows:

Machine Purchase Date Cost Useful Life Residual Value

1 October 7, 2015 P430,000 5 years 25,000

2 February 4, 2016 P480,000 6 years 30,000

Additional information:

LOVELY calculates depreciation to the nearest month and balances the records at month-end. Recorded

amounts are rounded to the nearest peso, and the reporting date is December 31.

LOVELY uses straight-line depreciation for all depreciable assets except vehicles, which are depreciated

on the diminishing balance of 40% per annum.

The vehicles account balance reflects the total paid for two identical delivery vehicles, each of which

cost P234,000

On acquiring the land and building, LOVELY estimated the building’s useful life and residual value at 20

years and P50,000, respectively

The following transactions occurred from January 1, 2019:

2019

Jan 03 Bought a new machine (Machine 3) for a cash price of P570,000. Freight charges of P4,420 and

installation costs of P17,580 were paid in cash. The useful life and residual value were estimated at five

years and P40,000, respectively.

June 22 Bought a second-hand vehicle for P152,000 cash. Repairing costs of P6,550 and four new tires

costing P3,450 were paid in cash

Aug 28 Exchanged machine 1 for the office furniture that had a fair value of P125,000 at the date of

exchange, The fair value of machine 1 at the date of exchange was P115,000. The office furniture

originally cost P360,000 and, to the date of exchange, had been depreciated by P241,000 in the previous

owner’s books. LOVELY estimated the office furniture’s useful life and residual value at eight years and

P5,400, respectively.

Dec 31 Recorded depreciation

2020

April 30 Paid for repairs and maintenance on the machinery at a cash cost of P9,280

May 25 Sold one of the vehicles bought on November 21, 2017. For P66,000 cash.

The following transactions occurred during 2019:

1. On May 5, Asset W was sold for P78,000 cash. The company’s bookkeeper recorded this

retirement in the following manner in the cash receipts journal:

Cash 78,000

Asset W 78,000

2. On December 31, it was determined that Asset A had been used 2,100 hours during 2019.

3. On December 31, before computing depreciation expense on Asset L, the management of

Lucban decided the useful life remaining from January 1, 2019, was 10 years.

4. On December 31, it was discovered that a plant asset purchased in 2018 had been expensed

completely in the year. This asset costs P132,000 and has a useful life of 10 years and no

Rizal Technological University 6

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

salvage value. Management has decided to use the double declining balance method for this

asset, which can be referred to as Asset Y.

Requirements:

18. The 2019 depreciation expense on Asset W is

a. 17,400

b. 19,092

c. 20,880

d. 54,687

19. The gain to be recorded on the sale of Asset W is

a. 0

b. 24,600

c. 26,292

d. 28,080

20. The 2019 depreciation expense on Asset A is

a. 40,320

b. 42,840

c. 52,800

d. 58,320

21. The 2019 depreciation expense on Asset L is

a. 16,365

b. 36,000

c. 39,000

d. 51,429

22. The total depreciation expense in 2019 on the above-mentioned PPE items is

a. 191,640

b. 196,920

c. 199,920

d. 200,400

PROBLEM 6

A flood recently destroyed many of the financial records of BALLS MANUFACTURING COMPANY.

Management has hired you to re-create as much financial information as possible for a month of July.

You are able to find out the company uses an average cost inventory valuation system. You also learn

that BALLS makes a physical count at the end of each month in order to determine monthly ending

inventory values. By examining various documents, you are able to gather the following information:

Ending inventory at July 31 50,000 units

Total cost of unit available for sale in July P118,800

Cost of goods sold during July P99,000

Cost of the beginning inventory, July 1 P0.35 per unit

Gross profit on sales for July P101,000

July purchases

DATE UNITS UNIT COST

July 5 60,000 P0.40

July 11 50,000 0.41

July 15 40,000 0.42

July 16 50,000 0.45

Rizal Technological University 7

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

QUESTIONS:

23. Number of units on hand, July 1

a. 35,000

b. 41,580

c. 12,250

d. 100,000

24. Units sold during July

a. 185,000

b. 162,250

c. 250,000

d. 191,580

25. Unit cost of inventory at July 31

a. 0.506

b. 0.396

c. 0.560

d. 0.492

26. Value of inventory at July 31

a. 25,300

b. 19,800

c. 28,000

d. 24,600

27. In obtaining evidence to establish the existence of inventories, which one of the following is

unlikely to be used by the auditor?

a. Reconciliation

b. Inspection

c. Observation

d. Confirmation

PROBLEM 7

As part of your audit of receivables of JAS Corp. you performed a cut off test of sales. Results of the cut

off test revealed the following:

Recorded as Sales in December 2020

INVOICE SELLING COST TERMS SHIPMENT RECEIVED

NUMBER PRICE DATE BY

CUSTOMERS

123 18,000 16,500 FOB Shipping 12/26/2020 12/29/2020

point

124 12,500 10,200 FOB 12/26/2020 12/29/2020

destination

125 8,680 7,240 FOB 12/28/2020 01/02/2021

destination

126 14,200 12,500 Shipped to 12/29/2020 01/02/2021

consignee

127 9,000 7,500 FOB Shipping 12/30/2020 01/02/2021

point

128 10,000 7,750 FOB 12/31/2020 01/03/2021

Destination

Rizal Technological University 8

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

129 7,800 7,800 FOB Shipping 12/31/2020 01/02/2021

point

130 14,000 12,000 Shipped to 12/31/2020 01/02/2021

consignee

Recorded Sales in January 2021

INVOICE SELLING COST TERMS SHIPMENT RECEIVED

NUMBER PRICE DATE BY

CUSTOMERS

131 21,000 18,200 FOB Shipping 12/31/2020 01/03/2021

point

132 10,500 8,800 FOB 12/30/2020 01/03/2021

destination

133 4,500 3,200 FOB 01/02/2021 01/03/2021

destination

134 6,500 5,000 FOB Shipping 01/02/2021 01/05/2021

point

A count of all inventories within the premises was made in the afternoon of December 30, 2020 (after

deliveries were made for the day). The total cost of the count was recorded as inventories as of

December 31, 2020. The goods shipped to consignees are still unsold at December 31.

The unadjusted ledger shows the following:

Accounts Receivables P276,500

Inventories 425,000

Sales 1,320,000

Cost of Sales 842,000

Determine the adjusted balances of the following:

28. Accounts Receivable

a. 229,620

b. 250,620

c. 261,120

d. 289,320

29. Inventories

a. 406,800

b. 420,440

c. 429,240

d. 449,500

30. Sales

a. 1,294,120

b. 1,304,620

c. 1,322,320

d. 1,351,500

31. Cost of sales

a. 817,500

b. 828,360

c. 846,560

d. 837,760

Rizal Technological University 9

MIDTERM EXAMINATION IN AUDITING AND ASSURANCE: CONCEPTS AND 1st Sem.

APPLICATIONS PART 1 SY 21-22

32. Effect of errors to net income

a. 21,640 over

b. 21,640 under

c. 4,240 under

d. 25,880 over

Prepared by: Noted by: Approved by:

DANIEL CALAOR Prof. Rowell C. Marasigan Dr. Leonila C. Crisostomo

Rizal Technological University 10

You might also like

- Restructuring - ProblemDocument2 pagesRestructuring - ProblemMarie GarpiaNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- NumerologyDocument24 pagesNumerologyphani60% (5)

- AnswerrDocument7 pagesAnswerrLeslie Mae Vargas ZafeNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Bonds PayableDocument5 pagesBonds PayableJoseph AsisNo ratings yet

- Far-Pw 5.23Document9 pagesFar-Pw 5.23Miguel ManagoNo ratings yet

- Jamolod - Unit 1 - General Features of Financial StatementDocument8 pagesJamolod - Unit 1 - General Features of Financial StatementJatha JamolodNo ratings yet

- 1st Final Quiz Assignment QuestionnaireDocument11 pages1st Final Quiz Assignment QuestionnaireBashayer M. SultanNo ratings yet

- Problem No. 1: QuestionsDocument3 pagesProblem No. 1: QuestionsPamela Ledesma SusonNo ratings yet

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument10 pagesNfjpia Nmbe Taxation 2017 AnsjaysonNo ratings yet

- ACC12 - Auditing and Assurance Concepts and Applications 1 Midterm ExaminationDocument2 pagesACC12 - Auditing and Assurance Concepts and Applications 1 Midterm ExaminationUn knownNo ratings yet

- Share-Based Payments - 2Document13 pagesShare-Based Payments - 2Dave GoNo ratings yet

- Introduction To Financial Statement AuditDocument28 pagesIntroduction To Financial Statement AuditJnn CycNo ratings yet

- Module 5&6Document29 pagesModule 5&6Lee DokyeomNo ratings yet

- Case 2 - Chapter 9: RequiredDocument4 pagesCase 2 - Chapter 9: RequiredEricaNo ratings yet

- Module 5Document14 pagesModule 5Sittie Nihaya MangondayaNo ratings yet

- Practical Accounting 1 ReviewerDocument13 pagesPractical Accounting 1 ReviewerKimberly RamosNo ratings yet

- Northern Cpa Review Center: Auditing ProblemsDocument12 pagesNorthern Cpa Review Center: Auditing ProblemsKim Cristian MaañoNo ratings yet

- Shareholders' Equity-Contributed Capital or Paid in CapitalDocument4 pagesShareholders' Equity-Contributed Capital or Paid in CapitalJennifer AdvientoNo ratings yet

- ACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesDocument18 pagesACTG413 - Auditing in CIS Environment - Week 6 Systems Development and Program Change ActivitiesMarilou Arcillas PanisalesNo ratings yet

- IA3 Chapter 15 AnswersDocument1 pageIA3 Chapter 15 AnswersBea TumulakNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Module 1 - Fundamental Principles of Assurance EngagementsDocument10 pagesModule 1 - Fundamental Principles of Assurance EngagementsLysss EpssssNo ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- EDP Auditing SemiFinalDocument4 pagesEDP Auditing SemiFinalErwin Labayog MedinaNo ratings yet

- Chapter Six Control &AISDocument6 pagesChapter Six Control &AISAmbelu AberaNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) LawDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) LawElmer JuanNo ratings yet

- Transaction Price - Problems (1) - Sarmiento, Jefferson D.Document3 pagesTransaction Price - Problems (1) - Sarmiento, Jefferson D.jefferson sarmientoNo ratings yet

- IA2 Quiz1 (ANTIDO)Document4 pagesIA2 Quiz1 (ANTIDO)Claire Magbunag AntidoNo ratings yet

- At 9402Document14 pagesAt 9402Epfie SanchesNo ratings yet

- MAS.07 Drill Balanced Scorecard and Responsibility AccountingDocument6 pagesMAS.07 Drill Balanced Scorecard and Responsibility Accountingace ender zeroNo ratings yet

- AUDCIS Problems PrelimDocument16 pagesAUDCIS Problems PrelimLian GarlNo ratings yet

- Lesson H - 1 Ch10 Exp. Cycle Act. Tech.Document57 pagesLesson H - 1 Ch10 Exp. Cycle Act. Tech.Blacky PinkyNo ratings yet

- GovernanceDocument3 pagesGovernanceAndrea Marie CalmaNo ratings yet

- AsdasdDocument3 pagesAsdasdMark Domingo MendozaNo ratings yet

- Psa 550 FNDocument1 pagePsa 550 FNkristel-marie-pitogo-4419No ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Quiz Mid PDFDocument8 pagesQuiz Mid PDFsino akoNo ratings yet

- AT EscalaDocument18 pagesAT EscalaRaiNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- CE On Agriculture T1 AY2020-2021Document2 pagesCE On Agriculture T1 AY2020-2021Luna MeowNo ratings yet

- AudTheo Reporting Chapter 3Document58 pagesAudTheo Reporting Chapter 3Tuya Dayom100% (1)

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- Intercompany Sale of PropertyDocument6 pagesIntercompany Sale of PropertyClauie BarsNo ratings yet

- Chapter 3 Auditing Theory 15 16 RoqueDocument34 pagesChapter 3 Auditing Theory 15 16 RoqueDarlene Ventura0% (1)

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- Corruption Is The Misuse of Entrusted Power (By HeritageDocument5 pagesCorruption Is The Misuse of Entrusted Power (By HeritageJhazreel BiasuraNo ratings yet

- University of Luzon College of Accountancy Adjusting EntriesDocument91 pagesUniversity of Luzon College of Accountancy Adjusting EntriesIL MareNo ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Responsibility Accounting and Transfer PricingDocument13 pagesResponsibility Accounting and Transfer PricingNicole Andrea TuazonNo ratings yet

- Situation 8 11Document8 pagesSituation 8 11GuinevereNo ratings yet

- Prelim Exam Aud AnswersDocument5 pagesPrelim Exam Aud Answerslois martinNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- June 9-Acquisition of PPEDocument2 pagesJune 9-Acquisition of PPEJolo RomanNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- What Makes The Banking Industry A Specialized IndustryDocument3 pagesWhat Makes The Banking Industry A Specialized IndustrylalagunajoyNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Module 1 Quick Review of The Need To Study Information TechnologyDocument15 pagesModule 1 Quick Review of The Need To Study Information TechnologyMaricar PinedaNo ratings yet

- Module 3 Transactions Processing CyclesDocument25 pagesModule 3 Transactions Processing CyclesMaricar PinedaNo ratings yet

- ELEC2 - Module 7 - Other Concepts and Valuation TechniquesDocument87 pagesELEC2 - Module 7 - Other Concepts and Valuation TechniquesMaricar PinedaNo ratings yet

- AIS Module 7Document98 pagesAIS Module 7Maricar PinedaNo ratings yet

- AIS Module 8 - 11Document30 pagesAIS Module 8 - 11Maricar PinedaNo ratings yet

- 1700 Itr SampleDocument2 pages1700 Itr SampleMaricar PinedaNo ratings yet

- Module 2 The Accounting Information SystemsDocument49 pagesModule 2 The Accounting Information SystemsMaricar PinedaNo ratings yet

- Cdi Pre Board Answer KeyDocument6 pagesCdi Pre Board Answer KeyMaricar Pineda100% (1)

- Module 4 Application of The Principles of Systems Analysis DesignDocument48 pagesModule 4 Application of The Principles of Systems Analysis DesignMaricar PinedaNo ratings yet

- ELEC2 - Module 2 - Asset Based ValuationDocument27 pagesELEC2 - Module 2 - Asset Based ValuationMaricar Pineda100% (1)

- ELEC2 - Module 3 - Liquidation Value MethodDocument31 pagesELEC2 - Module 3 - Liquidation Value MethodMaricar PinedaNo ratings yet

- Criminalistics Pre Board Answer KeyDocument6 pagesCriminalistics Pre Board Answer KeyMaricar Pineda100% (5)

- AC19 MODULE 5 - UpdatedDocument14 pagesAC19 MODULE 5 - UpdatedMaricar PinedaNo ratings yet

- Ac20 Quiz 4 - DGCDocument8 pagesAc20 Quiz 4 - DGCMaricar PinedaNo ratings yet

- Case Study 3 - Volume Telemarketing CompanyDocument2 pagesCase Study 3 - Volume Telemarketing CompanyMaricar PinedaNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- ELEC2 - Module 1 - Fundamentals Principles of ValuationDocument32 pagesELEC2 - Module 1 - Fundamentals Principles of ValuationMaricar PinedaNo ratings yet

- Quiz 2 Receivables - Solution GuideDocument8 pagesQuiz 2 Receivables - Solution GuideMaricar PinedaNo ratings yet

- Ac19 Module 4 - DGCDocument19 pagesAc19 Module 4 - DGCMaricar PinedaNo ratings yet

- ELEC2 - Module 4 - Income Based ValuationDocument30 pagesELEC2 - Module 4 - Income Based ValuationMaricar Pineda100% (2)

- Case Study 4 - Kennedy GraphicsDocument2 pagesCase Study 4 - Kennedy GraphicsMaricar PinedaNo ratings yet

- Ac20 Exercise 1 Solution - DGCDocument6 pagesAc20 Exercise 1 Solution - DGCMaricar PinedaNo ratings yet

- Case Study 2 Carlson Department StoreDocument2 pagesCase Study 2 Carlson Department StoreMaricar PinedaNo ratings yet

- Ac19 Module 1 - DGCDocument10 pagesAc19 Module 1 - DGCMaricar PinedaNo ratings yet

- Ac20 Quiz 1 - DGCDocument10 pagesAc20 Quiz 1 - DGCMaricar PinedaNo ratings yet

- Alex M. Versola: Personal InformationDocument3 pagesAlex M. Versola: Personal InformationMaricar PinedaNo ratings yet

- Auditing Theory SkeletonDocument6 pagesAuditing Theory SkeletonMaricar PinedaNo ratings yet

- Sabaw Ulam Gulay Isda OthersDocument1 pageSabaw Ulam Gulay Isda OthersMaricar PinedaNo ratings yet

- End of Chapter 2 ExerciesDocument11 pagesEnd of Chapter 2 ExerciesMaricar PinedaNo ratings yet

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDocument5 pagesPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaNo ratings yet

- Chapter 2 Indian Economy 1950-1990Document27 pagesChapter 2 Indian Economy 1950-1990Ajay pandeyNo ratings yet

- Rule 19 - Conduct of Vessels in RestrictedDocument58 pagesRule 19 - Conduct of Vessels in RestrictedMitch SpeederNo ratings yet

- Orangutan ListDocument5 pagesOrangutan ListRam ChandiranNo ratings yet

- CAPEX Acquisition ProcessDocument5 pagesCAPEX Acquisition ProcessRajaIshfaqHussainNo ratings yet

- BIOLS102-UOB-Chapter 10Document8 pagesBIOLS102-UOB-Chapter 10Noor JanahiNo ratings yet

- Prist University, Trichy Campus Department of Comnputer Science and Engineering B.Tech - Arrear Details (Part Time)Document2 pagesPrist University, Trichy Campus Department of Comnputer Science and Engineering B.Tech - Arrear Details (Part Time)diltvkNo ratings yet

- Notes On Jean Piaget DeweyDocument2 pagesNotes On Jean Piaget DeweyfadzillahNo ratings yet

- A 201Document1 pageA 201AnuranjanNo ratings yet

- Chapter 04Document37 pagesChapter 04BLESSEDNo ratings yet

- Distribution Channel of AMULDocument13 pagesDistribution Channel of AMULMeet JivaniNo ratings yet

- TCS AIP Take Home AssignmentDocument16 pagesTCS AIP Take Home AssignmentShruthiSAthreyaNo ratings yet

- 5 6Document3 pages5 6Giorgi VasadzeNo ratings yet

- Historical Moroccan JewishDocument10 pagesHistorical Moroccan JewishSanduNo ratings yet

- Fragment D Une Statue D Osiris ConsacreDocument11 pagesFragment D Une Statue D Osiris ConsacrePedro Hernández PostelNo ratings yet

- wst03 01 Que 20220611 1Document28 pageswst03 01 Que 20220611 1Rehan RagibNo ratings yet

- Sccan Resourcemanual Allpages Update v2Document154 pagesSccan Resourcemanual Allpages Update v2SiangNo ratings yet

- Tender InformationDocument167 pagesTender InformationComments ModeratorNo ratings yet

- Swathi Final Project AnilDocument100 pagesSwathi Final Project AnilHussainNo ratings yet

- Into Thy Word Bible Study in HebrewsDocument6 pagesInto Thy Word Bible Study in Hebrewsrichard5049No ratings yet

- Eb 12Document25 pagesEb 12SrewaBenshebilNo ratings yet

- Detailed Report On Gwadar PortDocument4 pagesDetailed Report On Gwadar PortxeninNo ratings yet

- Raga Purna Pancama: Analysis ModesDocument1 pageRaga Purna Pancama: Analysis ModesKermitNo ratings yet

- LSS Benefits of Kaizen To Business Excellence Evidence From A Case Study 2169 0316 1000251 (3197)Document15 pagesLSS Benefits of Kaizen To Business Excellence Evidence From A Case Study 2169 0316 1000251 (3197)Dasa ShelkNo ratings yet

- Low Voltage Current and Voltage Transformers PDFDocument260 pagesLow Voltage Current and Voltage Transformers PDFGustavo GamezNo ratings yet

- Shotgun StatisticsDocument1 pageShotgun Statistics-No ratings yet

- Soal BAHASA INGGRIS XIIDocument5 pagesSoal BAHASA INGGRIS XIIZiyad Frnandaa SyamsNo ratings yet

- Jiabs 26-2Document197 pagesJiabs 26-2JIABSonline100% (1)

- 1000mm BOPP Tape Coating Machine Two Color Printing 40 Speed TangerangDocument6 pages1000mm BOPP Tape Coating Machine Two Color Printing 40 Speed TangerangJaja JamaludinNo ratings yet