Professional Documents

Culture Documents

Chap 4

Chap 4

Uploaded by

Hoàng NhiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 4

Chap 4

Uploaded by

Hoàng NhiCopyright:

Available Formats

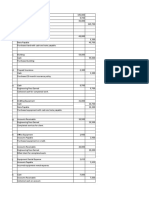

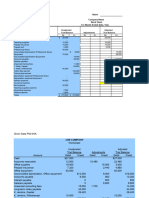

GENERAL JOURNAL

Adjusting Entries

Dr. Cr.

a. Supplies expense 5700

Supplies 5700

b. Insurance expense 3900

Prepaid Insurance 3900

c. Depreciation expense-Equipment 8500

Accumulated depreciation-Equipment 8500

d. Utilities expense 550

Accounts payable 550

e. Wages expene 1600

Wages payable 1600

f. Rent expense 200

Rent payable 200

g. Property taxes expense 900

Property taxes payable 900

h. Interest expense 240

Interest payable 240

Closing Entries

Dr. Cr.

Construction fees earned 134,000

Income summary 134,000

Income summary 94,700

Depreciation expense—Equipment 8,500

Wages expense 47,460

Interest expense 2,880

Insurance expense 3,900

Rent expense 13,400

Supplies expense 5,700

Property taxes expense 5,500

Repairs expense 2,810

Utilities expense 4,550

Income summary 39,300

S. Adams, Capital 39,300

S. Adams, Capital 30,000

S. Adams, withdrawals 30,000

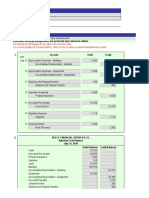

GENERAL LEDGER WORKSHEET

Unadjusted Trial Balance Adjustments

Dr. Cr. Dr.

Cash 17,500

Supplies 8,900 (a)

Prepaid insurance 6,200 (b)

Equipment 131,000

Accumulated depreciation—Equipment 25,250 (c)

Accounts payable 5,800 (d)

Interest payable - (h)

Rent payable - (f)

Wages payable - (e)

Property taxes payable - (g)

Long-term notes payable 24,000

S. Adams, Capital 77,660

S. Adams, Withdrawals 30,000

Construction fees earned 134,000

Depreciation expense—Equipment - (c) 8,500

Wages expense 45,860 (e) 1,600

Interest expense 2,640 (h) 240

Insurance expense - (b) 3,900

Rent expense 13,200 (f) 200

Supplies expense - (a) 5,700

Property taxes expense 4,600 (g) 900

Repairs expense 2,810

Utilities expense 4,000 (d) 550

Income summary 266,710 266,710 21,590

94,700 134,000 NET INCOME

39,300

WORKSHEET

Adjustments Adjusted Trial Balance Balance Sheet and Statement of Owner's Equity

Income Statement

Cr. Dr. Cr. Dr. Cr. Dr. Cr.

17,500 17,500

5,700 3,200 3,200

3,900 2,300 2,300

131,000 131,000

8,500 33,750 33,750

550 6,350 6,350

240 240 240

200 200 200

1,600 1,600 1,600

900 900 900

24,000 24,000

77,660 77,660

30,000 30,000

134,000 134,000

8,500 8,500

47,460 47,460

2,880 2,880

3,900 3,900

13,400 13,400

5,700 5,700

5,500 5,500

2,810 2,810

4,550 4,550

21,590 278,700 278,700 94,700 134,000 184,000 144,700

39,300 39,300

134,000 134,000 184,000 184,000

INCOME STATEMENT STATEMENT OF OWNER'S EQUITY

Construction Fees Earned 134,000 S. Adams, Capital, June 30 2010 52,660

Expenses: Plus:

Depreciation expense—Equipment (8,500) Additional investment by S. Adams 25,000

Wages expense (47,460) Net income 39,300

Interest expense (2,880) Less:

Insurance expense (3,900) S. Adams, Withdrawals (30,000)

Rent expense (13,400) S. Adams, Capital, June 30 2011 86,960

Supplies expense (5,700)

Property taxes expense (5,500)

Repairs expense (2,810)

Utilities expense (4,550)

NET INCOME 39,300

BALANCE SHEET

ASSETS LIAIBILITIES

Cash 17,500 Accounts payable

Supplies 3,200 Interest payable

Prepaid insurance 2,300 Rent payable

Equipment 131,000 Wages payable

Accumulated depreciation—Equipment (33,750) Property taxes payable

Long-term notes payable

TOTAL LIABILITIES

EQUITY

S. Adams, Capital

TOTAL ASSETS 120,250 TOTAL LIBILITIES & EQUITY

POST-CLOSING TRIAL BALANCE

LIAIBILITIES Dr. Cr.

6,350 Cash 17,500

240 Supplies 3,200

200 Prepaid insurance 2,300

1,600 Equipment 131,000

900 Accumulated depreciation—Equipment 33,750

24,000 Accounts payable 6,350

33,290 Interest payable 240

Rent payable 200

EQUITY Wages payable 1,600

86,960 Property taxes payable 900

Long-term notes payable 24,000

120,250 S. Adams, Capital - 86,960

TOTAL 154,000 154,000

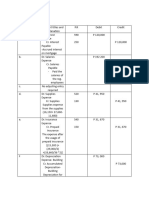

GENERAL JOURNAL

ADJUSTING ENTRIES

Dr. Cr.

a. Supplies expense 9900

Supplies 9900

b. Insurance expense 11500

Prepaid insurance 11500

c. Depreciation expense-Equipment 18000

Accumulated depreciation-Equipment 18000

d. Utilities expense 700

Accounts payable 700

e. Wages expense 2200

Wages payable 2200

f. Rent expense 5360

Rent payable 5360

g. Property taxes expense 450

Property taxes payable 450

h. Interest expense 200

Interest payable 200

CLOSING ENTRIES

Demolition fees earned 177,000

Income summary 177,000

Income summary 132,610

Depreciation expense—Equipment 18,000

Wages expense 53,600

Interest expense 2,400

Insurance expense 11,500

Rent expense 14,160

Supplies expense 9,900

Property taxes expense 8,850

Repairs expense 6,700

Utilities expense 7,500

Income summary 44,390

J. Bonair, capital 44,390

J. Bonair, capital 24,000

J. Bonair, withdrawals 24,000

GENERAL LEDGER WOR

Unadjusted Trial Balance

Dr. Cr.

Cash 9,000

Supplies 18,000

Prepaid insurance 14,600

Equipment 140,000

Accumulated depreciation—Equipment 10,000

Accounts payable 16,000

Interest payable -

Rent payable -

Wages payable -

Property taxes payable -

Long-term notes payable 20,000

J. Bonair, Capital 66,900

J. Bonair, Withdrawals 24,000

Demolition fees earned 177,000

Depreciation expense—Equipment -

Wages expense 51,400

Interest expense 2,200

Income summary Insurance expense -

132,610 177,000 Rent expense 8,800

44,390 Supplies expense -

0 Property taxes expense 8,400

Repairs expense 6,700

Utilities expense 6,800

Totals 289,900 289,900

Net Income

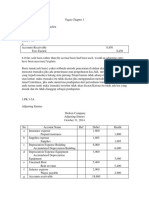

WORKSHEET

Adjustments Adjusted Trial Balance Income Statement

Balance Sheet and Statement of owner's equity

Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

9,000 9,000

(a) 9,900 8,100 8,100

(b) 11,500 3,100 3,100

140,000 140,000

(c) 18,000 28,000 28,000

(d) 700 16,700 16,700

(h) 200 200 200

(f) 5,360 5,360 5,360

(e) 2,200 2,200 2,200

(g) 450 450 450

20,000 20,000

66,900 66,900

24,000 24,000

177,000 177,000

(c) 18,000 18,000 18,000

(e) 2,200 53,600 53,600

(h) 200 2,400 2,400

(b) 11,500 11,500 11,500

(f) 5,360 14,160 14,160

(a) 9,900 9,900 9,900

(g) 450 8,850 8,850

6,700 6,700

(d) 700 7,500 7,500

48,310 48,310 316,810 316,810 132,610 177,000 184,200 139,810

44,390 44,390

177,000 177,000 184,200 184,200

INCOME STATEMENT STATEMENT OF OWNER'S EQUITY

Demolition fees earned 177,000 J. Bonair, Capital, April 30 2010

Expenses: Plus:

Depreciation expense—Equipment (18,000) Additional investment by J. Bonair

Wages expense (53,600) Net income

Interest expense (2,400) Less:

Insurance expense (11,500) J. Bonair, Withdrawals

Rent expense (14,160) J. Bonair, Capital, April 30 2011

Supplies expense (9,900)

Property taxes expense (8,850)

Repairs expense (6,700)

Utilities expense (7,500)

NET INCOME 44,390

WNER'S EQUITY BALANCE SHEET

36,900 ASSETS

Cash 9,000

30,000 Supplies 8,100

44,390 Prepaid insurance 3,100

Equipment 140,000

(24,000) Accumulated depreciation—Equipment (28,000)

87,290

TOTAL ASSETS 132,200

E SHEET POST-CLOSING TRIAL BALANCE

LIABILITIES Dr.

Accounts payable 16,700 Cash 9,000

Interest payable 200 Supplies 8,100

Rent payable 5,360 Prepaid insurance 3,100

Wages payable 2,200 Equipment 140,000

Property taxes payable 450 Accumulated depreciation—Equipment

Long-term notes payable 20,000 Accounts payable

Interest payable

Rent payable

EQUITY Wages payable

J. Bonair, Capital 87,290 Property taxes payable

TOTAL LIABILITIES & EQUITY 132,200 Long-term notes payable

J. Bonair, Capital -

TOTAL 160,200

NCE

Cr.

28,000

16,700

200

5,360

2,200

450

20,000

87,290

160,200

You might also like

- Don Casey's Complete Illustrated Sailboat Maintenance Manual: Including Inspecting the Aging Sailboat, Sailboat Hull and Deck Repair, Sailboat Refinishing, SailboFrom EverandDon Casey's Complete Illustrated Sailboat Maintenance Manual: Including Inspecting the Aging Sailboat, Sailboat Hull and Deck Repair, Sailboat Refinishing, SailboRating: 4.5 out of 5 stars4.5/5 (12)

- Aracel Engineering Completed The Following Transactions in The Month of June.Document12 pagesAracel Engineering Completed The Following Transactions in The Month of June.laale dijaan100% (1)

- Answer Key - Chapter 6 - ACCOUNTINGDocument92 pagesAnswer Key - Chapter 6 - ACCOUNTINGIL MareNo ratings yet

- Strategic Management - NU SKIN EnterpriseDocument29 pagesStrategic Management - NU SKIN EnterpriseFred Luke100% (1)

- Problem 3-5B: InstructionsDocument4 pagesProblem 3-5B: InstructionsAlba LunaNo ratings yet

- Analyze How in Responding To Financial Problems Management Accounting Can Lead Organizations To Sustainable SuccessDocument5 pagesAnalyze How in Responding To Financial Problems Management Accounting Can Lead Organizations To Sustainable SuccessThant Htet SintNo ratings yet

- Problem 3-5B: InstructionsDocument3 pagesProblem 3-5B: Instructionsselse060No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Problem 8, 9, 14Document5 pagesProblem 8, 9, 14Margarette Novem T. PaulinNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Closing Journal Entries - Post Closing Trial Balance - Sheet1Document1 pageClosing Journal Entries - Post Closing Trial Balance - Sheet1crobalde aeronNo ratings yet

- Dwidhitia Arnensy MustikaDocument3 pagesDwidhitia Arnensy MustikadNo ratings yet

- MH Associates - Group 11Document1 pageMH Associates - Group 11Storm ShadowNo ratings yet

- Uas Komp AkuntansiDocument3 pagesUas Komp AkuntansiDesy manurungNo ratings yet

- CHPTR 7 Worksheet DemoDocument1 pageCHPTR 7 Worksheet DemoParamorfsNo ratings yet

- CHAPTER 3the Adjusting Process#1Document6 pagesCHAPTER 3the Adjusting Process#1gameppass22No ratings yet

- AccountingDocument14 pagesAccountingRizwana MehwishNo ratings yet

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocument3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceMa Fe Tabasa100% (2)

- Tum CompanyDocument4 pagesTum CompanyNguyen My Khanh (K18 HCM)No ratings yet

- Siklus AkuntansiDocument15 pagesSiklus AkuntansiBachrul AlamNo ratings yet

- Problem 3-5A: InstructionsDocument2 pagesProblem 3-5A: InstructionsJEERAPA KHANPHETNo ratings yet

- Dnda Putri Nurhaliza - Tugas Chapter 3Document2 pagesDnda Putri Nurhaliza - Tugas Chapter 3dindawatanabe54No ratings yet

- Nguyen My Khanh - 25 - Mc1802Document6 pagesNguyen My Khanh - 25 - Mc1802Biên KimNo ratings yet

- General Accounting 3 - Express Handling and DeliveryDocument9 pagesGeneral Accounting 3 - Express Handling and DeliveryRheu ReyesNo ratings yet

- Homework FA1Document38 pagesHomework FA1Phương NguyễnNo ratings yet

- Chapter 4, Accounting CycleDocument23 pagesChapter 4, Accounting Cyclemuhammad.g27254No ratings yet

- Jawaban Individual AssignmentDocument3 pagesJawaban Individual AssignmentAtoy SomarNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- TT03 QuestionDocument1 pageTT03 QuestionTrinh Nguyen Linh ChiNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- Financial Statement HandoutDocument5 pagesFinancial Statement Handoutmuzamilarshad31No ratings yet

- Take Home Quiz 3Document3 pagesTake Home Quiz 3Sergio NicolasNo ratings yet

- (ANSWER) - 04 - Completing The Accounting CycleDocument9 pages(ANSWER) - 04 - Completing The Accounting CycledeltakoNo ratings yet

- E34Document9 pagesE34Nguyen Nguyen KhoiNo ratings yet

- Quijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodDocument4 pagesQuijonez Fashionables Comprehensive Prob Merchandising Solution - XLSX Direct Extension MethodzairahNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Accounting 1Document5 pagesAccounting 1afiatika ayyiNo ratings yet

- Financial StatementDocument20 pagesFinancial StatementMarielle CambaNo ratings yet

- Chapter 4Document35 pagesChapter 4Mohammad Mostafa MostafaNo ratings yet

- Corrected TB CH 2Document1 pageCorrected TB CH 2Birhanu DesalegnNo ratings yet

- Test 10-11Document2 pagesTest 10-11TIÊN NGUYỄN LÊ MỸNo ratings yet

- Assignment Questions PDFDocument3 pagesAssignment Questions PDFFahim TanvirNo ratings yet

- Trial BalanceDocument5 pagesTrial BalanceHanna Ysabelle AldeaNo ratings yet

- Assignment Week 4 Hal 205Document1 pageAssignment Week 4 Hal 205Pinarasrayan HaqueNo ratings yet

- Examination Question and Answers, Set D (Problem Solving), Chapter 2 - Analyzing TransactionsDocument2 pagesExamination Question and Answers, Set D (Problem Solving), Chapter 2 - Analyzing TransactionsJohn Carlos DoringoNo ratings yet

- Total: Net IncomeDocument4 pagesTotal: Net IncomeMohamed Abdi MohamedNo ratings yet

- Jawaban Pengantar Akuntansi KiesooDocument13 pagesJawaban Pengantar Akuntansi KiesooRazer FanaNo ratings yet

- Test 3-11Document2 pagesTest 3-11TIÊN NGUYỄN LÊ MỸNo ratings yet

- Adjusted Entries:: Dr. CRDocument2 pagesAdjusted Entries:: Dr. CRemem resuentoNo ratings yet

- Group - 4 - La Moderna - WorksheetDocument1 pageGroup - 4 - La Moderna - WorksheetJasminNo ratings yet

- Answers - Adjusting Entries AssignmentDocument5 pagesAnswers - Adjusting Entries AssignmentJames Matthew LomongoNo ratings yet

- Solution To Exercise Set Chapter 3-4Document22 pagesSolution To Exercise Set Chapter 3-4Pham Le Tram Anh (K16HCM)No ratings yet

- Solution To Exercise Set Chapter 3 4Document22 pagesSolution To Exercise Set Chapter 3 4jennibonilla19No ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Acc HWDocument5 pagesAcc HWHasan NajiNo ratings yet

- Seatwork No. 2 (Sanguine) AnswerDocument1 pageSeatwork No. 2 (Sanguine) AnswerJohn Paul Cristobal0% (1)

- Jay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFDocument4 pagesJay Cesar System Developer Worksheet DECEMBER 31 2019 Unadjusted Trial Balance REFAdam CuencaNo ratings yet

- POA Summer 2020 - Tut 3 ExerciseDocument13 pagesPOA Summer 2020 - Tut 3 ExerciseNguyen Dinh Quang MinhNo ratings yet

- Chapter 5 Quiz-AnswerDocument4 pagesChapter 5 Quiz-AnswerkakaoNo ratings yet

- Audel Guide to the 2005 National Electrical CodeFrom EverandAudel Guide to the 2005 National Electrical CodeRating: 4 out of 5 stars4/5 (1)

- Job Ready Program - Employment Confirmation FormDocument2 pagesJob Ready Program - Employment Confirmation FormrajvirNo ratings yet

- Aavin ProjectDocument42 pagesAavin ProjectlittlemagicpkNo ratings yet

- 5.8 QA-QC OrganisationChartDocument44 pages5.8 QA-QC OrganisationChartFahim AfrozeNo ratings yet

- Supply Chain ManagementDocument26 pagesSupply Chain ManagementLinh LêNo ratings yet

- Airbnb PDFDocument22 pagesAirbnb PDFABHISHEKNo ratings yet

- FX Trader of The Year Contest 2008: More Than 650 Participants RegisteredDocument1 pageFX Trader of The Year Contest 2008: More Than 650 Participants RegisteredRaja RajNo ratings yet

- Service Blueprint: LaptopDocument2 pagesService Blueprint: LaptopRida KhanNo ratings yet

- Hotjurist: Notes ofDocument16 pagesHotjurist: Notes ofSNLTNo ratings yet

- Consumer Protection in NepalDocument19 pagesConsumer Protection in NepalsauravNo ratings yet

- A. Make Key Decisions OnlyDocument3 pagesA. Make Key Decisions OnlyKath LeynesNo ratings yet

- Principles of Marketing-Q1-M1Document32 pagesPrinciples of Marketing-Q1-M1Graciously ElleNo ratings yet

- BAM Quiz 04Document4 pagesBAM Quiz 04Dabbu BaruaNo ratings yet

- Case3-Social Entrepreneurs-Green TrashDocument6 pagesCase3-Social Entrepreneurs-Green TrashBlue CliffNo ratings yet

- Topic: Investment Analysis: About Aditya Birla Money LimitedDocument3 pagesTopic: Investment Analysis: About Aditya Birla Money LimitedRaja ShekerNo ratings yet

- Write A Systematic Literature Review With Citations On The Challenges of Construction Contract Management in Public Building Onstruction Projects in Developing CountriesDocument3 pagesWrite A Systematic Literature Review With Citations On The Challenges of Construction Contract Management in Public Building Onstruction Projects in Developing CountriesChina AlemayehouNo ratings yet

- EMBA 2022-Apr 02 Till Apr 27, 2022-Module-V Sec2Document8 pagesEMBA 2022-Apr 02 Till Apr 27, 2022-Module-V Sec2MASPAKNo ratings yet

- Case Study 2Document3 pagesCase Study 2cherri blos59No ratings yet

- Factors Affecting Managerial DecisionDocument2 pagesFactors Affecting Managerial DecisionJao MatiasNo ratings yet

- Ril Pe Price DT.01.02.2019Document89 pagesRil Pe Price DT.01.02.2019Akshat Engineers Private LimitedNo ratings yet

- Spa Form Marlene BeofDocument2 pagesSpa Form Marlene BeofDMCI HOMES Property and Real Estate InvestmentNo ratings yet

- Orientation Ac1201Document10 pagesOrientation Ac1201gel hannaNo ratings yet

- TMBI vs. MitsuiDocument2 pagesTMBI vs. MitsuiMaria Lopez100% (1)

- Managerial Leadership Final Presentation: How The Mighty Fall and Why Some Companies Never Give in by Jim CollinsDocument14 pagesManagerial Leadership Final Presentation: How The Mighty Fall and Why Some Companies Never Give in by Jim CollinsSyeda Azka AliNo ratings yet

- 13 Forces AnalysisDocument5 pages13 Forces AnalysisJACA, John Lloyd B.No ratings yet

- Ford Case Study (Brief)Document2 pagesFord Case Study (Brief)Anoop Koshy100% (1)

- FORM A Application For Registration of A SocietyDocument2 pagesFORM A Application For Registration of A SocietyFredrick OdephNo ratings yet

- CH 3 - Capital Employed and Invested CapitalDocument9 pagesCH 3 - Capital Employed and Invested Capital李承翰No ratings yet

- StorageDocument70 pagesStorageRajendra ChaudharyNo ratings yet