Professional Documents

Culture Documents

Unit 6 Small Business-2-1

Unit 6 Small Business-2-1

Uploaded by

AkasaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 6 Small Business-2-1

Unit 6 Small Business-2-1

Uploaded by

AkasaCopyright:

Available Formats

SMALL BUSINESS 2

Procedure of registration as a Small Scale Industry (SSI)

One of the advantages of small scale industries is that they are more flexible to adapt to changes to the

new method of production, the introduction of new products, etc. Small scale units as compared to large

scale units are more change susceptible and highly reactive and responsive to socio-economic conditions.

The objective of small scale industries is to adapt to the latest technology and to produce better quality

products at lower costs.

Even in this type of business, registration is voluntary and not compulsory. But, its registration with the

State Directorate or Commissioner of industries or DIC’s makes the unit eligible for availing different

types of Government assistance like financial assistance from the Department of Industries, medium and

long terms loans from State Financial Corporations and other commercial banks, machinery on hire-

purchase basis from the National Small Industries Corporation, etc.

In the registration of SSI/MSME there are two types of certificates provided by the authorities, initially

provisional registration certificate is given to the companies which is valid for five years. It is given for

pre-operative period and after that a permanent registration certificate is given in perpetuity.

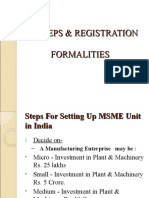

There are three slabs which are prescribed under MSME Act to define an enterprise:

Manufacturing Enterprises

Type of Service Industry

No. (Investment in Plant and

Enterprise (Investment in equipment)

Machinery)

Does not exceed Rs. 10

1. Micro Does not exceed Rs. 25 Lakh

Lakh

Exceeds Rs. 25 Lakh but does not Exceeds Rs. 25 Lakh but

2. Small

exceed Rs. 5 Crore does not exceed Rs. 5 Crore

Exceeds Rs. 5 Crore but does not Exceeds Rs. 2 Crore but

3. Medium

exceed Rs. 10 Crore does not exceed Rs. 5 Crore

The registration for a medium enterprise which is engaged in manufacturing is necessary to be registered

for other enterprises registration is optional.

PROCEDURE FOR REGISTRATION

Eligibility: All Micro & Small Enterprises which are registered with the Director of Industries

(DI)/District Industries Centre (DIC) as manufacturing/service enterprises or having Acknowledgement of

Entrepreneurs Memorandum (EM Part-II) are eligible for registration with NSIC under its Single Point

Registration Scheme (SPRS).

Compiled by Ca. A.N. Arsiwala Page 1

Micro & Small Enterprises who have already commenced their commercial production but not completed

one year of existence. The Provisional Registration Certificate can be issued to such Micro & Small

Enterprises under Single Point Registration scheme with monitory limit, minimum amount of money to

be invested, of Rs. 5 Lacs which shall be valid for the period of one year only from the date of issue after

levying the registration fee and obtaining the requisite documents.

How to apply: Micro and Small enterprises could be applied through online application that is provided

by the prescribed state website(State website’s of thou are applying for registration) respective state in

which or by submitting the application form in duplicate which is to be submitted the concerned

Zonal/Branch Office of NSIC located nearest to the unit.

Procedure:

Step 1: Provisional Small Scale Industry (SSI) Registration

To obtain SSI registration you must apply for provisional SSI registration certificate. This certificate is

given when the unit is in pre-operative stage and helps SSI unit obtain term loans and working capital.

This license is given for five years.

One could apply for this certificate online through the state website or by applying in the concerned zonal

department.

Important Documents for Provisional SSI registration:

Three passport size photographs of proprietors/partners/directors, as the case may be.

Photocopy of the partnership deed in case of a partnership unit. It is not necessary that the

partnership should be registered under the partnership Act.

Copy of the Memorandum and Articles of Association in case of Private Company along with

certificate of incorporation. Copy of the resolution of the company authorising one of the

Directors of the company to sign the application form and also appear for the interview.

Proof of legal possession i.e. rent receipt, NOC from the landlord with proof of ownership,

the power load authorised by the connection holder to the applicant

Provisional Registration would be allowed in approved Industrial areas only after the Unit has

obtained consent to establish from Delhi Pollution Control Committee

Some of the documents may differ because each state has different requirements of

documents. Above given documents are minimum required documents which are to be

submitted

Benefits of Provisional SSI registration

Material for construction of factory building : The material which is needed for construction of

the factory or building would be available to the factory at subsidized rates from government

Apply for Municipal Corporation License & power connection. With the provisional registration

the company would be able to get all the clearances from the concerned authorities.

Step 2: Start the Business

Compiled by Ca. A.N. Arsiwala Page 2

The next step towards having a permanent license is to start the business with SSI certificate. The owner

should start the production in the factory so that permanent licence could be given.

Step 3: Apply for Permanent SSI registration

After you have started the business you should apply for permanent SSI registration. This could be done

by applying online through state website or through the Zonal office or district office of the department.

Requirements for applying PRC(Permanent Registration Certificate)

You may apply for the PRC without an industrial license in case your unit is listed in Schedule-III

of the Industrial Licensing Exemption Notification. Other units must first acquire an industrial

license.

The unit should have obtained all clearances from the pollution control board, drug control board

etc.

The unit should not violate any locational restriction

The original value of plant including machinery should be within prescribed limits for which you

are applying.

The unit should not be a subsidiary, owned or controlled by another industrial undertaking.

Documents which are to be submitted for applying in

Proof of ownership of premises i.e. allotment letter/possession letter/lease Deed/property tax

receipt. If the unit has a municipal corporation license in its own name or in the name of its

proprietor or one of the Partner/Directors as the case may be, then no other proof of legal

possession is required.

In case premises are arranged on rental basis, unit should submit proof of Legal possession i.e. a

rent receipt and/or NOC from the landlord supported by the proof of land lord’s ownership. For

this purpose rent receipt/rent agreement with GPA (General Power of Attorney) is also accepted

provided the GPA is appointed by the owner/lessee through a Regd. deed.

One photo copy of sale bill of each end product applied for.

One photo copy of purchase bill of each raw material.

Copy of partnership deed in case of partnership unit (this need not be registered.)

Copy of Memorandum of Articles of Association with certificate of incorporation in case of

private limited company (in case of any change of Directors subsequently, copy of resolution and

intimation in form No.32)along with copy of resolution authorising one of the directors to sign

the application for grant of permanent SSI registration.

Copy of the industrial license from Govt. of India in case the end products require such license

under Industrial Development and Regulation Act.1951.

Compiled by Ca. A.N. Arsiwala Page 3

An affidavit on Rs.10/- Non judicial Stamp Paper duly attested by Notary Public affixed with

proper notarial Stamp giving the status of the unit, machinery installed, power requirement etc. as

per the prescribed format

Purchase bill of machinery installed.

Photo copy of valid consent letter from pollution control committee of that state.

Benefits for having a permanent SSI registration

Tax Benefits: Depending on your business, you may enjoyExcise Exemption Scheme as well as

exemption from certain Direct Taxes in the initial years of your business.

Availability of raw material depending on existing policy: Raw material for production would be

given by the government in the initial years at subsidized rates.

Benefits from Banks: All banks and other financial institutions recognise MSMEs and have

created special schemes for them. This usually includes priority sector lending, which means that

the likelihood of your business being sanctioned a loan is high, and lower bank interest rates.

There may also be preferential treatment in case of delay in repayment.

Benefits from State Governments: Most states offer those who’ve registered under the MSMED

Act subsidies on power, taxes and entry to state-run industrial estates. In particular, there is a

sales tax exemption in most states and purchase preference on goods p

Time taken for SSI or MSME registration ranges between 5 to 20 days depending on the state in which

the industry is located in.

State website for Provisional SSI registration

Maharashtra:http://dcmsme.gov.in/publications/forms/SetingNewSSIForms/applyprv.html

Advantages of SSI

1. Potential for large employment: Small Scale Industries have potential to create employment

opportunities on a massive scale. They are labor intensive in character. They use more labor than other

factors of production. They can be set up in short time and can provide employment opportunities to more

number of people. This is important for a labor abundant country like India.

2. Requirement of less capital: Small Scale Industries require less capital when compared to large scale

industries. India is a capital scarce country and therefore Small Scale Industries are more suitable in the

Indian context. They can be started and run by small entrepreneurs who have limited capital resources

3. Contribution to industrial output: Products manufactured by Small Scale Industries form a

significant portion of the industrial output of the country. They produce a number of consumer goods as

well as industrial components in large quantities and satisfy the needs of consumers. The consumer goods

produced by Small Scale Industries are cheaper and satisfy the requirements of the poorer sections.

Compiled by Ca. A.N. Arsiwala Page 4

4. Contribution to exports: Small Scale Industries contribute nearly 40 per cent to the industrial exports

of the country. Products such as hosiery, knitwear, hand loom, gems and jewellery, handicrafts, coir

products, textiles, sports goods, finished leather, leather products, woolen garments, processed food,

chemicals and allied products and a large number of engineering goods produced by the SSI sector

contribute substantially to India’s exports. Further products produced by Small Scale Industries are used

in the manufacture of products manufactured and exported by large scale industries. Therefore they

contribute both directly and indirectly to exports and earn valuable foreign exchange.

5. Earning foreign exchange: Small Scale Industries earn valuable foreign exchange for the country by

exporting products to different countries of the world. At the same time, their imports are very little and

so there is less foreign exchange outgo. Therefore Small Scale Industries are net foreign exchange

earners. For e.g. Small Scale Industries in Tiruppur contribute to a substantial portion of India’s textile

exports and earn valuable foreign exchange for the country.

6. Equitable distribution: Large scale industries lead to inequalities in income distribution and

concentration of economic power. But small scale industries distribute resources and wealth more

equitably. It is because income is distributed among more number of workers since it is labor intensive.

This results in both economic and social welfare.

7. Use of domestic resources: Small Scale Industries use locally available resources in a productive

manner which would have otherwise gone waste. Small amounts of savings which would have remained

idle is channelized into setting up of small enterprises. This increases capital formation and investment in

the economy.

8. Opportunities for entrepreneurship: Small Scale Industries provide opportunities for entrepreneurs

with limited capital. Setting up of an SSI requires less capital and lower investment in technology and

machines when compared to large scale enterprises. Therefore small entrepreneurs car start Small Scale

Industries easily and succeed. Japan which was devastated by the Second World War became a major

economic power because of many small entrepreneurs, who contributed greatly to the nation’s

development.

9. Cost efficiency: Small scale units can adopt lean production method. which offer better quality and

more variety at a lower cost. They can bi more cost efficient when compared to large scale units because

their expenses are lower.

10. Reducing migration: Migration happens when people living in rural areas are not able to find

employment and therefore migrate to urban areas seeking employment. Large scale migration puts

tremendous pressure on land, water and other resources in urban areas leading to poor quality of life.

Small Scale Industries use the skills and talents of rural craftsmen, artisans etc. They provide gainful

employment to those with inherited skills resulting in their economic upliftment. Thus Small Scale

Industries help in reducing migration.

11. Suitable for non-standardized products: Large scale enterprises are suitable for manufacturing

standardized products on a large scale whereas Small Scale Industries are more suitable for manufacturing

non-standardized products.

Compiled by Ca. A.N. Arsiwala Page 5

12. Flexibility in operation: Small scale enterprises are more flexible. They can adapt themselves to

changing market requirements very fast and benefit from new opportunities.

13. Quick decisions: Since the enterprise is small and there is not much hierarchy, quick decisions.can be

taken. Quick decisions are helpful in solving problems in the initial stages and also to exploit market

opportunities.

14. Adaptability to change: Small Scale Industries can understand the changing requirements of the

customers and adapt themselves much quickly. They can change their procedures, methods and

techniques faster and cater to new requirements of their customers.

15. Small market size: In case the market size is small, producing products on a large scale would not be

feasible. In such cases, Small Scale Industries are more suitable since they produce limited quantities.

16. Customization: Today customers prefer products tailored to their specific needs. They demand

unique products. In such cases where products have to be customized to individual customer needs large

scale production would not be suitable. Small Scale Industries are better suited in case products have to be

customized.

17. Low social costs: In the case of large scale enterprises, society has to incur high social costs in terms

of air and water pollution and environmental degradation. But in the case of small enterprises, such social

costs are less.

18. Opportunity for talent: Small Scale Industries provide opportunity for talented individuals who do

not have huge funds, to start enterprises on a small scale. Dhirubhai Ambani of Reliance, Karsanbhai

Patel of Nirma, Brij Mohan Munjal of Hero Honda, Venugopal Dhoot of Videocon, Sunil Mittal of Bharti

Enterprises (Airtel), Narayanamurthy and his co-promoters of Infosys, Ramalinga Raju of Satyam are all

examples of entrepreneurs who started their business on a small,scale, and through intelligence,

determination and commitment have transformed their small companies into large world class players.

19. Lesser industrial disputes: In large scale enterprises workers are more organized and in many large

scale enterprises there are strong trade unions. The trade unions fight for the workers rights. If the

management fails to accept the demands of the trade unions, the trade unions gherao the management,

adopt go slow tactics and strike work. But in small scale enterprises, workers are not well organized and

union activity is less. So there is very little possibility of industrial disputes to occur.

20. Personal contact with employees: Businesses engaged in small scale production have less number of

employees. It is easy to maintain personal contact with employees. Grievances and problems would be

known immediately and solved. Therefore there is very little possibility of any industrial dispute.

21. Personal contact with customers: The number of customers is limited and the small scale

entrepreneur would be directly involved in the business. Personal contact can be maintained with

customers. Their needs and requirements can be understood and satisfied. This results in satisfied

customers leading to stable demand.

Compiled by Ca. A.N. Arsiwala Page 6

22. Self interest: Small business is generally run by the sole proprietor of the business. He earns all and

risks all. Self interest act as a strong motivator. Therefore he would put in his best efforts to make the

business a success.

Problems faced by SSI in India

Small Scale Industries do not enjoy much of the advantages enjoyed by large scale enterprises because of

their nature and size. Though they have made significant contribution to economic development, they

have not realized their full potential. They face many problems in their functioning and many Small Scale

Industries are sick.

The government had reserved certain items for exclusive production by Small Scale Industries. Large

scale enterprises were not allowed to produce the items which were reserved for the SSI sector. With the

opening up of the economy and following the principles of liberalization and globalization, many items

have been successively De-reserved. Therefore Small Scale Industries have to now counter the twin

forces of competition from Indian large scale enterprises as well as foreign competitors.

PROBLEMS FACED BY SMALL SCALE INDUSTRIES

The following are the problems faced by Small Scale Industries:

1. Poor capacity utilization: In many of the Small Scale Industries, the capacity utilization is not even

50% of the installed capacity. Nearly half of the machinery remains idle. Capital is unnecessarily locked

up and idle machinery also occupies space and needs to be serviced resulting in increased costs.

2. Incompetent management: Many Small Scale Industries are run in an incompetent manner by poorly

qualified entrepreneurs without much skill or experience. Very little thought has gone into matters such as

demand, production level and techniques, financial availability, plant location, future prospects etc.

According to one official study, the major reason for SSI sickness is deficiency in project Management

i.e., inexperience of promoters in the basic processes of production, cash flow etc

3. Inadequate Finance: Many Small Scale Industries face the problem of scarcity of funds. They are not

able to access the domestic capital market to raise resources. They are also not able to tap foreign markets

by issuing ADR’s (American Depository Receipts) GDR’s (Global Depository Receipts) etc because of

their small capital base. Banks and financial institutions require various procedures and formalities to be

completed. Even after a long delay, the funds allocated are inadequate.

Bank credit to the small scale sector as a percentage of total credit has been declining. It fell from 16% in

1999 to 12.5% in 2002. Small Scale Industries are not able to get funds immediately for their needs. They

have to depend on private money lenders who charge high interest. Finance, as a whole, both long and

short term, accounts for as large as 43% of the sector’s sickness.

4. Raw material shortages: Raw materials are not available at the required quantity and quality. Since

demand for raw materials is more than the supply, the prices of raw materials are quite high which pushes

up the cost. Scarcity of raw materials results in idle capacity, low production, inability to meet demand

and loss of customers.

Compiled by Ca. A.N. Arsiwala Page 7

5. Lack of marketing support: Small Scale Industries lack market knowledge with regard to

competitors, consumer preferences, market trends. Since their production volume is small and cannot

meet demand for large quantities their market is very restricted. Now with the process of liberalization

and globalization they are facing competition from local industries as well as foreign competitors who sell

better quality products at lower prices. For e.g. heavily subsidized but better quality imports from China

has made most of the Indian SSI units producing toys, electronic goods, machine tools, chemicals, locks

and paper etc., unviable.

6. Problem of working capital: Many Small Scale Industries face the problem of inadequate working

capital. Due to lack of market knowledge their production exceeds demand, and capital gets locked in

unsold stock. They do not have enough funds to meet operational expenses and run the business.

7. Problems in Export: They lack knowledge about the export procedures, demand patterns, product

preferences, international currency rates and foreign buyer behavior. Small Scale Industries are not able to

penetrate foreign markets because of their poor quality and lack of cost competitiveness. In countries like

Taiwan, Japan etc. products produced by Small Scale Industries are exported to many foreign countries.

But in India not much thought and focus has gone into improving the export competitiveness of Small

Scale Industries.

8. Lack of technology up-gradation: Many Small Scale Industries still use primitive, outdated

technology leading to poor quality and low productivity. They do not have adequate funds, skills or

resources to engage in research and development to develop new technologies. Acquiring technology

from other firms is costly. Therefore Small Scale Industries are left with no choice but to continue with

their old techniques.

9. Multiplicity of labor laws: One of the merits of Small Scale Industries are that they are labor intensive

and can provide employment to a large number of people. But the multiplicity of labor laws, need to

maintain several records (PF, ESI, Muster Rolls etc), fines and penalties for minor violations etc place

Small Scale Industries at a great disadvantage.

10. Delayed payments: Small Scale Industries buy raw materials on cash but due to the intense

competition have to sell their products on credit. Buying on cash and selling on credit itself places a great

strain on finances. The greater problem is payments are delayed, sometimes even by 6 months to one

year. It is not only the private sector but even government departments are equally guilty. Delayed

payments severely impact the survival of many Small Scale Industries.

11. Poor industrial relations: Many Small Scale Industries are not able to match the pay and benefits

offered by large enterprises, because their revenues and profitability are low and also uncertain. This

leads to labor problems. Employees fight for higher wages and benefits which the SSI is not able to

provide. This may lead to strikes, resulting in damage to property in case of violence by employees,

production losses etc.

12. Lack of awareness: The government has set up many organizations to support and provide assistance

to Small Scale Industries. But, many of the entrepreneurs running Small Scale Industries are not aware of

the various support services.

Compiled by Ca. A.N. Arsiwala Page 8

Institutional support to SSI

The Indian government has been supporting and developing small unit sectors. India is focusing on rural

industries and cottage industries. According to layman’s language, a small business is a project or venture

that requires a small budget or is run by small group of people.

Both central and state government have been emphasizing more on self-employment opportunities in

rural sectors by providing help and support in financing in terms of loans, training in terms of programs,

infrastructure, raw materials and technology.

The core purpose of the government is to utilise the local manpower and locally available resources.

Which are further transformed into action by local departments, agencies, corporations, etc. The support

of small industries include:

Institutional Support

1. National Bank for Agriculture and Rural Development (NABARD)

NABARD established by the government in 1982 to give action and to promote the rural industries. It has

adopted multi-purpose strategies in promoting in rural business in India. It supports small industries, rural

artisans, rural industries, cottage industries along with agriculture. Also, it sets up training and

counselling plus it gives development programmes for rural entrepreneurs.

2. A Rural Small Business Development Centre (RSBDC)

RSBDC is a government centre sponsored by NABARD for micro, small and medium businesses which

is set up by world organization. The primary purpose of RSBDC is to work for socially and financially

disadvantaged people and groups. RSBDC does many programmes on skill up gradation,

entrepreneurship, awareness, counselling and training.

These programmes motivate various unemployed youth and young women learn different trades and

introduce them to other good benefits from it.

3. National Small Industries Corporation (NSIC)

NSIC was set up in 1995 by the government to popularize and support small businesses focusing on

commercial aspects. The important functions of NSIC are:

Supply imported goods and machine on hire purchase agreement.

Procurement of supply imported indigenous raw materials.

Developing small business by importing their products.

Supervising services.

Awareness on technical up gradation.

Also, a new scheme called performance and credit rating for small units have been started by NSIC, this

ensures that the more their credit rating, the more their financial assistance for their investment and

capital requirement.

Compiled by Ca. A.N. Arsiwala Page 9

4. Small Industries Development Bank of India (SIDBI)

It is a top government bank to provide direct and indirect financial support under various schemes to meet

credit requirements of various small businesses.

5. The National Commission for Enterprises in the Unorganised Sector (NCEUS)

NCEUS was formed in the September 2004 by the government with objectives:

Measures to improve the productivity of small industries in the informal sector.

Generation of employment in the rural sector.

Creating links between small sector and finance, infrastructure, raw materials and technology.

To create public and private partnerships for engagement in imparting skills for the informal

sector.

Providing micro-finance for the informal sector.

Providing social security for the informal sector.

To introduce competition of small scale in a global environment.

6. Rural and Women Entrepreneurship Development (RWED)

This is a government organisation that focuses to raise the business environment for women and to

support women’s business initiatives. It provides manual for training in entrepreneurship and renders

advisory services.

7. World Association for Small and Medium Enterprises (WASME)

WASME is an international body that is nongovernmental organisation of micro, small and medium

business units in India which establish an international committee and focus on rural development and

apply action plan model for sustained growth of rural industries.

8. Scheme of Funds for Re-generation of Traditional Industries

From 2005, the government established a fund to support these traditional small industries and to

facilitate higher productivity and to enhance their growth and development.

Government Policies for Development and Promotion of Small-Scale Industries in India

Some of the Government Policies for development and promotion of Small-Scale Industries in India are:

1. Industrial Policy Resolution (IPR) 1948, 2. Industrial Policy Resolution (IPR) 1956, 3. Industrial Policy

Resolution (IPR) 1977, 4. Industrial Policy Resolution (IPR) 1980 and 5. Industrial Policy Resolution

(IPR) 1990.

Since Independence, India has several Industrial Policies to her credit. So much so that Lawrence A. Veit

tempted to say that “if India has as much industry as it has industrial policy, it would be a far well-to-do

nation.” With this background in view, in what follows is a review of India’s Industrial Policies for the

development and promotion of small-scale enterprises in the country.

Compiled by Ca. A.N. Arsiwala Page 10

1. Industrial Policy Resolution (IPR) 1948: The IPR, 1948 for the first time, accepted the importance of

small-scale industries in the overall industrial development of the country. It was well realized that small-

scale industries are particularly suited for the utilization of local resources and for creation of employment

opportunities.

However, they have to face acute problems of raw materials, capital, skilled labour, marketing, etc. since

a long period of time. Therefore, emphasis was laid in the IPR, 1948 that these problems of small-scale

enterprises should be solved by the Central Government with the cooperation of the State Governments.

In nutshell, the main thrust of IPR 1948, as far as small-scale enterprises were concerned, was

‘protection.’

2. Industrial Policy Resolution (IPR) 1956: The main contribution of the IPR 1948 was that it set in the

nature and pattern of industrial development in the country. The post-IPR 1948 period was marked by

significant developments taken place in the country. For example, planning has proceeded on an

organised manner and the First Five Year Plan 1951-56 had been completed. Industries (Development

and Regulation) Act, 1951 was also introduced to regulate and control industries in the country.

The parliament had also accepted ‘the socialist pattern of society’ as the basic aim of social and economic

policy during this period. It was this background that the declaration of a new industrial policy resolution

seemed essential. This came in the form of IPR 1956.

The IPR 1956 provided that along with continuing policy support to the small sector, it also aimed at to

ensure that decentralised sector acquires sufficient vitality to self-supporting and its development is

integrated with that of large- scale industry in the country. To mention, some 128 items were reserved for

exclusive production in the small-scale sector.

Besides, the Small-Scale Industries Board (SSIB) constituted a working group in 1959 to examine and

formulate a development plan for small-scale industries during the, Third Five Year Plan, 1961-66. In the

Third Five Year Plan period, specific developmental projects like ‘Rural Industries Projects’ and

‘Industrial Estates Projects’ were started to strengthen the small-scale sector in the country. Thus, to the

earlier emphasis of ‘protection’ was added ‘development.’ The IPR 1956 for small-scale industries aimed

at “Protection plus Development.” In a way, the IPR 1956 initiated the modem SSI in India.

3. Industrial Policy Resolution (IPR) 1977: During the two decades after the IPR 1956, the economy

witnessed lopsided industrial development skewed in favour of large and medium sector, on the one hand,

and increase in unemployment, on the other. This situation led to a renewed emphasis on industrial

policy. This gave emergence to IPR 1977.

The Policy Statement categorically mentioned:

“The emphasis on industrial policy so far has been mainly on large industries, neglecting cottage

industries completely, relegating small industries to a minor role. The main thrust of the new industrial

policy will be on effective promotion of cottage and small-scale industries widely dispersed in rural areas

and small towns. It is the policy of the Government that whatever can be produced by small and cottage

industries must only be so produced.”

The IPR 1977 accordingly classified small sector into three broad categories:

Compiled by Ca. A.N. Arsiwala Page 11

1. Cottage and Household Industries which provide self-employment on a large scale.

2. Tiny sector incorporating investment in industrial units in plant and machinery up to Rs. 1 lakh and

situated in towns with a population of less than 50,000 according to 1971 Census.

3. Small-scale industries comprising of industrial units with an investment of upto Rs. 10 lakhs and in

case of ancillary units with an investment up to Rs. 15 lakhs.

The measures suggested for the promotion of small-scale and cottage industries included:

i) Reservation of 504 items for exclusive production in small-scale sector.

ii) Proposal to set up in each district an agency called ‘District Industry Centre’ (DIC) to serve as a

focal point of development for small-scale and cottage industries. The scheme of DIC was

introduced in May 1978. The main objective of setting up DICs was to promote under a single

roof all the services and support required by small and village entrepreneurs.

What follows from above is that to the earlier thrust of protection (IPR 1948) and development (IPR

1956), the IPR 1977 added ‘promotion’. As per this resolution, the small sector was, thus, to be

‘protected, developed, and promoted.’

4. Industrial Policy Resolution (IPR) 1980: The Government of India adopted a new Industrial Policy

Resolution (IPR) on July 23, 1980. The main objective of IPR 1980 was defined as facilitating an increase

in industrial production through optimum utilization of installed capacity and expansion of industries.

As to the small sector, the resolution envisaged:

i) Increase in investment ceilings from Rs. 1 lakh to Rs. 2 lakhs in case of tiny units, from Rs. 10

lakhs to Rs. 20 lakhs in case of small-scale units and from Rs. 15 lakhs to Rs. 25 lakhs in case of

ancillaries.

ii) Introduction of the concept of nucleus plants to replace the earlier scheme of the District Industry

Centres in each industrially backward district to promote the maximum small-scale industries

there.

iii) Promotion of village and rural industries to generate economic viability in the villages well

compatible with the environment.

Thus, the IPR 1980 reimphasised the spirit of the IPR 1956. The small-scale sector still remained the best

sector for generating wage and self-employment based opportunities in the country.

5. Industrial Policy Resolution (IPR) 1990: The IPR 1990 was announced during June 1990. As to the

small-scale sector, the resolution continued to give increasing importance to small-scale enterprises to

serve the objective of employment generation.

The important elements included in the resolution to boost the development of small-scale sector

were as follows:

(i) The investment ceiling in plant and machinery for small-scale industries (fixed in 1985) was raised

from Rs. 35 lakhs to Rs. 60 lakhs and correspondingly, for ancillary units from Rs. 45 lakhs to Rs. 75

lakhs.

Compiled by Ca. A.N. Arsiwala Page 12

(ii) Investment ceiling for tiny units had been increased from Rs. 2 lakhs to Rs. 5 lakhs provided the unit

is located in an area having a population of 50,000 as per 1981 Census.

(iii) As many as 836 items were reserved for exclusive manufacture in small- scale sector.

(iv) A new scheme of Central Investment Subsidy exclusively for small-scale sector in rural and

backward areas capable of generating more employment at lower cost of capital had been mooted and

implemented.

(iv) With a view, to improve the competitiveness of the products manufactured in the small-scale sector;

programmes of technology up gradation will be implemented under the umbrella of an apex Technology

Development Centre in Small Industries Development Organisation (SIDO).

(v) To ensure both adequate and timely flow of credit facilities for the small- scale industries, a new apex

bank known as ‘Small Industries Development Bank of India (SIDBI)’ was established in 1990.

(vi) Greater emphasis on training of women and youth under Entrepreneurship Development Programme

(EDP) and to establish a special cell in SIDO for this purpose.

(vii) Implementation of delicencing of all new units with investment of Rs. 25 crores in fixed assets in

non-backward areas and Rs. 75 crores in centrally notified backward areas. Similarly, delicensing shall be

implemented in the case of 100% Export Oriented Units (EOU) set up in Export Processing Zones (EPZ)

up to an investment ceiling of Rs. 75 lakhs

Compiled by Ca. A.N. Arsiwala Page 13

You might also like

- Marketing Audit ExampleDocument35 pagesMarketing Audit ExamplejanakaedNo ratings yet

- Projects Management: Komal GangiDocument3 pagesProjects Management: Komal GangiHimanshu PaliwalNo ratings yet

- Steps To Start A Small Scale IndustryDocument3 pagesSteps To Start A Small Scale Industrysajanmarian80% (5)

- Small and Medium Scale EnterprisesDocument5 pagesSmall and Medium Scale EnterprisesRao JeetuNo ratings yet

- Common Statuary Obligation RequiredDocument3 pagesCommon Statuary Obligation RequiredShubhankar GuptaNo ratings yet

- Registration of Small Scale IndustriesDocument8 pagesRegistration of Small Scale IndustriesMohitraheja007No ratings yet

- Constitution of BusinessDocument18 pagesConstitution of BusinessGangadhar MamadapurNo ratings yet

- Small Sclae IndustriesDocument22 pagesSmall Sclae IndustriesDev kartik AgarwalNo ratings yet

- Be Sem 1 Unit 2 SsiDocument17 pagesBe Sem 1 Unit 2 SsiYash KeshkamatNo ratings yet

- Licenses Needed For Furniture Decor StoreDocument2 pagesLicenses Needed For Furniture Decor StoreAparajita MarwahNo ratings yet

- On REGISTRATION NOC FROM POLLUTION BOARDDocument14 pagesOn REGISTRATION NOC FROM POLLUTION BOARDankitabhardwaj3750% (1)

- Steps To Register Small Scale IndustiresDocument2 pagesSteps To Register Small Scale IndustiresSara BradleyNo ratings yet

- Business Law AssignmentDocument8 pagesBusiness Law AssignmentMiraz HossainNo ratings yet

- Information About: Entrepreneurs Memorandum (EM) - I RegistrationDocument2 pagesInformation About: Entrepreneurs Memorandum (EM) - I RegistrationGanesh SantoshNo ratings yet

- Complete Guide To Setup A Software Export HouseDocument7 pagesComplete Guide To Setup A Software Export HouseSantosh KodereNo ratings yet

- Various Initial Registrations and LicensesDocument34 pagesVarious Initial Registrations and LicensesshrividhulaaNo ratings yet

- Advantages of Incentives and SubsidiesDocument38 pagesAdvantages of Incentives and SubsidiesShashank Jain67% (3)

- Small Enterprises and Enterprise LaunchingDocument37 pagesSmall Enterprises and Enterprise LaunchingKartika Bhuvaneswaran NairNo ratings yet

- 1) Udyog Aadhar (MSME) - : Memorandum of Association Articles of AssociationDocument2 pages1) Udyog Aadhar (MSME) - : Memorandum of Association Articles of Associationप्रेम शिवाNo ratings yet

- Gsecl Tenders 1stDocument72 pagesGsecl Tenders 1stSales JaincoRefNo ratings yet

- REGISTRATION PROCEDURE UNDER MSMED ACT2006 by Amey MorajkarDocument6 pagesREGISTRATION PROCEDURE UNDER MSMED ACT2006 by Amey Morajkarabhishek04201No ratings yet

- What Is IRDA License?: First StageDocument4 pagesWhat Is IRDA License?: First StageParas MittalNo ratings yet

- Legal Aspect of New Cement PlantDocument23 pagesLegal Aspect of New Cement PlantRajesh ChandravanshiNo ratings yet

- Basic Business Documents: Unit-IDocument144 pagesBasic Business Documents: Unit-IKalyan Reddy AnuguNo ratings yet

- Quick Reference GuidelinesDocument16 pagesQuick Reference GuidelinesShubham PandeyNo ratings yet

- Registration Formalities For A New FirmDocument9 pagesRegistration Formalities For A New FirmmrkktheroboNo ratings yet

- Starting Discussion:: License Refers To The Written Permission, Certificates Issued by AnyDocument10 pagesStarting Discussion:: License Refers To The Written Permission, Certificates Issued by AnyFahad AhamedNo ratings yet

- VI Semester Commerce Lab Study MaterialDocument106 pagesVI Semester Commerce Lab Study Materialamerm4562No ratings yet

- Presentation On: Presentation On: Features of and Benefits To Msmes Features of and Benefits To MsmesDocument41 pagesPresentation On: Presentation On: Features of and Benefits To Msmes Features of and Benefits To MsmesRajeevChandNo ratings yet

- Renewal NoticeDocument7 pagesRenewal NoticeDS SystemsNo ratings yet

- Licenses For FoodDocument9 pagesLicenses For FoodChandana SurthiNo ratings yet

- Ssi Steps & Registration FormalitiesDocument26 pagesSsi Steps & Registration Formalitieskartheek_aldiNo ratings yet

- Incorporation of A Private Limited CompanyDocument5 pagesIncorporation of A Private Limited CompanyAnoop KalathillNo ratings yet

- Starting A New Business Is Not Rocket Science If One Keeps The Basic Legal Requirements in MindDocument3 pagesStarting A New Business Is Not Rocket Science If One Keeps The Basic Legal Requirements in MindMansi AggarwalNo ratings yet

- FTL SopDocument10 pagesFTL Sopvivek singhalNo ratings yet

- 011.FAQs English PDFDocument32 pages011.FAQs English PDFLoveNo ratings yet

- Legal Requirements For Establishment of A New Unit Notes of EntrepreneurshipDocument5 pagesLegal Requirements For Establishment of A New Unit Notes of EntrepreneurshipArun Uday ChaudharyNo ratings yet

- MSME Schemes For Small Entrepreneurs or Startup Entrepreneurs Founders - Women EntrepreneursDocument31 pagesMSME Schemes For Small Entrepreneurs or Startup Entrepreneurs Founders - Women EntrepreneursAnil GuptaNo ratings yet

- State Bank of Travancore: Small and Medium Enterprises - Overview and Schemes AwardsDocument31 pagesState Bank of Travancore: Small and Medium Enterprises - Overview and Schemes Awardslock_jaw30No ratings yet

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- Startup - Bareilly - Zari-BambooDocument6 pagesStartup - Bareilly - Zari-Bamboosaakshiis295No ratings yet

- Startup India Kit - 2021 - V2Document25 pagesStartup India Kit - 2021 - V2Brian Fernandes100% (2)

- Law Industrisl 2076Document35 pagesLaw Industrisl 2076Roshan KhadkaNo ratings yet

- WWW - Bnrs.dti - Gov.ph Business Name Registration Application FormDocument7 pagesWWW - Bnrs.dti - Gov.ph Business Name Registration Application FormLouie BruanNo ratings yet

- Note On Ssi RegistrationDocument9 pagesNote On Ssi RegistrationJayanthi BalasubramaniamNo ratings yet

- Procedure For v. RegistrationDocument5 pagesProcedure For v. Registrationmanoj kumar SONWANENo ratings yet

- Book 0Document19 pagesBook 0Sovannarith NgyNo ratings yet

- Nsic RegistrationDocument2 pagesNsic Registrationpooja94300No ratings yet

- Start-Up: ObjectiveDocument10 pagesStart-Up: ObjectiveAventhikaNo ratings yet

- Faq Dish GomhDocument12 pagesFaq Dish Gomhmahesh battuNo ratings yet

- RFP - New Generation Security Operation Center (SOC) ServicesDocument6 pagesRFP - New Generation Security Operation Center (SOC) ServicesApurva ModyNo ratings yet

- Msme NotesDocument4 pagesMsme NotesAbhishek Rai0% (1)

- Government Stores Purchase ProgrammeDocument3 pagesGovernment Stores Purchase ProgrammeNiti_Jain_6174No ratings yet

- Industrial Licensing Policy in IndiaDocument3 pagesIndustrial Licensing Policy in IndiaHarshit Khandar100% (2)

- Benefits For MSME RegistrationDocument3 pagesBenefits For MSME RegistrationAnkita SinghNo ratings yet

- Companies Act, 2013: An Insight Into Latest AmendmentsDocument10 pagesCompanies Act, 2013: An Insight Into Latest Amendmentsvipul tutejaNo ratings yet

- Tender Commercial Terms and Condition-1109Document74 pagesTender Commercial Terms and Condition-1109Nirav ShahNo ratings yet

- Startup BenefitsDocument3 pagesStartup BenefitsSSNo ratings yet

- 1054 - Tender Commercial Terms and ConditionDocument74 pages1054 - Tender Commercial Terms and ConditionPeeyush JainNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Clean Institutional OwnershipDocument96 pagesClean Institutional Ownershippoutsos1984No ratings yet

- Ifrs 8Document11 pagesIfrs 8Huzaifa WaseemNo ratings yet

- Evaluation of Digital Realty Trust IncDocument18 pagesEvaluation of Digital Realty Trust Incwafula stanNo ratings yet

- CH 02Document36 pagesCH 02api-3804982100% (1)

- ONGC - Stock Update 240921Document14 pagesONGC - Stock Update 240921Mohit MauryaNo ratings yet

- Marketing Plan PresentationDocument40 pagesMarketing Plan Presentationapi-493988205No ratings yet

- Internship Report On Merchandising Activities ofDocument56 pagesInternship Report On Merchandising Activities ofNoshaba MaqsoodNo ratings yet

- ACC201 Seminar 1 - T06 - Grace KangDocument102 pagesACC201 Seminar 1 - T06 - Grace Kang潘 家德No ratings yet

- Statemant HSBCDocument1 pageStatemant HSBCVera DedkovskaNo ratings yet

- Proposal Project WholeDocument6 pagesProposal Project WholeJohn Daryl LuceroNo ratings yet

- CMTEDD Business Continuity and Disaster Recovery FrameworkDocument15 pagesCMTEDD Business Continuity and Disaster Recovery FrameworkAshiq MaanNo ratings yet

- 3.3.6 Mod EvaluationDocument6 pages3.3.6 Mod EvaluationWelshfyn ConstantinoNo ratings yet

- 0605 2018 - MP PDFDocument1 page0605 2018 - MP PDFAnonymous DohqBW7g0% (1)

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- Effective From 1 October 2020 1. Money Transfer-Cnic To Upaisa WalletDocument3 pagesEffective From 1 October 2020 1. Money Transfer-Cnic To Upaisa WalletAzhar Ali0% (1)

- Income Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Document1 pageIncome Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Star RamirezNo ratings yet

- Module 2-3Document9 pagesModule 2-3Rizwan FaridNo ratings yet

- Smart MoneyDocument23 pagesSmart MoneyYogesh NishadNo ratings yet

- Danshui Plant No. 2Document10 pagesDanshui Plant No. 2AnandNo ratings yet

- Resume 5Document3 pagesResume 5Zahid HussainNo ratings yet

- BPI Direct Savings Bank - A Case StudyDocument36 pagesBPI Direct Savings Bank - A Case StudyR83% (6)

- Marketing NotesDocument4 pagesMarketing NotesChristineNo ratings yet

- Principles of Business For CSEC®: 2nd EditionDocument3 pagesPrinciples of Business For CSEC®: 2nd Editionyuvita prasadNo ratings yet

- Interest On Loan 80eDocument2 pagesInterest On Loan 80ePaymaster ServicesNo ratings yet

- Mea Assignment WordDocument23 pagesMea Assignment WordNabila Afrin RiyaNo ratings yet

- ST Pocket MoneyDocument4 pagesST Pocket MoneyLincoln LowNo ratings yet

- 485 BRIEF Assignment 1Document3 pages485 BRIEF Assignment 1Duyên MaiNo ratings yet

- Afu 08504 - If - Forex Market - TQDocument4 pagesAfu 08504 - If - Forex Market - TQAbdulkarim Hamisi KufakunogaNo ratings yet

- 21-01-21 Siang Bahan Paparan BIM - Herry VazaDocument33 pages21-01-21 Siang Bahan Paparan BIM - Herry Vazaeryanto mrNo ratings yet