Professional Documents

Culture Documents

Seppo Pynn Onen Econometrics I

Seppo Pynn Onen Econometrics I

Uploaded by

orxanmehOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Seppo Pynn Onen Econometrics I

Seppo Pynn Onen Econometrics I

Uploaded by

orxanmehCopyright:

Available Formats

Introduction

Part I

Introduction

Seppo Pynnönen Econometrics I

Introduction

Econometrics

1 Introduction

Econometrics

Steps in Econometric Analysis

Types of Econometric Data

Causality, Ceteris Paribus

Key Terms

Seppo Pynnönen Econometrics I

Introduction

Econometrics

Econometrics is a discipline of statistics

specialized for using and developing mathematical and

statistical tools for

empirical estimation of economic relationships

testing economic theories

making economic predictions

evaluating government and business policy.

Data: Nonexperimental (observational)

Major tool: Regression analysis (in wide sense)

Seppo Pynnönen Econometrics I

Introduction

Econometrics

Why study econometrics?

Important to be able to apply economic theory to real world

data.

Theory may be ambiguous as to the effect of some policy

change, and in any case theory rarely tells us how large the

effect might be.

Forecasting economic variables (inflation, interest rates,

housing starts, and so on).

(Source: Scientific Word slides by Wooldridge, Accompanion to

Introductory Econometrics)

Seppo Pynnönen Econometrics I

Introduction

Steps in Econometric Analysis

1 Introduction

Econometrics

Steps in Econometric Analysis

Types of Econometric Data

Causality, Ceteris Paribus

Key Terms

Seppo Pynnönen Econometrics I

Introduction

Steps in Econometric Analysis

(a) Economic model

For example, consumption function

C = f (Y , W ), (1)

where C is consumption, Y is income, W is wealth, and f is

some function (typically unknown).

Of course there are other factors affecting consumption, but

equation (1) captures the essence of the problem.

Seppo Pynnönen Econometrics I

Introduction

Steps in Econometric Analysis

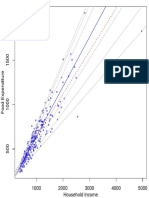

(b) Econometric model

Usually the economic model does not specify exactly the functional

form. In addition the economic model is assumed to be exact in the

simplified world satisfying the simplifying assumptions.

Consumption and Income Consumption and Wealth

● ●

● ●

● ● ● ●

● ● ● ● ●

●

● ● ●● ● ● ●● ● ●

●● ● ●

● ● ● ● ● ●

●● ●●●

● ● ● ● ● ● ●

●● ● ● ●●

●●

● ●● ● ●●● ●

● ● ● ● ●●●

● ●

●

●

● ● ●● ● ● ●

●●

●

●

●

●●

●

● ●

● ●● ● ●●

●● ●●

● ● ● ●●●●● ●

●● ●

●● ●●●● ●● ● ● ● ● ●●●● ●●●●● ● ●

● ●● ● ● ●●

●

● ● ●

●

●●

● ● ●● ● ●

● ●●

● ●●●●

●● ●●●● ● ● ●

●●

●

●●●●●

●●●●●● ●● ●

●●● ● ● ●

● ● ● ● ●● ● ● ● ●

● ●●●● ●●

●

●● ●

● ● ● ● ● ● ●●●●

●●●● ● ●

● ●● ● ● ● ●●● ● ●

● ●● ●

●● ●

●●

●● ●●● ● ●●

● ●● ● ●●

● ●

●

●●●●

●

●●●

●●

● ●

● ●

Consumption

● ●

Consumption

●●●●●

●●● ● ● ●

●●●●●

●●

● ●

●●● ●

●

●

● ● ● ●●●● ● ● ●●●

●●●

●

●

● ●

●● ●●

●●●●● ● ●

●● ● ● ●●●●

● ● ●●

●

● ●● ●● ●

● ● ● ●●●

● ●●●●

● ● ●

●

● ● ●● ● ● ● ●●

● ●

● ●

● ●

● ●● ●● ●● ●

● ● ● ●

●●●

●●

●●● ● ●

●●

● ●● ● ● ●●

●●

●

●●

● ●●●●

● ●● ●

●

●●●●●

●●● ●

●●●

●

●

●

● ● ●

● ●●

●

●

●

●

●

●

●●

● ●

●● ●●● ●

● ●● ●●●●

●

● ●●● ●

● ●●● ● ●

●

●●

●

●●●

●

●● ●●●

●●

●●

● ●

● ● ●● ● ● ●●

●●

●

●

●●●

●●●

●

●

●●

●●● ●

● ●

●●

●●●

● ● ● ●

●●

● ●●●●●

●

●●● ● ●● ●

●● ● ● ● ● ●

● ● ● ●

●

●

●●●●

●● ●

● ●

● ● ● ● ● ●

●●

● ●

●●●

●

●● ●●● ●●

●

● ●●

●●●● ● ●● ●● ● ●●

●●

● ●

●● ● ●

●●●

●●

●

●

●

●

●

●

●

●

●

●

●

●

● ● ●●

●●

●

●

●

●

●

●●

●

●●● ●●●

●● ●

●● ●

●

●● ●●

●● ●● ● ●

● ●●●●

●●●

●

● ●●

●

● ●●

●

●

●

●●● ●

●

●

● ●●

●

●● ●

●

●●

● ●

●

●

●●●●

●● ●●●● ● ● ●

● ●

●

●●

●●●● ●● ●

●●●

●● ●

●

● ● ● ● ● ●

●●

●●●

●● ● ●● ●

● ●● ●

●●●●

● ●●●

●●● ●● ●

●

●●●

●

●●

●

● ●●

● ●

●●● ●

●●

●

●

●●

●●●●

●

●●●

●

●●

● ●

● ●

●

●● ● ●● ● ● ● ● ●●

● ● ●●

● ●

●●

●

●● ●●●● ● ● ● ●●

●

● ●

● ● ● ● ●● ● ● ●

●●

●

●

●

●

●

●

●● ●●

● ●●●●

● ●

●

●●

●

●●●

●

●

●

●

●●●

●

●●

●

● ●

●● ● ● ● ● ●●

●

●

● ●

●● ●●● ● ●● ●● ● ● ●

●

● ● ● ● ● ● ●

● ● ●●

● ●

● ●

● ●

● ●

Income Wealth

Seppo Pynnönen Econometrics I

Introduction

Steps in Econometric Analysis

The task of econometrics is to turn the economic model to an

operational one. Usually this amounts to a linear approximation,

C = β0 + β1 Y + β2 W + u, (2)

where β0 , β1 , and β2 are parameters of the model, to be estimated

from the data, and u is (unobservable) random error or disturbance

term, which determines the stochastic properties of the model.

Seppo Pynnönen Econometrics I

Introduction

Steps in Econometric Analysis

Another popular specification in economics is the log-log model.

log(C ) = β0 + β1 log(Y ) + β2 log(W ) + u. (3)

where log is the natural logarithm. In (3) parameters β1 and β2

are elasticities. Coefficient β1 is the income elasticity of

consumption and β2 is the wealth elasticity of consumption. (Can

you prove this?)

Remark 1.1: Although the same symbols are used, parameters β0 , β1 , and

β2 in (2) and (3) are different. The same is true with the error term u.

Remark 1.2: Model (3) can be again consideed technically in the

framework of linear models by defining c = log(C ), y = log(Y ), and

w = log(W ) so that (3) becomes

c = β0 + β1 y + β2 w + u,

which is again a linear model.

Seppo Pynnönen Econometrics I

Introduction

Steps in Econometric Analysis

A third possibility could be

log(C ) = β0 + β1 Y + β2 W + u. (4)

Can you figure out how e.g. β1 can be interpreted here?

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

1 Introduction

Econometrics

Steps in Econometric Analysis

Types of Econometric Data

Causality, Ceteris Paribus

Key Terms

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

(a) Cross-sectional

Data collected at given point of time. E.g. a sample of

households or firms, from each of which are a number of

variables like turnover, operating margin, market value of

shares, etc., are measured.

From econometric point of view it is important that the

observations consist a random sample from the underlying

population.

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

Example 1

Cross-sectional data on wages and other individual characteristics

(Wooldridge; subset of wage1.raw).

obs wage educ exper tenure female married

1 3.10 11 2 0 1 0

2 3.24 12 22 2 1 1

3 3.00 11 2 0 0 0

4 6.00 8 44 28 0 1

5 5.30 12 7 2 0 1

6 8.75 16 9 8 0 1

. . . . . . .

. . . . . . .

. . . . . . .

525 11.56 16 5 1 0 1

526 3.50 14 5 4 1 0

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

(b) Time Series Data

A time series consist of observations on a variable(s) over

time. Typical examples are daily share prices, interest rates,

CPI values.

An important additional feature over cross-sectional data is

the ordering of the observations, which may convey important

information.

Another additional feature is data frequency which may

require special attention.

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

Example 2

Time data on minimum wage and other characteristics for Puerto Rico

(Wooldridge; prminwage.raw)

year avgmin avgwage avgcov prunemp prgnp

1950 0.198 0.398 0.201 15.4 878.7

1951 0.209 0.410 0.207 16.0 925.0

1952 0.225 0.421 0.226 14.8 1015.9

. . . . . .

. . . . . .

. . . . . .

1986 3.350 4.725 0.581 18.9 4281.6

1987 3.350 4.879 0.582 16.8 4496.7

year = years 1950-1987;

avgmin = weighted avg min wage, 44 indust

avgwage = wghted avg hourly wage, 44 indust

avgcov = wghted avg coverage, 8 industries

prunemp = PR unemployment rate

prgnp = PR GNP

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

(c) Pooled Cross-sections

Both time series and cross-section features.

An example is a data set where a number of firms are

randomly selected, say in 1990, and another sample is selected

in 2000. (I.e., data consist of two different random samples.)

If in both samples the same features are measured, combining

both years forms a pooled cross-section data set.

Pooled cross-section data is analyzed much the same way as

usual cross-section data.

However, many times it is important to pay special attention

to the fact that there are 10 years in between.

Usually the interest is whether there are some important

changes between the time points. Statistical tools are usually

the same as those used for analysis of differences between two

independently sampled populations.

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

(d) Panel Data

Panel data (longitudinal data) consists of time series for each

cross-sectional member (i.e., same individuals) in the data set.

That is one has series of history from each individual.

Seppo Pynnönen Econometrics I

Introduction

Types of Econometric Data

Example 3

Firm panel data on n = 157 firms for three years per firm (Wooldridge;

jtrain.raw.

fcode year employ sales avgsal

410032 1987 100 47000000 35000

410032 1988 131 43000000 37000

410032 1989 123 49000000 39000

410440 1987 12 1560000 10500

410440 1988 13 1970000 11000

410440 1989 14 2350000 11500

.

.

419483 1987 133 11000000 13957

419483 1988 108 11500000 14810

419483 1989 129 12000000 14227

419486 1987 80 7000000 16000

419486 1988 90 8500000 17000

419486 1989 100 9900000 18000

Seppo Pynnönen Econometrics I

Introduction

Causality, Ceteris Paribus

1 Introduction

Econometrics

Steps in Econometric Analysis

Types of Econometric Data

Causality, Ceteris Paribus

Key Terms

Seppo Pynnönen Econometrics I

Introduction

Causality, Ceteris Paribus

Causality: Cause and effect x → y

Ceteris Paribus: ”Holding other relevant factors fixed”.

Seppo Pynnönen Econometrics I

Introduction

Key Terms

1 Introduction

Econometrics

Steps in Econometric Analysis

Types of Econometric Data

Causality, Ceteris Paribus

Key Terms

Seppo Pynnönen Econometrics I

Introduction

Key Terms

Data

Experimental data

Nonexperimental, observational

Random sampling

Cross-sectional data

Time series data

Data frequency

Pooled cross section

Panel data

Model

Economic model

Causal effects

Ceteris paribus

Econometric model

Seppo Pynnönen Econometrics I

You might also like

- Quiz TK1114Document61 pagesQuiz TK1114harriediskandarNo ratings yet

- Magia CryptographicaDocument29 pagesMagia CryptographicaazzzNo ratings yet

- Intro To Statistical LearningDocument46 pagesIntro To Statistical LearningalvinNo ratings yet

- 5 Regression PDFDocument115 pages5 Regression PDFhawk91No ratings yet

- Applied Econometrics WithDocument50 pagesApplied Econometrics WithSamia NasreenNo ratings yet

- Time SeriesDocument19 pagesTime SeriesKIRAN KHANNo ratings yet

- Regression Analysis - From Statistics To Machine Learning: Ronald Hochreiter Sensational - AiDocument50 pagesRegression Analysis - From Statistics To Machine Learning: Ronald Hochreiter Sensational - AithcNo ratings yet

- ClusteringDocument62 pagesClusteringRichard RichieNo ratings yet

- Math 141: Lecture 18: Correlation and RegressionDocument26 pagesMath 141: Lecture 18: Correlation and RegressionCory DimagibaNo ratings yet

- STAT 432: Basics of Statistical Learning: Tree and Random ForestsDocument54 pagesSTAT 432: Basics of Statistical Learning: Tree and Random ForestsRichard AdhyaputraNo ratings yet

- MissingdataDocument10 pagesMissingdataAyaan ShahNo ratings yet

- Model Visualisation: (With Ggplot2)Document25 pagesModel Visualisation: (With Ggplot2)api-14814295No ratings yet

- LocalGLMnet: A Deep Learning Architecture For ActuariesDocument35 pagesLocalGLMnet: A Deep Learning Architecture For Actuariespapatest123No ratings yet

- Intro Macro, ECON10003 Lecture 7: Keynesian Model of The EconomyDocument16 pagesIntro Macro, ECON10003 Lecture 7: Keynesian Model of The EconomyAlyssaNo ratings yet

- RQ EngellogplotDocument1 pageRQ EngellogplotrojasleopNo ratings yet

- 2.lecture2 AteDocument61 pages2.lecture2 AteMarc RomaníNo ratings yet

- Analyzing The Great Firewall of China Over Space ADocument16 pagesAnalyzing The Great Firewall of China Over Space AManuelNo ratings yet

- Ejemplo de UsoDocument13 pagesEjemplo de UsoCristian Daniel Quiroz MorenoNo ratings yet

- Ggplot2 Course2 ch5 SlidesDocument23 pagesGgplot2 Course2 ch5 SlidesSxk 333No ratings yet

- Chapter 8Document4 pagesChapter 8Alain Michel KouiNo ratings yet

- Transformations and Misspecification of Econometric Models: August 27, 2014Document19 pagesTransformations and Misspecification of Econometric Models: August 27, 2014Maria RoaNo ratings yet

- Week05 NotesDocument16 pagesWeek05 NoteshasankaraborkNo ratings yet

- 1000 2000 3000 4000 5000 Household IncomeDocument1 page1000 2000 3000 4000 5000 Household IncomerojasleopNo ratings yet

- Original PDFDocument2 pagesOriginal PDFmaxalves77No ratings yet

- 330 Lecture15 2014Document53 pages330 Lecture15 2014PiNo ratings yet

- Old Faithful Geyser Data: 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 EruptionsDocument2 pagesOld Faithful Geyser Data: 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 EruptionsNointNo ratings yet

- 330 Lecture8 2014Document34 pages330 Lecture8 2014Anonymous gUySMcpSqNo ratings yet

- Old Faithful Geyser Data: 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 EruptionsDocument1 pageOld Faithful Geyser Data: 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 EruptionsSantiago ViñanNo ratings yet

- Myplot PDFDocument1 pageMyplot PDFarturdelrioNo ratings yet

- MyplotDocument1 pageMyplotsimuNo ratings yet

- Myplot2 PDFDocument1 pageMyplot2 PDFarturdelrioNo ratings yet

- Old Faithful Geyser Data: 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 EruptionsDocument1 pageOld Faithful Geyser Data: 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 EruptionsarturdelrioNo ratings yet

- K-Means RKDocument43 pagesK-Means RKPrince JaiswalNo ratings yet

- Products For PromotionDocument3 pagesProducts For PromotionVania Diego Velasco RiveraNo ratings yet

- 330 Lecture8 2015Document33 pages330 Lecture8 2015Anonymous gUySMcpSqNo ratings yet

- RQ RegsplineDocument1 pageRQ RegsplinerojasleopNo ratings yet

- Week06 NotesDocument15 pagesWeek06 NoteshasankaraborkNo ratings yet

- 0 200 400 600 800 1000 1200 1400 Try2$Operating - Days (Try2$Well - Num "Wellnum 17963")Document4 pages0 200 400 600 800 1000 1200 1400 Try2$Operating - Days (Try2$Well - Num "Wellnum 17963")Luthfi SaifudinNo ratings yet

- Economics 536 The Regression FallacyDocument9 pagesEconomics 536 The Regression FallacyMaria RoaNo ratings yet

- RQ Mcycle1Document1 pageRQ Mcycle1rojasleopNo ratings yet

- 330 Lecture9 2014Document40 pages330 Lecture9 2014Anonymous gUySMcpSqNo ratings yet

- Pnas 1811269115 SappDocument25 pagesPnas 1811269115 Sappbahix27973No ratings yet

- 2014 TestDocument13 pages2014 TestAnonymous gUySMcpSqNo ratings yet

- ExamplesR Power LawDocument12 pagesExamplesR Power LawKen MatsudaNo ratings yet

- Lec1 ppt2019Document23 pagesLec1 ppt2019lcaccompanyNo ratings yet

- MRT 1550 Vantage Orian Brochure MCAMR0143EADocument19 pagesMRT 1550 Vantage Orian Brochure MCAMR0143EASarpras RumkitNo ratings yet

- Lecture HPC 11 ParallelizationDocument128 pagesLecture HPC 11 ParallelizationAldo Ndun AveiroNo ratings yet

- Prelims StatsDocument39 pagesPrelims StatsSergioNo ratings yet

- Lpic Package - L TEX Over Graphics: Vinh Q. NguyenDocument4 pagesLpic Package - L TEX Over Graphics: Vinh Q. Nguyenvinhdizzo6130No ratings yet

- MRT 3020 Vantage Galan 3T V6 Brochure MCAMR0170EADocument21 pagesMRT 3020 Vantage Galan 3T V6 Brochure MCAMR0170EAminhhoangtranvpNo ratings yet

- Normal Q Q Plot (Sepal - Length) Normal Q Q Plot (Sepal - Width)Document1 pageNormal Q Q Plot (Sepal - Length) Normal Q Q Plot (Sepal - Width)Carlos MunozNo ratings yet

- Ca FX 4Document1 pageCa FX 4drassuss45No ratings yet

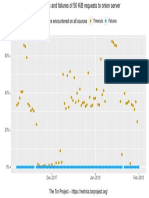

- Problems Encountered On All Sources: Timeouts FailuresDocument1 pageProblems Encountered On All Sources: Timeouts FailuresPatrick PerezNo ratings yet

- 1 Microbalance Accuracy: Manuel F. G. Weinkauf, José G. Kunze, Joanna J. Waniek, Michal Ku CeraDocument9 pages1 Microbalance Accuracy: Manuel F. G. Weinkauf, José G. Kunze, Joanna J. Waniek, Michal Ku CerawessilissaNo ratings yet

- OutliersDocument7 pagesOutliersSasidhar NandikollaNo ratings yet

- Costs: Developing The Language of CostsDocument27 pagesCosts: Developing The Language of Costsee400bps kudNo ratings yet

- Lectures Machine LearningDocument205 pagesLectures Machine LearningGuilherme MartheNo ratings yet

- Mutant Year Zero - Zone Log PDFDocument2 pagesMutant Year Zero - Zone Log PDFMasis 'Ara' ShahbaziansNo ratings yet

- Coordinates Terrain Rot Level Threat CommentDocument2 pagesCoordinates Terrain Rot Level Threat Commentfrsayhe5tueayher6uNo ratings yet

- As of Sep 16, 2021: Seppo Pynn Onen Econometrics IDocument60 pagesAs of Sep 16, 2021: Seppo Pynn Onen Econometrics IorxanmehNo ratings yet

- As of Sep 16, 2020: Seppo Pynn Onen Econometrics IDocument52 pagesAs of Sep 16, 2020: Seppo Pynn Onen Econometrics IorxanmehNo ratings yet

- STAT2110 Instructions For Practical Work 2021Document4 pagesSTAT2110 Instructions For Practical Work 2021orxanmehNo ratings yet

- Working Manual - How To Analyze Operations Strategy QualitativelyDocument15 pagesWorking Manual - How To Analyze Operations Strategy QualitativelyorxanmehNo ratings yet

- EC1000ADocument11 pagesEC1000AorxanmehNo ratings yet

- Publications: Year No. Conference Vol. Firm Country Author TitleDocument63 pagesPublications: Year No. Conference Vol. Firm Country Author TitleArjun Chitradurga RamachandraRaoNo ratings yet

- Neural Network and Fuzzy SystemDocument189 pagesNeural Network and Fuzzy SystemRenatus GodianNo ratings yet

- Sanyog Mahajan Resume UpdatedDocument1 pageSanyog Mahajan Resume UpdatedSanyog MahajanNo ratings yet

- Efficient Very Large-Scale Integration Architecture Design of Proportionate-Type Least Mean Square Adaptive FiltersDocument7 pagesEfficient Very Large-Scale Integration Architecture Design of Proportionate-Type Least Mean Square Adaptive FiltersIJRES teamNo ratings yet

- Reaction PaperDocument1 pageReaction PaperNhel AlvaroNo ratings yet

- FanC Whitepaper 1.1 Eng.34bfa504be19e3fc233bDocument35 pagesFanC Whitepaper 1.1 Eng.34bfa504be19e3fc233ballthatkmsNo ratings yet

- Business Plan FinalDocument16 pagesBusiness Plan FinalDiana CortezNo ratings yet

- Retro ThesisDocument7 pagesRetro Thesislindagosnellfortwayne100% (2)

- Lagrange InterpolationDocument18 pagesLagrange InterpolationdiviyabhavaaniNo ratings yet

- PIXILAB BlocksDocument120 pagesPIXILAB BlocksEzedinim IbrahimNo ratings yet

- Procedimiento de Embalaje y Envío de VálvulasDocument6 pagesProcedimiento de Embalaje y Envío de VálvulasБехар ТиагоNo ratings yet

- LIEBHERR L586 - G6.0 D - 1815 SM PreviewDocument41 pagesLIEBHERR L586 - G6.0 D - 1815 SM PreviewGovanny MaldonadoNo ratings yet

- Info Bermedi X-DryDocument2 pagesInfo Bermedi X-Drydumitrescu emilNo ratings yet

- BPC Biocistem EspectroDocument41 pagesBPC Biocistem EspectroBenigno C. SolisNo ratings yet

- Primacorelw-71 en PDFDocument2 pagesPrimacorelw-71 en PDFsattar12345No ratings yet

- Setup: This Notebook Contains All The Sample Code and Solutions To The Exercises in Chapter 8Document31 pagesSetup: This Notebook Contains All The Sample Code and Solutions To The Exercises in Chapter 8AmitNo ratings yet

- Heidrun Gerzymisch-Arbogast EtAl LSPTranslationScenariosDocument239 pagesHeidrun Gerzymisch-Arbogast EtAl LSPTranslationScenariosAura NavarroNo ratings yet

- ABC Hospital - SolutionDocument12 pagesABC Hospital - SolutionMayank Patel100% (1)

- XCOM User GuideDocument33 pagesXCOM User GuideAnonymous ljkiyqJt8MNo ratings yet

- Final New EditedDocument89 pagesFinal New EditedYayew MaruNo ratings yet

- All AnswwesDocument70 pagesAll AnswwesTristanNo ratings yet

- Science Laboratory Chemical and Equipment Inventory and Order ManagementDocument46 pagesScience Laboratory Chemical and Equipment Inventory and Order Managementyasir.elsharifNo ratings yet

- Service Manual: Harman/kardonDocument229 pagesService Manual: Harman/kardonSang NhNo ratings yet

- Civil Service BehaviorsDocument13 pagesCivil Service BehaviorsguydavidcrossNo ratings yet

- Adapter Sleeve With KM Lock Nut and MB Lock Washer, Metric DimensionsDocument3 pagesAdapter Sleeve With KM Lock Nut and MB Lock Washer, Metric DimensionsGilbert ClayNo ratings yet

- Ek 2020Document203 pagesEk 2020hu jackNo ratings yet

- Liquid Rotor Resistance Starter Conventional LrsDocument3 pagesLiquid Rotor Resistance Starter Conventional Lrsmayur3dhandeNo ratings yet

- Cullen v. Zoom Video Communications, Inc., Case 5:20-cv-02155-SVK (Northern District of California)Document23 pagesCullen v. Zoom Video Communications, Inc., Case 5:20-cv-02155-SVK (Northern District of California)Law&CrimeNo ratings yet