Professional Documents

Culture Documents

6809 Accounts Receivable

6809 Accounts Receivable

Uploaded by

Esse ValdezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6809 Accounts Receivable

6809 Accounts Receivable

Uploaded by

Esse ValdezCopyright:

Available Formats

CPA REVIEW SCHOOL OF THE PHILIPPINES

Mani la

FINANCIAL ACCOUNTING AND REPORTING VALIX/VALIX/ESCALA/SANTOS/DELA CRUZ

ACCOUNTS RECEIVABLE

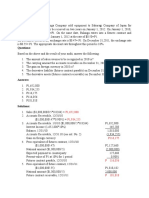

1. An entity provided the following information for the current year:

Accounts receivable – January 1 2,000,000

Credit sales 10,000,000

Collection from customers, excluding recovery of accounts written off 7,500,000

Accounts written off as worthless 100,000

Sales returns 400,000

Recovery of accounts written off 50,000

Estimated future sales returns on December 31 300,000

Estimated uncollectible accounts on December 31 per aging 600,000

What is the “amortized cost” of accounts receivable on December 31?

a. 4,000,000

b. 3,700,000

c. 3,450,000

d. 3,100,000

2. An entity prepared an aging of accounts receivable on December 31 and determined that the net

realizable value of the accounts receivable was P2,500,000.

Allowance for doubtful accounts on January 1 300,000

Accounts written off as uncollectible 200,000

Accounts receivable on December 31 2,900,000

Uncollectible accounts recovery 50,000

What amount should be recognized as doubtful accounts expense for the current year?

a. 350,000

b. 200,000

c. 150,000

d. 250,000

3. An entity provided the following data for the current year:

\

Allowance for doubtful accounts January 1 180,000

Sales 9,500,000

Sales returns and allowances 800,000

Sales discount 200,000

Accounts written off as uncollectible 200,000

The entity provided for doubtful accounts expense at the rate of 5% of net sales. What amount should

be reported as doubtful accounts expense for the current year?

a. 435,000

b. 425,000

c. 475,000

d. 415,000

4. Effective with the current year, an entity adopted a new accounting method for estimating the

allowance for doubtful accounts at the amount indicated by the year-end aging of accounts

receivable.

Allowance for doubtful accounts, January 1 250,000

Provision for doubtful accounts during the current year at 2% of credit sales of

P10,000,000 200,000

Accounts written off 205,000

Estimated uncollectible accounts per aging on December 31 220,000

What amount should be reported as doubtful accounts expense for current year?

a. 220,000

b. 205,000

c. 200,000

d. 175,000

6809

Page 2

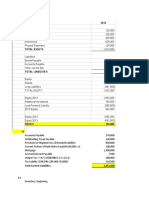

5. An entity provided the following accounts abstracted from the unadjusted trial balance at year-end:

Debit Credit

Accounts receivable 5,000,000

Allowance for doubtful accounts 100,000

Net credit sales 20,000,000

The entity estimated that 10% of the gross accounts receivable will become uncollectible.

What amount should be recognized as doubtful accounts expense for the current year?

a. 500,000

b. 400,000

c. 200,000

d. 600,000

6. From inception of operations, an entity provided for doubtful accounts under the allowance method

and provisions were made monthly at 2% of credit sales.

No year-end adjustments to the allowance account were made. The balance in the allowance for

doubtful accounts was P1,000,000 on January 1, 2021.

During 2021, credit sales totaled P20,000,000, interim provisions for doubtful accounts were made at

2% of credit sales, P200,000 of bad debts were written off, and recoveries of accounts previously

written off amounted to P50,000. An aging was made on December 31, 2021.

Classification Balance Uncollectible

November - December 6,000,000 10%

July - October 2,000,000 20%

January - June 1,500,000 30%

Prior to January 1, 2021 500,000 50%

Based on the review of collectibility of the account balances in the “prior to January 1, 2021” aging

category, additional accounts totaling P100,000 are to be written off on December 31, 2021. Effective

December 31, 2021, the entity adopted aging method for estimating the allowance for doubtful

accounts.

1. What is the required allowance for doubtful accounts on December 31, 2021?

a. 1,650,000

b. 1,950,000

c. 1,700,000

d. 1,450,000

2. What amount should be reported as doubtful accounts expense for current year?

a. 1,200,000

b. 1,650,000

c. 900,000

d. 950,000

3. What is the adjustment to the allowance for doubtful accounts on December 31, 2021?

a. 900,000 debit

b. 900,000 credit

c. 500,000 debit

d. 500,000 credit

4. What is the net realizable value of accounts receivable on December 31, 2021?

a. 9,900,000

b. 8,250,000

c. 8,350,000

d. 8,200,000

END

6809

You might also like

- Financial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Solution Manual Chapter 1Document25 pagesFinancial Accounting, 7e by Pfeiffer, Hanlon, Magee 2023, Solution Manual Chapter 1Test bank WorldNo ratings yet

- ACCCOB1 Module 2Document57 pagesACCCOB1 Module 2Ayanna CameroNo ratings yet

- The Unadjusted Trial Balance of La Mesa Laundry at AugustDocument1 pageThe Unadjusted Trial Balance of La Mesa Laundry at AugustAmit PandeyNo ratings yet

- Accounts Receivable and Receivable FinancingDocument4 pagesAccounts Receivable and Receivable FinancingLui50% (2)

- Flash Memory CaseDocument6 pagesFlash Memory Casechitu199233% (3)

- Business Finance Lecture NotesDocument118 pagesBusiness Finance Lecture NotesYashrajsing Luckkana100% (1)

- Accounting - UEB - Mock Test 2 - STDDocument14 pagesAccounting - UEB - Mock Test 2 - STDTiến NguyễnNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Intermediate Accounting 1 - 04 Activity 2 LaguitaoDocument2 pagesIntermediate Accounting 1 - 04 Activity 2 LaguitaoCatherine LaguitaoNo ratings yet

- Prefinals Agency and Other Credit TransactionsDocument5 pagesPrefinals Agency and Other Credit TransactionsJohn Paul BeloyNo ratings yet

- Investment Decisions:: Look Ahead and Reason BackDocument22 pagesInvestment Decisions:: Look Ahead and Reason BackHanacchiNo ratings yet

- Unit III Partnership LiquidationDocument20 pagesUnit III Partnership LiquidationLeslie Mae Vargas ZafeNo ratings yet

- Cash Cash Equivalents Reviewer2Document9 pagesCash Cash Equivalents Reviewer2anor.aquino.upNo ratings yet

- Pas 24Document7 pagesPas 24angelo vasquezNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Foreign Currency TransactionsDocument90 pagesForeign Currency TransactionsssabinaNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument30 pagesFinancial Statements, Cash Flow, and TaxesVincent BuyanNo ratings yet

- An Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsDocument38 pagesAn Introduction An Introduction: Nature and Scope of Accounting For Government and Non-Profit OrganizationsPhrexilyn PajarilloNo ratings yet

- Aud Application 2 - Handout 2 Borrowing Cost (UST)Document2 pagesAud Application 2 - Handout 2 Borrowing Cost (UST)RNo ratings yet

- Chapter 1-Introduction To Cost Accounting: True/FalseDocument1 pageChapter 1-Introduction To Cost Accounting: True/FalseJanelleNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- CH 2 (WWW - Jamaa Bzu - Com)Document6 pagesCH 2 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (1)

- PRE BATTERY EXAM 2018 Part 1 FARDocument11 pagesPRE BATTERY EXAM 2018 Part 1 FARFrl RizalNo ratings yet

- Cfas ReviewerDocument4 pagesCfas ReviewerLayla MainNo ratings yet

- Individual Illustration and Activity No. 2Document19 pagesIndividual Illustration and Activity No. 2김유나100% (1)

- Document 4 PDFDocument1 pageDocument 4 PDFMiljane PerdizoNo ratings yet

- Submissions - B-BLAW211 Law On Obligations and Contracts BSA21 1S AY20-21 - DLSU-D College - GSDocument3 pagesSubmissions - B-BLAW211 Law On Obligations and Contracts BSA21 1S AY20-21 - DLSU-D College - GSChesca AlonNo ratings yet

- Notes: True or False - Accounting Policies, Changes in Estimates & ErrorsDocument2 pagesNotes: True or False - Accounting Policies, Changes in Estimates & Errorskim cheNo ratings yet

- Effect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsDocument9 pagesEffect of Working Capital Management and Financial Leverage On Financial Performance of Philippine FirmsGeorgina De LiañoNo ratings yet

- Review and Discussion Questions Chapter TenDocument5 pagesReview and Discussion Questions Chapter TenDaniel DialinoNo ratings yet

- Conversion CycleDocument2 pagesConversion Cyclejoanbltzr0% (1)

- Contract Recognition Task: Property of STIDocument1 pageContract Recognition Task: Property of STIJohn SantosNo ratings yet

- CF FS and Reporting EntityDocument2 pagesCF FS and Reporting Entitypanda 1No ratings yet

- Alon-Contract-Objects Cause FormsDocument5 pagesAlon-Contract-Objects Cause FormsChesca AlonNo ratings yet

- Forms of Statement of Financial PositionDocument7 pagesForms of Statement of Financial PositionRocel DomingoNo ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- Intacc 3 HWDocument7 pagesIntacc 3 HWMelissa Kayla ManiulitNo ratings yet

- CH 9 - Intermediate AccountingDocument28 pagesCH 9 - Intermediate Accountinghana osmanNo ratings yet

- Theory of AccountsDocument7 pagesTheory of AccountsralphalonzoNo ratings yet

- Quiz Chapter-21 Investment-PropertyDocument3 pagesQuiz Chapter-21 Investment-Propertyjiachi.04212004No ratings yet

- 09 Capital Budgeting KEY PDFDocument24 pages09 Capital Budgeting KEY PDFRianna MangabatNo ratings yet

- Accounting 2Document28 pagesAccounting 2cherryannNo ratings yet

- Cash and Cash EquivalentsDocument52 pagesCash and Cash EquivalentsDeryl GalveNo ratings yet

- Law On Oblicon NotesDocument4 pagesLaw On Oblicon NotesaiswiftNo ratings yet

- PART I: True or False: Management Accounting Quiz 1 BsmaDocument4 pagesPART I: True or False: Management Accounting Quiz 1 BsmaAngelyn SamandeNo ratings yet

- (Diagnostic Exam) Advanced Studies in TaxationDocument25 pages(Diagnostic Exam) Advanced Studies in TaxationOjims Christjohn C CadungganNo ratings yet

- Cash & Cash Equivalents, Lecture &exercisesDocument16 pagesCash & Cash Equivalents, Lecture &exercisesNMCartNo ratings yet

- Intthry at Long Quiz 1 Answer Key 012718Document12 pagesIntthry at Long Quiz 1 Answer Key 012718Racel DelacruzNo ratings yet

- Prob 4-10 To 12Document2 pagesProb 4-10 To 12maryaniNo ratings yet

- Laura Taylor Wholesale Distributor WorksheetDocument3 pagesLaura Taylor Wholesale Distributor WorksheetHope Trinity EnriquezNo ratings yet

- Pas 28Document6 pagesPas 28AnneNo ratings yet

- Rich Angelie Muñez - Assignment 4 Adjusting EntriesDocument2 pagesRich Angelie Muñez - Assignment 4 Adjusting EntriesRich Angelie MuñezNo ratings yet

- Sample Problems INTACC-3 - PART-2Document6 pagesSample Problems INTACC-3 - PART-2Angela AlarconNo ratings yet

- BL Final Quiz KeyDocument1 pageBL Final Quiz KeyJanice BalabatNo ratings yet

- Units To Account For: 635,000: L2-Practice Problem: EUP-WADocument2 pagesUnits To Account For: 635,000: L2-Practice Problem: EUP-WAlalalalaNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Intermediate Accounting I Ppe AnswersDocument3 pagesIntermediate Accounting I Ppe AnswersChaCha Delos Reyes AguinidNo ratings yet

- FAR 2 Discussion Material - Shareholders' Equity PDFDocument4 pagesFAR 2 Discussion Material - Shareholders' Equity PDFAisah ReemNo ratings yet

- Takehome Quiz Ae 121Document3 pagesTakehome Quiz Ae 121Crissette RoslynNo ratings yet

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangNo ratings yet

- Ch28 Test Bank 4-5-10Document14 pagesCh28 Test Bank 4-5-10KarenNo ratings yet

- Mod 04 - Trade A - RDocument2 pagesMod 04 - Trade A - RMARY GRACE VARGAS0% (1)

- Receivables QuizDocument2 pagesReceivables Quizhoneyjoy salapantanNo ratings yet

- Accounts Receivable and InventoryDocument9 pagesAccounts Receivable and InventoryNoemi GuevarraNo ratings yet

- Joan Salgado Aud-Prob AssignmentDocument8 pagesJoan Salgado Aud-Prob AssignmentEsse ValdezNo ratings yet

- Assignment Auditing Problemmichelle PagulayanDocument7 pagesAssignment Auditing Problemmichelle PagulayanEsse ValdezNo ratings yet

- Clemente Ronaliza Auditing ProblemsDocument9 pagesClemente Ronaliza Auditing ProblemsEsse ValdezNo ratings yet

- Nicolas April Gwyneth S Midterm Assisgnemt Auditing ProblemsDocument8 pagesNicolas April Gwyneth S Midterm Assisgnemt Auditing ProblemsEsse ValdezNo ratings yet

- Valdez Blessed Nizelle - Midterm Assignemnt - Aud ProbDocument9 pagesValdez Blessed Nizelle - Midterm Assignemnt - Aud ProbEsse ValdezNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Christine Joy Abad AssignmentDocument8 pagesChristine Joy Abad AssignmentEsse ValdezNo ratings yet

- Name: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsDocument7 pagesName: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsEsse ValdezNo ratings yet

- Problem 1: InvestmentsDocument7 pagesProblem 1: InvestmentsEsse ValdezNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- 6803 Statement of Financial PositionDocument2 pages6803 Statement of Financial PositionEsse ValdezNo ratings yet

- 6811 Notes Receivable and Loan ImpairmentDocument2 pages6811 Notes Receivable and Loan ImpairmentEsse ValdezNo ratings yet

- 6806 Operating Segment and Interim ReportingDocument2 pages6806 Operating Segment and Interim ReportingEsse ValdezNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- Final Project of D G Khan CementDocument61 pagesFinal Project of D G Khan Cementumarfaro100% (1)

- MQ1 - Topics FAR.2901 To 2915.Document7 pagesMQ1 - Topics FAR.2901 To 2915.Waleed MustafaNo ratings yet

- Course Code COM-402 Advanced Accounting-Ii Credit Hours 3Document4 pagesCourse Code COM-402 Advanced Accounting-Ii Credit Hours 3goharmahmood203No ratings yet

- Accounting Concept and Principle QuizDocument2 pagesAccounting Concept and Principle QuizkristelNo ratings yet

- Financial Forecast, AFNDocument3 pagesFinancial Forecast, AFNayesha akhtarNo ratings yet

- Chap 001Document41 pagesChap 001ms_cherriesNo ratings yet

- Prudential Credit GuidelinesDocument8 pagesPrudential Credit GuidelinesRhea SimoneNo ratings yet

- Sample Business PlanDocument28 pagesSample Business Planksangeeth2000No ratings yet

- Project FMT 2Document15 pagesProject FMT 2KING KARTHIKNo ratings yet

- Entreprenuership Group ProjectDocument22 pagesEntreprenuership Group ProjectAmir IskandarNo ratings yet

- Second Grading ExaminationDocument17 pagesSecond Grading ExaminationAmie Jane MirandaNo ratings yet

- Cours Project BDocument21 pagesCours Project BMarina MorganNo ratings yet

- Nss 577Document390 pagesNss 577jay.kumNo ratings yet

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Submission Deadline: Week 9 (60%) : StepsDocument23 pagesSubmission Deadline: Week 9 (60%) : StepsRaja NomanNo ratings yet

- BuenaventuraBSA1B Problems1 4 Pages 410 413Document37 pagesBuenaventuraBSA1B Problems1 4 Pages 410 413AnonnNo ratings yet

- 13-Cash Flow StatementDocument66 pages13-Cash Flow Statementtibip12345100% (6)

- Summary of Accounting Standards From Cfas Book CompressDocument34 pagesSummary of Accounting Standards From Cfas Book Compressofficial.kwentoniagimatNo ratings yet

- Fiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingDocument10 pagesFiscal Management WF Dr. Emerita R. Alias Edgar Roy M. Curammeng Financial Forecasting, Corporate Planning and BudgetingJeannelyn CondeNo ratings yet

- Receivables AssignmentDocument24 pagesReceivables AssignmentRhona RamosNo ratings yet

- Accounting RatiosDocument4 pagesAccounting RatiosRakesh KumarNo ratings yet

- Fa I MidDocument7 pagesFa I MidFãhâd Õró ÂhmédNo ratings yet

- Chapter 7Document6 pagesChapter 7Paw VerdilloNo ratings yet

- Tally GST Module Question Set-1Document3 pagesTally GST Module Question Set-1Boni HalderNo ratings yet

- Chapter 7 The Accounting EquationDocument57 pagesChapter 7 The Accounting EquationCarmelaNo ratings yet