Professional Documents

Culture Documents

Epsf Form12bb 215322

Epsf Form12bb 215322

Uploaded by

anil sangwanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Epsf Form12bb 215322

Epsf Form12bb 215322

Uploaded by

anil sangwanCopyright:

Available Formats

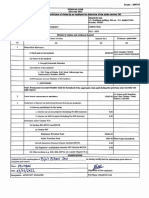

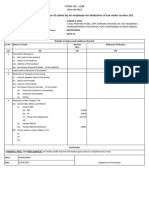

Ecode : 215322

FORM NO.12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

ANIL KUMAR

1) Name and address of employee

31/b sahib kunj, ghitorni, New Delhi(110030)

2) Permanent Account Number (PAN) of the employee CQTPK5621A

3) Financial year 2020 - 2021

Details of claims and evidence thereof

Sl. No. Nature of claim Amount (Rs.) Evidence / particulars

(1) (2) (3) (4)

1 House Rent Allowance:

Rent receipts / Rental

(i) Rent paid to the landlord 360000.00

Agreement / Bank statement

(ii) Name of the landlord

1. Sunil

(iii) Address of the landlord

1. 143,charkhi,charkhi dadri, haryana, 127306

(iv)Permanent Account Number of the landlord

1. FXAPS2103G

Note: Permanent Account Number shall be furnished if the aggregate rent paid during the previous year exceeds one

lakh rupees.

2 Leave travel concessions or assistance 0.00

3 Deduction of interest on borrowing (Income from house property) :

(i) Interest payable/paid to the lender

1. Interest on Let-out property (Including Pre-EMI Interest) 0.00

2. Interest on Self Occupied (Including Pre-EMI Interest) 0.00

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

Employees Provident Fund (Auto populated through

81846.00

payroll)

Photo copy of Payment

Mutual Funds / ULIP 70000.00 receipt / Account statement /

Certificate / Bond

(ii) Life Insurance Pension Scheme (Section 80CCC) 0.00

(iii) Employee's contribution towards NPS (Section 80CCD) 0.00

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

VERIFICATION

I ANIL KUMAR son/daughter of _____________________________________________________ do hereby certify that the information given above is complete

and correct

Place :

Date : (Signature of the employee)

Designation : PRINCIPAL/ASSOC DIR SOFTWARE ENGINEER Full Name: ANIL KUMAR

You might also like

- TDS Certificate - Form 16A - Q 1 - 23Document3 pagesTDS Certificate - Form 16A - Q 1 - 23ADBHUT CHARAN DAS IskconNo ratings yet

- Global Marketing Answers To Questions 14-19Document16 pagesGlobal Marketing Answers To Questions 14-19InesNo ratings yet

- Complete Phrasal Verbs ListDocument137 pagesComplete Phrasal Verbs ListHermes®No ratings yet

- Business Reporting July 2014Document16 pagesBusiness Reporting July 2014karlr9No ratings yet

- KV COM+ Library ManualDocument406 pagesKV COM+ Library Manualmgkso706100% (2)

- Manage Budgets and Financial PlansDocument23 pagesManage Budgets and Financial PlansMonique BugeNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- GOLKONDA RESORTS PRIVATE LIMITED - Company, Directors and Contact Details Zauba CorpDocument1 pageGOLKONDA RESORTS PRIVATE LIMITED - Company, Directors and Contact Details Zauba Corpitsmeou11No ratings yet

- 2019 Huntsman General Oilfield Chemical Presentation July 2019Document48 pages2019 Huntsman General Oilfield Chemical Presentation July 2019Cyprien67% (3)

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Epsf Form12bb 10006980Document2 pagesEpsf Form12bb 10006980Vikas SoniNo ratings yet

- Epsf Form12bb 903949Document2 pagesEpsf Form12bb 903949MALLA SAI YASWANTH REDDYNo ratings yet

- EPSF FORM12BB 10006980 SignedDocument2 pagesEPSF FORM12BB 10006980 SignedVikas SoniNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Form 12BBDocument1 pageForm 12BBBiranchi DasNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerAbhishekShuklaNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- Form12BB 1Document2 pagesForm12BB 1kolhe2377No ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pages"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToCA Ramajayam JayachandranNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportANTHONI FERNANDESNo ratings yet

- Aadcp9992n Q3 2023-24Document3 pagesAadcp9992n Q3 2023-24Harikrishan BhattNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- Form12BB ZensarDocument2 pagesForm12BB ZensarRam GuggulNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Part A General InformationDocument6 pagesItr-1 Sahaj Indian Income Tax Return: Part A General InformationRajatGuptaNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBPriyadharshini RamamurthyNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBSanjay SalunkheNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)anil sangwanNo ratings yet

- Payslip 10 2020Document1 pagePayslip 10 2020anil sangwanNo ratings yet

- Support Tracker Manoj - SepDocument3 pagesSupport Tracker Manoj - Sepanil sangwanNo ratings yet

- OpTransactionHistory05 05 2020Document1 pageOpTransactionHistory05 05 2020anil sangwanNo ratings yet

- Claim Form - Part A' To 'Claim Form For Health Insurance PolicyDocument6 pagesClaim Form - Part A' To 'Claim Form For Health Insurance Policyanil sangwanNo ratings yet

- Diary No: TCP-OFA/18846/2021 Application Dated: 13/10/2021 15:05:5Document2 pagesDiary No: TCP-OFA/18846/2021 Application Dated: 13/10/2021 15:05:5anil sangwanNo ratings yet

- Anil KumarDocument8 pagesAnil Kumaranil sangwanNo ratings yet

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDocument2 pagesAccount Statement: Date Value Date Description Cheque Deposit Withdrawal Balanceanil sangwanNo ratings yet

- Active and Passive VoiceDocument20 pagesActive and Passive Voiceanil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Bar Questions and Answers From 2005 To 2011Document14 pagesBar Questions and Answers From 2005 To 2011Ma Theresa BuracNo ratings yet

- Topics Covered: Does Debt Policy Matter ?Document11 pagesTopics Covered: Does Debt Policy Matter ?Tam DoNo ratings yet

- Major Financial DecisionsDocument9 pagesMajor Financial Decisionsjasminbains26No ratings yet

- Arborist: This List Will Be Updated Periodically. If You Have Any Questions, Please Call (225) 952-8100Document9 pagesArborist: This List Will Be Updated Periodically. If You Have Any Questions, Please Call (225) 952-8100HNo ratings yet

- Chapter 1 - Nature and Scope of NGASDocument26 pagesChapter 1 - Nature and Scope of NGASJapsNo ratings yet

- Tugas Mek I-9 OktDocument2 pagesTugas Mek I-9 OktAlifani SofiNo ratings yet

- ACCO 30033 Amoranto BSA 3-1-2Document1 pageACCO 30033 Amoranto BSA 3-1-2Christel OrugaNo ratings yet

- DIALUXDocument2 pagesDIALUXSergio CarrilloNo ratings yet

- Offer LetterDocument1 pageOffer Letterahmadkahan5272No ratings yet

- Final Exam Constitutional Law UkDocument3 pagesFinal Exam Constitutional Law UkZeeshan HaiderNo ratings yet

- Attachments - Rainbow RowellDocument29 pagesAttachments - Rainbow RowellAlvin Yerc0% (1)

- Bar Examination 2005 Q&ADocument20 pagesBar Examination 2005 Q&ADianne Esidera RosalesNo ratings yet

- Board of Assessment Appeals v. Samar Mining Co.Document3 pagesBoard of Assessment Appeals v. Samar Mining Co.Anit EmersonNo ratings yet

- D Bala Krishna Annamayya DistDocument5 pagesD Bala Krishna Annamayya DistMd.Ashrapunnisa BegumNo ratings yet

- Rico Prosecutors Manual May 2016Document556 pagesRico Prosecutors Manual May 2016SenateBriberyInquiryNo ratings yet

- Slip - 2: To Study The Comparison of Products of HDFC Bank and ICICI BankDocument10 pagesSlip - 2: To Study The Comparison of Products of HDFC Bank and ICICI BankTANVINo ratings yet

- Certification Request FormsDocument14 pagesCertification Request FormsCharles DoriaNo ratings yet

- Ga State BAR HandbookDocument192 pagesGa State BAR HandbookJohn StarkeyNo ratings yet

- Skeleton Arguments: A Practitioner's GuideDocument12 pagesSkeleton Arguments: A Practitioner's GuideLaexion100% (2)

- Kopp, Jeffrey - Ia Chiro BoardDocument6 pagesKopp, Jeffrey - Ia Chiro BoardEIowaNewsNowNo ratings yet

- Criminal Law CasesDocument8 pagesCriminal Law CasesArmstrong BosantogNo ratings yet

- Understanding Cybersecurity Frameworks and Information Security Standards-A Review and Comprehensive OverviewDocument21 pagesUnderstanding Cybersecurity Frameworks and Information Security Standards-A Review and Comprehensive OverviewbaekjungNo ratings yet

- Annual Report and Accounts 2020Document382 pagesAnnual Report and Accounts 2020EvgeniyNo ratings yet

- Abipid Ong Au Ceg Massè Centre-1Document33 pagesAbipid Ong Au Ceg Massè Centre-1JOWELLE SOTONMABOUNo ratings yet