Professional Documents

Culture Documents

Bus 5110 Discussion Forum Unit 5 Submission

Bus 5110 Discussion Forum Unit 5 Submission

Uploaded by

Ahmad HafezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bus 5110 Discussion Forum Unit 5 Submission

Bus 5110 Discussion Forum Unit 5 Submission

Uploaded by

Ahmad HafezCopyright:

Available Formats

lOMoARcPSD|9082414

BUS 5110 Discussion Forum Unit 5 submission

Managerial Accounting (University of the People)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by ?????? (alhafez2021@gmail.com)

lOMoARcPSD|9082414

“The budgeted Income statement is a resourceful tool for management to project the financial

performance and profitability of the entity. It sets the vision into numbers and serves as the basis of the

implementation of various strategies at all levels in the entity. With the exercise of managerial expertise

and due care in making assumptions and estimates, it can reduce the possibilities of inaccuracies and can

be utilised in planning the future investing and financing decisions effectively” (Thakur, M).

In Dom Inno Builders, at the end of each year the budget meeting take place to determine the budget for

the upcoming year with the presence of branch manager, sales manager, operation manager, CFO & CEO.

According to Heisinger & Hoyle (n.d.) Successful companies approach budgeting from the bottom up.

This requires the involvement of various employees within the organization, not just upper management.

Lower-level employees often know more about their functional areas than upper management, and they

can be an excellent source of information for budgeting purposes. Although getting input from employees

throughout the organization can be time consuming, this approach tends to increase employee motivation

and acceptance of the budget.

The Budgeted Income statement can be prepared quarterly or yearly. However, it is advisable to prepare

the current year financial projections at quarterly intervals to monitor the actual performance as compared

to budgeted numbers at the end of every quarter. It is merely the combination of Sales/Revenue Budget,

Cost of Goods Sold Budget, Operating expense budget and cash budget.

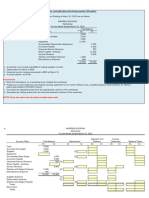

Dom Inno Builders Income Statement

Quarter 1 Quarter 3 Quarter 3 Quarter 4

Revenue 102000 135000 150000 140000

Cost to Goods

Sold 40000 55000 55000 55000

Gross Profit 62000 80000 95000 85000

Expenses

Salaries and

Benefits 26000 32000 35000 30000

Rent and

Overhead 10000 10000 10000 10000

Depreciation and

Amortization 18000 18000 18000 18000

Interest 2500 2500 2500 2500

Other 8800 8800 8800 8800

Total Expenses 65300 71300 74300 69300

Earning Before

Tax -3300 8700 20700 15700

Taxes 1001 2144 4231 4231

Net Earnings -4301 6556 16469 11469

Gross profit comes by subtracting revenue from the cost to goods sold. Total expenses is the summation

of the salaries, rent, depreciation, interest and other expenses. Difference between gross profit and total

expenses is the earning before tax. We can get net earnings by subtracting earning before taxes with taxes.

In the table we see Dom Inno builders have negative net earnings in the first quarter bit positive in the rest

of the year and 3rd quarter they are expecting highest net earnings.

Reference:

Downloaded by ?????? (alhafez2021@gmail.com)

lOMoARcPSD|9082414

Thakur, M. Budgeted Income Statement

Retrieved from https://www.wallstreetmojo.com/budgeted-income-statement/

Heisinger, K., & Hoyle, J. B. (n.d.). Accounting for Managers.

Retrieved from https://2012books.lardbucket.org/books/accounting-for-managers/s13-how-are-operating-

budgets-crea.html

Downloaded by ?????? (alhafez2021@gmail.com)

You might also like

- BUS 5111 - Financial Management - Written Assignment Unit 7Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 7LaVida Loca100% (1)

- UNIT 1-Written Assignment-BUS 5110Document5 pagesUNIT 1-Written Assignment-BUS 5110Aliyazahra Kamila100% (1)

- Discussion Assignment Unit-8 BUS 5110Document5 pagesDiscussion Assignment Unit-8 BUS 5110Djahan Rana100% (2)

- Written Assignment Unit 4Document3 pagesWritten Assignment Unit 4कुनाल सिंहNo ratings yet

- Written Assignment Unit 7 Business Law 5115Document7 pagesWritten Assignment Unit 7 Business Law 5115Ola leahNo ratings yet

- Bus 5110 Written Assignment Unit 7Document7 pagesBus 5110 Written Assignment Unit 7KonanRogerKouakouNo ratings yet

- Bus 145 Assignment 2Document18 pagesBus 145 Assignment 2Urvashi AroraNo ratings yet

- BUS 5110 - Written Assignment - Unit 6Document5 pagesBUS 5110 - Written Assignment - Unit 6Aliyazahra KamilaNo ratings yet

- BUS 5110 - Written Assignment - Unit 5 - MADocument5 pagesBUS 5110 - Written Assignment - Unit 5 - MAAliyazahra Kamila100% (1)

- Deferred Annuity: Sample ProblemDocument3 pagesDeferred Annuity: Sample ProblemChelsiemea Vargas100% (1)

- Unit 1 Written Assignment - Updated VersionDocument6 pagesUnit 1 Written Assignment - Updated VersionSimran Pannu100% (1)

- Written Assignment Unit 5 BUS 5110Document6 pagesWritten Assignment Unit 5 BUS 5110nefelikokNo ratings yet

- Bus 5110 Unit 2 AssignmentDocument5 pagesBus 5110 Unit 2 Assignmentwonnetta nicholson0% (1)

- BUS 5110 - Written Assignment Unit 5 University of The PeopleDocument5 pagesBUS 5110 - Written Assignment Unit 5 University of The Peoplechristian allosNo ratings yet

- Learning Guide Unit 2Document11 pagesLearning Guide Unit 2lebog0% (1)

- BUS 5115 - PF Unit 4Document5 pagesBUS 5115 - PF Unit 4christian allos100% (3)

- Written Assignment Unit 1 - Polly's Pet ProductsDocument3 pagesWritten Assignment Unit 1 - Polly's Pet ProductsJheralene Apple VistroNo ratings yet

- BUS 5114 Written Assignment Unit 7Document5 pagesBUS 5114 Written Assignment Unit 7Julie Udotai100% (1)

- Bus 5110-WK 4-Written AssignmentDocument3 pagesBus 5110-WK 4-Written Assignmentdavid olayiwolaNo ratings yet

- Book1 Group Act5110Document9 pagesBook1 Group Act5110SAMNo ratings yet

- Written Assignment 6 Bus 5110 Managerial AccountingDocument12 pagesWritten Assignment 6 Bus 5110 Managerial AccountingKonanRogerKouakouNo ratings yet

- BUS 5110 Managerial Accounting-Portfolio Activity Unit 8Document6 pagesBUS 5110 Managerial Accounting-Portfolio Activity Unit 8LaVida LocaNo ratings yet

- BUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Document5 pagesBUS 5110 Managerial Accounting Discussion Assignment Unit 6: Running Head: (Shortened Title Up To 50 Characters) 1Emmanuel Gift Bernard0% (1)

- Case Study Unit 6 Written AssignmentDocument5 pagesCase Study Unit 6 Written AssignmentBaiju RavalNo ratings yet

- Written Assignment Unit 3 BUS 5115-01Document7 pagesWritten Assignment Unit 3 BUS 5115-01modar KhNo ratings yet

- Group-Project-Bus-5110-For-Marketing-Activity Part 4Document3 pagesGroup-Project-Bus-5110-For-Marketing-Activity Part 4oukhirahamidNo ratings yet

- BUS 5115 - WK 5 - Written AssignmentDocument5 pagesBUS 5115 - WK 5 - Written AssignmentEzekiel PatrickNo ratings yet

- Bus 5110 - Managerial Accounting - Unit 2 - Written AssignmentDocument5 pagesBus 5110 - Managerial Accounting - Unit 2 - Written AssignmentLeslie100% (1)

- Portfolio Activity Unit 5 University of The PeopleDocument5 pagesPortfolio Activity Unit 5 University of The Peoplechristian allosNo ratings yet

- BUS 5116 Group 0009F Activity Part-IDocument15 pagesBUS 5116 Group 0009F Activity Part-IazgorNo ratings yet

- BUS 5110 - Assignment 1Document6 pagesBUS 5110 - Assignment 1michelle100% (1)

- BUS 5115 - WK 7 - Written AssignmentDocument4 pagesBUS 5115 - WK 7 - Written AssignmentEzekiel PatrickNo ratings yet

- Unit 2 Second PortfolioDocument3 pagesUnit 2 Second PortfolioSimran PannuNo ratings yet

- BUS 5110 - Managerial Accounting - Written Assignment Unit 4Document5 pagesBUS 5110 - Managerial Accounting - Written Assignment Unit 4Leslie100% (2)

- BUS 5111 - Financial Management - Written Assignment Unit 4Document5 pagesBUS 5111 - Financial Management - Written Assignment Unit 4LaVida LocaNo ratings yet

- Written Assignment Unit 3Document6 pagesWritten Assignment Unit 3Aby ZuñigaNo ratings yet

- BUS 5110 - PA Unit 6Document6 pagesBUS 5110 - PA Unit 6christian allosNo ratings yet

- BUS 5115 - WK 3 - Written AssignmentDocument4 pagesBUS 5115 - WK 3 - Written AssignmentEzekiel Patrick100% (1)

- BUS 5111 - Financial Management - Written Assignment Unit 2Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 2LaVida LocaNo ratings yet

- Written Assignment - BUS 5115 - Week 4Document8 pagesWritten Assignment - BUS 5115 - Week 4christian allos100% (1)

- University of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Document4 pagesUniversity of The People: BUS 5110 Managerial Accounting Portfolio Assignment 6Emmanuel Gift BernardNo ratings yet

- Polly's Pet ProductsDocument7 pagesPolly's Pet Productsseles23734No ratings yet

- Discussion Forum UNIT 1Document2 pagesDiscussion Forum UNIT 1Tesfa-Alem Alem100% (1)

- BUS 5110 Assignment Unit 7Document7 pagesBUS 5110 Assignment Unit 7Charles Irikefe100% (1)

- BUS 5111 - Financial Management - Written Assignment Unit 3Document5 pagesBUS 5111 - Financial Management - Written Assignment Unit 3LaVida LocaNo ratings yet

- Written Assignment Unit 4Document6 pagesWritten Assignment Unit 4Sidzz AbbasiNo ratings yet

- Written Assignment Unit 2-Bus5110Document4 pagesWritten Assignment Unit 2-Bus5110Franklyn Doh-Nani100% (1)

- BUS 5115 Unit 4 Portfolio Activity - Docx-SampleDocument5 pagesBUS 5115 Unit 4 Portfolio Activity - Docx-SampleRamy ahmed0% (1)

- Written Assignment Solution Unit 6Document6 pagesWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- Be Specific in Describing The Component Line Items of EachDocument2 pagesBe Specific in Describing The Component Line Items of EachNana Kweku Asifo OkyereNo ratings yet

- Bus 5110 Managerial Accounting Written Assignment Unit 74 PDFDocument10 pagesBus 5110 Managerial Accounting Written Assignment Unit 74 PDFEmmanuel Gift BernardNo ratings yet

- Written Assign 3 - CVP ANALYSISDocument5 pagesWritten Assign 3 - CVP ANALYSISFrank Kendoh100% (1)

- BUS 5110 Portfolio Activity Unit 5 BUS 5110 Portfolio Activity Unit 5Document5 pagesBUS 5110 Portfolio Activity Unit 5 BUS 5110 Portfolio Activity Unit 5ifeanyi ukachukwuNo ratings yet

- Assignment 5Document3 pagesAssignment 5Hilkiah MusNo ratings yet

- Unit 3 Discussion PostDocument3 pagesUnit 3 Discussion PostSimran PannuNo ratings yet

- Written Assignment Unit 7Document5 pagesWritten Assignment Unit 7Gregory PilarNo ratings yet

- Bus 5112 Marketing Management Written Assignment Unit 2Document5 pagesBus 5112 Marketing Management Written Assignment Unit 2rueNo ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaNo ratings yet

- BUS 5111 - Financial Management - Written Assignment Unit 1Document4 pagesBUS 5111 - Financial Management - Written Assignment Unit 1LaVida LocaNo ratings yet

- BUS 5110 - Portfolio Activity WK 1Document4 pagesBUS 5110 - Portfolio Activity WK 1Ezekiel Patrick100% (1)

- TBUS 5116 UNIT 1 WA FINAL The Case of BMWDocument6 pagesTBUS 5116 UNIT 1 WA FINAL The Case of BMWPyaihsone AungNo ratings yet

- Module 3 Problems On Income StatementDocument8 pagesModule 3 Problems On Income StatementShruthi PNo ratings yet

- Master of Business Administration, University of People BUS 5110: Managerial Accounting Written Assignment Unit 4Document6 pagesMaster of Business Administration, University of People BUS 5110: Managerial Accounting Written Assignment Unit 4Ahmad HafezNo ratings yet

- Portfolio Activity 7 Financial RatiosDocument6 pagesPortfolio Activity 7 Financial RatiosAhmad HafezNo ratings yet

- Written AssignementDocument9 pagesWritten AssignementAhmad HafezNo ratings yet

- MA Discussion Forum Week 5Document4 pagesMA Discussion Forum Week 5Ahmad HafezNo ratings yet

- Written Assignment Unit 4Document4 pagesWritten Assignment Unit 4Ahmad HafezNo ratings yet

- BUS 5110 Managerial Accounting Writing Unit 5Document1 pageBUS 5110 Managerial Accounting Writing Unit 5Ahmad HafezNo ratings yet

- Auditing ProblemsDocument29 pagesAuditing ProblemsPrincesNo ratings yet

- Macroeconomic Framework-Performance and Policies: Chapter #2Document28 pagesMacroeconomic Framework-Performance and Policies: Chapter #2Annam InayatNo ratings yet

- MCom - Accounts ch-13 Topic3Document19 pagesMCom - Accounts ch-13 Topic3Sameer GoyalNo ratings yet

- AE 121 Chapter 21 Summary NotesDocument3 pagesAE 121 Chapter 21 Summary NotesmercyvienhoNo ratings yet

- Persys Midterms FormulasDocument2 pagesPersys Midterms Formulaslingat airenceNo ratings yet

- Taxation 2 Syllabus Atty SaniDocument4 pagesTaxation 2 Syllabus Atty Saniyasser lucmanNo ratings yet

- Note The Key Components of The Following Types of BudgetsDocument2 pagesNote The Key Components of The Following Types of Budgetssajana kunwarNo ratings yet

- iFAST UOBDocument18 pagesiFAST UOBZheng Yuan TanNo ratings yet

- 3CD ReportDocument14 pages3CD ReportRuloans VaishaliNo ratings yet

- Tax Saving InstrumentsDocument4 pagesTax Saving InstrumentsDinesh CNo ratings yet

- FR111. FFA Solution CMA January 2022 ExaminationDocument5 pagesFR111. FFA Solution CMA January 2022 ExaminationMohammed Javed UddinNo ratings yet

- Homework - Chapter 2Document3 pagesHomework - Chapter 2JunnieNo ratings yet

- Pradnya Kale - Appointment LetterDocument3 pagesPradnya Kale - Appointment LetterPradnya KaleNo ratings yet

- 2130-Accounting For ManagersDocument1 page2130-Accounting For Managerskrushnakakde884No ratings yet

- II. Compilation of GDP by Income ApproachDocument15 pagesII. Compilation of GDP by Income ApproachPreetiNo ratings yet

- Multiple Choice QuestionsDocument77 pagesMultiple Choice QuestionsLara FloresNo ratings yet

- Tax Return of Individuals AssesseDocument19 pagesTax Return of Individuals AssesseShahidul IslamNo ratings yet

- 15 043 IBFD International Tax Glossary 7th Edition Final WebDocument20 pages15 043 IBFD International Tax Glossary 7th Edition Final WebDaisy AnitaNo ratings yet

- MF 4Document4 pagesMF 4harish dsNo ratings yet

- Literature Review On Tax PlanningDocument8 pagesLiterature Review On Tax Planningaflskdwol100% (1)

- 7.3 Prepare Financial Budgets - Principles of Accounting, Volume 2 - Managerial Accounting - OpenStaxDocument9 pages7.3 Prepare Financial Budgets - Principles of Accounting, Volume 2 - Managerial Accounting - OpenStaxGiang ĐặngNo ratings yet

- Project: Prepare A Worksheet, Financial Statements, and Adjusting and Closing Entries (15 Marks)Document5 pagesProject: Prepare A Worksheet, Financial Statements, and Adjusting and Closing Entries (15 Marks)jonialbadri1000No ratings yet

- Adjusting EntriesDocument22 pagesAdjusting EntriesShakir IsmailNo ratings yet

- Instructions ItrDocument988 pagesInstructions ItrBalasubramanian NatarajanNo ratings yet

- Sinking Fund and AmortizationDocument8 pagesSinking Fund and AmortizationMay Jovi JalaNo ratings yet

- Chap 9 Tax CorrectedDocument9 pagesChap 9 Tax CorrectedAdah Micah PlarisanNo ratings yet

- Topic:-Direct and Indirect Taxes: Department of Electronics & Telecommunication EngineeringDocument15 pagesTopic:-Direct and Indirect Taxes: Department of Electronics & Telecommunication EngineeringSakshi DewadeNo ratings yet

- CIR vs. ALGUE, 158 SCRA 9Document5 pagesCIR vs. ALGUE, 158 SCRA 9Khenlie VillaceranNo ratings yet