Professional Documents

Culture Documents

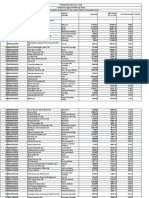

Monthly Portfolio Statement As On September 30,2021

Monthly Portfolio Statement As On September 30,2021

Uploaded by

amolkupwad0 ratings0% found this document useful (0 votes)

17 views4 pagesThe portfolio statement summarizes the fund's holdings as of September 30, 2021. It lists the name, ISIN, industry and quantity held for each of the top 50 equity holdings. The total market value of these holdings is Rs. 214,294.91 lacs, which represents approximately 100% of the fund's net assets. The portfolio has exposure to various sectors including banks, software, pharmaceuticals, automobiles and others.

Original Description:

Original Title

EB

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe portfolio statement summarizes the fund's holdings as of September 30, 2021. It lists the name, ISIN, industry and quantity held for each of the top 50 equity holdings. The total market value of these holdings is Rs. 214,294.91 lacs, which represents approximately 100% of the fund's net assets. The portfolio has exposure to various sectors including banks, software, pharmaceuticals, automobiles and others.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

17 views4 pagesMonthly Portfolio Statement As On September 30,2021

Monthly Portfolio Statement As On September 30,2021

Uploaded by

amolkupwadThe portfolio statement summarizes the fund's holdings as of September 30, 2021. It lists the name, ISIN, industry and quantity held for each of the top 50 equity holdings. The total market value of these holdings is Rs. 214,294.91 lacs, which represents approximately 100% of the fund's net assets. The portfolio has exposure to various sectors including banks, software, pharmaceuticals, automobiles and others.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

Home

Mirae Asset Emerging Bluech

(Large & Mid Cap Fund -An open ended equity scheme investing in bot

Monthly Portfolio Statement as on September 30,2021

Name of the Instrument ISIN Industry

Equity & Equity related

(a) Listed / awaiting listing on Stock Exchanges

IBCL05 HDFC Bank Limited INE040A01034 Banks

HDFB0 ICICI Bank Limited INE090A01021 Banks

3

INFS02 Axis Bank Limited INE238A01034 Banks

UTIB02 Infosys Limited INE009A01021 Software

SBAI02 State Bank of India INE062A01020 Banks

BTVL0 Bharti Airtel Limited INE397D01024 Telecom - Services

2

TCSL0 Voltas Limited INE226A01021 Consumer Durables

1

TISC01 MphasiS Limited INE356A01018 Software

JKCE0 JK Cement Limited INE823G01014 Cement & Cement Products

1

GSPL0 Gujarat State Petronet Limited INE246F01010 Gas

1

VOLT0 Tata Consultancy Services Limited INE467B01029 Software

2

BFLS0 Reliance Industries Limited IN9002A01032 Petroleum Products

1

MAUD0 Maruti Suzuki India Limited INE585B01010 Auto

1

MAXI02 Tata Steel Limited INE081A01012 Ferrous Metals

NAPH0 Max Financial Services Limited INE180A01020 Insurance

2

RIND03 SKF India Limited INE640A01023 Industrial Products

SKFB0 Sun Pharmaceutical Industries Limited INE044A01036 Pharmaceuticals

2

TOPH0 Ajanta Pharma Limited INE031B01049 Pharmaceuticals

2

AJPH0 SBI Life Insurance Company Limited INE123W01016 Insurance

3

GOOD Torrent Pharmaceuticals Limited INE685A01028 Pharmaceuticals

02

BPCL0 Indian Energy Exchange Limited INE022Q01020 Capital Markets

1

ASHL0 Vinati Organics Limited INE410B01037 Chemicals

2

SLIF01 Natco Pharma Limited INE987B01026 Pharmaceuticals

VORL0 Kansai Nerolac Paints Limited INE531A01024 Consumer Non Durables

3

PFCL0 HDFC Life Insurance Company Limited INE795G01014 Insurance

1

BALI02 Ashok Leyland Limited INE208A01029 Auto

KOMA0 Power Finance Corporation Limited INE134E01011 Finance

2

IEEL02 Atul Limited INE100A01010 Chemicals

CGCE0 Nuvoco Vistas Corporation Limited INE118D01016 Cement & Cement Products

1

LARS0 Larsen & Toubro Limited INE018A01030 Construction Project

2

HDFC0 Page Industries Limited INE761H01022 Textile Products

3

IPCA02 Bharat Electronics Limited INE263A01024 Aerospace & Defense

BHEL0 SBI Cards and Payment Services Limited INE018E01016 Finance

2

SAEL0 Balkrishna Industries Limited INE787D01026 Auto Ancillaries

2

UTIA01 Sona BLW Precision Forgings Limited INE073K01018 Auto Ancillaries

TELC0 IPCA Laboratories Limited INE571A01020 Pharmaceuticals

3

SRFL0 Havells India Limited INE176B01034 Consumer Durables

1

SPIL03 Crompton Greaves Consumer Electricals Limited INE299U01018 Consumer Durables

ITCL02 Bharat Petroleum Corporation Limited INE029A01011 Petroleum Products

PAGE0 ITC Limited INE154A01025 Consumer Non Durables

1

ATUL0 UTI Asset Management Company Limited INE094J01016 Capital Markets

1

SHTR0 Emami Limited INE548C01032 Consumer Non Durables

1

FRHL0 Kotak Mahindra Bank Limited INE237A01028 Banks

1

DABU0 Chemplast Sanmar Limited INE488A01050 Chemicals

2

CEAT0 Shriram Transport Finance Company Limited INE721A01013 Finance

2

GTWA0 Dr. Reddy's Laboratories Limited INE089A01023 Pharmaceuticals

1

RIND01 Housing Development Finance Corporation Limited INE001A01036 Finance

HAIL03 Tata Motors Limited INE155A01022 Auto

SBCP0 Krishna Institute Of Medical Sciences Limited INE967H01017 Healthcare Services

1

ZEET0 CEAT Limited INE482A01020 Auto Ancillaries

2

HLEL0 Fortis Healthcare Limited INE061F01013 Healthcare Services

2

HDLI01 TVS Motor Company Limited INE494B01023 Auto

EMAM0 Gateway Distriparks Limited INE852F01015 Transportation

2

hip Fund

th large cap and mid cap stocks)

Market/Fair Value(Rs.

Quantity % to Net Assets YTM

in Lacs)

7,794,044 124311.10 5.85%

17,324,841 121421.15 5.71%

12,570,088 96356.01 4.53%

5,432,584 91006.65 4.28%

17,485,277 79208.30 3.73%

9,330,111 64219.15 3.02%

5,065,203 61696.71 2.90%

1,920,120 59608.21 2.80%

1,726,914 53668.17 2.52%

16,141,511 51007.17 2.40%

1,335,005 50403.78 2.37%

2,661,111 49793.38 2.34%

639,650 46937.84 2.21%

3,495,142 45048.89 2.12%

4,209,673 42698.71 2.01%

1,332,527 41191.74 1.94%

4,536,056 37116.28 1.75%

1,579,911 35991.95 1.69%

2,879,550 34989.41 1.65%

1,125,255 34719.74 1.63%

5,357,513 34606.86 1.63%

1,776,832 34435.89 1.62%

3,597,768 32075.90 1.51%

4,986,854 31579.25 1.49%

4,361,819 31509.78 1.48%

23,438,665 31360.93 1.47%

21,132,745 30029.63 1.41%

317,250 30019.94 1.41%

5,334,495 28992.98 1.36%

1,553,881 26461.82 1.24%

82,055 26015.46 1.22%

12,698,851 25772.32 1.21%

2,472,317 25454.98 1.20%

997,465 25272.27 1.19%

4,535,019 25207.90 1.19%

1,011,504 24390.90 1.15%

1,759,387 24158.14 1.14%

5,015,246 24018.01 1.13%

5,484,685 23704.81 1.11%

10,036,631 23701.50 1.11%

2,178,389 23242.32 1.09%

3,994,419 22927.97 1.08%

1,131,599 22694.22 1.07%

3,703,174 22680.09 1.07%

1,709,812 22207.89 1.04%

447,950 21863.10 1.03%

783,921 21591.54 1.02%

5,575,000 18584.26 0.87%

1,510,452 18447.15 0.87%

1,392,982 18411.04 0.87%

6,736,743 17751.32 0.83%

3,072,459 16881.63 0.79%

6,284,480 14853.37 0.70%

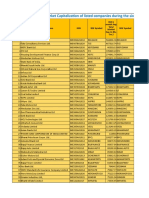

Zomato Limited INE758T01015 Retailing

NTPC Limited INE733E01010 Power

Bata India Limited INE176A01028 Consumer Durables

Motherson Sumi Systems Limited INE775A01035 Auto Ancillaries

DRRL0 Hindustan Unilever Limited INE030A01027 Consumer Non Durables

2

NACL0 Cholamandalam Investment and Finance Company Limited INE121A01024 Finance

3

BATA0 Hindustan Petroleum Corporation Limited INE094A01015 Petroleum Products

2

DLPL0 SRF Limited INE647A01010 Chemicals

1

HPEC0 National Aluminium Company Limited INE139A01034 Non - Ferrous Metals

1

SONB0 Reliance Industries Limited INE002A01018 Petroleum Products

1

CHOL0 Dabur India Limited INE016A01026 Consumer Non Durables

2

TWAT0 Titan Company Limited INE280A01028 Consumer Durables

2

AVSP0 Sub Total

1 (b) Unlisted

Bharti Airtel Limited ** INE397D20024 Telecom - Services

Sub Total

Total

Others

Mutual Fund Units

118859 Mirae Asset Cash Management Fund - DIRECT GROWTH INF769K01CM1

Sub Total

Total

TREPS / Reverse Repo

TRP_0 Triparty Repo

10721 Sub Total

Total

Net Receivables / (Payables)

GRAND TOTAL

$ Less Than 0.01% of Net Asset Value

** Non Traded Security

# Unlisted Security

1 year Portfolo Turnover Ratio 77.76%

10,819,789 14779.83 0.70%

9,182,332 13025.14 0.61%

689,114 12253.48 0.58%

5,041,636 11391.58 0.54%

205,733 5558.49 0.26%

753,048 4249.07 0.20%

1,318,654 3955.96 0.19%

25,000 2819.78 0.13%

934,439 872.77 0.04%

24,196 609.56 0.03%

94,879 585.45 0.03%

2,628 56.81 0.00%

2112457.43 99.35%

655,722 1005.22 0.05%

1005.22 0.05%

2113462.65 99.40%

2,393 52.83 0.00%

52.83 0.00%

52.83 0.00%

4901.72 0.23%

4901.72 0.23%

4901.72 0.23%

7899.60 0.37%

2126316.80 100.00%

You might also like

- DPR Ksidc 2492015 PDFDocument202 pagesDPR Ksidc 2492015 PDFpravass100% (3)

- Microgreens BusinessDocument42 pagesMicrogreens Businessi Kordi100% (11)

- Kelso Industries News ReleaseDocument2 pagesKelso Industries News Releaseapi-537942649No ratings yet

- MARWARI COLLEGE Project Work FinalDocument67 pagesMARWARI COLLEGE Project Work FinalAnkit Raj78% (9)

- Company Profile (Toyota)Document27 pagesCompany Profile (Toyota)Dnyaneshwar SuravaseNo ratings yet

- Mirare Asset Emerging Bluechip FolioDocument4 pagesMirare Asset Emerging Bluechip FoliokarlNo ratings yet

- Mirae Asset Monthly Full Portfolio August 2019Document61 pagesMirae Asset Monthly Full Portfolio August 2019sunnyramidiNo ratings yet

- Mirae Asset Full Portfolio January 2020Document69 pagesMirae Asset Full Portfolio January 2020brijsingNo ratings yet

- Mirae Asset Monthly Full Portfolio January 2021Document86 pagesMirae Asset Monthly Full Portfolio January 2021Ram hereNo ratings yet

- Mirae Asset Full Portfolio - March 2020Document68 pagesMirae Asset Full Portfolio - March 2020KarlosNo ratings yet

- Mirae Asset Full Portfolio-January2019Document54 pagesMirae Asset Full Portfolio-January2019Richa BhargavaNo ratings yet

- Large Cap Fund - An Open Ended Equity Scheme Predominantly Investing Across Large Cap StocksDocument4 pagesLarge Cap Fund - An Open Ended Equity Scheme Predominantly Investing Across Large Cap StocksAnand BiradarNo ratings yet

- Axis Midcap FundDocument9 pagesAxis Midcap FundRaj kishorNo ratings yet

- Monthly Portfolio Statement As On August 31,2023Document4 pagesMonthly Portfolio Statement As On August 31,2023Snehil KumarNo ratings yet

- DSP Equity Opportunities FundDocument8 pagesDSP Equity Opportunities FundswaypnilshandilyaNo ratings yet

- ELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitDocument4 pagesELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitAmar BhapkarNo ratings yet

- SUNMAFDocument9 pagesSUNMAFSridhar NarayananNo ratings yet

- Monthly Portfolio - Axis Children S Gift Fund - 29 Feb 2024Document6 pagesMonthly Portfolio - Axis Children S Gift Fund - 29 Feb 2024Jadon PrinceNo ratings yet

- Monthly Portfolio Statement As On September 30, 2021Document4 pagesMonthly Portfolio Statement As On September 30, 2021SUNNY SINGHNo ratings yet

- Monthly Portfolio Statement As On December 31,2022: Former Name: Mirae Asset ESG Sector Leaders ETFDocument4 pagesMonthly Portfolio Statement As On December 31,2022: Former Name: Mirae Asset ESG Sector Leaders ETFBlack Sheep (BlackSheep 黑羊)No ratings yet

- Monthly Portfolio - Axis Growth Opportunities Fund - 29 Feb 2024Document8 pagesMonthly Portfolio - Axis Growth Opportunities Fund - 29 Feb 2024Ranjith KumarNo ratings yet

- Axis Mid Cap FundDocument6 pagesAxis Mid Cap FundsaiNo ratings yet

- Bandhan Nifty 50 Index Fund 31 May 2023Document4 pagesBandhan Nifty 50 Index Fund 31 May 2023sache vilayetiNo ratings yet

- Factsheet Close Ended June 2020Document111 pagesFactsheet Close Ended June 2020umesh1807No ratings yet

- Monthly Portfolio Disclosure 31st Jan 2023 Woc Flexi Cap FundDocument7 pagesMonthly Portfolio Disclosure 31st Jan 2023 Woc Flexi Cap FundRaghunatha ReddyNo ratings yet

- ELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitDocument4 pagesELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitNishanth TRNo ratings yet

- Monthly Portfolio - Axis Mid Cap Fund - 31 Jan 2023Document6 pagesMonthly Portfolio - Axis Mid Cap Fund - 31 Jan 2023rathore400No ratings yet

- ELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitDocument4 pagesELSS - An Open Ended Equity Linked Saving Scheme With A Statutory Lock in of 3 Years and Tax BenefitEswar NNo ratings yet

- PPFAS Monthly Portfolio Report January 31 2024Document64 pagesPPFAS Monthly Portfolio Report January 31 2024Pratik HingeNo ratings yet

- Canara Robeco Elss Tax Saver: Monthly Portfolio Statement As On March 31, 2024Document14 pagesCanara Robeco Elss Tax Saver: Monthly Portfolio Statement As On March 31, 2024ptus nayakNo ratings yet

- SBI Long Term Equity Fund Scheme 01092aa1 57ad 4593 92af 0eb2161adfcbDocument11 pagesSBI Long Term Equity Fund Scheme 01092aa1 57ad 4593 92af 0eb2161adfcbamarmuz16No ratings yet

- PPFCF PPFAS Monthly Portfolio Report April 30 2024Document15 pagesPPFCF PPFAS Monthly Portfolio Report April 30 2024deshofficialdocumentNo ratings yet

- Sbi Mutual Fund: Scheme Name: Portfolio Statement As OnDocument9 pagesSbi Mutual Fund: Scheme Name: Portfolio Statement As OnNithin K ReethanNo ratings yet

- Axis Small Cap FundDocument8 pagesAxis Small Cap Fundvarun padmanabhanNo ratings yet

- Sundaram Large & Medium Cap MFDocument8 pagesSundaram Large & Medium Cap MFNirav AsherNo ratings yet

- SBI Mutual FundDocument11 pagesSBI Mutual Fundda MNo ratings yet

- Icici Prudential Smallcap FundDocument9 pagesIcici Prudential Smallcap Fundmadhavlohiya12gNo ratings yet

- Sbi Contra Fund Monthly Portfolio April 2024Document15 pagesSbi Contra Fund Monthly Portfolio April 2024skbmnnitNo ratings yet

- Sbi Contra Fund Portfolio (January-2022!12!1)Document12 pagesSbi Contra Fund Portfolio (January-2022!12!1)CgggvvgvvNo ratings yet

- Canara Robeco Emerging Equities: Monthly Portfolio Statement As On November 30, 2022Document6 pagesCanara Robeco Emerging Equities: Monthly Portfolio Statement As On November 30, 2022Omprakash Yadav KedarNo ratings yet

- PPFAS Monthly Portfolio Report February 29 2024Document73 pagesPPFAS Monthly Portfolio Report February 29 2024AdityaNo ratings yet

- SC (5)Document5 pagesSC (5)Intraday TraderNo ratings yet

- Monthly Portfolio - Axis Small Cap Fund - 28 Feb 2023Document6 pagesMonthly Portfolio - Axis Small Cap Fund - 28 Feb 2023mohan vamsiNo ratings yet

- Sbi Small Cap Fund Portfolio (November-2022-329-1)Document11 pagesSbi Small Cap Fund Portfolio (November-2022-329-1)Shivam PorwalNo ratings yet

- PPFAS Monthly Portfolio Report February 28 2023Document44 pagesPPFAS Monthly Portfolio Report February 28 2023DevendraNo ratings yet

- L&T Tax Advantage Fund Portfolio 31st Aug 22Document1 pageL&T Tax Advantage Fund Portfolio 31st Aug 22srinivas krishnaNo ratings yet

- SBI-BLUE-CHIP-FUND-MONTHLY-PORTFOLIO---APRIL-2024Document11 pagesSBI-BLUE-CHIP-FUND-MONTHLY-PORTFOLIO---APRIL-2024rajudimudiNo ratings yet

- PMS Entire Portfolios 30 June 2022Document14 pagesPMS Entire Portfolios 30 June 2022Deepak GoyalNo ratings yet

- Factsheet Close Ended Mar 2020Document114 pagesFactsheet Close Ended Mar 2020Aditya SharmaNo ratings yet

- Bandhan ELSS Tax Saver Fund 31 Mar 2024Document6 pagesBandhan ELSS Tax Saver Fund 31 Mar 2024ptus nayakNo ratings yet

- PPFCF PPFAS Monthly Portfolio Report August 31 2023Document13 pagesPPFCF PPFAS Monthly Portfolio Report August 31 2023AdityaNo ratings yet

- NBDocument6 pagesNBVijay S PatilNo ratings yet

- Sbi Blue Chip Fund Portfolio (November-2020-43-1)Document9 pagesSbi Blue Chip Fund Portfolio (November-2020-43-1)swapnil solankiNo ratings yet

- N2 (1)Document5 pagesN2 (1)Intraday TraderNo ratings yet

- Maebf Jan 2024Document6 pagesMaebf Jan 2024jain.kumar113642No ratings yet

- Monthly Portfolio Report Union Large Midcap Fund 31.07.2023Document17 pagesMonthly Portfolio Report Union Large Midcap Fund 31.07.2023cssrinfotech316No ratings yet

- ICICI Prudential Bluechip FundDocument10 pagesICICI Prudential Bluechip Fundmaheshgawand144No ratings yet

- Avg. Market Capitalization of Listed Companies During - Jul-Dec 2017Document232 pagesAvg. Market Capitalization of Listed Companies During - Jul-Dec 2017vineetksr1No ratings yet

- PPFCF PPFAS Monthly Portfolio Report December 31 2023Document16 pagesPPFCF PPFAS Monthly Portfolio Report December 31 2023vaibhav vermaNo ratings yet

- Name of The Instrument Isin Industry Equity & Equity Related (A) Listed / Awaiting Listing On Stock ExchangesDocument4 pagesName of The Instrument Isin Industry Equity & Equity Related (A) Listed / Awaiting Listing On Stock ExchangesPriya DasaNo ratings yet

- 1 Monthly Portfolio Jun 18Document122 pages1 Monthly Portfolio Jun 18Jennifer NievesNo ratings yet

- EADocument6 pagesEAofficeofgautammukherjiNo ratings yet

- Icici Prudential Bluechip FundDocument10 pagesIcici Prudential Bluechip FundRaj RathodNo ratings yet

- Sbi Blue Chip Fund June 2023Document9 pagesSbi Blue Chip Fund June 2023varipe1667No ratings yet

- How Better Regulation Can Shape the Future of Indonesia's Electricity SectorFrom EverandHow Better Regulation Can Shape the Future of Indonesia's Electricity SectorNo ratings yet

- Dairy Animal Health Care - Training GuideDocument86 pagesDairy Animal Health Care - Training GuideamolkupwadNo ratings yet

- Ayurvedic Panchakarma & Wellness In: Atmasantulana VillageDocument12 pagesAyurvedic Panchakarma & Wellness In: Atmasantulana VillageamolkupwadNo ratings yet

- DHA Past PapersDocument153 pagesDHA Past Papersamolkupwad100% (4)

- Treatmentplanning Chapter PublishedDocument68 pagesTreatmentplanning Chapter PublishedamolkupwadNo ratings yet

- Accounting For Spoilage, Defective Units and Scrap: 1. TerminologyDocument13 pagesAccounting For Spoilage, Defective Units and Scrap: 1. TerminologyWegene Benti UmaNo ratings yet

- Successful Entrepreneurs: by - Faizaan ShareefDocument8 pagesSuccessful Entrepreneurs: by - Faizaan Shareeffaizaan zakirNo ratings yet

- W4 QuizDocument1 pageW4 QuizMa. Bernadeth JimenezNo ratings yet

- 8 - Batch 1 - Eastern Condiments CaseDocument9 pages8 - Batch 1 - Eastern Condiments CaseAman SaxenaNo ratings yet

- Manufacturing Industries 10thDocument7 pagesManufacturing Industries 10thMushtaq KasbaNo ratings yet

- Part I: Multiple Choice: Choose The Best Answer From The Given Alternatives and The Correct Letter On The Answer Sheet ProvidedDocument2 pagesPart I: Multiple Choice: Choose The Best Answer From The Given Alternatives and The Correct Letter On The Answer Sheet ProvidedGetahun FantahunNo ratings yet

- Assignment AgricultureDocument5 pagesAssignment AgricultureSiLLa ÀntoNyNo ratings yet

- Third Party SubconDocument17 pagesThird Party SubconPrathap ReddyNo ratings yet

- MSG - 11 - 69322 - Age of IndustrialisationDocument3 pagesMSG - 11 - 69322 - Age of IndustrialisationUllhas Y KumarNo ratings yet

- Deepak MahurkarDocument8 pagesDeepak MahurkartarangtusharNo ratings yet

- Debitaccounttransactions Date Description Type Amount AvailableDocument1 pageDebitaccounttransactions Date Description Type Amount AvailableClifton WilsonNo ratings yet

- Theses Open DefenceDocument18 pagesTheses Open Defencebonahussen48No ratings yet

- There Is No Way But QARDocument12 pagesThere Is No Way But QAREdmark PedranoNo ratings yet

- Chapter 5: Cost Allocation Case Study: Angelo Trucking: Fachbereich Elektrische EnergietechnikDocument1 pageChapter 5: Cost Allocation Case Study: Angelo Trucking: Fachbereich Elektrische EnergietechnikShahid NaseemNo ratings yet

- Tev Study of MB Agro MillsDocument42 pagesTev Study of MB Agro MillsVidya SinghNo ratings yet

- Mahindra and MahindraDocument16 pagesMahindra and MahindraBhavuk Kabra100% (1)

- Apqp Test.Document2 pagesApqp Test.rajesh sharma100% (1)

- Eco - Size of The Market FVDocument6 pagesEco - Size of The Market FVParikshit KunduNo ratings yet

- Pfizer India LTDDocument5 pagesPfizer India LTDManish VermaNo ratings yet

- Land Reforms in India: Objectives, Measures and ImpactDocument22 pagesLand Reforms in India: Objectives, Measures and ImpactVaibhav KalraNo ratings yet

- Employee Update AugustDocument9 pagesEmployee Update AugustVinicios FerrazNo ratings yet

- Mahindra and Mahindra Report-2021Document30 pagesMahindra and Mahindra Report-2021Àñshùl Ràñgárí100% (2)

- Goat ProposalDocument14 pagesGoat ProposalJaypee Mar AlicanteNo ratings yet

- Annual Report 2018-19 - 1 PDFDocument216 pagesAnnual Report 2018-19 - 1 PDFhkNo ratings yet

- Research On Telecom SectorDocument7 pagesResearch On Telecom SectorShubhan KhanNo ratings yet