Professional Documents

Culture Documents

Act1111 Final Exam PDF Free

Act1111 Final Exam PDF Free

Uploaded by

Isla PageCopyright:

Available Formats

You might also like

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- 47 - Financial Reporting and Changing PricesDocument3 pages47 - Financial Reporting and Changing PricesYvonne Joy Mondano TehNo ratings yet

- Home Office BranchDocument5 pagesHome Office BranchMikaella SarmientoNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Karkits CorporationDocument4 pagesKarkits Corporation김우림0% (3)

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Page Comprehensive Theories and ProblemsDocument7 pagesPage Comprehensive Theories and Problemsharley_quinn11No ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Audit of Allowance For Doubtful AccountsDocument4 pagesAudit of Allowance For Doubtful AccountsCJ alandyNo ratings yet

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- Operating Segments - Discussion ProblemsDocument2 pagesOperating Segments - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Quiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisDocument11 pagesQuiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisHaidee Flavier SabidoNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- TVA Case StudyDocument19 pagesTVA Case StudyMig SablayNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Buang Ang TaxDocument17 pagesBuang Ang TaxEdeksupligNo ratings yet

- AUDP ROB REV-Correction of Errors Wit Ans KeyDocument12 pagesAUDP ROB REV-Correction of Errors Wit Ans KeyJohn Emerson PatricioNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Documento - MX Ap Receivables Quizzer QDocument10 pagesDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteNo ratings yet

- ACAFA Consignment SalesDocument8 pagesACAFA Consignment SalesMerr Fe PainaganNo ratings yet

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Document6 pagesProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- M2 Q Cfs and FinplnDocument7 pagesM2 Q Cfs and FinplnLeane MarcoletaNo ratings yet

- Audit-Of Inventory ACHA - KJDocument47 pagesAudit-Of Inventory ACHA - KJKhrisna Joy AchaNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- DocxDocument33 pagesDocxGray Javier0% (1)

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- Composition of Cash and Cash EquivalentDocument20 pagesComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanNo ratings yet

- DocxDocument358 pagesDocxAina AguirreNo ratings yet

- Cash Basis Accrual BasisDocument4 pagesCash Basis Accrual BasisForkenstein0% (1)

- Chapter 11 - RR: ConsignmentDocument17 pagesChapter 11 - RR: ConsignmentJane DizonNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- Auditing Problems MC Quizzer 02Document15 pagesAuditing Problems MC Quizzer 02anndyNo ratings yet

- Management AccountingDocument8 pagesManagement AccountingSeddrinth DracoNo ratings yet

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDocument4 pagesLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzNo ratings yet

- AFAR2 - Dayag - Solman PDFDocument411 pagesAFAR2 - Dayag - Solman PDFHazel Mae LasayNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- CH 08Document22 pagesCH 08xxxxxxxxxNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- CHAPTER 03 - Pg.4-6Document4 pagesCHAPTER 03 - Pg.4-6JabonJohnKennethNo ratings yet

- Practice AcctngDocument7 pagesPractice AcctngRubiliza GailoNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument6 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsGlen JavellanaNo ratings yet

- Part 2 PRE2Document3 pagesPart 2 PRE2School FilesNo ratings yet

- Quizzer 16 FinalDocument14 pagesQuizzer 16 FinalCamelle ArellanoNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- MQ 1 Receivables and InventoryDocument4 pagesMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Auditing ProblemsDocument26 pagesAuditing ProblemsKingChryshAnneNo ratings yet

- Audit ReviewDocument6 pagesAudit ReviewArnel RemorinNo ratings yet

- ReceivablesDocument5 pagesReceivablesEren Cruz100% (1)

- P1 1.3CashBasisAccrualBasisSingleEntryZETADocument3 pagesP1 1.3CashBasisAccrualBasisSingleEntryZETASophia AprilNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Presentation 1Document1 pagePresentation 1Haidee Flavier SabidoNo ratings yet

- Guillermo, Ramon.2011.The Problem of 'Indio' Inferiority in Science - Rizal's Two Views PDFDocument24 pagesGuillermo, Ramon.2011.The Problem of 'Indio' Inferiority in Science - Rizal's Two Views PDFHaidee Flavier SabidoNo ratings yet

- Albrecht Chap 13Document47 pagesAlbrecht Chap 13Haidee Flavier SabidoNo ratings yet

- Topic8. PPT. WCM - Inventory ManagementDocument21 pagesTopic8. PPT. WCM - Inventory ManagementHaidee Flavier Sabido100% (1)

- Risk ManagementDocument42 pagesRisk ManagementHaidee Flavier SabidoNo ratings yet

- AR Astern Niversity: General EducationDocument3 pagesAR Astern Niversity: General EducationHaidee Flavier SabidoNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFHaidee Flavier SabidoNo ratings yet

- Internal Control SystemDocument27 pagesInternal Control SystemHaidee Flavier SabidoNo ratings yet

- Guillermo, Ramon.2012.Moral Forces, Philosophy of History, and War in Jose RizalDocument29 pagesGuillermo, Ramon.2012.Moral Forces, Philosophy of History, and War in Jose RizalHaidee Flavier SabidoNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Recognition and Contestation of Indigenous Land Rights in The PhilippinesDocument13 pagesRecognition and Contestation of Indigenous Land Rights in The PhilippinesHaidee Flavier SabidoNo ratings yet

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- Being "Indigenous" in Indonesia and The Philippines: Contradictions and PitfallsDocument21 pagesBeing "Indigenous" in Indonesia and The Philippines: Contradictions and PitfallsHaidee Flavier SabidoNo ratings yet

- ACT1110 Fundamental Concepts of Risk ManagementDocument42 pagesACT1110 Fundamental Concepts of Risk ManagementHaidee Flavier SabidoNo ratings yet

- Corporate Governance - IIA AustraliaDocument2 pagesCorporate Governance - IIA AustraliaHaidee Flavier SabidoNo ratings yet

- Module 2 - Estate TaxDocument14 pagesModule 2 - Estate TaxHaidee Flavier SabidoNo ratings yet

- Fed Home Loan Boston vs. BanksDocument378 pagesFed Home Loan Boston vs. BanksCairo AnubissNo ratings yet

- Operational Guidelines For AnyoDocument5 pagesOperational Guidelines For AnyoMarl Louie SeminianoNo ratings yet

- CA Final Afm t380Document257 pagesCA Final Afm t380Bijay AgrawalNo ratings yet

- Definition Off Balance SheetDocument7 pagesDefinition Off Balance SheetdomomwambiNo ratings yet

- HW - Case 8-2 Pp. 240-241Document4 pagesHW - Case 8-2 Pp. 240-241rajo_onglaoNo ratings yet

- CH - 16 - Dilutive Securities and Earnings Per ShareDocument96 pagesCH - 16 - Dilutive Securities and Earnings Per ShareSamiHadadNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Important Judgments On SARFAESI ActDocument9 pagesImportant Judgments On SARFAESI Actaashick iqbalNo ratings yet

- Regulation of Financial Markets Take Home ExamDocument22 pagesRegulation of Financial Markets Take Home ExamBrandon TeeNo ratings yet

- Buss CombiDocument10 pagesBuss CombiIzzy BNo ratings yet

- Money and Banking Week 3Document16 pagesMoney and Banking Week 3Pradipta NarendraNo ratings yet

- Session 6.0 Financial StatementsDocument11 pagesSession 6.0 Financial StatementsBenzon Agojo OndovillaNo ratings yet

- EC3102 Macroeconomic Analysis II Questions and Answers Prepared by Ho Kong Weng Tutorial 10Document5 pagesEC3102 Macroeconomic Analysis II Questions and Answers Prepared by Ho Kong Weng Tutorial 10Chiew Jun Siew0% (1)

- Bonds ProblemDocument9 pagesBonds ProblemLouie De La TorreNo ratings yet

- Netflix Case-1Document6 pagesNetflix Case-1Eliza Sankar-GortonNo ratings yet

- Business Finance Week 1 and 2Document56 pagesBusiness Finance Week 1 and 2Jonathan De villaNo ratings yet

- Debt RestructureDocument2 pagesDebt RestructureJeffrey CincoNo ratings yet

- Exhibit G Securitization Is IllegalDocument28 pagesExhibit G Securitization Is IllegalrodclassteamNo ratings yet

- How To Determine Audit FeeDocument28 pagesHow To Determine Audit FeeAshu W ChamisaNo ratings yet

- Ikb Marketing Brochure PDF 000038548747Document74 pagesIkb Marketing Brochure PDF 000038548747hblodget6728No ratings yet

- IAI SP5 Syllabus 2024Document7 pagesIAI SP5 Syllabus 2024sriinaNo ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- Banking and Financial Markets - A Risk Management Perspective Syllabus-Preview PageDocument3 pagesBanking and Financial Markets - A Risk Management Perspective Syllabus-Preview Pagejoel wilsonNo ratings yet

- Governmental and Not-For-profit Accounting Solution of c8Document23 pagesGovernmental and Not-For-profit Accounting Solution of c8Cathy Gu100% (4)

- Master Circular On Guarantee,, Co-Acceptance & Letter of Credit Nov. 2021Document14 pagesMaster Circular On Guarantee,, Co-Acceptance & Letter of Credit Nov. 2021Nimitt ChoudharyNo ratings yet

- Crg660 Debt Financing PDFDocument3 pagesCrg660 Debt Financing PDFazianNo ratings yet

- Aadya Tiwary Shreya SharmaDocument19 pagesAadya Tiwary Shreya SharmaChandan TiwariNo ratings yet

Act1111 Final Exam PDF Free

Act1111 Final Exam PDF Free

Uploaded by

Isla PageOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act1111 Final Exam PDF Free

Act1111 Final Exam PDF Free

Uploaded by

Isla PageCopyright:

Available Formats

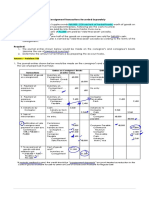

Far Eastern University

Manila City

Intermediate Accounting 3 December _, 2020

FINAL EXAMINATION Ms. Bernadette L. Baul

1) Big Bro Company borrows money under various loan agreement involving notes discounted and notes requiring interest

payments at maturity. During the current year ended December 31, Big Bro paid interest totaling P5,000,000. The balance

sheets included the following:

December 31 January 1

Interest payable 2,500,000 2,000,000

Prepaid interest 1,500,000 500,000

How much interest expense should Big Bro report for the current year?

Answer:

Use the following information for the next five (5) questions:

An analysis of incomplete records of Dayao Corporation produced the following information applicable to 2019:

Accounts Increases Accounts Decreases

Cash 4,200,000 Inventory 1,000,000

Accounts receivable 1,400,000 Equipment 100,000

Accounts payable 400,000 Notes receivable 600,000

Prepaid insurance 200,000 Accrued salaries payable 300,000

Summary of cash transactions were as follows:

Receipts:

Cash sales 3,000,000

Collections of accounts receivable 30,000,000

Collections on notes receivable 2,400,000

Interest on notes receivable 200,000

Purchase returns and allowances 500,000

Disbursements:

Cash purchases 1,000,000

Payments on accounts payable 16,500,000

Sales returns and allowances 400,000

Insurance 700,000

Salaries 10,000,000

Equipment 800,000

Other expenses 1,500,000

Dividends 1,000,000

Additional information:

• Total purchase returns and allowances amounted to P800,000

• Total sales returns and allowances amounted to P1,200,000.

2) What is the accrual basis Net sales?

Answer:

3) What is the accrual basis Net purchases?

Answer:

4) What is the accrual cost of sales?

Answer:

5) What is the depreciation expense?

Answer:

6) What is the net income under accrual basis of accounting?

Answer:

Use the following information for the next four (4) questions:

Cagindangan Company presented to you the following income statement.

Cagindangan Company

Income Statement

For the Year Ended December 31, 2020

Sales 10,350,000

Cost of Goods Sold 7,050,000

Gross profit 3,300,000

Operating expenses:

Selling 675,000

Administrative 1,050,000 1,725,000

Net income 1,575,000

Additional information:

• Accounts receivable decreased P540,000 during the year.

• Prepaid expenses increased P255,000 during the year.

• Accounts payable to suppliers of merchandise decreased P412,500 during the year.

• Accrued expenses payable decreased P150,000 during the year.

• Administrative expenses include depreciation expense of P90,000.

• Inventories decreased by P450,000.

7) What is the total amount of cash paid for operating expenses during the year?

Answer:

8) What is the net amount of cash provided by operating activities?

Answer:

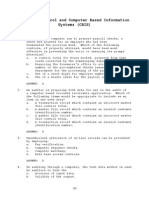

9) The following information relates to Jallorina Corporation for the year ended June 30, 2022.

Sales revenue 450,000

Opening balance of trade receivables (net of allowance) 100,000

Closing balance of trade receivable (net of allowance) 132,500

Doubtful debt expense 5,000

Increase in allowance for doubtful debts 2,000

Bad debts are written off against the allowance for doubtful debts. What is the amount of cash collected from the

customers during the year ended June 30, 2022?

Answer:

10) Alexis Company prepares its statement of cash flows using the direct method for operating activities. For the year ended

December 31, 2020, Alexis Company reports the following activity:

Sales on account 1,300,000

Cash sales 740,000

Decrease in accounts receivable 610,000

Increase in accounts payable 72,000

Increase in inventory 48,000

Cost of goods sold 975,000

What is the amount of cash payments to suppliers reported by Alexis Company for the year ended December 31, 2020?

Answer:

Use the following information for the next four (4) questions:

One Man Company provided the following information on selected transactions during 2022:

Purchase of land by issuing bonds 250,000

Proceeds from issuing bonds 500,000

Purchases of inventory 950,000

Purchases of treasury shares 150,000

Loans made to affiliated corporations 350,000

Dividends paid to preference shareholders 100,000

Proceeds from issuing preference share 400,000

Proceeds from sale of equipment 50,000

Intermediate Accounting 2 Page 2 of 7

11) The net cash provided (used) by investing activities during 2022 is

Answer:

12) The net cash provided by financing activities during 2022 is

Answer:

13) Net cash flows from operating activities for 2022 for Bajue Corporation was P300,000. The following items are reported

on the financial statements for 2022:

Cash dividends paid on ordinary shares 20,000

Depreciation amortization 12,000

Increase in accounts receivable 24,000

Based on the information above, Bajie’s net income for 2022 was

Answer:

14) The following information on selected cash transactions for 2022 has been provided by Temperance Company:

Proceeds from sale of land 160,000

Proceeds from long-term borrowings 400,000

Purchases of plant assets 144,000

Purchases of inventories 680,000

Proceeds from sale of Temperance ordinary share 240,000

What is the cash provided (used) by investing activities for the year ended December 31, 2022, as a result of the above

information?

Answer:

15) Selected information from Prison Break Company’s 2022 accounting records is as follows:

Proceeds from issuance of ordinary shares 400,000

Proceeds from issuance of bonds 1,200,000

Cash dividends on ordinary shares paid 160,000

Cash dividends on preference shares paid 60,000

Purchase of treasury shares 120,000

Sale of ordinary shares to officers and employees not included above 100,000

Prison Break’s statement of cash flows for the year ended December 31, 2022, would show net cash provided (used) by

financing activities of (include negative sign if used)

Answer:

16) Pyromancer Inc. manufactures steel. What will be the net cash flow from operating activities based on the following

information? (include negative sign if outflow)

Issue of shares 500,000

Repayment of debentures 300,000

Sale of goods on credit 1,200,000

Sale of goods on cash 300,000

Cash purchases 800,000

Additional term loan 200,000

Purchase of additional plant 600,000

Bad debts written off 20,000

Receivable – January 1 500,000

Receivables – December 31 600,000

Answer:

17) Thunderbringer Company provided the following selected information:

Accounts receivable – January 1, net of allowance of P100,000 1,200,000

Accounts receivable – December 31, net of allowance of P300,000 1,600,000

Sales of the year 8,000,000

Bad debt expense for the year 250,000

Cash expenses for the year 5,250,000

What is the net cash flow from operating activities?

Answer:

Intermediate Accounting 2 Page 3 of 7

18) Hag Company reported the following account balances at December 31, 2023:

Accounts receivable (net) 550,000

Trading securities 1,200,000

Accumulated depreciation on equipment and furniture 350,000

Cash 200,000

Inventory 600,000

Equipment and furniture 2,500,000

Patent 120,000

Deferred charges 40,000

Land held for future business site 800,000

What amount should be reported as total current asset?

Answer:

Use the following information for the next two (2) questions:

Foxhound Company provided the following balances on December 31, 2021:

Cash and cash equivalent 1,000,000

Trade and other receivable 950,000

Inventory 500,000

Financial assets at fair value through P&L 500,000

Financial assets at fair value through OCI 800,000

Property, Plant and Equipment 1,500,000

Further analysis of Foxhound Company’s accounts revealed the following:

• Trade and other receivable included the following:

§ Advances to an executive officer for P250,000 which is due on March 1, 2023.

§ Customer credit balance of P60,000 which deducted in relation to goods returned in 2021.

§ Equity over the assigned accounts of P120,000; the assigned accounts amounted to P200,000 while the related

note balance was P80,000.

• Property, Plant and Equipment includes a plot of land in which Foxhound Company has committed to a plan to sell it and

currently active in locating a buyer to complete the plan. The carrying value of the land included in the account was

P675,000 while its fair value less cost to sell is P600,000.

19) The amount reported as current asset on December 31, 2021 is

Answer:

20) The amount reported as noncurrent asset on December 31, 2021 is

Answer:

Use the following information for the next two (2) questions:

Alas Company provided the following balances on December 31, 2021:

Cash and cash equivalents 1,200,000

Inventory 650,000

Prepayments 120,000

Investment in associate 440,000

Deferred tax asset 200,000

Intangible assets 380,000

Further analysis of Alas Company’s accounts revealed the following:

• Cash account includes a sinking fund of P300,000, as well as P90,000 being held to pay VAT. The balance was net of

an overdraft amounting to P200,000 in its BPI account. Alas does not have any other account in BPI.

• Prepayments included a P50,000 security deposit which will expire by December 31, 2023.

• The deferred tax asset was due to a future deductible amount of which 40% will reverse in 2022 and the remaining portion

evenly from 2023 to 2025.

21) The amount reported as current assets on December 31, 2021 is

Answer:

22) The amount reported as noncurrent asset on December 31, 2021 is

Answer:

Intermediate Accounting 2 Page 4 of 7

23) Campbel Company’s records for the year ended December 31, 2022 included the following information:

Raw materials purchases 860,000

Work in progress inventory decrease 10,000

Finished goods inventory increase 70,000

Raw materials inventory decrease 30,000

Manufacturing overhead 600,000

Freight-out 90,000

Direct labor 400,000

Campbel Company’s cost of sales for the year 2022 is

Answer:

24) Blass Company provided the following information for the current year:

Unrealized loss on FVTOCI investments 500,000

Translation reserve – credit 600,000

Revaluation reserve 2,000,000

Accumulated profits adjustment – debit 100,000

Appropriated reserve 200,000

Gain on sale of treasury shares 150,000

Net income 6,000,000

What amount of comprehensive income should be reported for the current year?

Answer:

25) The following information for 2022 is provided by Kaya Mo Yan Company:

Sales 20,000,000

Cost of goods sold 12,000,000

Selling expenses 1,200,000

General and administrative expenses 1,800,000

Interest expense 1,500,000

Gain on early extinguishment of long-term debt 500,000

Correction of inventory error, net of income tax – credit 800,000

Investment income – equity method 600,000

Gain on sale of investment 2,000,000

Income tax expense 2,100,000

Dividends declared 2,500,000

What was the 2022 income from continuing operations?

Answer:

26) The following transactions for Brutavious Enterprises during the second quarter of 2022:

• Sales amounted to P5,000,000 and related cost of goods sold was P3,000,000

• Selling expenses for the given period was P250,000.

• Depreciation is usually recorded by Brutavious at annual amount of P1,200,000.

• Real property taxes for the year in the amount of P600,000 were paid on April 1, 2022.

• An inventory loss arising from a temporary market decline of P400,000 had occurred on June 30, 2022.

Ignoring income taxes, net income for the second quarter ending June 30, 2022 should be

Answer:

27) Arrow Company and its divisions are engaged solely in manufacturing operations. The following data pertains to the

industries in which operations were conducted for the year ended December 31, 2022.

Segments Total revenue Operating profit Identifiable assets

A 13,000,000 4,000,000 25,000,000

B 9,000,000 2,000,000 20,000,000

C 7,700,000 1,500,000 15,000,000

D 3,000,000 1,000,000 7,000,000

E 3,800,000 800,000 8,000,000

F 3,500,000 700,000 5,000,000

40,000,000 10,000,000 80,000,000

In its segment information for 2022, how many reportable operating segments does Arrow have?

Answer:

Intermediate Accounting 2 Page 5 of 7

Use the following information for the next three (3) questions:

On January 1, 2022, TLC Company classifies a hotel property a non-current asset held for sale. Immediately before the

classification as held for sale, the carrying amount of the property is P400,000,000 (cost of P500,000,000 and accumulated

depreciation of P100,000,000). The hotel is depreciated on the straight-line method with a useful life of 50 years. The estimate

of the fair value less cost to sell on this date is P350,000,000. On January 1, 2023 no buyer could be identified. On this date,

management concludes that the criteria for classification could not be met. The estimate of the fair value less cost to sell is

revised to P340,000,000 while the value in use at the time is estimated at P380,000,000.

28) What amount of impairment loss should TLC Company recognize at the date the asset was classified as held for sale?

Answer:

29) The amount taken to profit or loss on the date the asset was reclassified back to property, plant and equipment is

Answer:

30) The depreciation expense for 2023 after the asset was reclassified back to property, plant and equipment is

Answer:

Use the following information for the next two (2) questions:

Nobita Corporation has two business segments, Segment A and Segment B. Segment A’s business operation is continuing.

Segment B met the criteria to be classified as “held for sale”. The board of directors was able to dispose this segment (B) on

September 1, 2021. Net proceeds from the sale were P20,000,000; while the segments’ carrying amount on September 1,

2021 was P18,000,000. The following pertains to the results of the operations of Segment A & B during 2021:

Segment A Segment B

January 1 – December 31, 2021 January 1 – December 31, 2021

Revenue 25,000,000 2,000,000

Selling and general expenses 15,000,000 15,000,000

Income tax 35%

31) How much shall be presented as Discontinued operations on the face of the income statement?

Answer:

32) How much shall be presented as profit/loss on the face of the income statement?

Answer:

Use the following information for the next four (4) questions:

Jindo Company reported profits of P4,000,000 and P8,000,000 in 2021 and 2022, respectively. In 2023, the following prior

period errors were discovered:

• The inventory on December 31, 2021 was understated by P200,000.

• An equipment with an acquisition cost of P1,200,000 was erroneously charged as expense in 2021. The equipment has

an estimated useful life of 5 years with no residual value. Jindo Company provides full year depreciation in the year of

acquisition.

The unadjusted balances of retained earnings are P8,800,000 and P16,800,000 as of December 31, 2021 and 2022,

respectively.

33) How much is the correct profit in 2021?

Answer:

34) How much is the correct profit in 2022?

Answer:

35) How much is the correct retained earnings in 2021?

Answer:

36) How much is the correct retained earnings in 2022?

Answer:

37) Arachna Inc. has determined the following information related to operations for 2023:

Revenue from sales 7,000,000

Expenses 4,000,000

Income before income taxes 3,000,000

In reviewing the records, you discovered the following items:

Intermediate Accounting 2 Page 6 of 7

• During 2023, the company discovered an error in depreciation in 2022. The correction of this error, which has not

been recorded, will result in an increase in depreciation for 2022 of P200,000.

• During 2023, the company sustained a loss of P400,000 because of flood, which destroyed its inventory. The

company charged retained earnings and credited inventory for P400,000.

How much is the correct profit before tax for the year 2023?

Answer:

Use the following information for the next three (3) questions:

Wildsoul Company showed pre-tax income of P2,500,000 for the year ended December 31, 2022. On your year-end

verification of the transactions of the Company, you discovered the following errors:

• P1,000,000 worth of merchandise was purchased in 2022 and included in the ending inventory. However, the purchase

was recorded only in 2023.

• A merchandise shipment valued at P1,500,000 was properly recorded as purchases at year-end. The merchandise was

inadvertently omitted from the physical count, since it has not arrived by December 31, 2022.

• Value added tax for the fourth quarter of 2022, amounting to P500,000, was included in the Sales account.

• Rental of P300,000 on an equipment, applicable for six months, was received on November 1, 2022. The entire amount

was reported as revenue upon receipt.

• Rent paid on building covering the period from July 1, 2022 to July 1, 2023, amounting to P1,200,000, was paid and

recorded as expense on July 1, 2022. The company did not make any adjustment at the end of the year.

38) The correct pre-tax profit for 2022 should

Answer:

39) What is the net effect of the foregoing errors on the total assets at December 31, 2022? (use negative sign if overstated)

Answer:

40) What is the total understatement of the total liabilities at December 31, 2022?

Answer:

--- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- End--- ¥ --- ¥ --- ¥ --- ¥ --- ¥ --- ¥ ---

Intermediate Accounting 2 Page 7 of 7

You might also like

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- 47 - Financial Reporting and Changing PricesDocument3 pages47 - Financial Reporting and Changing PricesYvonne Joy Mondano TehNo ratings yet

- Home Office BranchDocument5 pagesHome Office BranchMikaella SarmientoNo ratings yet

- Advanced Accounting 2Document9 pagesAdvanced Accounting 2Elmin ValdezNo ratings yet

- Karkits CorporationDocument4 pagesKarkits Corporation김우림0% (3)

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Page Comprehensive Theories and ProblemsDocument7 pagesPage Comprehensive Theories and Problemsharley_quinn11No ratings yet

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- Audit of Allowance For Doubtful AccountsDocument4 pagesAudit of Allowance For Doubtful AccountsCJ alandyNo ratings yet

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- Operating Segments - Discussion ProblemsDocument2 pagesOperating Segments - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Quiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisDocument11 pagesQuiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisHaidee Flavier SabidoNo ratings yet

- Errors - Discussion ProblemsDocument2 pagesErrors - Discussion ProblemsHaidee Flavier SabidoNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- TVA Case StudyDocument19 pagesTVA Case StudyMig SablayNo ratings yet

- Cash Accrual Single EntryDocument3 pagesCash Accrual Single EntryJustine GuilingNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Buang Ang TaxDocument17 pagesBuang Ang TaxEdeksupligNo ratings yet

- AUDP ROB REV-Correction of Errors Wit Ans KeyDocument12 pagesAUDP ROB REV-Correction of Errors Wit Ans KeyJohn Emerson PatricioNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Documento - MX Ap Receivables Quizzer QDocument10 pagesDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteNo ratings yet

- ACAFA Consignment SalesDocument8 pagesACAFA Consignment SalesMerr Fe PainaganNo ratings yet

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Document6 pagesProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- M2 Q Cfs and FinplnDocument7 pagesM2 Q Cfs and FinplnLeane MarcoletaNo ratings yet

- Audit-Of Inventory ACHA - KJDocument47 pagesAudit-Of Inventory ACHA - KJKhrisna Joy AchaNo ratings yet

- Auditing Problems 2Document8 pagesAuditing Problems 2Rujean Salar AltejarNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- DocxDocument33 pagesDocxGray Javier0% (1)

- Finals - Receivables 2 Exercises WithoutDocument4 pagesFinals - Receivables 2 Exercises WithoutA.B AmpuanNo ratings yet

- Composition of Cash and Cash EquivalentDocument20 pagesComposition of Cash and Cash EquivalentYenelyn Apistar CambarijanNo ratings yet

- DocxDocument358 pagesDocxAina AguirreNo ratings yet

- Cash Basis Accrual BasisDocument4 pagesCash Basis Accrual BasisForkenstein0% (1)

- Chapter 11 - RR: ConsignmentDocument17 pagesChapter 11 - RR: ConsignmentJane DizonNo ratings yet

- Name: Jean Rose T. Bustamante Bsma-3: Let's CheckDocument10 pagesName: Jean Rose T. Bustamante Bsma-3: Let's CheckJean Rose Tabagay BustamanteNo ratings yet

- Auditing Problems MC Quizzer 02Document15 pagesAuditing Problems MC Quizzer 02anndyNo ratings yet

- Management AccountingDocument8 pagesManagement AccountingSeddrinth DracoNo ratings yet

- File 7595477826281120346Document13 pagesFile 7595477826281120346sunshineNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Audit of PPE ExercisesDocument3 pagesAudit of PPE ExercisesMARCUAP Flora Mel Joy H.No ratings yet

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDocument4 pagesLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzNo ratings yet

- AFAR2 - Dayag - Solman PDFDocument411 pagesAFAR2 - Dayag - Solman PDFHazel Mae LasayNo ratings yet

- CHAPTER 8 - Audit of Liabilities: Problem 1Document27 pagesCHAPTER 8 - Audit of Liabilities: Problem 1Mikaela Gale CatabayNo ratings yet

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraNo ratings yet

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- CH 08Document22 pagesCH 08xxxxxxxxxNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- CHAPTER 03 - Pg.4-6Document4 pagesCHAPTER 03 - Pg.4-6JabonJohnKennethNo ratings yet

- Practice AcctngDocument7 pagesPractice AcctngRubiliza GailoNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument6 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsGlen JavellanaNo ratings yet

- Part 2 PRE2Document3 pagesPart 2 PRE2School FilesNo ratings yet

- Quizzer 16 FinalDocument14 pagesQuizzer 16 FinalCamelle ArellanoNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationlouise carinoNo ratings yet

- MQ 1 Receivables and InventoryDocument4 pagesMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Auditing ProblemsDocument26 pagesAuditing ProblemsKingChryshAnneNo ratings yet

- Audit ReviewDocument6 pagesAudit ReviewArnel RemorinNo ratings yet

- ReceivablesDocument5 pagesReceivablesEren Cruz100% (1)

- P1 1.3CashBasisAccrualBasisSingleEntryZETADocument3 pagesP1 1.3CashBasisAccrualBasisSingleEntryZETASophia AprilNo ratings yet

- Cash Accrual Practice SetDocument2 pagesCash Accrual Practice SetMa. Trixcy De VeraNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- 162 003Document5 pages162 003Alvin John San Juan33% (3)

- AC191 Autumn 2011 FINALDocument9 pagesAC191 Autumn 2011 FINALgerlaniamelgacoNo ratings yet

- Cash and Accrual BasisDocument4 pagesCash and Accrual BasisBwwwiiiii100% (1)

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Presentation 1Document1 pagePresentation 1Haidee Flavier SabidoNo ratings yet

- Guillermo, Ramon.2011.The Problem of 'Indio' Inferiority in Science - Rizal's Two Views PDFDocument24 pagesGuillermo, Ramon.2011.The Problem of 'Indio' Inferiority in Science - Rizal's Two Views PDFHaidee Flavier SabidoNo ratings yet

- Albrecht Chap 13Document47 pagesAlbrecht Chap 13Haidee Flavier SabidoNo ratings yet

- Topic8. PPT. WCM - Inventory ManagementDocument21 pagesTopic8. PPT. WCM - Inventory ManagementHaidee Flavier Sabido100% (1)

- Risk ManagementDocument42 pagesRisk ManagementHaidee Flavier SabidoNo ratings yet

- AR Astern Niversity: General EducationDocument3 pagesAR Astern Niversity: General EducationHaidee Flavier SabidoNo ratings yet

- ACTIVITY 5 Interim Reporting PDFDocument2 pagesACTIVITY 5 Interim Reporting PDFHaidee Flavier SabidoNo ratings yet

- Internal Control SystemDocument27 pagesInternal Control SystemHaidee Flavier SabidoNo ratings yet

- Guillermo, Ramon.2012.Moral Forces, Philosophy of History, and War in Jose RizalDocument29 pagesGuillermo, Ramon.2012.Moral Forces, Philosophy of History, and War in Jose RizalHaidee Flavier SabidoNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Recognition and Contestation of Indigenous Land Rights in The PhilippinesDocument13 pagesRecognition and Contestation of Indigenous Land Rights in The PhilippinesHaidee Flavier SabidoNo ratings yet

- Statement of Cash FlowDocument2 pagesStatement of Cash FlowHaidee Flavier Sabido100% (1)

- Being "Indigenous" in Indonesia and The Philippines: Contradictions and PitfallsDocument21 pagesBeing "Indigenous" in Indonesia and The Philippines: Contradictions and PitfallsHaidee Flavier SabidoNo ratings yet

- ACT1110 Fundamental Concepts of Risk ManagementDocument42 pagesACT1110 Fundamental Concepts of Risk ManagementHaidee Flavier SabidoNo ratings yet

- Corporate Governance - IIA AustraliaDocument2 pagesCorporate Governance - IIA AustraliaHaidee Flavier SabidoNo ratings yet

- Module 2 - Estate TaxDocument14 pagesModule 2 - Estate TaxHaidee Flavier SabidoNo ratings yet

- Fed Home Loan Boston vs. BanksDocument378 pagesFed Home Loan Boston vs. BanksCairo AnubissNo ratings yet

- Operational Guidelines For AnyoDocument5 pagesOperational Guidelines For AnyoMarl Louie SeminianoNo ratings yet

- CA Final Afm t380Document257 pagesCA Final Afm t380Bijay AgrawalNo ratings yet

- Definition Off Balance SheetDocument7 pagesDefinition Off Balance SheetdomomwambiNo ratings yet

- HW - Case 8-2 Pp. 240-241Document4 pagesHW - Case 8-2 Pp. 240-241rajo_onglaoNo ratings yet

- CH - 16 - Dilutive Securities and Earnings Per ShareDocument96 pagesCH - 16 - Dilutive Securities and Earnings Per ShareSamiHadadNo ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Important Judgments On SARFAESI ActDocument9 pagesImportant Judgments On SARFAESI Actaashick iqbalNo ratings yet

- Regulation of Financial Markets Take Home ExamDocument22 pagesRegulation of Financial Markets Take Home ExamBrandon TeeNo ratings yet

- Buss CombiDocument10 pagesBuss CombiIzzy BNo ratings yet

- Money and Banking Week 3Document16 pagesMoney and Banking Week 3Pradipta NarendraNo ratings yet

- Session 6.0 Financial StatementsDocument11 pagesSession 6.0 Financial StatementsBenzon Agojo OndovillaNo ratings yet

- EC3102 Macroeconomic Analysis II Questions and Answers Prepared by Ho Kong Weng Tutorial 10Document5 pagesEC3102 Macroeconomic Analysis II Questions and Answers Prepared by Ho Kong Weng Tutorial 10Chiew Jun Siew0% (1)

- Bonds ProblemDocument9 pagesBonds ProblemLouie De La TorreNo ratings yet

- Netflix Case-1Document6 pagesNetflix Case-1Eliza Sankar-GortonNo ratings yet

- Business Finance Week 1 and 2Document56 pagesBusiness Finance Week 1 and 2Jonathan De villaNo ratings yet

- Debt RestructureDocument2 pagesDebt RestructureJeffrey CincoNo ratings yet

- Exhibit G Securitization Is IllegalDocument28 pagesExhibit G Securitization Is IllegalrodclassteamNo ratings yet

- How To Determine Audit FeeDocument28 pagesHow To Determine Audit FeeAshu W ChamisaNo ratings yet

- Ikb Marketing Brochure PDF 000038548747Document74 pagesIkb Marketing Brochure PDF 000038548747hblodget6728No ratings yet

- IAI SP5 Syllabus 2024Document7 pagesIAI SP5 Syllabus 2024sriinaNo ratings yet

- Sandfits Foundries Private LimitedDocument7 pagesSandfits Foundries Private Limitedvignesh seenirajNo ratings yet

- Banking and Financial Markets - A Risk Management Perspective Syllabus-Preview PageDocument3 pagesBanking and Financial Markets - A Risk Management Perspective Syllabus-Preview Pagejoel wilsonNo ratings yet

- Governmental and Not-For-profit Accounting Solution of c8Document23 pagesGovernmental and Not-For-profit Accounting Solution of c8Cathy Gu100% (4)

- Master Circular On Guarantee,, Co-Acceptance & Letter of Credit Nov. 2021Document14 pagesMaster Circular On Guarantee,, Co-Acceptance & Letter of Credit Nov. 2021Nimitt ChoudharyNo ratings yet

- Crg660 Debt Financing PDFDocument3 pagesCrg660 Debt Financing PDFazianNo ratings yet

- Aadya Tiwary Shreya SharmaDocument19 pagesAadya Tiwary Shreya SharmaChandan TiwariNo ratings yet