Professional Documents

Culture Documents

Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221

Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221

Uploaded by

Jeric TorionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221

Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221

Uploaded by

Jeric TorionCopyright:

Available Formats

PABRES, JOCELLE P ACC 221 (7751) 1:30-2:30pm

LET’S ANALYZE BVPS #4-7

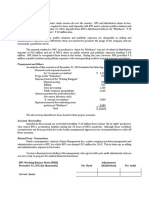

Problem 4 (Adapted) The shareholders equity of Joyce corporation on Dec.

31, 2018 shows the following

account balances:

10% preference share, 10,000 shares, 100 par 1,000,000

12% preference share, 12,000 shares, 100 par 1,200,000

Ordinary share, 20,000 shares, 40 par 800,000

Share premium 640,000

Accumulated profits 960,000

The 10% preference share is cumulative and fully participating, while the 12%

preference share is non

cumulative and fully participating. The last payment

of dividends was on Dec. 31, 2016. What is the book

value per share of ordinary shares?

Excess 10%Preference 12%Preference Ordinary

Balances

(640,000 + 960,000) 1,600,000 1,000,0000 1,200,000 800,000

10% x 1,000,000 x 2 (200,000) 200,000

12% x 1,200,000 x 1 (144,000) 144,000

10% x 800,000 x 1 (80,000) 80,000

Balance – prorate 1,176,000 392,000 470,400 313,600

Divide shares Outs. 10,000 12,000 20,000

Book value per share 159.2 151.2 59.68

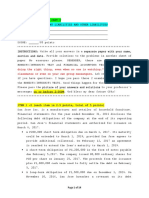

Problem 5

Dixie company’s equity at Dec. 31, 2017, consisted of the following:

8% cumulative preference share capital, 50 par, Liquidating value 55 per

share, authorized, Issued and outstanding 40,000 shares, 2,000,000,

Ordinary share capital, 25 par, 400,000 shares authorized, 100,000 shares

issued and outstanding, 5,000,000 and Retained earnings, 400,000.

Dividends on preference share have been paid through 2015 but have not

been declared for 2016 and 2017. At Dec. 31, 2017, what is Dixie’s book

value per ordinary share?

Total Equity ( 2,000,000 + 5,000,000 + 400,000) 7,400,000

Preference shareholders’ equity:

Preference Share Capital 3,000,000

Liquidating Premium {40,000 x (55-50)} 200,000

Preference Dividend in Arrears

( 2,000,000 x 8% x 2) 320,000 (2,520,000)

Ordinary shareholders’ Equity 4,880,000

Divide: Ordinary shares 100,000

Book Value per share 48.80

PABRES, JOCELLE P ACC 221 (7751) 1:30-2:30pm

LET’S ANALYZE BVPS #4-7

Problem 6 (Adapted)

Anna company presented the following account balances in the shareholders’ equity

section for the year ended December 31, 2018: Preference share capital, 12% P50

par, P3,000,000, Ordinary share capital, P100 par, P6,000,000 and deficit,

(P1,350,000). No dividends have been paid on the preference share since 2016.

Determine the book value per share under the following conditions:

a. Preference share is preferred as to assets

Answer:

Activity 7 (Adapted)

Shaina company reported the following shareholders’ equity on December 31,

2019: Preference share capital, 10% cumulative and non participating, P100

par, 10,000 shares P1,000,000 Ordinary share capital, P100 par, 20,000

shares 2,000,000 Subscribed ordinary share capital, 10,000 shares 1,000,000

Subscriptions receivable 250,000 Share Premium 500,000 Retained Earnings

1,200,000 Treasury ordinary shares, 5,000 at cost 400,000 The preference

dividends are in arrears for 2017, 2018 and 2019.

a. What is the book value per ordinary share?

TOTAL SHE 5,300,000

Capital Investment of shares (1,000,000)

Unpaid Earnings of Pref. Shares

(1,000,000 x 10% x 3) (300,000)

Remaining SHE for Ordinary Shares 4,000,000

Divide: Outstanding shares plus subscribe 25,000

BVPS 160

PABRES, JOCELLE P ACC 221 (7751) 1:30-2:30pm

LET’S ANALYZE BVPS #4-7

b.What is the book value per preference share?

Capital Investment of Pref. Shares 1,000,000

Unpaid earnings of Pref. Shares 300,000

Total 1,300,000

Divide: Outstanding Shares 10,000

BVPS 130

You might also like

- Book Value Per Share: RequiredDocument19 pagesBook Value Per Share: RequiredLouise67% (12)

- Book Value and Preference Dividends ProblemsDocument17 pagesBook Value and Preference Dividends ProblemsRheu Reyes100% (6)

- VOL 3 18. Book Value Per ShareDocument15 pagesVOL 3 18. Book Value Per ShareJohn Vincent CruzNo ratings yet

- Football Trading StrategyDocument27 pagesFootball Trading StrategyChem100% (2)

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- BLTDocument4 pagesBLTJaylord PidoNo ratings yet

- 5.1 Seatwork Quiz Receivable FinancingDocument2 pages5.1 Seatwork Quiz Receivable FinancingSean Aaron Segucio0% (1)

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Chap 008 - RETURN ON INVESTED CAPITAL AND PROFITABILITY ANALYSISDocument26 pagesChap 008 - RETURN ON INVESTED CAPITAL AND PROFITABILITY ANALYSIShy_saingheng_760260970% (10)

- Bridge Investments LTD On Pre IPO Market. Can You Better?Document7 pagesBridge Investments LTD On Pre IPO Market. Can You Better?Andres100% (2)

- Lets Analyze Bvps and Eps ParconDocument9 pagesLets Analyze Bvps and Eps ParconJeric TorionNo ratings yet

- Accounting For Exploration and Evaluation Expenditures and DepletionDocument1 pageAccounting For Exploration and Evaluation Expenditures and DepletionMark Angelo BustosNo ratings yet

- Impairment of Asset: Cash Generating UnitDocument28 pagesImpairment of Asset: Cash Generating UnitLumongtadJoanMaeNo ratings yet

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- 4 Activity 5 PPEDocument9 pages4 Activity 5 PPEDaniella Mae ElipNo ratings yet

- Finacc 3Document6 pagesFinacc 3Tong WilsonNo ratings yet

- Exercise - Part 3Document10 pagesExercise - Part 3lois martinNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- xACC 213Document10 pagesxACC 213CharlesNo ratings yet

- Assement Exam-Dysas 1st Quarter-P1Document5 pagesAssement Exam-Dysas 1st Quarter-P1JohnAllenMarillaNo ratings yet

- PDF Info 1 DLDocument28 pagesPDF Info 1 DLEdrickLouise DimayugaNo ratings yet

- MAS CompiledDocument5 pagesMAS CompiledadorableperezNo ratings yet

- Chapter 7Document18 pagesChapter 7kathleenNo ratings yet

- Answer KeysDocument26 pagesAnswer Keysmia uyNo ratings yet

- Financial Accounting III Midterm ExaminationDocument9 pagesFinancial Accounting III Midterm ExaminationKriz-leen TiuNo ratings yet

- ACC 221 - Fourth ExaminationDocument5 pagesACC 221 - Fourth ExaminationCharlesNo ratings yet

- This Study Resource Was: Invesment in Equity Securities UploadedDocument4 pagesThis Study Resource Was: Invesment in Equity Securities UploadedmerryNo ratings yet

- Benjo Lopez CoDocument2 pagesBenjo Lopez Conovy0% (1)

- 5 - Discussion - Standard Costing and Variance AnalysisDocument1 page5 - Discussion - Standard Costing and Variance AnalysisCharles TuazonNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- Seatwork Module 10Document3 pagesSeatwork Module 10Marjorie PalmaNo ratings yet

- Chapter 31SMEs Property Plant and EquipmentDocument2 pagesChapter 31SMEs Property Plant and EquipmentDez ZaNo ratings yet

- Iggy and SwaggyDocument3 pagesIggy and SwaggyJerah TorrejosNo ratings yet

- Acctg 121Document3 pagesAcctg 121YricaNo ratings yet

- ReviewerDocument5 pagesReviewermaricielaNo ratings yet

- Chapter 5 System Development and Program Change Activities PT 10Document2 pagesChapter 5 System Development and Program Change Activities PT 10Hiraya ManawariNo ratings yet

- DepletionDocument6 pagesDepletionjemjem14No ratings yet

- LiabilitiesDocument8 pagesLiabilitiesGerald F. SalasNo ratings yet

- Quiz 1 Part 3Document4 pagesQuiz 1 Part 3Yoite MiharuNo ratings yet

- This Study Resource Was: C. P6,050,000 D. P53,900Document2 pagesThis Study Resource Was: C. P6,050,000 D. P53,900Nah HamzaNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Far 6660Document2 pagesFar 6660Glessy Anne Marie FernandezNo ratings yet

- Impairment of AssetsDocument21 pagesImpairment of AssetsSteffanie Granada50% (2)

- Intangible AssetsDocument22 pagesIntangible AssetsKaye Choraine Naduma100% (1)

- Process CostingDocument3 pagesProcess CostingenzoNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- Multiple Choices - Computational Answer KeyDocument4 pagesMultiple Choices - Computational Answer KeyAleah kay BalontongNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- This Study Resource Was: Njpia Region 3 CouncilDocument7 pagesThis Study Resource Was: Njpia Region 3 CouncilPeachy Rose TorenaNo ratings yet

- Ch08 Property, Plant & EquipmentDocument6 pagesCh08 Property, Plant & EquipmentralphalonzoNo ratings yet

- Quiz On Other LiabilitiesDocument14 pagesQuiz On Other Liabilitiesimsana minatozakiNo ratings yet

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- Audit of INTANGIBLESDocument17 pagesAudit of INTANGIBLESFeem OperarioNo ratings yet

- SIM ACC 226ACCE 411 Week 4 To 5 COPY 1Document31 pagesSIM ACC 226ACCE 411 Week 4 To 5 COPY 1Mireya Yue100% (1)

- ULO A Analyze Act1Document5 pagesULO A Analyze Act1Marian B TersonaNo ratings yet

- Local Media271226407970108268Document17 pagesLocal Media271226407970108268Jana Rose PaladaNo ratings yet

- Property, Plant and Equipment Property, Plant and EquipmentDocument5 pagesProperty, Plant and Equipment Property, Plant and EquipmentWertdie stanNo ratings yet

- Basic Accounting Final - QuestionDocument6 pagesBasic Accounting Final - QuestionEdaNo ratings yet

- Quiz m2.5g HomeworkDocument10 pagesQuiz m2.5g HomeworkMarie MagallanesNo ratings yet

- Book Value Per Share PracticeDocument5 pagesBook Value Per Share PracticeRUNEL J. PACOTNo ratings yet

- Book Value Per ShareDocument5 pagesBook Value Per Sharesky wayNo ratings yet

- BVPSDocument18 pagesBVPSasdfghjklNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- SapDocument2 pagesSapJeric TorionNo ratings yet

- Lets Analyze Bvps and Eps ParconDocument9 pagesLets Analyze Bvps and Eps ParconJeric TorionNo ratings yet

- Employee LoyaltyDocument1 pageEmployee LoyaltyJeric TorionNo ratings yet

- Components of Internal ControlsDocument1 pageComponents of Internal ControlsJeric TorionNo ratings yet

- Preventative vs. Detective ControlsDocument1 pagePreventative vs. Detective ControlsJeric TorionNo ratings yet

- Research On The TopicDocument1 pageResearch On The TopicJeric TorionNo ratings yet

- Importance of Internal ControlsDocument1 pageImportance of Internal ControlsJeric TorionNo ratings yet

- Power Dressing HypeDocument1 pagePower Dressing HypeJeric TorionNo ratings yet

- FERNANDEZ - Solutions For Problem 4-7 BVPSDocument4 pagesFERNANDEZ - Solutions For Problem 4-7 BVPSJeric TorionNo ratings yet

- Handout On Chapter 12 Corporations PDFDocument9 pagesHandout On Chapter 12 Corporations PDFJeric TorionNo ratings yet

- DAGALA - Lets AnalyzeDocument4 pagesDAGALA - Lets AnalyzeJeric TorionNo ratings yet

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- Cababahay - 6th Exam Topic - SIM ANSWERSDocument7 pagesCababahay - 6th Exam Topic - SIM ANSWERSJeric TorionNo ratings yet

- ? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingDocument6 pages? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingJeric TorionNo ratings yet

- Government Accounting - Revenue and Other ReceiptsDocument16 pagesGovernment Accounting - Revenue and Other ReceiptsJeric TorionNo ratings yet

- Fernandez - SIM Activity - HyperinflationDocument5 pagesFernandez - SIM Activity - HyperinflationJeric TorionNo ratings yet

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- Nonprofit OrganizationDocument13 pagesNonprofit OrganizationJeric TorionNo ratings yet

- Funtilar 8 9 La Ulo ABCDocument1 pageFuntilar 8 9 La Ulo ABCJeric TorionNo ratings yet

- Sia Final Requirement ACP 311633Document3 pagesSia Final Requirement ACP 311633Jeric TorionNo ratings yet

- Partnership Installment Sales Problem Quiz 1Document5 pagesPartnership Installment Sales Problem Quiz 1Jeric TorionNo ratings yet

- Yellow Gray and Black Hand Drawn Process InfograhicDocument2 pagesYellow Gray and Black Hand Drawn Process InfograhicJeric TorionNo ratings yet

- Cheat Sheet BashidDocument76 pagesCheat Sheet BashidbashideNo ratings yet

- Week 014-Module Basic Concepts of Stocks and Bonds - Part 001Document5 pagesWeek 014-Module Basic Concepts of Stocks and Bonds - Part 001Rica Mae LopezNo ratings yet

- Capital Asset Pricing Model Written ReportDocument7 pagesCapital Asset Pricing Model Written Reportgalilleagalillee0% (1)

- Hongshi Cement CaseDocument7 pagesHongshi Cement CasePravin Sagar ThapaNo ratings yet

- FINANCIAL-MARKETS Prelims RevDocument13 pagesFINANCIAL-MARKETS Prelims RevJasmine TamayoNo ratings yet

- Investors Attitude Towards Online and Offline TradingDocument6 pagesInvestors Attitude Towards Online and Offline TradingYasser AhmedNo ratings yet

- E03 ExamDocument2 pagesE03 ExamTrang NguyễnNo ratings yet

- Lountzis Asset Management Annual Letter 2013Document31 pagesLountzis Asset Management Annual Letter 2013Tannor PilatzkeNo ratings yet

- 3-Risk Return (Recent Data)Document3 pages3-Risk Return (Recent Data)Yash AgarwalNo ratings yet

- Amrevx Basics PDFDocument139 pagesAmrevx Basics PDFArpitNo ratings yet

- Presented By:-Kshitij Shailja Namrata Shailendra PrashantDocument26 pagesPresented By:-Kshitij Shailja Namrata Shailendra Prashantprashantjain2708No ratings yet

- Forex SyllabusDocument8 pagesForex SyllabusTanvir AhmedNo ratings yet

- 9783642279300Document276 pages9783642279300duc anhNo ratings yet

- Navigating 2H23Document256 pagesNavigating 2H23Phương LinhNo ratings yet

- Bombay Stock ExchangeDocument4 pagesBombay Stock Exchangesatwinder sidhuNo ratings yet

- AnswersDocument9 pagesAnswersSandip AgarwalNo ratings yet

- NGNGNDocument2 pagesNGNGNshera48No ratings yet

- Equity Research For India InfolineDocument70 pagesEquity Research For India Infolinejyoti rNo ratings yet

- Demant AccountDocument78 pagesDemant AccountAmanjotNo ratings yet

- Aof Form GrowwDocument15 pagesAof Form GrowwNaveen RecizNo ratings yet

- Russell 2000 Membership List 2013Document23 pagesRussell 2000 Membership List 2013jeetNo ratings yet

- Impact of Dividend Policy On Shareholder's Wealth: I R M B RDocument7 pagesImpact of Dividend Policy On Shareholder's Wealth: I R M B RArsh UllahNo ratings yet

- Notice: Securities: National Association of Securities Dealers, Inc., Et Al.Document2 pagesNotice: Securities: National Association of Securities Dealers, Inc., Et Al.Justia.comNo ratings yet

- WQU Financial Markets Module 2 PDFDocument34 pagesWQU Financial Markets Module 2 PDFAbhishek Jyoti100% (1)

- Project On Sharekhan Investors Behavior For Investing in Equity Market in Various SectorDocument120 pagesProject On Sharekhan Investors Behavior For Investing in Equity Market in Various Sectorashish88% (26)

- ASLI Strategist 2010Document28 pagesASLI Strategist 2010api-26047937No ratings yet

- 50 Trading Codes and GuidelinesDocument27 pages50 Trading Codes and GuidelinesRakesh RanjanNo ratings yet