Professional Documents

Culture Documents

NPS Transaction Statement For Tier I Account: Current Scheme Preference

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

Abburi Kumar AshokOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NPS Transaction Statement For Tier I Account: Current Scheme Preference

NPS Transaction Statement For Tier I Account: Current Scheme Preference

Uploaded by

Abburi Kumar AshokCopyright:

Available Formats

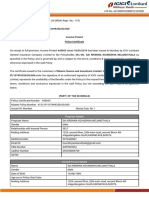

NPS TRANSACTION STATEMENT

April 01, 2021 to July 04, 2021

Statement Generation Date :July 04, 2021

08:48 PM

NPS Transaction Statement for Tier I Account

PRAN 110064138709 Registration Date 13-Oct-14

Subscriber Name SHRI ASHOK KUMAR ABBURI Tier I Status Active

OPPOSITE TO MRO OFFICE Tier II Status Not Activated

ABOVE ANDRHA BANK Tier II Tax Saver Not Activated

Status

JAGTIAL

CBO Registration No 6500421

Address

JAGTIAL CBO Name ANDHRA BANK

ANDHRA PRADESH - 505327 PB NO. 6, 5-9-11 HEAD OFFICE, DR. PATTABHI

CBO Address BHAWAN

INDIA SAIFABAD, HYDERABAD, 500004

CHO Registration No 5500176

Mobile Number 9502288450

CHO Name UNION BANK OF INDIA

Email ID ABBURI1608@GMAIL.COM

DEPARTMENT OF PERSONNEL CO, UNION

IRA Status IRA compliant BANK BHAVAN,

CHO Address

239, VIDHAN BHAVAN MARG,, NARIMAN POINT

MUMBAI, 400021

Tier I Nominee Name/s Percentage

DHARMA RAO ABBURI 50%

SAKUNTHALA ABBURI 50%

Current Scheme Preference

Scheme Choice - CORPORATE STANDARD

Investment Option Scheme Details Percentage

Scheme 1 SBI PENSION FUNDS PVT LTD SCHEME - CORPORATE-CG 100.00%

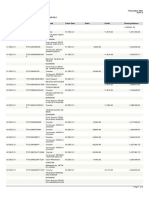

Investment Summary

Value of your Total Contribution Withdrawal/

Holdings(Investme No of in your account as Total Withdrawal Total Notional deduction in units

nts) as on Gain/Loss as on towards Return on

Contributions on Investment

as on July 04, July 04, 2021 (in ₹) July 04, 2021 (in ₹) July 04, 2021 (in ₹) intermediary

2021 (in ₹) charges (in ₹) (XIRR)

(A) (B) (C) D=(A-B)+C E

₹ 9,59,904.27 78 ₹ 7,10,526.70 ₹ 0.00 ₹ 2,49,377.57 ₹ 34.49 Returns for the

Financial Year

Investment Details - Scheme Wise Summary

Particulars References SBI PENSION FUNDS PVT LTD SCHEME -

CORPORATE-CG

Scheme wise Value of your Holdings(Investments) (in ₹) E=U*N 9,59,904.27

Total Units U 42,105.8661

NAV as on 02-Jul-2021 N 22.7974

Changes made during the selected period

No change affected in this period

Contribution/Redemption Details during the selected period

Contribution

Date Particulars Uploaded By Employee Employer's Total

Contribution Contribution (₹)

(₹) (₹)

22-Apr-2021 For February, 2021 Union Bank Of India (5000181), 12,073.88 12,073.88 24,147.76

29-Apr-2021 For March, 2021 Union Bank Of India (5000181), 6,548.74 6,548.74 13,097.48

10-May- For April, 2021 Union Bank Of India (5000181), 6,548.74 6,548.74 13,097.48

2021

04-Jun- For May, 2021 Union Bank Of India (5000181), 6,523.31 6,523.31 13,046.62

2021

Transaction Details

SBI PENSION FUNDS PVT LTD SCHEME -

Withdrawal/ deduction in units CORPORATE-CG

Date Particulars towards intermediary charges

Amount (₹)

(₹) Units

NAV (₹)

01-Apr-2021 Opening balance 39,294.5063

(34.49)

10-Apr-2021 Billing for Q4, 2020-2021 (34.49) (1.5347)

22.4734

24,147.76

22-Apr-2021 By Contribution for February,2021 1,079.3259

22.3730

13,097.48

29-Apr-2021 By Contribution for March,2021 581.8645

22.5095

13,097.48

10-May-2021 By Contribution for April,2021 579.7474

22.5917

13,046.62

04-Jun-2021 By Contribution for May,2021 571.9567

22.8105

04-Jul-2021 Closing Balance 42,105.8661

Notes

1.The 'Investment Details' section gives an overall status of the total contribution processed under the account and the returns accrued

2.'Notional Gain / Loss' indicates the overall gain or loss after factoring for the withdrawals processed in the account.

3.Returns based on Inflows' gives the annualized effective compounded return rate in PRAN account and is calculated using the formula of XIRR. The

calculation is done considering all the contribution / redemptions processed in PRAN account since inception and the latest valuation of the

investments. The transactions are sorted based on the NAV date.

View More

Retired life ka sahara, NPS hamara

Home | Contact Us | System Configuration / Best Viewed | Entrust Secured | Privacy Policy | Grievance Redressal Policy

You might also like

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountAkash RahangdaleNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAmit Gupta50% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Bharath33% (3)

- Lloyds Bank StatementDocument2 pagesLloyds Bank StatementZheng Yang100% (1)

- Jul 2021 Payment - ReceiptDocument1 pageJul 2021 Payment - ReceiptSandeepNayak0% (2)

- StarDocument1 pageStarMADANMOHANREDDY100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRahul PanwarNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar Reddy25% (4)

- NPS Contribution 2019 20 PDFDocument1 pageNPS Contribution 2019 20 PDFbindhu lingalaNo ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptPranay Kumar0% (1)

- Nps 2021Document3 pagesNps 2021Joyanto Saha100% (2)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferencePullakiranreddy ReddyNo ratings yet

- NPS CertificateDocument2 pagesNPS CertificateSatish Tiwari100% (1)

- Receipt Doc PDFDocument1 pageReceipt Doc PDFPraveen Cyssan0% (1)

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- Health Insurance Ebook PDFDocument29 pagesHealth Insurance Ebook PDFPrashant Pote100% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument1 pageNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRajakumar ReddyNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferenceVikash ChetiwalNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencekids funNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceGaurav SrivastavNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountthilaksafaryNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- PPFDocument1 pagePPFArnab RoyNo ratings yet

- 090003e88105430f SONIADocument3 pages090003e88105430f SONIAKoushik DuttaNo ratings yet

- JuneDocument10 pagesJuneЮлия ПNo ratings yet

- BinderDocument3 pagesBinderBK AcharyaNo ratings yet

- 4partnership DissolutionEDITED OnlineDocument15 pages4partnership DissolutionEDITED OnlinePaul BandolaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I Accountvikas0207ikash0% (1)

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- NPS Fy23Document5 pagesNPS Fy23Sudhir Kumar SinghNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceLaya DonthulaNo ratings yet

- Centralrecordkeepingagency: National Pension System Transaction Statement - Tier IDocument2 pagesCentralrecordkeepingagency: National Pension System Transaction Statement - Tier Izuheb0% (1)

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme Preferencevikas_2No ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I AccountDocument4 pagesNPS Transaction Statement For Tier I AccountabhishekNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceNIkhil GuptaNo ratings yet

- Parents Health Insurance - Payment 22-23Document1 pageParents Health Insurance - Payment 22-23nikhil nadakuditi100% (1)

- Nps 123Document3 pagesNps 123Md Sharma SharmaNo ratings yet

- NPS2Document1 pageNPS2tejaNo ratings yet

- Payment ReceiptDocument1 pagePayment Receiptnizamsagar tsgenco75% (4)

- NPS Transaction Statement For Tier I AccountDocument2 pagesNPS Transaction Statement For Tier I AccountQC&ISD1 LMD COLONYNo ratings yet

- Mediclaim ReceiptDocument1 pageMediclaim ReceiptParthiban KNo ratings yet

- PPF Receipt Jan 2020Document1 pagePPF Receipt Jan 2020prasad_batheNo ratings yet

- Mediclaim ParentsDocument1 pageMediclaim ParentsCA Ashish MehtaNo ratings yet

- PPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date RemarksDocument1 pagePPF E-Receipt: Reference Number Name of Account Holder PPF Account Number Transaction Date Remarksanurag srivastavaNo ratings yet

- Sam Park DocumentDocument4 pagesSam Park DocumentShahadNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceRaj Kumar SinghNo ratings yet

- Tax Certificate: R MargabandhuDocument2 pagesTax Certificate: R MargabandhuKunal ShethNo ratings yet

- CareHealth Policy 2020-21 Nihit FamilyDocument5 pagesCareHealth Policy 2020-21 Nihit FamilyJacob PruittNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementRakesh Kumar BainsNo ratings yet

- Interest Certificate Nov06 205111Document1 pageInterest Certificate Nov06 205111Sambasivarao ChindamNo ratings yet

- Intermediary Code CO0000000062 Akshaya Wealth Management PVT - LTD Phone No 080-26535701/02/8026535701 E-Mail Id Services@AkshayaweaDocument4 pagesIntermediary Code CO0000000062 Akshaya Wealth Management PVT - LTD Phone No 080-26535701/02/8026535701 E-Mail Id Services@Akshayaweapushpkant kumarNo ratings yet

- PnewDocument1 pagePnewPartha100% (1)

- ICICI COI IncomeProtect 445605Document5 pagesICICI COI IncomeProtect 445605sree koundinyaNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- Receipt DocDocument1 pageReceipt Doccharchit123No ratings yet

- Online Payment Acknowledgement Receipt CDocument1 pageOnline Payment Acknowledgement Receipt CSatyanarayana BalusaNo ratings yet

- Statement of Public Provident Fund Account: Ms - Neha Raghubar YadavDocument2 pagesStatement of Public Provident Fund Account: Ms - Neha Raghubar YadavNeha100% (1)

- Housing Loan Self DeclarationDocument1 pageHousing Loan Self DeclarationSreenivasa RaoNo ratings yet

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- Premium Paid Certificate: Date: 14-SEP-20 16Document1 pagePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaNo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument3 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceAbburi Kumar AshokNo ratings yet

- Receipt - Electronic Fund Transfer (Eft) : Account Number: MT 103 - Transactions Sub Type: Indicator: DateDocument3 pagesReceipt - Electronic Fund Transfer (Eft) : Account Number: MT 103 - Transactions Sub Type: Indicator: DateDani PermanaNo ratings yet

- FAR.2850 - Interim Financial Reporting.Document4 pagesFAR.2850 - Interim Financial Reporting.Ashley LegaspiNo ratings yet

- Commercial Bank OperationsDocument15 pagesCommercial Bank Operationsbonifacio gianga jrNo ratings yet

- Oracle Payables Reconciliation Accounting: Realized Gains and LossesDocument5 pagesOracle Payables Reconciliation Accounting: Realized Gains and LossessureshNo ratings yet

- Chapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Document17 pagesChapter 5: Books of Accounts & Double-Entry System (FAR By: Millan)Portia AbestanoNo ratings yet

- Unit2.Project IvanRivera6 MT481 Financial MarketsDocument4 pagesUnit2.Project IvanRivera6 MT481 Financial MarketsRashiNo ratings yet

- Indgiro 20181231 PDFDocument1 pageIndgiro 20181231 PDFHuiwen Cheok100% (1)

- Loans MeaningDocument20 pagesLoans MeaningrichabhanushaliNo ratings yet

- Shreejan CUSTOMER - SERVICES - DEPARTMENT - AND - MARKETING - ATDocument14 pagesShreejan CUSTOMER - SERVICES - DEPARTMENT - AND - MARKETING - ATtli.sanilshahNo ratings yet

- SLBC List of Members 1. Banks Operating in Bihar: Details: State Level Bankers Committee, BiharDocument2 pagesSLBC List of Members 1. Banks Operating in Bihar: Details: State Level Bankers Committee, Biharsaurs2No ratings yet

- Code Comment VCBVN001Document1,446 pagesCode Comment VCBVN001Ducha FamiNo ratings yet

- FM ReviewerDocument20 pagesFM ReviewerBSA - Cabangon, MerraquelNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAnonymous Gg6z0u9IBzNo ratings yet

- SAP Fico Feb-2020Document4 pagesSAP Fico Feb-2020sateesh konatamNo ratings yet

- Muhammad Shafiq Hakim Bin Muhamad Kharani DBF3B Personal StatementDocument1 pageMuhammad Shafiq Hakim Bin Muhamad Kharani DBF3B Personal Statementhakimstars2003No ratings yet

- Business-Administration - Banking-and-Finance - Beirut Arab UniversityDocument5 pagesBusiness-Administration - Banking-and-Finance - Beirut Arab UniversityAA BB MMNo ratings yet

- Eagle Eye Equities: IndexDocument7 pagesEagle Eye Equities: IndexAnshuman GuptaNo ratings yet

- Chapter-2 Review of LiteratureDocument5 pagesChapter-2 Review of LiteratureRajesh BathulaNo ratings yet

- STMT - Ent - Book - 2021-12-07T054024.832Document2 pagesSTMT - Ent - Book - 2021-12-07T054024.832melakuNo ratings yet

- Lecture-2 Principles of InsuranceDocument24 pagesLecture-2 Principles of InsuranceadilahtabassumNo ratings yet

- The Business Model For The Payment Banks in IndiaDocument8 pagesThe Business Model For The Payment Banks in IndiaNishi Shree HanumaanNo ratings yet

- Fac4863 104 - 2020 - 0 - BDocument93 pagesFac4863 104 - 2020 - 0 - BNISSIBETINo ratings yet

- iBT TOEFL Listening 단숨에 따라잡기: Part 1: 강의Document7 pagesiBT TOEFL Listening 단숨에 따라잡기: Part 1: 강의green1458No ratings yet

- CFAS Reviewer - Module 6Document14 pagesCFAS Reviewer - Module 6Lizette Janiya SumantingNo ratings yet

- Business Finance: AssignmentDocument2 pagesBusiness Finance: AssignmentLucifer Morning starNo ratings yet