Professional Documents

Culture Documents

Fast Photo Solution

Fast Photo Solution

Uploaded by

shreehariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fast Photo Solution

Fast Photo Solution

Uploaded by

shreehariCopyright:

Available Formats

Fast Photo Ltd

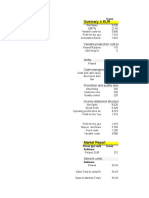

Cash Flow Statement for the year ended 31 December 2005

Cash flows from operating activities € €

Profit before interest and tax 11,855

Adjustments for:

Depreciation 2,771

Profit on sale of equipment -2,796

Operating profit before working capital changes 11,830

Increase in trade and other receivables -4,768

Increase in inventories -3,620

Increase in trade payables 5,627

Increase in accruals 420

Cash generated from operations 9,489

Interest paid -859

Tax paid -1,362

Net cash from operating activities 7,268

Cash flows from investing activities

Sale of property, plant and equipment 7,535

Purchase of property, plant and equipment -9,054

Net cash from investing activities -1,519

Cash flows from financing activities

Proceeds from issue of share capital 32

Share Premium * 319

Dividends paid -1,966

Receipt from long term loan 2,153

Net cash from financing activities 538

Increase in cash and cash equivalents 6,287

Cash and cash equivalents at beginning of period 14,648

Cash and cash equivalents at end of period 20,935

Note 2004 2005 Change

Cash at bank 3,648 5,935 2,287

Current asset investments 11,000 15,000 4,000

Cash and cash equivalents 14,648 20,935 6,287

* Mistake in question - share premium @ 31/12/04 should be €6,435 instead of €6,432

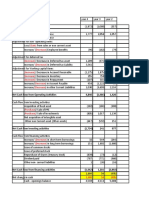

Movement in trade receivables

Balance at end of 2004 27,399

Balance at end of 2005 32,167

Increase 4,768

=> cash outflow

Movement in inventories

Balance at end of 2004 19,935

Balance at end of 2005 23,555

Increase 3,620

=> cash outflow

Movement in trade payables

Balance at end of 2004 33,461

Balance at end of 2005 39,088

Increase 5,627

=> cash inflow

Movement in accruals

Balance at end of 2004 4,115

Balance at end of 2005 4,535

Increase 420

=> cash inflow

Tax paid for the year

Opening tax liability at start of the year 4,695

Tax charge for 2005 1,980

6,675

Tax paid 1,362

Tax liability at 31 December 2005 5,313

Share capital and share premium

2005 2004 Increase

Share capital 3,954 3,922 32

Share premium 6,754 6,435 319

351

Total cash received from issue of shares 351

Solution shows this split between share capital (32) and share premium (319)

but showing one total figure is also acceptable

Disposal of plant and machinery

Cost of disposed machinery 15,000

Net book value at time of disposal 4,739

Accumulated depreciation on disposed asset 10,261

To find proceeds of disposal, look at NBV and profit or loss on disposal

Net book value 4,739

Gain made on disposal 2,796

Therefore we received a total of 7,535

Plant and machinery - reconcile opening and closing balances

Cost

Opening cost at start of the year 50,946

Less: cost of asset disposed of - 15,000

Cost of remaining plant and machinery 35,946

Cost of plant and machinery at end of the year 45,000

Difference must be additions during the year 9,054

Accumulated Depreciation

Acc Dep on P+M at start of the year 18,463

Less: Acc Dep on asset disposed of - 10,261

Accumulated Depreciation of remaining P+M 8,202

Accumulated Depreciation at end of the year 10,973

Difference must be this year's depreciation charge 2,771

Movement in bank loan balance

Balance at end of 2004 12,938

Balance at end of 2005 15,091

Increase 2,153

=> cash inflow

You might also like

- Strategic Audit Report Example 1Document68 pagesStrategic Audit Report Example 1Santhiya Mogen100% (1)

- Continental Carriers Case AnalysisDocument2 pagesContinental Carriers Case AnalysisCharlene100% (3)

- Reading 15 Currency Exchange RatesDocument15 pagesReading 15 Currency Exchange RatesAmineNo ratings yet

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocument6 pagesComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNo ratings yet

- M096LON 2122MAYAUG - Exam - QuestionDocument10 pagesM096LON 2122MAYAUG - Exam - QuestionMaya RotonNo ratings yet

- Cashflow Analysis - Beta - GammaDocument14 pagesCashflow Analysis - Beta - Gammashahin selkarNo ratings yet

- Financial Management Chapter 2Document28 pagesFinancial Management Chapter 2beyonce0% (1)

- Economic Returns, Reversion To The Mean, and Total Shareholder Returns Anticipating Change Is Hard But ProfitableDocument15 pagesEconomic Returns, Reversion To The Mean, and Total Shareholder Returns Anticipating Change Is Hard But ProfitableAhmed MadhaNo ratings yet

- Nike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018Document3 pagesNike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018David Rolando García OpazoNo ratings yet

- A3 6Document3 pagesA3 6David Rolando García OpazoNo ratings yet

- Financial Plan For A Start UpDocument12 pagesFinancial Plan For A Start UpNayab ArshadNo ratings yet

- Fatima Jinnah Women University Department of Computer Arts Home Assignment For Class DiscussionDocument6 pagesFatima Jinnah Women University Department of Computer Arts Home Assignment For Class DiscussionHajra ZANo ratings yet

- FM204Document8 pagesFM204Vinoth KumarNo ratings yet

- Session 6Document4 pagesSession 6samuel tabotNo ratings yet

- Summary, K EUR: Variable Production Cost Per Unit, EURDocument15 pagesSummary, K EUR: Variable Production Cost Per Unit, EURSiddharth Singh TomarNo ratings yet

- Finance For Non-Finance: Ratios AppleDocument12 pagesFinance For Non-Finance: Ratios AppleAvinash GanesanNo ratings yet

- Meta (FB) : Balance SheetDocument20 pagesMeta (FB) : Balance SheetRatul AhamedNo ratings yet

- Statement of Cash Flow: Rafhan Oil & Maize ProductsDocument5 pagesStatement of Cash Flow: Rafhan Oil & Maize ProductsAdeena AmirNo ratings yet

- Practice Solution 2Document4 pagesPractice Solution 2Luigi NocitaNo ratings yet

- Aspen Colombiana Sas (Colombia) : SourceDocument5 pagesAspen Colombiana Sas (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- IMT CeresDocument10 pagesIMT Cerescabmeuk07No ratings yet

- Alkem LabroriesDocument17 pagesAlkem LabroriesMukesh kumar singh BoraNo ratings yet

- Ezz Steel Ratio Analysis - Fall21Document10 pagesEzz Steel Ratio Analysis - Fall21farahNo ratings yet

- GB20003: International Financial Statement Analysis Individual Case Study (30%)Document7 pagesGB20003: International Financial Statement Analysis Individual Case Study (30%)Priyah RathakrishnahNo ratings yet

- Current Assets Liabilties QuestionsDocument4 pagesCurrent Assets Liabilties QuestionssusieNo ratings yet

- Bkal1013 Business Accounting (Group Project)Document19 pagesBkal1013 Business Accounting (Group Project)Chin EnNo ratings yet

- Comparative Financials Pakistani Rupees in '000 (PKR) 2015: Fixed AssetsDocument19 pagesComparative Financials Pakistani Rupees in '000 (PKR) 2015: Fixed AssetsMuhammad Daniyal HassanNo ratings yet

- Cash Flow Solutions2Document6 pagesCash Flow Solutions2mithun mohanNo ratings yet

- Advanced Financial Management - Finals-11Document2 pagesAdvanced Financial Management - Finals-11graalNo ratings yet

- PT Dwi CTRL: 2016 2015 Increase / (Decrease)Document5 pagesPT Dwi CTRL: 2016 2015 Increase / (Decrease)AnTonius TjandraNo ratings yet

- Final Exam AccountingDocument7 pagesFinal Exam Accountingshirley franciscoNo ratings yet

- 3 - CokeDocument30 pages3 - CokePranali SanasNo ratings yet

- HE 4 Questions - Updated-1Document13 pagesHE 4 Questions - Updated-1halelz69No ratings yet

- 8candorcashflowsolution 1452888678351Document2 pages8candorcashflowsolution 1452888678351uttam2001No ratings yet

- 2013 04 24 171829 Accounting 504 6q Uestions 1 1Document16 pages2013 04 24 171829 Accounting 504 6q Uestions 1 1jodh26No ratings yet

- ALK CH 9Document10 pagesALK CH 9Anisa Margi0% (1)

- Microsoft Financial Data - FY19Q3Document29 pagesMicrosoft Financial Data - FY19Q3trisanka banikNo ratings yet

- Statement of CF - Callow LTD - Introduction Level ExerciseDocument5 pagesStatement of CF - Callow LTD - Introduction Level ExerciseNhư QuỳnhNo ratings yet

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedNo ratings yet

- Cashflow (Direct Method)Document7 pagesCashflow (Direct Method)Umair ShahzadNo ratings yet

- Reliance Industries Limited Cash Flow Statement For The Year 20 13-14Document2 pagesReliance Industries Limited Cash Flow Statement For The Year 20 13-14Vaidehi VihariNo ratings yet

- Chaitanya Gorle CeresDocument9 pagesChaitanya Gorle Ceresgskc27No ratings yet

- CHAPTER 6-FA Questions - BAsicDocument3 pagesCHAPTER 6-FA Questions - BAsicHussna Al-Habsi حُسنى الحبسيNo ratings yet

- Results r04Document36 pagesResults r04Logan paulNo ratings yet

- 7.2 STAR With AnswerDocument2 pages7.2 STAR With Answerxxsummerblue.23No ratings yet

- Cash Flows From Operating Activites: Operating Profit Beforre Working Capital Changes Net Change inDocument4 pagesCash Flows From Operating Activites: Operating Profit Beforre Working Capital Changes Net Change inDesi HollywoodNo ratings yet

- Module 4 - Analysis WorksheetDocument5 pagesModule 4 - Analysis WorksheetElizabethNo ratings yet

- Chapter 5 Solution To Problems and CasesDocument22 pagesChapter 5 Solution To Problems and Caseschandel08No ratings yet

- Colgate ModelDocument19 pagesColgate ModelRajat Agarwal100% (1)

- 31-Mar-20 31-Mar-19: Non-Current AssetsDocument6 pages31-Mar-20 31-Mar-19: Non-Current AssetsKunalNo ratings yet

- ABSDocument8 pagesABSashwani singhaniaNo ratings yet

- Excel Sheet - SAMPLE 2Document23 pagesExcel Sheet - SAMPLE 2Bhavdeep singh sidhuNo ratings yet

- Productos Ramo Sas (Colombia) : Emis 12Th Floor 30 Crown Place London, EC2A 4EB, United KingdomDocument4 pagesProductos Ramo Sas (Colombia) : Emis 12Th Floor 30 Crown Place London, EC2A 4EB, United KingdomAndres RamirezNo ratings yet

- Lopez Holdings Corporation and Subsidiaries Consolidated Statements of Financial PositionDocument4 pagesLopez Holdings Corporation and Subsidiaries Consolidated Statements of Financial PositionKaname KuranNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- Fsa On Thi FinalDocument40 pagesFsa On Thi FinaltrangNo ratings yet

- DP1.3_APM Extracts of Financial Statements V11Document6 pagesDP1.3_APM Extracts of Financial Statements V11Salam NaddafNo ratings yet

- Cash Flows - SolvedDocument4 pagesCash Flows - SolvedChetan DhuriNo ratings yet

- Fertilizer RatiosDocument12 pagesFertilizer RatiosomairNo ratings yet

- Financial Information of PT SrikandiDocument1 pageFinancial Information of PT SrikandiNadira AristyaNo ratings yet

- Dollar Amounts in Thousands: Balance SheetDocument1 pageDollar Amounts in Thousands: Balance SheetJai Bhushan BharmouriaNo ratings yet

- Instructions:: Candor Cash Flow SolutionDocument1 pageInstructions:: Candor Cash Flow SolutionPirvuNo ratings yet

- Rak Properties 1Document9 pagesRak Properties 1Govind Kumar VermaNo ratings yet

- Modified UCA Cash Flow FormatDocument48 pagesModified UCA Cash Flow FormatJohan100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Pretest Operation and DissolutionDocument1 pagePretest Operation and DissolutionMondays AndNo ratings yet

- Structure of Uganda's EconomyDocument34 pagesStructure of Uganda's EconomyJeremiah NakibingeNo ratings yet

- Crystal Meadows of TahoeDocument8 pagesCrystal Meadows of TahoePrashuk Sethi100% (1)

- Forum s5Document6 pagesForum s5Aruni PribadiNo ratings yet

- Cfap 1 Afr Summer 2023Document6 pagesCfap 1 Afr Summer 2023Ali MohammadNo ratings yet

- Sovereign Wealth InvestDocument8 pagesSovereign Wealth InvestairbowNo ratings yet

- Bajaj Auto FinancialsDocument21 pagesBajaj Auto FinancialsJanendra YadavNo ratings yet

- Financial Investment Project - EditedDocument15 pagesFinancial Investment Project - Editedwafula stanNo ratings yet

- Berkshire Hathaway Float MemoDocument4 pagesBerkshire Hathaway Float Memoclaphands22No ratings yet

- Cfs Direct Method - IaDocument35 pagesCfs Direct Method - IaCanny TrầnNo ratings yet

- Accounting Principles and Procedures m001 PDFDocument2 pagesAccounting Principles and Procedures m001 PDFUmer BhuttaNo ratings yet

- Question and Answer - 24Document30 pagesQuestion and Answer - 24acc-expertNo ratings yet

- Escaping The Discount TrapDocument2 pagesEscaping The Discount TrapSAURAV KUMAR KALITA 2227652No ratings yet

- 2015 Oliver Wyman The Digital Disruption Battlefield PDFDocument19 pages2015 Oliver Wyman The Digital Disruption Battlefield PDFVaishnaviRaviNo ratings yet

- Testing Ben Graham NCAV Strategy in LondonDocument16 pagesTesting Ben Graham NCAV Strategy in LondonAdvanced Security AnalysisNo ratings yet

- Investment FunctionDocument16 pagesInvestment FunctionAnuj SinghNo ratings yet

- Bloomberg MIT Spring Tech TalkDocument2 pagesBloomberg MIT Spring Tech TalkBita MoghaddamNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- LeafletDocument4 pagesLeafletKate ShtankoNo ratings yet

- Discontinued OperationsDocument15 pagesDiscontinued OperationsEjaz AhmadNo ratings yet

- Harvard 1925 - Syllabus F2020 Aug 17 PDFDocument10 pagesHarvard 1925 - Syllabus F2020 Aug 17 PDF谢雅丽No ratings yet

- Accounting and Finance For The Non Financial Executive - An IntDocument305 pagesAccounting and Finance For The Non Financial Executive - An Intgasiorska100% (2)

- Stock ValuationDocument8 pagesStock Valuationgabby209No ratings yet

- UBS - Bond BasicsDocument51 pagesUBS - Bond Basicshuqixin1100% (2)

- Blackrock PeriodicDocument2 pagesBlackrock Periodicsameer1987kazi4405No ratings yet