Professional Documents

Culture Documents

Chapter 2 Problem 9 in Win Ballada Parcor

Chapter 2 Problem 9 in Win Ballada Parcor

Uploaded by

Katrina PetracheCopyright:

Available Formats

You might also like

- Chapter 7 - Assignment 2Document9 pagesChapter 7 - Assignment 2Gwen Stefani DaugdaugNo ratings yet

- UCC 1 Financing Statement-B. BryantDocument1 pageUCC 1 Financing Statement-B. BryantTiyemerenaset Ma'at El77% (13)

- PTG Three-Day Cycle PDFDocument6 pagesPTG Three-Day Cycle PDFDraženS100% (3)

- Insider TradingDocument1 pageInsider TradingmattNo ratings yet

- Liquidation Problem Partnership and Corporation AccountingDocument3 pagesLiquidation Problem Partnership and Corporation AccountingChichoNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- Chapter 2Document83 pagesChapter 2Eliza RiveraNo ratings yet

- UntitledDocument4 pagesUntitledShevina Maghari shsnohsNo ratings yet

- Corp. Retained EarningsDocument9 pagesCorp. Retained EarningshsjhsNo ratings yet

- Baral, Malaluan, CastroDocument2 pagesBaral, Malaluan, CastroAndrea TugotNo ratings yet

- Chapter 3 ProblemshhhDocument15 pagesChapter 3 Problemshhhahmed arfanNo ratings yet

- Corporation Problems-1Document18 pagesCorporation Problems-1Avia Chelsy DeangNo ratings yet

- Solved The Partnership of Angel Investors Began Operations On January 1... - Course HeroDocument2 pagesSolved The Partnership of Angel Investors Began Operations On January 1... - Course HeroeannetiyabNo ratings yet

- MARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsDocument5 pagesMARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsMoon YoungheeNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx100% (1)

- ParCor Chapter 5 - Hernandez - BSA 1-1 PDFDocument5 pagesParCor Chapter 5 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Admission and Retirement of PartnersDocument3 pagesAdmission and Retirement of PartnersJohn Eric MacallaNo ratings yet

- TOPIC EconDocument44 pagesTOPIC EconChristy HabelNo ratings yet

- Chapter 3 ParcorDocument6 pagesChapter 3 ParcorJwhll MaeNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx0% (1)

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela SerranoNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Take-Home No. 3Document1 pageTake-Home No. 3John Alfred CastinoNo ratings yet

- Partnership Dissolution 3Document10 pagesPartnership Dissolution 3Jamaica RumaNo ratings yet

- ParCor Chapter 4 - Hernandez - BSA 1-1 PDFDocument7 pagesParCor Chapter 4 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- MCQ PartnershipDocument24 pagesMCQ Partnershiplou-924No ratings yet

- UM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedDocument2 pagesUM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedJessa BeloyNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- Activity 3Document7 pagesActivity 3Rishaan Dominic100% (1)

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- Problem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsDocument4 pagesProblem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsJessa0% (1)

- FISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007Document4 pagesFISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007MayaNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- Acct102 Midterm NotesDocument15 pagesAcct102 Midterm NotesWymple Kate Alexis FaisanNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- Chapter 2&3 Par - CorDocument31 pagesChapter 2&3 Par - CorJUARE MaxineNo ratings yet

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapNo ratings yet

- Parcor Proj (Version 1)Document45 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerDarlene Angela IcasiamNo ratings yet

- Science Technology and Society: Gordon CollegeDocument72 pagesScience Technology and Society: Gordon CollegeRon Aisen Howard100% (1)

- Problem 20-23Document5 pagesProblem 20-23Teresa Pantallano DivinagraciaNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Fish RUsDocument11 pagesFish RUseia aieNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Acct NG SolutionsDocument1 pageAcct NG SolutionsGelyn Cruz100% (1)

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Chapter 3 Case PartnershipDocument19 pagesChapter 3 Case PartnershipZPadsNo ratings yet

- Answers Lt2Document4 pagesAnswers Lt2scryx bloodNo ratings yet

- Exercise 1 Investment in AssociatesDocument7 pagesExercise 1 Investment in AssociatesJoefrey Pujadas BalumaNo ratings yet

- Document 9Document7 pagesDocument 9John ManatadNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Product Pricing-PRINTDocument12 pagesProduct Pricing-PRINTKatrina PetracheNo ratings yet

- ANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireDocument5 pagesANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireKatrina PetracheNo ratings yet

- Partnership Liquidation QuizDocument11 pagesPartnership Liquidation QuizKatrina PetracheNo ratings yet

- StatisticsDocument27 pagesStatisticsKatrina PetracheNo ratings yet

- MODULE 1 (CH 31-33) INTANGIBLE ASSETS LandscapeDocument39 pagesMODULE 1 (CH 31-33) INTANGIBLE ASSETS LandscapeKatrina PetracheNo ratings yet

- Form 2200-M, PetracheDocument2 pagesForm 2200-M, PetracheKatrina PetracheNo ratings yet

- QUIZ 1 Intangible AssetsDocument21 pagesQUIZ 1 Intangible AssetsKatrina PetracheNo ratings yet

- Form 2200-C, PetracheDocument2 pagesForm 2200-C, PetracheKatrina PetracheNo ratings yet

- Property, Plant and EquipmentDocument18 pagesProperty, Plant and EquipmentKatrina PetracheNo ratings yet

- Depreciation: Systematic Allocation of The Depreciable Amount of An Asset Over Its Useful LifeDocument24 pagesDepreciation: Systematic Allocation of The Depreciable Amount of An Asset Over Its Useful LifeKatrina PetracheNo ratings yet

- REVALUATIONDocument17 pagesREVALUATIONKatrina PetracheNo ratings yet

- International Trade and DevelopmentDocument31 pagesInternational Trade and DevelopmentKatrina PetracheNo ratings yet

- Business Ethics Case Study: The Medrano Machine CompanyDocument4 pagesBusiness Ethics Case Study: The Medrano Machine CompanyKatrina PetracheNo ratings yet

- Petrache Katrina, TUTOR DOCTOR - How Learning Hits HomeDocument12 pagesPetrache Katrina, TUTOR DOCTOR - How Learning Hits HomeKatrina PetracheNo ratings yet

- Group 4-BSMA1203-PepsiCoDocument20 pagesGroup 4-BSMA1203-PepsiCoKatrina PetracheNo ratings yet

- PADMON Condominium vs. Ortigas Case DigestDocument2 pagesPADMON Condominium vs. Ortigas Case DigestKatrina PetracheNo ratings yet

- Accenture Liquidity Coverage Ratio PDFDocument24 pagesAccenture Liquidity Coverage Ratio PDFKunal TijareNo ratings yet

- Deutsche Bank Research IndoTelco and TowerDocument13 pagesDeutsche Bank Research IndoTelco and TowerStefanarichta100% (1)

- China Banking Corp V CADocument7 pagesChina Banking Corp V CANikko SterlingNo ratings yet

- QuarterlyBo 12081800 01739053 31122019 PDFDocument1 pageQuarterlyBo 12081800 01739053 31122019 PDFSangamesh Sangu0% (1)

- Financial Market & Institutions ExamDocument7 pagesFinancial Market & Institutions Examviettuan91No ratings yet

- Fixed Income Portfolio StrategiesDocument28 pagesFixed Income Portfolio Strategies9986212378No ratings yet

- Balakrishna TemplateDocument4 pagesBalakrishna TemplatebagyaNo ratings yet

- The Financial Environment: Markets, Institutions, and Interest RatesDocument2 pagesThe Financial Environment: Markets, Institutions, and Interest RatesKristel SumabatNo ratings yet

- SEBI Promotor IssueDocument13 pagesSEBI Promotor Issuesiva_sankar826481No ratings yet

- NCR Cup 1 Final RoundDocument6 pagesNCR Cup 1 Final RoundMich ClementeNo ratings yet

- Law On AGENCYDocument9 pagesLaw On AGENCYPark Min EunNo ratings yet

- Financial Modeling - PUNE Financial ModelingDocument1 pageFinancial Modeling - PUNE Financial ModelingBHARAT PRAKASH MAHANTNo ratings yet

- Guide of Audit in InvestmentsDocument21 pagesGuide of Audit in InvestmentsNicco OrtizNo ratings yet

- Money of The FutureDocument321 pagesMoney of The FutureWeb Financial Group100% (1)

- Undertaking - Copy Edited 01Document2 pagesUndertaking - Copy Edited 01meliton caprichoNo ratings yet

- Chap 1Document19 pagesChap 1p4priyaNo ratings yet

- Corp Tax OutlineDocument81 pagesCorp Tax OutlinesashimimanNo ratings yet

- CIF+-+Replacement+ +prospectus+ (Executed+10Apr19)Document210 pagesCIF+-+Replacement+ +prospectus+ (Executed+10Apr19)EDWARD LEENo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- File 29Document4 pagesFile 29Krishna C NNo ratings yet

- Pennantpark Investment Corporation: PNNT - NasdaqDocument8 pagesPennantpark Investment Corporation: PNNT - NasdaqnicnicooNo ratings yet

- Fim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementDocument4 pagesFim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementJomar VillenaNo ratings yet

- AC119 Cashflow StatementDocument82 pagesAC119 Cashflow StatementTINASHENo ratings yet

- Liabilities of Parties: Regulatory Framework and Legal Issues in BusinessDocument7 pagesLiabilities of Parties: Regulatory Framework and Legal Issues in BusinessPhryz PajarilloNo ratings yet

- TITLE-III Board of Directors Trustees and OfficersDocument7 pagesTITLE-III Board of Directors Trustees and Officersjeanlyn domingoNo ratings yet

- Caltex (Philippines), Inc. v. CADocument3 pagesCaltex (Philippines), Inc. v. CAAgee Romero-ValdesNo ratings yet

- Trading MathDocument29 pagesTrading MathOm Prakash88% (8)

Chapter 2 Problem 9 in Win Ballada Parcor

Chapter 2 Problem 9 in Win Ballada Parcor

Uploaded by

Katrina PetracheOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Problem 9 in Win Ballada Parcor

Chapter 2 Problem 9 in Win Ballada Parcor

Uploaded by

Katrina PetracheCopyright:

Available Formats

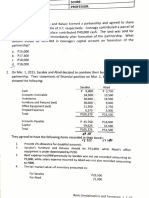

PROBLEM 9 - RULES FOR DIVISION OF PROFITS AND L

1.) Cash 2,400,000

Building 2,200,000

Equipment 1,400,000

Marasigan, Capital 2,400,000

Asacta, Capital 3,600,000

To record the investments of Marasigan and Asacta

2.) Computations for 2019

Marasigan Asacta Total

a.) 840,000 x 50% 420,000

840,000 x 50% 420,000 840,000

b.) 840,000 x 2,400,000 / 6,000,000 336,000

840,000 x 3,600,000 / 6,000,000 504,000 840,000

c.) 840,000 x 2,400,000 / 6,000,000 336,000

840,000 x 3,600,000 / 6,000,000 504,000 840,000

d.) 10% interest on

original investment

10% x 2,400,000 240,000

10% x 3,600,000 360,000 600,000

Balance to be

divided equally

(840,000 - 600,000)

240,000 x 50% 120,000

240,000 x 50% 120,000 240,000

Total share in profit 360,000 480,000 840,000

e.) Salary allowances

400,000 280,000 680,000

Balance to be

divided equally

(840,000-680,00)

160,000 x 50% 80,000

160,000 x 50% 80,000 160,000

Total share of profit 480,000 360,000 840,000

f.) Salary allowances

400,000 280,000 680,000

9% interest on

original investment

2,400,000 x 9% 216,000

3,600,000 x 9% 324,000 540,000

Balance to be

divided equally

(840,000 - 1,220,000)

380,000 x 50% (190,000)

380,000 x 50% (190,000) (380,000)

Total share in profit 426,000 414,000 840,000

R DIVISION OF PROFITS AND LOSSES

Computations for 2020

Marasigan Asacta Total

a.) 400,000 x 50% 200,000

400,000 x 50% 200,000 400,000

b.) 400,000 x 2,400,000 / 6,000,000 160,000

400,000 x 3,600,000 / 6,000,000 240,000 400,000

c.) 400,000 x 2,400,000 / 6,000,000 160,000

400,000 x 3,600,000 / 6,000,000 240,000 400,000

d.) 10% interest on

original investment

10% x 2,400,000 240,000

10% x 3,600,000 360,000 600,000

Balance to be

divided equally

(400,000 - 600,000)

(200,000) x 50% (100,000)

(200,000) x 50% (100,00) (200,000)

Total share in profit 140,000 260,000 400,000

e.) Salary allowances

400,000 280,000 680,000

Balance to be

divided equally

(400,000-680,00)

(280,000) x 50% (140,000)

(280,000) x 50% (140,000) (280,000)

Total share of profit 260,000 140,000 400,000

f.) Salary allowances 400,000 280,000 680,000

9% interest on

original investment

2,400,000 x 9% 216,000

3,600,000 x 9% 324,000 540,000

Balance to be

divided equally

(400,,000 - 1,220,000)

(820,000) x 50% (410,000)

(820,000) x 50% (410,000) (820,000)

Total share in profit 206,000 194,000 400,000

You might also like

- Chapter 7 - Assignment 2Document9 pagesChapter 7 - Assignment 2Gwen Stefani DaugdaugNo ratings yet

- UCC 1 Financing Statement-B. BryantDocument1 pageUCC 1 Financing Statement-B. BryantTiyemerenaset Ma'at El77% (13)

- PTG Three-Day Cycle PDFDocument6 pagesPTG Three-Day Cycle PDFDraženS100% (3)

- Insider TradingDocument1 pageInsider TradingmattNo ratings yet

- Liquidation Problem Partnership and Corporation AccountingDocument3 pagesLiquidation Problem Partnership and Corporation AccountingChichoNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- Chapter 2Document83 pagesChapter 2Eliza RiveraNo ratings yet

- UntitledDocument4 pagesUntitledShevina Maghari shsnohsNo ratings yet

- Corp. Retained EarningsDocument9 pagesCorp. Retained EarningshsjhsNo ratings yet

- Baral, Malaluan, CastroDocument2 pagesBaral, Malaluan, CastroAndrea TugotNo ratings yet

- Chapter 3 ProblemshhhDocument15 pagesChapter 3 Problemshhhahmed arfanNo ratings yet

- Corporation Problems-1Document18 pagesCorporation Problems-1Avia Chelsy DeangNo ratings yet

- Solved The Partnership of Angel Investors Began Operations On January 1... - Course HeroDocument2 pagesSolved The Partnership of Angel Investors Began Operations On January 1... - Course HeroeannetiyabNo ratings yet

- MARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsDocument5 pagesMARVIN LISING Exercise 1 Installment Liquidation With Schedule of Safe PaymentsMoon YoungheeNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx100% (1)

- ParCor Chapter 5 - Hernandez - BSA 1-1 PDFDocument5 pagesParCor Chapter 5 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Admission and Retirement of PartnersDocument3 pagesAdmission and Retirement of PartnersJohn Eric MacallaNo ratings yet

- TOPIC EconDocument44 pagesTOPIC EconChristy HabelNo ratings yet

- Chapter 3 ParcorDocument6 pagesChapter 3 ParcorJwhll MaeNo ratings yet

- Parco RSPDocument5 pagesParco RSPElli Francis Tomenio0% (2)

- EXAM. MIDTERM. April 20, 2022Document15 pagesEXAM. MIDTERM. April 20, 2022Raziel Angelo AnsusNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyx0% (1)

- Guide Questions For Chapter 2Document5 pagesGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Partnership Operation 003Document12 pagesPartnership Operation 003John GacumoNo ratings yet

- Partnership OperationDocument2 pagesPartnership OperationCjhay MarcosNo ratings yet

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela SerranoNo ratings yet

- Acfar1130 - Chapter 12 ProblemsDocument2 pagesAcfar1130 - Chapter 12 ProblemsMae BarsNo ratings yet

- Take-Home No. 3Document1 pageTake-Home No. 3John Alfred CastinoNo ratings yet

- Partnership Dissolution 3Document10 pagesPartnership Dissolution 3Jamaica RumaNo ratings yet

- ParCor Chapter 4 - Hernandez - BSA 1-1 PDFDocument7 pagesParCor Chapter 4 - Hernandez - BSA 1-1 PDFBSA 1-1No ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- MCQ PartnershipDocument24 pagesMCQ Partnershiplou-924No ratings yet

- UM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedDocument2 pagesUM Panabo College 6th Examination Accounting 2a Test I - Multiple Choice Theory. No Erasures AllowedJessa BeloyNo ratings yet

- Chpter 1.problem 7.mullesDocument11 pagesChpter 1.problem 7.mullesKim OlimbaNo ratings yet

- Activity 3Document7 pagesActivity 3Rishaan Dominic100% (1)

- Name:: Score: ProfessorDocument6 pagesName:: Score: ProfessorkakaoNo ratings yet

- Problem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsDocument4 pagesProblem No. 1: Journal Entries PROBLEM NO. 5: JE and Statement of Financial Position Books of The Partnership Books of Fish R' UsJessa0% (1)

- FISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007Document4 pagesFISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007MayaNo ratings yet

- Win Ballada Parcor Chapter 4 ProblemDocument2 pagesWin Ballada Parcor Chapter 4 ProblemKrngyxNo ratings yet

- Acct102 Midterm NotesDocument15 pagesAcct102 Midterm NotesWymple Kate Alexis FaisanNo ratings yet

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocument4 pagesRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNo ratings yet

- Partnership Operation 004Document2 pagesPartnership Operation 004John GacumoNo ratings yet

- Chapter 2&3 Par - CorDocument31 pagesChapter 2&3 Par - CorJUARE MaxineNo ratings yet

- Requirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksDocument7 pagesRequirement: A New Set of Books Will Be Opened by The Partnership Roces' Books Sales' BooksJunzen Ralph YapNo ratings yet

- Parcor Proj (Version 1)Document45 pagesParcor Proj (Version 1)Jwhll MaeNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerDarlene Angela IcasiamNo ratings yet

- Science Technology and Society: Gordon CollegeDocument72 pagesScience Technology and Society: Gordon CollegeRon Aisen Howard100% (1)

- Problem 20-23Document5 pagesProblem 20-23Teresa Pantallano DivinagraciaNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- Chap 3 and 4 - ParcorDocument4 pagesChap 3 and 4 - ParcorAnne Gwynneth RadaNo ratings yet

- Fish RUsDocument11 pagesFish RUseia aieNo ratings yet

- Activity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIDocument5 pagesActivity 1. Partnership Formation Books of Roces: Bryle Jay P. Lape BSA-IIIBryle Jay Lape40% (5)

- Acct NG SolutionsDocument1 pageAcct NG SolutionsGelyn Cruz100% (1)

- Exercise 3: 1. Initial Capital Investments (Compound Entry) DR CRDocument4 pagesExercise 3: 1. Initial Capital Investments (Compound Entry) DR CRasdfNo ratings yet

- Problem 1: Lump Sum LiquidationDocument2 pagesProblem 1: Lump Sum LiquidationAina Aguirre100% (2)

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Chapter 3 Case PartnershipDocument19 pagesChapter 3 Case PartnershipZPadsNo ratings yet

- Answers Lt2Document4 pagesAnswers Lt2scryx bloodNo ratings yet

- Exercise 1 Investment in AssociatesDocument7 pagesExercise 1 Investment in AssociatesJoefrey Pujadas BalumaNo ratings yet

- Document 9Document7 pagesDocument 9John ManatadNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Product Pricing-PRINTDocument12 pagesProduct Pricing-PRINTKatrina PetracheNo ratings yet

- ANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireDocument5 pagesANSWER KEY - ACC 308 - Midterm Examination - QuestionnaireKatrina PetracheNo ratings yet

- Partnership Liquidation QuizDocument11 pagesPartnership Liquidation QuizKatrina PetracheNo ratings yet

- StatisticsDocument27 pagesStatisticsKatrina PetracheNo ratings yet

- MODULE 1 (CH 31-33) INTANGIBLE ASSETS LandscapeDocument39 pagesMODULE 1 (CH 31-33) INTANGIBLE ASSETS LandscapeKatrina PetracheNo ratings yet

- Form 2200-M, PetracheDocument2 pagesForm 2200-M, PetracheKatrina PetracheNo ratings yet

- QUIZ 1 Intangible AssetsDocument21 pagesQUIZ 1 Intangible AssetsKatrina PetracheNo ratings yet

- Form 2200-C, PetracheDocument2 pagesForm 2200-C, PetracheKatrina PetracheNo ratings yet

- Property, Plant and EquipmentDocument18 pagesProperty, Plant and EquipmentKatrina PetracheNo ratings yet

- Depreciation: Systematic Allocation of The Depreciable Amount of An Asset Over Its Useful LifeDocument24 pagesDepreciation: Systematic Allocation of The Depreciable Amount of An Asset Over Its Useful LifeKatrina PetracheNo ratings yet

- REVALUATIONDocument17 pagesREVALUATIONKatrina PetracheNo ratings yet

- International Trade and DevelopmentDocument31 pagesInternational Trade and DevelopmentKatrina PetracheNo ratings yet

- Business Ethics Case Study: The Medrano Machine CompanyDocument4 pagesBusiness Ethics Case Study: The Medrano Machine CompanyKatrina PetracheNo ratings yet

- Petrache Katrina, TUTOR DOCTOR - How Learning Hits HomeDocument12 pagesPetrache Katrina, TUTOR DOCTOR - How Learning Hits HomeKatrina PetracheNo ratings yet

- Group 4-BSMA1203-PepsiCoDocument20 pagesGroup 4-BSMA1203-PepsiCoKatrina PetracheNo ratings yet

- PADMON Condominium vs. Ortigas Case DigestDocument2 pagesPADMON Condominium vs. Ortigas Case DigestKatrina PetracheNo ratings yet

- Accenture Liquidity Coverage Ratio PDFDocument24 pagesAccenture Liquidity Coverage Ratio PDFKunal TijareNo ratings yet

- Deutsche Bank Research IndoTelco and TowerDocument13 pagesDeutsche Bank Research IndoTelco and TowerStefanarichta100% (1)

- China Banking Corp V CADocument7 pagesChina Banking Corp V CANikko SterlingNo ratings yet

- QuarterlyBo 12081800 01739053 31122019 PDFDocument1 pageQuarterlyBo 12081800 01739053 31122019 PDFSangamesh Sangu0% (1)

- Financial Market & Institutions ExamDocument7 pagesFinancial Market & Institutions Examviettuan91No ratings yet

- Fixed Income Portfolio StrategiesDocument28 pagesFixed Income Portfolio Strategies9986212378No ratings yet

- Balakrishna TemplateDocument4 pagesBalakrishna TemplatebagyaNo ratings yet

- The Financial Environment: Markets, Institutions, and Interest RatesDocument2 pagesThe Financial Environment: Markets, Institutions, and Interest RatesKristel SumabatNo ratings yet

- SEBI Promotor IssueDocument13 pagesSEBI Promotor Issuesiva_sankar826481No ratings yet

- NCR Cup 1 Final RoundDocument6 pagesNCR Cup 1 Final RoundMich ClementeNo ratings yet

- Law On AGENCYDocument9 pagesLaw On AGENCYPark Min EunNo ratings yet

- Financial Modeling - PUNE Financial ModelingDocument1 pageFinancial Modeling - PUNE Financial ModelingBHARAT PRAKASH MAHANTNo ratings yet

- Guide of Audit in InvestmentsDocument21 pagesGuide of Audit in InvestmentsNicco OrtizNo ratings yet

- Money of The FutureDocument321 pagesMoney of The FutureWeb Financial Group100% (1)

- Undertaking - Copy Edited 01Document2 pagesUndertaking - Copy Edited 01meliton caprichoNo ratings yet

- Chap 1Document19 pagesChap 1p4priyaNo ratings yet

- Corp Tax OutlineDocument81 pagesCorp Tax OutlinesashimimanNo ratings yet

- CIF+-+Replacement+ +prospectus+ (Executed+10Apr19)Document210 pagesCIF+-+Replacement+ +prospectus+ (Executed+10Apr19)EDWARD LEENo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- File 29Document4 pagesFile 29Krishna C NNo ratings yet

- Pennantpark Investment Corporation: PNNT - NasdaqDocument8 pagesPennantpark Investment Corporation: PNNT - NasdaqnicnicooNo ratings yet

- Fim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementDocument4 pagesFim01-Fundamental of Financial Management 01 - An Overview of Financial Management J. Villena, Cpa Financial ManagementJomar VillenaNo ratings yet

- AC119 Cashflow StatementDocument82 pagesAC119 Cashflow StatementTINASHENo ratings yet

- Liabilities of Parties: Regulatory Framework and Legal Issues in BusinessDocument7 pagesLiabilities of Parties: Regulatory Framework and Legal Issues in BusinessPhryz PajarilloNo ratings yet

- TITLE-III Board of Directors Trustees and OfficersDocument7 pagesTITLE-III Board of Directors Trustees and Officersjeanlyn domingoNo ratings yet

- Caltex (Philippines), Inc. v. CADocument3 pagesCaltex (Philippines), Inc. v. CAAgee Romero-ValdesNo ratings yet

- Trading MathDocument29 pagesTrading MathOm Prakash88% (8)