Professional Documents

Culture Documents

Exam 1 Practice Short Answer - Key

Exam 1 Practice Short Answer - Key

Uploaded by

bibimgm2000Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam 1 Practice Short Answer - Key

Exam 1 Practice Short Answer - Key

Uploaded by

bibimgm2000Copyright:

Available Formats

Additional Exam 1 Practice

1) What is the duration of a par value bond with a coupon rate of 8% and a remaining time to maturity

of 5 years, assuming interest compounds annually?

Calculations are shown below.

2) What is the modified duration of a seven-year par value bond has a coupon rate of 9%?

3) Calculate the requested measures in the following questions for Bond A, assuming interest

is paid semiannually and a face value of $100.

Bond A

Coupon 8%

Yield to maturity 8%

Maturity (years) 2

Par $100.00

Price $100.00

a. What is the price value of a basis point for Bond A?

PMT = 4 I/Y = 8.0/2=4.00, N = 4, FV = 100, Compute PV =100

PMT = 4, I/Y = 8.01/2=4.005, N = 4, FV = 100, Compute PV = 99.98185266

PVBP = 100 - 99.98185266= $.01814734

b. Compute the Macaulay duration for the bond.

1( 4) 2(4) 3(4) 4 (1 0 4)

+ + +

Macaulay duration (half years) = 1.04 1 1.042 1.04 3 1.04 4

100

377.509

¿ =3.77509

100

Macaulay duration (years) = Macaulay duration (half years) / 2 = 3.77509 / 2 = 1.8875.

c. Compute the modified duration for Bond A.

modified duration = Macaulay duration / (1 + y) = 1.8875 / 1.04 = 1.814948.

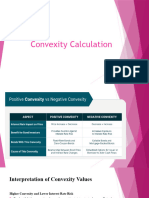

d. Calculate the convexity for Bond A.

convexity measure (half years) =

2($4) 1 2($4)4 4(5) 100 $4 / 0.04

3

1 4

1

(0.04) 1.04 (0.04) 2 1.04 1.04 6

5

$100

= 17.10934

convexity measure in m period per year

2

Convexity measure (years) = m = 17.10934 / 2(2) = 17.10934 / 4

= 4.277335

e. Calculate the actual price of a bond for a 100-basis point increase in interest rates.

FV = 100, PMT = 4, I/Y = 4.5, N = 4, Compute PV = -98.20623715

f. Using duration, estimate the price of the bond for a 100-basis point increase in

interest rates.

dP

P = (modified duration)(dy) = 1.814948 (0.01) = .01814948

dP

1 P

New price = P = (1 .01814948)*100 = $98.18505

g. Using both duration and convexity measures, estimate the price change of the bond

for a 100-basis point increase in interest rates.

dP 1

P = (modified duration)(dy) + 2 convexity measure (dy)2

1

= 1.814948 (0.01) + 4.277335 (.01)2 = .01794

2

You might also like

- Martellini Priaulet Fixed Income Solutions StudentsDocument53 pagesMartellini Priaulet Fixed Income Solutions Studentsvenkatr2004100% (2)

- Manufacturing Engineering HandbookDocument1,193 pagesManufacturing Engineering Handbookgustavogomezch96% (24)

- Bond Portfolio ManagementDocument90 pagesBond Portfolio ManagementAbhishek DuaNo ratings yet

- Pheochromocytoma 1Document31 pagesPheochromocytoma 1umair ahmadNo ratings yet

- Chapter 13 SolutionsDocument16 pagesChapter 13 SolutionsEdmond ZNo ratings yet

- More Minute Math Drills, Grades 1 - 3: Addition and SubtractionFrom EverandMore Minute Math Drills, Grades 1 - 3: Addition and SubtractionRating: 1 out of 5 stars1/5 (1)

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- Data Industri JabodetabekDocument669 pagesData Industri JabodetabekBudy Nugraha88% (25)

- Furnace PDFDocument9 pagesFurnace PDFBilalNo ratings yet

- Docslide - Us People Monitoring and Safety Solutions 3rd EditionDocument4 pagesDocslide - Us People Monitoring and Safety Solutions 3rd EditionAnonymous LOcT0gjqdSNo ratings yet

- Time Value of Money Analysis 2Document26 pagesTime Value of Money Analysis 2nabilanabelsNo ratings yet

- Compound InterestDocument35 pagesCompound InterestToukaNo ratings yet

- HONMD1Y Compulsory Assignment 01 2012Document4 pagesHONMD1Y Compulsory Assignment 01 2012Benedict MoshiaNo ratings yet

- Contoh Soal SOADocument14 pagesContoh Soal SOA045 - Hidayatilla RishalNo ratings yet

- Chapter 10: Risk and Return: Lessons From Market History: Answers To End-of-Chapter Problems B-121Document10 pagesChapter 10: Risk and Return: Lessons From Market History: Answers To End-of-Chapter Problems B-121Kaveh ArabpourNo ratings yet

- Student Solution ManualDocument94 pagesStudent Solution ManualNicolas Lefevre-Laumonier100% (1)

- Applied Solutions: The Time Value of Money: Chapter 2 QuestionsDocument21 pagesApplied Solutions: The Time Value of Money: Chapter 2 Questionsinfiniti786No ratings yet

- Answer Chapter 4 Time Value of MoneyDocument6 pagesAnswer Chapter 4 Time Value of MoneyFatikchhari USO100% (1)

- FM Textbook Solutions Chapter 8 Second EditionDocument11 pagesFM Textbook Solutions Chapter 8 Second EditionlibredescargaNo ratings yet

- Topic 3 - Homework3 SolutionDocument7 pagesTopic 3 - Homework3 SolutionTsz Wei CHANNo ratings yet

- Hw1 Bus424 SolDocument17 pagesHw1 Bus424 SolnobuyukiNo ratings yet

- Gabaritorendafixa1 PDFDocument7 pagesGabaritorendafixa1 PDFhmvungeNo ratings yet

- QF2101 1112S1 Tutorial 4Document3 pagesQF2101 1112S1 Tutorial 4Wei Chong KokNo ratings yet

- 102 Sol 1104Document10 pages102 Sol 1104api-3701114No ratings yet

- 11-Integrity Module 2 Yu LeonDocument7 pages11-Integrity Module 2 Yu LeonCaroline LaynoNo ratings yet

- Chapter 4Document7 pagesChapter 4Gilang PurwoNo ratings yet

- ACST202/ACST851: Mathematics of Finance Tutorial Solutions 10: BondsDocument7 pagesACST202/ACST851: Mathematics of Finance Tutorial Solutions 10: BondsAbhishekMaranNo ratings yet

- BMA 12e SM CH 03 FinalDocument14 pagesBMA 12e SM CH 03 FinalNikhil ChadhaNo ratings yet

- Bond RiskDocument31 pagesBond RiskSophia ChouNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsSadia R ChowdhuryNo ratings yet

- Financial Mathematics For Actuaries: Bond Management Learning ObjectivesDocument63 pagesFinancial Mathematics For Actuaries: Bond Management Learning ObjectivesRehabUddinNo ratings yet

- 연습문제 (영어) 2Document8 pages연습문제 (영어) 29dm9h2s48kNo ratings yet

- SOL - INV - Practice Final - 2022Document2 pagesSOL - INV - Practice Final - 2022nes403No ratings yet

- VMIT15 401F08 Midterm SolDocument3 pagesVMIT15 401F08 Midterm SolJohnNo ratings yet

- Fixed Income Assignment 2Document4 pagesFixed Income Assignment 2Rattan Preet SinghNo ratings yet

- Chapter 3 Time Value of MoneyDocument21 pagesChapter 3 Time Value of Moneyndc6105058No ratings yet

- Problem Set IV (9 Marks) : YTM/2) (n2)Document5 pagesProblem Set IV (9 Marks) : YTM/2) (n2)steve bobNo ratings yet

- QF2104 Tutorial - Assignment 4Document3 pagesQF2104 Tutorial - Assignment 4igndunnoNo ratings yet

- Fixed Income NMIMS BLR S3Document28 pagesFixed Income NMIMS BLR S3harshit.dwivedi320No ratings yet

- 2020 Chap6 Theory Discounted Cash FlowDocument63 pages2020 Chap6 Theory Discounted Cash Flowvalorant radiantNo ratings yet

- Hashim Imran Wahla InvestmentDocument6 pagesHashim Imran Wahla Investmentھاشم عمران واھلہNo ratings yet

- Bonds AllDocument97 pagesBonds AllAman jhaNo ratings yet

- 2 Time Value of MoneyDocument30 pages2 Time Value of MoneyAnkita SharmaNo ratings yet

- Convexity CalculationDocument7 pagesConvexity CalculationRabeya AktarNo ratings yet

- Problem Set 4 FIN 7000Document3 pagesProblem Set 4 FIN 7000Ripudaman SinghNo ratings yet

- BMA - 12e - SM - CH - 03 - Final (AutoRecovered)Document16 pagesBMA - 12e - SM - CH - 03 - Final (AutoRecovered)Aalo M ChakrabortyNo ratings yet

- INGESTriskmgt (2012) - Slides - Session 3 - V5Document44 pagesINGESTriskmgt (2012) - Slides - Session 3 - V5khopdi_number1No ratings yet

- Week 3Document34 pagesWeek 3Fabrizio Da MotaNo ratings yet

- LUYỆN TẬP BT CÓ CÔNG THỨC - TTCKDocument11 pagesLUYỆN TẬP BT CÓ CÔNG THỨC - TTCKLâm Thị Như ÝNo ratings yet

- ACF329 Prep 1: Due Before Class On Thursday, Jan 22 Do Not Turn In, But Must Be Completed!Document3 pagesACF329 Prep 1: Due Before Class On Thursday, Jan 22 Do Not Turn In, But Must Be Completed!Dingyu WangNo ratings yet

- Answers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security ValuationDocument8 pagesAnswers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security Valuationimamoody1No ratings yet

- Exam20001 2015FinalWithSolsDocument6 pagesExam20001 2015FinalWithSolsA SunNo ratings yet

- 3 BA304 2019 2020 Spring Week34 Time Value of MoneyDocument142 pages3 BA304 2019 2020 Spring Week34 Time Value of MoneyMurat DenizNo ratings yet

- Valuation of ForwardDocument18 pagesValuation of ForwardbuviaroNo ratings yet

- CVEN3101 Quiz 3 2017 SolutionsDocument11 pagesCVEN3101 Quiz 3 2017 SolutionsRafa ClayNo ratings yet

- Solutions To Problems : Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 11Document6 pagesSolutions To Problems : Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 11Ahmed El KhateebNo ratings yet

- Assessment 2Document2 pagesAssessment 2Trisha DiegoNo ratings yet

- General Mathematics: Simple InterestsDocument7 pagesGeneral Mathematics: Simple InterestsClaire BalatucanNo ratings yet

- Time Value of Money I - SolutionsDocument2 pagesTime Value of Money I - SolutionsraymondNo ratings yet

- FIN221 Chapter 3 - (Q&A)Document15 pagesFIN221 Chapter 3 - (Q&A)jojojoNo ratings yet

- Assignment 4 (Revised) (Answers)Document3 pagesAssignment 4 (Revised) (Answers)kaankNo ratings yet

- Society of Actuaries/Casualty Actuarial Society: Exam FM Sample SolutionsDocument26 pagesSociety of Actuaries/Casualty Actuarial Society: Exam FM Sample SolutionsRyan Shee Soon TeckNo ratings yet

- Real Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsFrom EverandReal Estate Math Express: Rapid Review and Practice with Essential License Exam CalculationsNo ratings yet

- Sterling Test Prep College Physics Practice Questions: Vol. 1, High Yield College Physics Questions with Detailed ExplanationsFrom EverandSterling Test Prep College Physics Practice Questions: Vol. 1, High Yield College Physics Questions with Detailed ExplanationsNo ratings yet

- Jumpstarters for Algebra, Grades 7 - 8: Short Daily Warm-ups for the ClassroomFrom EverandJumpstarters for Algebra, Grades 7 - 8: Short Daily Warm-ups for the ClassroomNo ratings yet

- RPT 2021 DLP Math Year 5 KSSR SemakanDocument16 pagesRPT 2021 DLP Math Year 5 KSSR SemakanShalini SuriaNo ratings yet

- Spar Design of A Fokker D-VII - Aerospace Engineering BlogDocument8 pagesSpar Design of A Fokker D-VII - Aerospace Engineering Blogjohn mtz100% (1)

- FX2N-16DNET Devicenet User ManualDocument126 pagesFX2N-16DNET Devicenet User ManualNguyen QuanNo ratings yet

- Fowler - The New MethodologyDocument18 pagesFowler - The New MethodologypglezNo ratings yet

- FINAL - Presentations in Your OfficeDocument2 pagesFINAL - Presentations in Your OfficeSyed Mohammed AzharuddinNo ratings yet

- Sta 9 1Document125 pagesSta 9 1Jayaprakash Polimetla100% (1)

- Manual SunStarMPPTDocument53 pagesManual SunStarMPPTmikenrNo ratings yet

- Quality Gurus (Pioneers of TQM) : Unit - 1Document33 pagesQuality Gurus (Pioneers of TQM) : Unit - 1Sowbhagya LakshmiNo ratings yet

- Unemployment and PovertyDocument9 pagesUnemployment and PovertyRaniNo ratings yet

- Garnet CompanyDocument2 pagesGarnet CompanycheckaiNo ratings yet

- Walkathon Brochure - 2021 Trifold 2Document2 pagesWalkathon Brochure - 2021 Trifold 2api-208159640No ratings yet

- NABA Application Form UG Q4Document5 pagesNABA Application Form UG Q4technicalhub512No ratings yet

- 2020 21 RGICL Annual ReportDocument113 pages2020 21 RGICL Annual ReportShubrojyoti ChowdhuryNo ratings yet

- Geographic Information System ArchitectureDocument32 pagesGeographic Information System ArchitectureElisha ManishimweNo ratings yet

- 2 A 96 A 5 C 94 Ec 59855Document34 pages2 A 96 A 5 C 94 Ec 59855alaa altaeeNo ratings yet

- Coal IGCC For Hydrogen Production, CO Recovery and ElectricityDocument30 pagesCoal IGCC For Hydrogen Production, CO Recovery and ElectricityscottigNo ratings yet

- Master Thesis Excl. AppendixDocument118 pagesMaster Thesis Excl. AppendixNikher VermaNo ratings yet

- Kidde Spec AEGIS 2010Document9 pagesKidde Spec AEGIS 2010Jorge InostrozaNo ratings yet

- Psychological Science Modeling Scientific Literacy With DSM-5 Update Mark Krause, Daniel Corts Test BankDocument5 pagesPsychological Science Modeling Scientific Literacy With DSM-5 Update Mark Krause, Daniel Corts Test BanksaxNo ratings yet

- Talisic Vs Atty. Rinen Feb. 12,2014Document3 pagesTalisic Vs Atty. Rinen Feb. 12,2014Katharina CantaNo ratings yet

- University of KarachiDocument53 pagesUniversity of KarachiWaqasBakaliNo ratings yet

- Mechanics of Deformable Bodies Module 2Document19 pagesMechanics of Deformable Bodies Module 2eysNo ratings yet

- ZomatoDocument3 pagesZomato2305112130010No ratings yet

- Judiciary: Structure, Organization and FunctioningDocument5 pagesJudiciary: Structure, Organization and FunctioningGaurav SinghNo ratings yet

- Test Bank For Advanced Accounting 2nd Edition HamlenDocument36 pagesTest Bank For Advanced Accounting 2nd Edition Hamlenacetize.maleyl.hprj100% (58)