Professional Documents

Culture Documents

Null - 2021-12-15T162511.916

Null - 2021-12-15T162511.916

Uploaded by

Mayur NagdiveOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Null - 2021-12-15T162511.916

Null - 2021-12-15T162511.916

Uploaded by

Mayur NagdiveCopyright:

Available Formats

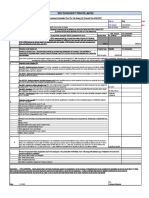

ICICI Prudential Lifelong Gift Plus is designed to give you lifelong income to help you achieve your financial

goals.

What are the benefits of this policy?

1. Lifelong regular income:

• From Dec

Mar 2022

2023 to Dec

Mar 2028

2025, you will receive an income of ` 37,500/-

10,00,000/- every year

<year> `

• From Dec

Mar 2029

2026 to Dec 2032, you will receive an income of ` 2,18,700/-

Mar 2035 10,00,000/- every year

year>

• From Dec

Mar 2039

2021 to Dec 2033, you will receive an income^ of ` 4,83,000/-

Mar 2085 10,00,000/- every year

<year>

^Note: The income shown is at an assumed rate of return of 8% as depicted in the Benefit Illustration of ICICI Pru Lakshya Lifelong Income. At an

1,96,125/-

assumed rate of return of 4%, the income from ICICI Pru Lakshya Lifelong Income is ` <5,60,000/->.

2. One-time bonus: In Dec

Mar 2038

2035, you will receive a lump sum of ` 6,37,500/-

10,00,00/- at an assumed rate

of return of 8% from ICICI Pru Lakshya Lifelong Income. There is no lump sum at an assumed rate

of return of 4%.

This amount is referred to as ’Accrued Regular Additions’ in the Benefit Illustration of ICICI Pru

``

Lakshya Lifelong Income.

3. Maturity Benefit: You will receive a lump sum on maturity in Dec

<Mar2085

2032>

The below illustration shows what you will receive at two different assumed rates of return.

`

Assumed rate of return You will receive

8% per annum ` 45,00,000/-

10,00,00,000/-

4% per annum ` 37,50,000/-

10,00,00,000/-

4. Life Insurance Benefit: If the person whose life is covered under this policy passes away during the

term of the policy, a lump sum will be paid out to the person specified by you (known as the

Nominee) in your policy. The amount paid will be a cumulative amount of both your policies as

mentioned below:

ICICI Pru Guaranteed Income For Tomorrow ICICI Pru Lakshya

` 18,75,000/-

10,00,000/- * till

MarDec2030

2029 ` 37,50,000/-

10,00,000/- Mar Dec 2085

* till2030

The nominee can initiate the process of receiving this amount by visiting www.iciciprulife.com/claims

The Life Insurance Benefit payable will be based on the year of death of the Life Assured. Please refer to the Benefit Illustration for Life Insurance Benefit

payable during the policy term.

5. Tax Benefit: You can avail tax benefits on: a) The premium you pay towards this plan b) The

benefits you receive under this plan

The tax benefits you receive are subject to conditions under section 80C,10(10D),115BAC & other

provisions of the Income Tax Act, 1961. Tax laws are subject to amendments from time to time.

How much premium do you need to pay?

To enjoy these benefits, pay ` 3,12,500/- 1012 years in ICICI Pru Lakshya and 10,00,000/-

10,00,000/- for ` 1,87,500/- 10for 7 years

in ICICI Pru Guaranteed Income For Tomorrow.

Therefore, pay ` 5,00,000/-

10,00,000/- 107 years and pay10,00,000/-

for initial ` 3,12,500/- 10 5 years.

subsequently for next

What happens if you don't pay premiums for the complete premium payment term?

It is in your best interest that you pay premiums till Dec

Mar 2032

2030 in this policy so that you enjoy all the `

`

benefits of this policy.

• If you stop paying premiums after paying for at least two full years, your policy will continue with

reduced benefits.

• If you stop paying premiums in the first two years, no benefits will be payable.

The values appearing in this feature document are based on the information provided and the type of cover sought by you in the duly filed proposal form. It is pertinent to note that any

change affected by you in the details provided in the proposal form may lead to a change in the benefits or premium payable under this policy. COMP/DOC/Jul/2020/107/3944

ICICI Prudential Life Insurance Company Limited. IRDAI Regn No. 105. CIN: L66010MH2000PLC127837. Registered Address: 1089, Appasaheb Marathe Marg, Prabhadevi, Mumbai 400025.

Reg No: 105. For more details on risk factors, terms and conditions, please read the policy document. COMP/DOC/Sep/2021/19/6540.

You might also like

- KFD New21102022134713238 E34Document5 pagesKFD New21102022134713238 E34Manish BhojaniNo ratings yet

- KFD New18032024162138470 E28Document5 pagesKFD New18032024162138470 E28Suraj BhasmeNo ratings yet

- ICICI Guaranteed BenifitsDocument3 pagesICICI Guaranteed BenifitsNaveen SettyNo ratings yet

- KFD New07112023153153412 E28Document5 pagesKFD New07112023153153412 E28Mayur NagdiveNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Meenu SinghNo ratings yet

- Os19611729 EbiDocument4 pagesOs19611729 EbiSoumya SwainNo ratings yet

- KFD New20012024140359061 E35Document17 pagesKFD New20012024140359061 E35msaurabh9142No ratings yet

- Icici Lakshya - 10kDocument5 pagesIcici Lakshya - 10kManjunath RNo ratings yet

- KFD New04122022004727946 E28Document5 pagesKFD New04122022004727946 E28Ashfaq hussainNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)shashank pathakNo ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow (Long-Term)ShreyaNo ratings yet

- Features of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?Document3 pagesFeatures of ICICI Pru Guaranteed Income For Tomorrow: What Are Benefits of This Policy?ShreyaNo ratings yet

- KFD New16022024101242313 E28Document19 pagesKFD New16022024101242313 E28Mr ZekeNo ratings yet

- Age 67 12 PayDocument5 pagesAge 67 12 PayRohit yadavNo ratings yet

- KFD New E36Document6 pagesKFD New E36Gaurav ShahNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Ipru Pension 10 Year X 2 LacDocument5 pagesIpru Pension 10 Year X 2 LacHK Option LearnNo ratings yet

- Features of ICICI Pru Signature: How Does This Plan Work?Document6 pagesFeatures of ICICI Pru Signature: How Does This Plan Work?Sneha Abhash SinghNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- KFD New14102023114539156 E35Document8 pagesKFD New14102023114539156 E35saurabh.imbhuNo ratings yet

- KFD New17082022140700359 E28Document5 pagesKFD New17082022140700359 E28sb RogerdatNo ratings yet

- Illustration 2Document7 pagesIllustration 2muks.jags.2023No ratings yet

- KFD New14022024162942806 E28Document5 pagesKFD New14022024162942806 E28Mayur NagdiveNo ratings yet

- Guarantee A Secure Tomorrow, Today: Kotak Assured Savings PlanDocument2 pagesGuarantee A Secure Tomorrow, Today: Kotak Assured Savings PlanPrashanth BabuNo ratings yet

- Personalised Proposal For Securing Your Guaranteed Income NeedsDocument6 pagesPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiNo ratings yet

- Personalised Proposal For Securing Your Life Goals: Hi FatherDocument8 pagesPersonalised Proposal For Securing Your Life Goals: Hi FatherAbcNo ratings yet

- Gift SaveDocument5 pagesGift Savepr nayakNo ratings yet

- Lic of India LTDDocument4 pagesLic of India LTDAnish PenmahaleNo ratings yet

- (UIN: 104N135V01) : Ms. MeghaDocument6 pages(UIN: 104N135V01) : Ms. Meghayogesh pawarNo ratings yet

- 1684 - Hemal Patel PPT 7 - 845Document6 pages1684 - Hemal Patel PPT 7 - 845jdchandrapal4980No ratings yet

- Edelweiss Tokio Life - GCAP - : OverviewDocument2 pagesEdelweiss Tokio Life - GCAP - : OverviewarunNo ratings yet

- LetterDocument5 pagesLetterJyotirmay SahuNo ratings yet

- KFD New28112023155349583 E28Document5 pagesKFD New28112023155349583 E28drstudyteamNo ratings yet

- Compensation 1682945 2020-2021Document9 pagesCompensation 1682945 2020-2021Alisha riya FrancisNo ratings yet

- 4906-ICICI Pru-Lakshya-Gold Plan-One Pager-27DecDocument2 pages4906-ICICI Pru-Lakshya-Gold Plan-One Pager-27DecMehul Bajaj100% (1)

- Max Life Return PlanDocument6 pagesMax Life Return PlanExcel 4CAsNo ratings yet

- KFD New E36Document6 pagesKFD New E36vishalNo ratings yet

- IIITDM Jabalpur Offer Ankit MishraDocument3 pagesIIITDM Jabalpur Offer Ankit MishraKumar shivamNo ratings yet

- Life Link Pension SP LeafletDocument2 pagesLife Link Pension SP LeafletSarvesh MishraNo ratings yet

- A Safe Journey: To A Rising FutureDocument54 pagesA Safe Journey: To A Rising FutureKuldip BarmanNo ratings yet

- SaveNGrow Online LeafletDocument2 pagesSaveNGrow Online LeafletAmit Kumar KandiNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Rad 107 BBDocument2 pagesRad 107 BBHarish ChandNo ratings yet

- Century Royale Brochure Ver 05 (1) - 7-7Document1 pageCentury Royale Brochure Ver 05 (1) - 7-7arunsm1611No ratings yet

- Tax Certificate - 008927742 - 131310Document2 pagesTax Certificate - 008927742 - 131310Vignesh MahadevanNo ratings yet

- IPru Easy Retirement Leaflet PDFDocument6 pagesIPru Easy Retirement Leaflet PDFRameshNo ratings yet

- SBI Life - Smart Platina Plus - Cr1 Handbill - SIBDocument1 pageSBI Life - Smart Platina Plus - Cr1 Handbill - SIBKiran JohnNo ratings yet

- Vinith Kumar SLI TLI CLI (MG01 - MG06)Document3 pagesVinith Kumar SLI TLI CLI (MG01 - MG06)vineethpowerstarNo ratings yet

- SSR CRITERIA V 5.2.1 Student Progression Students Placement Offer LettersDocument92 pagesSSR CRITERIA V 5.2.1 Student Progression Students Placement Offer LettersNAGARAJ GNo ratings yet

- PruCash Double Reward BrochureDocument31 pagesPruCash Double Reward BrochureDavid ChungNo ratings yet

- Aditya Life InsuranceDocument2 pagesAditya Life InsuranceMirzaNo ratings yet

- Smart Income Protect BrochureDocument12 pagesSmart Income Protect BrochureSumit RpNo ratings yet

- KFD New28032024144639995 E28Document5 pagesKFD New28032024144639995 E28Mayur NagdiveNo ratings yet

- Life Insurance Corporation of IndiaDocument10 pagesLife Insurance Corporation of IndiaroyjohnnyNo ratings yet

- Shreenath LNU PDFDocument3 pagesShreenath LNU PDFshrinathNo ratings yet

- Federal Budget 2021Document4 pagesFederal Budget 2021api-227304535No ratings yet

- KFD New29112023095424701 UW3Document8 pagesKFD New29112023095424701 UW3Mayur NagdiveNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- KFD New28062022133153132 E32Document5 pagesKFD New28062022133153132 E32Mayur NagdiveNo ratings yet

- KFD New07112023153153412 E28Document5 pagesKFD New07112023153153412 E28Mayur NagdiveNo ratings yet

- KFD New06012024143830079 T51Document5 pagesKFD New06012024143830079 T51Mayur NagdiveNo ratings yet

- Null (19) - 5Document5 pagesNull (19) - 5Mayur NagdiveNo ratings yet

- Null - 2022-12-14T183756.993Document5 pagesNull - 2022-12-14T183756.993Mayur NagdiveNo ratings yet

- Benefit Illustration of ICICI Pru Lakshya Prepared For: Mr. A BDocument3 pagesBenefit Illustration of ICICI Pru Lakshya Prepared For: Mr. A BMayur NagdiveNo ratings yet

- Ubed ResumeDocument2 pagesUbed ResumeMayur NagdiveNo ratings yet

- Sinhgad Management Institutes: and Organizational Growth To The Best of My AbilityDocument2 pagesSinhgad Management Institutes: and Organizational Growth To The Best of My AbilityMayur NagdiveNo ratings yet

- Admission Notice For Mba/Mms For Academic Year 2019-20Document5 pagesAdmission Notice For Mba/Mms For Academic Year 2019-20Mayur NagdiveNo ratings yet

- OfferLetter PDFDocument5 pagesOfferLetter PDFSatwardhan NaiduNo ratings yet

- Art 1181-1192Document4 pagesArt 1181-1192KEWKNo ratings yet

- Common - Proposal Form Health Policy StarDocument4 pagesCommon - Proposal Form Health Policy Stardeepak sharmaNo ratings yet

- Group B-Project PaperDocument52 pagesGroup B-Project Papernurul fatihahNo ratings yet

- Parcor ExamDocument2 pagesParcor ExamRose Ann GarciaNo ratings yet

- Luzon Brokerage Vs Maritime BLDGDocument8 pagesLuzon Brokerage Vs Maritime BLDGcharmdelmoNo ratings yet

- MNC - SEC Form 17-C (Final Stabilization Report)Document6 pagesMNC - SEC Form 17-C (Final Stabilization Report)johngo888No ratings yet

- Business Environment and Law PDFDocument452 pagesBusiness Environment and Law PDFrajeev sharmaNo ratings yet

- Diamond BatteryDocument5 pagesDiamond BatteryAbhishek YadavNo ratings yet

- Salas v. First Finance Leasing CorporationDocument2 pagesSalas v. First Finance Leasing CorporationKatrina PerezNo ratings yet

- Solante vs. COA Case DigestDocument2 pagesSolante vs. COA Case DigestLance-JellyVNo ratings yet

- Labor LawDocument5 pagesLabor LawQueenie Diane MontañoNo ratings yet

- Freelance Service AgreementDocument6 pagesFreelance Service AgreementAayush MishraNo ratings yet

- 2021 Business Studies Grade 11 Notes Chapter SixDocument10 pages2021 Business Studies Grade 11 Notes Chapter SixLethabo MokotiNo ratings yet

- Lo v. KJS Eco-Formwork SystemDocument7 pagesLo v. KJS Eco-Formwork SystemNiel DabuetNo ratings yet

- Insular Life Assurance Co. v. NLRCDocument11 pagesInsular Life Assurance Co. v. NLRCPrincess Samantha SarcedaNo ratings yet

- Joint Affidavit - Universal AquariusDocument2 pagesJoint Affidavit - Universal AquariusKris NageraNo ratings yet

- Insurance Project Edited 1Document34 pagesInsurance Project Edited 1hareesh karrothuNo ratings yet

- Fees For Technical Assis-Tance and Advisory Work: Service Letter SL2022-720/JERADocument5 pagesFees For Technical Assis-Tance and Advisory Work: Service Letter SL2022-720/JERADmitrii PustoshkinNo ratings yet

- 2018 Test 2 Student VersionDocument3 pages2018 Test 2 Student VersionsithembeleNo ratings yet

- National League FootballDocument25 pagesNational League FootballManuel Moreno GarcíaNo ratings yet

- Commercial Laws of KuwaitDocument7 pagesCommercial Laws of KuwaitAssignmentLab.comNo ratings yet

- Laforteza V MachucaDocument2 pagesLaforteza V MachucaABNo ratings yet

- Arbitration AgreementDocument16 pagesArbitration AgreementMohamed SaaDNo ratings yet

- Partnership Firm TaxationDocument4 pagesPartnership Firm TaxationAvishek PathakNo ratings yet

- Fundamentals of Corporate Law - Module 1 IntroductionDocument6 pagesFundamentals of Corporate Law - Module 1 IntroductionRonan FerrerNo ratings yet

- Intellectual Property Code of The PhilippinesDocument55 pagesIntellectual Property Code of The PhilippinesSkyla FiestaNo ratings yet

- Group 1 (Corpo)Document8 pagesGroup 1 (Corpo)MaanNo ratings yet

- Hospital Lease AgreementDocument35 pagesHospital Lease Agreementalpanah0001No ratings yet

- Oparel Vs AbariaDocument8 pagesOparel Vs AbariaRap PatajoNo ratings yet