Professional Documents

Culture Documents

Deposit Confirmation/Renewal Advice

Deposit Confirmation/Renewal Advice

Uploaded by

Aster D SilvaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deposit Confirmation/Renewal Advice

Deposit Confirmation/Renewal Advice

Uploaded by

Aster D SilvaCopyright:

Available Formats

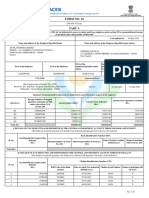

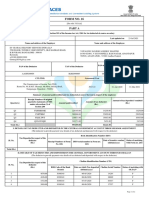

DEPOSIT CONFIRMATION/RENEWAL ADVICE

Type of Deposit NRE

Deposit Account Number 50300515597622

Name and Holding pattern STANLEY ASTER DSILVA(Sole Owner)

Currency INDIAN RUPEES

Mode of Operation FD Booked Through Net

Current* Principal Amount Deposit Start Date Period of Deposit Rate of Interest(%p.a.) Deposit Maturity Date Current* Maturity Amount

550000.00 06 may 2021 12 months 0 days 4.90 06 May 2022 577450.00

Maturity Instructions : Renew Principal + Interest Thank you for banking with us.

Lien Amount : 0.00 This is a system generated Advice, hence does not require any Signature.

Nomination : Registered

IMPORTANT - "As per section 206AAintroduced by finance (No.2) Act, 2009 wef01.4.2010, every person who receives income on which TDS is deductible shall furnish his PAN, failing which TDS shall be deducted at the rate of 20%

(as against 10%which is existing TDS rate)in case of domestic deposits and 30.09% in case of NRO deposits". Please further note that in the absence of PAN as per CBDT circular no: 03/11, TDS certificate will not be issued . Form 15G/H and

other exemption certificates will be invalid even if submitted and Penal TDS will be applicable.

Terms & Conditions (T&C)

Bank computes interest based on the actual number of days’ in a year. In case, the deposit is spread over a leap or a • For deposits <5cr booked on or after 7th March’19, the base rate is the rate applicable to deposits of less than Rs.2 Cr

non-leap year, the interest is calculated based on the number of days .i.e. 366 days in a leap year & 365 days in a as on the date of booking the deposit. Prior to this the base rate is the rate applicable to deposits of less than Rs.1 Cr as on

non-leap year. date of booking the deposit. For 5 Crore and above deposits, the base rate is the rate applicable for 5 cr deposits .

Tax Deduction at Source (TDS) • As per terms & conditions of the fixed deposits accounts of the bank in case of premature closure of Fixed Deposit

• As per section 206AA introduced by finance (No.2) Act, 2009 wef 01.4.2010, every person who receives income on (including sweep in / partial closure) the interest rate will be 1.00% below the contracted rate or the base rate applicable

which TDS is deductible shall furnish his pan, failing which TDS shall be deducted at the rate of 20% (as against 10% for the period the deposit has remained with the bank, whichever is lower. except for the deposits booked with tenor 7-14

which is existing TDS rate) in case of domestic deposits and 30% plus applicable surcharge and health and Education days,for deposit with amount >= 5.25 cr to < 5.50 cr (wef 29th Aug 2018), for deposits>=24.75 cr to < 25 cr (wef 29th

Cess in case of NRO deposits". Please further note that in the absence of PAN as per CBDT circular no: 03/11. TDS Aug 2018)and also for FD's booked with value >=25 crore (single fd booked post Sept 2017)

certificate will not be issued. In absence of PAN, Form 15G/H and other exemption certificates will be invalid even if • In case of death of primary holder of the deposit prior to maturity date, premature termination of the deposit would be

submitted and TDS at higher rate will be applicable. allowed as per the terms of contract subject to necessary verifications and submission of proof of death of the depositor.

• TDS rate is applicable from time to time as per the IT Act, 1961 and IT rules. The current rates applicable for TDS Such premature withdrawals will not attract any penal charge.

would be displayed on Bank’s website.Today, TDS is recovered when interest payable or reinvested on FD & RD per Insurance Cover for Deposits The deposits in the Bank are insured with DICGC for an amount of Rs 5 lakhs (principal

customer, across all Branch, exceeds Rs 40,000/- (Rs. 50,000/- for senior citizen) in a Financial Year. Further, TDS is + interest) per depositor.

recovered at the end of the financial year on Interest accruals if applicable. Non Withdrawable Fixed Deposits (Applicable for Resident and Non Resident)

• If interest amount is insufficient to recover TDS, the same may get recovered from the principal amount of Fixed • The Deposits cannot be closed by the depositor before expiry of the tenure. However, the Bank may allow premature

Deposit.If customer wishes to have TDS recovered from CASA, same can be availed by filling separate declaration at withdrawal of these deposits in certain exceptional circumstances, in the event of direction from any statutory and / or

branch. regulatory body or deceased claim settlement cases.

• For renewed deposits, the new deposit amount consists of the original deposit amount plus Interest Less TDS, if any, • In the event of premature withdrawal of these deposits under above mentioned exceptional circumstances, the Bank

less compounding effect on TDS. For reinvestment deposit, the interest reinvested is post TDS recovery and "hence the will not pay any interest on the principal amount of the deposit. Any interest credited or paid upto the date of such

maturity amount for reinvestment deposits would vary to the extent of tax and compounding effect on tax for the period premature closure will be recovered from the deposit.

subsequent of deduction till maturity. • Sweep-in facility is not allowed.

• As Per Section 139A(5A) of IT Act, every person receiving any sum of income or amount from which tax has been • The minimum tenor for resident and NRO deposits is 91 days and 1 Year for NRE deposits.

deducted under the provisions of IT Act shall provide his PAN to the person responsible for deducting such tax. In case • The deposit will be booked with maturity instruction as ‘Do Not Renew’.

PAN is not provided as required, the bank shall not be liable for the non availment of the credit of Tax deducted at Source • The Non Withdrawable Deposit is offered for amount 5 crore and above only.

and non-issuance of TDS certificate. • Only first party FD OD is provided with 90% limit. Third party FD OD is not allowed.

If your PAN is not updated with the Bank or is incorrect; please visit your nearest branch to submit your PAN details. Important Points

• No deductions of Tax shall be made from the taxable interest in the case of an individual resident in India, if such • Senior Citizens (60 years and above) who are Resident Indians are eligible for senior citizen rates for deposits less

individual furnishes to the Bank, a declaration in writing in the prescribed Format (Form 15G / Form 15H as applicable) than 5cr.

to the effect that the tax on his estimated total income for the year in which such interest income is to be included in • Benefit of additional interest rate on deposits on account of being bank’s own staff or senior citizens shall not be

computing his total income will be Nil. This is subject to PAN availability on Bank records. applicable to NRE and NRO Deposits.

• If aggregated value of all outstanding FDs/RDs booked in same customer id during the Financial Year exceeds INR • Please quote the Deposit Account Number in all Communication

5Lakhs limit (*) then PAN/Form 60 is mandatory. • Please record change of maturity instructions with us well in advance to enable us serve you better.

In absence of PAN/Form 60: (a)• FD/RD will not be renewed on maturity and maturity proceeds will be credited to • Any changes made online in respect to change in maturity instruction / tenure, details can be viewed online post the

your linked account or a Demand Draft will be sent to your mailing address as updated in Bank's records. (b) Maturity changes.

instructions to convert RD proceeds to FD will not be acted upon and RD proceeds will be credited to your linked account • Please Ignore this advice If you have redeemed or renewed this deposit on or after the maturity date as mentioned

on maturity. herein.

The maximum interest not charged to tax during the financial year where form 15 G/H is submitted is as below: • In case of Renewals you will receive a new Fixed Deposit Confirmation / renewal advice.

• Upto 2, 50,000/- for residents of India below the age of 60 years or a person (not being a company or firm). • Rate applicable on monthly interest option will be discounted rate over the standard FD Rate.

• Upto 5,00,000/- for senior citizen residents of India between the age of 60-79 years at any time during the FY • In case of more than one deposit linked for Sweep-In, the system will first Sweep-In funds from the last or recently

• Upto 5,00,000/- for senior citizen residents of India who are 80 years or more at any time during the FY. opened deposit,i.e. on LIFO(Last-In-First-Out) basis.

• Form 15G/ H to be submitted by customer in triplicate to the bank, for submitting one copy to IT Department, one • In case your fixed deposit is booked without nomination details, please visit the Branch to update the same.

copy for Bank record and third copy to be returned to customer with Branch seal as an acknowledgment. A fresh Form • In case of NRO / Resident FD, no interest will be paid if the deposit is prematurely withdrawn before completion of 7

15G /H needs to be submitted at the start of every new Financial Year. In case form 15G/H is submitted post interest days.

payout/credit, waiver shall be effective from the day next to the interest payout /credit immediately preceding the date of • In case of NRE FD interest will not be paid if the deposit is prematurely withdrawn before completion of 1 year.

submission of form 15G/H. • Form 15G/H is not applicable to NRIs

• Form 15G/H needs to be submitted for every fixed Deposits booked with bank for Tax exemption. • TDS is not applicable for Interest earned on NRE deposits

• The bank shall not be liable for any consequences arising due to delay or non-submission of Form 15G/H • No penalty shall be levied for premature withdrawal of NRE term deposits.

• To enable us to serve you better kindly submit the Form 15G/H latest by April 1st of the new financial year • Fixed Deposits booked with monthly or quarterly interest payout option, TDS recovery will by default happen from

Note: The above guidelines are subject to change as per Income Tax regulations /directives of Finance Ministry Govt of linked current / savings account. Please visit nearest branch / contact RM for further clarification.

India prevalent from time to time. • When you open a Fixed deposit with the Bank Interest on Term Deposit is calculated as below:

Automatic Renewal We will be happy to renew your deposit, unless we hear from you to the contrary, for the same o On a Quarterly basis for deposits > 6 months. Simple interest is paid at maturity for deposits <= 6 months.

period as the original deposit, at the prevailing rate of interest. You can change the deposit instruction within 7 days. o Cumulative Interest/ re-investment interest is calculated every quarter, and is added to the principal such that Interest

Without prejudice to clause above, I hereby authorise the Bank and/or its authorised person to approach me through is paid on the Interest earned in the previous quarter as well.

various mode of communication, viz. via email, telephone call, voice bot (through chat bot or any other Artificial o In case of monthly deposit scheme, the interest shall be calculated for the quarter and paid monthly at discounted rate

Intelligent Tool), message, etc. and seek my consent/confirmation to renew the existing Fixed Deposit for same tenure over the Standard FD Rate.

and at the prevailing applicable rate of interest. I confirm that the consent/confirmation given by me through the above • If FD is not booked / renewed as per applicable T &, Bank reserves the right to rebook the same with correct details.

channels for renewal shall be treated as written instruction / advice given by me to the Bank for renewal of the Fixed • Please visit our website/nearest branch/contact RM for further clarification.

Deposit as above.

Premature Encashment

• In the event of death of one of the joint account holders, the right to the deposit proceeds does not automatically

devolve on the surviving joint deposit account holder, unless there is a survivorship clause.

• In case of joint fixed deposits with a survivorship clause, the Bank shall be discharged by paying the Fixed Deposit

proceeds prematurely to survivor/s, on request, in the event of one or more Joint Depositor.

• In the case of premature encashment, all signatories to the deposit must sign the encashment instruction

• All premature encashment will be governed by rules of Reserve Bank of India Prevalent at the time of encashment

• In case joint holder mandate submitted to the bank, any of the holders can sign where mode of operation is either or

survivor / former or survivor.

• As per IT laws, if aggregate amount of the deposit/(s) held by a person with a branch either in his own name or jointly

with any person on the date of repayment together with the interest at payable is equal to or exceeds 20,000/- then the

amount will be paid by bank draft drawn in the name of the deposit holder or by crediting the savings / current account of

the deposit holder.

• Partial Premature withdrawal and sweep-in facility is not allowed for fixed deposits with amount>=5 cr to <25 cr.

• The interest rate applicable for premature closure of deposits (all amounts) will be lower of: The rate of Original

/contracted tenure for which the deposit has been booked OR base rate applicable for the tenure for which deposit has

been in force with the Bank.

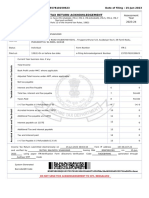

Maturity Instructions:

_______________________________________

Signature(s)

For Office Use only:

Liquidation Instructions

Liquidation : On Maturity / Premature withdrawal

Credit Account No. : ____________________________

Issue Pay order favouring : ____________________________

Date of Liquidation : ____________________________

You might also like

- E-Fixed Deposit Account ReceiptDocument1 pageE-Fixed Deposit Account ReceiptEsther DregoNo ratings yet

- IDfC FD CertificateDocument3 pagesIDfC FD Certificatenisha bhardwaj100% (2)

- Form 16 Part ADocument2 pagesForm 16 Part ATAX INDIA0% (1)

- Ca ReportDocument8 pagesCa ReportHarjot SinghNo ratings yet

- Deloitte Financial Advisory Services India Private LimitedDocument1 pageDeloitte Financial Advisory Services India Private LimitedPRASHANT BANDAWARNo ratings yet

- HDFC Bank StatementDocument4 pagesHDFC Bank StatementAsmin Sultana AhmedNo ratings yet

- UNION BANK Saving LatterDocument1 pageUNION BANK Saving LatterSonu F1No ratings yet

- Mergent Online As Reported - Tesla IncDocument2 pagesMergent Online As Reported - Tesla IncLyca MaeNo ratings yet

- Yes Bank FD Harjinder KaurDocument1 pageYes Bank FD Harjinder KaurTanvi DhingraNo ratings yet

- PDF 776152000311221Document1 pagePDF 776152000311221NandhakumarNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearMurugadassNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part ANidhish AgrawalNo ratings yet

- Mutual Fund Account Statement: ICICI Securities LimitedDocument4 pagesMutual Fund Account Statement: ICICI Securities LimitedSourabh PunshiNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicedeepak pandeyNo ratings yet

- FD ReceiptDocument2 pagesFD ReceiptManjit Debbarma100% (1)

- DefaultDocument1 pageDefaultAshok KumarNo ratings yet

- Offer Letter - Navneet JassiDocument3 pagesOffer Letter - Navneet JassiEr navneet jassiNo ratings yet

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Indusind BankDocument65 pagesIndusind BankNadeem KhanNo ratings yet

- The Intelligent InvestorDocument7 pagesThe Intelligent InvestorAlethea AineNo ratings yet

- Account Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountDocument2 pagesAccount Number Deposit Amount Interest Rate (%P.A.) Start Date Maturity Date Maturity AmountKhushbu NanavatiNo ratings yet

- FDAdvice 10153571792 134129209Document2 pagesFDAdvice 10153571792 134129209Manjeet SharmaNo ratings yet

- Rate of Interest (% P.a.)Document2 pagesRate of Interest (% P.a.)MeeNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceShivam SinghNo ratings yet

- ReceiptDocument2 pagesReceiptAjinder Pal Singh ChawlaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicekunal singhNo ratings yet

- Customer Name: Customer Number Debit Account Number: Scheme: Mode of Operation Maturity InstructionDocument1 pageCustomer Name: Customer Number Debit Account Number: Scheme: Mode of Operation Maturity InstructionSurya Goud0% (1)

- Sbi Fix Deposit Slip PDFDocument1 pageSbi Fix Deposit Slip PDFAbdullah siddikiNo ratings yet

- Ad31296951 06052021095104Document1 pageAd31296951 06052021095104MayankNo ratings yet

- Deposit Amount Date of Issue Rate of Interest (P.a.) Maturity Date Maturity AmountDocument1 pageDeposit Amount Date of Issue Rate of Interest (P.a.) Maturity Date Maturity Amountdpk0No ratings yet

- SSG TAX SAVING FD PDFDocument1 pageSSG TAX SAVING FD PDFamirunnbegamNo ratings yet

- Hishu FD PDFDocument1 pageHishu FD PDFFresher NoobNo ratings yet

- Sbi Fix Deposit Slip PDFDocument3 pagesSbi Fix Deposit Slip PDFsanat naik100% (1)

- March Pay in SlipDocument1 pageMarch Pay in SlipMahenderNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment Yearehsan ahmed0% (1)

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Yes Bank Interest CertificateDocument1 pageYes Bank Interest CertificateSourabh PunshiNo ratings yet

- Sbi Fix Deposit Slip PDFDocument3 pagesSbi Fix Deposit Slip PDFMoses KajinaNo ratings yet

- Icici Bank: METRO BRANCH (13398)Document1 pageIcici Bank: METRO BRANCH (13398)Mayank chauhan100% (1)

- PDF 237557810150623Document1 pagePDF 237557810150623sgkv vasaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajNo ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2022-23: Assessment YearRajagopal ArunachalamNo ratings yet

- PDF 309648880270623Document1 pagePDF 309648880270623Vinay PatelNo ratings yet

- Current Account New MewaDocument15 pagesCurrent Account New MewaSonu F1No ratings yet

- PDF 387693400310722Document1 pagePDF 387693400310722kumar kishanNo ratings yet

- NEERALDocument4 pagesNEERALSimran MehraNo ratings yet

- Provisional Certificate0230Document1 pageProvisional Certificate0230Neduri KalyanNo ratings yet

- Ad09025351 15092020022949Document1 pageAd09025351 15092020022949Anita MishraNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearWILLOFDREAMNo ratings yet

- Rutansh Itr 2022-23Document1 pageRutansh Itr 2022-23Rutansh JagtapNo ratings yet

- ReceiptDocument2 pagesReceiptmahesh100% (1)

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearDirector GGINo ratings yet

- Itr Acknowledgement 2020Document1 pageItr Acknowledgement 2020AJAY KUMAR JAISWALNo ratings yet

- 558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaDocument2 pages558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaPankaj GuptaNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- Ad30047683 28032020011700 PDFDocument1 pageAd30047683 28032020011700 PDFKaran SharmaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceRitu PatelNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicemadhuramfoods.chiralaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdvicethisissandeepsudNo ratings yet

- Document5 AMEX Dec 2013Document14 pagesDocument5 AMEX Dec 2013Daniel TaylorNo ratings yet

- System of Investment Desk in The Banking SectorDocument6 pagesSystem of Investment Desk in The Banking SectorJohn AmazingNo ratings yet

- Psa 120Document14 pagesPsa 120Kimberly LimNo ratings yet

- Essentials of Managerial Finance, 13th Edition: Besley and Brigham Errata SheetDocument1 pageEssentials of Managerial Finance, 13th Edition: Besley and Brigham Errata SheetHas RabNo ratings yet

- Denali Investors Partner Letter - 2014Q1Document10 pagesDenali Investors Partner Letter - 2014Q1ValueWalkNo ratings yet

- Accruals Q1Document3 pagesAccruals Q1Riyu RimmyNo ratings yet

- Excel Function ListDocument130 pagesExcel Function ListdesaikeyurNo ratings yet

- Provident Fund Control Sys (Bilt)Document53 pagesProvident Fund Control Sys (Bilt)zinu786No ratings yet

- Week 5 BudgetDocument3 pagesWeek 5 Budgetapi-309620551No ratings yet

- Cash Flow Estimation and Risk AnalysisDocument39 pagesCash Flow Estimation and Risk AnalysisRanyDAmandaNo ratings yet

- MBA Reporton HRM Practice in NAtional Bank LimitedDocument66 pagesMBA Reporton HRM Practice in NAtional Bank LimitedIshtiak AhmedNo ratings yet

- Basics of Aircraft Market Analysis v1Document30 pagesBasics of Aircraft Market Analysis v1avianovaNo ratings yet

- New Chandigarh CaseDocument96 pagesNew Chandigarh CaseOjaswa PathakNo ratings yet

- Nickel Pig Iron in China: CommoditiesDocument8 pagesNickel Pig Iron in China: CommoditiesDavid Budi SaputraNo ratings yet

- Natureview Farm Case StudyDocument12 pagesNatureview Farm Case StudyAditya R Mohan100% (2)

- North Atlantic Treaty Organization (NATO) :: Played An Instrumental Role 1968 TreatyDocument3 pagesNorth Atlantic Treaty Organization (NATO) :: Played An Instrumental Role 1968 TreatyDenise LabagnaoNo ratings yet

- Performance Measurement, Balanced Scorecards, and Performance RewardsDocument40 pagesPerformance Measurement, Balanced Scorecards, and Performance RewardsEricka BendongNo ratings yet

- Public Finances Management) Act 1995 (Consolidated To No 57Document49 pagesPublic Finances Management) Act 1995 (Consolidated To No 57desmond100% (1)

- Strategic Pricing: Coordinating The Drivers of ProfitabilityDocument26 pagesStrategic Pricing: Coordinating The Drivers of ProfitabilityBien GolecruzNo ratings yet

- Barringer E5 PPT 03Document35 pagesBarringer E5 PPT 03Priyank PaliwalNo ratings yet

- Company Analysis and Stock ValuationDocument0 pagesCompany Analysis and Stock ValuationxxxthejobNo ratings yet

- Applied EconomicsDocument47 pagesApplied EconomicsRoe SupnetNo ratings yet

- Chapter - Iii An Introduction To Banking and Banking ServicesDocument28 pagesChapter - Iii An Introduction To Banking and Banking ServicesVijay KumarNo ratings yet

- Foreign TransactionsDocument3 pagesForeign TransactionsMary Jescho Vidal AmpilNo ratings yet

- Protfolio ManagementDocument88 pagesProtfolio ManagementSatish ChakravarthyNo ratings yet

- Franchise Accounting - DoneDocument3 pagesFranchise Accounting - DoneJymldy EnclnNo ratings yet

- F3CB PreviewDocument21 pagesF3CB PreviewTaranpreet KaurNo ratings yet