Professional Documents

Culture Documents

Exercise - Income Approach

Exercise - Income Approach

Uploaded by

Thùy Linh Vũ NguyễnOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise - Income Approach

Exercise - Income Approach

Uploaded by

Thùy Linh Vũ NguyễnCopyright:

Available Formats

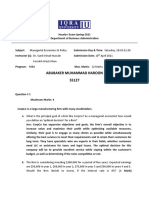

INCOME APPROACH

Property consists of 10 office suites, 4 on the first floor and 6 on the second.

Contract rents: 2 suites at $1,500 per month, 2 at $3,600 per month, and 6 at

$1,560 per month.

Vacancy and collection losses: 10% per year

Operating expenses: 40% of effective gross income each year;

Capital expenditures: 5% of effective gross income each year;

Expected holding period: 5 years;

PGI increasing 3 percent per year. Selling expenses are forecasted to be 4

percent of the expected sale price.

Using DCF approach to estimate the value of the property.

Comparable Sale Price NOI1

A $500,000 $55,000

B $420,000 $50,400

C $475,000 $53,400

Note:

Year 1 2 3 4 5

Debt Service 125,000 125,000 125,000 125,000 125,000

Mortgage balance 1,250,000

Cost of Sale 4% of Sale price

1. Using the information provided, calculate the overall capitalization rate by direct

market extraction assuming each property is equally comparable to the subject.

2. Using cap rate in Question 1, compute a value for the property using direct

capitalization.

3. Using cap rate in Question 1, the property will be held by a buyer for five years,

compute the value of the property based on discounting unlevered cash flows.

4. Using cap rate in Question 1, the property will be held by a buyer for five years,

what is the present value of the levered cash flows?

You might also like

- Chapter 11Document60 pagesChapter 11Ey EmNo ratings yet

- Test Bank For International Trade, 5e Robert Feenstra, Alan Taylor Test BankDocument32 pagesTest Bank For International Trade, 5e Robert Feenstra, Alan Taylor Test BankNail BaskoNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument3 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- ECON 201 Midterm 2012WDocument6 pagesECON 201 Midterm 2012WVaga boundedNo ratings yet

- Final Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. ControllingDocument4 pagesFinal Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. ControllingSandip AgarwalNo ratings yet

- Leonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceDocument12 pagesLeonardo Wagster Decided To Open Wagster's Window Washing On September 1, 2020. in September, The Following Transactions Took PlaceJohnMurray111100% (1)

- Chapter 04 - IfRS Part IDocument11 pagesChapter 04 - IfRS Part IDianaNo ratings yet

- Finance Practice ProblemsDocument54 pagesFinance Practice ProblemsMariaNo ratings yet

- Chapter 1 The Nature of Real Estate and Real Estate MarketsDocument10 pagesChapter 1 The Nature of Real Estate and Real Estate MarketsFnno SalehNo ratings yet

- Accounting Principles 10e Chapter 2 NotesDocument18 pagesAccounting Principles 10e Chapter 2 NotesallthefreakypeopleNo ratings yet

- Chapter 3 Accounting For Branch Record ADocument14 pagesChapter 3 Accounting For Branch Record Aathirah jamaludinNo ratings yet

- 8318 - Making Investment Decision - Case StudyDocument1 page8318 - Making Investment Decision - Case Studyanon_593009167No ratings yet

- ME Lecture5Document33 pagesME Lecture5Song YueNo ratings yet

- All Practice Set SolutionsDocument22 pagesAll Practice Set SolutionsJohn TomNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Accounting Concepts and Accounting Equation DrillsDocument3 pagesAccounting Concepts and Accounting Equation Drillsken garciaNo ratings yet

- Untitled 6Document17 pagesUntitled 6Ersin TukenmezNo ratings yet

- Accounting Indvidual AssignmentDocument3 pagesAccounting Indvidual AssignmentEmbassy and NGO jobs100% (1)

- 2009 F-1 Class NotesDocument4 pages2009 F-1 Class NotesgqxgrlNo ratings yet

- Chapter 28 Financial AnalysisDocument4 pagesChapter 28 Financial AnalysisSaranyieh RamasamyNo ratings yet

- Lease Problems Hw1Document6 pagesLease Problems Hw1Vi NguyenNo ratings yet

- Week 4 Discussion ProblemsDocument10 pagesWeek 4 Discussion ProblemsGokul Kumar100% (1)

- Week 1 Practice SolutionsDocument7 pagesWeek 1 Practice SolutionsalexandraNo ratings yet

- Bank Management Assignment 2: Name: Dinesh M Section: A Roll No: 19PGP051Document11 pagesBank Management Assignment 2: Name: Dinesh M Section: A Roll No: 19PGP051DinNo ratings yet

- IFRS C1 QuizDocument12 pagesIFRS C1 QuizDuongNguyenNo ratings yet

- CPT PaperDocument4 pagesCPT Paperpsawant77No ratings yet

- CF MathDocument5 pagesCF MathArafat HossainNo ratings yet

- Answers: Section (2) CH 5: The Financial Statements of Banks and Their Principal CompetitorsDocument7 pagesAnswers: Section (2) CH 5: The Financial Statements of Banks and Their Principal CompetitorsDina AlfawalNo ratings yet

- Ryerson University Department of Economics ECN 204 Midterm Winter 2013Document22 pagesRyerson University Department of Economics ECN 204 Midterm Winter 2013creepyslimeNo ratings yet

- Chapter 3 Working With Financial Statement - Student VersionDocument4 pagesChapter 3 Working With Financial Statement - Student VersionNga PhamNo ratings yet

- Chapter 11 Partnership DissolutionDocument19 pagesChapter 11 Partnership DissolutionAira Nhaire Cortez MecateNo ratings yet

- Practice QuestionDocument4 pagesPractice QuestionnabayeelNo ratings yet

- Model Exit Exam - Financial Management IDocument10 pagesModel Exit Exam - Financial Management Inatnaelsleshi3100% (1)

- FIN 515 Midterm ExamDocument4 pagesFIN 515 Midterm ExamDeVryHelpNo ratings yet

- Assignment 8 AnswersDocument6 pagesAssignment 8 AnswersMyaNo ratings yet

- Chapter 4 - Inventories - 27 PagesDocument27 pagesChapter 4 - Inventories - 27 PagesSamartha UmbareNo ratings yet

- Abubaker Muhammad Haroon 55127Document4 pagesAbubaker Muhammad Haroon 55127Abubaker NathaniNo ratings yet

- Test 3 - Chap 24Document7 pagesTest 3 - Chap 24Bhushan Sawant100% (1)

- Capital Budgeting: Test Code: R35 CABU Q-BankDocument7 pagesCapital Budgeting: Test Code: R35 CABU Q-BankMarwa Abd-ElmeguidNo ratings yet

- Question Paper PDFDocument17 pagesQuestion Paper PDFSaianish KommuchikkalaNo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Doc-20230205-Wa0215 230205 191422Document45 pagesDoc-20230205-Wa0215 230205 191422Silvia alfonsNo ratings yet

- IAS 36 ImpairmentDocument9 pagesIAS 36 ImpairmentDaniyal AhmedNo ratings yet

- MngEcon06 Ch02Document55 pagesMngEcon06 Ch02dmkelompok3 exNo ratings yet

- Test Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector PereraDocument24 pagesTest Bank For International Accounting 5th Edition Timothy Doupnik Mark Finn Giorgio Gotti Hector Pererajaperstogyxp94cNo ratings yet

- Solution Manual For Economic Development 12th Edition Todaro SmithDocument15 pagesSolution Manual For Economic Development 12th Edition Todaro SmithJinuel PodiotanNo ratings yet

- MCQ QuizDocument13 pagesMCQ QuizSharNo ratings yet

- Assignment 3Document15 pagesAssignment 3Shubh JainNo ratings yet

- Case Study - AuditingDocument5 pagesCase Study - AuditingPhương Huyền LêNo ratings yet

- Q No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsDocument5 pagesQ No.1 Use Following Title of Accounts To Complete Journal Entries of Given TransactionsNoorNo ratings yet

- Chapter 5 Inflation TEST BANK 1Document20 pagesChapter 5 Inflation TEST BANK 1Marouani RouaNo ratings yet

- ECON 212 Exam #3 Practice ProblemsDocument5 pagesECON 212 Exam #3 Practice ProblemsJulian TirtadjajaNo ratings yet

- Quiz 4Document6 pagesQuiz 4BibliophilioManiac100% (1)

- Sources of Funding For MNC'sDocument22 pagesSources of Funding For MNC'sNeeraj Kumar80% (5)

- Chapter1 Final 1Document96 pagesChapter1 Final 1Mạnh Đỗ ĐứcNo ratings yet

- Wiley - Chapter 8: Valuation of Inventories: A Cost-Basis ApproachDocument23 pagesWiley - Chapter 8: Valuation of Inventories: A Cost-Basis ApproachIvan Bliminse100% (1)

- TB 18Document30 pagesTB 18mzh1992No ratings yet

- Basic Microeconomics ExercisesDocument8 pagesBasic Microeconomics ExercisesPUPT-JMA VP for Audit100% (1)

- Exercise Income ApproachDocument2 pagesExercise Income ApproachNgọc ThảoNo ratings yet

- Exercise - Income ApproachDocument2 pagesExercise - Income ApproachanhxxxtuanxxxNo ratings yet

- The Intense Rate of Change in The World - QuestionsDocument5 pagesThe Intense Rate of Change in The World - QuestionsThùy Linh Vũ NguyễnNo ratings yet

- Health - Keeping FitDocument6 pagesHealth - Keeping FitThùy Linh Vũ Nguyễn100% (1)

- The Preparing For The Threat - QuestionsDocument4 pagesThe Preparing For The Threat - QuestionsThùy Linh Vũ NguyễnNo ratings yet

- Writing Task 1Document12 pagesWriting Task 1Thùy Linh Vũ NguyễnNo ratings yet

- IELTS Speaking - Leisure TimeDocument8 pagesIELTS Speaking - Leisure TimeThùy Linh Vũ NguyễnNo ratings yet

- B. T/T After ShipmentDocument79 pagesB. T/T After ShipmentThùy Linh Vũ NguyễnNo ratings yet

- 1.1 IELTS WRITING TASK 1 - T NG QuanDocument23 pages1.1 IELTS WRITING TASK 1 - T NG QuanThùy Linh Vũ NguyễnNo ratings yet

- Reading Practice 1Document13 pagesReading Practice 1Thùy Linh Vũ NguyễnNo ratings yet