Professional Documents

Culture Documents

Financial Management - Homework 3 & 4

Financial Management - Homework 3 & 4

Uploaded by

San HeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management - Homework 3 & 4

Financial Management - Homework 3 & 4

Uploaded by

San HeeCopyright:

Available Formats

Financial Management – Homework 3 & 4

Name: San Hee Miyata Müss

Student ID: 6408090011

26.11.2021

Homework 3:

Task: You have been approached by the president of the company with a request to analyze the

project. Calculate the payback period, profitability index, average accounting return, net present

value, internal rate of return, and modified internal rate of return for the new strip mine. Should

Bethesda mining take the contract and open the mine?

Year 1 Year 2 Year 3 Year 4

Contract 43.000.000 43.000.000 43.000.000 43.000.000

(500.000*86)

Spot (620.000- (680.000- (730.000- (590.000-

500.000)*77=9.240.000 500.000)*77=13.860.00 500.000)*=17.710.00 500.000)*77=6.930.000

0 0

Sales per year 43.000.000+9.240.000= 43.000.000+13.860.000 43.000.000+17.710.0 43.000.000+6.930.000=

(total) 52.240.000 =56.860.000 00=60.710.000 49.930.000

Equipment - 95.000.000

Land - 6.500.000

NWC - 2.612.000

Cash flow today (total) - 104.112.000

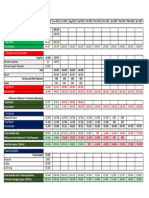

Calculating the operating cashflow for each year:

Year 1 2 3 4 5 6

Sales 52.240.000 56.860.000 60.710.000 49.930.000

VC 19.220.000 21.080.000 22.630.000 18.290.000

FC 4.100.000 4.100.000 4.100.000 4.100.000 2.700.000 6.000.000

Dep. 13.575.500 23.265.500 16.615.500 11.865.500

EBT 15.344.500 8.414.500 17.364.500 15.674.500 - 2.700.000 - 6.000.000

Tax 3.836.125 2.103.625 4.341.125 3.918.625 675.000 1500.000

NI 11.508.375 6.310.875 13.023.375 11.755.875 -2.025.000 -4.500.000

+Dep. 13.575.500 23.265.500 16.615.500 11.865.500

OCF 25.083.875 29.576.375 29.638.875 23.621.375 -2.025.000 -4.500.000

Calculating the net working capital cash flow for each year:

Year 1 2 3 4

Beg. NWC 2.612.000 2.843.000 3.035.500 2.496.500

End NWC 2.843.000 3.035.500 2.496.500 0

NWC CF -231.000 -192.500 539.000 2.496.500

Book value of equipment = 95.000.000 - 13.575.500 - 23.265.500 - 16.615.500 - 11.865.500

Financial Management – Homework 3 & 4

Book value of equipment = 29.678.000

Market value of the equipment = 95.000.000*0,6 = 57.000.000

Taxes on sale of equipment = (29.678.000 – 57.000.000)*0.25 = - 6.830.500

Aftertax salvage value = 57.000.000 – 6.830.500 = 50.169.500

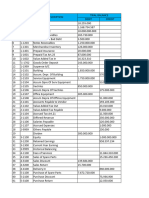

Year Cash flow

0 - 104.112.000

1 24.852.875

2 29.383.875

3 30.177.875

4 76.287.375

5 - 2.025.000

6 - 4.500.000

Payback period = 3 + 19.697.375/76.287.375

Payback period = 3.26 years

Profitability index = (24.852.875/1.12 + 29.383.875/1.12 2 + 30.177.875/1.123 + 76.287.375/1.124 –

2.025.000/1.125 – 4.500.000/1.126) / 104.112.000

Profitability index = 1.08

Net Present Value = -104.112.000 + 24.852.875/1.12 + 29.383.875/1.12 2 + 30.177.875/1.123 +

76.287.375/1.124 – 2.025.000/1.125 – 4.500.000/1.126

Net Present Value = 8.035.854,1

The equation for IRR is:

0 = –104.112.000 + 24.852.875/(1 + IRR) + 29.383.875/(1 + IRR)² + 30.177.875/(1 + IRR)³ +

76.287.375/(1 + IRR)4 – 2.025.000/(1 + IRR)5 – 4.500.000/(1 + IRR)6

IRR = 15,09%

Answer: Yes, the company should accept the project because the net present value is higher than

zero.

Homework 4: Cost of Capital / Required Rate of Return

Task: Find Cost of Capital / Required Rate of Return of 2 companies in the same industry.

Volkswagen BMW

Cost of capital 3.81%. 12 %

You might also like

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaNo ratings yet

- Renova Bioenergy Rej Ing 24 06 019Document6 pagesRenova Bioenergy Rej Ing 24 06 019neftali alvarezNo ratings yet

- Economic Nationalism - Claro M. RectoDocument58 pagesEconomic Nationalism - Claro M. RectoGabriel Achacoso Mon76% (17)

- Written Assignment Solution Unit 6Document6 pagesWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- Time 1Document3 pagesTime 1pancrasNo ratings yet

- PR 53Document8 pagesPR 53viswadevassociates.tvmNo ratings yet

- Finance Case StudyDocument4 pagesFinance Case StudyKelvin CharlesNo ratings yet

- Moi QuizDocument3 pagesMoi QuizCelestial Nicole VergañoNo ratings yet

- Itsa Excel SheetDocument7 pagesItsa Excel SheetraheelehsanNo ratings yet

- Question 3Document5 pagesQuestion 3tta384227No ratings yet

- Title Student's Name: Course Code: Institutional Affiliation: DateDocument5 pagesTitle Student's Name: Course Code: Institutional Affiliation: DateChristopher KipsangNo ratings yet

- Assesmnet Task 1Document6 pagesAssesmnet Task 1Anonymous XYQ2ceuNo ratings yet

- Spinning Project FeasibilityDocument19 pagesSpinning Project FeasibilityMaira ShahidNo ratings yet

- Finance Mid Term Mba - 2B Presented To Wael AbdulkaderDocument4 pagesFinance Mid Term Mba - 2B Presented To Wael AbdulkaderMahmoud RedaNo ratings yet

- Fnce370 Assign3Document29 pagesFnce370 Assign3smaNo ratings yet

- SohoDocument4 pagesSohoTiara Ayu PratamaNo ratings yet

- Loan 8 Lakhs Promoter 2.5 LakhsDocument8 pagesLoan 8 Lakhs Promoter 2.5 Lakhsviswadevassociates.tvmNo ratings yet

- PR 117 Part 2Document9 pagesPR 117 Part 2viswadevassociates.tvmNo ratings yet

- Annual Income StatementDocument2 pagesAnnual Income StatementAjhia ThymiaNo ratings yet

- Plastics - B. PlanDocument7 pagesPlastics - B. PlanmgNo ratings yet

- Financial Management Act 5Document11 pagesFinancial Management Act 5Nancy Milena Rueda LeonNo ratings yet

- 6.86L Agarbatti ManufacturingDocument9 pages6.86L Agarbatti ManufacturingVedant AssociatesNo ratings yet

- Group Assignment Business Valuation and AnalysisDocument8 pagesGroup Assignment Business Valuation and Analysischarlesmicky82No ratings yet

- Financial ModelDocument16 pagesFinancial ModelAdnan AhmarNo ratings yet

- ACCT500 (16) Answers To Seminar 6Document5 pagesACCT500 (16) Answers To Seminar 6rashid rahmanzada100% (1)

- Tugas Akuntansi Maulana Ramadhan 22522014Document25 pagesTugas Akuntansi Maulana Ramadhan 22522014King AzazirNo ratings yet

- Analisis de AmazonDocument6 pagesAnalisis de AmazonFrancisco MuñozNo ratings yet

- 3.8L Agarbatti MakingDocument9 pages3.8L Agarbatti MakingVedant AssociatesNo ratings yet

- Business PlanDocument10 pagesBusiness PlanDanah Jane GarciaNo ratings yet

- PR 53Document8 pagesPR 53viswadevassociates.tvmNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument4 pagesIncome Statement - Annual - As Originally ReportedAnkurNo ratings yet

- Cashflow FoodcourtDocument1 pageCashflow Foodcourtdidin sumpenaNo ratings yet

- A. Biaya Tidak Tetap: Uraian T A H U NDocument1 pageA. Biaya Tidak Tetap: Uraian T A H U NAzima RahmahNo ratings yet

- Project Report Ca SignDocument9 pagesProject Report Ca SignRavindra JondhaleNo ratings yet

- Audited Financ Report 2022-2023 15Document3 pagesAudited Financ Report 2022-2023 15IYAMUREMYE EMMANUELNo ratings yet

- Mini CaseDocument3 pagesMini CaseThùy DươngNo ratings yet

- M C R E ,: Inicase: Onch Epublic LectronicsDocument4 pagesM C R E ,: Inicase: Onch Epublic Lectronicsnara100% (3)

- Ashik UPDATEDDocument10 pagesAshik UPDATEDpriyankaNo ratings yet

- Inputs: YR-1 YR-2 YR-3 YR-4 YR-5Document5 pagesInputs: YR-1 YR-2 YR-3 YR-4 YR-5omar hashmiNo ratings yet

- TABLE G.1: INFORMATION (From Financial Year 2013-2018) NO 2013 2014 2015 2016 2017 2018Document6 pagesTABLE G.1: INFORMATION (From Financial Year 2013-2018) NO 2013 2014 2015 2016 2017 2018WENG LUCK CHEANGNo ratings yet

- Project Free Cash FlowsDocument8 pagesProject Free Cash FlowsIkhaa AlbashNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- 4 5845855793034823827Document4 pages4 5845855793034823827Gena HamdaNo ratings yet

- Table XXX. Linear Regression Analysis ComputationDocument4 pagesTable XXX. Linear Regression Analysis ComputationCharisse VisteNo ratings yet

- Cash Flow ProjectionsDocument2 pagesCash Flow ProjectionsKabo LucasNo ratings yet

- FS Gas StationDocument25 pagesFS Gas StationKathlyn JambalosNo ratings yet

- FS Model - 05112018-1Document123 pagesFS Model - 05112018-1Muhammad JunaidNo ratings yet

- Chapter 9Document12 pagesChapter 9Ruthchell CiriacoNo ratings yet

- AnswerDocument23 pagesAnswerYousaf BhuttaNo ratings yet

- Income Statement FinalDocument4 pagesIncome Statement Finalr3gjc.nfjpia2223No ratings yet

- Cost Saving FinalDocument21 pagesCost Saving FinalAshan MartinoNo ratings yet

- Cash Flow Forecast M15 MANAGEMENTCONTROLLER May-22Document1 pageCash Flow Forecast M15 MANAGEMENTCONTROLLER May-22Rizki PrabowoNo ratings yet

- Corporate Finance Solution Chapter 6Document9 pagesCorporate Finance Solution Chapter 6Kunal KumarNo ratings yet

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- Financial StatementDocument6 pagesFinancial StatementKathlyn JambalosNo ratings yet

- Project On Pharmaceuticals DistributionDocument13 pagesProject On Pharmaceuticals Distributiongourav rameNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- MKS PRJDocument4 pagesMKS PRJKASIRAJANNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarNo ratings yet

- 108 Efe 94 F 05642 C 6 BcfeDocument11 pages108 Efe 94 F 05642 C 6 BcfeKryzha RemojoNo ratings yet

- Fundamentals of Engineering Economic NinoelDocument60 pagesFundamentals of Engineering Economic NinoelAmelita Mendoza PaduaNo ratings yet

- Soneri Bank Limited1Document14 pagesSoneri Bank Limited1Anonymous YkMptv9jNo ratings yet

- RSH 221025 EnglishDocument9 pagesRSH 221025 EnglishPoppinstaNo ratings yet

- CAT 2002 Solutions of Question Set 1 PDFDocument12 pagesCAT 2002 Solutions of Question Set 1 PDFPapun ScribdNo ratings yet

- Sanchayan Society BrochureDocument5 pagesSanchayan Society BrochureNarendar KumarNo ratings yet

- Chapter-1: Marketing Channels: Structure and Functions What Is Marketing Channel?Document3 pagesChapter-1: Marketing Channels: Structure and Functions What Is Marketing Channel?KaziRafiNo ratings yet

- KOPPERS INC 10-K (Annual Reports) 2009-02-20Document288 pagesKOPPERS INC 10-K (Annual Reports) 2009-02-20http://secwatch.com100% (2)

- NBank FinanciceDocument27 pagesNBank FinanciceNick JagolinoNo ratings yet

- 5 Company AccountsDocument11 pages5 Company Accountsdeo omachNo ratings yet

- Semester 6 (UG) Subject: Business Environment: Unit Iv Money MarketDocument7 pagesSemester 6 (UG) Subject: Business Environment: Unit Iv Money MarketManohar SumathiNo ratings yet

- Explain The Concept of Working CapitalDocument3 pagesExplain The Concept of Working CapitallakshamuNo ratings yet

- TradingDocument3 pagesTradingMohd AqibNo ratings yet

- Self-Paced Lesson On GDP, GNP, Balance of Payments and TradeDocument14 pagesSelf-Paced Lesson On GDP, GNP, Balance of Payments and TradeJeno GonoNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument26 pagesFinancial Statement Analysis: K R Subramanyam John J WildichabooksNo ratings yet

- What Is Meant by Debit&Credit?: Human Life in Different StagesDocument30 pagesWhat Is Meant by Debit&Credit?: Human Life in Different StagesRenuka RenuNo ratings yet

- Strategies in ActionDocument51 pagesStrategies in ActionEnass Amin100% (1)

- Sample Copy Only For The Purpose of Confirmation by The Author ConcernedDocument129 pagesSample Copy Only For The Purpose of Confirmation by The Author ConcernedSuresh Kumar100% (1)

- Hatch Final ReportDocument47 pagesHatch Final ReportJennifer UrsuaNo ratings yet

- Contemporary Issues in Banking 2019 ProgrammeDocument2 pagesContemporary Issues in Banking 2019 Programmevandana katariaNo ratings yet

- Tybms Corporatecommunicationandpublicrelation 2019 03 02 04 02 PDFDocument126 pagesTybms Corporatecommunicationandpublicrelation 2019 03 02 04 02 PDFPraveen RohiraNo ratings yet

- Determination Thar CoalDocument45 pagesDetermination Thar CoalRobert LaneNo ratings yet

- Intangible Investments, Scaling, and The Trend in The Accrual-Cash Flow AssociationDocument69 pagesIntangible Investments, Scaling, and The Trend in The Accrual-Cash Flow AssociationKári FinnssonNo ratings yet

- Agape Wedding Hall and Catering Business Plan PresentationDocument34 pagesAgape Wedding Hall and Catering Business Plan PresentationAnam AliNo ratings yet

- Tourism Strategy of Turkey-2023Document74 pagesTourism Strategy of Turkey-2023Ruslan La Tenrilawa100% (1)

- Advertising Project FinalDocument95 pagesAdvertising Project FinalIramNo ratings yet

- Foreign Direct InvestmentDocument8 pagesForeign Direct InvestmentHarshita BhallaNo ratings yet

- Saep 74Document29 pagesSaep 74munna100% (2)

- Black Book Tybms Sem-ViDocument70 pagesBlack Book Tybms Sem-ViKARTIKPATILNo ratings yet