Professional Documents

Culture Documents

Indian Income Tax Return: (Refer Instructions For Eligibility)

Indian Income Tax Return: (Refer Instructions For Eligibility)

Uploaded by

Deepak BOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return: (Refer Instructions For Eligibility)

Indian Income Tax Return: (Refer Instructions For Eligibility)

Uploaded by

Deepak BCopyright:

Available Formats

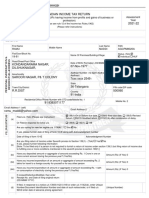

Acknowledgement Number : 296196010150821

INDIAN INCOME TAX RETURN

[For individuals being a resident (other than not ordinarily

resident) having total income upto Rs.50 lakh, having Income

from Salaries, one house property, other sources (Interest etc.), Assessment

ITR-1

and agricultural income upto Rs.5 thousand] Year

SAHAJ

[Not for an individual who is either Director in a company or has 2021 - 22

invested in unlisted equity shares or in cases where TDS has

been deducted u/s 194N or if income-tax is deferred on ESOP]

(Refer instructions for eligibility)

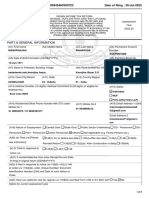

PART A GENERAL INFORMATION

PAN Name Date of Birth Aadhaar Number (12 digits)/Aadhaar Enrolment Id (28 digits)

AMRPD8912H BAGAVATHIRAJ DEEPAK 02-Apr-1991 (If eligible for Aadhaar No.)

4xxx xxxx 9613

Mobile No. Email Address Address:

+ 91 9092555225 deepakbagavathiraj@gmail.com 120/24, Kanjayamman Kovil Street, Cumbum LSG SO, THENI,

Gandhinagar (Cumbum) S.O, 625516

Filed u/s (Tick) ✔ 139(1)-On or before due date, Nature of employment-

[Please see 139(4)-Belated, 139(5)-Revised, Central Govt. State Govt.

instruction] 119(2)(b)- After Condonation of delay Public Sector Undertaking

Pensioners ✔ Others

Or Filed in 139(9), 142(1), 148, 153A, Not Applicable (e.g. Family Pension etc.)

response to notice 153C

u/s

If revised/defective, then enter Receipt No. and Date of filing original return

(DD/MM/YYYY)

If filed in response to notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119

(2)(b)- enter Unique Number/Document Identification Number (DIN) & Date of

such Notice or Order

Are you opting for new tax regime u/s 115BAC ? Yes ✔ No

Are you filing return of income under Seventh proviso to section 139(1) but otherwise not required to furnish return of income? - (Tick)

Yes ✔ No

If yes, please furnish following information

[Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling

one or more conditions mentioned in the seventh proviso to section 139(1)]

Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current 0

account during the previous year?

Yes ✔ No

Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for 0

travel to a foreign country for yourself or for any other person?

Yes ✔ No

Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on 0

consumption of electricity during the previous year? Yes ✔ No

You might also like

- Solution Manual (Letter Answers Only)Document21 pagesSolution Manual (Letter Answers Only)villanuevacassandrabeatriz1No ratings yet

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media GeneralDahagam Saumith100% (1)

- Casino Jackpot Accounting TreatmentDocument14 pagesCasino Jackpot Accounting Treatmentkenjames007No ratings yet

- MERS QA Procedures Transitional 101711-2Document38 pagesMERS QA Procedures Transitional 101711-2Tiggle MadaleneNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 PreviewRg RrgNo ratings yet

- Itr4 PreviewDocument11 pagesItr4 PreviewRg RrgNo ratings yet

- ITR Form AY 21-22Document96 pagesITR Form AY 21-22Anurag Kumar ReloadedNo ratings yet

- Form_pdf_317945670100322Document89 pagesForm_pdf_317945670100322companyinc2020No ratings yet

- Form PDF 682284950301221Document90 pagesForm PDF 682284950301221rajNo ratings yet

- Form PDF 679108540131021Document90 pagesForm PDF 679108540131021DhanaNo ratings yet

- Form PDF 127831180260722Document10 pagesForm PDF 127831180260722Aishvary GuptaNo ratings yet

- Form PDF 452773420280322Document87 pagesForm PDF 452773420280322mohit singlaNo ratings yet

- Form PDF 822704360271122Document10 pagesForm PDF 822704360271122archana bagalNo ratings yet

- Form PDF 313916560090322Document86 pagesForm PDF 313916560090322Priyanka SharmaNo ratings yet

- Form PDF 690991540220622Document10 pagesForm PDF 690991540220622Vijay BhaipNo ratings yet

- E-FILLINGDocument14 pagesE-FILLINGas1923670No ratings yet

- Form PDF 784883900311221Document91 pagesForm PDF 784883900311221Digvijay YadavNo ratings yet

- Form PDF 909243860311222Document10 pagesForm PDF 909243860311222Ashutosh ThakurNo ratings yet

- Form PDF 463253190080921Document88 pagesForm PDF 463253190080921hanuNo ratings yet

- Form PDF 898493730311222Document7 pagesForm PDF 898493730311222RAMESH WAGHMARENo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)SUBHASH CHANDRANo ratings yet

- Form PDF 674816100160622Document10 pagesForm PDF 674816100160622Hasan KhanNo ratings yet

- AY 2022-23 FormDocument7 pagesAY 2022-23 FormharshaNo ratings yet

- Acknowledgement Number 981933260051221Document90 pagesAcknowledgement Number 981933260051221Suman jhaNo ratings yet

- Form_pdf_289607030300722Document7 pagesForm_pdf_289607030300722crawat433No ratings yet

- ComputationDocument10 pagesComputationRaghav SharmaNo ratings yet

- Form PDF 798974670130722Document10 pagesForm PDF 798974670130722Rahul AroraNo ratings yet

- Form PDF 784967040061122Document10 pagesForm PDF 784967040061122Asfa rehmanNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRg RrgNo ratings yet

- Form PDF 751794940060722Document7 pagesForm PDF 751794940060722AWANEENDRA DUBEYNo ratings yet

- Form PDF 931954470220722Document7 pagesForm PDF 931954470220722vaierNo ratings yet

- Form PDF 166390820121221Document38 pagesForm PDF 166390820121221SethuramanNo ratings yet

- Form PDF 166390820121221Document38 pagesForm PDF 166390820121221SethuramanNo ratings yet

- Form PDF 240143980290722Document7 pagesForm PDF 240143980290722RebornNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRg RrgNo ratings yet

- Form PDF 252276720181221Document82 pagesForm PDF 252276720181221ror ketanNo ratings yet

- Form PDF 869004400261222Document10 pagesForm PDF 869004400261222mohilNo ratings yet

- ITR 1 - AY 2023-24 - V1.3.xlsmDocument18 pagesITR 1 - AY 2023-24 - V1.3.xlsmsrinukkNo ratings yet

- Form PDF 349419710310722Document10 pagesForm PDF 349419710310722Ashutosh ThakurNo ratings yet

- Form PDF 344472690310722Document11 pagesForm PDF 344472690310722NandhakumarNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)MAHESHANAND NAUTIYALNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)gautam_05121970No ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewPriyanshuNo ratings yet

- Itr 4 - Ay 2022-23 - VarunDocument10 pagesItr 4 - Ay 2022-23 - VarunAkash AggarwalNo ratings yet

- Form 20-21Document91 pagesForm 20-21vemareddykasireddy1No ratings yet

- Form PDF 148273390270722Document7 pagesForm PDF 148273390270722Sanjay KumarNo ratings yet

- Form PDF 828997910301122 PDFDocument10 pagesForm PDF 828997910301122 PDFNIRBHAY SRIVASTAVNo ratings yet

- Form PDF 549509850210921Document40 pagesForm PDF 549509850210921Smita SharmaNo ratings yet

- Itr3 PreviewDocument82 pagesItr3 PreviewAmit KumarNo ratings yet

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanNo ratings yet

- Shug Am 42223Document11 pagesShug Am 42223Daman SharmaNo ratings yet

- Form PDF 157347710270722Document7 pagesForm PDF 157347710270722ravirulesvitNo ratings yet

- Form PDF 445389430261221Document36 pagesForm PDF 445389430261221yogesh pawarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)pramod suradkarNo ratings yet

- Computation AY 2021 22Document83 pagesComputation AY 2021 22Vadivel Kumar TNo ratings yet

- Divya Designo Tiles 201920 Itr - 1Document79 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- Form PDF 825982490131121Document6 pagesForm PDF 825982490131121chowdarygadesulaNo ratings yet

- Form PDF 934595970220722Document7 pagesForm PDF 934595970220722Sayan DeyNo ratings yet

- Income Tax ReturnDocument10 pagesIncome Tax ReturnAlok KumarNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewPowerNo ratings yet

- Form PDF 910494870311222Document9 pagesForm PDF 910494870311222Navin DongreNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)Sourabh PunshiNo ratings yet

- 4045 Form PDF 295945460300722Document9 pages4045 Form PDF 295945460300722Manoranjan MoharanaNo ratings yet

- Foreign Exchange Shamim BhaiDocument39 pagesForeign Exchange Shamim BhaiAbdullah Al NomanNo ratings yet

- Module 3 - PAS10 and PAS24Document6 pagesModule 3 - PAS10 and PAS24Roen Jasper EviaNo ratings yet

- Bismillah Group FraudDocument8 pagesBismillah Group FraudTowsif Noor JameeNo ratings yet

- The 5 Cs of Credit Underwriting 2010-06Document2 pagesThe 5 Cs of Credit Underwriting 2010-06S.Aji BalaNo ratings yet

- Introduction To Asset-Backed SecuritiesDocument5 pagesIntroduction To Asset-Backed SecuritiesShai RabiNo ratings yet

- Fiduciary Duty and Investment Advice Attitudes of 401k and 403b Participants AARPDocument58 pagesFiduciary Duty and Investment Advice Attitudes of 401k and 403b Participants AARPScott DauenhauerNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument39 pages© The Institute of Chartered Accountants of IndiaGowriNo ratings yet

- Chapter 3 - Money and Credit: CBSE Notes Class 10 Social Science EconomicsDocument3 pagesChapter 3 - Money and Credit: CBSE Notes Class 10 Social Science EconomicsWIN FACTSNo ratings yet

- QF205 Week 10Document137 pagesQF205 Week 10Lim Xin YiNo ratings yet

- Untuk Mahasiswa, CVP AnalysisDocument60 pagesUntuk Mahasiswa, CVP AnalysisErick JonathanNo ratings yet

- LGB Forge Limited: Summary of Rating ActionDocument7 pagesLGB Forge Limited: Summary of Rating ActionPuneet367No ratings yet

- Notes LAW OF TAXATIONDocument266 pagesNotes LAW OF TAXATIONsadia zaahirNo ratings yet

- Partnership Formation ProblemsDocument24 pagesPartnership Formation ProblemsHazel Bianca GabalesNo ratings yet

- Full Download Test Bank For Strategic Management 10th Edition by Hitt PDF Full ChapterDocument36 pagesFull Download Test Bank For Strategic Management 10th Edition by Hitt PDF Full Chapterempyesis.princockijlde4100% (22)

- Dwnload Full Fundamental Accounting Principles 23rd Edition Wild Solutions Manual PDFDocument35 pagesDwnload Full Fundamental Accounting Principles 23rd Edition Wild Solutions Manual PDFexiguity.siroc.r1zj100% (10)

- Equity Valuation ThesisDocument5 pagesEquity Valuation ThesisJose Katab100% (2)

- Equity ApplicationDocument3 pagesEquity ApplicationanniesachdevNo ratings yet

- Kotak FinalDocument46 pagesKotak FinalRahul FaliyaNo ratings yet

- AbdulSamad - 12 - 16594 - 3 - CH 06 Merchandise InventoryDocument13 pagesAbdulSamad - 12 - 16594 - 3 - CH 06 Merchandise InventoryHassaan QaziNo ratings yet

- Risk & Return: Chapte RDocument52 pagesRisk & Return: Chapte RMohammad Salim HossainNo ratings yet

- MODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALDocument7 pagesMODAUD2 - Unit 1 - Investment Property, NCAHS & Discontinued Operations - T31516 - FINALmimi96No ratings yet

- NC 3 Bookkeeping Answer Sheet Periodic - REVISEDDocument8 pagesNC 3 Bookkeeping Answer Sheet Periodic - REVISEDGab AguilaNo ratings yet

- Average True Range (ATR) Formula, What It Means, and How To Use ItDocument10 pagesAverage True Range (ATR) Formula, What It Means, and How To Use ItAbdulaziz AlshakraNo ratings yet

- MNC WordDocument4 pagesMNC WordChristianMarkSebastianNo ratings yet

- CMA SFM Vasudha MaamDocument369 pagesCMA SFM Vasudha Maamahuja2855No ratings yet

- 10 - Borrowing Costs PS 12edDocument15 pages10 - Borrowing Costs PS 12edbusiness docNo ratings yet