Professional Documents

Culture Documents

What Is Budget??: 2. Management Accounting and Budgeting

What Is Budget??: 2. Management Accounting and Budgeting

Uploaded by

Mohand Omar Yousef0 ratings0% found this document useful (0 votes)

5 views12 pagesOriginal Title

A-M-A 2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views12 pagesWhat Is Budget??: 2. Management Accounting and Budgeting

What Is Budget??: 2. Management Accounting and Budgeting

Uploaded by

Mohand Omar YousefCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 12

2.

Management Accounting and Budgeting

What is Budget??

A quantitative expression of a proposed plan by

management for a specified period in the future.

An aid to coordinate what needs to be done to

implement that plan.

May include both financial and nonfinancial data.

© 2012 Pearson Education. All rights reserved.

Advantages of Budgets

Putting business strategy into operation.

Provides a framework for judging performance.

Promotes coordination and communication among

subunits within the company.

Enables control.

Motivates managers and other employees.

© 2012 Pearson Education. All rights reserved.

Types of Budgets

Operating budgets.

Financial budgets.

© 2012 Pearson Education. All rights reserved.

Basic Financial Budgets

1. The cash budget.

2. The Capital expenditures budget.

3. The budgeted statement of cash flows.

© 2012 Pearson Education. All rights reserved.

Budgets and Feedback

Budgets offer feedback in the form of variances

between actual results and budgeted targets. These

variances provide managers with:

A basis for performance evaluation.

A basis for strategy evaluation.

An early warning of problems.

© 2012 Pearson Education. All rights reserved.

1. The Cash Budget

The cash budget includes period cash receipts and

cash payments only.

The cash budget aims to determine the cash position

(if there is excess cash or there is a cash shortage)

in order to take in advance actions to invest excess cash

or overcome cash shortage.

© 2012 Pearson Education. All rights reserved.

Cash budget

First Second Third Fourth Total

quarter quarter quarter quarter

Beginning cash balance (1)

Cash receipts only as:

Cash sales

Receipts from accounts

receivables (customers)

Cash receipts from sale of

fixed assets

Other cash receipts

Total cash receipts (2)

Available cash (3) = (1 + 2)

© 2012 Pearson Education. All rights reserved.

First Second Third Fourth total

quarter quarter quarter quarter

Cash payments:

Cash purchases

cash payments to accounts

payable (suppliers)

Direct labor cost

Overhead cash expenses

(without depreciation)

Selling and administrative

expenses

Cash payments (expenditures)

to buy fixed assets

Other cash payments

Total cash payments (4)

Ending cash balance (3 – 4)

© 2012 Pearson Education. All rights reserved.

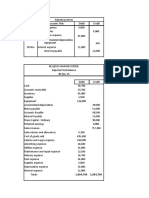

Example (1)

Prepare the cash budget for Ceramica Cleopatra Group

for the first quarter of 2016 using the following data:

December January February March

2015 2016 2016 2016

Ending cash balance 10,000

Sales volume (units) 5,000 6,000 7,000 8,000

Unit selling price in cash $10 $11 $12 $12

Other cash receipts 80,000 60,000 180,000

Cash purchases 20,000 30,000 40,000 40,000

Direct labor cost 20,000 20,000 30,000

Overhead expenses 10,000 15,000 20,000

(including 2,000 depreciation

expense)

Selling and administrative expenses 14,000 18,000 12,000

Other cash payments 10,000

© 2012 Pearson Education. All rights reserved.

Cash budget

Jan. Feb. March Total

2016 2016 2016

Beginning cash balance (1) 10,000 84,000 127,000 10,000

Cash receipts only as:

Cash sales 6,000 × 11 7,000 × 12 8,000 × 12 246,000

66,000 84,000 96,000

Receipts from accounts - - - -

receivables (customers)

Cash receipts from sale of - - - -

fixed assets

Other cash receipts 80,000 60,000 180,000 320,000

Total cash receipts (2) 146,000 144,000 276,000 566,000

Available cash (3) = (1 + 2) 156,000 228,000 403,000 576,000

© 2012 Pearson Education. All rights reserved.

Jan. Feb. March total

2016 2016 2016

Cash payments:

Cash purchases 30,000 40,000 40,000 110,000

cash payments to accounts - - - -

payable (suppliers)

Direct labor cost 20,000 20,000 30,000 70,000

Overhead cash expenses (without 8,000 13,000 18,000 39,000

depreciation)

Selling expenses and 14,000 18,000 12,000 44,000

Administrative expenses

Cash payments (expenditures) to - - - -

buy fixed assets

Other cash payments - 10,000 - 10,000

Total cash payments (4) 72,000 101,000 100,000 273,000

Ending cash balance (3 – 4) 84,000 127,000 303,000 303,000

Beginning of Beginning of

Feb. March

© 2012 Pearson Education. All rights reserved.

Remarks:

Ending cash balance for Dec. 2015 = beginning cash

balance for Jan. 2016 = 10,000 = beginning cash

balance for total.

Ending cash balance for Jan. 2016 = beginning cash

balance for Feb. 2016 = 84,000

Ending cash balance for Feb. 2016 = beginning cash

balance for March 2016 = 127,000

Ending cash balance for March 2016 = ending cash

balance for total = 303,000

© 2012 Pearson Education. All rights reserved.

You might also like

- Planning Campaigns (2111) - 40080344-July 2021-1Document27 pagesPlanning Campaigns (2111) - 40080344-July 2021-1anfal ibrahim83% (12)

- SAP Group Reporting and ConsolidationDocument21 pagesSAP Group Reporting and ConsolidationA V Srikanth100% (4)

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- IKEA's Business and Operating Models: Product Design ProcessDocument5 pagesIKEA's Business and Operating Models: Product Design ProcessTioNo ratings yet

- Asset Liability ManagementDocument10 pagesAsset Liability ManagementAnonymous x5odvnNV50% (2)

- Analysis Case Study KIT KATDocument7 pagesAnalysis Case Study KIT KATNguyên Khánh Phan VõNo ratings yet

- Acct 100 Chapter 5 S22Document23 pagesAcct 100 Chapter 5 S22Cyntia ArellanoNo ratings yet

- Ratio Analysis Complete HuzaifaDocument13 pagesRatio Analysis Complete HuzaifaHuzaifa RajputNo ratings yet

- 6 Sem Cost Control and MNGT Acct., Probs On Tech of Finan Stat AnalysisDocument12 pages6 Sem Cost Control and MNGT Acct., Probs On Tech of Finan Stat Analysismohammedabdulmuqeet07No ratings yet

- Accountancy Class 12 Project On Ratio AnalysisDocument11 pagesAccountancy Class 12 Project On Ratio Analysisaarav100% (1)

- FM-Cash Budget)Document9 pagesFM-Cash Budget)Aviona GregorioNo ratings yet

- Cash Flow AssignmentDocument39 pagesCash Flow AssignmentMUHAMMAD HASSANNo ratings yet

- 2023 - Session12 - 13 FSA2 - MBA - SentDocument32 pages2023 - Session12 - 13 FSA2 - MBA - SentAkshat MathurNo ratings yet

- Understanding Financial Statements: Student - Feedback@sti - EduDocument6 pagesUnderstanding Financial Statements: Student - Feedback@sti - Eduvince mendozaNo ratings yet

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitNo ratings yet

- Senior High School Department: LessonDocument10 pagesSenior High School Department: LessonJane Decenine CativoNo ratings yet

- Financial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsDocument22 pagesFinancial Management - Solved Paper 2015-2016 - 5th Sem B.SC HHA - Hmhub - Perfect ? Hub For 120k+ ? Hospitality ?? ? StudentsMOVIEZ FUNDANo ratings yet

- Тasks for individual workDocument7 pagesТasks for individual workДарина БережнаяNo ratings yet

- Corporate Accounting & Audit Q&ADocument20 pagesCorporate Accounting & Audit Q&ACreation of MoneyNo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Assiment Samanta Sir FinanceDocument7 pagesAssiment Samanta Sir Financesyedkaifi aftabNo ratings yet

- October 21, 2020 Financial AssetDocument12 pagesOctober 21, 2020 Financial AssetareebNo ratings yet

- 3rd Week Cash Flow AnalysisDocument19 pages3rd Week Cash Flow AnalysisCj TolentinoNo ratings yet

- (IV) Statement of Cash-FlowsDocument38 pages(IV) Statement of Cash-FlowsmusthaqhassanNo ratings yet

- Course Paper FinalDocument18 pagesCourse Paper FinalPrinces Elizabeth P PeñafielNo ratings yet

- FIN101 Principles of FinanceDocument6 pagesFIN101 Principles of FinanceIshrat KhanNo ratings yet

- Student Name: Student ID: Class: DateDocument4 pagesStudent Name: Student ID: Class: DateKinNo ratings yet

- Mid Autumn 2016 EP60005Document3 pagesMid Autumn 2016 EP60005Sohini RoyNo ratings yet

- 2024 CasesDocument18 pages2024 CasesVictor RollandNo ratings yet

- Act AssignmentDocument33 pagesAct AssignmentLabib KhanNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Ias 07Document72 pagesIas 07Hannan Fatima EllahiNo ratings yet

- Working Capital ManagementDocument67 pagesWorking Capital ManagementAam aadmiNo ratings yet

- AssignmentDocument11 pagesAssignmentkireeti415No ratings yet

- AccountingDocument123 pagesAccountingMEROO statuesNo ratings yet

- Answer To MTP - Final - Syllabus 2012 - Jun2015 - Set 1: Paper - 20: Financial Analysis & Business ValuationDocument6 pagesAnswer To MTP - Final - Syllabus 2012 - Jun2015 - Set 1: Paper - 20: Financial Analysis & Business ValuationAbhimanyu Singh RaghavNo ratings yet

- CAPE U1 Ratio QuestionDocument12 pagesCAPE U1 Ratio QuestionNadine DavidsonNo ratings yet

- Financial Position Report & Cash Flow Statement Analyze Transactions To The AccountDocument32 pagesFinancial Position Report & Cash Flow Statement Analyze Transactions To The AccountRafi EffendyNo ratings yet

- Financial Statement Analysis DemoDocument51 pagesFinancial Statement Analysis DemoMylene SalvadorNo ratings yet

- PC 2 QuestionnaireDocument3 pagesPC 2 QuestionnaireLuWiz DiazNo ratings yet

- Chapter 5 - Preparation of Master Budget 2Document2 pagesChapter 5 - Preparation of Master Budget 2Lysss EpssssNo ratings yet

- Ratio Analysis AssessmentDocument2 pagesRatio Analysis AssessmentShyam SNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- PT Fabm 2 AND BFDocument12 pagesPT Fabm 2 AND BFLushelle JiNo ratings yet

- Cash BudgetsDocument23 pagesCash Budgetsarjun sachdevNo ratings yet

- Chapter 2 (Basic Financial Statements)Document25 pagesChapter 2 (Basic Financial Statements)Brylle Leynes100% (1)

- Cash Management: Sale of EquipmentDocument4 pagesCash Management: Sale of EquipmentjohnNo ratings yet

- Assignment 1 FMDocument4 pagesAssignment 1 FMgobiNo ratings yet

- 362 End Term FRA SecDDocument5 pages362 End Term FRA SecDkhushali goharNo ratings yet

- Accounts DDocument13 pagesAccounts DRahit MitraNo ratings yet

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- II PUC Accountancy Paper Model PaperDocument6 pagesII PUC Accountancy Paper Model PaperCommunity Institute of Management Studies100% (1)

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Practice Questions For Final W Brick FinancialsDocument7 pagesPractice Questions For Final W Brick FinancialsJoana SilvaNo ratings yet

- FRFSA Previous Year Questions 2020-2023Document29 pagesFRFSA Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- Management Accounting SchemeDocument8 pagesManagement Accounting SchemeSpandana Madhan SmrbNo ratings yet

- New AFU 07407 CF Slides 2022Document73 pagesNew AFU 07407 CF Slides 2022janeth pallangyoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- P3 4Document3 pagesP3 4Nam Nguyen100% (1)

- E-Business Value MatrixDocument8 pagesE-Business Value MatrixNaveen Pandey0% (1)

- FAQ - ATM, at The Money OfferingsDocument16 pagesFAQ - ATM, at The Money Offeringsdajeca7No ratings yet

- Equity Report On Fu Wang Foods LimitedDocument30 pagesEquity Report On Fu Wang Foods LimitedNowshad AyubNo ratings yet

- IMBCDocument26 pagesIMBCloanltt88No ratings yet

- Service Marketing in The Digital AgeDocument76 pagesService Marketing in The Digital AgeDatalicious Pty LtdNo ratings yet

- How To Build A Powerful Human Resources Strategy: Master Course - Episode 04Document9 pagesHow To Build A Powerful Human Resources Strategy: Master Course - Episode 04Muhammad Jafar100% (1)

- (MAC1) Job Order CostingDocument10 pages(MAC1) Job Order CostingBSA 1-2 RUIZ, MARC BRIAN S.No ratings yet

- Case Zara CH 2 Management OperationDocument2 pagesCase Zara CH 2 Management OperationFika AprianiNo ratings yet

- Chopra scm5 Tif ch10Document25 pagesChopra scm5 Tif ch10Madyoka RaimbekNo ratings yet

- EDE Final Micro ProjectDocument18 pagesEDE Final Micro ProjectShubham KushwahaNo ratings yet

- 5 Erp Implementation L5Document9 pages5 Erp Implementation L5tahaNo ratings yet

- Internship Opportunities at YounityDocument25 pagesInternship Opportunities at Younityramu varmaNo ratings yet

- Mydin Study Case PDFDocument5 pagesMydin Study Case PDFNur Ain AtirahNo ratings yet

- LBM RevDocument7 pagesLBM RevCollege DumpfilesNo ratings yet

- How To Measure Digital Transformation With KPIs & MetricsDocument17 pagesHow To Measure Digital Transformation With KPIs & MetricsajayvgNo ratings yet

- Mba Curriculum FinalDocument53 pagesMba Curriculum FinalKameswara Rao Poranki75% (4)

- Meaning of MarketingDocument7 pagesMeaning of MarketingkritikanemaNo ratings yet

- Business Plan-Group 10Document13 pagesBusiness Plan-Group 10Reine Jholo BagaipoNo ratings yet

- Chapter 7 Inventory ManagementDocument40 pagesChapter 7 Inventory ManagementDaizy DerigayNo ratings yet

- 5 0Document14 pages5 0Shashwat sai VyasNo ratings yet

- Ibiv FTP 2Document382 pagesIbiv FTP 2Srinivasa KirankumarNo ratings yet

- BA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Document42 pagesBA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Becky GonzagaNo ratings yet

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Operations Management: Product DesignDocument48 pagesOperations Management: Product DesignAshokNo ratings yet