Professional Documents

Culture Documents

CC 201: Cost and Management Accounting (CMA) : 1. Course Objective

CC 201: Cost and Management Accounting (CMA) : 1. Course Objective

Uploaded by

Kritu GuptaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CC 201: Cost and Management Accounting (CMA) : 1. Course Objective

CC 201: Cost and Management Accounting (CMA) : 1. Course Objective

Uploaded by

Kritu GuptaCopyright:

Available Formats

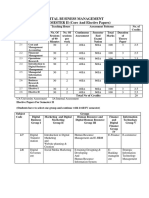

MBA

Semester II

CC 201 : Cost and Management Accounting (CMA)

1. Course Objective:

The course intends to equip students with the ability to apply cost concepts in managerial

decision making. At the end of the course, they are expected to have learnt the methodology

and techniques for application of cost and managerial accounting and information in the

formation of policies and in the planning and control of the operations of the organization. The

course covers the nature of managerial accounting; activity costing; marginal costing;

standard costing, etc.

2. Course Duration:

The course will have 40 sessions of 75 minutes duration.

3. Course Contents:

Module Modules/Sub-Modules Session Marks

No (20% of 70)

1 Cost Management and Cost Estimation 8 14

Cost and Management Accounting Overview Reading:

Chapter 1 (PS), Chapter 1 (CT) Various Cost

Concepts. Reading: Chapter 2 and 6 (PS), Chapter 2

(CT) Cost Estimation approaches, tools and

techniques Reading: Chapter 5, (PS), Chapter 10 (CT)

Cases: Apollo Community Hospital (PS) and Rajesh

Xerox and Print (PS)

2 Cost allocation and Job/ batch Costing 8 14

Cost Allocation, Activity Based and Target Costing

Reading: Chapter 5 and 19 (PS), Chapter 15 (CT)

Cases: Avon Company (PS) and National Bank (PS)

Job and Batch Costing Reading: Chapter 7, (PS),

Chapter 4 (CT) Introduction to the concept of operating

costs

3 Costing Methods 8 14

Operating Costing. Reading: Chapter 8 (PS) Chapter 4

(CT)

Cases: Tasty Bread Manufacturing (PS) Dental

Practice (PS) Process Costing and Joint and

Byproduct Costing. Reading: Chapter 10 (PS), Chapter

16 and 17 (CT)

Cases: Lalwani Company (PS), Lilavati Company (PS)

4 Management Applications 8 14

Marginal (Variable) Costing and Absorption Costing

Reading: Chapter 16 (PS), Chapter 9(CT). Case:

Krishna Optics (PS) Marginal Costing and CVP

www.gtucampus.com MBA-Semester-I Page 1 of 3

Analysis.

Reading: Chapter 16 (PS), Chapter 3 (CT). Case:

Chain of Hotels (PS)

Decision Involving Alternative Choices and Pricing

Decisions Reading: Chapter 17, 18 (PS); Chapter 11,

12 (CT)

Cases: Ajanta House (PS), Sawasthi – Make-or-Buy

(PS);Jagdamba Caterers (PS)

5 Planning, Control and Decision Making 8 14

Budgeting and Budgetary Control System

Reading: Chapter 12 (PS), Chapter 6,7 and 8 (CT).

Case: Angel Company (PS) Standard Costing and

Variance Analysis

Reading: Chapter 13 (PS), Chapter 7, 8, 14 (CT).

Case: Priety

Company (PS) Contemporary Issues like Kaizen

Costing, Target Costing, Life Cycle Costing, and Cost

Audit and Cost Accounting Standards

Reading: Chapter 15, 19, and 21 (PS)

4. Teaching Methods:

The course will use the following pedagogical tools:

(a) Case discussion covering a cross section of decision situations.

(b) Discussions on issues and techniques

(c) Projects/ Assignments/ Quizzes/ Class participation etc

5. Evaluation:

The students will be evaluated on a continuous basis and broadly follow the scheme

given below:

Weightage

A Assignments / Presentations/ Quizzes / Class Participation/ 10%

etc. (Internal Assessment)

B Mid-Semester Examination 20%

(Internal Assessment)

C End-Semester Examination 20%

(External Assessment)

6. Basic Text Books:

T1: Management Accounting by Paresh Shah (Oxford University Press) (PS)

T2: Cost Accounting by Charles T. Hongren, S. M. Datar, and others. (Pearson) (13 th Edition)

(CT)

7. Reference Books:

1. Cost Management: Strategies for Business Decisions by Hilton, Maher, and Selto (TMH)

2. Costing for Management by S. K. Bhattacharya and John Dearden (Vikas)

www.gtucampus.com MBA-Semester-I Page 2 of 3

3. Management Accounting by Khan and Jain (TMH)

4. Cost and Management Accounting by Ravi Kishore (Taxmann)

5. Cost and Management Accounting and Control by Hansen & Mowen (Thomson

Publishers)

8. List of Journals/Periodicals/ Magazines/ Newspapers:

Indian Journal of Accounting; Cost and Accounts Journal

9. Session Plan :

CC 201 : Cost and Management Accounting (CMA)

Sessions Topics

1 -2 Cost and Management Accounting Overview

3-5 Cost Concepts

6- 8 Cost Estimation

Cases: Apollo Community Hospital (PS)

Rajesh Xerox and Print (PS)

9-12 Cost Allocation, Activity Based and Target Costing

Cases: Avon Company (PS) National Bank (PS)

13- 15 Job and Batch Costing

16-18 Operating Costing

Cases: Tasty Bread Manufacturing (PS) Dental Practice (PS)

19- 22 Process Costing and Joint & By Product Costing

Cases: Lalwani Company (PS) Lilavati Company (PS)

23-24 Marginal (Variable) Costing and Absorption Costing

Case: Krishna Optics (PS)

25-28 Marginal Costing and CVP Analysis

Case: Chain of Hotels (PS)

29-31 Decision Involving Alternative Choices and Pricing Decisions

Cases: Ajanta House (PS)

Sawasthi – Make-or-Buy (PS);

Jagdamba Caterers (PS)

32-34 Budgeting and Budgetary Control System

Case: Angel Company (PS)

35-38 Standard Costing and Variance Analysis

Case: Priety Company (PS)

39-40 Contemporary Issues like Kaizen Costing, Target Costing, Life Cycle

Costing, and Cost Audit and Cost Accounting Standards

The Instructor/s (Faculty Member/s) will be required to guide the students regarding

suggested readings from the Text(s) and references in items 6 and 7 mentioned above.

www.gtucampus.com MBA-Semester-I Page 3 of 3

You might also like

- Sucheta Mahajan - Independence and Partition - The Erosion of Colonial Power in India-SAGE Publications (2000)Document427 pagesSucheta Mahajan - Independence and Partition - The Erosion of Colonial Power in India-SAGE Publications (2000)Bitan kumar DeNo ratings yet

- Cost & Management Accounting (CMA) : SyllabusDocument7 pagesCost & Management Accounting (CMA) : SyllabusMandish AjmeriNo ratings yet

- Course OutlineDocument4 pagesCourse OutlineChurag KhandelwalNo ratings yet

- BCA II Semester 2017-18 & OnwardsDocument20 pagesBCA II Semester 2017-18 & OnwardssontoshNo ratings yet

- Indian Institute of Management CalcuttaDocument4 pagesIndian Institute of Management CalcuttaHariSharanPanjwaniNo ratings yet

- LO & LP of Cost Accounting 23-05-2012Document3 pagesLO & LP of Cost Accounting 23-05-2012Amit Kumar NagNo ratings yet

- Manac Outline 2023-24Document4 pagesManac Outline 2023-24priyankaNo ratings yet

- Indian Institute of Management Kozhikode Post Graduate Programme in ManagementDocument4 pagesIndian Institute of Management Kozhikode Post Graduate Programme in ManagementRiturajPaulNo ratings yet

- Updated - Cma - PGP 25 t2 Course OutlineDocument4 pagesUpdated - Cma - PGP 25 t2 Course OutlineSwati PorwalNo ratings yet

- 3529202Document4 pages3529202HarishNo ratings yet

- Course Outline Aacsb Mba 611 Management AccountingDocument6 pagesCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNo ratings yet

- Cost Accounting: Course ObjectiveDocument4 pagesCost Accounting: Course ObjectiveS. BalaNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisPANDYA DHRUMILKUMARNo ratings yet

- Chemical Process Plant Design and EconomicsDocument3 pagesChemical Process Plant Design and Economics2020001873.gcetNo ratings yet

- Course Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionDocument4 pagesCourse Title: Advanced Cost and Management Accounting Course Code: ACFN 521 Credit Hours: 3 Ects: 7 Course DescriptionSefiager MarkosNo ratings yet

- Marketing of Services - Tripti G SharmaDocument6 pagesMarketing of Services - Tripti G SharmaPrakharNo ratings yet

- Course Outline - Cost & Management AccountingDocument2 pagesCourse Outline - Cost & Management AccountingBhunesh KumarNo ratings yet

- Readings: Dr. Nidhi Malhotra/Dr - Smita Dayal/Prof - Manav ViggDocument4 pagesReadings: Dr. Nidhi Malhotra/Dr - Smita Dayal/Prof - Manav ViggAbhishekNo ratings yet

- M.B.A Sem I NewDocument25 pagesM.B.A Sem I NewManish PariharNo ratings yet

- 4.1 C MMS Sem II PDFDocument32 pages4.1 C MMS Sem II PDFAnonymous DgofvfjGTNo ratings yet

- Financial Planning & Analysis (Ferri) SU2016Document16 pagesFinancial Planning & Analysis (Ferri) SU2016darwin120% (1)

- MBA SyllabusDocument18 pagesMBA SyllabusShaheen MahmudNo ratings yet

- Dokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Document748 pagesDokumen - Pub Cost and Management Accounting I 9789387572423 9387572420Sie Humas Septia Ardianti100% (1)

- Cost and Capital Accounting For Decision MakingDocument2 pagesCost and Capital Accounting For Decision MakingRishi CharanNo ratings yet

- MADM Course Outline 2020 - 21 - v2Document6 pagesMADM Course Outline 2020 - 21 - v2KaranNo ratings yet

- Ebook Cost and Management Accounting I PDF Full Chapter PDFDocument67 pagesEbook Cost and Management Accounting I PDF Full Chapter PDFedwina.perry203100% (36)

- Management AccountingDocument5 pagesManagement AccountingAtulya JhaNo ratings yet

- Management Accounting - Module 2010Document4 pagesManagement Accounting - Module 2010Ying LiuNo ratings yet

- Update Syllabus Advanced Cost & Management Accounting Gasal 2019Document8 pagesUpdate Syllabus Advanced Cost & Management Accounting Gasal 2019rief1010No ratings yet

- ACC301 Sem1Document24 pagesACC301 Sem1Kei LiewNo ratings yet

- Cost Management Course Policy For Accounting Dept 1400Document5 pagesCost Management Course Policy For Accounting Dept 1400Zabih UllahNo ratings yet

- Acc 301Document24 pagesAcc 301Tan Tzi XinNo ratings yet

- Business & Corporate FinanceDocument5 pagesBusiness & Corporate Financearbaz khanNo ratings yet

- Abc 8 PDFDocument17 pagesAbc 8 PDFNathan LeNo ratings yet

- Lesson Plan NaacDocument6 pagesLesson Plan Naacgarima0% (1)

- Course Outline ADA PGDM Executive 2020Document4 pagesCourse Outline ADA PGDM Executive 2020Utkarsh PandeyNo ratings yet

- Economic Environment Course Outline 2019Document4 pagesEconomic Environment Course Outline 2019Pooja SmithiNo ratings yet

- FM Pgpwe 2024Document4 pagesFM Pgpwe 2024ANKIT SHARMANo ratings yet

- (Managerial Economics) : Subject GuideDocument25 pages(Managerial Economics) : Subject GuideJie WangNo ratings yet

- Cost and Management Accounting I Mohammed Hanif Full ChapterDocument67 pagesCost and Management Accounting I Mohammed Hanif Full Chapterrobert.hoppe659100% (8)

- Course Syllabus MANAC 2015-16Document6 pagesCourse Syllabus MANAC 2015-16Piyuesh GoyalNo ratings yet

- BMT6125 - Costing-Methods-And-Techniques - TH - 1.0 - 55 - BMT6125 - 54 AcpDocument2 pagesBMT6125 - Costing-Methods-And-Techniques - TH - 1.0 - 55 - BMT6125 - 54 AcpchrisNo ratings yet

- Strategic Cost Management-Vanita PatelDocument3 pagesStrategic Cost Management-Vanita PatelChiragNo ratings yet

- MCom BFE I II 2015 16Document15 pagesMCom BFE I II 2015 16Anonymous AXQLK7No ratings yet

- Cost Accounting SyallbusDocument4 pagesCost Accounting SyallbusJack100% (1)

- Bba Banking Finance (Syllabus) 2018Document21 pagesBba Banking Finance (Syllabus) 2018Aditya JhaNo ratings yet

- Xavier Institute of Management and Research MMS-2020-2022 - Batch - II Semester Financial Management - Course OutlineDocument4 pagesXavier Institute of Management and Research MMS-2020-2022 - Batch - II Semester Financial Management - Course OutlineNicole Ayesha D'SilvaNo ratings yet

- Managerial Economics NIAMDocument2 pagesManagerial Economics NIAMStan leeNo ratings yet

- Course OutlineDocument53 pagesCourse OutlineSagar Garg (IN)No ratings yet

- CS8T1 MefaDocument2 pagesCS8T1 MefaKishoreReddyNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisJaanhvi MehtaNo ratings yet

- Financial Management 2Document3 pagesFinancial Management 2Sarthak GuptaNo ratings yet

- BBA Syllabus FinalDocument13 pagesBBA Syllabus FinalHimanshuNo ratings yet

- Quantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPDocument41 pagesQuantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPEngMohamedReyadHelesyNo ratings yet

- Gujarat Technological University: Finance Management and Cost ControlDocument2 pagesGujarat Technological University: Finance Management and Cost ControlAoneNo ratings yet

- 43 Corporate Excellence With Econometrics TirtaD 3 Crds PP PGP T6 Vsept2022Document8 pages43 Corporate Excellence With Econometrics TirtaD 3 Crds PP PGP T6 Vsept2022AyushiNo ratings yet

- Advanced Financial ModelingDocument4 pagesAdvanced Financial ModelingAQEELA MUNIRNo ratings yet

- Unit GuideDocument7 pagesUnit GuideHải Anh ĐặngNo ratings yet

- Cost ManagementDocument2 pagesCost ManagementSimran Malhotra0% (1)

- Syllabus: Faculty of Management Studies, University of DelhiDocument7 pagesSyllabus: Faculty of Management Studies, University of DelhiAtul MittalNo ratings yet

- Value and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsFrom EverandValue and Capital Management: A Handbook for the Finance and Risk Functions of Financial InstitutionsRating: 5 out of 5 stars5/5 (1)

- Intro To Production & Operation Mgt.Document2 pagesIntro To Production & Operation Mgt.Kritu GuptaNo ratings yet

- Udayan Report AkankshaDocument22 pagesUdayan Report AkankshaKritu GuptaNo ratings yet

- Ankit FIIB-SIP-2022-Team Project ProposalDocument3 pagesAnkit FIIB-SIP-2022-Team Project ProposalKritu GuptaNo ratings yet

- Strategic Management 1Document13 pagesStrategic Management 1Kritu GuptaNo ratings yet

- Jet Airways Present BusinessDocument6 pagesJet Airways Present BusinessKritu GuptaNo ratings yet

- FIIB-IQAC-CO-3-20F-CO SM Student Version New FormatDocument9 pagesFIIB-IQAC-CO-3-20F-CO SM Student Version New FormatKritu GuptaNo ratings yet

- Kritika Agarwal: PGDM Human Resource /operationsDocument1 pageKritika Agarwal: PGDM Human Resource /operationsKritu GuptaNo ratings yet

- Marketing Team ProjectDocument30 pagesMarketing Team ProjectKritu GuptaNo ratings yet

- Managing Network & OrganizationDocument16 pagesManaging Network & OrganizationKritu GuptaNo ratings yet

- Gopal Gupta 2K20PES09 SignedDocument23 pagesGopal Gupta 2K20PES09 SignedKritu GuptaNo ratings yet

- Case Study - Organizational Structure - Mintzberg's FrameworkDocument4 pagesCase Study - Organizational Structure - Mintzberg's FrameworkKritu GuptaNo ratings yet

- Gopal Gupta 2K20PES09Document23 pagesGopal Gupta 2K20PES09Kritu GuptaNo ratings yet

- Gopal Gupta 2K20PES09-1Document18 pagesGopal Gupta 2K20PES09-1Kritu Gupta100% (1)

- Matketing Management Ii: Submitted To Submitted byDocument29 pagesMatketing Management Ii: Submitted To Submitted byKritu GuptaNo ratings yet

- Resume RL - 2014 Growth PortfolioDocument3 pagesResume RL - 2014 Growth Portfolioapi-250802146No ratings yet

- DLL in MIL 10th WeekDocument3 pagesDLL in MIL 10th WeekJulius GaviolaNo ratings yet

- PDC Results - AddendumDocument20 pagesPDC Results - AddendumRicardo LunaNo ratings yet

- Character Certificate For Army RecruitmentDocument11 pagesCharacter Certificate For Army Recruitmentkijni2024No ratings yet

- Transaction AnalysisDocument7 pagesTransaction AnalysisNaman LadhaNo ratings yet

- Wood Magazine - 3 in One Bed For All Ages Part 1Document4 pagesWood Magazine - 3 in One Bed For All Ages Part 1clnieto2450% (2)

- Class 11 Eng Half Yarly BPDocument2 pagesClass 11 Eng Half Yarly BPAyush singhNo ratings yet

- Artificial Neural NetworksDocument9 pagesArtificial Neural Networksm_pandeeyNo ratings yet

- John Robinson ResumeDocument2 pagesJohn Robinson Resumeapi-508032756No ratings yet

- Yeasin Arafat: Career ObjectivesDocument2 pagesYeasin Arafat: Career ObjectivesAraf AhmedNo ratings yet

- Skrip Pengacara Perhimpunan Dalam Bahasa InggerisDocument7 pagesSkrip Pengacara Perhimpunan Dalam Bahasa InggerisNaDirah BahariNo ratings yet

- To Be Science CommunicationDocument35 pagesTo Be Science CommunicationWenni QorinnaNo ratings yet

- Performance Standards Guide For English Year 5Document3 pagesPerformance Standards Guide For English Year 5Suresh RajanNo ratings yet

- Historia SapDocument21 pagesHistoria SapLuis MiguelNo ratings yet

- PAkistan Garden 3Document10 pagesPAkistan Garden 3Fahad KhanNo ratings yet

- Ina 329Document4 pagesIna 329Dennis LeeNo ratings yet

- المجتمع المدني الصالح العامDocument329 pagesالمجتمع المدني الصالح العامali soufliNo ratings yet

- Cambridge English: First Practice Test ADocument3 pagesCambridge English: First Practice Test AJuan NarvaezNo ratings yet

- Hult Prize Trainings: by LecoachDocument25 pagesHult Prize Trainings: by LecoachIbtihel MelkiNo ratings yet

- Tech Leap-AWS-Data-Engineer-TeachLeap-School-Final PDFDocument14 pagesTech Leap-AWS-Data-Engineer-TeachLeap-School-Final PDFPartha GhoshNo ratings yet

- Session Course & Code Weeks Credit (S) Prerequisite (S)Document4 pagesSession Course & Code Weeks Credit (S) Prerequisite (S)Naqiuddin MuhamadNo ratings yet

- Factors Defining Bahala NaDocument2 pagesFactors Defining Bahala NaZelle SerranoNo ratings yet

- Rhetoric Honors Thesis BerkeleyDocument4 pagesRhetoric Honors Thesis Berkeleyspqeyiikd100% (2)

- My Hopes and Dreams For My FamilyDocument1 pageMy Hopes and Dreams For My FamilyThez BritanicoNo ratings yet

- Flag Football Unit PlanDocument43 pagesFlag Football Unit Planapi-486348259No ratings yet

- 02 Ar2e 6 Test STD U6Document3 pages02 Ar2e 6 Test STD U6Montserrat Martinez Doello100% (1)

- MITSDE 10 Pages Brochure - 16-17Document10 pagesMITSDE 10 Pages Brochure - 16-17nag_akNo ratings yet

- Assignment 2a Assessment 2Document14 pagesAssignment 2a Assessment 2api-430488040No ratings yet

- GD Goenka Public School Vasant Kunj Holiday Homework 2015Document8 pagesGD Goenka Public School Vasant Kunj Holiday Homework 2015g663q32m100% (1)