Professional Documents

Culture Documents

Mainland and Hong Kong Closer Economic Partnership Arrangement Hong Kong Service Supplier Requisition For Copies of Tax Documents

Mainland and Hong Kong Closer Economic Partnership Arrangement Hong Kong Service Supplier Requisition For Copies of Tax Documents

Uploaded by

caperpOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mainland and Hong Kong Closer Economic Partnership Arrangement Hong Kong Service Supplier Requisition For Copies of Tax Documents

Mainland and Hong Kong Closer Economic Partnership Arrangement Hong Kong Service Supplier Requisition For Copies of Tax Documents

Uploaded by

caperpCopyright:

Available Formats

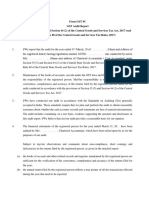

稅務局

Inland Revenue Department

內地與香港關於建立更緊密經貿關係的安排

Mainland and Hong Kong Closer Economic Partnership Arrangement

香港服務提供者

Hong Kong Service Supplier

申請索取稅務文件副本表格

Requisition for copies of Tax Documents

( 這份表格可用中文或英文填寫,填寫前請參閱表格下面的備註。)

(This form can be completed either in Chinese or English. Please read the notes below before writing.)

申請人資料Applicant’s Particulars

姓名 職位 * 東主 / 合夥人 / 董事

Name Capacity * Proprietor/Partner/Director

稅務局檔案號碼 電話號碼 傳真號碼

IRD File No. Tel. No. Fax No.

業務所用名稱 商業登記號碼

Name of business Business Registration No.

通訊地址

Correspondence Address

* 請刪去不適用者 Please delete as appropriate

# #

要求索取副本的文件 Copies Requested

業務遞交予稅務局的報稅表

Tax Return submitted by the business to IRD

前3年 前5年 其他 Others

past 3 years past 5 years (請註明課稅年度)

(Please specify the year(s) of assessment)

稅務局發出的評稅及繳納稅款通知書

Notice of Assessment and Demand for tax issued by IRD

前3年 前5年 其他 Others

past 3 years past 5 years (請註明課稅年度)

(Please specify the year(s) of assessment)

稅務局發出的評定虧損通知書

Statement of losses issued by IRD

前3年 前5年 其他 Others

past 3 years past 5 years (請註明課稅年度)

(Please specify the year(s) of assessment)

稅務局通知暫時無須按年遞交利得稅報稅表的函件

Correspondence issued by IRD stating that annual submission of Tax Returns was not required

業務最近遞交予稅務局的僱員薪酬及退休金報稅表(BIR56A)

The latest Employer’s Return of Remuneration and Pensions (BIR56A) submitted by the business to IRD

#

請在適當空格內填上「 」號 Please “ “ as appropriate

簽署 日期

Signature Date

備註

Notes

1. 本局會按照翻印記錄所需的成本收取費用,並預先告知你所需繳付的費用。

A charge reflecting the cost of reproducing the records concerned may be levied. The department will advise you in advance of any such charge.

2. 根據工業貿易署的要求,稅務文件副本須由經指定專業人士核證。

As required by the Trade and Industry Department, copies of tax documents require certification by Designated Professional.

3. 就本表格的要求及於本局處理你的申請的過程中提供個人資料屬自願性質。然而,如你未能提供充分資料,本局可能無法處理你的申請。本

局會把你提供的資料,用於施行本局專責執行的法例。本局並可在法律授權或准許的情況下,向任何其他人士或機構披露/轉移該等資料的

任何或全部內容。你有權要求查閱及改正你的個人資料,但屬《個人資料(私隱)條例》豁免披露的情況除外。如欲查閱或改正個人資料,

請致函評稅主任(地址為香港郵政總局郵箱132號),同時請註明你於本局的檔案號碼。

The provision of personal data required by this form and during the processing of your application is voluntary. However, if you do not

provide sufficient information, the Department may not be able to process your request. The Department will use the information provided

by you for the purposes of the Ordinances administered by it and may disclose/transfer any or all of such information to any other parties

provided that the disclosure/transfer is authorized or permitted by law. Except where there is an exemption provided under the Personal

Data (Privacy) Ordinance, you have the right to request access to and correction of your personal data. You should send such request in

writing to the Assessor at GPO Box 132, Hong Kong and quote your file number in this Department.

IR1408 (6/2020)

You might also like

- Anandam Case Study - AFSDocument20 pagesAnandam Case Study - AFSSiddhesh Mahadik67% (3)

- Escalation ProcedureDocument5 pagesEscalation ProcedureJuan EgaraNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Power BI - Final ProjectDocument212 pagesPower BI - Final ProjectABC XYZNo ratings yet

- Ghana Revenue Authority: Company Self-Assessment FormDocument2 pagesGhana Revenue Authority: Company Self-Assessment FormDavid BiahNo ratings yet

- Acctg122 - Chapter 1Document25 pagesAcctg122 - Chapter 1Ice James Pachano0% (1)

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of Representativegordon scottNo ratings yet

- Research Proposal PDFDocument1 pageResearch Proposal PDFcaperp100% (1)

- td558 E-Fillable EngDocument6 pagestd558 E-Fillable EngCook HuangNo ratings yet

- 2018 Nys Ct3a Comb FormDocument13 pages2018 Nys Ct3a Comb FormMatt MuellerNo ratings yet

- Ghana Revenue Authority: Company Self Assessment FormDocument2 pagesGhana Revenue Authority: Company Self Assessment Formokatakyie1990No ratings yet

- US Internal Revenue Service: f8453p - 2001Document2 pagesUS Internal Revenue Service: f8453p - 2001IRSNo ratings yet

- US Internal Revenue Service: f8879c - 2003Document2 pagesUS Internal Revenue Service: f8879c - 2003IRSNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internasmar corNo ratings yet

- Power of Attorney and Declaration of RepresentativeDocument2 pagesPower of Attorney and Declaration of RepresentativeJohn KammererNo ratings yet

- F 2553Document3 pagesF 2553alpinetigerNo ratings yet

- US Internal Revenue Service: f8879s - 2003Document2 pagesUS Internal Revenue Service: f8879s - 2003IRSNo ratings yet

- Document Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyDocument20 pagesDocument Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyEDWARD LEENo ratings yet

- US Internal Revenue Service: F8879eo - 2003Document2 pagesUS Internal Revenue Service: F8879eo - 2003IRSNo ratings yet

- 206AB-DeclarationDocument1 page206AB-Declarationharikrishnacn99No ratings yet

- td469a_e-fillable_chiDocument3 pagestd469a_e-fillable_chiTommy TsangNo ratings yet

- Caffrey Trading Corp.: Units 2703 & 2705 Finance Centre 26 St. Cor 9 Ave., Fort Bonifacio Global City, TaguigDocument2 pagesCaffrey Trading Corp.: Units 2703 & 2705 Finance Centre 26 St. Cor 9 Ave., Fort Bonifacio Global City, Taguigrowena balaguerNo ratings yet

- Membership Updated Form 06.10.22Document5 pagesMembership Updated Form 06.10.22Sirajia CngNo ratings yet

- NAR1 (Private) Specimen eDocument19 pagesNAR1 (Private) Specimen eMatthew TsangNo ratings yet

- 14 GST Audit Report Format PDFDocument56 pages14 GST Audit Report Format PDFShalu Maria GeorgeNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printeugenio02No ratings yet

- 3 - Irs 2849Document2 pages3 - Irs 2849Hï FrequencyNo ratings yet

- Explains The Procedures in Making The Business LegalDocument6 pagesExplains The Procedures in Making The Business LegalBerlin AlcaydeNo ratings yet

- Registration & Licensing Application FormDocument2 pagesRegistration & Licensing Application FormSahil AnasNo ratings yet

- Kyc Updation Cum Customer Service Request Form (Non Individuals)Document4 pagesKyc Updation Cum Customer Service Request Form (Non Individuals)Dheeraj AcharyaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- Membership Application Form-May 2019Document5 pagesMembership Application Form-May 2019Sarfraz KhanNo ratings yet

- U.S. Corporation Income Tax Declaration For An IRS E-File ReturnDocument1 pageU.S. Corporation Income Tax Declaration For An IRS E-File ReturnSrinivas GopalanNo ratings yet

- Renewal NoticeDocument7 pagesRenewal NoticeDS SystemsNo ratings yet

- 2307 LessorDocument3 pages2307 LessorPaul EspinosaNo ratings yet

- Form for Self-evaluation on Income from Employment Applying for the Reduction in or Exemption from Tax under the Provisions of an Agreement for the Avoidance of Double Taxation with Respect to Taxes-1110318Document5 pagesForm for Self-evaluation on Income from Employment Applying for the Reduction in or Exemption from Tax under the Provisions of an Agreement for the Avoidance of Double Taxation with Respect to Taxes-1110318bbbillyNo ratings yet

- Form 8879-CDocument1 pageForm 8879-Cankit goenkaNo ratings yet

- 6330 - PC (Uk) 2023Document14 pages6330 - PC (Uk) 2023Jabbar HassanNo ratings yet

- Individual Tax Residency Self-Certification Form: (CRS-I (HK) )Document4 pagesIndividual Tax Residency Self-Certification Form: (CRS-I (HK) )Nigel ParsonsNo ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuNo ratings yet

- Bir Te BuddiiDocument5 pagesBir Te Buddii'Em Jay IllüçiöniştNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3Monico IlardeNo ratings yet

- US Internal Revenue Service: f8453p - 2004Document2 pagesUS Internal Revenue Service: f8453p - 2004IRSNo ratings yet

- Irs Form 2848Document2 pagesIrs Form 2848john rossi100% (1)

- 9Document2 pages9Le Lhiin CariñoNo ratings yet

- Sanogo 2019 TFDocument40 pagesSanogo 2019 TFbassomassi sanogoNo ratings yet

- U.S. Partnership Declaration and Signature For Electronic FilingDocument2 pagesU.S. Partnership Declaration and Signature For Electronic FilingIRSNo ratings yet

- Annex A - Application Form BIR Form 2119Document2 pagesAnnex A - Application Form BIR Form 2119Antonio Reyes IVNo ratings yet

- 2307Document2 pages2307Bunny Sardina Pandongan0% (1)

- US Internal Revenue Service: f8453p - 1999Document2 pagesUS Internal Revenue Service: f8453p - 1999IRSNo ratings yet

- BIR2307 Jan 2018 ENCS v3 (1)Document3 pagesBIR2307 Jan 2018 ENCS v3 (1)Danica Joy ArceoNo ratings yet

- FM105W - SLR - CRS - SELFCERT - IND - JUL20 - 002 (Writable)Document3 pagesFM105W - SLR - CRS - SELFCERT - IND - JUL20 - 002 (Writable)HKRRL HKRRLNo ratings yet

- US Internal Revenue Service: f8878 - 2005Document2 pagesUS Internal Revenue Service: f8878 - 2005IRSNo ratings yet

- BIR 2307 For BR#0000000 Referreral Partners Inc - P 571.43Document1 pageBIR 2307 For BR#0000000 Referreral Partners Inc - P 571.43KASHMIR PONSARANNo ratings yet

- PetronDocument61 pagesPetronTrinity Mae QuinaNo ratings yet

- International Business or Company Tax Reg FormDocument4 pagesInternational Business or Company Tax Reg FormNithinNo ratings yet

- Maharashtra State Electricity Distribution Company Limited - 932020122335154Document7 pagesMaharashtra State Electricity Distribution Company Limited - 932020122335154CAAniketGangwalNo ratings yet

- Corporate Tax Registration CertificateDocument2 pagesCorporate Tax Registration Certificateaahmadhussain2024No ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Accounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryFrom EverandAccounting, Tax Preparation, Bookkeeping & Payroll Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Everthing You Need To Know To Start An Auto DealershipFrom EverandEverthing You Need To Know To Start An Auto DealershipRating: 5 out of 5 stars5/5 (1)

- Lease Renewal PDFDocument4 pagesLease Renewal PDFcaperpNo ratings yet

- Video Production ProposalDocument9 pagesVideo Production ProposalcaperpNo ratings yet

- Independent Contractor AgreementDocument9 pagesIndependent Contractor AgreementcaperpNo ratings yet

- Power of Attorney PDFDocument4 pagesPower of Attorney PDFcaperp100% (2)

- Investor AgreementDocument6 pagesInvestor AgreementcaperpNo ratings yet

- 會員轄下物業資料 Members Protfolios Property RegistersDocument2 pages會員轄下物業資料 Members Protfolios Property RegisterscaperpNo ratings yet

- Shareholder Agreement: Parties: T A, - , 20 - , "P ," C A, (L. Ipsum P, INC, "C "Document4 pagesShareholder Agreement: Parties: T A, - , 20 - , "P ," C A, (L. Ipsum P, INC, "C "caperpNo ratings yet

- Acctg 11 2nd Term Final ExamDocument13 pagesAcctg 11 2nd Term Final ExamJanet AnotdeNo ratings yet

- Functional Requirement-Team ADocument7 pagesFunctional Requirement-Team AAbdullah .AlsmariNo ratings yet

- Brand Mantras Rationale Criteria and ExamplesDocument11 pagesBrand Mantras Rationale Criteria and ExamplesBrownbrothaMNo ratings yet

- Building Strong: Rick Reese, P.EDocument16 pagesBuilding Strong: Rick Reese, P.EOsama GhannamNo ratings yet

- SR. Mechanical EngineerDocument3 pagesSR. Mechanical Engineerulhaq637No ratings yet

- Operation & Maintenance Engineering Guideline For RCM ImplementationDocument57 pagesOperation & Maintenance Engineering Guideline For RCM ImplementationGlad Blaz100% (2)

- PDF 20231221 094643 0000Document3 pagesPDF 20231221 094643 0000elvee.hrNo ratings yet

- RAS - GEC Elec 2 - Activity #5Document2 pagesRAS - GEC Elec 2 - Activity #5George Blaire Ras100% (1)

- Sonia Thakker 184 Jignesh Bhatt 105 Rekha Wachkawde 188 Shailendra Singh 178 Pravin Nayak 147 Jibu James 128Document44 pagesSonia Thakker 184 Jignesh Bhatt 105 Rekha Wachkawde 188 Shailendra Singh 178 Pravin Nayak 147 Jibu James 128treakoNo ratings yet

- Detroit: Environment 2Document12 pagesDetroit: Environment 2Allie GrossNo ratings yet

- ICAO Airport Planning Maunal Part 3 PDFDocument109 pagesICAO Airport Planning Maunal Part 3 PDFMabel Lo100% (1)

- K Limited WorksheetDocument4 pagesK Limited WorksheetHamdan MushoddiqNo ratings yet

- Impact of GST On Supply ChainDocument1 pageImpact of GST On Supply ChainMithunNo ratings yet

- Operations-Production PlanDocument3 pagesOperations-Production PlanKofiya WillieNo ratings yet

- Assignment 2: Continental Hotel Budget Planner: BMIH5007 - Financial Management For The Hotel IndustryDocument11 pagesAssignment 2: Continental Hotel Budget Planner: BMIH5007 - Financial Management For The Hotel IndustryPratik BasakNo ratings yet

- Test Bank For M Management 3rd Edition Bateman Full DownloadDocument67 pagesTest Bank For M Management 3rd Edition Bateman Full Downloadmelissapollardoxieprwsdb100% (50)

- EVORA - Feasibility StudyDocument11 pagesEVORA - Feasibility StudyEvora, Sichem D.No ratings yet

- Kano S Theory of Attractive Quality and PackagingDocument33 pagesKano S Theory of Attractive Quality and PackagingAvyno AvynoNo ratings yet

- Manufacturing Overhead VarianceDocument2 pagesManufacturing Overhead VarianceTampuk KawutNo ratings yet

- Acctg For Special Transaction - 3rd Lesson PDFDocument9 pagesAcctg For Special Transaction - 3rd Lesson PDFDebbie Grace Latiban LinazaNo ratings yet

- Business Research Methods AssignmentDocument2 pagesBusiness Research Methods AssignmentWorth ItNo ratings yet

- Effects of Power Use in Buyer Supplier Relationships 2022 Industrial MarketDocument13 pagesEffects of Power Use in Buyer Supplier Relationships 2022 Industrial MarkethenroymenNo ratings yet

- Gelua Accounting - PlatoDocument57 pagesGelua Accounting - PlatoJerome NatividadNo ratings yet

- Hach MWP-W1-lkkkkDocument1 pageHach MWP-W1-lkkkkankit singhNo ratings yet

- Module 1 Service Quality Management in Tourism and HospitalityDocument5 pagesModule 1 Service Quality Management in Tourism and HospitalitySmiling JoyceNo ratings yet

- Week 12 - Module10 - Managing Production and ServicesDocument9 pagesWeek 12 - Module10 - Managing Production and ServicesJitlee PapaNo ratings yet

- 8615 OkDocument16 pages8615 OkRubab MalikNo ratings yet