Professional Documents

Culture Documents

Puregold Price Club, Inc.: Philstocks Action Plan

Puregold Price Club, Inc.: Philstocks Action Plan

Uploaded by

lourdes germanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Puregold Price Club, Inc.: Philstocks Action Plan

Puregold Price Club, Inc.: Philstocks Action Plan

Uploaded by

lourdes germanCopyright:

Available Formats

Puregold Price Club, Inc.

PGOLD

Monday, July 20, 2020 BUY TP: Php 52.13

Reference: Claire T. Alviar

Company Report

PHILSTOCKS ACTION PLAN COMPANY KEY STATS

Last Traded Price Php 48.65

BUY shares of PGOLD as we project its FY2020 earnings to spike by 11%, and its growth Entry Point </= Php 44.00

for the next two years to hit 8.5% and 8.1%, respectively. We expect the company to outper- Target Price Php 52.13—61.14

form this year given the resilience of its products in this time of pandemic, evidenced by

Potential Upside / Downside (Based on entry point) 18.48% - 38.94%

higher net income for the first quarter 2020, surging 16.75% y/y, higher than its 5-year

52 wk High and Low Php 26-55.05

CAGR of 11%.

20 MA Volume 3.01M

Accumulate shares around or below the P44.00 support area. Technical-wise, it is currently P/E Ratio 19.87

at consolidation—an accumulation phase before the anticipated uptrend. P/B Ratio 2.20

YTD performance 22.39%

KEY INVESTMENT HIGHLIGHTS Year to Date Performance (YTD)

Upside risks

Resilience against Covid-19 pandemic impact

Unlike many companies that have suffer losses or earnings growth slowdown, Pureg-

old’s financials remained strong in the first quarter. Revenues grew 17.38% y/y, to

P40.95 billion; Net income jumped 16.75% y/y, to P1.76 billion.

Inventory turnover (days) also improved to 51.4 days in the first quarter from 55.4 days

in 2019.

S&R posted a stellar performance despite the community quarantine in the Philippines.

Gross profit surged 32.2% y/y, faster than revenue growth of 16.6% y/y, while net in-

come jumped 41.6% y/y.

Unlike other businesses, PGOLD’s expansion continues despite the pandemic setting

the retailer up for bright growth prospects.

Mobile app was launched allowing customers to shop online, meeting their demands

amid the pandemic.

Share remains undervalued COMPANY PROFILE

Forward P/E of 18.63x is lower than 5 year average of 20x, and peers’ 5-yr average of PGOLD trades goods such as consumer products (canned goods,

housewares, toiletries, dry goods, food products, pharmaceutical and

42.61x. medical goods, etc.) on a wholesale and retail basis. In 2012, the

Foreigners are net buyers year-to-date (as of July 17, 2020) amounting to P219.04 million. company acquired, which was later called “S&R Membership Shop-

ping.”

Downside risks By the end of 1Q 2020, Puregold was operating a total of 232 hyper-

markets, 102 supermarkets, 50 extra, 20 S&R, 39 S&R QSR, for a

total of 443 stores nationwide.

Pre-Covid problems could weigh on growth

Q1 2020 Gross profit margin (GPM) of 16.90% was narrower than peers’ average of Net Foreign Transactions

(In Million PHP, As of July 17, 2020)

23.83%, amid increasing costs of suppliers.

For Puregold only, costs have dragged the bottom line which marginally grew by 1.7%,

below its 5-year CAGR of 6.2%. Net margin declined to 3.00% from 3.5% in Q1 2019.

Dividend yield is expected to decline as PGOLD maintains its historical cash dividend at

P0.40 per share for regular and special each.

Employees are at risk of Covid-19 infection which may in turn affect the company’s opera-

tions.

Philstocks Research 2020 1 |Page

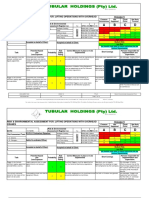

FINANCIAL RESULTS

For the first quarter of 2020, net sales increased 17.4% y/y, to P40.95 billion, STATEMENT OF FINANCIAL CONDITION

driven by its fully operated new organic stores in addition to the like-for-like In Million Pesos (Except

stores sales. However, cost of sales grew faster by 18.25% y/y, bringing gross for EPS)

profit to P6.9 billion with gross margin at 16.9%, lower compared to the 17.5% For the three Months

2020 2019 % Change

margin in the same period last year. On the bright side, net income margin period ended March 31

was maintained at 4.3%, with net income growing by 16.8% y/y, to P1.76 Net Sales 40,953.00 34,889.00 17.38%

billion outperforming its 11.94% y/y growth in the same period last year and its Cost of Sales 34,018.00 28,767.00 18.25%

5-year CAGR of 10.84%. According to the company, this was driven by the

Gross Profit 6,935.00 6,122.00 13.28%

continuous expansion of stores due to sustained strong consumer demand,

The stellar performance of PGOLD was also seen to be caused by the strong Other Operating Income 823.00 729.00 12.89%

demand during the Enhanced Community Quarantine (ECQ) which triggered Gross Income 7,758.00 6,851.00 13.24%

panic-buying.

Operating Expenses 4,791.00 4,280.00 11.94%

On its balance sheet, Total Assets contracted by 1.22% as of the first quarter Operating Income 2,967.00 2,571.00 15.40%

compared with its year end 2019 figure. This was primarily due to the 3.5%

drop in current assets driven by the lower receivables (-33%) and investments Other expenses-net - 476.00 - 433.00 9.93%

in trading securities (-28.6%) vs the amount in year end 2019. This was Net income before tax 2,491.00 2,138.00 16.51%

partially offset by the 0.11% increase in Noncurrent Assets. The slight uptick

Income tax expense 728.00 628.00 15.92%

was driven by the recognition of deferred tax in compliance with the PFRS 16-

Leases, with deferred tax asset, +8.3%. This was partly neutralized by the Net Income 1,763.00 1,510.00 16.75%

decline of other noncurrent assets and right-of-use assets by 5.1% and 0.4%,

respectively. Current liabilities were reduced by 21.2% brought by the partial

settlement made to Kareila Management, Inc. under the short-term loans STATEMENT OF FINANCIAL POSITION

payable account. Settlement of due to related parties account contributed to March 31, 2020

December

% Change

31, 2019

the decline of current liabilities. As current liabilities fell more than current

assets, current ratio was brought to 3.16x, higher than 2019’s 2.58x. Debt Total Current Assets 38,640.00 40,040.35 -3.50%

ratio remained stable at 0.41x. Meanwhile, return on assets and return on Total Noncurrent Assets 68,671.00 68,594.44 0.11%

equity in the first quarter recorded 1.60% and 2.80%, respectively. TOTAL ASSETS 107,311.00 108,634.80 -1.22%

Inventory days have improved to 51.4 days, compared with 55.4 days in 2019.

LIABILITIES AND STOCK-

This is good for the company as faster inventory turnover generates more HOLDERS' EQUITY

revenue. PGOLD also turned trade receivables quicker to 5.4 days vs 6.6 Total Current Liabilities 12,213.00 15,490.81 -21.16%

days in 2019. This means the company collects receivables more effectively.

Total Noncurrent Liabilities 31,435.00 31,245.00 0.61%

Trade payables were also paid within a shorter time period from 22.9 days in

Total Liabilities 43,648.00 46,735.00 -6.61%

2019 to 17.1 days in Q1.

Retained earnings 35,414.00 33,650.25 5.24%

Moreover, Puregold’s only foot traffic declined by 4.3%. Nonetheless, average

Total Stockholders' equity 63,663.00 61,899.35 2.85%

net ticket grew 22.9% to P749. These figures are seen to be driven by the

panic-buying in Mid-March. For S&R, growth remained with foot traffic TOTAL LIABILITIES AND

107,311.00 108,634.80 -1.22%

increasing 9.5% and average net ticket growing 9.3% STOCKHOLDERS' EQUITY

Traffic (in M) PGOLD S&R

2018 178 8.20

2019 180 8.90

1Q 20 42 (-4.3%) 2.3 (9.5%)

Average Ticket (in Php)

2018 612 3,959

2019 656 4,212

1Q 20 749 (22.9%) 4,327 (9.3%)

Source: Puregold Price Club, Inc. 1st Quarter 2020 Presentation, Financial Statements

Philstocks Research 2020 2 |Page

FINANCIAL RESULTS

For Puregold only, GPM narrowed to 14.8% in the first

quarter from 16.4% in the same period last year. This was

due to the Cost of Goods sold’s growth of 20% which was

faster than the revenue growth of 17.66%. This weighed

on its bottom line which grew by only 1.7%, slower than

its 5-year CAGR of 6.2%. Net margin declined to 3.00%

from 3.5% in Q1 2019.

For S&R, the stellar performance continued in the first

quarter despite some challenges. Gross profit surged

32.2% y/y, faster than revenue growth of 16.6%, with

GPM hitting 24.00%, higher than the 21.2% in the first

quarter last year. S&R’s cost efficiency brought net profit

to P813 million, growing 41.6% y/y, with net margin in-

creasing to 8.50% from 7.00% in the same period last

year.

As of December 31, 2019, PGOLD has a 565,995 sqm

(6,092,319.47 sqft.) stores’ net selling area. Sales, net

selling area , and sales per square foot area are consist-

ently increasing each year but at a slowing pace.

Source: Puregold Price Club, Inc. 1st Quarter 2020 Presentation, Financial Statements

CAPITAL EXPENDITURE GUIDANCE

The company has allotted P3.4 billion for capital expenditure this year, P600 Format Number of stores to be opened Amount ( PHP)

million of which is for maintenance expenses. It will be funded by internally

Puregold Stores 25 1 billion

generated funds and short term loans, if necessary. As of the first quarter

S&R stores 2 1.6 billion

2020, it has 443 stores nationwide, 37.5% of which are in Metro Manila. Thirty-

S&R QSR 10 200 million

seven stores will be added this year, amounting to P2.8 billion.

Total 37 2.8 billion

Source: Puregold Price Club, Inc. 1st Quarter 2020 Presentation,

RELATIVE VALUATION

Outstanding Mkt Cap (in Forward P/E

LTP (As of 07/02) EPS 1Q P/E 1Q BVPS 1Q P/B 1Q GM: 1Q20 OM: 1Q20 NM:1Q20

shares (In Mn) Mn) FY2020*

PGOLD 2,884.23 46.40 133,828.39 2.45 18.94 20.00 22.18 2.09 16.90% 7.20% 4.30%

Average 3,330.43 39.50 46,420.35 1.01 42.61 29.38 12.63 12.22 26.46% 2.49% 1.41%

RRHI 1,573.06 65.00 102,248.91 2.67 24.34 25.32 46.14 1.41 21.81% 3.48% 2.54%

SEVN 756.41 126.50 95,686.91 1.90 66.58 66.33 10.76 11.76 35.02% 3.10% 0.79%

MM 7,594.93 3.29 24,987.34 0.03 109.67 - 0.07 47.00 7.80% 1.95% 1.05%

MRSGI 3,429.37 1.58 5,418.41 0.21 7.52 12.65 2.70 0.59 21.59% 0.27% 0.09%

SSI 3,298.40 1.14 3,760.18 0.23 4.96 22.94 3.49 0.33 46.10% 3.62% 2.60%

*Based on 5-year average

PGOLD’s trailing twelve months (TTM) 2020 first quarter EPS printed higher than most of its peers, bringing its P/E ratio to 18.94x which is

more attractive than the industrial average of 42.61x. Puregold is also more marketable relative to peers in terms of P/B Ratio, with PGOLD’s at

2.09x, lower than the industrial average of 12.22x. Take note that the industry average was pushed by MerryMart’s high P/B ratio. In terms of

margins, PGOLD lags behind most of its peers in managing direct costs with its gross margin at 16.90%, below the industrial average of

26.46%. Nonetheless, Puregold beats peers in managing overall expenses, recording the highest net margin at 4.30%. This means that Pureg-

old is good at keeping other expenses lower, while direct costs could somehow depend on suppliers.

Philstocks Research 2020 3 |Page

VALUATION

As of July 17, 2020, Puregold is trading at 19.87x P/E TTM, a 32.36% discount from its 5-year peers’ average of 29.38x. Looking forward, the

estimated 11% EPS growth this year to P2.61 makes the stock more attractive based from its current price. At 20x P/E, the stock price is

seen to reach P52.13. Using moving CAGR, PGOLD’s growth for the next two years is projected at 8.5% and 8.1%, respectively. Given this,

market price could hit P61.14 in the year 2022.

INDUSTRY OVERVIEW

The consumer retail industry is one of the resilient sectors in this time of pandemic. During the first implementation

of enhanced community quarantine (ECQ) in Luzon, panic buying was prevalent as consumers bought goods at

high quantities to prepare for the stringent measures. The situation benefited the company which resulted to higher

average net ticket in the first quarter. Foot traffic declined however due to strict lockdown measures. Fortunately,

grocery is one of the essential businesses that remained open even during the ECQ.

Meanwhile, the general price level is seen to be supportive of retail operations as inflation is expected to remain

benign in the coming years. The Bangko Sentral ng Pilipinas (BSP) sees the price increases tamed in the next three

years, with average inflation outlook for 2020 at 2.3% -still within the 2 to 4 percent target. This can boost purchasing power, which could

lead to more sales, along with the positive effect of the tax reform law wherein taxpayers with a net taxable income of P250,000 and below

are exempted from paying personal income taxes.

To meet customers’ needs, PGOLD has launched SALLY-your shopping ally, a mobile app that lets you shop online to avoid hassle queue

when shopping which encourages more customers, particularly in the middle of the coronavirus pandemic.

Sentiment-wise, the optimism on expectation of higher sales due to panic-buying has dissipated as quarantine measures get downgraded.

Still, strong fundamentals are expected to remain.

FORECASTS AND ESTIMATES

2018A 2019A 2020E 2021E 2022E

Revenue 141,139,261,418 154,490,309,082 174,223,800,896.24 195,803,829,701.37 218,718,713,806.79

Revenue growth 13.18% 9.5% 12.8% 12.4% 11.7%

Net income 6,199,500,293 6,772,787,778 7,517,794,433.58 8,156,090,346.24 8,816,427,404.69

Net income growth 12.84% 9.2% 11.0% 8.5% 8.1%

Net income margin 4.39% 4.38% 4.32% 4.17% 4.03%

EPS 2.15 2.35 2.61 2.83 3.06

Dividend yield 0.47% 0.50% 0.77% 0.71% 0.65%

Price (Php) 43 39.76 52.13 56.56 61.14

Philstocks Research 2020 4 |Page

Philstocks Research

TECHNICAL ANALYSIS JUSTINO B. CALAYCAY, JR

AVP-Head, Research & Engagement

(632)588-1962

JAPHET LOUIS O. TANTIANGCO

Sr. Research Analyst

(632)588-1927

PIPER CHAUCER E. TAN

Engagement Officer/Research Associate

(632)588-1928

CLAIRE T. ALVIAR

Research Associate

(632)588-1925

Ground Floor, East Tower

PSE Center, Tektite Towers

Ortigas Center, Pasig City

PHILIPPINES

Source: Tradingview

DISCLAIMER

The opinion, views and recommendations

PGOLD’s primary trend (>12mos) is still pointing downwards. Nonetheless, its secondary contained in this material were prepared by

the Philstocks Research Team, individually

trend is showing optimistic signs after breaching the trend resistance (broken diagonal

and separately, based on their specific

red line)—indicating a bullish reversal. Previous trend resistance is now the new support. sector assignments, contextual framework,

personal judgments, biases and prejudices,

On the Fibonacci retracement, PGOLD has already crossed above 50% Fib implying that time horizons, methods and other factors.

it may continue to reach the 100% Fibonacci retracement. Given this, accumulate shares The reader is enjoined to take this into

around 0.5 (P42.03) or around 0.618 (P45.11) which act as support levels. Resistance is account when perusing and considering the

contents of the report as a basis for their

at 0.786 or around P49-50.00. stock investment or trading decisions.

Furthermore, projection made and presented

Historically, its first major resistance is at P50.00, next is at P55.00. Support is at P44.00. in this report may change or be updated in

between the periods of release. Ergo, the

Golden cross, a strong buying signal, already showed during the first week of May. The validity of the projections and/or estimates

50-day exponential moving average (EMA) and 200-day EMA will be PGOLD’s dynamic mentioned are good as of the date indicated

support. and may be changed without immediate

notification.

This report is primarily intended for

information purposes only and should not be

considered as an exclusive basis for making

investment decision. The recommendations

contained in this report is not tailored-fit any

particular investor type, situation, or

objective and must not be taken as such.

Determining the suitability of an investment

remains within the province of the investor.

Our estimates are based on information we

believe to be reliable. Nevertheless, nothing

in this report shall be construed as an offer

of a guarantee of a return of any kind and at

any time.

Rating Definitions:

BUY - More than 15% upside base on the target price

in the next 9-12 months

HOLD - 15% or less upside or downside in the next

9-12 months

SELL - More than 15% downside base on the target

price in the next 9-12 months

TRADE - A potential 10% and above short-term upside

base on entry price and selling price.

Philstocks Research 2020 5 |Page

You might also like

- Blend Q4 Fy20Document6 pagesBlend Q4 Fy20Ni007ckNo ratings yet

- Equity Valuation Report On Square Pharmaceuticals Limited (Update)Document34 pagesEquity Valuation Report On Square Pharmaceuticals Limited (Update)maybelNo ratings yet

- Avenue Supermarts (DMART IN) : Q4FY20 Result UpdateDocument7 pagesAvenue Supermarts (DMART IN) : Q4FY20 Result UpdatecandyNo ratings yet

- Stocks in Focus:: Infected Count Death Toll Total RecoveredDocument4 pagesStocks in Focus:: Infected Count Death Toll Total RecoveredJNo ratings yet

- Future Lifestyle Fashions: Revenue Growth Impressive, One-Time Expenses Dent MarginsDocument6 pagesFuture Lifestyle Fashions: Revenue Growth Impressive, One-Time Expenses Dent MarginsdarshanmadeNo ratings yet

- Natco Pharma LTD: Exports Overshadow Domestic Challenges..Document5 pagesNatco Pharma LTD: Exports Overshadow Domestic Challenges..Kiran KudtarkarNo ratings yet

- 2Q Profits Up 24% On Strong Sales and Opex Savings: Puregold Price Club, IncDocument7 pages2Q Profits Up 24% On Strong Sales and Opex Savings: Puregold Price Club, Incacd1355No ratings yet

- 1182311122021672glenmark Pharma Q2FY22Document5 pages1182311122021672glenmark Pharma Q2FY22Prajwal JainNo ratings yet

- FY21 Q2 Balkrishna Industries Investor PresentationDocument39 pagesFY21 Q2 Balkrishna Industries Investor PresentationAnand SNo ratings yet

- Ciptadana Sekuritas KINO - Key Takeaways From MeetingDocument3 pagesCiptadana Sekuritas KINO - Key Takeaways From Meetingbudi handokoNo ratings yet

- Renata Valuation ReportDocument23 pagesRenata Valuation ReportNgo TungNo ratings yet

- Prospect 25768Document9 pagesProspect 25768Luciano Moraes Torres BarbosaNo ratings yet

- Jubilant Food Stock Report PDFDocument33 pagesJubilant Food Stock Report PDFPranav WarneNo ratings yet

- Glenmark Pharmaceuticals PDFDocument23 pagesGlenmark Pharmaceuticals PDFsandyNo ratings yet

- Nocil LTD.: Margins Have Bottomed Out, Import Substitution in PlayDocument8 pagesNocil LTD.: Margins Have Bottomed Out, Import Substitution in PlaySadiq SadiqNo ratings yet

- Source: The Wall Street Journal: - Jollibee Foods CorporationDocument5 pagesSource: The Wall Street Journal: - Jollibee Foods CorporationPaulNo ratings yet

- ABBOTT INDIA LTD Centrum 0620 QTR Update 020920 Growing Amid LockdownDocument12 pagesABBOTT INDIA LTD Centrum 0620 QTR Update 020920 Growing Amid LockdownShanti RanganNo ratings yet

- PI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13Document8 pagesPI Industries LTD - Q1FY23 Result Update - 10082022 - 10!08!2022 - 13SandeepNo ratings yet

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Jyothy - Lab Sharekhan PDFDocument7 pagesJyothy - Lab Sharekhan PDFAniket DhanukaNo ratings yet

- Jyothy Laboratories LTD Accumulate: Retail Equity ResearchDocument5 pagesJyothy Laboratories LTD Accumulate: Retail Equity Researchkishor_warthi85No ratings yet

- AGM Presentation 28 April 2022Document22 pagesAGM Presentation 28 April 2022YukiNo ratings yet

- Poly Medicure LTD.: Company Overview: DetailsDocument6 pagesPoly Medicure LTD.: Company Overview: DetailsRaghav BehaniNo ratings yet

- Vaibhav Global LTD: Ended FY21 With A Bang, Gearing Up For FutureDocument7 pagesVaibhav Global LTD: Ended FY21 With A Bang, Gearing Up For FutureShivangi RathiNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- Supreme Industries LTD Hold: Retail Equity ResearchDocument5 pagesSupreme Industries LTD Hold: Retail Equity ResearchanjugaduNo ratings yet

- Pidilite CompanyDocument6 pagesPidilite Companykhalsa.taranjitNo ratings yet

- Aarti Industries LTDDocument5 pagesAarti Industries LTDViju K GNo ratings yet

- ITC Limited: Resilient Quarter Amidst Weak Industry DemandDocument5 pagesITC Limited: Resilient Quarter Amidst Weak Industry DemandGeebeeNo ratings yet

- Cipla - 2QFY19 Results - ICICI DirectDocument13 pagesCipla - 2QFY19 Results - ICICI DirectSheldon RodriguesNo ratings yet

- BP Wealth On Hikal - 06.11.2020Document7 pagesBP Wealth On Hikal - 06.11.2020VM ONo ratings yet

- RHB Report My HPP Holdings Ipo Note 20201230 55456608300173055feb4c180905fDocument10 pagesRHB Report My HPP Holdings Ipo Note 20201230 55456608300173055feb4c180905fiqadinNo ratings yet

- Avenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthDocument10 pagesAvenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthLucifer GamerzNo ratings yet

- Sunp 28 5 23 PLDocument8 pagesSunp 28 5 23 PLraj patilNo ratings yet

- Marico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthDocument10 pagesMarico (MARLIM) : Soft Copra Prices To Drive Earnings GrowthAshokNo ratings yet

- Indag Rubber Note Jan20 2016Document5 pagesIndag Rubber Note Jan20 2016doodledeeNo ratings yet

- Amport IoperDocument1 pageAmport IoperJeo Adrian LingNo ratings yet

- Valuation Report-Renata LimitedDocument24 pagesValuation Report-Renata LimitedSamin ChowdhuryNo ratings yet

- RIL 4Q FY18 Analyst Presentation 27apr18 PDFDocument110 pagesRIL 4Q FY18 Analyst Presentation 27apr18 PDFneethuNo ratings yet

- 2018 08 01 PH e Urc - 2 PDFDocument8 pages2018 08 01 PH e Urc - 2 PDFherrewt rewterwNo ratings yet

- Core Income Down 3.2% in 2Q18, Behind Both COL and Consensus EstimatesDocument8 pagesCore Income Down 3.2% in 2Q18, Behind Both COL and Consensus EstimatesheheheheNo ratings yet

- HDFC Securities ITC 27-6-2020Document13 pagesHDFC Securities ITC 27-6-2020Sivas SubramaniyanNo ratings yet

- Iiww 161210Document4 pagesIiww 161210rinku23patilNo ratings yet

- Marico Result UpdatedDocument10 pagesMarico Result UpdatedAngel BrokingNo ratings yet

- Telecommunication Services - Etihad Etisalat - 7020Document2 pagesTelecommunication Services - Etihad Etisalat - 7020AliNo ratings yet

- 1.8. Jarir Aljazira Capital 2022.8Document3 pages1.8. Jarir Aljazira Capital 2022.8robynxjNo ratings yet

- Mphasis 1QFY20 Result Update - 190729 - Antique Research PDFDocument6 pagesMphasis 1QFY20 Result Update - 190729 - Antique Research PDFdarshanmadeNo ratings yet

- PVR LTD: Healthy PerformanceDocument9 pagesPVR LTD: Healthy PerformanceGaurav KherodiaNo ratings yet

- National Medical Care Co - Al Jazira Capital PDFDocument2 pagesNational Medical Care Co - Al Jazira Capital PDFikhan809No ratings yet

- Ki Adro 20190305Document6 pagesKi Adro 20190305krisyanto krisyantoNo ratings yet

- Navin Q3FY20 Earning Call Transcript PDFDocument23 pagesNavin Q3FY20 Earning Call Transcript PDFjohari23No ratings yet

- P.I. Industries (PI IN) : Q1FY20 Result UpdateDocument7 pagesP.I. Industries (PI IN) : Q1FY20 Result UpdateMax BrenoNo ratings yet

- CCL Products (India) LTD.: Result Update MAY 30, 2019Document6 pagesCCL Products (India) LTD.: Result Update MAY 30, 2019Clandestine AspirantNo ratings yet

- Pharma: Export Sales To Dip FurtherDocument7 pagesPharma: Export Sales To Dip FurtherwhitenagarNo ratings yet

- Bajaj Ru Q4fy20 LKP 21st May'20Document4 pagesBajaj Ru Q4fy20 LKP 21st May'20Deepak GNo ratings yet

- Indopremier Company Update 1Q24 ASII 29 Apr 2024 Upgrade To BuyDocument6 pagesIndopremier Company Update 1Q24 ASII 29 Apr 2024 Upgrade To BuyfinancialshooterNo ratings yet

- Glaxosmithkline Pharmaceuticals LTD: Revenue De-GrowthDocument7 pagesGlaxosmithkline Pharmaceuticals LTD: Revenue De-GrowthGuarachandar ChandNo ratings yet

- EIB Group Survey on Investment and Investment Finance 2020: EU overviewFrom EverandEIB Group Survey on Investment and Investment Finance 2020: EU overviewNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Managing People - AssignmentDocument10 pagesManaging People - AssignmentayeshaNo ratings yet

- 11th Zoology Volume 1 New School Books Download English MediumDocument240 pages11th Zoology Volume 1 New School Books Download English Mediumaishikanta beheraNo ratings yet

- F1.4 - Marine Sediment Treatment and ReuseDocument14 pagesF1.4 - Marine Sediment Treatment and ReuseKwan Chun SingNo ratings yet

- RA For Assessment For Lifting OperationsDocument19 pagesRA For Assessment For Lifting OperationsMohamedSaidNo ratings yet

- CED-PQP-5225-F01 Rev.0 Sieve AnalysisDocument4 pagesCED-PQP-5225-F01 Rev.0 Sieve AnalysisSslan seelanNo ratings yet

- Reading b2 c1Document4 pagesReading b2 c1Karenza ThomasNo ratings yet

- Guidelines For PCB Layout DesignDocument5 pagesGuidelines For PCB Layout DesigncooksandNo ratings yet

- 1.2 Safety & Rules in Biology LaboratoryDocument32 pages1.2 Safety & Rules in Biology LaboratoryasyuraNo ratings yet

- Unit 5. PHCDocument24 pagesUnit 5. PHCFenembar MekonnenNo ratings yet

- Awareness and Practices of Self-Management and Influence Factors Among Individuals With Type 2 Diabetes in Urban Community Settings in Anhui Province, ChinaDocument13 pagesAwareness and Practices of Self-Management and Influence Factors Among Individuals With Type 2 Diabetes in Urban Community Settings in Anhui Province, ChinaLeni RozaniNo ratings yet

- Suzumar Boat Engine PackagesDocument7 pagesSuzumar Boat Engine PackagesmarkoNo ratings yet

- 2022 WCRC Rules and Regulations - 2021-12-06Document32 pages2022 WCRC Rules and Regulations - 2021-12-06Adhi MuhyidinNo ratings yet

- Checklist For T&C of Chemical Fire Suppression SystemDocument2 pagesChecklist For T&C of Chemical Fire Suppression Systembeho2000No ratings yet

- 10: Radioactivitysmk Jati Physics Panel: Radioactive EmissionDocument16 pages10: Radioactivitysmk Jati Physics Panel: Radioactive Emissionyudrea88No ratings yet

- Experiment 13 Ultrafiltration UnitDocument13 pagesExperiment 13 Ultrafiltration UnitKishen NaniNo ratings yet

- Clinical Research HypertensionDocument4 pagesClinical Research HypertensionJay Linus Rante SanchezNo ratings yet

- From Gathering To Growing Food: Neinuo's LunchDocument10 pagesFrom Gathering To Growing Food: Neinuo's Lunchsoumya KavdiaNo ratings yet

- Revised Case Report - HemorrhoidsDocument47 pagesRevised Case Report - Hemorrhoidschristina_love08100% (2)

- Chapter 6 Food Handlers Safety HygieneDocument20 pagesChapter 6 Food Handlers Safety HygieneIrish MalabananNo ratings yet

- LA Myxoma Case PresentationDocument34 pagesLA Myxoma Case PresentationWiwik Puji LestariNo ratings yet

- GHB FactsheetDocument2 pagesGHB FactsheetABC Action NewsNo ratings yet

- Liber eDocument15 pagesLiber eFatimaNo ratings yet

- Stretching ExerciesDocument2 pagesStretching ExerciesGanesh Babu100% (1)

- Jsa Installation of Supports and Cable Racks1Document16 pagesJsa Installation of Supports and Cable Racks1loveson709100% (3)

- Building Construction Company ProfileDocument62 pagesBuilding Construction Company ProfileFadhlan Dwi Gusti WarmanNo ratings yet

- ScopeDocument3 pagesScopeGalano, Hana MarieNo ratings yet

- Immigration PowerpointDocument17 pagesImmigration Powerpointapi-296259840No ratings yet

- FDA Dairy Product Recall Rizo-Lopez Foods IncDocument9 pagesFDA Dairy Product Recall Rizo-Lopez Foods IncWXMINo ratings yet

- (II) Misadventure Is Mischance, Accident or Disaster. It Is of Three TypesDocument3 pages(II) Misadventure Is Mischance, Accident or Disaster. It Is of Three TypesSandeep BansalNo ratings yet