Professional Documents

Culture Documents

Personal Note: This Is A System Generated Payslip, Does Not Require Any Signature

Personal Note: This Is A System Generated Payslip, Does Not Require Any Signature

Uploaded by

Shakti NaikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Note: This Is A System Generated Payslip, Does Not Require Any Signature

Personal Note: This Is A System Generated Payslip, Does Not Require Any Signature

Uploaded by

Shakti NaikCopyright:

Available Formats

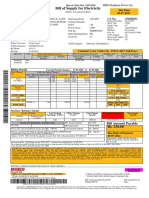

Neptunus Power Plant Services Pvt. Ltd.

Pay Slip for the month of June-2021

Neptunus Power Plant Services Pvt Ltd Plot A554, TTC Industrial Area, Mahape, Ghansoli, Navi Mumbai, 400710 , Mumbai -

400710

Maharashtra

Employee Code : 157 Payable Days : 26.00

Name : Mr. Shakti Dev Naik PF No. : THVSH01150600000000062

Department : Service PAN : AJUPN4818N

Designation : Technician-I Location : NPPS SITE

Tax Regime : OLD

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic DA 12100.00 12100.00 0.00 12100.00 PF 1800.00

HRA 6050.00 6050.00 0.00 6050.00 PROF. TAX 200.00

LTA 4000.00 4000.00 0.00 4000.00 LWF. 12.00

Uniform Allowance 3000.00 3000.00 0.00 3000.00

Car and Driver Vehicle Allow 3000.00 3000.00 0.00 3000.00

Meal Allowance 1460.00 1460.00 0.00 1460.00

GROSS EARNINGS 29610.00 29610.00 0.00 29610.00 GROSS DEDUCTIONS 2012.00

Net Pay : 27,598.00

Net Pay in words : INR Twenty Seven Thousand Five Hundred Ninety Eight Only

Income Tax Worksheet for the Period April 2021 - March 2022(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(NON-METRO)

Basic DA 145200.00 0.00 145200.00 Investments u/s 80C Exempted Qualifying Rent Paid 0.00

HRA 72600.00 0.00 72600.00 PROVIDENT FUND 21600.00 150000.00 From 01/04/2021

LTA 48000.00 0.00 48000.00 To 31/03/2022

Uniform Allowance 36000.00 36000.00 0.00 1. Actual HRA 72600.00

Car and Driver Vehicle Allow 36000.00 0.00 36000.00 2. 40% or 50% of Basic 58080.00

Meal Allowance 17520.00 0.00 17520.00 3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 72600.00

Gross 355320.00 36000.00 319320.00 Total of Investments u/s 80C 21600.00 150000.00

Deductions U/S 80C 21600.00 150000.00 TDS Deducted Monthly

Previous Employer Taxable Income 0.00 Total of Ded Under Chapter VI-A 21600.00 150000.00 Month Amount

Professional Tax 2500.00 April-2021 0.00

Under Chapter VI-A 21600.00 May-2021 0.00

Standard Deduction 50000.00 June-2021 0.00

Any Other Income 0.00 Tax Deducted on Perq. 0.00

Taxable Income 245220.00 Total 0.00

Total Tax 0.00

Marginal Relief 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 0.00

Tax Deduction for this month 0.00

Personal Note: This is a system generated payslip, does not require any signature.

You might also like

- British Gas - OldDocument2 pagesBritish Gas - Oldky139396No ratings yet

- Full Download Solution Manual For Excursions in Modern Mathematics 9th Edition Peter Tannenbaum PDF Full ChapterDocument36 pagesFull Download Solution Manual For Excursions in Modern Mathematics 9th Edition Peter Tannenbaum PDF Full Chapterpratic.collopvg0fx100% (23)

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash Lamani100% (1)

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsVivek ViviNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Econ 101: Principles of Microeconomics Fall 2012Document1 pageEcon 101: Principles of Microeconomics Fall 2012wwongvgNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- VishalDocument1 pageVishalgig.sachinrajakNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Employee DataDocument1 pageEmployee DataDinesh RNo ratings yet

- Jan SlipDocument1 pageJan Slipherlyn8762No ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- June Salry PDFDocument1 pageJune Salry PDFomkassNo ratings yet

- Doc-20240410-Wa0004. 20240513 191957 0000Document1 pageDoc-20240410-Wa0004. 20240513 191957 0000sachinsinghofficial55No ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8No ratings yet

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051No ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsayanbhargav3No ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Jagan Mohan Absli Payslip AprilDocument1 pageJagan Mohan Absli Payslip AprilSurya GodasuNo ratings yet

- April2018 PDFDocument1 pageApril2018 PDFomkassNo ratings yet

- Jul 2023Document1 pageJul 2023Praveen SainiNo ratings yet

- April Salary PDFDocument1 pageApril Salary PDFomkassNo ratings yet

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraNo ratings yet

- SettlementReportDocument1 pageSettlementReportPraneeth Sasanka TadepalliNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BNo ratings yet

- SettlementReportDocument1 pageSettlementReportSarath KumarNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsabhigopal444No ratings yet

- Jan PayslipDocument1 pageJan Payslipnegishilpa051No ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctRahul RajawatNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- M027729 SalarySlipwithTaxDetailsDocument1 pageM027729 SalarySlipwithTaxDetailsaseemshankarNo ratings yet

- BI01263 SalarySlipwithTaxDetailsDocument1 pageBI01263 SalarySlipwithTaxDetailsGREAT INDIANo ratings yet

- July 2017Document1 pageJuly 2017omkass100% (1)

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- Mar18 PDFDocument1 pageMar18 PDFomkassNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Aug2023 38349 SalarySlipwithTaxDetailsDocument1 pageAug2023 38349 SalarySlipwithTaxDetailsshyam kumarNo ratings yet

- E010072 Payslip 01-JanDocument1 pageE010072 Payslip 01-JanhariprasadhpNo ratings yet

- SEP2023 STFC PaySlipDocument2 pagesSEP2023 STFC PaySlipJHP CreationsNo ratings yet

- Uni-Com India PVT - LTDDocument1 pageUni-Com India PVT - LTDcredit cardNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- H2coms C001 Ani2387 202305Document1 pageH2coms C001 Ani2387 202305chagusahoo170No ratings yet

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiNo ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiNo ratings yet

- Employee DataDocument1 pageEmployee DataSubhankar DasNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- Wa0023.Document2 pagesWa0023.ManiNo ratings yet

- Ghodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsDocument1 pageGhodawat Enterprises Pvt. Ltd. (Star Air) : Earnings DeductionsSivi BabuNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- D-37/1, TTC MIDC, Turbhe, Navi Mumbai-400 703: ThyrocareDocument3 pagesD-37/1, TTC MIDC, Turbhe, Navi Mumbai-400 703: ThyrocareShakti NaikNo ratings yet

- Govpub C13Document118 pagesGovpub C13Shakti NaikNo ratings yet

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikNo ratings yet

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikNo ratings yet

- Air StarterDocument44 pagesAir StarterShakti NaikNo ratings yet

- Wani Reforming Pakistans Tax System PublishedDocument3 pagesWani Reforming Pakistans Tax System PublishedZahra MunirNo ratings yet

- India's Foreign Trade Policy - 29 August 2021Document17 pagesIndia's Foreign Trade Policy - 29 August 2021Akanksha GuptaNo ratings yet

- Q&A, November 2023Document9 pagesQ&A, November 2023Cerealis FelicianNo ratings yet

- Law of Taxation and The Constitution of India - IDocument2 pagesLaw of Taxation and The Constitution of India - Inandhinipalanivelan2122No ratings yet

- Chapter 1 International Marketing University of Gondar AschalewDocument15 pagesChapter 1 International Marketing University of Gondar AschalewrezikaabdulkadirNo ratings yet

- Electricity Bill Receipt 2669114725 PDFDocument1 pageElectricity Bill Receipt 2669114725 PDFdinesh parmarNo ratings yet

- Basics About Sales Tax in Microsoft DynamicsDocument25 pagesBasics About Sales Tax in Microsoft Dynamicskashif safarNo ratings yet

- Republic Act No. 9513: GOVPH (/)Document29 pagesRepublic Act No. 9513: GOVPH (/)RMC PropertyLawNo ratings yet

- Non-Current Assets - Ppe: Conceptual Framework & Accounting StandardsDocument14 pagesNon-Current Assets - Ppe: Conceptual Framework & Accounting StandardsDebbie Grace Latiban LinazaNo ratings yet

- A - General Principles - 2020 Part 1Document3 pagesA - General Principles - 2020 Part 1Russel Saez ReyNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)rajuNo ratings yet

- Extended Due Dates Under GSTDocument2 pagesExtended Due Dates Under GSTLeenaNo ratings yet

- It Form 22 23 Cps Old RegimeDocument12 pagesIt Form 22 23 Cps Old RegimeSARAVANAN PNo ratings yet

- Electric BillDocument1 pageElectric BillChloe AlinsonorinNo ratings yet

- SNGPL - Web BillDocument1 pageSNGPL - Web Billhassan_m2222No ratings yet

- Hoger Dizayee-Ervil, LLC ComplaintDocument8 pagesHoger Dizayee-Ervil, LLC ComplaintJaram JohnsonNo ratings yet

- Statement 04567035Document3 pagesStatement 04567035workgonchar87No ratings yet

- Excise Taxes On Certain GoodsDocument4 pagesExcise Taxes On Certain GoodsshakiraNo ratings yet

- Tax Reforms in Pakistan Historic and Critical ViewDocument299 pagesTax Reforms in Pakistan Historic and Critical ViewJąhąnząib Khąn KąkąrNo ratings yet

- Electrification and Bio-Energy Options in Rural IndiaDocument40 pagesElectrification and Bio-Energy Options in Rural IndiaMudit DuaNo ratings yet

- Government and Global BusinessDocument20 pagesGovernment and Global Businesssalamat lang akinNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesChalla RamanamurtyNo ratings yet

- N KK 58 BUYg FJL 1626951361612Document1 pageN KK 58 BUYg FJL 1626951361612Ashish Singh Negi100% (1)

- H19140 Mge Essay PDFDocument2 pagesH19140 Mge Essay PDFPranab NaiduNo ratings yet

- Economics Chapter 8 9 SsDocument3 pagesEconomics Chapter 8 9 SsswetasahNo ratings yet

- Bescom GSTN No: 29Aaccb1412G1Z5Document2 pagesBescom GSTN No: 29Aaccb1412G1Z5Ashwin JoshiNo ratings yet

- Paper 15: Direct Tax Laws and International Taxation (Dit) 100 MarksDocument2 pagesPaper 15: Direct Tax Laws and International Taxation (Dit) 100 MarksSridhanyas kitchenNo ratings yet