Professional Documents

Culture Documents

SM 05

SM 05

Uploaded by

azertyuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SM 05

SM 05

Uploaded by

azertyuCopyright:

Available Formats

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

CHAPTER 5

MERCHANDISING OPERATIONS

LEARNING OBJECTIVES

1. Identify the differences between service and merchandising companies.

2. Prepare entries for purchases under a perpetual inventory system.

3. Prepare entries for sales under a perpetual inventory system.

4. Prepare a single-step and a multiple-step income statement.

5. Calculate the gross profit margin and profit margin.

6. Account and report inventory in a periodic inventory system (Appendix 5A).

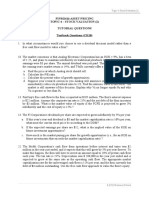

SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND

BLOOM’S TAXONOMY

Item LO BT Item LO BT Item LO BT Item LO BT Item LO BT

Questions

1. 1 C 6. 2 C 11. 2,3 C 16. 4 K 21. 5 C

2. 1 C 7. 2 AP 12. 3 C 17. 4 C 22. 5 C

3. 1 C 8. 2,3 C 13. 3 C 18. 4 C 23. 6 C

4. 1 C 9. 2,3 C 14. 3 C 19. 4 C 24. 6 C

5. 1 C 10. 2,3 C 15. 4 C 20. 5 C 25. 6 C

Brief Exercises

1. 1 C 5. 2 AP 9. 4 C 13. 6 AP

2. 1 AN 6. 3 AP 10. 4,5 AN 14. 6 AP

3. 2 AP 7. 4 AP 11. 5 AN 15. 6 AP

4. 2,3 AP 8. 4 C 12. 6 AP 16. 6 AP

Exercises

1. 1 C 5. 2 AP 9. 4 AP 13. 5 AN 17. 6 AN

2. 2,3 AN 6. 2 AN 10. 4,5 AN 14. 6 AP

3. 2,3 AP 7. 2,3,5 AP 11. 4,5 AN 15. 2,3,6 AP

4. 2 AP 8. 4 C 12. 4,6 AN 16. 6 AN

Problems: Set A and B

1. 1 AN 4. 2,3 AP 7. 4 AP 10. 5 AN 13. 6 AP

2. 1,2,3 AN 5. 2,3,4 AP 8. 5 AN 11. 1,6 AN 14. 5,6 AP

3. 2,3 AP 6. 4 AN 9. 4,5 AN 12. 6 AP 15. 6 AP

Accounting Cycle Review

1. 2,3,4 AP

Cases

1. 1,4,5 AN 3. 4,5 E 5. 2 C

2. 5 AN 4. 2,3,5 E 6. 4,5 AN

Solutions Manual 5-1 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

Legend: The following abbreviations will appear throughout the solutions manual file.

LO Learning objective

BT Bloom's Taxonomy

K Knowledge

C Comprehension

AP Application

AN Analysis

S Synthesis

E Evaluation

Difficulty: Level of difficulty

S Simple

M Moderate

C Complex

Time: Estimated time to prepare in minutes

AACSB Association to Advance Collegiate Schools of Business

Communication Communication

Ethics Ethics

Analytic Analytic

Tech. Technology

Diversity Diversity

Reflec. Thinking Reflective Thinking

CPA CM CPA Canada Competency

cpa-e001 Ethics Professional and Ethical Behaviour

cpa-e002 PS and DM Problem-Solving and Decision-Making

cpa-e003 Comm. Communication

cpa-e004 Self-Mgt. Self-Management

cpa-e005 Team & Lead Teamwork and Leadership

cpa-t001 Reporting Financial Reporting

cpa-t002 Stat. & Gov. Strategy and Governance

cpa-t003 Mgt. Accounting Management Accounting

cpa-t004 Audit Audit and Assurance

cpa-t005 Finance Finance

cpa-t006 Tax Taxation

Solutions Manual 5-2 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

ANSWERS TO QUESTIONS

1. (a) The operating cycle is the time it takes to go from cash to cash in

producing revenues.

(b) The normal operating cycle for a merchandising company is likely to be

longer than that of a service company because, in a merchandising

company, inventory must first be purchased and sold, and then the

receivables must be collected whereas, in a service company, the services

only need to be provided (not purchased first and then stored until sold)

and then the receivables must be collected.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

2. (a) The income measurement process of a merchandising company is the

same as the service company in that net income is arrived at by deducting

expenses from revenues.

(b) The income measurement process of a merchandising company differs

from that of a service company in that its revenue is derived from sales

revenue, not service revenue. In addition, cost of goods sold is deducted

from sales revenue to determine gross profit, before operating and other

expenses, similar to both types of companies, are deducted (or other

revenues are added).

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

3. The company needs to compare the cost of the detailed record keeping

required in a perpetual inventory system to the benefits of having the additional

information about the inventory. One of the benefits of a perpetual inventory

system is the ability to answer questions from customers about merchandise

availability. In a used clothing business, this may not be of much benefit unless

each inventory item is unique. Another benefit is the monitoring of inventory

quantities in order to avoid running out of stock. Again, this may not be of benefit

since the company does not order recurring or similar merchandise, and may

not have a supplier to order from. But if the company is selling used clothing on

consignment, it will need to track each item in order to determine which

consignor to pay when an item is sold.

Solutions Manual 5-3 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

3. (continued)

The company should carefully determine the cost of the detailed record keeping

required, in particular for a new company. A perpetual inventory system

requires more record keeping and therefore is more expensive to use. For

example, a perpetual inventory system usually requires an investment in a

point-of-sale system that is integrated with the inventory system.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

4. A physical count is an important control feature. By using a perpetual inventory

system, a company knows what should be on hand. Performing a physical

count and checking it to the perpetual records is necessary to detect any errors

in record keeping and/or shortages in stock.

LO 1 BT: C Difficulty: M Time: 2 min. AACSB: None CPA: cpa-t001 CM: Reporting

5. The key distinction between a periodic inventory system and a perpetual

inventory system is whether or not information on inventory and cost of goods

sold (units and dollars) are always (perpetually) available or only known when

inventory counts are conducted (periodically). Because information on the cost

of goods sold is only known after an inventory count has been carried out under

the periodic system, no entry is made for the cost of goods sold at the time of

each sale. Instead, cost of goods sold is a residual number, determined by

subtracting ending inventory (as determined by the inventory account) from cost

of goods available for sale. This means that any goods not included in ending

inventory are assumed to have been sold. In order to arrive at the cost of goods

available for sale, separate accounts are set up in the general ledger to keep

track of the purchases, freight-in, purchase returns and allowances, and

purchase discounts. Under the periodic inventory system, management is not

able to look up in the general ledger accounts for the balance of inventory at a

particular point in time. In order to arrive at the inventory value, a physical count

of the inventory must be performed.

LO 1 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-4 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

6. The reason for recording the purchase of merchandise for resale in a separate

account is to enable a company to determine its cost of goods sold and gross

profit. This information is useful in managing costs and setting prices.

LO 2 BT: C Difficulty: M Time: 2 min. AACSB: None CPA: cpa-t001 CM: Reporting

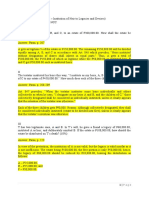

7. (a) The value of the purchase discount to Butler’s Roofing is $480 ($48,000 ×

1%).

(b) Failing to take advantage of the discount terms is like paying the supplier

an extra $480 in order to settle a $47,520 invoice 20 days later. This works

out to 1.01% [$480 ÷ $47,520] every 20 days. On an annual basis this

amounts to 18.4% [($480 ÷ $47,520 × (365 ÷ 20)]. Butler’s should take

advantage of the cash discount offered.

LO 2 BT: AP Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and Finance

8. (a) Lebel Ltée should record the sale as revenue in June, when it is sold to a

customer. When the merchandise was purchased in April, it should be

recorded as an asset, inventory. It should be recorded as cost of goods

sold (an expense) in June when the inventory is sold and the revenue is

recognized. This is necessary in order to match the cost with the related

revenue

(b) Lebel’s customer should recognize the purchase in June, when the

inventory is received.

LO 2,3 BT: C Difficulty: C Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-5 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

9. (a) FOB shipping point means that the goods are placed free on board by the

seller at the point of shipping. The buyer pays the freight costs from the

point of shipping to the buyer’s destination because title passes at

shipping point. FOB destination means the goods are delivered by the

seller to their destination, where the title passes. The seller pays for

shipping to the buyer’s destination.

(b) FOB shipping point will result in a debit to the Inventory account by the

buyer because title has transferred at shipping point and the inventory is

now owned by the buyer. FOB destination will result in a debit to Freight

Out by the seller because they are paying for the freight.

LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

10. In a perpetual inventory system, purchase returns are credited to Inventory

because the items purchased have been returned to the vendor and are no

longer available to be sold to customers. Sales returns are not debited directly

to the Sales account because this would not provide information about the

goods returned. This information can be useful in making decisions. Debiting

returns directly to sales may also cause problems in comparing sales for

different periods.

LO 2,3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

11. (a) A quantity discount gives a reduction in the price according to the volume

of the purchase. A purchase discount is offered by a seller to a buyer for

early payment of an invoice. When the buyer pays the invoice within the

discount period, the amount of the discount decreases the Inventory

account. A sales discount is the same as a purchase discount but from the

seller’s point of view.

(b) Quantity discounts are not recorded or accounted for separately but

become part of the recorded sales price. Buyers record purchase

discounts taken as a credit to Inventory under the perpetual system or to

Purchase Discounts when using the periodic system. The seller records a

sales discount as a debit to the Sales Discounts account, which is a contra

revenue account to Sales, when the invoice is paid within the discount

period.

LO 2,3 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-6 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

12. Contra accounts are used to reduce the account they are contra to, such as

accumulated depreciation reducing equipment. A debit (decrease) recorded

directly to Sales would make it more difficult for management to determine the

percentage of total sales that ends up being lost through sales returns and

allowances, so a contra revenue account (sales returns and allowances) is

used. Another example of a contra revenue account is sales discounts. This

account keeps track of the costs incurred for discounts taken by customers for

paying early, in accordance with the discount terms offered. The contra revenue

accounts reduce sales to net sales, reported on the income statement.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

13. If the merchandise is not resaleable, it cannot be included in inventory since it

cannot be resold and it has no value. The cost remains in cost of goods sold

since it is a cost of doing business. If the merchandise is resaleable, it still has

value to the company. In this case, the cost of the merchandise is debited to

inventory again and cost of goods sold is credited.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

14. The sales taxes are collected on behalf of the federal and provincial

governments, and must be periodically remitted to these authorities. Sales

taxes that are collected from selling a product or service are not recorded as

revenue, instead they are recorded as a liability until they are paid to the

government.

LO 3 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-7 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

15. In a single-step income statement, all data are classified into two categories:

(1) revenues and (2) expenses. It is referred to as a single-step income

statement because only a single step—subtracting expenses from revenues—

is needed to determine income before income tax. A multiple-step income

statement requires several steps to determine income before income tax. First,

cost of goods sold is deducted from net sales to determine gross profit.

Operating expenses are then deducted to calculate income from operations.

Finally, other revenues and expenses are added or deducted to determine

income before income tax. The deduction of income tax to calculate net income

(loss) is the same under both formats. In addition, both formats produce the

same profit amount for the period.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

16. North West Company uses a multiple-step income statement.

LO 4 BT: K Difficulty: S Time: 2 min. AACSB: None CPA: cpa-t001 CM: Reporting

17. (a) When classifying expenses by their nature, they are reported in

accordance with their natural classification (for example, salaries,

deprecation, and so on). When classifying expenses by their function, they

are reported according to the activity (business function) for which they

were incurred (for example, cost of goods sold, administrative, selling).

(b) It does not matter whether a single-step or multiple-step income statement

is prepared, expenses must be classified either by nature or by function.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

18. Because the Overwaitea is a private enterprise, it can follow Accounting

Standards for Private Enterprises (ASPE). Companies following ASPE can

classify their expenses in whatever manner is useful to them. Loblaws, which

follows IFRS, must classify its expenses by their nature or their function.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-8 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

19. Interest expense is a non-operating expense because it relates to how a

company’s operations are financed, not to the company’s main operations.

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

20. The difference between gross profit margin and profit margin is that the gross

profit margin measures the amount by which the selling price exceeds the cost

of goods sold while the profit margin measures the extent to which sales cover

all expenses (including the cost of goods sold).

LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

21. Factors affecting a company’s gross profit margin include the selling price and

the cost of the merchandise. Recall that gross profit = net sales cost of goods

sold. Selling products with a higher price or “mark-up” or selling products with

a lower cost would result in an increased gross profit margin. Selling products

with a lower price (perhaps due to increased competition that results in lower

selling prices) or selling products with a higher cost (perhaps due to price

increases from suppliers and shippers) would result in a lower gross profit

margin.

LO 5 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

22. High gross profit Low gross profit

Computer services and Low-price retail companies

such as

software companies Walmart

Pharmaceutical manufacturers Grocery stores

Luxury goods retailers Forestry and wood products

LO 5 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-9 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*23.

(a) (b)

Accounts Added/Deducted Normal Balance

Purchase Returns and Allowances Deducted Credit

Purchase Discounts Deducted Credit

Freight In Added Debit

LO 6 BT: C Difficulty: M Time: 5 min. AACSB: None CPA: cpa-t001 CM: Reporting

*24. Periodic System

Cost of Goods Sold = Beginning Inventory + Cost of Goods Purchased

(Purchases – Purchase Discounts – Purchase Returns and Allowances +

Freight In) – Ending Inventory

Ending inventory and cost of goods sold for the period are calculated at the end

of the period.

Perpetual System

Cost of Goods Sold = the cost of the item(s) sold

Cost of goods sold is calculated at the time of each sale and recorded as an

increase (debit) to the Cost of Goods Sold account and a decrease (credit) to

the Inventory account.

LO 6 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-10 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*25. The calculation of cost of goods sold is shown in detail in the income statement

of a company using the periodic system. In a perpetual system, it is one line

and amount only.

Periodic System

Cost of Goods Sold =

1. Add the cost of goods purchased (where the cost of goods purchased is

equal to purchases less purchases discounts, and purchases returns and

allowances plus freight in) to the cost of goods on hand at the beginning of

the period (beginning inventory). The result is the cost of goods available for

sale.

2. Subtract the cost of goods on hand at the end of the period (ending inventory)

from the cost of goods available for sale. The result is the cost of goods sold.

Perpetual System

Cost of Goods Sold = one number, which is the total of cost of goods sold as

previously determined and recorded for all sales.

LO 6 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-11 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO BRIEF EXERCISES

BRIEF EXERCISE 5-1

(a) The company with the most efficient operating cycle is Company A as it uses

the fewest number of days in its cycle to obtain cash.

(b) The company which is most likely a service company is Company A as it does

not have to manufacture or deliver inventory and consequently takes the fewest

number of days to obtain cash. Company C, with the highest number of days in

its operating cycle, is likely the manufacturing company, and the merchandising

company would be in the middle (Company B), with neither the highest nor the

lowest number of days in its operating cycle.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 5-2

(a) [1] Income before tax = $100 – $65 = $35

[2] Net income = $35 (from [1]) – $9 = $26

[3] Cost of goods sold = $100 – $60 = $40

[4] Operating expenses = $60 – $35 = $25

[5] Income tax expense = $35 – $26 = $9

(b) Company A is the service company, since it has no cost of goods sold.

Company B is the merchandising company, since it has cost of goods sold.

LO 1 BT: AN Difficulty: M Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-12 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-3

Inventory

Beginning Balance 55,000

Purchases 220,000

26,000 Purchase returns

9,700 Purchase discounts

Freight in 2,700

218,000 Cost of goods sold

Ending Balance 24,000

Although not required, the following are the journal entries of the transactions.

Purchases Inventory .................................................................. 220,000

Accounts Payable ............................................... 220,000

Purchase Accounts Payable .................................................... 26,000

Returns Inventory ............................................................. 26,000

Purchase Accounts Payable ($220,000 – $26,000) ................. 194,000

Discounts Inventory ($194,000 × 5%) ................................. 9,700

Cash ................................................................... 184,300

Freight In Inventory .................................................................. 2,700

Accounts Payable ............................................... 2,700

Cost of Cost of Goods Sold .................................................. 218,000

Sales Inventory ............................................................. 218,000

LO 2 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-13 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-4

Pocras Corporation (Buyer):

Aug. 24 Inventory ................................................................. 32,000

Accounts Payable ............................................... 32,000

Wydell Inc. (Seller):

Aug. 24 Accounts Receivable ................................................ 32,000

Sales ................................................................... 32,000

24 Cost of Goods Sold .................................................. 14,400

Inventory ............................................................. 14,400

LO 2,3 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 5-5

Jan. 2 Inventory ................................................................. 45,000

Accounts Payable ............................................... 45,000

5 No entry necessary – Freight costs paid by Fundy Corp.

6 Accounts Payable .................................................... 6,000

Inventory ............................................................. 6,000

11 Accounts Payable ($45,000 - $6,000) ...................... 39,000

Inventory ($39,000 × 2%) ................................... 780

Cash ................................................................... 38,220

LO 2 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-14 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-6

Jan. 2 Accounts Receivable ................................................ 45,000

Sales ................................................................... 45,000

2 Cost of Goods Sold .................................................. 25,200

Inventory ............................................................. 25,200

5 Freight Out ............................................................... 900

Cash ................................................................... 900

6 Sales Returns and Allowances................................. 6,000

Accounts Receivable .......................................... 6,000

6 Inventory .................................................................. 3,360

Cost of Goods Sold ............................................. 3,360

11 Cash ......................................................................... 38,220

Sales Discounts ($39,000 × 2%) .............................. 780

Accounts Receivable ($45,000 - $6,000) ............ 39,000

LO 3 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-15 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-7

(a) Sales .................................................................... $1,110,000

Less: Sales returns and allowances ................... $22,000

Sales discounts ......................................... 18,000 40,000

Net sales .............................................................. $1,070,000

(b) Net sales ..................................................................... $1,070,000

Less: Cost of goods sold ........................................... 658,000

Gross profit ................................................................. $ 412,000

(c) Gross profit ................................................................. $412,000

Less: Administrative expenses .................................. $160,000

Selling expenses .............................................. 110,000 270,000

Income from operations .............................................. $142,000

(d) Income from operations .............................................. $142,000

Add: Other revenues ................................................ $26,000

Less: Other expenses ................................................ (35,000)_ (9,000)

Income before income tax........................................... $133,000

(e) Income before income tax........................................... $133,000

Less: Income tax expense ......................................... 27,000

Net income ................................................................. $106,000

LO 4 BT: AP Difficulty: S Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-16 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-8

As the name suggests, numerous steps are required in determining net income in a

multiple-step statement.

(a) (b)

Item Single-Step Multiple-Step

Depreciation expense Expenses Operating expenses

Cost of goods sold Expenses Cost of goods sold

Freight out Expenses Operating expenses

Income tax expense Income tax expense Income tax expense

Interest expense Expenses Other revenues and expenses

Interest revenue Revenues Other revenues and expenses

Rent revenue Revenues Other revenues and expenses

Salaries expense Expenses Operating expenses

Sales Revenues Sales revenue

Sales discounts Revenues Sales revenue

Sales returns and allowances Revenues Sales revenue

LO 4 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

BRIEF EXERCISE 5-9

(a) The company is using a multiple-step form of income statement.

(b) The company is classifying its expenses by their function. They are reported

according to the activity (business function) for which they were incurred (for

example, cost of goods sold, administrative, selling).

LO 4 BT: C Difficulty: M Time: 5 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-17 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-10

(a)

2018 2017

Sales $250,000 $200,000

Cost of goods sold 137,500 114,000

Gross profit 112,500 86,000

Operating expenses 50,000 40,000

Income from operations 62,500 46,000

Other revenues ______ 10,000

Income before income taxes 62,500 56,000

Income tax expense 20,000 15,000

Net income $42,500 $41,000

(b)

2018 2017

Gross profit $112,500 $86,000

margin = 45.0% = 43.0%

$250,000 $200,000

Profit

$42,500 = 17.0% $41,000 = 20.5%

margin

$250,000 $200,000

(c) Modder Corporation’s gross profit margin increased in 2018 indicating an

increase in the percentage mark-up, or a reduction in the cost of goods sold, or

both. On the other hand, in 2018, the company’s profit margin dropped. The

decrease in profit margin is caused by the other revenues in 2017 that were not

available in 2018. Operating expenses were 20% of sales in both years.

LO 4,5 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 and : cpa-t005CM: Reporting and

Finance

Solutions Manual 5-18 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

BRIEF EXERCISE 5-11

(a)

($ in millions) 2015 2014

Gross profit $12,279.6 – $7,747.1 $12,462.9 – $8,033.2

margin = 36.9% = 35.5%

$12,279.6 $12,462.9

Profit $735.9 $639.3

= 6.0% = 5.1%

margin $12,279.6 $12,462.9

(b) Canadian Tire Corporation’s gross profit margin increased in 2015. Although

sales dropped 1.5%, [($12,279.6 - $12,462.9) ÷ $12,462.9] cost of goods sold

dropped 3.6% [($7,747.1 - $8,033.2) ÷ $8,033.2] which lead to the increased

gross profit margin. The profit margin also increased in 2015, but not as much.

Operating expenses or interest or income tax expense must have increased as

a percentage of sales.

LO 5 BT: AN Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 and cpa-t005 CM: Reporting and

Finance

*BRIEF EXERCISE 5-12

Jan. 2 Purchases ................................................................ 45,000

Accounts Payable ............................................... 45,000

5 No entry necessary - Freight costs paid by Fundy Corp.

6 Accounts Payable .................................................... 6,000

Purchase Returns and Allowances ..................... 6,000

11 Accounts Payable ($45,000 - $6,000) ...................... 39,000

Purchase Discounts ($39,000 × 2%) .................. 780

Cash ................................................................... 38,220

LO 6 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-19 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 5-13

Jan. 2 Accounts Receivable ................................................ 45,000

Sales ................................................................... 45,000

2 No cost of goods sold entry at time of sale

5 Freight Out ............................................................... 900

Cash ................................................................... 900

6 Sales Returns and Allowances................................. 6,000

Accounts Receivable .......................................... 6,000

6 No cost of goods sold entry at the time of sale

11 Cash ......................................................................... 38,220

Sales Discounts ($39,000 × 2%) .............................. 780

Accounts Receivable ($45,000 - $6,000) ............ 39,000

LO 6 BT: AP Difficulty: S Time: 10 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-20 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 5-14

(a) Sales ............................................................................. $1,860,000

Less: Sales returns and allowances ............................ $124,000

Sales discounts .................................................. 28,000 152,000

Net Sales ...................................................................... $1,708,000

(b) Purchases ..................................................................... $880,000

Less: Purchase returns and allowances ...................... $13,000

Purchase discounts ............................................ 14,000 27,000

Net purchases ............................................................... $853,000

(c) Net purchases ............................................................... $853,000

Add: Freight in ............................................................ 16,000

Cost of goods purchased .............................................. $869,000

(d) Beginning inventory ...................................................... $ 96,000

Add: Cost of goods purchased ................................... 869,000

Cost of goods available for sale .................................... 965,000

Less: Ending inventory ................................................ 82,000

Cost of goods sold ........................................................ $883,000

(e) Net sales ....................................................................... $1,708,000

Less: Cost of goods sold ............................................... 883,000

Gross profit ................................................................... $825,000

LO 6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-21 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 5-15

(a) Cost of goods sold

Beginning inventory ...........................................

$105,000

Purchases .......................................................... $195,000

Less: Purchase returns and allowances ............ $ 6,600

Purchase discounts .................................. 20,400 27,000

Net purchases .................................................... 168,000

Add: Freight In ................................................... 5,250

Cost of goods purchased ................................... 173,250

Cost of goods available for sale ......................... 278,250

Ending inventory ................................................ 120,000

Cost of goods sold ............................................. $158,250

(b) There would be no difference in the remainder of the income statement for

Halifax Limited whether the periodic or perpetual inventory systems were used.

Purchases – Purchase returns and allowances – Purchase discounts + Freight-in =

Cost of goods purchased

(Beginning inventory+ Cost of goods purchased – Ending inventory = Cost of goods

sold)

LO 6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-22 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*BRIEF EXERCISE 5-16

Dec. 31 Inventory (ending) .................................................... 68,000

Cost of Goods Sold .................................................. 401,000*

Purchase Discounts ................................................. 6,000

Inventory (beginning) .......................................... 75,000

Purchases ........................................................... 388,000

Freight In............................................................. 12,000

* Cost of goods sold = Beginning inventory + Purchases Purchase

discounts Purchase returns and allowances + Freight in – Ending

inventory

Cost of goods sold = $75,000 + $388,000 $6,000 + $12,000 –

$68,000 = $401,000

LO 6 BT: AP Difficulty: M Time: 15 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-23 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

SOLUTIONS TO EXERCISES

EXERCISE 5-1

(a) Toys “R” Us, Inc. is a merchandiser (retailer), Fasken Martineau LLP is a

service company, and Atlantic Grocery Distributors Ltd. is a merchandiser

(wholesaler).

(b) The operating cycle of these three businesses will be different. The longest

operating cycle will be experienced by the retailer, as the sales of merchandise

will be the slowest. The organization with the shortest operating cycle will be

the service firm that does not sell inventory. The third company, the distributing

wholesaler, will have an operating cycle between that of the retailer and the law

firm because its inventory is more likely to sell faster and the law firm has no

inventory to sell.

LO 1 BT: C Difficulty: M Time: 10 min. AACSB: None CPA: cpa-t001 CM: Reporting

Solutions Manual 5-24 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-2

Account Debited Account Credited

Item (a) (b) (c) (a) (b) (c)

1. Asset Inventory +$3,500 Asset Cash –$3,500

2. Liability Accounts –$750 Asset Inventory –$750

Payable

3. Asset Inventory +$4,000 Liability Accounts +$4,000

Payable

4. Asset Inventory +$400 Asset Cash –$400

5. Liability Accounts –$3,500 Asset Cash –$3,430

Payable Asset Inventory –$70

6. Asset Accounts +$10,000 Revenue Sales +$10,000

Receivable

Expense Cost of Goods +$4,000 Asset Inventory –$4,000

Sold

7. Contra Sales Returns +$750 Asset Cash –$750

Sales and Allowances

8. Expense Freight Out +$600 Asset Cash –$600

9. Contra Sales Returns +$1,000 Asset Accounts –$1,000

Sales and Allowances Receivable

Asset Inventory +$400 Expense Cost of –$400

Goods

Sold

10. Asset Cash +$6,000 Asset Accounts –$6,000

Receivable

LO 2,3 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-25 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-3

(a)

Sept. 2 Inventory (750 × $20).................................................. 15,000

Accounts Payable .................................................. 15,000

10 Accounts Payable (10 × $20) ...................................... 200

Inventory................................................................ 200

11 Accounts Receivable (260 × $30) ............................... 7,800

Sales ..................................................................... 7,800

Cost of Goods Sold (260 × $20) ................................. 5,200

Inventory................................................................ 5,200

14 Sales Returns and Allowances (10 × $30) .................. 300

Accounts Receivable ............................................. 300

Inventory (10 × $20).................................................... 200

Cost of Goods Sold ............................................... 200

21 Accounts Receivable (300 × $30) ............................... 9,000

Sales ..................................................................... 9,000

Cost of Goods Sold (300 × $20) ................................. 6,000

Inventory................................................................ 6,000

29 Accounts Payable ($15,000 – $200) ........................... 14,800

Cash ...................................................................... 14,800

30 Cash ($9,000 – $90) ................................................... 8,910

Sales Discounts ($9,000 × 1%)................................... 90

Accounts Receivable ............................................. 9,000

Solutions Manual 5-26 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-3 (CONTINUED)

(b)

Inventory

Sept. 1 Bal. 2,000 Sept.10 200

2 15,000 11 5,200

14 200 21 6,000

Sept. 30 Bal. 5,800

Cost of Goods Sold

Sept. 11 5,200 Sept. 14 200

21 6,000

Sept. 30 Bal. 11,000

(c)

Ending Inventory:

Number of calculators at September 30: 100 + 750 – 10 – 260 + 10 – 300 = 290

Cost of calculators at September 30: 290 × $20 = $5,800

Cost of Goods Sold:

Number of calculators sold in September: 260 – 10 + 300 = 550

Cost of calculators sold in September: 550 x $20 = $11,000

LO 2,3 BT: AP Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-27 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-4

(a) April 3 Inventory........................................................ 28,000

Accounts Payable .................................... 28,000

6 Inventory........................................................ 700

Cash......................................................... 700

7 Supplies......................................................... 5,000

Accounts Payable .................................... 5,000

8 Accounts Payable .......................................... 3,500

Inventory .................................................. 3,500

30 Accounts Payable ($28,000 – $3,500) .......... 24,500

Cash ........................................................ 24,500

(b) April 12 Accounts Payable ($28,000 – $3,500) .......... 24,500

Cash ($24,500 – $245) ............................ 24,255

Inventory ($24,500 × 1%) ......................... 245

LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-28 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-5

(a) April 3 Accounts Receivable ..................................... 28,000

Sales ........................................................ 28,000

Cost of Goods Sold ....................................... 19,000

Inventory .................................................. 19,000

6 No entry necessary - Freight costs paid by Olaf.

7 No entry necessary.

8 Sales Returns and Allowances ...................... 3,500

Accounts Receivable................................ 3,500

Inventory........................................................ 2,300

Cost of Goods Sold .................................. 2,300

30 Cash .............................................................. 24,500

Accounts Receivable ($28,000 – $3,500) 24,500

(b) April 12 Cash ($28,000 $3,500 – $245) ................... 24,255

Sales Discounts [($28,000 – $3,500) × 1%] .. 245

Accounts Receivable ($28,000 – $3,500) 24,500

LO 2 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-29 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-6

Boyle should choose to borrow cash at 8% 10 days from the date of the invoice. The

amount borrowed could be as little as the amount of the invoice less the purchase

discount. This is the amount needed to settle the payment 10 days from the date of

the invoice and earn the purchase discount of 1%. The loan can then be repaid after

20 days, which would be the date the invoice would have been paid if the loan had not

been obtained. The relevant period is 20 days because this is the amount of time a

loan would be outstanding in order to make the choice to pay within the discount

period.

Converting a 1% discount for 20 days equals an annualized interest rate of 18.25%

calculated as follows (1% × 365 ÷ 20) = 18.25%. Paying 8% to the bank to receive

18.25% from the supplier is the more favourable procedure to follow.

LO 2 BT: AP Difficulty: C Time: 15 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and

Finance

Solutions Manual 5-30 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-7

(a) Dec. 3 Accounts Receivable .......................................... 68,000

Sales ............................................................. 68,000

3 Cost of Goods Sold ............................................. 36,000

Inventory........................................................ 36,000

7 No entry necessary.

8 Sales Returns and Allowances ........................... 2,100

Accounts Receivable ..................................... 2,100

Inventory ............................................................. 1,150

Cost of Goods Sold ....................................... 1,150

11 Cash ($65,900 – $1,318) .................................... 64,582

Sales Discounts [($68,000 – $2,100) × 2%]........ 1,318

Accounts Receivable ($68,000 – $2,100) ...... 65,900

(b) Dec. 3 Inventory ............................................................. 68,000

Accounts Payable .......................................... 68,000

7 Inventory ............................................................. 900

Cash .............................................................. 900

8 Accounts Payable ............................................... 2,100

Inventory........................................................ 2,100

11 Accounts Payable ($68,000 – $2,100) ................ 65,900

Inventory [($68,000 - $2,100) × 2%] .............. 1,318

Cash ($65,900 – $1,318) ............................... 64,582

Solutions Manual 5-31 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-7 (CONTINUED)

(c) Sales ................................................................................... $68,000

Less: Sales returns and allowances ................................... $2,100

Sales discounts ........................................................ 1,318 3,418

Net sales ............................................................................. 64,582

Cost of goods sold ($36,000 – $1,150) ............................... 34,850

Gross profit ......................................................................... $29,732

LO 2,3,5 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-32 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-8

Account Statement Classification

Accounts payable Statement of financial position Current liabilities

Accounts receivable Statement of financial position Current assets

Accumulated depreciation Statement of financial position Property, plant, and

equipment (contra

account)

Administrative expenses Income statement Operating expenses

Buildings Statement of financial position Property, plant, and

equipment

Cash Statement of financial position Current assets

Common shares Statement of financial position Shareholders’ equity

Equipment Statement of financial position Property, plant, and

equipment

Income tax expense Income statement Income tax expenses

Interest expense Income statement Other revenues and

expenses

Interest payable Statement of financial position Current liabilities

Inventory Statement of financial position Current assets

Land Statement of financial position Property, plant, and

equipment

Mortgage payable Statement of financial position Non-current liabilities

Prepaid insurance Statement of financial position Current assets

Property tax payable Statement of financial position Current liabilities

Salaries payable Statement of financial position Current liabilities

Sales Income statement Revenue

Sales discounts Income statement Revenue (contra

account)

Sales returns and allowances Income statement Revenue (contra

account)

Unearned revenue Statement of financial position Current liabilities

LO 4 BT: C Difficulty: S Time: 20 min. AACSB: Analytic CPA:cpa-t001 CM: Reporting

Solutions Manual 5-33 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-9

(a)

BLUE DOOR CORPORATION

Income Statement (Single-Step)

Year Ended December 31, 2018

Revenues

Sales ......................................................................... $2,650,000

Less: Sales returns and allowances ............ $41,000

Sales discounts .................................. 19,500 60,500

Net sales ................................................................... 2,589,500

Interest revenue ....................................................... 30,000

Rent revenue ............................................................ 24,000 $2,643,500

Expenses

Cost of goods sold .................................................... $1,172,000

Salaries expense ....................................................... 705,000

Depreciation expense................................................ 125,000

Interest expense ........................................................ 62,000

Advertising expense .................................................. 55,000

Freight out ................................................................. 25,000

Insurance expense .................................................... 23,000

............................................................................. 2,167,000

Income before income tax .............................................. ............................. 476,500

Income tax expense ..................................................................................... 70,000

Net income ................................................................................................... $ 406,500

Solutions Manual 5-34 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-9 (CONTINUED)

(b)

BLUE DOOR CORPORATION

Income Statement (Multiple-Step)

Year Ended December 31, 2018

Sales ........................................................................................................ $2,650,000

Less: Sales returns and allowances ................................. $41,000

Sales discounts ....................................................... 19,500 60,500

Net sales................................................................................................... 2,589,500

Cost of goods sold .................................................................................... 1,172,000

Gross profit ............................................................................................... 1,417,500

Operating expenses

Salaries expense .......................................................... $705,000

Depreciation expense................................................... 125,000

Advertising expense ..................................................... 55,000

Freight out .................................................................... 25,000

Insurance expense ....................................................... 23,000

Total operating expenses ............................................................... 933,000

Income from operations ............................................................................ 484,500

Other revenues and expenses

Interest revenue .......................................................... $30,000

Rent revenue................................................................ 24,000

Interest expense ........................................................... (62,000) (8,000)

Income before income tax ........................................................................ 476,500

Income tax expense ................................................................................. 70,000

Net income ............................................................................................... $ 406,500

(Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from

operations)

(c) Blue Door Corporation is classifying its expenses by nature, such as salaries,

depreciation, and advertising. There is no classification of expenses into

administrative or selling as would be the case if classifying expenses by

functional areas. For smaller companies such as this one, the difference

between classification of items on the income statement by function or nature

is not significant.

LO 4 BT: AP Difficulty: M Time: 40 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-35 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-10

(a) Young Ltd.

Sales ....................................................................................... $99,000

*Less: Sales returns and allowances [1] ................................. 10,000

Net sales ................................................................................. $89,000

Net sales ................................................................................. $89,000

Less: Cost of goods sold ......................................................... 58,750

*Gross profit [2] ....................................................................... $30,250

Gross profit.............................................................................. $30,250

Less: Operating expenses ...................................................... 19,500

*Income from operations [3] .................................................... $10,750

Income from operations .......................................................... $10,750

Add: Other revenues ............................................................... 750

*Income before income tax [4]................................................. $11,500

Income before income tax ....................................................... $11,500

Less: Income tax expense ...................................................... 2,300

*Net income [5]........................................................................ $ 9,200

Rioux Ltée

*Sales [6] ................................................................................. $105,000

Less: Sales returns and allowances ........................................ 5,000

Net sales ................................................................................. $100,000

Net sales ................................................................................. $100,000

*Less: Cost of goods sold [7]................................................... 60,000

Gross profit.............................................................................. $ 40,000

Gross profit.............................................................................. $40,000

*Less: Operating expenses [8] ................................................ 22,000

Income from operations .......................................................... $18,000

Solutions Manual 5-36 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-10 (CONTINUED)

(a) (continued)

Income from operations .......................................................... $18,000

Less: Other expenses ............................................................. 2,000

*Income before income tax [9]................................................. $16,000

Income before income tax ....................................................... $16,000

*Less: Income tax expense [10] .............................................. 3,200

Net income .............................................................................. $12,800

* Indicates missing amount

(b) Young Rioux

Gross profit margin $30,250 ÷ $89,000 = 34.0% $40,000 ÷ $100,000 = 40.0%

Profit margin $9,200 ÷ $89,000 = 10.3% $12,800 ÷ $100,000 = 12.8%

LO 4,5 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and

Finance

Solutions Manual 5-37 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-11

(a) Marchant Ltd.

Sales ..................................................................................... $1,460,000

Less: Sales returns and allowances ..................................... 28,000

*Net sales [1] ......................................................................... $1,432,000

Net sales ............................................................................... $1,432,000

Less: Cost of goods sold ....................................................... 657,000

*Gross profit [2] ..................................................................... $ 775,000

Gross profit............................................................................ $775,000

Less: Operating expenses .................................................... 580,000

*Income from operations [3] .................................................. $195,000

Income from operations ........................................................ $195,000

Add: Other revenues ............................................................. 3,600

*Income before income tax [4]............................................... $198,600

Income before income tax ..................................................... $198,600

Less: Income tax expense .................................................... 38 600

*Net income [5]...................................................................... $160,000

Dueck Ltd.

*Sales [6] ............................................................................... $2,178,000

Less: Sales returns and allowances ...................................... 48,000

Net sales ............................................................................... $2,130,000

Net sales ............................................................................... $2,130,000

*Less: Cost of goods sold [7]................................................. 1,172,000

Gross profit............................................................................ $ 958,000

Gross profit............................................................................ $958,000

*Less: Operating expenses [8] .............................................. 648,000

Income from operations ........................................................ $310,000

Solutions Manual 5-38 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-11 (CONTINUED)

(a) (continued)

Income from operations ........................................................ $310,000

Less: Other expenses ........................................................... _ 4,100

*Income before income tax [9]............................................... $305,900

Income before income tax ..................................................... $305,900

*Less: Income tax expense [10] ............................................ 55,000

Net income ............................................................................ $250,900

* Indicates missing amount

(b) Marchant Dueck

Gross profit margin $775,000 ÷ $1,432,000 = 54.1% $958,000 ÷ $2,130,000 = 45.0%

Profit margin $160,000 ÷ $1,432,000 = 11.2% $250,900 ÷ $2,130,000 = 11.8%

LO 4,5 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and

Finance

Solutions Manual 5-39 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-12

(a)

MONTMORENCY LTÉE

Income Statement (Multiple-step)

Year Ended August 31, 2018

Sales ............................................................................... $7,200,000

Less: Sales discounts ....................................................... 110,000

Net sales................................................................................................... $7,090,000

Cost of goods sold .................................................................................... 4,030,000

Gross profit ............................................................................................... 3,060,000

Operating expenses

Administrative expenses .............................................. $670,000

Selling expenses .......................................................... 260,000

Total operating expenses ............................................................... 930,000

Income from operations ............................................................................ 2,130,000

Other revenues and expenses

Interest expense .................................................................................. 270,000

Income before income tax ........................................................................ 1,860,000

Income tax expense ................................................................................. 560,000

Net income ............................................................................................... $1,300,000

(Revenues – Contra revenues – Cost of goods sold – Operating expenses = Income from

operations)

(b) Expenses are classified by function (cost of goods sold, administrative, selling).

(c) Gross profit margin $3,060,000 ÷ $7,090,000 = 43.2%

Profit margin $1,300,000 ÷ $7,090,000 = 18.3%

LO 4,6 BT: AN Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and

Finance

Solutions Manual 5-40 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

EXERCISE 5-13

(in USD millions)

(a) Gross profit margin

2016: ($39,528 – $30,334) ÷ $39,528 = 23.3%

2015: ($40,339 – $31,292) ÷ $40,339 = 22.4%

2014: ($40,611 – $31,212) ÷ $40,611 = 23.1%

Profit margin (using net income)

2016: $807 ÷ $39,528 = 2.0%

2015: $1,246 ÷ $40,339 = 3.1%

2014: $695 ÷ $40,611 = 1.7%

(b) The gross profit margin has been holding steady, with a slight deterioration in

2015. The trend is the opposite for the profit margin, where the results of 2015

exceeded those of 2014 and 2016.

(c) Profit margin (using income from operations)

2016: $1,375 ÷ $39,528 = 3.5%

2015: $1,450 ÷ $40,339 = 3.6%

2014: $1,144 ÷ $40,611 = 2.8%

The profit margin using income from operations has followed the same trend in

2014 and 2016 when compared to profit margin. On the other hand, profit

margin using net income increased dramatically in 2015 while profit margin

using income from operations increased only slightly for the same year. The

major elements that are in the calculation of the profit margin ratio but are not

in the profit margin using income from operations are other revenues and

expenses, and income tax expense. In 2015, there must have been a significant

other revenue, or possibly a gain that caused a substantial increase in profit

margin compared to the year before and after 2015.

LO 5 BT: AN Difficulty: C Time: 20 min. AACSB: Analytic CPA: cpa-t001, cpa-t005 CM: Reporting and

Finance

Solutions Manual 5-41 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 5-14

Olaf Corp. (Buyer)

(a) Apr. 3 Purchases ................................................................... 28,000

Accounts Payable .................................................. 28,000

6 Freight In..................................................................... 700

Cash ...................................................................... 700

7 Supplies ...................................................................... 5,000

Accounts Payable .................................................. 5,000

8 Accounts Payable ....................................................... 3,500

Purchase Returns and Allowances ........................ 3,500

30 Accounts Payable ($28,000 – $3,500) ........................ 24,500

Cash ..................................................................... 24,500

(b) Apr. 12 Accounts Payable ($28,000 – $3,500) ........................ 24,500

Cash ($24,500 – $245) .......................................... 24,255

Purchase Discounts ($24,500 × 1%) ..................... 245

DeVito Ltd. (Seller)

(a) Apr. 3 Accounts Receivable .................................................. 28,000

Sales ..................................................................... 28,000

8 Sales Returns and Allowances ................................... 3,500

Accounts Receivable ............................................. 3,500

30 Cash .......................................................................... 24,500

Accounts Receivable ($28,000 – $3,500) .............. 24,500

(b) Apr. 12 Cash ($24,500 – $245) ............................................... 24,255

Sales Discounts [($28,000 – $3,500) × 1%]................ 245

Accounts Receivable ($28,000 – $3,500) .............. 24,500

LO 6 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-42 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 5-15

(a) Duvall Ltd. (Seller)

(1) Perpetual Inventory System

June 10 Accounts Receivable ........................................ 5,000

Sales ........................................................... 5,000

Cost of Goods Sold ........................................... 3,000

Inventory...................................................... 3,000

11 No entry

12 Sales Returns and Allowances ......................... 500

Accounts Receivable ................................... 500

19 Cash ($4,500 – $45) ......................................... 4,455

Sales Discounts ($4,500 × 1%) ........................ 45

Accounts Receivable ($5,000 – $500) ......... 4,500

(2) Periodic Inventory System

June 10 Accounts Receivable ........................................ 5,000

Sales ........................................................... 5,000

11 No entry

12 Sales Returns and Allowances ......................... 500

Accounts Receivable ................................... 500

19 Cash ($4,500 – $45) ......................................... 4,455

Sales Discounts ($4,500 × 1%) ........................ 45

Accounts Receivable ($5,000 – $500) ......... 4,500

Solutions Manual 5-43 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 5-15 (CONTINUED)

(b) Pele Ltd. (Buyer)

(1) Perpetual Inventory System

June 10 Inventory ............................................................. 5,000

Accounts Payable .......................................... 5,000

11 Inventory (freight) ................................................ 250

Cash .............................................................. 250

12 Accounts Payable ............................................... 500

Inventory (returns) ......................................... 500

19 Accounts Payable ($5,000 – $500) ..................... 4,500

Inventory ($4,500 × 1%) ................................ 45

Cash ($4,500 – $45) ...................................... 4,455

(2) Periodic Inventory System

June 10 Purchases ......................................................... 5,000

Accounts Payable ........................................ 5,000

11 Freight In........................................................... 250

Cash ............................................................ 250

12 Accounts Payable ............................................. 500

Purchase Returns and Allowances .............. 500

19 Accounts Payable ($5,000 – $500) ................... 4,500

Purchase Discounts ($4,500 × 1%) ............. 45

Cash ($4,500 – $45) .................................... 4,455

LO 2,3,6 BT: AP Difficulty: M Time: 20 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-44 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.

Kimmel, Weygandt, Kieso, Trenholm, Irvine, Burnley Financial Accounting, Seventh Canadian Edition

*EXERCISE 5-16

[1] $1,420 = ($1,500 – $50 – $30) [10] $7,560 = ($7,210 + $150 + $200)

[2] $1,550 = ($1,420 + $130) [11] $590 = ($7,800 – $7,210)

[3] $1,750 = ($1,550 + $200) [12] $8,800 = ($1,000 + $7,800)

[4] $270 = ($1,750 – $1,480) [13] $7,550 = ($8,800 [12]) – $1,250)

[5] $270 = [4] (same as ending, Yr 1) [14] $1,250 = given (same as ending, Yr 1)

[6] $1,950 = ($100 + $50 + $1,800) [15] $8,050 = ($8,550 – $400 – $100)

[7] $230 = ($2,030 [8] – $1,800) [16] $8,600 = ($8,050 [15] + $550)

[8] $2,030 = ($2,300 – $270 [5]) [17] $9,850 = ($1,250 [14] + $8,600 [16])

[9] $1,950 = ($2,300 – $350) [18] $8,350 = ($9,850 [17] – $1,500)

LO 6 BT: AN Difficulty: M Time: 30 min. AACSB: Analytic CPA: cpa-t001 CM: Reporting

Solutions Manual 5-45 Chapter 5

Copyright © 2017 John Wiley & Sons Canada, Ltd. Unauthorized copying, distribution, or transmission of this page is strictly prohibited.