Professional Documents

Culture Documents

Book Value of Stu (100%) : Pop Corporation and Subsidiary

Book Value of Stu (100%) : Pop Corporation and Subsidiary

Uploaded by

Kimberly0 ratings0% found this document useful (0 votes)

5 views4 pagesThe document provides financial information for Pop Corporation's partial acquisition and consolidation of Stu.

It summarizes that Pop acquired a 70% interest in Stu for $1,400, implying a total fair value of $2,000 for Stu. Stu's book value was $1,600, resulting in $400 of excess fair value over book value. This excess was allocated to inventories, plant assets, and goodwill.

At the end of 2011, Pop's investment balance in Stu was $1,442, Stu's noncontrolling interest was valued at $618, and various consolidation adjustments were made to present the consolidated financial statements of Pop Corporation and Subsidiary.

Original Description:

Tugas akl

Original Title

AKL

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial information for Pop Corporation's partial acquisition and consolidation of Stu.

It summarizes that Pop acquired a 70% interest in Stu for $1,400, implying a total fair value of $2,000 for Stu. Stu's book value was $1,600, resulting in $400 of excess fair value over book value. This excess was allocated to inventories, plant assets, and goodwill.

At the end of 2011, Pop's investment balance in Stu was $1,442, Stu's noncontrolling interest was valued at $618, and various consolidation adjustments were made to present the consolidated financial statements of Pop Corporation and Subsidiary.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views4 pagesBook Value of Stu (100%) : Pop Corporation and Subsidiary

Book Value of Stu (100%) : Pop Corporation and Subsidiary

Uploaded by

KimberlyThe document provides financial information for Pop Corporation's partial acquisition and consolidation of Stu.

It summarizes that Pop acquired a 70% interest in Stu for $1,400, implying a total fair value of $2,000 for Stu. Stu's book value was $1,600, resulting in $400 of excess fair value over book value. This excess was allocated to inventories, plant assets, and goodwill.

At the end of 2011, Pop's investment balance in Stu was $1,442, Stu's noncontrolling interest was valued at $618, and various consolidation adjustments were made to present the consolidated financial statements of Pop Corporation and Subsidiary.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

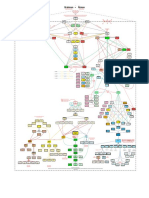

Preliminary computations (in thousands)

Cost of 70% investment in Stu $1400

Implied fair of Stu($1,400 / 70%) $2000

Book value of Stu (100%) 1600

Excess $400

Excess allocated:

Invetories $40

Plant assets 160

Goodwill 200

Excess 400

Investment balance at January 1, 2011 $1400

Share of Stu’s retained earnings increase( $120 x 70% ) 84

Less: amortization'

70% of excess allocated to inventories (sold in 2011) -28

70% of excess allocated to plant assets ($160 /8 years) -14

Investment balance at December 31, 2011 $1442

Noncontrolling interest at December 31

30% of Stu’s book value at December 31 ($1,720 x 30%) $516

30% of Goodwill 60

30% Unamortized excess for plant assets

30% x ($160 - $20 amortization) 42

Noncontrolling at December 31 (fair value) $618

Pop Corporation and Subsidiary

Consolidated Balance Sheet Working Papers at December 31, 2011

70% (in thousands)

Pop Stu Adjustments and Consolidated

Eliminations Balance Sheet

Cash $ 120 $ 40 $ 160

Accounts receivable — net 880 400 1,280

Accounts receivable — Pop 20 b 20

Dividends receivable 14 c 14

Inventories 1,000 640 1,640

Land 200 300 500

Plant assets — net 1,400 700 a 140 2,240

Investment in Stu 1,442 a 1,442

Goodwill a 200 200

Assets $5,056 $2,100 $6,020

Accounts payable $ 600 $ 160 $ 760

Account payable to Stu 20 b 20

Dividends payable 80 20 c 14 86

Long-term debt 1,200 200 1,400

Capital stock 2,000 1,000 a 1,000 2,000

Retained earnings 1,156 720 a 720 1,156

Noncontrolling interest

($2,060,000 30%) a 618 618

Equities $5,056 $2,100 $6,020

2011

Preliminary computations (in thousands)

80% Investment in Sam at cost January 1, 2011 $1520

Implied total fair value of Sam ($1,520 / 80%) $1900

Sam book value 1800

Excess fair value over book value recorded as goodwill $100

80% of

Sam Sam net

net

dividends income

income

2011 $80 $160 $128

2012 100 200 160

2013 120 240 192

$300 $600 $480

1. Sams divindends for 2012 ( $80 / 80% ) $100

2. Sams net income for 2012 ( $160 / 80% ) $200

3. Goodwill - Dec 31, 2013 $100

4. Noncontrolling interest share of income 2013

Sam’s income for 2013

($96 dividends received/80%) X 2 $240

Noncontrolling interest percentage 20%

Noncontrolling interest share $48

5. Noncontrolling interest December 31, 2013

Equity of Sam January 1, 2011 $1800

Add: Income for 2011, 2012 and 2013 600

Deduct: Dividends for 2011, 2012 and 2013 -300

Equity book value of Sam December 31, 2013 2100

Goodwill 100

Equity fair value of Sam December 31, 2013 $2200

Noncontrolling interest percentage 20%

Noncontrolling interest December 31, 2013 $440

6. Controlling share of consolidated net income for 2013

Pen’s separate income $560

Add: Income from Sam 192

Controlling share of consolidated net income $752

Pen’s net income $560

Sam’s net income 240

Consolidated net income $800

Less: Noncontrolling interest share ($240 x 20% ) 48

Controlling interest share $752

You might also like

- P4Document21 pagesP4reviska100% (1)

- Sheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalanceDocument4 pagesSheet at Acquisition: A. P.3-2. Allocation Schedule For Fair Value/book Value Differential and Consolidated BalancePrince Frederic Mangambu100% (1)

- P4Document21 pagesP4nancy tomanda100% (2)

- 3-9 FINANCIAL STATEMENTS The Davidson CorporationDocument3 pages3-9 FINANCIAL STATEMENTS The Davidson Corporationlai vivianNo ratings yet

- Ejercicio 7.5Document6 pagesEjercicio 7.5Enrique M.No ratings yet

- Andreau 2003, Banking and Business in The Roman World PDFDocument194 pagesAndreau 2003, Banking and Business in The Roman World PDFAlin DiaconuNo ratings yet

- TLE10 - ACP-NC-II - G10 - Q1 - Mod1 - Determine Inventory Inputs According To Enterprise Requirements - v3Document18 pagesTLE10 - ACP-NC-II - G10 - Q1 - Mod1 - Determine Inventory Inputs According To Enterprise Requirements - v3carolina lizardoNo ratings yet

- YeDocument5 pagesYeTiara Eva TresnaNo ratings yet

- Pacilio Securtiy Service Accounting EquationDocument11 pagesPacilio Securtiy Service Accounting EquationKailash KumarNo ratings yet

- CH 3 ADocument7 pagesCH 3 AZakariaHasaneenNo ratings yet

- Silvi Dewi Twigyasari - P3.11Document33 pagesSilvi Dewi Twigyasari - P3.11silvia twigNo ratings yet

- Reyhan Ario - 041911333106Document3 pagesReyhan Ario - 041911333106Reyhan ArioNo ratings yet

- Solution E3-8 (In Thousands) 1: Capital StockDocument3 pagesSolution E3-8 (In Thousands) 1: Capital StockRifda AmaliaNo ratings yet

- Tugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Document5 pagesTugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- Pangestu Jalu Bagaskoro F0317079Document2 pagesPangestu Jalu Bagaskoro F0317079Geroro D'PhoenixNo ratings yet

- Tugas AklDocument5 pagesTugas AklJessica HutabaratNo ratings yet

- TUGAS Pamplin MK1.Document2 pagesTUGAS Pamplin MK1.Nan BaeeeNo ratings yet

- Palmer Corporation and Subsidiary Consolidated Balance Sheet at December 31,2006 (In Thousands)Document3 pagesPalmer Corporation and Subsidiary Consolidated Balance Sheet at December 31,2006 (In Thousands)m habiburrahman55No ratings yet

- Tugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Document8 pagesTugas Minggu 7 Akl Nama: Hidayani Puteri NIM: 20043136Hidayani Puteri100% (1)

- Quiz Advance AccountingDocument5 pagesQuiz Advance AccountingGeryNo ratings yet

- Tugas IndividuDocument6 pagesTugas IndividuMuhammad Fauzan H FauzanNo ratings yet

- Tugas 3 - AKL 1Document2 pagesTugas 3 - AKL 1Geroro D'PhoenixNo ratings yet

- Tugas Chapter 4 - Part 2 - 041811333044 - Yefi Nia OpianaDocument4 pagesTugas Chapter 4 - Part 2 - 041811333044 - Yefi Nia OpianaYefinia OpianaNo ratings yet

- Combined Income and Retained EarningsDocument2 pagesCombined Income and Retained Earningsyusufahriza25No ratings yet

- Pop Corporation and SubsidiaryDocument1 pagePop Corporation and SubsidiaryRezita ElyaNo ratings yet

- Advanced Accounting Eams 11 Ed-Halaman-DihapusDocument2 pagesAdvanced Accounting Eams 11 Ed-Halaman-DihapusAurell MonicaNo ratings yet

- Income Statement: Poe Corporation and SubsidiaryDocument11 pagesIncome Statement: Poe Corporation and SubsidiaryRima WahyuNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Tugas AKL P3-2 P3-3 - Athaya Sekar - 120110190049Document4 pagesTugas AKL P3-2 P3-3 - Athaya Sekar - 120110190049AthayaSekarNovianaNo ratings yet

- Latihan Soal Akl CH 1 Dan 2Document12 pagesLatihan Soal Akl CH 1 Dan 2DheaNo ratings yet

- CH 3 Cost ControlDocument3 pagesCH 3 Cost ControlAli B BasahiNo ratings yet

- Syukur Tugas Akl IiDocument3 pagesSyukur Tugas Akl IiMuhammad SyukurNo ratings yet

- Aa CH 6Document26 pagesAa CH 6into-the- unknownNo ratings yet

- AFN MINI CASE STUDY CLASS Excel SAMPLEDocument6 pagesAFN MINI CASE STUDY CLASS Excel SAMPLEMuhammad Ali SamarNo ratings yet

- An Introduction To Consolidated Financial StatementDocument27 pagesAn Introduction To Consolidated Financial StatementKelvin Febriansyah PratamaNo ratings yet

- Tugas Problem - Kel7Document3 pagesTugas Problem - Kel7AshdhNo ratings yet

- Preliminary ComputationsDocument3 pagesPreliminary ComputationsFarrell DmNo ratings yet

- Horsefield - CorrectedDocument4 pagesHorsefield - CorrectedMarie Xavier - FelixNo ratings yet

- Kasus Chapter 4.answerDocument3 pagesKasus Chapter 4.answermadesugandhiNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Anggota 1. Elsa Listiana 6. 2. Fadhila Alya Darindrani 7. 3. Intan Fitriani 8. 4. Iraul Aini 9. 5. Irfa' Muhammad AkromDocument12 pagesAnggota 1. Elsa Listiana 6. 2. Fadhila Alya Darindrani 7. 3. Intan Fitriani 8. 4. Iraul Aini 9. 5. Irfa' Muhammad AkromRima WahyuNo ratings yet

- AKL P6-2 Achmad Faizal AzmiDocument5 pagesAKL P6-2 Achmad Faizal AzmiTiara Eva Tresna100% (1)

- P9-1 Polly and Subsidiaries: Sea's BooksDocument9 pagesP9-1 Polly and Subsidiaries: Sea's BooksFarrell DmNo ratings yet

- CH 4 Cost ControlDocument6 pagesCH 4 Cost ControlAli B BasahiNo ratings yet

- p4 2Document5 pagesp4 2Ernike SariNo ratings yet

- 417 Assignment #1Document26 pages417 Assignment #1Gloria GuanNo ratings yet

- Materi Lab 5 - Consolidated Techniques and ProceduresDocument7 pagesMateri Lab 5 - Consolidated Techniques and ProceduresrahayuNo ratings yet

- Chapter 5 SolutionDocument47 pagesChapter 5 SolutionJay-PNo ratings yet

- FM1Document4 pagesFM1Minas SydNo ratings yet

- Accounting in BusinessesDocument5 pagesAccounting in BusinessesNyesha GarbuttNo ratings yet

- LAB 5 - Materi (Consolidation Techniques - Procedures)Document6 pagesLAB 5 - Materi (Consolidation Techniques - Procedures)Alvira FajriNo ratings yet

- Carley NDocument11 pagesCarley NaliNo ratings yet

- Chapter 2. Model For Financial Statements, Cash Flows, and TaxesDocument3 pagesChapter 2. Model For Financial Statements, Cash Flows, and TaxesNaser Fayyaz KhawajaNo ratings yet

- Fahmi Gilang Madani - 120110170024 - Tugas AKLDocument6 pagesFahmi Gilang Madani - 120110170024 - Tugas AKLFahmi GilangNo ratings yet

- Jawaban Soal Hitungan Bab 4Document16 pagesJawaban Soal Hitungan Bab 4Aheir lessNo ratings yet

- Problem 7-3 Akl 2Document3 pagesProblem 7-3 Akl 2andi nanaNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 4.3 Sant Gadge MaharajDocument10 pages4.3 Sant Gadge MaharajSaahil LedwaniNo ratings yet

- Intro To Vedanta and Tattva Bodha Mind MDocument1 pageIntro To Vedanta and Tattva Bodha Mind MNitin BaviskarNo ratings yet

- TR 11 Properties of New Zealand Concrete AggregatesDocument62 pagesTR 11 Properties of New Zealand Concrete Aggregatesmugger400No ratings yet

- Scoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuDocument4 pagesScoala: Avizat Director, Profesor: Clasa: Manual:: Gimnaziala Nr.2, MilcovatuGianina EneNo ratings yet

- Liofilchem SystemsDocument12 pagesLiofilchem SystemsDialife Medical Equipment and Supplies100% (1)

- FAWDE 30 kVA 4DW92-39DDocument2 pagesFAWDE 30 kVA 4DW92-39DckondoyNo ratings yet

- Thesis The Relationship Between LeadershDocument80 pagesThesis The Relationship Between LeadershsegunNo ratings yet

- 18 Waw MaddDocument76 pages18 Waw MaddKarim AlGafarawyNo ratings yet

- DATA6211 EaDocument9 pagesDATA6211 Eanzfpbte564No ratings yet

- Catamco. A InfographDocument1 pageCatamco. A InfographAvian Henna CatamcoNo ratings yet

- Elec 3 Presentation GuidelinesDocument2 pagesElec 3 Presentation Guidelinesarnel moontonNo ratings yet

- Bidding Document For Construction of Indoor Stadium at Zuangtui, Aizawl Volume-IiDocument104 pagesBidding Document For Construction of Indoor Stadium at Zuangtui, Aizawl Volume-Iisonmezender9100% (1)

- Tests Flyers 4 BookDocument76 pagesTests Flyers 4 BookEduard DaneliucNo ratings yet

- Square or Quadrille.: Classifications of Folk Dance A. Geographical Origin D. FormationDocument6 pagesSquare or Quadrille.: Classifications of Folk Dance A. Geographical Origin D. FormationchrstnmrsgnNo ratings yet

- Gender and Women's History in America Reading List (2019)Document5 pagesGender and Women's History in America Reading List (2019)Abby GruberNo ratings yet

- Anna University: Courses Ug CoursesDocument7 pagesAnna University: Courses Ug Coursesbasheersmiles100% (5)

- Diction Literary TermDocument2 pagesDiction Literary Termbeautifullife never giveupNo ratings yet

- Module 3Document37 pagesModule 3Melanie De Felipe SilveroNo ratings yet

- Books Doubtnut Question BankDocument125 pagesBooks Doubtnut Question BankjyvnkuvvvNo ratings yet

- 9 - Marking and Packing InstructionsDocument10 pages9 - Marking and Packing InstructionsarkcgemNo ratings yet

- Tender - Supply of Surveyor & SupervisorDocument16 pagesTender - Supply of Surveyor & SupervisormeenuNo ratings yet

- Press Maintenance Troubleshooting AND "Pressroom Safety" ManualDocument45 pagesPress Maintenance Troubleshooting AND "Pressroom Safety" ManualArturo de la VegaNo ratings yet

- City of Richmond Employee Salaries-2022-10Document192 pagesCity of Richmond Employee Salaries-2022-10OpenOversightVA.orgNo ratings yet

- Persuasive Speech Analysis InstructionsDocument2 pagesPersuasive Speech Analysis Instructionsapi-552410496No ratings yet

- Classified 2015 03 29 000000Document9 pagesClassified 2015 03 29 000000sasikalaNo ratings yet

- 407 ETR HighwayDocument14 pages407 ETR Highwaybhavin shahNo ratings yet

- Data Is Useless ENFRDocument28 pagesData Is Useless ENFRMathieu Dufour (Bloodbee)No ratings yet