Professional Documents

Culture Documents

Unit - 4.6 Hicks Theory.

Unit - 4.6 Hicks Theory.

Uploaded by

Deeksha KapoorCopyright:

Available Formats

You might also like

- Macro Economy Today 14th Edition Schiller Test Bank 1Document96 pagesMacro Economy Today 14th Edition Schiller Test Bank 1deborah100% (56)

- Quiz 561Document5 pagesQuiz 561Haris NoonNo ratings yet

- Ba0508 19-20 1Document8 pagesBa0508 19-20 1ccNo ratings yet

- The Modern Theory of Income and EmploymentDocument12 pagesThe Modern Theory of Income and EmploymentShivani Goel100% (1)

- Investment Multiplier - EconomicsDocument5 pagesInvestment Multiplier - Economicsanon_357116694100% (1)

- Hicks Theory of Trade CycleDocument4 pagesHicks Theory of Trade Cyclecontactraj08No ratings yet

- Business CyclesDocument25 pagesBusiness CyclesMayank SinghalNo ratings yet

- KaldorsDocument7 pagesKaldorsArbin KhatriNo ratings yet

- NOTES On Investment Function in An EconomyDocument8 pagesNOTES On Investment Function in An EconomyNazmun BegamNo ratings yet

- 7f03investment DecisionDocument22 pages7f03investment DecisionphanikrishNo ratings yet

- Accelerator Theory of InvestmentDocument14 pagesAccelerator Theory of InvestmentcarolsaviapetersNo ratings yet

- Summary Ch.7 Economic GrowthDocument4 pagesSummary Ch.7 Economic GrowthExza XNo ratings yet

- Investment TheoryDocument7 pagesInvestment TheoryJoshua KirbyNo ratings yet

- Module 2Document6 pagesModule 2Cristeta BaysaNo ratings yet

- Domar Model of Growt1Document6 pagesDomar Model of Growt1vikram inamdarNo ratings yet

- Assignm NT 2 EconDocument4 pagesAssignm NT 2 EconMeherun MehbuNo ratings yet

- ECONOMICSDocument15 pagesECONOMICSAnirrudh JoshiNo ratings yet

- Module-6 Rational Expectations Equilibrium ApproachDocument20 pagesModule-6 Rational Expectations Equilibrium ApproachNeha GuptaNo ratings yet

- Theory of EmploymentDocument19 pagesTheory of EmploymentRajesh GargNo ratings yet

- Introduction To Solow-Swan Model by Aghion & HowittDocument8 pagesIntroduction To Solow-Swan Model by Aghion & HowittrezaewewqewqeNo ratings yet

- Trade CyclesDocument13 pagesTrade CyclesAppan Kandala VasudevacharyNo ratings yet

- WINSEM2023-24 BMT2001 TH CH2023240502140 Reference Material I 18-01-2024 Principle of AcceleratorDocument14 pagesWINSEM2023-24 BMT2001 TH CH2023240502140 Reference Material I 18-01-2024 Principle of AcceleratorSwetha iyerNo ratings yet

- An Analysis On Theories of Business CycleDocument5 pagesAn Analysis On Theories of Business CycleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chapter 6 - The Investment FunctionDocument22 pagesChapter 6 - The Investment FunctionChelsea Anne VidalloNo ratings yet

- Chap 10-Business CycleDocument43 pagesChap 10-Business CycleNabeel AhmedNo ratings yet

- Business Cycles & Theories of Business CyclesDocument7 pagesBusiness Cycles & Theories of Business CyclesAppan Kandala VasudevacharyNo ratings yet

- MacroeconomicsDocument14 pagesMacroeconomicsmafan9946No ratings yet

- The Business Cycle: Definition and PhasesDocument6 pagesThe Business Cycle: Definition and PhasesIbrahim Khan100% (1)

- Attachment Video 1 - The IS Curve Lyst7050 PDFDocument22 pagesAttachment Video 1 - The IS Curve Lyst7050 PDFSaumyaNo ratings yet

- Theory of Unbalanced Growth PDFDocument19 pagesTheory of Unbalanced Growth PDFSuardi Hidayat PrikitiewwNo ratings yet

- Keynesian Analysis of Unemployment and InflationDocument10 pagesKeynesian Analysis of Unemployment and InflationShantie PittNo ratings yet

- Theories of Multiplier, Accelerator and Business CyclesDocument30 pagesTheories of Multiplier, Accelerator and Business CyclesProfessor Tarun DasNo ratings yet

- IGNOU MEC-002 Free Solved Assignment 2012Document8 pagesIGNOU MEC-002 Free Solved Assignment 2012manish.cdmaNo ratings yet

- Solow Growth ModelDocument10 pagesSolow Growth Modelanonim anonimNo ratings yet

- Keynesian Theory of Trade Cycle: 7 Criticisms: Crucial Role of InvestmentDocument9 pagesKeynesian Theory of Trade Cycle: 7 Criticisms: Crucial Role of InvestmentSwastik GroverNo ratings yet

- Mahalanobis MOdel of GrowthDocument7 pagesMahalanobis MOdel of GrowthPrajjwal AgrawalNo ratings yet

- Meaning of Business CycleDocument10 pagesMeaning of Business CycleAAMIR IBRAHIMNo ratings yet

- Year 12 Economics Mid Semester 1 Revision 2019: 1. The Business CycleDocument27 pagesYear 12 Economics Mid Semester 1 Revision 2019: 1. The Business CycleLucy PhanNo ratings yet

- Chapter No.34Document13 pagesChapter No.34Kamal Singh100% (2)

- IGNOU MEC-004 Free Solved Assignment 2012Document8 pagesIGNOU MEC-004 Free Solved Assignment 2012manish.cdmaNo ratings yet

- Keynesian Theory of Employment: ObjectivesDocument16 pagesKeynesian Theory of Employment: ObjectivesShashank Cooled RanaNo ratings yet

- Equilibrium Income and OutputDocument10 pagesEquilibrium Income and OutputPraveen ManchalNo ratings yet

- EconomicsDocument5 pagesEconomicsDhananjay ChauhanNo ratings yet

- Lesson 40 PDFDocument17 pagesLesson 40 PDFSusheel KumarNo ratings yet

- Business Cycles: Prof. (DR) Vandana BhavsarDocument34 pagesBusiness Cycles: Prof. (DR) Vandana BhavsarAKHIL JOSEPHNo ratings yet

- Course Code: ECON3020R: Solow ModelDocument23 pagesCourse Code: ECON3020R: Solow Modelelizabethhapsay01No ratings yet

- Circular Flow of Income - 2 Sector, 3 Sector and 4 Sector EconomyDocument20 pagesCircular Flow of Income - 2 Sector, 3 Sector and 4 Sector Economysumitsaha2630% (1)

- Evolution of CapitalismDocument9 pagesEvolution of CapitalismRitika MalhotraNo ratings yet

- 2.4. National IncomeDocument10 pages2.4. National IncomeVaskia KastroNo ratings yet

- The Theory of Multiplier and Acceleration Principle: Vaghela Nayan K. SDJ International CollegeDocument21 pagesThe Theory of Multiplier and Acceleration Principle: Vaghela Nayan K. SDJ International CollegeAnonymous y3E7iaNo ratings yet

- Assignment Solution Guide SESSION: (2017-2018) : AnswersDocument11 pagesAssignment Solution Guide SESSION: (2017-2018) : Answersnitikanehi100% (1)

- L4 - Academic ScriptDocument24 pagesL4 - Academic ScriptNaomi SaldanhaNo ratings yet

- IGNOU MEC-004 Free Solved Assignment 2012Document8 pagesIGNOU MEC-004 Free Solved Assignment 2012manuraj4No ratings yet

- 1210830238model of Economic Growth of John Robinson - MA (Sem-IV) - Economics (1) 2Document6 pages1210830238model of Economic Growth of John Robinson - MA (Sem-IV) - Economics (1) 2valentinoeleftheriouNo ratings yet

- The Circular Flow of National IncomeDocument12 pagesThe Circular Flow of National IncomePallaviSinhaNo ratings yet

- Harrod Model of GrowthDocument6 pagesHarrod Model of Growthvikram inamdarNo ratings yet

- CH - 13, 14 and 15 (Solved Booklet Page)Document14 pagesCH - 13, 14 and 15 (Solved Booklet Page)Rumana AliNo ratings yet

- Chapter No.35Document5 pagesChapter No.35Kamal SinghNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- MCom-Commerce 071022Document55 pagesMCom-Commerce 071022Deeksha KapoorNo ratings yet

- Quantitative Chapter 9 - Permutations and CombinationsDocument13 pagesQuantitative Chapter 9 - Permutations and CombinationsDeeksha KapoorNo ratings yet

- MBA Admission Policy Batch 2022 24Document3 pagesMBA Admission Policy Batch 2022 24Deeksha KapoorNo ratings yet

- Quantitative Chapter 7 - Indices and SurdsDocument9 pagesQuantitative Chapter 7 - Indices and SurdsDeeksha KapoorNo ratings yet

- Master Series CAT 9Document89 pagesMaster Series CAT 9Deeksha KapoorNo ratings yet

- Quantitative Chapter 4 - GeometryDocument25 pagesQuantitative Chapter 4 - GeometryDeeksha KapoorNo ratings yet

- Cat 400Document52 pagesCat 400Deeksha KapoorNo ratings yet

- Quantitative Chapter 8 - LogarithmDocument7 pagesQuantitative Chapter 8 - LogarithmDeeksha KapoorNo ratings yet

- Master Series CAT 10Document90 pagesMaster Series CAT 10Deeksha KapoorNo ratings yet

- MBA Colleges For FinanceDocument1 pageMBA Colleges For FinanceDeeksha KapoorNo ratings yet

- XAT-2022 Score Vs PercentileDocument1 pageXAT-2022 Score Vs PercentileDeeksha KapoorNo ratings yet

- Books and Authors 2021Document4 pagesBooks and Authors 2021Deeksha KapoorNo ratings yet

- Name of Exercise Participating Nations Conducted atDocument3 pagesName of Exercise Participating Nations Conducted atDeeksha KapoorNo ratings yet

- Marketing Mix: Basic Marketing - A Managerial ApproachDocument4 pagesMarketing Mix: Basic Marketing - A Managerial ApproachDeeksha KapoorNo ratings yet

- HKKJRH Izca/K Lalfkku Banksj: Indian Institute of Management IndoreDocument12 pagesHKKJRH Izca/K Lalfkku Banksj: Indian Institute of Management IndoreDeeksha KapoorNo ratings yet

- DocScanner 12 Nov 2022 8 47 PMDocument1 pageDocScanner 12 Nov 2022 8 47 PMDeeksha KapoorNo ratings yet

- Quantitative Part 2 Solution - 1Document45 pagesQuantitative Part 2 Solution - 1Deeksha KapoorNo ratings yet

- Top DILR Sets For CAT 2022Document42 pagesTop DILR Sets For CAT 2022Deeksha KapoorNo ratings yet

- Marketing Management C-506 Buying Motives of ConsumersDocument3 pagesMarketing Management C-506 Buying Motives of ConsumersDeeksha KapoorNo ratings yet

- Statistical Quality ControlDocument8 pagesStatistical Quality ControlDeeksha KapoorNo ratings yet

- Income Tax PDF 1Document18 pagesIncome Tax PDF 1Deeksha KapoorNo ratings yet

- Performance Analysis of Public & Private Sector Insurance Companies in IndiaDocument5 pagesPerformance Analysis of Public & Private Sector Insurance Companies in IndiaDeeksha KapoorNo ratings yet

- StatisticsDocument5 pagesStatisticsDeeksha KapoorNo ratings yet

- Consumer Behaviour: Kritika Malhotra NPGCDocument18 pagesConsumer Behaviour: Kritika Malhotra NPGCDeeksha KapoorNo ratings yet

- Unit - 3.1 Keynes Theory of Employment.Document3 pagesUnit - 3.1 Keynes Theory of Employment.Deeksha KapoorNo ratings yet

- Verification of Specific Intangible AssetsDocument3 pagesVerification of Specific Intangible AssetsDeeksha KapoorNo ratings yet

- Liabilities of An Audito1Document6 pagesLiabilities of An Audito1Deeksha KapoorNo ratings yet

- Indian-Financial-System - Full NotesDocument118 pagesIndian-Financial-System - Full NotesDeeksha KapoorNo ratings yet

- Unit 2 - Vouching: Vouching OF Cash ReceiptsDocument11 pagesUnit 2 - Vouching: Vouching OF Cash ReceiptsDeeksha KapoorNo ratings yet

- Unit III Answers To Extra Practice QuestionsDocument96 pagesUnit III Answers To Extra Practice QuestionsShahana KhanNo ratings yet

- Assignment Standard Costing SolutionsDocument13 pagesAssignment Standard Costing SolutionsMartha MasalangkayNo ratings yet

- NOTE All These Questions Will Have Similar Answer Q .How Will Equilibrium Level of Income Be Reached in Following CasesDocument3 pagesNOTE All These Questions Will Have Similar Answer Q .How Will Equilibrium Level of Income Be Reached in Following CasesTashiTamangNo ratings yet

- National Income Practice QuestionsDocument29 pagesNational Income Practice QuestionsSujalNo ratings yet

- Economics-II: Ashita AllamrajuDocument47 pagesEconomics-II: Ashita AllamrajuutkarshNo ratings yet

- Growth Crisis in Agriculture: Severity and Options at National and State LevelsDocument6 pagesGrowth Crisis in Agriculture: Severity and Options at National and State LevelsNidheesh JosephNo ratings yet

- Investment TheoryDocument23 pagesInvestment TheoryAnkita MalikNo ratings yet

- Product Costing Overview SAPDocument48 pagesProduct Costing Overview SAPKathiresan NagarajanNo ratings yet

- Chapter 4Document13 pagesChapter 4Tariku KolchaNo ratings yet

- Lecture 5 - Marginal Costing Differential Cost AnalysisDocument2 pagesLecture 5 - Marginal Costing Differential Cost Analysisprapulla sureshNo ratings yet

- Foundations of Macroeconomics 7th Edition Bade Test Bank 1Document91 pagesFoundations of Macroeconomics 7th Edition Bade Test Bank 1harry100% (42)

- Prs Econ Ch21 9eDocument55 pagesPrs Econ Ch21 9eAlecks MadronaNo ratings yet

- Macroeconomics 15th Edition Mcconnell Solutions ManualDocument17 pagesMacroeconomics 15th Edition Mcconnell Solutions Manualdencuongpow5100% (26)

- DHL Global Connectedness Index 2011Document242 pagesDHL Global Connectedness Index 2011bcrucqNo ratings yet

- EW BEP L2 GrowthDocument21 pagesEW BEP L2 GrowthSimanta SahaNo ratings yet

- 10 - Standard Costing and Variance AnalysisDocument26 pages10 - Standard Costing and Variance AnalysisKonodio DarudeNo ratings yet

- 0-Dom511 Operations Management Practice Topic OneDocument65 pages0-Dom511 Operations Management Practice Topic OneostapNo ratings yet

- Bilu Chap 3Document16 pagesBilu Chap 3borena extensionNo ratings yet

- Factors Influencing Economic Growth of BangladeshDocument52 pagesFactors Influencing Economic Growth of BangladeshMahmud EnterpriseNo ratings yet

- Employee ProductivityDocument91 pagesEmployee Productivityhemanth100% (1)

- Class Ec DevelopmentDocument109 pagesClass Ec DevelopmentJacques MUnyemanaNo ratings yet

- Ica Question BankDocument22 pagesIca Question Bankicchapurtiutsavmandal1No ratings yet

- Measures of National Income and OutputDocument10 pagesMeasures of National Income and OutputMohammed YunusNo ratings yet

- CBM Module 2Document3 pagesCBM Module 2Valdez AlyssaNo ratings yet

- Economics of Input and Product SubstitutionDocument105 pagesEconomics of Input and Product SubstitutionNadhiNo ratings yet

- tb10 1Document14 pagestb10 1PeterNo ratings yet

- CH 4 The Theory of Production and CostDocument30 pagesCH 4 The Theory of Production and Costserway bookNo ratings yet

Unit - 4.6 Hicks Theory.

Unit - 4.6 Hicks Theory.

Uploaded by

Deeksha KapoorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit - 4.6 Hicks Theory.

Unit - 4.6 Hicks Theory.

Uploaded by

Deeksha KapoorCopyright:

Available Formats

Navigation

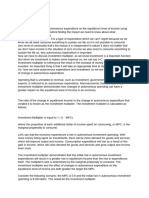

Hicks’ Theory of Trade Cycle

Hicks put forward a theory of business cycles based on the interaction between

the multiplier and accelerator by choosing certain values of marginal propensity

to consume (c) and capital- output ratio (v).

ik

sh

k au

al

m

ka

Hicks’ theory of business cycles has been explained with the help of Fig. In this

figure, AA line represents autonomous investment. Hicks assumes that

autonomous investment grows annually at a constant rate given by the slope of

the line AA.

Given the marginal propensity to consume, the simple multiplier is determined.

Then the magnitude of multiplier and autonomous investment together

determine the equilibrium path of income shown by the line LL. Hicks calls this

the floor line as this sets the lower limits below which income (output) cannot fall

because of a given rate of growth of autonomous investment and the given size of

the multiplier.

If national income grows from one year to the next, as it would move along the

line LL, there is some amount of induced investment via accelerator. The line EE

shows the equilibrium growth path of national income determined by

autonomous investment and the combined effect of the multiplier and

accelerator. FF is the full employment ceiling.

Given the constant growth of autonomous investment, the magnitude of

multiplier and the induced investment determined by the accelerator, the

ik

economy will be moving along the equilibrium growth path line EE. Thus starting

from point E, the economy will be in equilibrium moving along the path EE

sh

determined by the combined effect of multiplier and accelerator and the growing

level of the autonomous investment.

au

Suppose when the economy reaches point P0 along the path EE, there is an

k

external shock—say an outburst of investment due to certain innovation or jump

in governmental investment. When the economy experiences such an outburst of

al

autonomous investment it pushes the economy above the equilibrium growth

m

path EE after point P0.

The rise in autonomous investment due to external shock causes national income

ka

to increase at a greater rate than that shown by the slope of EE. This greater

increase in national income will cause further increase in induced investment

through acceleration effect. This increase in induced investment causes national

income to increase by a magnified amount through multiplier.

So under the combined effect of multiplier and accelerator, national income or

output will rapidly expand along the path from P 0 to P1. Movement from PQ to

P1 represents the upswing or expansion phase of the business cycle. But this

expansion must stop at P1 because this is the full employment output ceiling. The

limited human and material resources of the economy do not permit a greater

expansion of national income than shown by the ceiling line CC.

Therefore, when point P1 is reached the rapid growth of national income must

come to an end. When point P1 is reached the economy must grow at the same

rate as the usual growth in autonomous investment.

For a short time the economy may crawl along the full employment ceiling CC.

But because national income has ceased to increase at the rapid rate, the induced

investment via accelerator falls off to the level consistent with the modest rate of

growth determined by the constant rate of growth of autonomous investment.

But the economy cannot crawl along its full employment ceiling for a long time.

The sharp decline in growth of income and consumption when the economy

strikes the ceiling causes a sharp decline in induced investment. Thus with the

sharp decline in induced investment when national income and hence

ik

consumption ceases to increase rapidly, the contraction in the level of the income

and business actually must begin.

sh

Once the downswing starts, the accelerator works in the reverse direction. Thus

au

there is slackening off at point P2 and national income starts moving toward

equilibrium growth path EE. This movement from P2 downward therefore

k

represents the downswing or contraction phase of the business cycle.

In this downswing investment falls off rapidly and therefore multiplier works in

al

the reverse direction. The fall in national income and output resulting from the

m

sharp fall in induced investment will not stop on touching the level EE but will go

further down. The economy must consequently move all the way down from

ka

point P2 to point Q1. But at point Q1 the floor has been reached.

After hitting the floor the economy may for some time crawl along the floor

through the path Q1 to Q2. In doing so, there is some growth in the level of

national income. This rate of growth as before induces investment and both the

multiplier and accelerator come into operation and the economy will move

towards Q3 and the full employment ceiling CC. This is how the upswing of

cyclical movement again starts.

Critical Appraisal of Hicks’ Theory:

But Hicks’ theory of trade cycles is not without critics. A major weakness of

Hicks’ theory, according to Kaldor, is that it is based on the principle of

acceleration in its rigid form. If the rigid form of acceleration principle is not

valid, then the interaction of the multiplier and accelerator which is the crucial

concept of the Hicksian theory of trade cycles is not valid.

Thus Duesenberry writes, “The basic concept of multiplier-accelerator interaction

is important one but we cannot really accept to explain observed cycles by a

mechanical application of that concept.” and, according to him, Hicks in his

business cycle theory actually tries to do so.

However, despite the shortcomings of Hicks’ theory of business cycles, this is a

valuable contribution to the theory of business cycles. Even its critics such as

Kaldor though indicating some of its weaknesses acknowledge its merits.

Thus Kaldor writes that “Hicks’ theory of trade cycles provides us many brilliant

ik

and original pieces of analysis”. Duesenberry considers it as an “ingenious piece

sh

of work’.

k au

al

m

ka

You might also like

- Macro Economy Today 14th Edition Schiller Test Bank 1Document96 pagesMacro Economy Today 14th Edition Schiller Test Bank 1deborah100% (56)

- Quiz 561Document5 pagesQuiz 561Haris NoonNo ratings yet

- Ba0508 19-20 1Document8 pagesBa0508 19-20 1ccNo ratings yet

- The Modern Theory of Income and EmploymentDocument12 pagesThe Modern Theory of Income and EmploymentShivani Goel100% (1)

- Investment Multiplier - EconomicsDocument5 pagesInvestment Multiplier - Economicsanon_357116694100% (1)

- Hicks Theory of Trade CycleDocument4 pagesHicks Theory of Trade Cyclecontactraj08No ratings yet

- Business CyclesDocument25 pagesBusiness CyclesMayank SinghalNo ratings yet

- KaldorsDocument7 pagesKaldorsArbin KhatriNo ratings yet

- NOTES On Investment Function in An EconomyDocument8 pagesNOTES On Investment Function in An EconomyNazmun BegamNo ratings yet

- 7f03investment DecisionDocument22 pages7f03investment DecisionphanikrishNo ratings yet

- Accelerator Theory of InvestmentDocument14 pagesAccelerator Theory of InvestmentcarolsaviapetersNo ratings yet

- Summary Ch.7 Economic GrowthDocument4 pagesSummary Ch.7 Economic GrowthExza XNo ratings yet

- Investment TheoryDocument7 pagesInvestment TheoryJoshua KirbyNo ratings yet

- Module 2Document6 pagesModule 2Cristeta BaysaNo ratings yet

- Domar Model of Growt1Document6 pagesDomar Model of Growt1vikram inamdarNo ratings yet

- Assignm NT 2 EconDocument4 pagesAssignm NT 2 EconMeherun MehbuNo ratings yet

- ECONOMICSDocument15 pagesECONOMICSAnirrudh JoshiNo ratings yet

- Module-6 Rational Expectations Equilibrium ApproachDocument20 pagesModule-6 Rational Expectations Equilibrium ApproachNeha GuptaNo ratings yet

- Theory of EmploymentDocument19 pagesTheory of EmploymentRajesh GargNo ratings yet

- Introduction To Solow-Swan Model by Aghion & HowittDocument8 pagesIntroduction To Solow-Swan Model by Aghion & HowittrezaewewqewqeNo ratings yet

- Trade CyclesDocument13 pagesTrade CyclesAppan Kandala VasudevacharyNo ratings yet

- WINSEM2023-24 BMT2001 TH CH2023240502140 Reference Material I 18-01-2024 Principle of AcceleratorDocument14 pagesWINSEM2023-24 BMT2001 TH CH2023240502140 Reference Material I 18-01-2024 Principle of AcceleratorSwetha iyerNo ratings yet

- An Analysis On Theories of Business CycleDocument5 pagesAn Analysis On Theories of Business CycleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Chapter 6 - The Investment FunctionDocument22 pagesChapter 6 - The Investment FunctionChelsea Anne VidalloNo ratings yet

- Chap 10-Business CycleDocument43 pagesChap 10-Business CycleNabeel AhmedNo ratings yet

- Business Cycles & Theories of Business CyclesDocument7 pagesBusiness Cycles & Theories of Business CyclesAppan Kandala VasudevacharyNo ratings yet

- MacroeconomicsDocument14 pagesMacroeconomicsmafan9946No ratings yet

- The Business Cycle: Definition and PhasesDocument6 pagesThe Business Cycle: Definition and PhasesIbrahim Khan100% (1)

- Attachment Video 1 - The IS Curve Lyst7050 PDFDocument22 pagesAttachment Video 1 - The IS Curve Lyst7050 PDFSaumyaNo ratings yet

- Theory of Unbalanced Growth PDFDocument19 pagesTheory of Unbalanced Growth PDFSuardi Hidayat PrikitiewwNo ratings yet

- Keynesian Analysis of Unemployment and InflationDocument10 pagesKeynesian Analysis of Unemployment and InflationShantie PittNo ratings yet

- Theories of Multiplier, Accelerator and Business CyclesDocument30 pagesTheories of Multiplier, Accelerator and Business CyclesProfessor Tarun DasNo ratings yet

- IGNOU MEC-002 Free Solved Assignment 2012Document8 pagesIGNOU MEC-002 Free Solved Assignment 2012manish.cdmaNo ratings yet

- Solow Growth ModelDocument10 pagesSolow Growth Modelanonim anonimNo ratings yet

- Keynesian Theory of Trade Cycle: 7 Criticisms: Crucial Role of InvestmentDocument9 pagesKeynesian Theory of Trade Cycle: 7 Criticisms: Crucial Role of InvestmentSwastik GroverNo ratings yet

- Mahalanobis MOdel of GrowthDocument7 pagesMahalanobis MOdel of GrowthPrajjwal AgrawalNo ratings yet

- Meaning of Business CycleDocument10 pagesMeaning of Business CycleAAMIR IBRAHIMNo ratings yet

- Year 12 Economics Mid Semester 1 Revision 2019: 1. The Business CycleDocument27 pagesYear 12 Economics Mid Semester 1 Revision 2019: 1. The Business CycleLucy PhanNo ratings yet

- Chapter No.34Document13 pagesChapter No.34Kamal Singh100% (2)

- IGNOU MEC-004 Free Solved Assignment 2012Document8 pagesIGNOU MEC-004 Free Solved Assignment 2012manish.cdmaNo ratings yet

- Keynesian Theory of Employment: ObjectivesDocument16 pagesKeynesian Theory of Employment: ObjectivesShashank Cooled RanaNo ratings yet

- Equilibrium Income and OutputDocument10 pagesEquilibrium Income and OutputPraveen ManchalNo ratings yet

- EconomicsDocument5 pagesEconomicsDhananjay ChauhanNo ratings yet

- Lesson 40 PDFDocument17 pagesLesson 40 PDFSusheel KumarNo ratings yet

- Business Cycles: Prof. (DR) Vandana BhavsarDocument34 pagesBusiness Cycles: Prof. (DR) Vandana BhavsarAKHIL JOSEPHNo ratings yet

- Course Code: ECON3020R: Solow ModelDocument23 pagesCourse Code: ECON3020R: Solow Modelelizabethhapsay01No ratings yet

- Circular Flow of Income - 2 Sector, 3 Sector and 4 Sector EconomyDocument20 pagesCircular Flow of Income - 2 Sector, 3 Sector and 4 Sector Economysumitsaha2630% (1)

- Evolution of CapitalismDocument9 pagesEvolution of CapitalismRitika MalhotraNo ratings yet

- 2.4. National IncomeDocument10 pages2.4. National IncomeVaskia KastroNo ratings yet

- The Theory of Multiplier and Acceleration Principle: Vaghela Nayan K. SDJ International CollegeDocument21 pagesThe Theory of Multiplier and Acceleration Principle: Vaghela Nayan K. SDJ International CollegeAnonymous y3E7iaNo ratings yet

- Assignment Solution Guide SESSION: (2017-2018) : AnswersDocument11 pagesAssignment Solution Guide SESSION: (2017-2018) : Answersnitikanehi100% (1)

- L4 - Academic ScriptDocument24 pagesL4 - Academic ScriptNaomi SaldanhaNo ratings yet

- IGNOU MEC-004 Free Solved Assignment 2012Document8 pagesIGNOU MEC-004 Free Solved Assignment 2012manuraj4No ratings yet

- 1210830238model of Economic Growth of John Robinson - MA (Sem-IV) - Economics (1) 2Document6 pages1210830238model of Economic Growth of John Robinson - MA (Sem-IV) - Economics (1) 2valentinoeleftheriouNo ratings yet

- The Circular Flow of National IncomeDocument12 pagesThe Circular Flow of National IncomePallaviSinhaNo ratings yet

- Harrod Model of GrowthDocument6 pagesHarrod Model of Growthvikram inamdarNo ratings yet

- CH - 13, 14 and 15 (Solved Booklet Page)Document14 pagesCH - 13, 14 and 15 (Solved Booklet Page)Rumana AliNo ratings yet

- Chapter No.35Document5 pagesChapter No.35Kamal SinghNo ratings yet

- The Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataFrom EverandThe Investment Trusts Handbook 2024: Investing essentials, expert insights and powerful trends and dataRating: 2 out of 5 stars2/5 (1)

- MCom-Commerce 071022Document55 pagesMCom-Commerce 071022Deeksha KapoorNo ratings yet

- Quantitative Chapter 9 - Permutations and CombinationsDocument13 pagesQuantitative Chapter 9 - Permutations and CombinationsDeeksha KapoorNo ratings yet

- MBA Admission Policy Batch 2022 24Document3 pagesMBA Admission Policy Batch 2022 24Deeksha KapoorNo ratings yet

- Quantitative Chapter 7 - Indices and SurdsDocument9 pagesQuantitative Chapter 7 - Indices and SurdsDeeksha KapoorNo ratings yet

- Master Series CAT 9Document89 pagesMaster Series CAT 9Deeksha KapoorNo ratings yet

- Quantitative Chapter 4 - GeometryDocument25 pagesQuantitative Chapter 4 - GeometryDeeksha KapoorNo ratings yet

- Cat 400Document52 pagesCat 400Deeksha KapoorNo ratings yet

- Quantitative Chapter 8 - LogarithmDocument7 pagesQuantitative Chapter 8 - LogarithmDeeksha KapoorNo ratings yet

- Master Series CAT 10Document90 pagesMaster Series CAT 10Deeksha KapoorNo ratings yet

- MBA Colleges For FinanceDocument1 pageMBA Colleges For FinanceDeeksha KapoorNo ratings yet

- XAT-2022 Score Vs PercentileDocument1 pageXAT-2022 Score Vs PercentileDeeksha KapoorNo ratings yet

- Books and Authors 2021Document4 pagesBooks and Authors 2021Deeksha KapoorNo ratings yet

- Name of Exercise Participating Nations Conducted atDocument3 pagesName of Exercise Participating Nations Conducted atDeeksha KapoorNo ratings yet

- Marketing Mix: Basic Marketing - A Managerial ApproachDocument4 pagesMarketing Mix: Basic Marketing - A Managerial ApproachDeeksha KapoorNo ratings yet

- HKKJRH Izca/K Lalfkku Banksj: Indian Institute of Management IndoreDocument12 pagesHKKJRH Izca/K Lalfkku Banksj: Indian Institute of Management IndoreDeeksha KapoorNo ratings yet

- DocScanner 12 Nov 2022 8 47 PMDocument1 pageDocScanner 12 Nov 2022 8 47 PMDeeksha KapoorNo ratings yet

- Quantitative Part 2 Solution - 1Document45 pagesQuantitative Part 2 Solution - 1Deeksha KapoorNo ratings yet

- Top DILR Sets For CAT 2022Document42 pagesTop DILR Sets For CAT 2022Deeksha KapoorNo ratings yet

- Marketing Management C-506 Buying Motives of ConsumersDocument3 pagesMarketing Management C-506 Buying Motives of ConsumersDeeksha KapoorNo ratings yet

- Statistical Quality ControlDocument8 pagesStatistical Quality ControlDeeksha KapoorNo ratings yet

- Income Tax PDF 1Document18 pagesIncome Tax PDF 1Deeksha KapoorNo ratings yet

- Performance Analysis of Public & Private Sector Insurance Companies in IndiaDocument5 pagesPerformance Analysis of Public & Private Sector Insurance Companies in IndiaDeeksha KapoorNo ratings yet

- StatisticsDocument5 pagesStatisticsDeeksha KapoorNo ratings yet

- Consumer Behaviour: Kritika Malhotra NPGCDocument18 pagesConsumer Behaviour: Kritika Malhotra NPGCDeeksha KapoorNo ratings yet

- Unit - 3.1 Keynes Theory of Employment.Document3 pagesUnit - 3.1 Keynes Theory of Employment.Deeksha KapoorNo ratings yet

- Verification of Specific Intangible AssetsDocument3 pagesVerification of Specific Intangible AssetsDeeksha KapoorNo ratings yet

- Liabilities of An Audito1Document6 pagesLiabilities of An Audito1Deeksha KapoorNo ratings yet

- Indian-Financial-System - Full NotesDocument118 pagesIndian-Financial-System - Full NotesDeeksha KapoorNo ratings yet

- Unit 2 - Vouching: Vouching OF Cash ReceiptsDocument11 pagesUnit 2 - Vouching: Vouching OF Cash ReceiptsDeeksha KapoorNo ratings yet

- Unit III Answers To Extra Practice QuestionsDocument96 pagesUnit III Answers To Extra Practice QuestionsShahana KhanNo ratings yet

- Assignment Standard Costing SolutionsDocument13 pagesAssignment Standard Costing SolutionsMartha MasalangkayNo ratings yet

- NOTE All These Questions Will Have Similar Answer Q .How Will Equilibrium Level of Income Be Reached in Following CasesDocument3 pagesNOTE All These Questions Will Have Similar Answer Q .How Will Equilibrium Level of Income Be Reached in Following CasesTashiTamangNo ratings yet

- National Income Practice QuestionsDocument29 pagesNational Income Practice QuestionsSujalNo ratings yet

- Economics-II: Ashita AllamrajuDocument47 pagesEconomics-II: Ashita AllamrajuutkarshNo ratings yet

- Growth Crisis in Agriculture: Severity and Options at National and State LevelsDocument6 pagesGrowth Crisis in Agriculture: Severity and Options at National and State LevelsNidheesh JosephNo ratings yet

- Investment TheoryDocument23 pagesInvestment TheoryAnkita MalikNo ratings yet

- Product Costing Overview SAPDocument48 pagesProduct Costing Overview SAPKathiresan NagarajanNo ratings yet

- Chapter 4Document13 pagesChapter 4Tariku KolchaNo ratings yet

- Lecture 5 - Marginal Costing Differential Cost AnalysisDocument2 pagesLecture 5 - Marginal Costing Differential Cost Analysisprapulla sureshNo ratings yet

- Foundations of Macroeconomics 7th Edition Bade Test Bank 1Document91 pagesFoundations of Macroeconomics 7th Edition Bade Test Bank 1harry100% (42)

- Prs Econ Ch21 9eDocument55 pagesPrs Econ Ch21 9eAlecks MadronaNo ratings yet

- Macroeconomics 15th Edition Mcconnell Solutions ManualDocument17 pagesMacroeconomics 15th Edition Mcconnell Solutions Manualdencuongpow5100% (26)

- DHL Global Connectedness Index 2011Document242 pagesDHL Global Connectedness Index 2011bcrucqNo ratings yet

- EW BEP L2 GrowthDocument21 pagesEW BEP L2 GrowthSimanta SahaNo ratings yet

- 10 - Standard Costing and Variance AnalysisDocument26 pages10 - Standard Costing and Variance AnalysisKonodio DarudeNo ratings yet

- 0-Dom511 Operations Management Practice Topic OneDocument65 pages0-Dom511 Operations Management Practice Topic OneostapNo ratings yet

- Bilu Chap 3Document16 pagesBilu Chap 3borena extensionNo ratings yet

- Factors Influencing Economic Growth of BangladeshDocument52 pagesFactors Influencing Economic Growth of BangladeshMahmud EnterpriseNo ratings yet

- Employee ProductivityDocument91 pagesEmployee Productivityhemanth100% (1)

- Class Ec DevelopmentDocument109 pagesClass Ec DevelopmentJacques MUnyemanaNo ratings yet

- Ica Question BankDocument22 pagesIca Question Bankicchapurtiutsavmandal1No ratings yet

- Measures of National Income and OutputDocument10 pagesMeasures of National Income and OutputMohammed YunusNo ratings yet

- CBM Module 2Document3 pagesCBM Module 2Valdez AlyssaNo ratings yet

- Economics of Input and Product SubstitutionDocument105 pagesEconomics of Input and Product SubstitutionNadhiNo ratings yet

- tb10 1Document14 pagestb10 1PeterNo ratings yet

- CH 4 The Theory of Production and CostDocument30 pagesCH 4 The Theory of Production and Costserway bookNo ratings yet