Professional Documents

Culture Documents

FORM-GST-RFD-08 Notice For Rejection of Application For Refund

FORM-GST-RFD-08 Notice For Rejection of Application For Refund

Uploaded by

MK KodiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FORM-GST-RFD-08 Notice For Rejection of Application For Refund

FORM-GST-RFD-08 Notice For Rejection of Application For Refund

Uploaded by

MK KodiaCopyright:

Available Formats

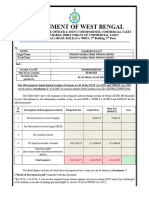

OFFICE OF THE ASSISTANT COMMISSIONER OF

CENTRAL GST, DIV-II (REFUNDS), MUMBAI SOUTH

Meher Building, Bombay Garage, Chowpatty, Marine Lines,

Mumbai-400 007.

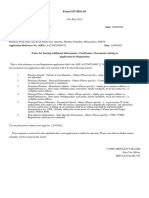

FORM-GST-RFD-08

[See Rule 92(3)]

Notice for rejection of application for refund

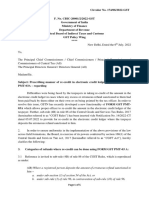

To

M/s. Riyaz Shiraz Poonawala

1st Floor, Office No.102/103, Mistry Building,

SBS Road, Ferre Road, Fort Mumbai-400001

27AYRPP4054G1Z0(GSTIN)

ARN No. AA2708210106389 Dated : 02.08.2021

Ack No.ZR2708210204065 dated : 15.08.2021

This has reference to your above-mentioned refund application filed vide

ARN – AA2708210106389 dated 02.08.2021 for the month of June, 2021

under section 54 of the Act. On examination, it appears that refund application

is liable to be rejected on account of the following reasons:

Sr. Description (select the Remarks

No reasons of inadmissibility of

refund from the drop down)

1 Form GST INS-01 issued on As per the SOP dated 10.08.2020 issued by the

29.09.2021 Additional Commissioner, CGST & C.Ex, Mumbai

South, this office has conducted physical

verification on the registered premise and it appears

that you/your company is not operating from the

above mentioned registered place.

2 Statement -3 {Rule 89(2)(h)} It appears that Zero rated supplies in GSTR-3B is

Rs.45,33,633/- and Zero rated supplies in GSTR-1

is Rs.44,48,275/-, but an amount Rs.10,90,895/-

has taken for calculation of refund as per RFD-01.

Explanation required.

3 Statement 3A [Rule 89(4)] As per Statement 3A [Rule 89(4)], Turnover of Zero

Rated Supplies of Goods appears Rs.10,90,895/-

and the refund claimed of eligible Input Tax Credit

is Rs.10,28,000/-. Explanation required.

4 Refund Recalculation as per In view of the above points at Sr. No. 1, 2 & 3, your

Points above. refund application is liable to be rejected for the

above mentioned reasons.

Refund permissible- Rs. NIL

Refund not permissible- Rs.10,28,000/-

In view of the above, you are hereby called upon to show cause as to why

your refund claim, to the extent of the amount of refund specified above,

should not be rejected for reasons stated above.

You are hereby directed to furnish a reply to this notice within fifteen

days from the date of service of this notice.

You are also directed to appear before the undersigned on 18.10.2021 at

15:30 hrs. If you fail to furnish a reply within the stipulated date or fail to

appear for personal hearing on the appointed date and time, the case will be

decided ex parte on the basis of available records and on merits.

Date: 16.10.2021

Place: Mumbai Signature- S/D

Name: Dharmender Singh

Designation: Assistant Commissioner

CGST, Division-II, Mumbai South.

Office Address: MEHER BUILDING,

BOMBAY GARAGE, CHOWPATTY, MARINE

LINES, MUMBAI-400007

You might also like

- Purchase OrderDocument6 pagesPurchase OrderMANGAL MUNSHINo ratings yet

- Statics and Mechnics of StructuresDocument511 pagesStatics and Mechnics of StructuresPrabu RengarajanNo ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- Tolia AppealDocument7 pagesTolia Appealmau8684No ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Contigent Bill OE 54 - Dated 11.09.2023Document5 pagesContigent Bill OE 54 - Dated 11.09.2023jaideep sainiNo ratings yet

- 2021 129 Taxmann Com 304 Gujarat 2021 282 Taxman 520 Gujarat 19 08 2021 Hitachi HiDocument26 pages2021 129 Taxmann Com 304 Gujarat 2021 282 Taxman 520 Gujarat 19 08 2021 Hitachi Hiashish poddarNo ratings yet

- Tri Pre Engl LHeadNotice Danieli India 280221Document4 pagesTri Pre Engl LHeadNotice Danieli India 280221Sandeep Kumar GuptaNo ratings yet

- Pushpa Nahata v. ITO (2023) 150 Taxmann - Com 84 (Bombay)Document4 pagesPushpa Nahata v. ITO (2023) 150 Taxmann - Com 84 (Bombay)Arunachalam ANo ratings yet

- Direct Tax Case Email No 212 - 2018Document4 pagesDirect Tax Case Email No 212 - 2018AbidRazaca0% (1)

- Penalty U/s 271 (1) (C) Case Reference Shree Nirmal Commercial Ltd. v. CitDocument39 pagesPenalty U/s 271 (1) (C) Case Reference Shree Nirmal Commercial Ltd. v. CitCAclubindiaNo ratings yet

- DemoDocument2 pagesDemopalashkhurpiaNo ratings yet

- Taxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTDocument6 pagesTaxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTmohd.samadNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionAnkur MishraNo ratings yet

- Rdso-Stores-Po-Tribo Meter-03012024Document2 pagesRdso-Stores-Po-Tribo Meter-03012024Karthikeyan RajamanickamNo ratings yet

- DCIT Vs Force Motors Limited ITAT PuneDocument11 pagesDCIT Vs Force Motors Limited ITAT PuneNIMESH BHATTNo ratings yet

- 'RFD 06Document3 pages'RFD 06ahmgstserviceNo ratings yet

- Niraj ParabDocument9 pagesNiraj ParabnickNo ratings yet

- A S Traders Aa270223154463f - SCN09032023Document1 pageA S Traders Aa270223154463f - SCN09032023GSTMS ANSARINo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- Itat Nos 212Document8 pagesItat Nos 212Atul GoelNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- ALLOTMENTDocument9 pagesALLOTMENTShubham MainNo ratings yet

- RD THDocument2 pagesRD THRizwan PathanNo ratings yet

- Perfetti Van Melle IndiaDocument18 pagesPerfetti Van Melle IndiaramitkatyalNo ratings yet

- SR Notice Zd080522047841e 20220530032518Document1 pageSR Notice Zd080522047841e 20220530032518Sonu JainNo ratings yet

- 1684303940-ITA No.1070-D-2022 - Havells India LTDDocument5 pages1684303940-ITA No.1070-D-2022 - Havells India LTDArulnidhi Ramanathan SeshanNo ratings yet

- Ford PDFDocument3 pagesFord PDFAbhay DesaiNo ratings yet

- GSTN: 19AADFP9388F1ZO Partners DetailsDocument20 pagesGSTN: 19AADFP9388F1ZO Partners DetailsSOURAV GUPTANo ratings yet

- Regional Bench - Court No. I: VersusDocument30 pagesRegional Bench - Court No. I: VersusPRERANA JOSHI 205B002No ratings yet

- Tender Document 11032019Document275 pagesTender Document 11032019Shivani SoniNo ratings yet

- DCIT Vs Toshvin Analytical Private Limited ITAT MumbaiDocument3 pagesDCIT Vs Toshvin Analytical Private Limited ITAT MumbaiCA Prakash Chandra BhandariNo ratings yet

- 2024 (5) TMI 795 - AT - M - S Ashiana Housing Limited Versus Commissioner of Central Excise &..Document7 pages2024 (5) TMI 795 - AT - M - S Ashiana Housing Limited Versus Commissioner of Central Excise &..ABHINo ratings yet

- Bharat Petroleum Corporation ... Vs Addl Cit RG 2 (1), Mumbai On 14 June, 2017Document14 pagesBharat Petroleum Corporation ... Vs Addl Cit RG 2 (1), Mumbai On 14 June, 2017NIMESH BHATTNo ratings yet

- CIT v. MKJ Enterprises Ltd.-Cal HCDocument2 pagesCIT v. MKJ Enterprises Ltd.-Cal HCSaksham ShrivastavNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Automatic Scratch Hardness Tester Khushboo 35225107100308Document3 pagesAutomatic Scratch Hardness Tester Khushboo 35225107100308Ashutosh KumarNo ratings yet

- PO No 33225004100210 DESIGN, SUPPLY, INSTALLATION, COMMISSIONING & MAINTENANCE OF ASPIRATION TYPE AUTOMATIC SMOKE FIRE DETECTION WITH ALARM SYSTEMDocument3 pagesPO No 33225004100210 DESIGN, SUPPLY, INSTALLATION, COMMISSIONING & MAINTENANCE OF ASPIRATION TYPE AUTOMATIC SMOKE FIRE DETECTION WITH ALARM SYSTEMSrDEN CoordinationNo ratings yet

- PRADIPDocument7 pagesPRADIPGovindNo ratings yet

- Weekly Updates 16th Apr 2023 To 22nd Apr 2023Document7 pagesWeekly Updates 16th Apr 2023 To 22nd Apr 2023Swathi JainNo ratings yet

- 26 - I - Form Gratuity Appln by Emp. Who Appointed After 10Document2 pages26 - I - Form Gratuity Appln by Emp. Who Appointed After 10Ranjan KumarNo ratings yet

- Relay Test Kit Po SR Railway 8 2 2024Document2 pagesRelay Test Kit Po SR Railway 8 2 2024Nagi Reddy ChintakuntaNo ratings yet

- Aa2709220990712 SCN30092022Document1 pageAa2709220990712 SCN30092022DHANU DANGINo ratings yet

- Divi's Labs Ltd. vs. CCE SEZ ST ExmptnDocument6 pagesDivi's Labs Ltd. vs. CCE SEZ ST ExmptnChakravarthi B ANo ratings yet

- Lalkuan PODocument6 pagesLalkuan POAsad ShakilNo ratings yet

- Retro Reflective Equipment Number Plates For Isolator WR PO 81236155101097 DTD 09.10.23Document3 pagesRetro Reflective Equipment Number Plates For Isolator WR PO 81236155101097 DTD 09.10.23SSE TRD JabalpurNo ratings yet

- Shree Krishna EnterprisesDocument3 pagesShree Krishna EnterprisesVinay JainNo ratings yet

- P. Madhavi Devi, Member (J) and B. Ramakotaiah, Member (A)Document14 pagesP. Madhavi Devi, Member (J) and B. Ramakotaiah, Member (A)Amitesh TejaswiNo ratings yet

- RBS July, 2009Document5 pagesRBS July, 2009pmNo ratings yet

- GeetaramDocument2 pagesGeetarammeritta2002No ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- To Be Replied Within 24 HoursDocument24 pagesTo Be Replied Within 24 HoursIjaz AwanNo ratings yet

- E NEWSLETTER May 2013Document9 pagesE NEWSLETTER May 2013sd naikNo ratings yet

- Zd100823015457o RFD03Document2 pagesZd100823015457o RFD03CA kundan kumarNo ratings yet

- Demand NoticeDocument5 pagesDemand Noticeg95jyt8hg2No ratings yet

- Gst-Excus: Electronic Library For GST, Customs, Excise, Exim, Fema & Allied LawsDocument2 pagesGst-Excus: Electronic Library For GST, Customs, Excise, Exim, Fema & Allied LawsAbhay DesaiNo ratings yet

- Before Shri P.M. Jagtap, AMDocument14 pagesBefore Shri P.M. Jagtap, AMPriyanka Porwal JainNo ratings yet

- Ishida India Pvt. Ltd.Document2 pagesIshida India Pvt. Ltd.Reshmi VarmaNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionAnkur MishraNo ratings yet

- Landmark Cases 439Document17 pagesLandmark Cases 439Anand Kumar KediaNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Table 10: Mean and Standard Deviation (SD) of Investor's Behaviour Towards Commodities MarketDocument1 pageTable 10: Mean and Standard Deviation (SD) of Investor's Behaviour Towards Commodities MarketMK KodiaNo ratings yet

- HAVJJDocument1 pageHAVJJMK KodiaNo ratings yet

- PERCEPTIONDocument1 pagePERCEPTIONMK KodiaNo ratings yet

- PublichDocument1 pagePublichMK KodiaNo ratings yet

- Faculty of Commerce, University of MumbaiDocument1 pageFaculty of Commerce, University of MumbaiMK KodiaNo ratings yet

- Certificate: Faculty of Commerce, University of MumbaiDocument90 pagesCertificate: Faculty of Commerce, University of MumbaiMK KodiaNo ratings yet

- Research Design MBA MK02 UNIT IIDocument15 pagesResearch Design MBA MK02 UNIT IIAmit Kumar100% (3)

- Verbal Communication SkillsDocument61 pagesVerbal Communication SkillsSOUMYA MUKHERJEE-DM 20DM215No ratings yet

- Snapshots of A Daughter in LawDocument2 pagesSnapshots of A Daughter in LawReshal AroraNo ratings yet

- Short Ice Breaker GamesDocument9 pagesShort Ice Breaker GamesIrina AndreeaNo ratings yet

- Electrolysis of Copper (II) Sulfate Solution PDFDocument3 pagesElectrolysis of Copper (II) Sulfate Solution PDFJoko SusiloNo ratings yet

- Act No 2031 NILDocument30 pagesAct No 2031 NILHp AmpsNo ratings yet

- GR-125532-Guingona-v.-Court-of-Appeals-JUL-10-1998 182Document1 pageGR-125532-Guingona-v.-Court-of-Appeals-JUL-10-1998 182Reino CabitacNo ratings yet

- ACE Organic Functional GroupsDocument3 pagesACE Organic Functional Groupsluigiram1No ratings yet

- Biopad BiosprayDocument24 pagesBiopad BiosprayLuci ContiuNo ratings yet

- L27 What Is Genetic Engineering 1Document37 pagesL27 What Is Genetic Engineering 1Kent Gabriel DumendenNo ratings yet

- Solar System EssayDocument1 pageSolar System Essayapi-327692674No ratings yet

- 3 - Together We Build PDFDocument205 pages3 - Together We Build PDFAnaNo ratings yet

- Katarungang Pambarangay Law PDFDocument8 pagesKatarungang Pambarangay Law PDFChristine Nartea100% (1)

- Blibli Merchant API Documentation v-3.6.0 PDFDocument92 pagesBlibli Merchant API Documentation v-3.6.0 PDFKanto TerrorNo ratings yet

- Tsung Tsin Christian Academy S.5 English Vocabulary Quiz (1) Revision Name: - ClassDocument6 pagesTsung Tsin Christian Academy S.5 English Vocabulary Quiz (1) Revision Name: - ClasskeiNo ratings yet

- Mini Research CCUDocument15 pagesMini Research CCUWildina TheressaNo ratings yet

- Cisco - Two Mds San Switches After Connecting With Isl or EislDocument11 pagesCisco - Two Mds San Switches After Connecting With Isl or EislbahugunaharishNo ratings yet

- Planning, Design, Construction and RehabilitationDocument440 pagesPlanning, Design, Construction and RehabilitationMilica BebinaNo ratings yet

- Activity STSDocument1 pageActivity STSRalph ZeusNo ratings yet

- Transport Across Cell MembraneDocument38 pagesTransport Across Cell MembraneViswadeep DasNo ratings yet

- Storification - The Next Big Content Marketing Trend and 3 Benefits Marketers Shouldn't Miss Out OnDocument3 pagesStorification - The Next Big Content Marketing Trend and 3 Benefits Marketers Shouldn't Miss Out OnKetan JhaNo ratings yet

- Class 10Document9 pagesClass 10Vijay GuptaNo ratings yet

- Lesson #1 - 2018 APA PresentationDocument34 pagesLesson #1 - 2018 APA PresentationMarianne Gaile BergantinoNo ratings yet

- MPS-blank Template Production SchedulingDocument8 pagesMPS-blank Template Production SchedulingSaesaeNo ratings yet

- Pharmaceutical Document Manager in NYC Philadelphia PA Resume Christopher ReillyDocument2 pagesPharmaceutical Document Manager in NYC Philadelphia PA Resume Christopher ReillyChristopherReillyNo ratings yet

- Exibições: Chandelier Cifra: Principal 412.396 TomDocument7 pagesExibições: Chandelier Cifra: Principal 412.396 TomAnonymous kgBjU5Qp8No ratings yet

- GIAN Template-ProposalDocument4 pagesGIAN Template-ProposalRamesh GowdaNo ratings yet

- HR ManualDocument130 pagesHR Manualshikha khanejaNo ratings yet

- User Manual Smart Eather Ensors: A Passion For Precision Passion Pour La PrécDocument169 pagesUser Manual Smart Eather Ensors: A Passion For Precision Passion Pour La PrécJose MorenoNo ratings yet