Professional Documents

Culture Documents

HDFC Ltd.

HDFC Ltd.

Uploaded by

Parag Kusalkar0 ratings0% found this document useful (0 votes)

14 views3 pagesThis document contains a statement of claims by an employee, Parag Kusalkar, for tax deductions under Section 192. It lists various deductions claimed including Rs. 65,386 for life insurance premiums, Rs. 14,940 for children's education fees, Rs. 68,321 for repayment of housing loan principal, and Rs. 45,971 under Section 80EE for interest on home loan. It also includes details of an interest payment of Rs. 200,000 to HDFC Ltd. Parag Kusalkar verifies that the information provided is complete and correct.

Original Description:

Original Title

260028

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a statement of claims by an employee, Parag Kusalkar, for tax deductions under Section 192. It lists various deductions claimed including Rs. 65,386 for life insurance premiums, Rs. 14,940 for children's education fees, Rs. 68,321 for repayment of housing loan principal, and Rs. 45,971 under Section 80EE for interest on home loan. It also includes details of an interest payment of Rs. 200,000 to HDFC Ltd. Parag Kusalkar verifies that the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views3 pagesHDFC Ltd.

HDFC Ltd.

Uploaded by

Parag KusalkarThis document contains a statement of claims by an employee, Parag Kusalkar, for tax deductions under Section 192. It lists various deductions claimed including Rs. 65,386 for life insurance premiums, Rs. 14,940 for children's education fees, Rs. 68,321 for repayment of housing loan principal, and Rs. 45,971 under Section 80EE for interest on home loan. It also includes details of an interest payment of Rs. 200,000 to HDFC Ltd. Parag Kusalkar verifies that the information provided is complete and correct.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

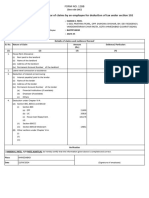

FORM NO.

12BB 1

WALTER P MOORE ENGINEERING INDIA PRIVATE LIMITED

Statement showing particulars of claims by an employee for deduction of tax under section 192

Employee Code & Name : 260028 PARAG KUSALKAR

Employee Address :

PAN No. : ASZPK2443A Financial Year. : 2020-2021

Details of claims and evidence thereof

Sl.No Nature of claim Amount Evidence/Particulars

(1) (2) (3) (4)

1. House Rent Allowance

(i) Rent paid to the landlord

(ii) Name of the landlord

(iii) Address of the landlord

(iv) PAN No of the landlord

Note: Permanent Account Number shall be furnished if the aggregate

rent paid during the previous year exceeds one lakh rupees.

2. Leave travel concessions or assistance

3. Deduction of interest on borrowing :

(i) Interest payable / paid to the lender -200,000.00

(ii) Name of the lender

647660358;

HDFC LTD.;

(iii) Address of the lender

Ramon House, Churchgate, Mumbai-400020;

(iv) PAN No of the lender

AAACH0997E;

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

4. Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) Life Insurance Premium 65,386.00

(b) Payment in respect of non-commutable deffered annuity

(c) Deposit in Public Provident Fund (PPF)

(d) U L I P

(e) National Saving Certificates (NSC)

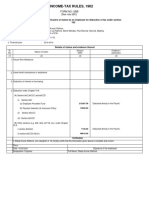

FORM NO.12BB 2

WALTER P MOORE ENGINEERING INDIA PRIVATE LIMITED

Statement showing particulars of claims by an employee for deduction of tax under section 192

Employee Code & Name : 260028 PARAG KUSALKAR

Employee Address :

PAN No. : ASZPK2443A Financial Year. : 2020-2021

Details of claims and evidence thereof

Sl.No Nature of claim Amount Evidence/Particulars

(1) (2) (3) (4)

(f) Interest on NSC Purchased in Previous Years

(g) Children Education Fee (Tuition Fee Only) 14,940.00

(h) Approved Debentures/ Shares/ Mutual Funds

(i) Fixed Deposit for 5 years or more

(j) Payment of Equity linked Mutual Fund

(k) Repayment of Housing Loan (only Principal Amount) 68,321.00

(l) Deposit in Sukanya Samridhi Account

(ii) Section 80CCC

(iii) Section 80CCD

(iv) Section 80CCD(1B)

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

(i) Section 80D

(ii) Section 80DD

(iii) Section 80DDB

(iv) Section 80E

(v) Section 80EE 45,971.00

(vi) Section 80EEA

(vii) Section 80EEB

(viii) Section 80TTA

(ix) Section 80TTB

(x) Section 80U

(xi) Section 80G

(xii) Section 80GGA

5. Interest on other savings or any other kind of interest is fully taxable

FORM NO.12BB 3

WALTER P MOORE ENGINEERING INDIA PRIVATE LIMITED

Statement showing particulars of claims by an employee for deduction of tax under section 192

Employee Code & Name : 260028 PARAG KUSALKAR

Employee Address :

PAN No. : ASZPK2443A Financial Year. : 2020-2021

Details of claims and evidence thereof

Sl.No Nature of claim Amount Evidence/Particulars

(1) (2) (3) (4)

Verification

I , PARAG KUSALKAR son/daughter of do hereby certify that the information given above is complete and correct.

Place..............................................

(Signature of the employee)

Date................................................

Designation...................................... Full Name: PARAG KUSALKAR

You might also like

- The Pandora Company A U S Based Manufacturer of Furniture and AppliancesDocument1 pageThe Pandora Company A U S Based Manufacturer of Furniture and AppliancesAmit Pandey0% (1)

- GENESYS™ 10S UV-Vis SpectrophotometerDocument3 pagesGENESYS™ 10S UV-Vis SpectrophotometerTwin EngineersNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Form. 12BBDocument6 pagesForm. 12BBaruyl001No ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Form12BB 1Document2 pagesForm12BB 1kolhe2377No ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongNo ratings yet

- Form12bb 8757720Document1 pageForm12bb 8757720gajender raoNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form 12BBDocument4 pagesForm 12BBAkhilesh PurohitNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Inflection Points and Bar Cut OffDocument8 pagesInflection Points and Bar Cut Offjohn sorianoNo ratings yet

- Eat That Frog BookDocument14 pagesEat That Frog BookDivyanshu JoshiNo ratings yet

- 8.building Analysis ModelDocument64 pages8.building Analysis ModeltierSargeNo ratings yet

- ACR-Brigada Eskwela 2022Document4 pagesACR-Brigada Eskwela 2022C Ferrer100% (2)

- Nec Inverter 104pw191Document10 pagesNec Inverter 104pw191samee 692No ratings yet

- No Fees Required For The Filing, Evaluation and Approval of CSHPDocument3 pagesNo Fees Required For The Filing, Evaluation and Approval of CSHPJai C. SantosNo ratings yet

- OSHA Citations Against O&G and Ducci ElectricDocument107 pagesOSHA Citations Against O&G and Ducci ElectricRepublican-AmericanNo ratings yet

- Planetary Mixer TK2Document2 pagesPlanetary Mixer TK2waad mellitiNo ratings yet

- MDR PDFDocument16 pagesMDR PDFBandameedi RamuNo ratings yet

- Zebron Plus GC Inlet LinerDocument16 pagesZebron Plus GC Inlet LinerRoberto RebolledoNo ratings yet

- Rad-Studio-Feature-Matrix 10.4Document25 pagesRad-Studio-Feature-Matrix 10.4endickhkNo ratings yet

- A Level Math Paper 1 Quadratic EquationsDocument7 pagesA Level Math Paper 1 Quadratic EquationsisifumwiduNo ratings yet

- Designing Organizational Structure: Specialization and CoordinationDocument47 pagesDesigning Organizational Structure: Specialization and CoordinationNil AydınNo ratings yet

- Knight Who Wouldn T Fight Extract 1528597Document6 pagesKnight Who Wouldn T Fight Extract 1528597Ionela CiudinNo ratings yet

- Chainsaw Training FlyerDocument2 pagesChainsaw Training Flyerthe TWOGNo ratings yet

- Arc Hydro For StormwaterDocument24 pagesArc Hydro For Stormwaterمهندس ابينNo ratings yet

- Frostpunk Kickstarter Deluxe Board Game With Frostlander Expansion (S15) - EbayDocument1 pageFrostpunk Kickstarter Deluxe Board Game With Frostlander Expansion (S15) - Ebayno thanksNo ratings yet

- 5x5 For Muscle and StrengthDocument6 pages5x5 For Muscle and Strengthmohamed aliNo ratings yet

- Siasat V IACDocument14 pagesSiasat V IACCathy BelgiraNo ratings yet

- Fundamentals of Information Systems PDFDocument164 pagesFundamentals of Information Systems PDFharshithaNo ratings yet

- PGDM Admissions Brochure Chennai 2021 23Document32 pagesPGDM Admissions Brochure Chennai 2021 23shahulNo ratings yet

- Abbas - Firoozabadi - Fractured Petroleum Reserviors PDFDocument284 pagesAbbas - Firoozabadi - Fractured Petroleum Reserviors PDFHugoNo ratings yet

- Inspection and Test Plan (ITP) Sample IPAL PalembangDocument3 pagesInspection and Test Plan (ITP) Sample IPAL PalembangBudi TooleeNo ratings yet

- Ce Feb16 FinalDocument76 pagesCe Feb16 Finaltest2012No ratings yet

- CHAPTER - 7 Structural DesignDocument32 pagesCHAPTER - 7 Structural Designzakaria100% (2)

- 03 Positive Displacement Compressors RotaryDocument5 pages03 Positive Displacement Compressors RotaryLe Anh DangNo ratings yet

- Difference Betwn Gross Salary, CTCDocument8 pagesDifference Betwn Gross Salary, CTCabdulyunus_amirNo ratings yet

- 21st Century Artifact Reflection 7th GRD 1Document2 pages21st Century Artifact Reflection 7th GRD 1api-237162684No ratings yet