Professional Documents

Culture Documents

Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, Pune

Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, Pune

Uploaded by

Simran MeherOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, Pune

Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, Pune

Uploaded by

Simran MeherCopyright:

Available Formats

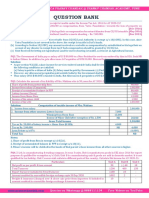

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

QUESTION BANK

PQ1. Compute capital gains of Mr. X in the following Individual situations for AY 2020-21

Asset Gold Land Residential House

Date of purchase 1.7.1990 1.4.1992 1.7.1994

Cost price 4,00,000 6,00,000 8,00,000

Cost of improvement 1,00,000 2,00,000 4,00,000

Year of improvement 1999-2000 2000-01 2005-06

Fair market value on 1.4.2001 30,00,000 60,00,000 5,00,000

Date of Sale 1.1.2020 1.1.2020 1.1.2020

Full value of consideration 95 Lacs 190 Lacs 50 Lacs

Solution:

Asset Gold Land Residential House

Full value of consideration 95 Lacs 190 Lacs 50 Lacs

Less: Indexed cost of acquisition 86,70,000 1,73,40,000 (23,12,000)

(30 L x 289/100) (60L x 289/100) (8L x 289/100)

Less: Indexed cost of improvement - - 9,88,034

(4 L x 289/117)

Long term capital gain 8,30,000 16,60,000 16,99,966

PQ2. Mr. X owns a plot of land acquired on 1.6.2002 for Rs. 2 Lacs. He enters into an agreement to sell the property on

15.3.2020 for Rs. 20 Lacs. In part performance of the contract, he handed over the possession of land on 21.03.2020 on which

date he received the full consideration. As on 31st March 2020, the sale was not registered. Discuss the liability to capital gain

for AY 2020-21.

Solution: Transfer includes Giving possession of IMMOVABLE PROPERTY under Part performance of a contract. Thus it is

treated as transfer in PY 2019-20 & capital gain will be attracted.

Computation of Capital Gains for AY 2020-21

Full value of consideration Rs. 20,00,000

Less: Indexed cost of acquisition [2,00,000 x 289/105] (Rs. 5,50,476)

Long Term Capital Gain Rs. 14,49,524

PQ3. Mr. X purchased one house on 1.7.2002 for Rs. 3,50,000. He constructed its first floor on 1.10.2011 by incurring Rs. 4

lacs & constructed its second floor on 1.10.2012 by incurring Rs. 6,00,000 & third floor on 1.10.2014 by incurring Rs.

7,00,000. Finally, sold the building on 1.1.2020 for Rs. 120 Lacs & selling expenses were 2% of the sale price. Compute taxable

capital gains for AY 2020-21.

Solution: Computation of Capital Gains

Full value of consideration 120 Lacs

Less: Selling Expenses = 2% of Rs. 120,00,000 (2,40,000)

Net Sale Consideration 1,17,60,000

Less: Indexed cost of acquisition [3,50,000 x 289/105] (9,63,333)

Less: Indexed COI - Cost of constructing 1 floor [4,00,000 x 289/184]

st (6,28,260)

Less: Indexed COI - Cost of constructing 2nd floor [6,00,000 x 289/200] (8,67,000)

Less: Indexed COI - Cost of constructing third floor [7,00,000 x 289/240] (8,42,917)

Long Term Capital Gain 84,76,490

PQ4. Mr. Y bought a vacant Land for Rs. 80 Lacs in May 2004. Registration & other expenses were 10% of cost of land. He

constructed a residential building on the said land for Rs. 100 Lacs during FY 2006-07. He entered into an agreement for sale

of the above said residential house with Mr. John (not a relative) in April 2016. Sale consideration was fixed at Rs. 700 Lacs

& on 23.4.2016, Mr. Y received 20 lacs as advance. Sale deed was executed & registered on 14.1.2020 for agreed

consideration. However, Stamp Duty authority had revised the values; hence value of property for stamp duty purposes was

Rs. 770 Lacs. Mr. Y paid 1% as brokerage on sale consideration received. Mr. Y made following investments after sale:

(i) Acquired a residential house at Delhi for Rs. 110 Lacs. (ii) Acquired a residential house at London for Rs. 190 Lacs.

(iii) Subscribed to NHAI capital gains bond for Rs. 45 Lacs on 29-3-2020 & for 50 Lacs on 12-5-2020.

Compute the income chargeable u/h ‘Capital Gains'. CII: FY 2004-05 = 113; FY 2006-07 = 122; FY 2019-20 = 289

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Solution: Computation of Capital Gains of Mr. Y for AY 2020-21

Full value of consideration 770,00,000

Less: Brokerage (7,00,000)

Net Sale consideration 7,63,00,000

Less: Indexed cost of acquisition

Indexed cost of land (88,00,000 x 289/113) (2,25,06,195)

Indexed cost of building (100,00,000 x 289/122) (2,36,88,525)

Long term capital gain 3,01,05,280

Less: Investment in house property section 54 (110,00,000)

Less: Investment in NHAI section 54EC (assumed redeemable after 5 years) (50,00,000)

Long Term Capital Gains 1,41,05,280

Note:

1. Registration & other expenses paid at the time of purchase shall be part of the cost.

2. SDV on date of actual sale shall be taken as consideration as per section 50C because advance was paid in cash.

3. Maximum Deduction allowed u/s 54EC during a particular previous year shall be Rs. 50,00,000.

4. Residential house purchased in India is eligible for exemption u/s 54. (Residential house purchased outside India is not

eligible for exemption u/s 54.)

PQ5. Examine, with reasons, whether the following statements are True or False:

(i) Alienation of a residential house in a transaction of reverse mortgage under a scheme made & notified by the Central

Government is treated as “transfer” for the purpose of capital gains.

(ii) ZCBs means a bond on which no payment & benefits are received or receivable before maturity or redemption.

(iii) Zero coupon bonds of eligible corporation, held for more than 12 months, will be LTCAs.

(iv) Where an urban agricultural land owned by an individual, continuously used by him for agricultural purposes for a

period of two years prior to the date of transfer, is compulsorily acquired under law & the compensation is fixed by the

State Government, resultant capital gain is exempt.

Answer:

(i) False: As per section 47(xvi), such alienation in a transaction of reverse mortgage under a scheme made & notified by

the Central Government is not regarded as “transfer” for the purpose of capital gains.

(ii) True: As per section 2(48), ‘Zero Coupon Bond’ means a bond issued by any infrastructure capital company or

infrastructure capital fund or a public sector company, or Scheduled Bank on or after 1st June 2005, i.r.o. which no

payment & benefit is received or receivable before maturity or redemption from such issuing entity & notified by CG.

(iii) True: Under the proviso to section 2(42A), zero coupon bond held for not more than 12 months will be treated as a

short-term capital asset. Consequently, such bond held for more than 12 months will be a LTCA.

(iv) False: As per section 10(37), where an individual owns urban agricultural land which has been used for agricultural

purposes for a period of two years immediately preceding the date of transfer, & same is compulsorily acquired under

any law & the compensation is determined or approved by CG/RBI, resultant capital gain will be exempt.

PQ6. Mrs. Padmini owned two motor-cars, which were mainly used for business purposes. WDV on 1.4.2019 of the Block of

Assets comprising of only these two cars, both of which were purchased in May 2008 was Rs. 1,81,000. These two cars were

sold in June 2019, for Rs. 1,50,000. In Feb. 2020, she sold 1,000 Shares in X Ltd (unlisted), an Indian Company, for Rs.

3,50,000. She had purchased the same during Jan. 2017 for Rs. 2,44,000. A House Plot purchased by her in March 2008 for

Rs.2,73,000 was sold by her for Rs. 6,50,000 on 18.01.2020. Compute Capital Gains for AY 2020-21. [Nov 93]

Solution: Computation of Capital Gain on Sale of Assets

Particulars Motor cars Share in X Ltd. House plot

Sale Consideration 1,50,000 3,50,000 6,50,000

Less: Expenses on Transfer Nil Nil Nil

Net Sale Consideration 1,50,000 3,50,000 6,50,000

Less: WDV/Indexed CoA (1,81,000) (2,67,106) (5,33,088)

(2,44,000 x 289/264) (2,73,000 × 289/148)

LTCG/STCG/(Loss) (31,000) 82,894 1,16,912

Net Taxable LTCG = Rs. 1,68,806

Notes:

1. Gain/Loss on Sale of Depreciable Assets will be treated as Short Term Capital Gain/Loss Only.

2. Shares in X Ltd, a Financial Asset, is held for more than 24 months & hence is a LTCA.

3.Current Year Short Term Capital Loss can be adjusted against any Capital Gain. (Sec. 70)

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

PQ7. Mr. X (age 55) owned a Residential House in Ghaziabad. It was acquired by Mr. X on 10.10.2006 for 6 lacs. He sold it for

53 lacs on 4.11.2019. Stamp valuation authority of the state fixed value of the property at 70 Lacs. Assessee paid 2% of the

sale consideration as brokerage on the sale of the said property.

Mr. X Acquired a Residential House property at Kolkata on 10.12.2019 for Rs. 10,00,000 & deposited Rs. 4,00,000 on

10.4.2020 & Rs. 5,00,000 on 15.6.2020 in capital gains bonds of RECL Ltd. He deposited 4 lacs on 6.7.2020 & 3 lacs on

1.11.2020 in capital gain deposit scheme in Nationalized Bank for construction of additional floor on house property in

Kolkata. Compute Capital Gain for AY 2020-21. [CII for FY 2006-07 = 122] [MAY-2014]

Solution: Computation of Capital Gains in the hands of Mr. X for AY 2019-20

Full value of Consideration 70,00,000

Less: Brokerage @ 2% (1,06,000)

Less: Indexed cost of acquisition [ Rs. 6,00,000 x 289/122] (14,21,311)

Long-term capital gain 54,72,689

Less: Exemption u/s 54:Acquisition of residential house property at Kolkata (10,00,000)

Amount deposited in capital gains accounts scheme (4,00,000)

Exemption u/s 54EC: Amount deposited in capital gains bonds of RECL on 10.04.2020 (4,00,000)

Long-term capital gain 36,72,689

Total Income (rounded off u/s 288A) 36,72,690

Note:

As per the decision of Gauhati High Court in CIT vs Rajesh Kumar Jalan (2006) & Punjab & Haryana High Court in CIT vs

Jagriti Aggarwal (2011), exemption u/s 54 is allowable even if the amount of capital gain is deposited in CGAS after due

date specified u/s 139(1) but before DD for filing a belated return u/s 139(4).

If we apply the above interpretation in this case, Mr. X would be eligible for exemption u/s 54 in respect of Rs. 3,00,000

deposited in Capital Gains Accounts Scheme on 01.11.2020 also, since the said date falls within the time specified u/s

139(4). On the basis of this interpretation, taxable LTCG in hands of Mr. X = 33,72,689

PQ8. Mr. X, a resident individual, aged 55 years, purchased 10 Plots in FY 2003-04 for Rs. 12 Lac. On 1.4.2004, he started a

business of property dealing & converted all 10 plots into SIT of his business & recorded Rs. 40 Lac in his books being FMV

the said date.

On 31st March 2011, he sold all 10 Plots for Rs. 55 Lacs & purchased a residential house property for Rs. 50 Lacs. He has

constructed 2 rooms in this residential house in June 2011 & has spent 8 Lacs.

He sold the above residential house on 5.2.2020 for 80 Lacs. Stamp duty value was 105 Lacs. On the request of Mr. X, AO

made a reference to valuation officer. Valuation Officer determined the value at 108 Lac.

Mr. X paid brokerage 1% of sale consideration. Compute Capital gains of Mr. X for AY 2020-21.

(CII: 2003-04: 109; 2004-05: 113; 2010-11: 167; 2011-12: 184; 2019-20: 289) [NOV-2016]

Solution: Computation of capital gains of Mr. X for AY 2020-21

Capital Gains on sale of residential house property

Full value of consideration [Note 1] 105,00,000

Less: Brokerage @ 1% of sale consideration (80,000)

Less: Indexed cost of acquisition (Rs. 50,00,000 289/167)

x (86,52,695)

Less: Indexed cost of improvement (Rs. 8,00,000 x 289/184) (12,56,522)

Long-term capital gain 5,10,783

Note: If SC < SDV & SDV < Value by VO, SDV shall be taken as full value of consideration.

PQ9. Mr. Sunil entered into an agreement with Mr. Dhaval to sell his residential house located at Navi Mumbai on 16.8.2019

for Rs. 80 Lacs. Sale proceeds was to be paid in the following manner:

(i) 20% through account payee bank draft on the date of agreement. (ii) 60% on the date of the possession of the property.

(iii) Balance after the completion of the registration of the title of the property.

Mr. Dhaval was handed over the possession of property on 15.12.2019 & registration process was completed on 14.01.2020.

Sale proceeds was paid as per sale agreement. SDV on 16.08.2019 was Rs. 90 Lacs & SDV on 14.1.2020 was Rs. 91.50 Lacs

Mr. Sunil had acquired the property on 1.4.2001 for Rs. 10,00,000. After recovering the sale proceeds from Dhaval, he

purchased another residential house property for Rs. 35,00,000.

Compute the income u/h “Capital Gains” for AY 2020-21. [CIIs: FY 2001-02: 100 FY 2019-20: 289] [NOV 2017]

Solution:

As per section 50C, if sale consideration < SDV, then FVC shall be taken to be Stamp duty value.

Since DoA & DoR are different & 20% amount was paid on DoA through A/c payee bank draft, SDV on DoA shall be

considered.

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Computation of Capital Gains u/s 48

Full value of consideration 90,00,000.00

Less: Indexed cost of acquisition (10,00,000 x 289/100) (28,90,000)

Long term capital gain 61,10,000

Less: Exemption u/s 54 - Investment in House Property (35,00,000)

Long Term Capital Gains 26,10,000

PQ10. Mr. Rakesh purchased a House Property on 14.4.1996 for 2,50,000. He entered into an agreement with Mr. B for sale

of house on 15.9.1999 & received an Advance of 25,000. However, since Mr. B did not remit the balance amount, Mr. Rakesh

forfeited the advance. Later on, he gifted the House Property to his friend Mr. A on 15.6.2001. Following renovations were

carried out by Mr. Rakesh & Mr. A to the House Property:

Particulars Amount

By Mr. Rakesh during FY 1996-1997 1,00,000

By Mr. A during FY 2005-2006 1,00,000

By Mr. A during FY 2009-2010 2,50,000

FMV of the Property on 1.4.2001 is Rs. 2,50,000. Mr. A entered into an agreement with Mr. C for sale of the House on 1 st June

2015 & received an Advance of Rs. 1,00,000. The said amount was forfeited by Mr. A, since Mr. C could not fulfil the terms of

the agreement. Finally, the House was sold by Mr. A to Mr. Sanjay on 2 nd Jan 2020 for Rs. 15 lacs. Compute taxable Capital

Gains in hands of Mr. A for AY 2020-21. [May 2011]

Solution: Computation of Capital Gain

Particulars Rs.

Sale Consideration Rs. 15,00,000

Less: Indexed Cost of Acquisition = (2,50,000 x 289/100) (Rs. 7,22,500)

Less: Indexed Cost of Improvement [(1,00,000 x 289/117) + (2,50,000x 289/148)] (Rs. 7,35,184)

Long Term Capital Gain Rs. 42,316

Income from Other Sources: Advance Forfeited [Sec. 56(2)(ix)] Rs. 1,00,000

Notes:

1. As per Sec. 51, any Advance Money or any other sum received & retained by the Assessee will be treated as Income from

other Sources. The Cost of Acquisition shall not be reduced by that amount.

2. Advance Money received & forfeited by the Previous Owner shall not be considered u/s 51.

3. Improvement done by the previous owner is also considered if it is done after 1.4.2001.

PQ11. Mr. A is an Individual carrying on business. His stock & machinery were damaged & destroyed in a fire accident.

The value of stock lost (totally damaged) was Rs. 6,50,000. Certain portion of the Machinery could be salvaged. Opening WDV

of the Block as on 1.4.2019 was Rs. 10,80,000.

During the process of safeguarding machinery & in fire fighting operations, Mr. A lost his gold chain & a diamond ring, which

he had purchased in April 2012 for Rs. 1,20,000. Market Value of these two items on the date of fire accident was Rs. 1,80,000.

Mr. A received the following amounts from the Insurance Company:

(a) Towards Loss of Stock: Rs. 4,80,000; (b) Towards Damage of Machinery: Rs. 6,00,000

(c) Towards Gold Chain & Diamond Ring: Rs. 1,80,000.

Comment on the tax treatment of the above three items under the provisions of the Income Tax Act, 1961. [NOV 2006]

Answer:

Loss of Loss of Stock-in-Trade used for the purpose of business is a Business Loss.

Stock It is a loss incurred during the course of business & allowable u/s 37.

Loss in excess of the Insurance Compensation will be allowable as a deduction u/s 37.

Rs. 1,70,000 (Insurance Compensation Rs. 4,80,000 – Loss of Stock Rs. 6,50,000) is an allowable business

expenditure u/s 37.

ICAI Answer: Any compensation received from the insurance company towards loss/damage to SIT is to be construed as

a trading receipt. Hence, Rs. 4,80,000 received as insurance claim for loss of stock has to be assessed u/h ‘PGBP’. Assessee

can claim the value of stock destroyed by fire as revenue loss, eligible for deduction while computing income u/h ‘PGBP’.

Machinery Machinery is a Capital Asset u/s 2(14) on which depreciation has been claimed.

Compensation received from Insurance Company on destruction of Machinery by fire is taxable u/s 45(1

A), subject to Sec. 50.

Since part of the Machinery is salvaged, compensation received from the Insurers shall be reduced from

WDV of the Block.

ICAI Answer: The question does not mention whether the salvaged machinery is taken over by Insurance company or

whether there was any replacement of machinery during the year. Assuming that the salvaged machinery is taken over

by the Insurance company, and there was no fresh addition of machinery during the year, block of machinery will cease

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

to exist. Therefore, Rs. 4,80,000 being the excess of WDV (i.e. Rs. 10,80,000) over insurance compensation (i.e. Rs. 6 Lacs)

will be assessable as STCL.

Note: If new machinery is purchased in next year, it will constitute the new block of machinery, on which depreciation

can be claimed for that year.

Gold Jewellery is a Capital Asset u/s 2(14).

Chain & Sec. 45(1A) provides for tax consequences of compensation received from Insurers on account of damage

Diamond or destruction of Capital Assets due to accidental fire or explosion.

Ring However, damage or destruction does not include loss of assets other than accidents by way of fire or

explosion. So, the gains on account of compensation received from Insurers in this case, shall not be

brought to tax under the head Capital Gains u/s 45(1 A).

Such compensation being a Capital Receipt is not chargeable to tax.

ICAI Answer: Gold chain and diamond ring are capital assets as envisaged by section 2(14). They are not “personal

effects”, which alone are to be excluded. If any profit or gain arises in a previous year owing to receipt of insurance claim,

the same shall be chargeable to tax as capital gains. Capital gains has to be computed by reducing the indexed cost of

acquisition of jewellery from the insurance compensation of Rs. 1,80,000.

PQ12. Ms. Gunjan purchased a Land at Rs. 50 Lacs in PY 2008-09 & held the same as her capital asset till 31st Aug 2014. She

started her Real Estate Business on 1st Sep 2014 & converted the said Land into SIT of her business on the said date when

FMV of the Land was Rs. 320 Lacs. She constructed 8 Flats of equal size, quality & dimension. Cost of Construction of each

Flat is Rs. 36 Lacs. Construction was completed in January 2018. She sold 5 Flats at Rs. 90 Lacs per Flat in April 2019.

She invested Rs. 50 Lacs in Bonds issued by National Highways Authority of India on 31st May 2019. She also invested another

Rs. 50 lakhs in bonds of Rural Electrification Corporation Ltd. in June, 2020.

Compute Capital Gains & Business Income arising from the above transactions in the hands of Ms. Gunjan for AY 2020-21.

[CII: FY 2008-09: 137; FY 2014-15: 240; FY 2015-16: 254; FY 2019: 289] [RTP + ICAI Ex Q3 (Similar)]

Solution: Computation of Capital Gain & business income of Ms. Gunjan

Full Value of Consideration [FMV of Land on date of conversion] 320 Lacs

Less: Indexed Cost of Acquisition [Rs. 50,00,000 x 240/137] (87,59,124)

Capital Gains 2,32,40,876

Proportionate LTCG taxable in AY 2020-21 [Rs. 2,32,40,876 × 5/8] 1,45,25,548

Less: Exemption u/s 54EC (restricted to Rs. 50 Lacs) (50 Lacs)

Taxable LTCG 95,25,548

Business Income

Sale Price of Flats (5x Rs.90 Lacs) 450 Lacs

Less: Cost of Flats: (a) FMV of Land on the date of conversion (Rs. 3,20 Lacs x 5/8) (200 Lacs)

(b) Cost of Construction of Flats (5 × Rs. 36 Lacs) (180 Lacs)

Business Income 70 Lacs

Note:

1. Conversion of Capital Asset into SIT is a transfer u/s 2(47). It would be treated as a transfer in PY in which Capital Asset

is converted into SIT. But Capital Gains will be taxable only in the PY in which SIT is sold.

2. Indexation is available only upto the year of conversion of Capital Asset to SIT & not upto year of sale of SIT

3. 5 flats out of 8 Flats is sold in PY 2019-20. So, only proportionate Capital Gains (5/8th) is taxable in AY 2020-21.

4. In case of conversion of Capital Asset into SIT & subsequent sale of SIT, period of 6 months, for the purpose of exemption

u/s 54EC, is to be reckoned from the date of sale of SIT. In this case, since investment in bonds of NHAI has been made

within 6 months of sale of flats, exemption u/s 54EC is available.

5. W.r.t LTCG arising on land or building or both in any FY, maximum deduction u/s 54EC would be Rs. 50 lacs, whether the

investment in bonds of NHAI or RECL are made in same FY or next FY.

Therefore, even though investment of Rs. 50 lacs have been made in bonds of NHAI during the PY 2019-20 & investment

of Rs. 50 lacs have been made in bonds of RECL during the P.Y.2020-21, both within the stipulated six-month period,

maximum deduction allowable for AY 2020-21 i.r.o LTCG arising on sale of LTCA(s) during PY 2019-20 is only Rs. 50 lacs.

PQ13. Mr. X purchased 100 equity shares in ABC Ltd. on 1.10.1996 @ Rs. 10 per share. The company has issued 100 bonus

shares on 1.10.1999 & FMV of the shares on 1.4.2001 was Rs. 7 per share. The company has again issued 100 bonus shares

on 1.10.2013. The company has offered 100 right shares on 1.4.2019 @ Rs. 140 per share though FMV is Rs. 250 per share.

Mr. X purchased half of the shares & remaining half were renounced by him in favour of his friend Mr. Y. He has charged Rs.

20 per share from Mr. Y for renouncing the right. All the shares were sold by Mr. X & Mr. Y @ Rs. 300 per share on 1.1.2020

& STT has been paid. Compute Capital gains of Mr. X for AY 2020-21.

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Solution: Computation of Capital Gains Mr. X

Original Shares

Full value of consideration (100 x 300) Rs. 30,000

Less: Cost of Acquisition (100 x 10) (Rs. 1,000)

Long Term Capital Gain u/s 112A Rs. 29,000

1st Bonus Shares 2nd Bonus Shares

Full value of consideration (100 x 300) 30,000 Full value of consideration (100 x 300) 30,000

Less: Cost of Acquisition (100 x 7) (700) Less: Cost of Acquisition [After 1.4.2001] Nil

Long Term Capital Gain u/s 112A 29,300 Long Term Capital Gain u/s 112A 30,000

Right shares Sale of Rights

Full value of consideration (50 x 300) 15,000 Full value of consideration 1,000

Less: Cost of Acquisition (50 x 140) (7,000) Less: Cost of Acquisition Nil

Short Term Capital Gain u/s 111A 8,000 STCG (Taxable @ slab rate) 1,000

Note: No Indexation is available for LTCG u/s 112A.

PQ14. Star Enterprises has transferred its unit R to A Ltd by way of slump sale on 23rd Feb 2020. Compute the Capital Gains

arising from slump sale of Unit R for AY 2020-21.

Liabilities Amount (Rs. in Lacs) Assets Amount (in Lacs)

Own Capital 1,750 Fixed Assets:

Accumulated P & L Balance 670 (i) Unit P 200

Liabilities: (ii) Unit Q 150

(i) Unit P 90 (iii) Unit R 600

(ii) Unit Q 160 Other Assets:

(iii) Unit R 140 (i) Unit P 570

(ii) Unit Q 850

(iii) Unit R 440

Slump Sale consideration on transfer of Unit R was Rs. 930 Lacs.

Fixed Assets of Unit R includes land which was purchased at Rs. 110 Lacs in 2009 & was revalued at 140 Lacs.

Other Fixed Assets are reflected at Rs. 460 Lacs, (i.e. Rs. 600 Lacs less value of land) which represents WDV of those assets

as per books. The written down value of these asset is Rs. 430 Lacs.

Unit R was set up by Star Enterprises in 2007. [CII for FY 2007-08 & FY 2019-20 are 129 & 289 respectively. [MAY 18]

Answer: Computation of Capital Gains

Particulars (In Lacs)

Consideration 930

Less: Expenses on transfer (Nil)

Net consideration 930

Less: Net Worth [Refer Note below] (840)

Long term Capital Gain 90

Note: Computation of Net Worth

Particulars (in Lacs)

Fixed Assets [Cost of land Rs.110 + Other depreciable assets @ WDV as per IT Act Rs. 430] 540

Other Assets 440

Total Assets taken over 980

Less: Liabilities of Unit R (140)

Net Worth 840

Notes: No Indexation is available on Slump Sale transaction.

2. Revaluation effect shall be ignored for the purpose of computing Cost of Acquisition u/s 50B.

PQ15. Mr. C inherited from his father 8 plots of Land in 1999. His father had purchased the plots in 1986 for 5 Lacs. FMV of

the Plots as on 1.4.2001 was Rs. 16 Lacs. (Rs. 2 Lac for each plot). On 1.6.2005, C started a Business of dealer in plots &

converted 8 plots as SIT of his business. He recorded the plots in his books at 64 Lacs being the FMV on the date. In June

2009, C sold the 8 plots for Rs. 75 Lacs.

In the same PY, he acquired a Residential House Property for Rs. 50 Lacs. He invested an amount of Rs. 5 Lacs in construction

of one more floor in his house in June 2010. The house was sold by him in June 2019 for Rs. 80 lacs. SDV was Rs. 98,50,000.

As per Assessee's request, AO made a reference to a Valuation Officer. Value determined by Valuation Officer was Rs.

99,20,000. Brokerage of 1% of Sale Consideration was paid by C.

[CII: FY 2002-2003: 105; FY 2005-2006: 117; FY 2009- 10: 148; FY 2010-11: 167; PY 2019-20: 289 [NOV 2012 + NOV 2016]

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

Solution:

1. Transfer: Conversion of a Capital Asset into SIT is treated as a transfer.

2. PY of Taxation: Capital Gains shall be taxable as Income of the PY in which the converted SIT is sold.

3. Indexation: Indexation shall available till the PY of concersion of CA into SIT only.

4. Indexed COA = Higher of Original Cost to Previous Assessee or FMV on 1.4.2001. Thus COA = 16 lacs (for 8 flats).

5. CII should be based on the year in which the Asset is first held by the Previous Owner & not the Assessee.

PY 2009-10

(i) Business Income on Sale of Stock: Sale Value - FMV on the date of conversion = 75 lacs – 64 lacs Rs. 11 lacs

(ii) Income u/h Capital Gains

Full Value of consideration [Section 50C is not applicable in case of deemed sale u/s 45(2)] 64,00,000

Less: Indexed Cost of Acquisition (Rs. 16,00,000 x 117/100) (18,72,000)

Long Term Capital Gain taxable in PY 2009-10 45,28,000

Less: Exemption u/s 54: Lower of (i) Amount invested or (ii) Capital Gain (45,28,000)

Taxable Long-Term Capital Gain Nil

Gross Total Income 11,00,000

PY 2019-20

Particulars Amount

Sale Consideration (Note) 98,50,000

Less: Expenses (Brokerage at 1% on 80,00,000) (80,000)

Net Consideration 97,70,000

Less: (a) Indexed Cost of Acquisition: [50,00,000 × 289/148] (97,63,514)

(b) Indexed Cost of Improvement: [5,00,000 × 289/167] (8,65,269)

Long Term Capital Loss (8,58,783)

Note: ASC = Rs. 80 Lacs; SDV = Rs. 98.5 Lacs; Value by VO = Rs. 100 Lacs. Thus FVC = SDV since SDV < Value by VO but > ASC.

PQ16. Mr. Raj purchases 2,500 (non-listed) Shares in ABC Ltd on 16th August 2006 for Rs. 10,000. On 17th May 2008, he gets

500 Bonus Shares. On 20th October 2014, he acquires 1500 Right Shares @ Rs. 15 per Share. He sells all the shares (unlisted)

Shares in ABC Ltd on 12th Feb 2020 at Rs. 150 per Share (Brokerage on Sale is 2%). He owns one Residential House. He

purchases a Residential House on 29th June 2020 for Rs. 3,50,000. Compute taxable Capital Gains for AY 2020-21.

Solution:

Particulars Original shares Bonus share Right shares

(2500 shares) (500 shares) (1500 shares)

Sale Consideration (Rs. 150 per Share) 3,75,000 75,000 2,25,000

Less: Expenses on Transfer (2%) 7,500 1,500 4,500

Net Sale Consideration [A] 3,67,500 73,500 2,20,500

Less: Indexed CoA (23,689) Nil (27,094)

(10,000 x 289/122) (22500 × 289/240)

Long term capital gains [B] 3,43,811 73,500 1,93,406

[(LTCG/NSC) x 100] [B/A] 93.55% 100% 87.71%

Rank of Claiming Exemption u/s 54F (Note) II I III

Amount of Investment in House Property out of 2,76,500 73,500 Nil

sale proceeds (3,50,000 – 73,500)

Less: Exemption u/s 54F =

LTCG

x Amount Invested 2,58,677 73,500 Nil

NSC

Taxable LTCG 17823 NIL 1,94,250

Note: Since exemption u/s 54F is given in the proportion of the LTCG to Net Sale Consideration, larger the proportion, higher

the exemption amount. Hence, ranks are allotted based on ratio of LTCG to Net Consideration.

Firstly, investment shall be apportioned to the highest ranked alternative. Thus we have allotted Rs. 73,500 on the capital

gains arising on transfer of bouns shares.

Now, the balance amount of investment (i.e Rs. 3,50,000 – Rs. 73,500) Rs. 2,76,500 shall be apportioned to next highest

ranked alternative (i.e original shares in this case).

Since we do not have any balance of investment left, the exemption will be restricted to (II) & (I).

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

ERRORLESS TAXATION BY CA PRANAV CHANDAK @ PRANAV CHANDAK ACADEMY, PUNE

PQ17. Mr. X (age 82) purchased urban agricultural land on 1.10.2001 for Rs. 3 Lacs & it was being used for agricultural

purposes by him. It was sold on 1.1.2020 for Rs. 58.67 Lacs. Assessee has purchased 1 agricultural land in rural area on

10.1.2020 for Rs. 10 Lacs & this land was sold by him on 11.2.2020 for Rs. 11 Lacs & has invested Rs. 30,000 in NSC. Compute

taxable Capital gains for AY 2020-21. (b) What if the land was purchased in urban area instead of rural area.

Solution:

(a) Computation of Capital Gains

Full value of consideration 58,67,000

Less: Indexed cost of acquisition [3,00,000 x 289/100] (8,67,000)

Long Term Capital Gain 50,00,000

Less: Exemption u/s 54B (10,00,000)

Long Term Capital Gain 40,00,000

Note: If land is purchased in rural area, exemption will be allowed u/s 54B. On sale of Rural agricultural land, no capital

gains will arise since rural agricultural land is not a capital asset as defined u/s 2(14).

(b) If the newly acquired land is a urban land & it has been sold, exemption granted u/s 54B will be withdrawn.

In such case, assessee will have 2 options. Option 1: Not to take exemption u/s 54B; Option 2: Take exemption u/s 54B.

Option I: Exemption is not availed LTCG = Rs. 50,00,000;

STCG on sale of urban agri. Land = Rs. 11 Lacs – Rs. 10 Lacs = Rs. 1 Lac.

Option II: Exemption is availed LTCG = Rs. 40,00,000;

STCG on sale of urban agri. Land = Rs. 11 Lacs – Rs. 0 Lacs = Rs. 11 Lacs.

Hence the assessee should opt for option I & his tax liability shall be Rs. 9,20,000 + 4% HEC = Rs. 9,56,800.

PQ18. Mr. X owns several assets but does not own any residential house. He sells the following assets & requests you to

compute his tax liability for the AY 2020-21.

1. Shares (non-listed) purchased in April 2007 for Rs. 1,30,000 sold on 19.07.2019 for Rs. 12,00,000.

2. He sold jewellery on 15.8.2019 for Rs. 18 lac purchased in 1996 for Rs. 1,80,000. FMV on 1.4.2001 was Rs. 3. Lacs.

3. Debentures (unlisted) purchased in April 2018 for Rs. 80,000 sold on 31.12.2018 for Rs. 1,40,000.

4. Sold his motor car purchased in August 2007 for Rs. 1,50,000 on 15.03.2019 for Rs. 18,000.

5. He purchased equity shares of ABC Limited on 1.11.2018 for Rs. 2,00,000 & sold all the shares on 1.6.2019 for Rs. 10 Lacs

& has paid STT @ 0.25% of sale price. Compute his income tax liability.

Additional Information:

In December 2019, he also purchased a small residential house for Rs. 2,00,000. He has deposited Rs. 1,60,000 on 20.01.2020

in CGAS for construction of the house which he has purchased in Dec. 2019.

On 15.01.2020, he invested Rs. 2,50,000 in bonds issued by NHAI which are redeemable after 5 years.

Solution: Computation of capital gains in the hands of Mr. X

Particulars Non – Listed Shares Jewellery Debentures Equity shares in ABC Ltd

Sale Consideration [A] 12,00,000 18,00,000 1,40,000 10,00,000

Less: Indexed COA (2,91,240) (10,11,500) (80,000) (2,00,000)

[1,30,000 x 289/129] [3,50,000 x 289/100]

LTCG/STCG [B] LTCG = 9,08,760 LTCG = 7,88,500 STCG = 60,000 STCG = 8,00,000

Rate of Tax 20% u/s 112 20% u/s 112 Slab Rate 15% u/s 111A

Ranking [B/A] [I] 75.73% [II] 43.80% NA NA

Exmeption u/s 54F (2,72,628) - - -

Taxable LTCG 6,36,132 LTCG = 7,88,500 STCG = 60,000 STCG = 8,00,000

Analysis for exemption u/s 54F:

Investment in Residential house of Rs. 2 Lacs + Deposit in CGAS of Rs. 1,60,000 is eligible for exemption u/s 54F.

Exemption of Section 54F is proportionate & is available only on LTCG.

So we have to rank capital gains on Non-Listed shares & jewellery on the basis of LTCG/NSC.

Since ratio of LTCG/NSC is more for Non-Listed shares, we will take exemption of section 54F from Non-Listed share.

Exemption u/s 54F = 3,60,000 x 9,08,760/12L = 2,72,628.

Note: Motor car is covered under the personal movable effects, hence, no capital gains shall be computed.

Note: Exemption u/s 54EC is available only if sold asset is immovable property being land or building or both.

www.pranavchandak.com Queries on Whatsapp @ 8888111134 Free Videos on YouTube

You might also like

- 7001 Assignment #2Document11 pages7001 Assignment #2南玖No ratings yet

- Preferred Stock in Private Equity Transactions Significant Tax IssuesDocument23 pagesPreferred Stock in Private Equity Transactions Significant Tax IssuesDestiny AigbeNo ratings yet

- Chapter 1 - Current LiabilitiesDocument6 pagesChapter 1 - Current LiabilitiesXiena100% (1)

- Mba 3rd Sem Finance Notes (Bangalore University)Document91 pagesMba 3rd Sem Finance Notes (Bangalore University)Pramod Aiyappa50% (2)

- Capital Gain Sums With SolutionDocument10 pagesCapital Gain Sums With Solutionkomil bogharaNo ratings yet

- Work Sheet Computation of Income Under The Head "Capital Gains"Document4 pagesWork Sheet Computation of Income Under The Head "Capital Gains"Vishal SarkarNo ratings yet

- INCOME TAX 30 Qns & AnsDocument29 pagesINCOME TAX 30 Qns & AnsDineshNo ratings yet

- Income Under Head Capital Gains Assignment EscholarsDocument24 pagesIncome Under Head Capital Gains Assignment EscholarspuchipatnaikNo ratings yet

- CG Extra Sum May 24 Nov 24Document19 pagesCG Extra Sum May 24 Nov 24goten66790No ratings yet

- CG Extra SumsDocument19 pagesCG Extra SumsPruthil Monpariya50% (2)

- Chapter 3 - Income From Capital Gains - NotesDocument65 pagesChapter 3 - Income From Capital Gains - NotesYashSukhwal100% (1)

- WorkSheet Capital GainDocument12 pagesWorkSheet Capital GainakshatkharcheNo ratings yet

- Capital Gains Notes PDFDocument6 pagesCapital Gains Notes PDFmohanraokp2279No ratings yet

- Revision Capital GainDocument10 pagesRevision Capital GainSuhani RathiNo ratings yet

- Capital Gain and IFOS - SolutionDocument6 pagesCapital Gain and IFOS - SolutionVenkataRajuNo ratings yet

- 73264bos59105 Inter P1aDocument12 pages73264bos59105 Inter P1aRaish QURESHINo ratings yet

- Bos 55636 Finalp 2 ADocument13 pagesBos 55636 Finalp 2 AVipul JainNo ratings yet

- Capital Gains WsDocument20 pagesCapital Gains WsDisha Commerce AcademyNo ratings yet

- Capital Gain 2Document11 pagesCapital Gain 2Aishwarya SundararajNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKuperajahNo ratings yet

- Capital Gain ProblemsDocument6 pagesCapital Gain Problems20-UCO-517 AJAY KELVIN ANo ratings yet

- 15 Job and Contract CostingDocument6 pages15 Job and Contract CostingLakshay SharmaNo ratings yet

- Top 200 FRDocument4 pagesTop 200 FRjasleenchawla326No ratings yet

- SFM DJB - Nov20 Suggested Answers PDFDocument22 pagesSFM DJB - Nov20 Suggested Answers PDFJash BhagatNo ratings yet

- Capital Gains Q&A Solution To Question 34 As Per PY 2022 23 AYDocument1 pageCapital Gains Q&A Solution To Question 34 As Per PY 2022 23 AYMehul GuptaNo ratings yet

- Date: 27 / 03 /23Document2 pagesDate: 27 / 03 /23selvam sNo ratings yet

- CA Inter Accounts (New) Suggested Answer Dec2021Document24 pagesCA Inter Accounts (New) Suggested Answer Dec2021omaisNo ratings yet

- Correction in Income TaxDocument13 pagesCorrection in Income TaxchiragsmguptaNo ratings yet

- Book 1Document50 pagesBook 1Md YeasinNo ratings yet

- 921 Financial Accounting Reporting Sep Oct 2022Document4 pages921 Financial Accounting Reporting Sep Oct 2022supritha724No ratings yet

- Income Tax IISep Oct 2022Document15 pagesIncome Tax IISep Oct 2022supritha724No ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- DT CPS TEST 2 SolnDocument11 pagesDT CPS TEST 2 SolnMayank GoyalNo ratings yet

- (RTP Nov. 2020 Old) : AnswerDocument10 pages(RTP Nov. 2020 Old) : Answersandesh SandeshNo ratings yet

- 57096bos46250finalnew p1 A PDFDocument18 pages57096bos46250finalnew p1 A PDFAayush LaddhaNo ratings yet

- Inter - Nov 2023 Exam - Acc Test 1 - QueDocument3 pagesInter - Nov 2023 Exam - Acc Test 1 - QueSrushti AgarwalNo ratings yet

- Questio 1Document8 pagesQuestio 1gurukulmaterialNo ratings yet

- Day 3 - Lecture Examples - Chapter 6Document5 pagesDay 3 - Lecture Examples - Chapter 6NikolaNikoloskiNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- Income From Capital Gains: Depreciable AssetsDocument5 pagesIncome From Capital Gains: Depreciable AssetsPalak PunjabiNo ratings yet

- P17Document21 pagesP17anandhan61No ratings yet

- CAPITAL GAINS REVISION (Part 2)Document31 pagesCAPITAL GAINS REVISION (Part 2)Mana SharmaNo ratings yet

- Investment PropertyDocument14 pagesInvestment PropertyJerome BaluseroNo ratings yet

- Finacial Management MockDocument12 pagesFinacial Management MockRomaric DjokoNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Ex Cap 14Document10 pagesEx Cap 14ZoeNo ratings yet

- 1 Sim Answer Key Investment PropertyDocument5 pages1 Sim Answer Key Investment PropertySherri BonquinNo ratings yet

- M.B.A (2019 Pattern)Document291 pagesM.B.A (2019 Pattern)SurajNo ratings yet

- Cae05-Chapter 2 Current Liabilities Problem DiscussionDocument7 pagesCae05-Chapter 2 Current Liabilities Problem DiscussionSteffany RoqueNo ratings yet

- CU Leaked Paper Financial Accounting-IDocument5 pagesCU Leaked Paper Financial Accounting-Idarindainsaan420No ratings yet

- All 9 Homeworks FAR 1Document22 pagesAll 9 Homeworks FAR 1Ahmed RazaNo ratings yet

- CBCS BCOM HONS Sem-3 COMMERCEDocument5 pagesCBCS BCOM HONS Sem-3 COMMERCEbittughNo ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- Accounts Paper Answer 24.06.2020Document17 pagesAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNo ratings yet

- Financial Model - The FrontiersDocument47 pagesFinancial Model - The FrontiersAnandh SharavanNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Question Paper Nov 23 - Group 1Document28 pagesQuestion Paper Nov 23 - Group 1freeuse350No ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Procedure For Incorporating A Company Through RUN (Reserve Unique Name)Document2 pagesProcedure For Incorporating A Company Through RUN (Reserve Unique Name)Simran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Theory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument10 pagesTheory Questions: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument8 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- HR 0 K 31 It 4 SxstrjojltjDocument197 pagesHR 0 K 31 It 4 SxstrjojltjSimran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument4 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- Company Law NCLT Rules & Striking Off Section 248 To 252 Class Notes Uploaded On 07th Mar 2018 636560432861884854Document14 pagesCompany Law NCLT Rules & Striking Off Section 248 To 252 Class Notes Uploaded On 07th Mar 2018 636560432861884854Simran MeherNo ratings yet

- CA Inter Unscheduled Test Series Nov 2021 1626503339Document7 pagesCA Inter Unscheduled Test Series Nov 2021 1626503339Simran MeherNo ratings yet

- Ca Final DT Rtps Paper 4Document29 pagesCa Final DT Rtps Paper 4chandrakantchainani606No ratings yet

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manual 1Document15 pagesByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manual 1laura100% (36)

- The Effect of Dividend Policy On Share Prices of BDocument7 pagesThe Effect of Dividend Policy On Share Prices of BRobbyShougaraNo ratings yet

- 2003 BMGF 990pf Part 2Document296 pages2003 BMGF 990pf Part 2shikha.mindfulNo ratings yet

- Capital Gains TaxationDocument44 pagesCapital Gains TaxationPrince Anton DomondonNo ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperVenkataRajuNo ratings yet

- 19-20 - Computation - Mrs. Jayshree PeriwalDocument6 pages19-20 - Computation - Mrs. Jayshree PeriwalakshaykgodaraNo ratings yet

- IFSEDocument42 pagesIFSEvenkatNo ratings yet

- Chandan Itr 2form Downloaded 20-21Document33 pagesChandan Itr 2form Downloaded 20-21Ameet ChandanNo ratings yet

- Capital Gain ProblemsDocument6 pagesCapital Gain Problems20-UCO-517 AJAY KELVIN ANo ratings yet

- Direct Taxation NotesDocument1,068 pagesDirect Taxation Notes570 BAF Drashti ShahNo ratings yet

- Capital Gains Losses 1Document2 pagesCapital Gains Losses 1shai santiagoNo ratings yet

- Taxation On Individuals: A. Resident CitizenDocument49 pagesTaxation On Individuals: A. Resident CitizenVeron Gem DalumbarNo ratings yet

- FTP - Corporation 2021Document2 pagesFTP - Corporation 2021Claude PeñaNo ratings yet

- 75776bos61307 p7Document31 pages75776bos61307 p7wareva7754No ratings yet

- SAVANT FrameworkDocument19 pagesSAVANT Frameworkmarjorie blancoNo ratings yet

- TAXN7321 - Semester PlanDocument4 pagesTAXN7321 - Semester Plansadz3690No ratings yet

- Corporate Tax Planning Activities: Overview of Concepts, Theories, Restrictions, Motivations and ApproachesDocument10 pagesCorporate Tax Planning Activities: Overview of Concepts, Theories, Restrictions, Motivations and ApproachesSanjay G SNo ratings yet

- Capital GainDocument3 pagesCapital GainSHALINI JHANo ratings yet

- Short Term CapitalDocument21 pagesShort Term CapitalGNR ASSOCIATESNo ratings yet

- RAS - GEC Elec 2 - Activity #5Document2 pagesRAS - GEC Elec 2 - Activity #5George Blaire Ras100% (1)

- Critical Appraisal of The Nigeria Tax Laws As Administered by The Enugu State GovernmentDocument134 pagesCritical Appraisal of The Nigeria Tax Laws As Administered by The Enugu State GovernmentEmmanuel KingsNo ratings yet

- ICAB Certificate Level Taxation Nov 17Document9 pagesICAB Certificate Level Taxation Nov 17Prithvi PrasadNo ratings yet

- Tds Tcs Adv TaxDocument22 pagesTds Tcs Adv TaxrachitNo ratings yet

- Income Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. OgrimenDocument18 pagesIncome Taxes For Individuals CA5109 Income Taxation Prepared By: Joseph Angelo B. Ogrimenlayla scotNo ratings yet

- Annual Information Statement (AIS) User Guide - AIS Utility: Directorate of Income Tax (Systems)Document38 pagesAnnual Information Statement (AIS) User Guide - AIS Utility: Directorate of Income Tax (Systems)G L SWAMYNo ratings yet

- Holding Summary:: Account Name: TARUN JOSHIDocument2 pagesHolding Summary:: Account Name: TARUN JOSHIArshil KhanNo ratings yet

- Chapter 4 v4 RevisedDocument18 pagesChapter 4 v4 RevisedThe makas AbababaNo ratings yet