Professional Documents

Culture Documents

Chapter 3 Arbitrage Pricing Theory - Part 2

Chapter 3 Arbitrage Pricing Theory - Part 2

Uploaded by

Esraa Ghonam0 ratings0% found this document useful (0 votes)

56 views17 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

56 views17 pagesChapter 3 Arbitrage Pricing Theory - Part 2

Chapter 3 Arbitrage Pricing Theory - Part 2

Uploaded by

Esraa GhonamCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 17

Arbitrage Pricing Theory and Multifactor

Models of Risk and Return

INVESTMENTS | BODIE, KANE, MARCUS

McGraw-Hill/Irwin Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

10-2

Arbitrage Pricing Theory (APT)

INVESTMENTS | BODIE, KANE, MARCUS

10-3

Assumptions of Arbitrage Pricing

Theory (APT)

• 1. Unsystematic risk can be diversified away in a

portfolio.

• 2. Returns are generated using a factor model. The

APT provides little practical guidance for the

identification of the risk factors.

• 3. No arbitrage opportunities exist. This assumption

implies that investors will undertake infinitely large

positions (long and short) to exploit any perceived

mispricing, causing asset prices to adjust

immediately to their equilibrium values.

INVESTMENTS | BODIE, KANE, MARCUS

10-4

Assumptions of Arbitrage Pricing

Theory (APT)

• EXAMPLE: Exploiting an arbitrage opportunity

• Suppose your investment firm uses a single-factor model

to evaluate assets. Consider the following data for

portfolios A, B, and C:

• Calculate the arbitrage opportunity from

the data provided.

INVESTMENTS | BODIE, KANE, MARCUS

10-5

Wb = (Cbeta – Abeta)

(Bbeta – Abeta)

Wa = 1- Wb

INVESTMENTS | BODIE, KANE, MARCUS

10-6

Assumptions of Arbitrage Pricing

Theory (APT)

• Answer:

• By allocating 50% of our funds to portfolio A and

50% to portfolio B, we can obtain a portfolio (D)

with beta equal to the portfolio C beta (1.5):

• Beta for portfolio D = 0.5(1) + 0.5(2) = 1.5

• While the betas for portfolios D and C are

identical, the expected returns are different:

• Expected return for portfolio D = 0.5(0.10) +

0.5(0.20) = 0.15 = 15%

INVESTMENTS | BODIE, KANE, MARCUS

10-7

Assumptions of Arbitrage Pricing

Theory (APT)

• Answer:

• Therefore, we have created portfolio D that has

the same risk as portfolio C (beta = 1.5) but has

a higher expected return than portfolio C (15%

versus 13%).

• By purchasing portfolio D and short-selling

portfolio C, we expect to earn a 2% return (15%

minus 13%).

INVESTMENTS | BODIE, KANE, MARCUS

10-8

Assumptions of Arbitrage Pricing

Theory (APT)

• An arbitrage opportunity is defined as an

investment opportunity that bears no risk and

no cost, but provides a profit.

INVESTMENTS | BODIE, KANE, MARCUS

10-9

Arbitrage Pricing Theory

The law of one price

• If two assets are equivalent in all

economically relevant respects, then they

should have the same market price

• The law of one price is in force by

arbitrageurs, if they observe a violation of

the law they will engage in arbitrage

activity until the arbitrage opportunity is

eliminated

INVESTMENTS | BODIE, KANE, MARCUS

10-10

Arbitrage Pricing Theory

The law of one price

• So how to do arbitrage?

• Buy at the lower-price market, then sell at

the higher-price market

INVESTMENTS | BODIE, KANE, MARCUS

10-11

Arbitrage Pricing Theory

The law of one price

• In a very liquid and active markets ; the

buy and sell process can be done

simultaneously

• It has zero risk since you are long and

short the same amount of asset

• That is why you can borrow at risk free

rate

INVESTMENTS | BODIE, KANE, MARCUS

10-12

Arbitrage Pricing Theory

• An arbitrage Since no

opportunity arises investment is

when an investor can required, investors

earn riskless profits

without making a net

will create large

investment positions to obtain

large profits.

INVESTMENTS | BODIE, KANE, MARCUS

10-13

Arbitrage Pricing Theory

• Regardless of • In efficient

wealth or risk markets, profitable

aversion, investors arbitrage

will want an infinite opportunities will

position in the risk- quickly disappear.

free arbitrage

portfolio.

INVESTMENTS | BODIE, KANE, MARCUS

10-14

Arbitrage Pricing Theory

• Meaning : Arbitrageurs will keep the law of

one price always, active and any

mispricing will be eliminated instantly

INVESTMENTS | BODIE, KANE, MARCUS

10-15

Arbitrage Pricing Theory

• Summary of APT assumptions

– On the long run no arbitration opportunity

exists

– There is no costs or taxes on arbitrage

– Some investors are welling to perform large

diversified portfolios

– Systematic risk is the only relevant risk

(unsystematic risk can be totally be

diversified)

INVESTMENTS | BODIE, KANE, MARCUS

10-16

APT Model

• APT applies to well diversified portfolios and

not necessarily to individual stocks.

• APT can be extended to multifactor models.

INVESTMENTS | BODIE, KANE, MARCUS

10-17

APT and CAPM

APT CAPM

• Equilibrium means no • Model is based on an

arbitrage opportunities. inherently unobservable

• APT equilibrium is quickly “market” portfolio.

restored even if only a few • Rests on mean-variance

investors recognize an

arbitrage opportunity. efficiency. The actions of

many small investors restore

• The expected return–beta

relationship can be derived CAPM equilibrium.

without using the true market • CAPM describes equilibrium

portfolio. for all assets.

• It is difficult to estimate beta

INVESTMENTS | BODIE, KANE, MARCUS

You might also like

- Home Alarm AnswersDocument4 pagesHome Alarm Answersphoggydayal100% (6)

- CNE5 Empirical Notes July 2012Document59 pagesCNE5 Empirical Notes July 2012guojun wangNo ratings yet

- 2-Factor Black Karasinski Interest Rate Model PDFDocument38 pages2-Factor Black Karasinski Interest Rate Model PDFstehbar9570No ratings yet

- Duration Convexity Bond Portfolio ManagementDocument49 pagesDuration Convexity Bond Portfolio ManagementParijatVikramSingh100% (1)

- Sample Exam Questions (And Answers)Document22 pagesSample Exam Questions (And Answers)Diem Hang VuNo ratings yet

- CT8 Financial Economics PDFDocument6 pagesCT8 Financial Economics PDFVignesh SrinivasanNo ratings yet

- Forward Bond Price Using Repo and FuturesDocument19 pagesForward Bond Price Using Repo and Futuressumit_uk1No ratings yet

- Quantitative Finance Problems and SolutionsDocument2 pagesQuantitative Finance Problems and SolutionsJosiah KhorNo ratings yet

- Sleepless L.A. - Case AnalysisDocument6 pagesSleepless L.A. - Case AnalysisSreenandan NambiarNo ratings yet

- IEOR E4630 Spring 2016 SyllabusDocument2 pagesIEOR E4630 Spring 2016 Syllabuscef4No ratings yet

- R1.P1.T1.Crouhy Ch.1,2,4 v5SDocument6 pagesR1.P1.T1.Crouhy Ch.1,2,4 v5SNurul Amalina ZulkifliNo ratings yet

- ACE White Paper 200705Document70 pagesACE White Paper 200705Bass1237No ratings yet

- Numerical ExampleDocument2 pagesNumerical ExampleVishal GoyalNo ratings yet

- Financial System, Markets and ServicesDocument65 pagesFinancial System, Markets and Servicessatya123b8101100% (1)

- Risk Aversion and Capital AllocationDocument35 pagesRisk Aversion and Capital Allocationzakaria islam protikNo ratings yet

- Chapter 12 Bond Portfolio MGMTDocument41 pagesChapter 12 Bond Portfolio MGMTsharktale2828No ratings yet

- Class 1 Investments BKM Chapter9Document19 pagesClass 1 Investments BKM Chapter9Daniel PortellaNo ratings yet

- No-Armageddon Measure For Arbitrage-Free Pricing of Index Options in A Credit CrisisDocument21 pagesNo-Armageddon Measure For Arbitrage-Free Pricing of Index Options in A Credit CrisisSapiensNo ratings yet

- AM LecturesDocument1,520 pagesAM LecturesmohamedNo ratings yet

- CH 12 Hull Fundamentals 8 The DDocument25 pagesCH 12 Hull Fundamentals 8 The DjlosamNo ratings yet

- Empirical Studies in FinanceDocument8 pagesEmpirical Studies in FinanceAhmedMalikNo ratings yet

- CH 13 Hull Fundamentals 8 The DDocument22 pagesCH 13 Hull Fundamentals 8 The DjlosamNo ratings yet

- A Step-By-Step Guide To The Black-Litterman Model Incorporating User-Specified Confidence LevelsDocument34 pagesA Step-By-Step Guide To The Black-Litterman Model Incorporating User-Specified Confidence LevelsMang AwanNo ratings yet

- FRM Lecture2Document117 pagesFRM Lecture2Dang Thi Tam AnhNo ratings yet

- Lse FM474Document47 pagesLse FM474Hu HeNo ratings yet

- Stock ValuvationDocument30 pagesStock ValuvationmsumanraoNo ratings yet

- CFA - L2 - Quicksheet Sample PDFDocument1 pageCFA - L2 - Quicksheet Sample PDFMohit PrasadNo ratings yet

- Literature ReviewDocument7 pagesLiterature ReviewadjoeadNo ratings yet

- Week 1 Lecture SlidesDocument30 pagesWeek 1 Lecture SlidesPHAT NGUYENNo ratings yet

- Fixed Income (Debt) Securities: Source: CFA IF Chapter 9 (Coverage of CH 9 Is MUST For Students)Document17 pagesFixed Income (Debt) Securities: Source: CFA IF Chapter 9 (Coverage of CH 9 Is MUST For Students)Oona NiallNo ratings yet

- Investment TheoryDocument29 pagesInvestment Theorypgdm23samamalNo ratings yet

- Financial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sDocument77 pagesFinancial Reporting For Financial Institutions MUTUAL FUNDS & NBFC'sParvesh Aghi0% (1)

- P1.T3. Financial Markets & Products Chapter 1 - Banks Bionic Turtle FRM Study NotesDocument22 pagesP1.T3. Financial Markets & Products Chapter 1 - Banks Bionic Turtle FRM Study NotesChristian Rey MagtibayNo ratings yet

- 10 - Market EfficiencyDocument5 pages10 - Market EfficiencyJosh AckmanNo ratings yet

- Capm and AptDocument10 pagesCapm and AptRajkumar35No ratings yet

- Danthine ExercisesDocument22 pagesDanthine ExercisesmattNo ratings yet

- Risk 0801 PortfolioDocument5 pagesRisk 0801 PortfolioDiveysNo ratings yet

- Bond MathematicsDocument68 pagesBond MathematicsDeepali JhunjhunwalaNo ratings yet

- SOA Recent Curriculum ChangesDocument25 pagesSOA Recent Curriculum ChangeskidNo ratings yet

- Macroeconomic Analysis 2003: Monetary Policy: Transmission MechanismDocument26 pagesMacroeconomic Analysis 2003: Monetary Policy: Transmission MechanismYasir IrfanNo ratings yet

- FRM Currency FutureDocument48 pagesFRM Currency FutureParvez KhanNo ratings yet

- A Merton Model Approach To Assessing The Default Risk of UK Public Companies PDFDocument18 pagesA Merton Model Approach To Assessing The Default Risk of UK Public Companies PDFAndri WibowoNo ratings yet

- Options, Futures and Other Derivatives Course Lecture 3Document51 pagesOptions, Futures and Other Derivatives Course Lecture 3SolNo ratings yet

- R21 Capital Budgeting IFT NotesDocument25 pagesR21 Capital Budgeting IFT NotesAdnan MasoodNo ratings yet

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Document20 pagesStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderNo ratings yet

- Fixed Income ValuationDocument120 pagesFixed Income ValuationtarunNo ratings yet

- Fabozzi Bmas7 Ch23 ImDocument37 pagesFabozzi Bmas7 Ch23 ImSandeep SidanaNo ratings yet

- Fixed-Income Arbitrage-Free Valuation Framework (Binomial Tree)Document32 pagesFixed-Income Arbitrage-Free Valuation Framework (Binomial Tree)Shriya JanjikhelNo ratings yet

- Investments & RiskDocument20 pagesInvestments & RiskravaladityaNo ratings yet

- Derivatives Individual AssignmentDocument24 pagesDerivatives Individual AssignmentCarine TeeNo ratings yet

- 2007 FRM Practice ExamDocument116 pages2007 FRM Practice Examabhishekriyer100% (1)

- Expected Returns On Stocks and BondsDocument21 pagesExpected Returns On Stocks and BondshussankaNo ratings yet

- Multiple Curve Disocunt PDFDocument82 pagesMultiple Curve Disocunt PDFKishlay Kumar100% (1)

- Topic 9 - The Standard Capital Asset Pricing Model Answer PDFDocument20 pagesTopic 9 - The Standard Capital Asset Pricing Model Answer PDFSrinivasa Reddy S100% (1)

- Pykhtin MFADocument6 pagesPykhtin MFAhsch345No ratings yet

- SFM New Sums Added in Study Material by CA Mayank KothariDocument112 pagesSFM New Sums Added in Study Material by CA Mayank KothariSNo ratings yet

- CApm DerivationDocument27 pagesCApm Derivationpaolo_nogueraNo ratings yet

- FRM Part I VAR Risk Models PDFDocument17 pagesFRM Part I VAR Risk Models PDFHardik ShahNo ratings yet

- Alternative InvestmentDocument7 pagesAlternative InvestmentAbhi Jayakumar100% (1)

- CP v1993 n6 2Document6 pagesCP v1993 n6 2leelaNo ratings yet

- Ion - Why Is It Necessary - How It WorksDocument7 pagesIon - Why Is It Necessary - How It WorksPankaj D. DaniNo ratings yet

- Stolyarov MFE Study GuideDocument279 pagesStolyarov MFE Study GuideChamu ChiwaraNo ratings yet

- Credit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsFrom EverandCredit Models and the Crisis: A Journey into CDOs, Copulas, Correlations and Dynamic ModelsNo ratings yet

- Financial 2021Document26 pagesFinancial 2021Esraa GhonamNo ratings yet

- Lecturer 4: The Business, Tax, and Financial EnvironmentsDocument23 pagesLecturer 4: The Business, Tax, and Financial EnvironmentsEsraa GhonamNo ratings yet

- Background UpdateDocument13 pagesBackground UpdateEsraa GhonamNo ratings yet

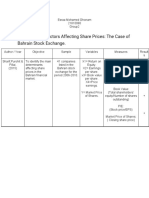

- Analysis of Factors Affecting Share Prices: The Case of Bahrain Stock ExchangeDocument6 pagesAnalysis of Factors Affecting Share Prices: The Case of Bahrain Stock ExchangeEsraa GhonamNo ratings yet

- A Case Study Competition: CasetifyDocument10 pagesA Case Study Competition: CasetifyPravesh KumarNo ratings yet

- An Early Morning Trader StrategyDocument3 pagesAn Early Morning Trader StrategySasikumar ThangaveluNo ratings yet

- Principles of Micro EconomicsDocument275 pagesPrinciples of Micro Economicsashairways67% (3)

- Assignment 4Document3 pagesAssignment 4Tahmina RemiNo ratings yet

- EconomicsDocument55 pagesEconomicsFrancis LewahNo ratings yet

- How Apple's Corporate Strategy Drove High GrowthDocument3 pagesHow Apple's Corporate Strategy Drove High GrowthFadhila Nurfida HanifNo ratings yet

- Tutorial Mkt243 Chapter 5: Define Product and Differentiate Types of Consumer ProductDocument2 pagesTutorial Mkt243 Chapter 5: Define Product and Differentiate Types of Consumer Productmuhammad nurNo ratings yet

- Business and Finance Mock Test (14!09!2018)Document2 pagesBusiness and Finance Mock Test (14!09!2018)Shahid MahmudNo ratings yet

- Datamarket: Brand Management: Instituto Politécnico NacionalDocument6 pagesDatamarket: Brand Management: Instituto Politécnico NacionalJose CarlosNo ratings yet

- Ar T.C Om: EadingDocument8 pagesAr T.C Om: Eadingarun1974No ratings yet

- Blcok-3 MCO-7 Unit-1Document23 pagesBlcok-3 MCO-7 Unit-1Tushar SharmaNo ratings yet

- Coca-Cola, MicroeconomicsDocument15 pagesCoca-Cola, MicroeconomicsSaad Rabbani100% (1)

- Biodiesel Magazine - HedgingDocument3 pagesBiodiesel Magazine - HedgingKhairul Anuar AhmadNo ratings yet

- Types of Markets: Consumer Products: Goods or ServicesDocument23 pagesTypes of Markets: Consumer Products: Goods or Servicesnitin1286No ratings yet

- Mark Scheme Q7 MicroeconomicsDocument5 pagesMark Scheme Q7 MicroeconomicsVittoria RussoNo ratings yet

- Business Economics PDFDocument5 pagesBusiness Economics PDFAnkit SinghNo ratings yet

- Economics 10Th Edition Colander Solutions Manual Full Chapter PDFDocument31 pagesEconomics 10Th Edition Colander Solutions Manual Full Chapter PDFjoshua.king500100% (12)

- Objectives of E-Commerce: You Focus On Product DevelopmentDocument9 pagesObjectives of E-Commerce: You Focus On Product DevelopmentAvantika ChandnaNo ratings yet

- RM - Pre MidsDocument239 pagesRM - Pre MidsasniNo ratings yet

- Unit 7 Channels of DistributionDocument14 pagesUnit 7 Channels of DistributionKritika RajNo ratings yet

- Consumer BehaviourDocument27 pagesConsumer BehaviourRahul SharmaNo ratings yet

- Market MicrostructureDocument15 pagesMarket MicrostructureBen Gdna100% (2)

- Tchibo Ideas: Group5Document10 pagesTchibo Ideas: Group5Diksharth HarshNo ratings yet

- Economics DemandDocument5 pagesEconomics DemandMuhammad Tariq100% (2)

- Bapuji Project ModifyDocument74 pagesBapuji Project ModifyMichael WellsNo ratings yet

- Mkt05nestlechocolates 1211547107477034 9Document20 pagesMkt05nestlechocolates 1211547107477034 9Bhumika MiraniNo ratings yet

- AQA (A-Level Year 1 and AS) Demand and AD NOTESDocument27 pagesAQA (A-Level Year 1 and AS) Demand and AD NOTESnaqqi abbasNo ratings yet