Professional Documents

Culture Documents

Answered - BCD Company Offer Its Investors Option - Bartleby

Answered - BCD Company Offer Its Investors Option - Bartleby

Uploaded by

Trisha AgraamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answered - BCD Company Offer Its Investors Option - Bartleby

Answered - BCD Company Offer Its Investors Option - Bartleby

Uploaded by

Trisha AgraamCopyright:

Available Formats

menu Search for textbooks, step-by-step explanations to homework questions… message Ask an Expert notifications account_circle

Business / Finance / Q&A Library / BCD Company offer its investors option contracts to buy their shares at a price of P50. Currently, the value of their stoc…

BCD Company offer its investors option contracts to buy their shares at a price of P50. Currently, the value of the…

Question

How much is the total option pay off for the stock? (No peso signs and other special characters but you are required to use two decimal places.)

fullscreen Expand

Transcribed Image Text

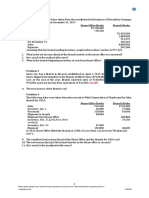

BCD Company offer its investors option contracts to buy their shares at a price of

P50. Currently, the value of their stocks in the market stands at P60. The 52-week

high of the

share price is P83 and its 52-week low is P47. The treasury bill issued by

the government yields 8.25% currently.

check_circle Expert Answer thumb_up thumb_down

Step 1 Call option and payoff:

A call option is the type of vanilla option that provides the right to buy the underlying assets, such as stocks and bonds on or before a maturity period at a certain

price. The option does not really exchange the stocks. It is created to hedge the fluctuations in the price of stocks. The payoff for the options is the difference

between the market price of the stocks and the exercise price of stocks that are underlying the option. The option premium paid by the option holders acts as a cost

and reduces a payoff value.

Step 2 Calculation and explanation:

The market price of the stock= P 60, the exercise price of stock: P50,

As per the information, the option is related to buying the shares at a maturity period. Hence, it is a call option. The call option provides the payoff to the option

holder with the following method:

Payoff=Market value of underlying share − Exercise price of underlying share

=60 − 50

=10

The option has no cost in the form of a premium. So, the difference in the underlying prices provides the net payoff to the option holders.

Hence, the payoff is 10 for the option.

Was this solution helpful? thumb_up thumb_down

You might also like

- Solved Nora Transfers To Needle Corporation Depreciable Machinery Originally Costing 18 000Document1 pageSolved Nora Transfers To Needle Corporation Depreciable Machinery Originally Costing 18 000Anbu jaromiaNo ratings yet

- E2t Traders Survival Guide Ebook Vol1 - enDocument27 pagesE2t Traders Survival Guide Ebook Vol1 - enfizzNo ratings yet

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Document31 pagesQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNo ratings yet

- Items 1Document7 pagesItems 1RYANNo ratings yet

- Mikong Due MARCH 30 Hospital and HmosDocument6 pagesMikong Due MARCH 30 Hospital and HmosCoke Aidenry SaludoNo ratings yet

- 02 Fundamentals of Assurance ServicesDocument5 pages02 Fundamentals of Assurance ServicesKristine TiuNo ratings yet

- Long Problems For Prelim'S Product: Case 1Document7 pagesLong Problems For Prelim'S Product: Case 1Mae AstovezaNo ratings yet

- Psa 610 Using The Work of Internal Auditors: RequirementsDocument2 pagesPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoNo ratings yet

- CH 13Document19 pagesCH 13pesoload100No ratings yet

- Receivables Problem 1: Account Is One To Six Months ClassificationDocument4 pagesReceivables Problem 1: Account Is One To Six Months ClassificationMary Grace NaragNo ratings yet

- Psa 401Document5 pagesPsa 401novyNo ratings yet

- Cpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)Document10 pagesCpa Review School of The Philippines: (P1,832,400-P598,400-P19,200-P180,000-P65,000-P73,000-P178,200)RIZA LUMAADNo ratings yet

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezNo ratings yet

- Pre Week NewDocument30 pagesPre Week NewAnonymous wDganZNo ratings yet

- 12 Further Audit Procedures - Substantive TestingDocument6 pages12 Further Audit Procedures - Substantive Testingrandomlungs121223No ratings yet

- ASCA301 Module 1 DiscussionDocument22 pagesASCA301 Module 1 DiscussionKaleu MellaNo ratings yet

- Acctg Ats1Document2 pagesAcctg Ats1Christian N MagsinoNo ratings yet

- T03 - Home Office & BranchDocument3 pagesT03 - Home Office & BranchChristian YuNo ratings yet

- Problem 4Document6 pagesProblem 4jhobsNo ratings yet

- Finals Reviewer AudtheoDocument36 pagesFinals Reviewer AudtheoMae VillarNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- PSA 220 Quality Control For Historical Info SummaryDocument6 pagesPSA 220 Quality Control For Historical Info SummaryAbraham ChinNo ratings yet

- Fin ExamDocument6 pagesFin ExamKissesNo ratings yet

- Leonila Rivera MGT9Document1 pageLeonila Rivera MGT9Asvag OndaNo ratings yet

- AFAR-06 (Revenue From Customer Contracts - Other Topics)Document26 pagesAFAR-06 (Revenue From Customer Contracts - Other Topics)mysweet surrenderNo ratings yet

- Confidential: Section A - 20 Marks Scenario A. (3 Questions)Document4 pagesConfidential: Section A - 20 Marks Scenario A. (3 Questions)Otherr HafizNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- 1Document10 pages1Viannice AcostaNo ratings yet

- 08 InvestmentquestfinalDocument13 pages08 InvestmentquestfinalAnonymous l13WpzNo ratings yet

- Discussion Questions and Problems Chapter 2 and 3Document3 pagesDiscussion Questions and Problems Chapter 2 and 3Muhammad Ullah0% (1)

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- 5share OptionsDocument21 pages5share OptionsnengNo ratings yet

- Classification of Assurance EngagementDocument3 pagesClassification of Assurance EngagementJennybabe PetaNo ratings yet

- PRTC 1st Preboard Solution GuideDocument48 pagesPRTC 1st Preboard Solution GuideAnonymous Lih1laax100% (2)

- Chapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementDocument33 pagesChapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementYukiNo ratings yet

- Philippine MysteriesDocument41 pagesPhilippine MysteriesYes ChannelNo ratings yet

- 3 - Discussion - Joint Products and ByproductsDocument2 pages3 - Discussion - Joint Products and ByproductsCharles TuazonNo ratings yet

- 3 4Document5 pages3 4RenNo ratings yet

- Cpar Far Must ReviewDocument23 pagesCpar Far Must ReviewNikki GarciaNo ratings yet

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDocument3 pagesExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.No ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Auditing Theory - Risk AssessmentDocument10 pagesAuditing Theory - Risk AssessmentYenelyn Apistar CambarijanNo ratings yet

- PFRS-15-LTCC Franchise ConsignmentDocument2 pagesPFRS-15-LTCC Franchise ConsignmentArlyn A. Zuniega0% (1)

- Stock Edited PDFDocument29 pagesStock Edited PDFCzarina PanganibanNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- I. 1. Acquisition Method: Non-Controlling Interest Consolidated StatementDocument14 pagesI. 1. Acquisition Method: Non-Controlling Interest Consolidated StatementCookies And CreamNo ratings yet

- Auditing Problems ReviewerDocument9 pagesAuditing Problems Revieweralexis prada0% (1)

- Chapter 11 Activity/Assignment: Ans. 10,000 SolutionDocument1 pageChapter 11 Activity/Assignment: Ans. 10,000 SolutionRandelle James FiestaNo ratings yet

- Applied Auditing Assignment 3Document2 pagesApplied Auditing Assignment 3Leny Joy DupoNo ratings yet

- Lets Goat Company AkeyDocument2 pagesLets Goat Company AkeyJeane Mae BooNo ratings yet

- First QuizDocument4 pagesFirst QuizArn HicoNo ratings yet

- Prepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020Document1 pagePrepare The Current Liabilities Section of The Statement of Financial Position For The Layla Company As of December 31, 2020versNo ratings yet

- Chapter06 - Answer PDFDocument6 pagesChapter06 - Answer PDFJONAS VINCENT SamsonNo ratings yet

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiNo ratings yet

- QuizzerDocument343 pagesQuizzerAn JoNo ratings yet

- Finals Part 1 Answers May 2019Document5 pagesFinals Part 1 Answers May 2019edwin_dauzNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- Preliminary ExaminationDocument5 pagesPreliminary ExaminationRen EyNo ratings yet

- Applied Auditing Review Course Pre-Board - FinalDocument13 pagesApplied Auditing Review Course Pre-Board - FinalROMAR A. PIGANo ratings yet

- Genmath - Las - Week 5-6Document6 pagesGenmath - Las - Week 5-6Aguila AlvinNo ratings yet

- Learning Activity Sheets in General Mathematics Week 5Document7 pagesLearning Activity Sheets in General Mathematics Week 5Aguila AlvinNo ratings yet

- Question: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Document2 pagesQuestion: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Trisha AgraamNo ratings yet

- PDF Audit of Equity - CompressDocument44 pagesPDF Audit of Equity - CompressTrisha AgraamNo ratings yet

- Question: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Document2 pagesQuestion: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Trisha AgraamNo ratings yet

- Answered - The Company Offered Its Investors - BartlebyDocument1 pageAnswered - The Company Offered Its Investors - BartlebyTrisha AgraamNo ratings yet

- Corresponding Probs PDFDocument8 pagesCorresponding Probs PDFTrisha AgraamNo ratings yet

- TrishaDocument2 pagesTrishaTrisha AgraamNo ratings yet

- S Announcement 20566 PDFDocument3 pagesS Announcement 20566 PDFTrisha AgraamNo ratings yet

- The Province of Abra vs. Honorable Harold M. Hernando, Et Al. G.R. No. L-49336 August 31, 1981Document1 pageThe Province of Abra vs. Honorable Harold M. Hernando, Et Al. G.R. No. L-49336 August 31, 1981Trisha AgraamNo ratings yet

- Agraam, Trisha Camille G. BSAC 2 CFE 103 1928Document1 pageAgraam, Trisha Camille G. BSAC 2 CFE 103 1928Trisha AgraamNo ratings yet

- The Stock MarketDocument4 pagesThe Stock Marketjane garciaNo ratings yet

- Anton KreilDocument16 pagesAnton KreilRaghavendra Rao TNo ratings yet

- Daily Digest From BDO Securities 2Document64 pagesDaily Digest From BDO Securities 2Glenford “Glen” EbroNo ratings yet

- RSI Basic LiteDocument41 pagesRSI Basic LiteDinesh CNo ratings yet

- Has The Water Entered My ShipDocument1 pageHas The Water Entered My ShipRamesh Ram HingoraneeNo ratings yet

- 1.3 Introduction To Money and Interest RatesDocument2 pages1.3 Introduction To Money and Interest RatesJessa Lyn Gao LapinigNo ratings yet

- Case 4. Morgan Stanley and The Market RiskDocument8 pagesCase 4. Morgan Stanley and The Market RiskJakeNo ratings yet

- Trading BasicsDocument43 pagesTrading BasicsIndicatorGuys100% (1)

- Applied Economics (MIDTERM EXAM) SENIORDocument2 pagesApplied Economics (MIDTERM EXAM) SENIORJoan Mae Angot - VillegasNo ratings yet

- Behavioral Finance QUIZDocument2 pagesBehavioral Finance QUIZChelsea MedranoNo ratings yet

- Elasticity of DemandDocument7 pagesElasticity of DemandLakshmiRengarajan100% (2)

- 05dec23 Asia FCRST Market BriefingDocument55 pages05dec23 Asia FCRST Market BriefingJarodNo ratings yet

- 5 Degrees of Price Elasticity of DemandDocument17 pages5 Degrees of Price Elasticity of DemandSelenaNo ratings yet

- Methodology January 2020: MCX Icomdex MethodolologyDocument25 pagesMethodology January 2020: MCX Icomdex MethodolologySANCHIT DEKATE-IBNo ratings yet

- Options Sellers vs. Buyers: Who Wins?Document4 pagesOptions Sellers vs. Buyers: Who Wins?Prasad KshirsagarNo ratings yet

- Adjusting Option Trades With Bill LaddDocument3 pagesAdjusting Option Trades With Bill LaddAndrew ChanNo ratings yet

- Evaluation ModelDocument4 pagesEvaluation ModelBiantoroKunartoNo ratings yet

- US Economic Briefing: High Frequency Indicators: Yardeni Research, IncDocument28 pagesUS Economic Briefing: High Frequency Indicators: Yardeni Research, IncmaxNo ratings yet

- GuruSpeak - Ankush Bajaj - An Algo Trader On How He Trades Multiple Strategies For Steady ReturnsDocument5 pagesGuruSpeak - Ankush Bajaj - An Algo Trader On How He Trades Multiple Strategies For Steady ReturnsShekharNo ratings yet

- Investopedia Stock Simulator - Investopedia Stock Simulator - PortfolioDocument1 pageInvestopedia Stock Simulator - Investopedia Stock Simulator - PortfoliohpliveNo ratings yet

- RMD New SyllabusDocument4 pagesRMD New SyllabusRancho RanchoNo ratings yet

- Financial Technologies (India) Limited (FTIL)Document2 pagesFinancial Technologies (India) Limited (FTIL)Kevin DsouzaNo ratings yet

- ZerodhaDocument3 pagesZerodhatanujaNo ratings yet

- Perry's Chemical Engineers' Handbook, 8th Edition 240Document1 pagePerry's Chemical Engineers' Handbook, 8th Edition 240Ooi Chia EnNo ratings yet

- International Trade: of ChinaDocument3 pagesInternational Trade: of ChinaCrina-Elena CostacheNo ratings yet

- Today News Update in NigeriaDocument9 pagesToday News Update in NigeriaHussein Ibrahim GebiNo ratings yet

- Solution Manual For International Economics 15th EditionDocument4 pagesSolution Manual For International Economics 15th Editiondandyizemanuree9nn2y100% (25)