Professional Documents

Culture Documents

Answered - The Company Offered Its Investors - Bartleby

Answered - The Company Offered Its Investors - Bartleby

Uploaded by

Trisha AgraamOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answered - The Company Offered Its Investors - Bartleby

Answered - The Company Offered Its Investors - Bartleby

Uploaded by

Trisha AgraamCopyright:

Available Formats

menu Search for textbooks, step-by-step explanations to homework questions,… message Ask an Expert

notifications account_circle

Business / Finance / Q&A Library / The company offered its investors option contracts to buy their shares at P72 with the current price of P90. They were only given 90 days to exercise th…

The company offered its investors option contracts to buy their shares at P72 with the c…

Question

The company offered its investors option contracts to buy their shares at P72 with the current price of P90.

They were only given 90 days to exercise their rights. 52 week-high for the stock is P95 while the 52-week low is

P70. The T-bill rate is 7.32%.

REQUIRED:

1. Value of Nd1. (Use 4 decimal places)

2. Value of Nd2. (Use 4 decimal places)

3. Volatility rate. (Use percentage and at least, two decimal places)

4. Value of the call option. (Use two decimal places)

5. Value of the put options. (Use two decimal places)

check_circle Expert Answer thumb_up thumb_down

Step 1 Tagged in

Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts for you. To get Business Finance Black scholes model

the remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.

Stock options

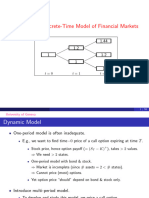

Step 2 The Black Scholes model for option pricing:

The option pricing has two most important models such as the Black Scholes model and the binomial model. Knowledge Booster

The Black Scholes model determines the price of call and put option with the help of strike price, spot price,

risk-free rate, volatility rate, time, and other factors. Learn more about this topic with our new Knowledge

Booster section down below.

The Nd1 and Nd2 are commutative normal probability values of d1 and d2. These values can determine with

the help of commutative normal distribution tables. keyboard_arrow_downSee content below

Step 3 Calculation:

The given information:

The company offered its investors option contracts to buy their shares at P72 with the current price of P90.

They were only given 90 days to exercise their rights. 52 week-high for the stock is P95 while the 52-week low is

P70. The T-bill rate is 7.32%.

Part 1) Value of Nd1:

The value of Nd1 and Nd2 require the volatility rate. So we will solve part 3 for it.

The volatility rate= {(High stock price-Low stock price)/High price} x100

={($95-$70)/$95}x100

={($15/$95)}x100

=15.789%

Now the Nd1 and Nd2 are as follows with the above information:

Step 4

Firstly we have to determine d1:

Now, Nd1 is can determine using the cumulative normal distribution table:

N(d1)=N(3.1182)=N(3.11)+0.82[N(3.12)-N(3.11)]

=0.9991+0.82[0.9991-0.9991)]= =0.9991+0

Nd1 = 0.9991

Step 5 Part b) The value of Nd2:

d2 can determine with the help of d1. The d2 would be as follows:

Now, Nd2 is can determine using the cumulative normal distribution table:

N(d2)=N(3.0934)=N(3.09)+0.34[N(3.10)-N(3.09)]

=0.999+0.82[0.999-0.999)]= =0.9990+0

Nd2 = 0.9990

Step 6

Part 3) The volatility rate has been determined in the part 1.

The volatility rate is 15.78%.

Explore similar questions

Was this solution helpful? thumb_up thumb_down

Knowledge Booster

Similar questions arrow_back_iosarrow_forward_ios

Q The company offered its investors option contracts

to buy their shares at P72 with the current price of…

arrow_forward Q Nanno Company offers its investors option contracts

to buy their shares at a price of P50. Currently, the…

arrow_forward

Q Boles Bottling Co. has issued rights to its arrow_forward Q OneChicago has just introduced a single-stock arrow_forward

shareholders. The subscription price is $74 and… futures contract on Brandex stock, a company tha…

You might also like

- Darden Capital Management - The Cavalier FundDocument8 pagesDarden Capital Management - The Cavalier FundKshitishNo ratings yet

- Management and Cost Accounting 11Th Edition Colin Drury Online Ebook Texxtbook Full Chapter PDFDocument69 pagesManagement and Cost Accounting 11Th Edition Colin Drury Online Ebook Texxtbook Full Chapter PDFdaniel.taylor909100% (9)

- 3 The Pricing of Commodity ContractsDocument13 pages3 The Pricing of Commodity ContractsTze Shao0% (1)

- 739 SAP SD Interview Questions Answers GuideDocument7 pages739 SAP SD Interview Questions Answers GuideFormateur Sap SageNo ratings yet

- Module 7 - Merchandising Business Special TransactionsDocument40 pagesModule 7 - Merchandising Business Special TransactionsMaria Nicole OroNo ratings yet

- Study+school+slides Market Risk ManagementDocument64 pagesStudy+school+slides Market Risk ManagementEbenezerNo ratings yet

- ERP Quiz 3Document18 pagesERP Quiz 3simi263No ratings yet

- IGCSE Economics CDDocument9 pagesIGCSE Economics CDPhytorNo ratings yet

- Prospective Analysis Theory and ConceptDocument32 pagesProspective Analysis Theory and ConceptEster Sabatini100% (1)

- HW1 PDFDocument2 pagesHW1 PDFMantas SinkeviciusNo ratings yet

- Answered - BCD Company Offer Its Investors Option - BartlebyDocument1 pageAnswered - BCD Company Offer Its Investors Option - BartlebyTrisha AgraamNo ratings yet

- Pay Less To Save More: Learning StandardsDocument3 pagesPay Less To Save More: Learning StandardsRandolf Byron S. VirayNo ratings yet

- JPM Quant Mentorship Case Study 2021Document18 pagesJPM Quant Mentorship Case Study 2021Anjali SharmaNo ratings yet

- OMG 6 English Form 4 - Unit 3 SEDocument14 pagesOMG 6 English Form 4 - Unit 3 SEShoba DeviNo ratings yet

- FIN 6060 Module 2 WorksheetDocument2 pagesFIN 6060 Module 2 WorksheetemoshokemehgraceNo ratings yet

- Options RevisedDocument130 pagesOptions Revisedakhil reddy kalvaNo ratings yet

- Content Problem Sets 4. Review Test Submission: Problem Set 08Document8 pagesContent Problem Sets 4. Review Test Submission: Problem Set 08gggNo ratings yet

- Case 6: Winter Olympics BiddingDocument4 pagesCase 6: Winter Olympics BiddingSANDEEP jogaNo ratings yet

- Notes Cfa Fixed Income R41Document30 pagesNotes Cfa Fixed Income R41Ayah AkNo ratings yet

- All Case Studies Are Compulsory. 2. Each Case Study Carries Equal Marks. 3. Do Not Write Your Name On The Answer Sheet. Q.1 Case StudyDocument4 pagesAll Case Studies Are Compulsory. 2. Each Case Study Carries Equal Marks. 3. Do Not Write Your Name On The Answer Sheet. Q.1 Case StudyDarshanNo ratings yet

- Week 8 OptionsDocument37 pagesWeek 8 OptionsMidha MoeenNo ratings yet

- The Following Information Is Provided For Two Item...Document3 pagesThe Following Information Is Provided For Two Item...Kausaliya NanthakumarNo ratings yet

- Options I UploadDocument3 pagesOptions I UploadManav DhimanNo ratings yet

- Week 8 - OptionsDocument39 pagesWeek 8 - Optionslaiba mujahidNo ratings yet

- AssignmentDocument3 pagesAssignmentanon-927447No ratings yet

- Chapter 09Document18 pagesChapter 09simeNo ratings yet

- EFN406 Module 03 Notes S12022Document21 pagesEFN406 Module 03 Notes S12022zx zNo ratings yet

- Term-4 End Term Question PapersDocument93 pagesTerm-4 End Term Question PapersParas KhuranaNo ratings yet

- Chapter Seven Analysis of Derivative SecuritiesDocument25 pagesChapter Seven Analysis of Derivative Securitiesbiniyam zelekeNo ratings yet

- EFB344 Lecture08, Options 1Document39 pagesEFB344 Lecture08, Options 1Tibet LoveNo ratings yet

- Models For The Valuation of SharesDocument4 pagesModels For The Valuation of SharesWajahat RehmanNo ratings yet

- Stock ValuationDocument16 pagesStock ValuationHassaan NasirNo ratings yet

- Chapter4 QuickRecapOptionsDocument16 pagesChapter4 QuickRecapOptions이경은No ratings yet

- Lec 4Document41 pagesLec 4Pamula SindhuNo ratings yet

- Erp Practice Quiz 3Document18 pagesErp Practice Quiz 3amritesh pandeyNo ratings yet

- Af PS3 2014 15Document4 pagesAf PS3 2014 15rtchuidjangnanaNo ratings yet

- Dynamic ArbitrageDocument59 pagesDynamic ArbitragertchuidjangnanaNo ratings yet

- Math Subject For High School 9th Grade Quadratic FunctionsDocument23 pagesMath Subject For High School 9th Grade Quadratic FunctionsFaith Daniela FullanteNo ratings yet

- A European Call Option Gives A Person The Right ToDocument1 pageA European Call Option Gives A Person The Right ToAmit PandeyNo ratings yet

- Topic 4 - Valuation of SharesDocument26 pagesTopic 4 - Valuation of SharesMiera FrnhNo ratings yet

- CH 5 Equity AnswersDocument177 pagesCH 5 Equity Answersgustavo eichholzNo ratings yet

- Fmi Assignment - 9Document5 pagesFmi Assignment - 9Muskan ValbaniNo ratings yet

- Career Paths Accounting SB-34 PDFDocument1 pageCareer Paths Accounting SB-34 PDFYanetNo ratings yet

- VNT - Step 3 - Group - 212032 - 31 CopiladoDocument14 pagesVNT - Step 3 - Group - 212032 - 31 Copiladocarlos andres salgado restrepoNo ratings yet

- 8BS0 02 Rms 20190815Document16 pages8BS0 02 Rms 20190815ShepardNo ratings yet

- Frozen PizzaDocument16 pagesFrozen Pizzadionlkk6No ratings yet

- Complete The Transformation: Deped CompetencyDocument5 pagesComplete The Transformation: Deped CompetencyVanessa Fampula FaigaoNo ratings yet

- Daily Lesson Plan: Abm-11-Business-Mathematics-Q1-W8-Mod1pdfDocument5 pagesDaily Lesson Plan: Abm-11-Business-Mathematics-Q1-W8-Mod1pdfApril Rose BondadNo ratings yet

- BM 12 PT 2 - Activity SheetDocument3 pagesBM 12 PT 2 - Activity SheetkweenNo ratings yet

- Solved - You Have $50,000 To Invest in Three Stocks. Let Ri Be ...Document3 pagesSolved - You Have $50,000 To Invest in Three Stocks. Let Ri Be ...Ameer HamzaNo ratings yet

- Inv - CH-4Document57 pagesInv - CH-4mickamhaaNo ratings yet

- Opion Strategies - TYBMSDocument19 pagesOpion Strategies - TYBMSVaishali Trivedi OjhaNo ratings yet

- Chapter 4 - The Value of Common Stocks (Compatibility Mode)Document18 pagesChapter 4 - The Value of Common Stocks (Compatibility Mode)Hanh TranNo ratings yet

- FRM I 2016 - VaR Quiz 2 - NewDocument9 pagesFRM I 2016 - VaR Quiz 2 - NewImran MobinNo ratings yet

- Lecture 8Document42 pagesLecture 8utariansweetNo ratings yet

- Mbaf 605 Lecture Week 2-4Document135 pagesMbaf 605 Lecture Week 2-4Gen AbulkhairNo ratings yet

- Chapter 7 The Value of Common StocksDocument48 pagesChapter 7 The Value of Common StocksPrajval Somani100% (2)

- Valuation: Packet 3 Real Options, Acquisition Valuation and Value EnhancementDocument157 pagesValuation: Packet 3 Real Options, Acquisition Valuation and Value EnhancementSandeep Kumar BNo ratings yet

- Stat Ess Mod 3 Ses 1Document29 pagesStat Ess Mod 3 Ses 1Akila100% (1)

- Valuation MethodsDocument25 pagesValuation MethodsAd QasimNo ratings yet

- MINI CASE - TheAssume You Have Just Been Hired As A...Document10 pagesMINI CASE - TheAssume You Have Just Been Hired As A...noorNo ratings yet

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- Equity Financing and Stock Valuation. Dividends. Real OptionsDocument5 pagesEquity Financing and Stock Valuation. Dividends. Real OptionsDaniel Chan Ka LokNo ratings yet

- Derivatives and Risk ManagementDocument30 pagesDerivatives and Risk Managementkashan khanNo ratings yet

- CH - 21 OptionsDocument17 pagesCH - 21 OptionsdavidNo ratings yet

- Math Practice Simplified: Division (Book F): Developing Fluency with Basic Number Combinations for DivisionFrom EverandMath Practice Simplified: Division (Book F): Developing Fluency with Basic Number Combinations for DivisionNo ratings yet

- Question: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Document2 pagesQuestion: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Trisha AgraamNo ratings yet

- Question: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Document2 pagesQuestion: Violet Corporation Has P500,000 Current Liabilities, P2,500,000Trisha AgraamNo ratings yet

- Answered - BCD Company Offer Its Investors Option - BartlebyDocument1 pageAnswered - BCD Company Offer Its Investors Option - BartlebyTrisha AgraamNo ratings yet

- PDF Audit of Equity - CompressDocument44 pagesPDF Audit of Equity - CompressTrisha AgraamNo ratings yet

- S Announcement 20566 PDFDocument3 pagesS Announcement 20566 PDFTrisha AgraamNo ratings yet

- Corresponding Probs PDFDocument8 pagesCorresponding Probs PDFTrisha AgraamNo ratings yet

- TrishaDocument2 pagesTrishaTrisha AgraamNo ratings yet

- The Province of Abra vs. Honorable Harold M. Hernando, Et Al. G.R. No. L-49336 August 31, 1981Document1 pageThe Province of Abra vs. Honorable Harold M. Hernando, Et Al. G.R. No. L-49336 August 31, 1981Trisha AgraamNo ratings yet

- Agraam, Trisha Camille G. BSAC 2 CFE 103 1928Document1 pageAgraam, Trisha Camille G. BSAC 2 CFE 103 1928Trisha AgraamNo ratings yet

- Trap-Ease: The Big Cheese of Mousetraps: Canadian BusinessDocument2 pagesTrap-Ease: The Big Cheese of Mousetraps: Canadian BusinessMoona MalikNo ratings yet

- Managerial Finance AssignmentDocument21 pagesManagerial Finance AssignmentPrashikshan UlakNo ratings yet

- Porter's Five Forces Model of Competition-1Document14 pagesPorter's Five Forces Model of Competition-1Kanika RustagiNo ratings yet

- Customs Valuation Rules, 2007Document9 pagesCustoms Valuation Rules, 2007Shashi SukenkarNo ratings yet

- Warant & ConvertibleDocument13 pagesWarant & ConvertibleHayu AriantiNo ratings yet

- Sotero 6quiz1 InventoryDocument3 pagesSotero 6quiz1 Inventorybernadette soteroNo ratings yet

- 6.1 Price Inflation: Igcse /O Level EconomicsDocument11 pages6.1 Price Inflation: Igcse /O Level EconomicsAditya GhoshNo ratings yet

- Arithmetic 2Document20 pagesArithmetic 2Khizran ZubairNo ratings yet

- Supply and DemandDocument21 pagesSupply and DemandDenis BergemannNo ratings yet

- MarketingDocument18 pagesMarketingrabirabi71% (7)

- 001.the Basics of Engineering EconomyDocument3 pages001.the Basics of Engineering EconomyJohn Vincent Dela CruzNo ratings yet

- I. Case Study CASE STUDY #1 - Industry Revolution and Economic GrowthDocument2 pagesI. Case Study CASE STUDY #1 - Industry Revolution and Economic GrowthchetanNo ratings yet

- Glossary 30 Day Trading BootcampDocument9 pagesGlossary 30 Day Trading Bootcampschizo mailNo ratings yet

- Demand & SupplyDocument19 pagesDemand & SupplyAmalia MNo ratings yet

- The Success of The "Vive 100"Document2 pagesThe Success of The "Vive 100"JuanPabloJaramilloNo ratings yet

- 2022F Microeconomics Ch2Document34 pages2022F Microeconomics Ch2Jyunde WuNo ratings yet

- CH 1Document16 pagesCH 1Mick MalickNo ratings yet

- The Average of 6 Consecutive Odd Numbers Is 26Document2 pagesThe Average of 6 Consecutive Odd Numbers Is 26vincevillamora2k11No ratings yet

- 1mankiw N G Taylor M P Economics (184-201)Document18 pages1mankiw N G Taylor M P Economics (184-201)Ilahe MuradzadeNo ratings yet

- PPLDocument3 pagesPPLdrishti AgnihotriNo ratings yet

- Job Description: I. The CompanyDocument3 pagesJob Description: I. The CompanySayantani SamantaNo ratings yet

- Eton College King S 13 Plus Maths Scholarship A 2022Document21 pagesEton College King S 13 Plus Maths Scholarship A 2022Kaushik SarkarNo ratings yet

- Detailed Solutions With Links For Tutorial VIDEOS, All Made byDocument29 pagesDetailed Solutions With Links For Tutorial VIDEOS, All Made byAubrey Lattao50% (2)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Amit KumarNo ratings yet